UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

Commission File Number: 001-14534

Precision Drilling Corporation

(Exact name of registrant as specified in its charter)

800, 525 - 8 Avenue S.W.

Calgary, Alberta

Canada T2P 1G1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [ X ]

SIGNATURES

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | Precision Drilling Corporation |

| | | (Registrant) |

| | | |

| | | |

| Date: October 26, 2023 | | /s/ Carey T Ford |

| | | Carey T Ford |

| | | Chief Financial Officer |

| | | |

EXHIBIT 99.1

Precision Drilling Announces 2023 Third Quarter Unaudited Financial Results

CALGARY, Alberta, Oct. 26, 2023 (GLOBE NEWSWIRE) -- This news release contains “forward-looking information and statements” within the meaning of applicable securities laws. For a full disclosure of the forward-looking information and statements and the risks to which they are subject, see the “Cautionary Statement Regarding Forward-Looking Information and Statements” later in this news release. This news release contains references to certain Financial Measures and Ratios, including Adjusted EBITDA (earnings before income taxes, loss (gain) on investments and other assets, gain on repurchase of unsecured senior notes, finance charges, foreign exchange, gain on asset disposals and depreciation and amortization), Funds Provided by (Used in) Operations, Net Capital Spending and Working Capital. These terms do not have standardized meanings prescribed under International Financial Reporting Standards (IFRS) and may not be comparable to similar measures used by other companies, see “Financial Measures and Ratios” later in this news release.

Precision Drilling announces strong 2023 third quarter financial results:

- Revenue increased to $447 million compared with $429 million in the third quarter of 2022 driven by higher drilling day rates, offset in part by lower drilling and service activity.

- Revenue per utilization day continues to be strong and grew 20% in Canada to $32,224 and 26% in the U.S. to US$35,135 compared to the same quarter last year.

- We continued to scale our AlphaTM digital technologies and EverGreenTM suite of environmental solutions across our Super Triple rig fleet, increasing revenue from these offerings by 30% year over year. Approximately 75% of our Super Triple rig fleet is equipped with AlphaTM and at least one EverGreenTM product.

- Adjusted EBITDA(1) was $115 million and included $31 million of share-based compensation as our share price increased 41% during the quarter, bringing our year to date share-based compensation to $22 million. In the third quarter of 2022, Adjusted EBITDA was $120 million and included a $6 million charge for share-based compensation.

- Net earnings were $20 million or $1.45 per share compared to $31 million or $2.26 per share in 2022. For the first nine months of the year, we have generated net earnings of $10.45 per share.

- During the quarter, we generated cash from operations of $89 million and repurchased and cancelled US$18 million of 2026 unsecured senior notes.

- As at September 30, 2023, we have reduced total debt by $126 million since the beginning of the year and remain on track to meet our 2023 debt reduction target of $150 million.

- We ended the quarter with $49 million of cash and more than $600 million of available liquidity.

- In Canada, we averaged 57 active rigs in the third quarter, similar to our activity for the same quarter last year. Demand for our Super Triple and Super Single pad-capable fleets continues to exceed supply and we expect these rigs to remain fully utilized well into 2024.

- In the U.S., we averaged 41 active rigs compared to 57 in the third quarter of 2022 due to lower industry activity year over year.

- Internationally, we activated our seventh rig in late September and expect to activate our eighth rig in the next few weeks. In 2024, we expect to have eight rigs working under long-term contracts, increasing our international earnings approximately 50% over 2023.

- Completion and Production Services generated revenue of $58 million and Adjusted EBITDA of $14 million, largely consistent with the third quarter of 2022.

- We expect the acquisition of CWC Energy Service Corp. (CWC) to be completed in the fourth quarter and provide accretive cash flow on a per share basis in 2024.

- In response to increased customer-funded rig upgrades and to facilitate the strategic purchase of certain long-lead items, we have increased our 2023 capital spending budget from $195 million to $215 million.

(1) See “FINANCIAL MEASURES AND RATIOS.”

Precision’s President and CEO, Kevin Neveu, stated:

“Precision’s third quarter financial results and recent customer contracting demonstrate strong demand for our Super Series rigs, AlphaTM technologies, and EverGreenTM products. The North American land drilling market has matured with participants demonstrating capital discipline and operators rewarding the highest performance drilling contractors.

“Our Canadian business continues to showcase this trend. While Canada’s industry activity during the third quarter was 6% lower than the same period last year, utilization of Precision’s Super Triple and Super Single rigs was up year over year, with 29 Super Triples and 32 Super Singles active during the quarter. Despite customer capital discipline and lower industry activity, customer demand for Super-Spec rigs has never been higher and we continue to strengthen our contract book. Since the end of the second quarter, we have added thirteen term contracts with take-or-pay provisions for our Super Triples and customer-funded upgrades for our Super Singles. The outlook for Canada remains encouraging with 67 rigs active today, significant oil and natural gas pipeline takeaway capacity coming online in early 2024, and current customer conversations indicating incremental demand for Super Triple and Super Single drilling programs in 2024.

“In the U.S., our rig count was stable throughout the third quarter, and we currently have 44 rigs active. Customer interest in AlphaTM digital technologies and our EverGreenTM suite of environmental solutions remains strong, with virtually all our U.S. Super Triple rigs utilizing AlphaAutomationTM and 60% generating incremental revenue from EverGreenTM products. With firm oil prices and a new budget cycle, we expect customer outlook to improve and drive more drilling activity later this year and into 2024.

“Internationally, we currently have seven rigs running and expect to activate our eighth rig within the next few weeks. With our additional rig activations this year, we expect our 2024 international earnings to increase by approximately 50% over 2023, and should remain at this higher level for the next several years as our recent contract awards are under five-year terms.

“During the third quarter, our Adjusted EBITDA was $115 million and excluding our share-based compensation of $31 million increased year over year. This increase was driven by our Canadian drilling operations where strong fundamentals continue to support improving returns. Net earnings were $20 million for the quarter and year to date we have delivered earnings of $10.45 on a per share basis.

“Cash generated from operations during the third quarter was $89 million compared to $8 million last year, reflecting the efforts of our team to focus on cash generation. Year to date, we have reduced our total debt by $126 million and returned $13 million to shareholders through share repurchases and are well on track to achieve the targets we set at the beginning of the year. With strong demand for our Super Series rigs, we are increasing our 2023 capital budget by $20 million to support customer-funded rig upgrades and the purchase of certain long-lead items.

“In September, we announced the acquisition of CWC, which will position Precision as the premier well service provider in Canada and bolster our drilling operations in both the U.S. and Canada. We expect to realize $20 million in operational synergies and generate accretive cash flow on a per share basis in 2024.

“I am proud of the discipline Precision continues to show throughout the organization despite short-term industry cyclicality. We remain focused on our strategic priorities, which include delivering operational excellence, maximizing free cash flow, and improving our balance sheet. With a focused strategy and discipline, I am confident Precision will continue to deliver increased shareholder value,” concluded Mr. Neveu.

SELECT FINANCIAL AND OPERATING INFORMATION

| Financial Highlights | | | | | |

| | For the three months ended September 30, | | | For the nine months ended September 30, | |

| (Stated in thousands of Canadian dollars, except per share amounts) | | 2023 | | | | 2022 | | | % Change | | | | 2023 | | | | 2022 | | | % Change | |

| Revenue | | 446,754 | | | | 429,335 | | | | 4.1 | | | | 1,430,983 | | | | 1,106,690 | | | | 29.3 | |

| Adjusted EBITDA(1) | | 114,575 | | | | 119,561 | | | | (4.2 | ) | | | 459,887 | | | | 220,515 | | | | 108.6 | |

| Net earnings (loss) | | 19,792 | | | | 30,679 | | | | (35.5 | ) | | | 142,522 | | | | (37,776 | ) | | | (477.3 | ) |

| Cash provided by operations | | 88,500 | | | | 8,142 | | | | 987.0 | | | | 330,316 | | | | 78,022 | | | | 323.4 | |

| Funds provided by operations(1) | | 91,608 | | | | 81,327 | | | | 12.6 | | | | 388,220 | | | | 171,655 | | | | 126.2 | |

| | | | | | | | | | | | | | | | | | |

| Cash used in investing activities | | 34,278 | | | | 31,711 | | | | 8.1 | | | | 157,157 | | | | 98,836 | | | | 59.0 | |

| Capital spending by spend category(1) | | | | | | | | | | | | | | | | | |

| Expansion and upgrade | | 13,479 | | | | 25,461 | | | | (47.1 | ) | | | 39,439 | | | | 50,606 | | | | (22.1 | ) |

| Maintenance and infrastructure | | 38,914 | | | | 25,642 | | | | 51.8 | | | | 108,463 | | | | 76,335 | | | | 42.1 | |

| Proceeds on sale | | (6,698 | ) | | | (22,337 | ) | | | (70.0 | ) | | | (20,724 | ) | | | (32,033 | ) | | | (35.3 | ) |

| Net capital spending(1) | | 45,695 | | | | 28,766 | | | | 58.9 | | | | 127,178 | | | | 94,908 | | | | 34.0 | |

| | | | | | | | | | | | | | | | | | |

| Net earnings (loss) per share: | | | | | | | | | | | | | | | | | |

| Basic | | 1.45 | | | | 2.26 | | | | (35.8 | ) | | | 10.45 | | | | (2.79 | ) | | | (474.6 | ) |

| Diluted | | 1.45 | | | | 2.03 | | | | (28.6 | ) | | | 9.84 | | | | (2.79 | ) | | | (452.7 | ) |

(1) See “FINANCIAL MEASURES AND RATIOS.”

| Operating Highlights | | | | | |

| | For the three months ended September 30, | | | For the nine months ended September 30, | |

| | 2023 | | | 2022 | | | % Change | | | 2023 | | | 2022 | | | % Change | |

| Contract drilling rig fleet | | 224 | | | | 225 | | | | (0.4 | ) | | | 224 | | | | 225 | | | | (0.4 | ) |

| Drilling rig utilization days: | | | | | | | | | | | | | | | | | |

| U.S. | | 3,815 | | | | 5,287 | | | | (27.8 | ) | | | 13,823 | | | | 14,914 | | | | (7.3 | ) |

| Canada | | 5,284 | | | | 5,432 | | | | (2.7 | ) | | | 15,247 | | | | 14,461 | | | | 5.4 | |

| International | | 554 | | | | 552 | | | | 0.4 | | | | 1,439 | | | | 1,638 | | | | (12.1 | ) |

| Revenue per utilization day: | | | | | | | | | | | | | | | | | |

| U.S. (US$) | | 35,135 | | | | 27,847 | | | | 26.2 | | | | 35,216 | | | | 25,864 | | | | 36.2 | |

| Canada (Cdn$) | | 32,224 | | | | 26,927 | | | | 19.7 | | | | 32,583 | | | | 25,843 | | | | 26.1 | |

| International (US$) | | 51,570 | | | | 50,216 | | | | 2.7 | | | | 51,306 | | | | 51,687 | | | | (0.7 | ) |

| Operating costs per utilization day: | | | | | | | | | | | | | | | | | |

| U.S. (US$) | | 21,655 | | | | 18,220 | | | | 18.9 | | | | 20,217 | | | | 18,484 | | | | 9.4 | |

| Canada (Cdn$) | | 18,311 | | | | 16,893 | | | | 8.4 | | | | 19,239 | | | | 16,803 | | | | 14.5 | |

| | | | | | | | | | | | | | | | | | |

| Service rig fleet | | 121 | | | | 135 | | | | (10.4 | ) | | | 121 | | | | 135 | | | | (10.4 | ) |

| Service rig operating hours | | 46,894 | | | | 52,340 | | | | (10.4 | ) | | | 144,944 | | | | 120,994 | | | | 19.8 | |

| Financial Position | | | | | | |

| (Stated in thousands of Canadian dollars, except ratios) | September 30, 2023 | | | December 31, 2022 | | |

| Working capital(1) | | 177,740 | | | | 60,641 | | |

| Cash | | 49,065 | | | | 21,587 | | |

| Long-term debt | | 963,827 | | | | 1,085,970 | | |

| Total long-term financial liabilities | | 1,054,661 | | | | 1,206,619 | | |

| Total assets | | 2,808,201 | | | | 2,876,123 | | |

| Long-term debt to long-term debt plus equity ratio (1) | | 0.41 | | | | 0.47 | | |

(1) See “FINANCIAL MEASURES AND RATIOS.”

Summary for the three months ended September 30, 2023:

- Revenue of $447 million was 4% higher than 2022 due to the further strengthening of drilling and service revenue rates, partially offset by lower activity. Drilling rig utilization days decreased 28% and 3% in the U.S. and Canada, respectively, while international activity remained consistent. Our service rig operating hours decreased 10% as compared with 2022.

- Adjusted EBITDA was $115 million as compared with $120 million in 2022. Our lower 2023 Adjusted EBITDA was primarily the result of increased share-based compensation charges and lower activity, partially offset by higher revenue rates. Share-based compensation was $31 million as compared with $6 million in 2022. Please refer to “Other Items” later in this news release for additional information on share-based compensation charges.

- Adjusted EBITDA as a percentage of revenue was 26% as compared with 28% in 2022.

- Our U.S. revenue per utilization day was US$35,135 compared with US$27,847 in 2022. The increase was primarily the result of higher fleet average day rates and higher idle but contracted rig revenue. We recognized revenue from idle but contracted rigs of US$6 million as compared with US$1 million in 2022. Consistent with 2022, we did not recognize revenue from turnkey projects during the quarter. Revenue per utilization day, excluding the impact of idle but contracted rigs was US$33,543, compared to US$27,682 in 2022, an increase of US$5,861 or 21%. Revenue per utilization day, excluding idle but contracted rigs, decreased US$1,014 from the second quarter of 2023.

- Our U.S. operating costs per utilization day increased to US$21,655 compared with US$18,220 in 2022. The increase was primarily due to higher rig operating costs, repairs and maintenance and the impact of fixed costs being spread over fewer activity days. Our higher rig operating costs in the current period pertained to field rate increases completed in the fourth quarter of 2022. U.S. operating costs per utilization day, excluding turnkey, was US$21,623 compared with US$18,236 in 2022. Sequentially, excluding the impact of turnkey activity, operating costs per utilization day increased US$2,677. The increase was primarily due to higher repairs and maintenance and the impact of fixed costs being spread over fewer activity days.

- In Canada, revenue per utilization day was $32,224 compared with $26,927 in 2022. The increase was a result of higher average day rates and customer cost recoveries. Sequentially, revenue per utilization day decreased $1,311 due to lower customer cost recoveries.

- Our Canadian operating costs per utilization day increased to $18,311, compared with $16,893 in 2022, due to higher field wages, repairs and maintenance and costs that were recovered from our customers. Sequentially, our daily operating costs decreased $3,021 due to lower repairs and maintenance, customer cost recoveries and operating overheads being spread over a higher activity base.

- Completion and Production Services revenue and Adjusted EBITDA were $58 million and $14 million, respectively, compared with $57 million and $15 million in 2022.

- We realized US$29 million of international contract drilling revenue compared with US$28 million in 2022.

- General and administrative expenses were $44 million as compared with $25 million in 2022. The increase was primarily due to higher share-based compensation charges.

- Net finance charges were $20 million, a decrease of $3 million compared with 2022 and was the result of lower outstanding long-term debt.

- Cash provided by operations was $89 million compared with $8 million in 2022. We generated $92 million of funds provided by operations compared with $81 million in 2022. Our increased day rates, revenue efficiency and operational leverage continued to drive higher cash generation in the current quarter.

- Capital expenditures were $52 million compared with $51 million in 2022. Capital spending by spend category (see “FINANCIAL MEASURES AND RATIOS”) included $13 million for expansion and upgrades and $39 million for the maintenance of existing assets, infrastructure, and intangible assets.

- We repaid $26 million of debt, repurchasing and cancelling US$18 million of 2026 unsecured senior notes, and ended the quarter with $49 million of cash and more than $600 million of available liquidity.

Summary for the nine months ended September 30, 2023:

- Revenue for the first nine months of 2023 was $1,431 million, an increase of 29% from 2022.

- Adjusted EBITDA was $460 million as compared with $221 million in 2022. Our higher Adjusted EBITDA was attributable to increased revenue rates, higher Canadian drilling and service activity and lower share-based compensation, partially offset by lower U.S. and international drilling activity.

- General and administrative costs were $83 million, a decrease of $19 million from 2022 primarily due to lower share-based compensation, partially offset by higher labour-related costs and the impact of the weakening Canadian dollar on our translated U.S. dollar-denominated costs.

- Net finance charges were $64 million, consistent with 2022, as the impact of our lower debt balance was offset by higher variable debt interest rates and higher translated U.S. dollar-denominated interest expense due to the weakening of the Canadian dollar.

- Cash provided by operations was $330 million as compared with $78 million in 2022. Funds provided by operations in 2023 were $388 million, an increase of $217 million from the comparative period.

- Capital expenditures were $148 million in 2023, an increase of $21 million from 2022. Capital spending by spend category included $39 million for expansion and upgrades and $108 million for the maintenance of existing assets, infrastructure, and intangible assets.

- Year to date, we have reduced our total debt by $126 million through the full repayment of our Senior Credit Facility and the repurchase and cancellation of US$48 million of our 2026 unsecured senior notes. In addition, we repurchased and cancelled 193,616 common shares for $13 million under our Normal Course Issuer Bid (NCIB).

STRATEGY

Precision’s vision is to be globally recognized as the High Performance, High Value provider of land drilling services. We work toward this vision by defining and measuring our results against strategic priorities that we establish at the beginning of every year.

Precision’s 2023 strategic priorities and the progress made during the third quarter and year to date are as follows:

- Deliver High Performance, High Value service through operational excellence.

- Year to date, we have increased our Canadian drilling rig utilization days and well servicing rig operating hours, maintaining our position as the leading provider of high-quality and reliable services in Canada.

- Activated our seventh rig in the Middle East and expect to have an eighth rig working in the next few weeks. These eight rigs represent over US$500 million in backlog revenue that stretches into 2028.

- Announced the acquisition of CWC, expanding our Canadian well servicing business and our drilling fleets in both the U.S. and Canada. The proposed transaction is expected to provide approximately $20 million in annual synergies and be accretive on a 2024 cash flow per share basis.

- Reinvested $148 million year to date into our equipment and infrastructure as we progress toward our total expected 2023 investment of $215 million.

- Maximize free cash flow by increasing Adjusted EBITDA margins, revenue efficiency, and growing revenue from Alpha™ technologies and EverGreen™ suite of environmental solutions.

- Realized third quarter daily operating margins (revenue per utilization day less operating costs per utilization day) of $13,913 in Canada and US$13,480 in the U.S., representing increases of 39% and 40%, respectively, compared with the third quarter of 2022.

- Grew combined Alpha™ technologies and EverGreen™ suite of environmental solutions third quarter revenue by 30% compared with the same quarter last year.

- At September 30, we had 74 of our AC Super Triple rigs equipped with Alpha™ technologies, representing a 19% increase over the third quarter of 2022.

- Continued to scale our EverGreen™ suite of environmental solutions. Approximately 75% of our Super Triple fleet is equipped with at least one EverGreen™ product, including 11 field deployed EverGreen™ Battery Energy Storage Systems (BESS).

- Reduce debt by at least $150 million and allocate 10% to 20% of free cash flow before debt repayments for share repurchases. Long-term debt reduction target of $500 million between 2022 and 2025 and sustained Net Debt to Adjusted EBITDA ratio(1) of below 1.0 times by the end of 2025.

- Generated significant third quarter cash from operations of $89 million which allowed us to repurchase and cancel US$18 million of 2026 unsecured senior notes.

- As of September 30, 2023, we have reduced debt by $126 million and remain committed to reducing debt by at least $150 million in 2023.

- We have allocated $13 million of free cash flow to share repurchases for the first nine months of the year and in September we renewed our NCIB for an additional year as we believe it continues to be another tool to enhance shareholder value.

- We remain committed to our long-term debt reduction target and reaching a sustained Net Debt to Adjusted EBITDA ratio of below 1.0 times by the end of 2025.

(1) See “FINANCIAL MEASURES AND RATIO.”

OUTLOOK

Energy industry fundamentals continue to support drilling activity for oil and natural gas despite economic uncertainty and geopolitical instability. During the third quarter, persistent challenges and stresses from interest rate hikes and recessionary risks began to weaken, and commodity prices moved higher. While the recent conflict in the Middle East has had little direct impact on global oil and natural gas supply, an escalation of events and involvement from additional regional powers could disrupt supply in the world’s top oil producing region.

Today, oil prices are supported by increasing global demand and limited supply growth as OPEC continues to honour its lower production quotas and producers remain committed to returning capital to shareholders versus increasing production. Natural gas has demonstrated short-term price weaknesses; however, this lower-carbon energy source is becoming increasingly favored as countries around the world stress the importance of sustainability, decarbonization and energy security. With demand for Liquefied Natural Gas (LNG) exports grog and the next wave of North American LNG projects expected to begin coming online in 2025 (including LNG Canada), we anticipate a sustained period of elevated natural gas drilling activity in both the U.S. and Canada.

In Canada, Precision’s year to date drilling activity has surpassed 2022 levels and we expect high activity levels to continue into 2024, due to strong oil prices and increases in hydrocarbon export capacity. The Trans Mountain oil pipeline expansion and the Coastal GasLink pipeline are each expected to begin operations in the first quarter of 2024. Northwestern Alberta and Northeastern British Columbia natural gas developments are prime beneficiaries of the LNG Canada project and the January 2023 agreement between the Government of British Columbia and the Blueberry River First Nation, which has facilitated a significant increase in drilling license approvals and should lead to more drilling activity in the region. Large pad drilling programs are ideally suited for our Super Triple rigs, resulting in strong customer interest for these rigs for the next several years. Our Super Triple fleet is currently fully utilized and we expect customer demand to continue to exceed supply, driving higher day rates, daily operating margins and longer-term take-or-pay contracts. We are currently upgrading one of our Canadian rigs and expect to add it to our Super Triple Canadian fleet in January 2024 on a three-year term contract, bringing our fleet size to 30.

In the Canadian heavy oil market, we expect activity levels to remain strong as Canadian producers are benefiting from favorable oil pricing due to a weaker Canadian dollar exchange rate and improving heavy oil differentials. Precision’s Super Single rigs are well suited for long-term conventional heavy oil development in the oil sands and Clearwater formation. We expect our Super Single pad-capable rigs to be fully utilized well into 2024, driving higher day rates.

In the U.S., drilling activity had been increasing since mid-2020 but began to weaken in early 2023 due to lower natural gas prices and oil price volatility. As at October 25, 2023, the Baker Hughes’ active U.S. land rig count declined 21% from the start of the year. If oil prices remain stable and around today’s level, we expect demand to improve late in the fourth quarter and gain momentum in 2024 as customers embark on a new budget cycle and seek to maintain or possibly increase production levels and replenish inventories.

Our Alpha™ technologies and EverGreen™ suite of environmental solutions continue to gain momentum and have become key competitive differentiators for our rigs as these offerings deliver exceptional value to our customers by reducing risks, well construction costs and carbon footprint. We currently have 11 EverGreen™ BESS deployed in the field and have commitments for two additional deployments by year end. Precision’s EverGreen™ BESS have proven to be an economically viable emissions reduction solution for our customers and we anticipate continued demand for additional deployments in 2024.

Internationally, we currently have seven rigs working on term contracts, four in Kuwait and three in the Kingdom of Saudi Arabia, increasing to eight in the next few weeks. In 2024, our international earnings are expected to increase approximately 50% over 2023 levels and provide stable and predictable cash flow that stretches into 2028. We continue to bid our remaining idle rigs within the region and remain optimistic about our ability to secure rig reactivations.

Precision is the leading provider of high-quality and reliable well services in Canada and the outlook for this business is positive. High customer demand for well maintenance and completion services is expected to add tightness to the availability of staffed service rigs, supporting healthy activity and pricing into the foreseeable future. In September, Precision announced the acquisition of CWC, which will allow us to enhance our Canadian well service offering with high-quality rigs in complementary geographic regions. The acquisition is expected to close in the fourth quarter of 2023 and provide accretive cash flow on a per share basis in 2024.

Contracts

The following chart outlines the average number of drilling rigs under term contract by quarter as at October 25, 2023. For those quarters ending after September 30, 2023, this chart represents the minimum number of term contracts from which we will earn revenue. We expect the actual number of contracted rigs to vary in future periods as we sign additional term contracts.

| | | Average for the quarter ended 2022 | | | Average for the quarter ended 2023 | |

| | | Mar. 31 | | | June 30 | | | Sept. 30 | | | Dec. 31 | | | Mar. 31 | | | June 30 | | | Sept. 30 | | | Dec. 31 | |

Average rigs under term contract

as of October 25, 2023: | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. | | | 27 | | | | 29 | | | | 31 | | | | 35 | | | | 40 | | | | 37 | | | | 32 | | | | 28 | |

| Canada | | | 6 | | | | 8 | | | | 10 | | | | 16 | | | | 19 | | | | 23 | | | | 23 | | | | 21 | |

| International | | | 6 | | | | 6 | | | | 6 | | | | 6 | | | | 4 | | | | 5 | | | | 7 | | | | 8 | |

| Total | | | 39 | | | | 43 | | | | 47 | | | | 57 | | | | 63 | | | | 65 | | | | 62 | | | | 57 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The following chart outlines the average number of drilling rigs that we had under term contract for 2022 and the average number of rigs we have under term contract as at October 25, 2023.

| | | Average for the year ended | | | |

| | | 2022 | | | 2023 | | | |

Average rigs under term contract

as of October 25, 2023: | | | | | | | | |

| U.S. | | | 31 | | | | 34 | | | |

| Canada | | | 10 | | | | 22 | | | |

| International | | | 6 | | | | 6 | | | |

| Total | | | 47 | | | | 62 | | | |

| | | | | | | | | | | |

In Canada, term contracted rigs normally generate 250 utilization days per year because of the seasonal nature of well site access. Accordingly, our anticipated Canadian rigs under term contract may fluctuate as customers complete their commitments earlier than projected. In most regions in the U.S. and internationally, term contracts normally generate 365 utilization days per year. Internationally, we expect to have eight rigs operating under long-term contract by the end of 2023.

Drilling Activity

The following chart outlines the average number of drilling rigs that we had working or moving by quarter for the periods noted.

| | Average for the quarter ended 2022 | Average for the quarter ended 2023 |

| | Mar. 31 | | | June 30 | | | Sept. 30 | | | Dec. 31 | | | Mar. 31 | | | June 30 | | | Sept. 30 | |

| Average Precision active rig count: | | | | | | | | | | | | | | | | | | | | |

| U.S. | | 51 | | | | 55 | | | | 57 | | | | 60 | | | | 60 | | | | 51 | | | | 41 | |

| Canada | | 63 | | | | 37 | | | | 59 | | | | 66 | | | | 69 | | | | 42 | | | | 57 | |

| International | | 6 | | | | 6 | | | | 6 | | | | 6 | | | | 5 | | | | 5 | | | | 6 | |

| Total | | 120 | | | | 98 | | | | 122 | | | | 132 | | | | 134 | | | | 98 | | | | 104 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

According to industry sources, as at October 25, 2023, the U.S. active land drilling rig count has decreased 21% from the same point last year while the Canadian active land drilling rig count has decreased 6%. To date in 2023, approximately 79% of the U.S. industry’s active rigs and 59% of the Canadian industry’s active rigs were drilling for oil targets, compared with 79% for the U.S. and 63% for Canada at the same time last year.

Capital Spending and Free Cash Flow Allocation

We remain committed to disciplined cash flow management, capital spending and returning capital to shareholders. In response to increased customer contracted rig upgrades and to facilitate the strategic purchase of certain long-lead items, capital spending in 2023 is expected to increase by $20 million to $215 million. By spend category, we expect to incur $155 million for sustaining, infrastructure and intangibles and $60 million for expansion and upgrades. We expect that the $215 million will be split as follows: $201 million in the Contract Drilling Services segment, $11 million in the Completion and Production Services segment, and $3 million in the Corporate segment. As at September 30, 2023, Precision had capital commitments of approximately $229 million with payments expected through 2026.

SEGMENTED FINANCIAL RESULTS

Precision’s operations are reported in two segments: Contract Drilling Services, which includes our drilling rig, oilfield supply and manufacturing divisions; and Completion and Production Services, which includes our service rig, rental and camp and catering divisions.

| | For the three months ended September 30, | | | For the nine months ended September 30, | |

| (Stated in thousands of Canadian dollars) | | 2023 | | | 2022 | | | % Change | | | | 2023 | | | 2022 | | | % Change | |

| Revenue: | | | | | | | | | | | | | | | | | |

| Contract Drilling Services | | 390,728 | | | | 374,465 | | | | 4.3 | | | | 1,257,762 | | | | 982,909 | | | | 28.0 | |

| Completion and Production Services | | 57,573 | | | | 56,642 | | | | 1.6 | | | | 178,257 | | | | 127,921 | | | | 39.3 | |

| Inter-segment eliminations | | (1,547 | ) | | | (1,772 | ) | | | (12.7 | ) | | | (5,036 | ) | | | (4,140 | ) | | | 21.6 | |

| | | 446,754 | | | | 429,335 | | | | 4.1 | | | | 1,430,983 | | | | 1,106,690 | | | | 29.3 | |

| Adjusted EBITDA:(1) | | | | | | | | | | | | | | | | | |

| Contract Drilling Services | | 131,701 | | | | 118,599 | | | | 11.0 | | | | 468,302 | | | | 260,202 | | | | 80.0 | |

| Completion and Production Services | | 14,118 | | | | 14,788 | | | | (4.5 | ) | | | 39,031 | | | | 26,166 | | | | 49.2 | |

| Corporate and Other | | (31,244 | ) | | | (13,826 | ) | | | 126.0 | | | | (47,446 | ) | | | (65,853 | ) | | | (28.0 | ) |

| | | 114,575 | | | | 119,561 | | | | (4.2 | ) | | | 459,887 | | | | 220,515 | | | | 108.6 | |

(1) See “FINANCIAL MEASURES AND RATIOS.”

SEGMENT REVIEW OF CONTRACT DRILLING SERVICES

| | For the three months ended September 30, | | | For the nine months ended September 30, | |

| (Stated in thousands of Canadian dollars, except where noted) | | 2023 | | | | 2022 | | | % Change | | | | 2023 | | | | 2022 | | | % Change | |

| Revenue | | 390,728 | | | | 374,465 | | | | 4.3 | | | | 1,257,762 | | | | 982,909 | | | | 28.0 | |

| Expenses: | | | | | | | | | | | | | | | | | |

| Operating | | 247,937 | | | | 246,442 | | | | 0.6 | | | | 759,750 | | | | 692,169 | | | | 9.8 | |

| General and administrative | | 11,090 | | | | 9,424 | | | | 17.7 | | | | 29,710 | | | | 30,538 | | | | (2.7 | ) |

| Adjusted EBITDA(1) | | 131,701 | | | | 118,599 | | | | 11.0 | | | | 468,302 | | | | 260,202 | | | | 80.0 | |

| Adjusted EBITDA as a percentage of revenue(1) | | 33.7 | % | | | 31.7 | % | | | | | | 37.2 | % | | | 26.5 | % | | | |

(1) See “FINANCIAL MEASURES AND RATIOS.”

| United States onshore drilling statistics:(1) | 2023 | | | 2022 | | |

| | Precision | | | Industry(2) | | | Precision | | | Industry(2) | | |

| Average number of active land rigs for quarters ended: | | | | | | | | | | | | |

| March 31 | | 60 | | | | 744 | | | | 51 | | | | 603 | | |

| June 30 | | 51 | | | | 700 | | | | 55 | | | | 687 | | |

| September 30 | | 41 | | | | 631 | | | | 57 | | | | 746 | | |

| Year to date average | | 51 | | | | 692 | | | | 54 | | | | 679 | | |

(1) United States lower 48 operations only.

(2) Baker Hughes rig counts.

| Canadian onshore drilling statistics:(1) | 2023 | | | 2022 | | |

| | Precision | | | Industry(2) | | | Precision | | | Industry(2) | | |

| Average number of active land rigs for quarters ended: | | | | | | | | | | | | |

| March 31 | | 69 | | | | 221 | | | | 63 | | | | 205 | | |

| June 30 | | 42 | | | | 117 | | | | 37 | | | | 113 | | |

| September 30 | | 57 | | | | 188 | | | | 59 | | | | 199 | | |

| Year to date average | | 56 | | | | 175 | | | | 53 | | | | 172 | | |

(1) Canadian operations only.

(2) Baker Hughes rig counts.

SEGMENT REVIEW OF COMPLETION AND PRODUCTION SERVICES

| | For the three months ended September 30, | | | For the nine months ended September 30, | |

| (Stated in thousands of Canadian dollars, except where noted) | | 2023 | | | | 2022 | | | % Change | | | | 2023 | | | | 2022 | | | | |

| Revenue | | 57,573 | | | | 56,642 | | | | 1.6 | | | | 178,257 | | | | 127,921 | | | | 39.3 | |

| Expenses: | | | | | | | | | | | | | | | | | |

| Operating | | 41,612 | | | | 40,198 | | | | 3.5 | | | | 133,325 | | | | 96,365 | | | | 38.4 | |

| General and administrative | | 1,843 | | | | 1,656 | | | | 11.3 | | | | 5,901 | | | | 5,390 | | | | 9.5 | |

| Adjusted EBITDA(1) | | 14,118 | | | | 14,788 | | | | (4.5 | ) | | | 39,031 | | | | 26,166 | | | | 49.2 | |

| Adjusted EBITDA as a percentage of revenue(1) | | 24.5 | % | | | 26.1 | % | | | | | | 21.9 | % | | | 20.5 | % | | | |

| Well servicing statistics: | | | | | | | | | | | | | | | | | |

| Number of service rigs (end of period) | | 121 | | | | 135 | | | | (10.4 | ) | | | 121 | | | | 135 | | | | (10.4 | ) |

| Service rig operating hours | | 46,894 | | | | 52,340 | | | | (10.4 | ) | | | 144,944 | | | | 120,994 | | | | 19.8 | |

| Service rig operating hour utilization | | 42 | % | | | 47 | % | | | | | | 44 | % | | | 43 | % | | | |

(1) See “FINANCIAL MEASURES AND RATIOS.”

SEGMENT REVIEW OF CORPORATE AND OTHER

Our Corporate and Other segment provides support functions to our operating segments. The Corporate and Other segment had negative Adjusted EBITDA of $31 million as compared with $14 million in 2022. Our higher current quarter Adjusted EBITDA was impacted by higher share-based compensation charges and higher translated U.S. dollar-denominated costs.

OTHER ITEMS

Share-based Incentive Compensation Plans

We have several cash and equity-settled share-based incentive plans for non-management directors, officers, and other eligible employees. Our accounting policies for each share-based incentive plan can be found in our 2022 Annual Report.

A summary of expense amounts under these plans during the reporting periods are as follows:

| | For the three months ended

September 30, | | | For the nine months ended

September 30, | |

| (Stated in thousands of Canadian dollars) | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| Cash settled share-based incentive plans | | 30,105 | | | | 5,543 | | | | 20,091 | | | | 57,802 | |

| Equity settled share-based incentive plans | | 701 | | | | — | | | | 1,834 | | | | 427 | |

| Total share-based incentive compensation plan expense | | 30,806 | | | | 5,543 | | | | 21,925 | | | | 58,229 | |

| | | | | | | | | | | | |

| Allocated: | | | | | | | | | | | |

| Operating | | 7,692 | | | | 1,922 | | | | 6,732 | | | | 14,694 | |

| General and Administrative | | 23,114 | | | | 3,621 | | | | 15,193 | | | | 43,535 | |

| | | 30,806 | | | | 5,543 | | | | 21,925 | | | | 58,229 | |

| | | | | | | | | | | | | | | | |

Cash settled share-based compensation expense for the quarter was $30 million as compared with $6 million in 2022. The higher expense in 2023 was primarily due to our improved share price performance as compared with 2022.

During the first quarter of 2023, we issued Executive Restricted Share Units (Executive RSUs) to certain senior executives. Accordingly, our equity-settled share-based compensation expense for the quarter was $1 million as compared with nil in 2022.

As at September 30, 2023, the majority of our share-based compensation plans were classified as cash-settled and will be impacted by changes in our share price. Although accounted for as cash-settled, Precision retains the ability to settle certain vested units in common shares at its discretion.

Finance Charges

Net finance charges were $20 million, a decrease of $3 million compared with 2022 and the result of lower outstanding long-term debt. Interest charges on our U.S. dollar-denominated long-term debt were US$13 million ($17 million) as compared with US$16 million ($20 million) in 2022.

Income Tax

Income tax expense for the quarter was $8 million as compared with $6 million in 2022. During the third quarter, we continued to not recognize deferred tax assets on certain Canadian and international operating losses.

Normal Course Issuer Bid

During the quarter, the Toronto Stock Exchange (TSX) approved the renewal of our Normal Course Issuer Bid. Pursuant to the NCIB, we are authorized to repurchase and cancel up to a maximum of 1,326,321 common shares. Purchases under the renewed NCIB may commence on September 19, 2023 and will terminate no later than September 18, 2024, or such earlier time as we complete our maximum purchases pursuant to the NCIB or provide notice of termination.

Cathedral Energy Services Ltd.

During the third quarter of 2023, we exercised 2 million warrants for $1 million in exchange for 2 million common shares of Cathedral Energy Services Ltd. (Cathedral). In addition, we divested 11 million common shares of Cathedral for net proceeds of $10 million.

LIQUIDITY AND CAPITAL RESOURCES

Liquidity

| Amount | | Availability | | Used for | | Maturity |

| Senior Credit Facility (secured) | | | | | | |

US$447 million (extendible, revolving

term credit facility with US$353 million accordion feature) | | Nil drawn and US$55 million in

outstanding letters of credit | | General corporate purposes | | June 18, 2025 |

| Real estate credit facilities (secured) | | | | | | |

| US$9 million | | Fully drawn | | General corporate purposes | | November 19, 2025 |

| $17 million | | Fully drawn | | General corporate purposes | | March 16, 2026 |

| Operating facilities (secured) | | | | | | |

| $40 million | | Undrawn, except $20 million in

outstanding letters of credit | | Letters of credit and general

corporate purposes | | |

| US$15 million | | Undrawn | | Short-term working capital

requirements | | |

| Demand letter of credit facility (secured) | | | | | | |

| US$40 million | | Undrawn, except US$21 million in

outstanding letters of credit | | Letters of credit | | |

| Unsecured senior notes (unsecured) | | | | | | |

| US$299 million – 7.125% | | Fully drawn | | Debt redemption and repurchases | | January 15, 2026 |

| US$400 million – 6.875% | | Fully drawn | | Debt redemption and repurchases | | January 15, 2029 |

| | | | | | | |

As at September 30, 2023, we had $978 million outstanding under our Senior Credit Facility, Real Estate Credit Facilities and unsecured senior notes as compared with $1,103 million at December 31, 2022. The current blended cash interest cost of our debt is approximately 7.0%.

During the quarter, we repurchased and cancelled US$18 million principal amount of our 2026 unsecured senior notes.

Covenants

As at September 30, 2023, we were in compliance with the covenants of our Senior Credit Facility and Real Estate Credit Facilities.

| | Covenant | | At September 30,

2023 | | |

| Senior Credit Facility | | | | | |

| Consolidated senior debt to consolidated covenant EBITDA(1) | < 2.50 | | | 0.05 | | |

| Consolidated covenant EBITDA to consolidated interest expense | > 2.50 | | | 6.74 | | |

| Real Estate Credit Facilities | | | | | |

| Consolidated covenant EBITDA to consolidated interest expense | > 2.50 | | | 6.74 | | |

(1) For purposes of calculating the leverage ratio consolidated senior debt only includes secured indebtedness.

Average shares outstanding

The following tables reconcile net earnings (loss) and the weighted average shares outstanding used in computing basic and diluted net earnings (loss) per share:

| | For the three months ended

September 30, | | | For the nine months ended

September 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| Net earnings (loss) – basic | | 19,792 | | | | 30,679 | | | | 142,522 | | | | (37,776 | ) |

Effect of share options and other

equity compensation plans | | — | | | | (94 | ) | | | 3,679 | | | | — | |

| Net earnings (loss) – diluted | | 19,792 | | | | 30,585 | | | | 146,201 | | | | (37,776 | ) |

| | For the three months ended

September 30, | | | For the nine months ended

September 30, | |

| (Stated in thousands) | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| Weighted average shares outstanding – basic | | 13,607 | | | | 13,580 | | | | 13,643 | | | | 13,549 | |

Effect of share options and

other equity compensation plans | | 3 | | | | 1,464 | | | | 1,215 | | | | — | |

| Weighted average shares outstanding – diluted | | 13,610 | | | | 15,044 | | | | 14,858 | | | | 13,549 | |

| | | | | | | | | | | | | | | | |

QUARTERLY FINANCIAL SUMMARY

| (Stated in thousands of Canadian dollars, except per share amounts) | | | 2022 | | | 2023 | |

| Quarters ended | | December 31 | | | March 31 | | | June 30 | | | September 30 | |

| Revenue | | | 510,504 | | | | 558,607 | | | | 425,622 | | | | 446,754 | |

| Adjusted EBITDA(1) | | | 91,090 | | | | 203,219 | | | | 142,093 | | | | 114,575 | |

| Net earnings | | | 3,483 | | | | 95,830 | | | | 26,900 | | | | 19,792 | |

| Net earnings per basic share | | | 0.27 | | | | 7.02 | | | | 1.97 | | | | 1.45 | |

| Net earnings per diluted share | | | 0.27 | | | | 5.57 | | | | 1.63 | | | | 1.45 | |

| Funds provided by operations(1) | | | 111,339 | | | | 159,653 | | | | 136,959 | | | | 91,608 | |

| Cash provided by operations | | | 159,082 | | | | 28,356 | | | | 213,460 | | | | 88,500 | |

| (Stated in thousands of Canadian dollars, except per share amounts) | | | 2021 | | | 2022 | |

| Quarters ended | | December 31 | | | March 31 | | | June 30 | | | September 30 | |

| Revenue | | | 295,202 | | | | 351,339 | | | | 326,016 | | | | 429,335 | |

| Adjusted EBITDA(1) | | | 63,881 | | | | 36,855 | | | | 64,099 | | | | 119,561 | |

| Net earnings (loss) | | | (27,336 | ) | | | (43,844 | ) | | | (24,611 | ) | | | 30,679 | |

| Net earnings (loss) per basic share | | | (2.05 | ) | | | (3.25 | ) | | | (1.81 | ) | | | 2.26 | |

| Net earnings (loss) per diluted share | | | (2.05 | ) | | | (3.25 | ) | | | (1.81 | ) | | | 2.03 | |

| Funds provided by operations(1) | | | 62,681 | | | | 29,955 | | | | 60,373 | | | | 81,327 | |

| Cash provided by (used in) operations | | | 59,713 | | | | (65,294 | ) | | | 135,174 | | | | 8,142 | |

(1) See “FINANCIAL MEASURES AND RATIOS.”

FINANCIAL MEASURES AND RATIOS

| Non-GAAP Financial Measures |

| |

| We reference certain additional Non-Generally Accepted Accounting Principles (Non-GAAP) measures that are not defined terms under IFRS to assess performance because we believe they provide useful supplemental information to investors. |

| |

| Adjusted EBITDA | We believe Adjusted EBITDA (earnings before income taxes, loss (gain) on investments and other assets, gain on repurchase of unsecured senior notes, finance charges, foreign exchange, gain on asset disposals and depreciation and amortization), as reported in our Condensed Interim Consolidated Statements of Net Earnings (Loss) and our reportable operating segment disclosures, is a useful measure because it gives an indication of the results from our principal business activities prior to consideration of how our activities are financed and the impact of foreign exchange, taxation and depreciation and amortization charges.

The most directly comparable financial measure is net earnings (loss). |

| | For the three months ended

September 30, | | | For the nine months ended

September 30, | |

| (Stated in thousands of Canadian dollars) | | 2023 | | | | 2022 | | | | 2023 | | | | 2022 | |

| Adjusted EBITDA by segment: | | | | | | | | | | | |

| Contract Drilling Services | | 131,701 | | | | 118,599 | | | | 468,302 | | | | 260,202 | |

| Completion and Production Services | | 14,118 | | | | 14,788 | | | | 39,031 | | | | 26,166 | |

| Corporate and Other | | (31,244 | ) | | | (13,826 | ) | | | (47,446 | ) | | | (65,853 | ) |

| Adjusted EBITDA | | 114,575 | | | | 119,561 | | | | 459,887 | | | | 220,515 | |

| Depreciation and amortization | | 73,192 | | | | 69,448 | | | | 218,823 | | | | 207,662 | |

| Gain on asset disposals | | (2,438 | ) | | | (8,238 | ) | | | (15,586 | ) | | | (22,152 | ) |

| Foreign exchange | | 363 | | | | 1,344 | | | | (894 | ) | | | 1,362 | |

| Finance charges | | 19,618 | | | | 22,521 | | | | 63,946 | | | | 64,294 | |

| Gain on repurchase of unsecured notes | | (37 | ) | | | — | | | | (137 | ) | | | — | |

| Loss (gain) on investments and other assets | | (3,813 | ) | | | (2,515 | ) | | | 6,075 | | | | (3,738 | ) |

| Incomes taxes | | 7,898 | | | | 6,322 | | | | 45,138 | | | | 10,863 | |

| Net earnings (loss) | | 19,792 | | | | 30,679 | | | | 142,522 | | | | (37,776 | ) |

Funds Provided by

(Used in) Operations | We believe funds provided by (used in) operations, as reported in our Condensed Interim Consolidated Statements of Cash Flows, is a useful measure because it provides an indication of the funds our principal business activities generate prior to consideration of working capital changes, which is primarily made up of highly liquid balances.

The most directly comparable financial measure is cash provided by (used in) operations. |

| | |

| Net Capital Spending | We believe net capital spending is a useful measure as it provides an indication of our primary investment activities.

The most directly comparable financial measure is cash provided by (used in) investing activities.

Net capital spending is calculated as follows: |

| | | For the three months ended

September 30, | | | For the nine months ended

September 30, | |

| (Stated in thousands of Canadian dollars) | | | 2023 | | | | 2022 | | | | 2023 | | | | 2022 | |

| Capital spending by spend category | | | | | | | | | | | | |

| Expansion and upgrade | | | 13,479 | | | | 25,461 | | | | 39,439 | | | | 50,606 | |

| Maintenance, infrastructure and intangibles | | | 38,914 | | | | 25,642 | | | | 108,463 | | | | 76,335 | |

| | | | 52,393 | | | | 51,103 | | | | 147,902 | | | | 126,941 | |

| Proceeds on sale of property, plant and equipment | | | (6,698 | ) | | | (22,337 | ) | | | (20,724 | ) | | | (32,033 | ) |

| Net capital spending | | | 45,695 | | | | 28,766 | | | | 127,178 | | | | 94,908 | |

| Business acquisitions | | | — | | | | 10,200 | | | | 28,000 | | | | 10,200 | |

| Proceeds from sale of investments and other assets | | | (10,013 | ) | | | — | | | | (10,013 | ) | | | — | |

| Purchase of investments and other assets | | | 3,211 | | | | 73 | | | | 5,282 | | | | 609 | |

| Receipt of finance lease payments | | | (64 | ) | | | — | | | | (64 | ) | | | — | |

| Changes in non-cash working capital balances | | | (4,551 | ) | | | (7,328 | ) | | | 6,774 | | | | (6,881 | ) |

| Cash used in investing activities | | | 34,278 | | | | 31,711 | | | | 157,157 | | | | 98,836 | |

| Working Capital | We define working capital as current assets less current liabilities, as reported in our Condensed Interim Consolidated Statements of Financial Position.

Working capital is calculated as follows: |

| | September 30, | | | December 31, | |

| (Stated in thousands of Canadian dollars) | | 2023 | | | | 2022 | |

| Current assets | | 477,396 | | | | 470,670 | |

| Current liabilities | | 299,656 | | | | 410,029 | |

| Working capital | | 177,740 | | | | 60,641 | |

| Non-GAAP Ratios |

| |

| We reference certain additional Non-GAAP ratios that are not defined terms under IFRS to assess performance because we believe they provide useful supplemental information to investors. |

| |

Adjusted EBITDA %

of Revenue | We believe Adjusted EBITDA as a percentage of consolidated revenue, as reported in our Condensed Interim Consolidated Statements of Net Earnings (Loss), provides an indication of our profitability from our principal business activities prior to consideration of how our activities are financed and the impact of foreign exchange, taxation and depreciation and amortization charges. |

| | |

Long-term debt to

long-term debt plus

equity | We believe that long-term debt (as reported in our Condensed Interim Consolidated Statements of Financial Position) to long-term debt plus equity (total shareholders’ equity as reported in our Condensed Interim Consolidated Statements of Financial Position) provides an indication of our debt leverage. |

| | |

Net Debt to

Adjusted EBITDA | We believe that the Net Debt (long-term debt less cash, as reported in our Condensed Interim Consolidated Statements of Financial Position) to Adjusted EBITDA ratio provides an indication of the number of years it would take for us to repay our debt obligations. |

| | |

| Supplementary Financial Measures |

| |

| We reference certain supplementary financial measures that are not defined terms under IFRS to assess performance because we believe they provide useful supplemental information to investors. |

| |

Capital Spending by

Spend Category | We provide additional disclosure to better depict the nature of our capital spending. Our capital spending is categorized as expansion and upgrade, maintenance and infrastructure, or intangibles. |

| | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION AND STATEMENTS

Certain statements contained in this release, including statements that contain words such as “could”, “should”, “can”, “anticipate”, “estimate”, “intend”, “plan”, “expect”, “believe”, “will”, “may", “continue”, “project”, “potential” and similar expressions and statements relating to matters that are not historical facts constitute “forward-looking information" within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking information and statements”).

In particular, forward-looking information and statements include, but are not limited to, the following:

- our strategic priorities for 2023;

- our capital expenditures, free cash flow allocation and debt reduction plan for 2023;

- anticipated activity levels, demand for our drilling rigs, day rates and daily operating margins in 2023;

- the average number of term contracts in place for 2023;

- customer adoption of Alpha™ technologies and EverGreen™ suite of environmental solutions;

- timing and amount of accretive cash flow from acquired drilling and well servicing assets;

- potential commercial opportunities and rig contract renewals; and

- our future debt reduction plans.

These forward-looking information and statements are based on certain assumptions and analysis made by Precision in light of our experience and our perception of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances. These include, among other things:

- our ability to react to customer spending plans as a result of changes in oil and natural gas prices;

- the status of current negotiations with our customers and vendors;

- customer focus on safety performance;

- existing term contracts are neither renewed nor terminated prematurely;

- our ability to deliver rigs to customers on a timely basis;

- the impact of an increase/decrease in capital spending; and

- the general stability of the economic and political environments in the jurisdictions where we operate.

Undue reliance should not be placed on forward-looking information and statements. Whether actual results, performance or achievements will conform to our expectations and predictions is subject to a number of known and unknown risks and uncertainties which could cause actual results to differ materially from our expectations. Such risks and uncertainties include, but are not limited to:

- volatility in the price and demand for oil and natural gas;

- fluctuations in the level of oil and natural gas exploration and development activities;

- fluctuations in the demand for contract drilling, well servicing and ancillary oilfield services;

- our customers’ inability to obtain adequate credit or financing to support their drilling and production activity;

- changes in drilling and well servicing technology, which could reduce demand for certain rigs or put us at a competitive advantage;

- shortages, delays and interruptions in the delivery of equipment supplies and other key inputs;

- liquidity of the capital markets to fund customer drilling programs;

- availability of cash flow, debt and equity sources to fund our capital and operating requirements, as needed;

- the impact of weather and seasonal conditions on operations and facilities;

- competitive operating risks inherent in contract drilling, well servicing and ancillary oilfield services;

- ability to improve our rig technology to improve drilling efficiency;

- general economic, market or business conditions;

- the availability of qualified personnel and management;

- a decline in our safety performance which could result in lower demand for our services;

- changes in laws or regulations, including changes in environmental laws and regulations such as increased regulation of hydraulic fracturing or restrictions on the burning of fossil fuels and greenhouse gas emissions, which could have an adverse impact on the demand for oil and natural gas;

- terrorism, social, civil and political unrest in the foreign jurisdictions where we operate;

- fluctuations in foreign exchange, interest rates and tax rates; and

- other unforeseen conditions which could impact the use of services supplied by Precision and Precision’s ability to respond to such conditions.

Readers are cautioned that the forgoing list of risk factors is not exhaustive. Additional information on these and other factors that could affect our business, operations or financial results are included in reports on file with applicable securities regulatory authorities, including but not limited to Precision’s Annual Information Form for the year ended December 31, 2022, which may be accessed on Precision’s SEDAR profile at www.sedar.com or under Precision’s EDGAR profile at www.sec.gov. The forward-looking information and statements contained in this release are made as of the date hereof and Precision undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, except as required by law.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (UNAUDITED)

| (Stated in thousands of Canadian dollars) | | September 30, 2023 | | | December 31, 2022 | |

| ASSETS | | | | | | |

| Current assets: | | | | | | |

| Cash | | $ | 49,065 | | | $ | 21,587 | |

| Accounts receivable | | | 393,286 | | | | 413,925 | |

| Inventory | | | 35,045 | | | | 35,158 | |

| Total current assets | | | 477,396 | | | | 470,670 | |

| Non-current assets: | | | | | | |

| Income tax recoverable | | | 699 | | | | 1,602 | |

| Deferred tax assets | | | 454 | | | | 455 | |

| Property, plant and equipment | | | 2,238,680 | | | | 2,303,338 | |

| Intangibles | | | 18,047 | | | | 19,575 | |

| Right-of-use assets | | | 57,168 | | | | 60,032 | |

| Finance lease receivables | | | 5,112 | | | | — | |

| Investments and other assets | | | 10,645 | | | | 20,451 | |

| Total non-current assets | | | 2,330,805 | | | | 2,405,453 | |

| Total assets | | $ | 2,808,201 | | | $ | 2,876,123 | |

| | | | | | | |

| LIABILITIES AND EQUITY | | | | | | |

| Current liabilities: | | | | | | |

| Accounts payable and accrued liabilities | | $ | 280,519 | | | $ | 392,053 | |

| Income taxes payable | | | 3,197 | | | | 2,991 | |

| Current portion of lease obligations | | | 13,650 | | | | 12,698 | |

| Current portion of long-term debt | | | 2,290 | | | | 2,287 | |

| Total current liabilities | | | 299,656 | | | | 410,029 | |

| | | | | | | |

| Non-current liabilities: | | | | | | |

| Share-based compensation | | | 28,360 | | | | 60,133 | |

| Provisions and other | | | 7,331 | | | | 7,538 | |

| Lease obligations | | | 55,143 | | | | 52,978 | |

| Long-term debt | | | 963,827 | | | | 1,085,970 | |

| Deferred tax liabilities | | | 70,149 | | | | 28,946 | |

| Total non-current liabilities | | | 1,124,810 | | | | 1,235,565 | |

| Shareholders’ equity: | | | | | | |

| Shareholders’ capital | | | 2,306,545 | | | | 2,299,533 | |

| Contributed surplus | | | 74,389 | | | | 72,555 | |

| Deficit | | | (1,158,751 | ) | | | (1,301,273 | ) |

| Accumulated other comprehensive income | | | 161,552 | | | | 159,714 | |

| Total shareholders’ equity | | | 1,383,735 | | | | 1,230,529 | |

| Total liabilities and shareholders’ equity | | $ | 2,808,201 | | | $ | 2,876,123 | |

| | | | | | | | | |

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF NET EARNINGS (LOSS) (UNAUDITED)

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| (Stated in thousands of Canadian dollars, except per share amounts) | | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Revenue | | $ | 446,754 | | | $ | 429,335 | | | $ | 1,430,983 | | | $ | 1,106,690 | |

| Expenses: | | | | | | | | | | | | |

| Operating | | | 288,002 | | | | 284,868 | | | | 888,039 | | | | 784,394 | |

| General and administrative | | | 44,177 | | | | 24,906 | | | | 83,057 | | | | 101,781 | |

Earnings before income taxes, loss (gain) on

investments and other assets, gain on

repurchase of unsecured senior notes,

finance charges, foreign exchange, gain on

asset disposals, and depreciation and

amortization | | | 114,575 | | | | 119,561 | | | | 459,887 | | | | 220,515 | |

| Depreciation and amortization | | | 73,192 | | | | 69,448 | | | | 218,823 | | | | 207,662 | |

| Gain on asset disposals | | | (2,438 | ) | | | (8,238 | ) | | | (15,586 | ) | | | (22,152 | ) |

| Foreign exchange | | | 363 | | | | 1,344 | | | | (894 | ) | | | 1,362 | |

| Finance charges | | | 19,618 | | | | 22,521 | | | | 63,946 | | | | 64,294 | |

| Gain on repurchase of unsecured senior notes | | | (37 | ) | | | — | | | | (137 | ) | | | — | |

| Loss (gain) on investments and other assets | | | (3,813 | ) | | | (2,515 | ) | | | 6,075 | | | | (3,738 | ) |

| Earnings (loss) before income taxes | | | 27,690 | | | | 37,001 | | | | 187,660 | | | | (26,913 | ) |

| Income taxes: | | | | | | | | | | | | |

| Current | | | 2,047 | | | | 958 | | | | 4,008 | | | | 2,563 | |

| Deferred | | | 5,851 | | | | 5,364 | | | | 41,130 | | | | 8,300 | |

| | | | 7,898 | | | | 6,322 | | | | 45,138 | | | | 10,863 | |

| Net earnings (loss) | | $ | 19,792 | | | $ | 30,679 | | | $ | 142,522 | | | $ | (37,776 | ) |

| Net earnings (loss) per share: | | | | | | | | | | | | |

| Basic | | $ | 1.45 | | | $ | 2.26 | | | $ | 10.45 | | | $ | (2.79 | ) |

| Diluted | | $ | 1.45 | | | $ | 2.03 | | | $ | 9.84 | | | $ | (2.79 | ) |

| | | | | | | | | | | | | | | | | |

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| (Stated in thousands of Canadian dollars) | | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| Net earnings (loss) | | $ | 19,792 | | | $ | 30,679 | | | $ | 142,522 | | | $ | (37,776 | ) |

Unrealized gain on translation of assets and

liabilities of operations denominated in foreign

currency | | | 39,180 | | | | 111,811 | | | | 3,322 | | | | 139,478 | |

Foreign exchange loss on net investment hedge

with U.S. denominated debt | | | (24,616 | ) | | | (84,060 | ) | | | (1,484 | ) | | | (105,123 | ) |

| Comprehensive income (loss) | | $ | 34,356 | | | $ | 58,430 | | | $ | 144,360 | | | $ | (3,421 | ) |

| | | | | | | | | | | | | | | | | |

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| (Stated in thousands of Canadian dollars) | | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| Cash provided by (used in): | | | | | | | | | | | | |

| Operations: | | | | | | | | | | | | |

| Net earnings (loss) | | $ | 19,792 | | | $ | 30,679 | | | $ | 142,522 | | | $ | (37,776 | ) |

| Adjustments for: | | | | | | | | | | | | |

| Long-term compensation plans | | | 11,577 | | | | 411 | | | | 9,200 | | | | 34,847 | |

| Depreciation and amortization | | | 73,192 | | | | 69,448 | | | | 218,823 | | | | 207,662 | |

| Gain on asset disposals | | | (2,438 | ) | | | (8,238 | ) | | | (15,586 | ) | | | (22,152 | ) |

| Foreign exchange | | | 1,275 | | | | 773 | | | | (13 | ) | | | 924 | |

| Finance charges | | | 19,618 | | | | 22,521 | | | | 63,946 | | | | 64,294 | |

| Income taxes | | | 7,898 | | | | 6,322 | | | | 45,138 | | | | 10,863 | |

| Other | | | — | | | | (2 | ) | | | (220 | ) | | | 273 | |

| Loss (gain) on investments and other assets | | | (3,813 | ) | | | (2,515 | ) | | | 6,075 | | | | (3,738 | ) |

| Gain on repurchase of unsecured senior notes | | | (37 | ) | | | — | | | | (137 | ) | | | — | |

| Income taxes paid | | | (187 | ) | | | (220 | ) | | | (2,395 | ) | | | (3,023 | ) |

| Income taxes recovered | | | 4 | | | | 10 | | | | 7 | | | | 10 | |

| Interest paid | | | (35,500 | ) | | | (38,005 | ) | | | (79,702 | ) | | | (80,706 | ) |

| Interest received | | | 227 | | | | 143 | | | | 562 | | | | 177 | |

| Funds provided by operations | | | 91,608 | | | | 81,327 | | | | 388,220 | | | | 171,655 | |

| Changes in non-cash working capital balances | | | (3,108 | ) | | | (73,185 | ) | | | (57,904 | ) | | | (93,633 | ) |

| | | | 88,500 | | | | 8,142 | | | | 330,316 | | | | 78,022 | |

| Investments: | | | | | | | | | | | | |

| Purchase of property, plant and equipment | | | (51,546 | ) | | | (51,103 | ) | | | (146,378 | ) | | | (126,941 | ) |

| Purchase of intangibles | | | (847 | ) | | | — | | | | (1,524 | ) | | | — | |

| Proceeds on sale of property, plant and equipment | | | 6,698 | | | | 22,337 | | | | 20,724 | | | | 32,033 | |

| Proceeds from sale of investments and other assets | | | 10,013 | | | | — | | | | 10,013 | | | | — | |

| Business acquisitions | | | — | | | | (10,200 | ) | | | (28,000 | ) | | | (10,200 | ) |

| Purchase of investments and other assets | | | (3,211 | ) | | | (73 | ) | | | (5,282 | ) | | | (609 | ) |

| Receipt of finance lease payments | | | 64 | | | | — | | | | 64 | | | | — | |

| Changes in non-cash working capital balances | | | 4,551 | | | | 7,328 | | | | (6,774 | ) | | | 6,881 | |

| | | | (34,278 | ) | | | (31,711 | ) | | | (157,157 | ) | | | (98,836 | ) |

| Financing: | | | | | | | | | | | | |

| Issuance of long-term debt | | | 23,600 | | | | 50,360 | | | | 162,649 | | | | 144,889 | |

| Repayments of long-term debt | | | (49,517 | ) | | | (34,475 | ) | | | (288,538 | ) | | | (118,586 | ) |

| Repurchase of share capital | | | — | | | | (5,010 | ) | | | (12,951 | ) | | | (10,010 | ) |

Issuance of common shares from the exercise

of options | | | — | | | | — | | | | — | | | | 6,162 | |

| Lease payments | | | (2,410 | ) | | | (1,777 | ) | | | (6,413 | ) | | | (5,186 | ) |

| | | | (28,327 | ) | | | 9,098 | | | | (145,253 | ) | | | 17,269 | |

| Effect of exchange rate changes on cash | | | 251 | | | | 2,878 | | | | (428 | ) | | | 3,005 | |

| Increase (decrease) in cash | | | 26,146 | | | | (11,593 | ) | | | 27,478 | | | | (540 | ) |

| Cash, beginning of period | | | 22,919 | | | | 51,641 | | | | 21,587 | | | | 40,588 | |

| Cash, end of period | | $ | 49,065 | | | $ | 40,048 | | | $ | 49,065 | | | $ | 40,048 | |

| | | | | | | | | | | | | | | | | |

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY (UNAUDITED)

| (Stated in thousands of Canadian dollars) | | Shareholders’

Capital | | | Contributed

Surplus | | | Accumulated

Other

Comprehensive

Income | | | Deficit | | | Total

Equity | |

| Balance at January 1, 2023 | | $ | 2,299,533 | | | $ | 72,555 | | | $ | 159,714 | | | $ | (1,301,273 | ) | | $ | 1,230,529 | |

| Net earnings for the period | | | — | | | | — | | | | — | | | | 142,522 | | | | 142,522 | |

Other comprehensive income

for the period | | | — | | | | — | | | | 1,838 | | | | — | | | | 1,838 | |

Settlement of Executive Performance

and Restricted Share Units | | | 19,206 | | | | — | | | | — | | | | — | | | | 19,206 | |

| Share repurchases | | | (12,951 | ) | | | — | | | | — | | | | — | | | | (12,951 | ) |

Redemption of non-management

directors share units | | | 757 | | | | — | | | | — | | | | — | | | | 757 | |

| Share-based compensation expense | | | — | | | | 1,834 | | | | — | | | | — | | | | 1,834 | |

| Balance at September 30, 2023 | | $ | 2,306,545 | | | $ | 74,389 | | | $ | 161,552 | | | $ | (1,158,751 | ) | | $ | 1,383,735 | |

| (Stated in thousands of Canadian dollars) | | Shareholders’

Capital | | | Contributed

Surplus | | | Accumulated

Other

Comprehensive

Income | | | Deficit | | | Total

Equity | |

| Balance at January 1, 2022 | | $ | 2,281,444 | | | $ | 76,311 | | | $ | 134,780 | | | $ | (1,266,980 | ) | | $ | 1,225,555 | |

| Net loss for the period | | | — | | | | — | | | | — | | | | (37,776 | ) | | | (37,776 | ) |

Other comprehensive income

for the period | | | — | | | | — | | | | 34,355 | | | | — | | | | 34,355 | |

| Share options exercised | | | 8,843 | | | | (2,681 | ) | | | — | | | | — | | | | 6,162 | |

| Share repurchases | | | (10,010 | ) | | | — | | | | — | | | | — | | | | (10,010 | ) |

Share-based compensation

reclassification | | | 14,083 | | | | (219 | ) | | | — | | | | — | | | | 13,864 | |

| Share-based compensation expense | | | — | | | | 646 | | | | — | | | | — | | | | 646 | |

| Balance at September 30, 2022 | | $ | 2,294,360 | | | $ | 74,057 | | | $ | 169,135 | | | $ | (1,304,756 | ) | | $ | 1,232,796 | |

| | | | | | | | | | | | | | | | | | | | | |

2023 THIRD QUARTER RESULTS CONFERENCE CALL AND WEBCAST

Precision Drilling Corporation has scheduled a conference call and webcast to begin promptly at 12:00 noon MT (2:00 p.m. ET) on Thursday, October 26, 2023.

To participate in the conference call please register at the URL link below. Once registered, you will receive a dial-in number and a unique PIN, which will allow you to ask questions.

https://register.vevent.com/register/BId053b471716a4107bc5fb11e4c46d7b5

The call will also be webcast and can be accessed through the link below. A replay of the webcast call will be available on Precision’s website for 12 months.

https://edge.media-server.com/mmc/p/vzdcuqii

About Precision

Precision is a leading provider of safe and environmentally responsible High Performance, High Value services to the energy industry, offering customers access to an extensive fleet of Super Series drilling rigs. Precision has commercialized an industry-leading digital technology portfolio known as Alpha™ that utilizes advanced automation software and analytics to generate efficient, predictable, and repeatable results for energy customers. Our drilling services are enhanced by our EverGreen™ suite of environmental solutions, which bolsters our commitment to reducing the environmental impact of our operations. Additionally, Precision offers well service rigs, camps and rental equipment all backed by a comprehensive mix of technical support services and skilled, experienced personnel.

Precision is headquartered in Calgary, Alberta, Canada and is listed on the Toronto Stock Exchange under the trading symbol “PD” and on the New York Stock Exchange under the trading symbol “PDS”.

For further information, please contact:

Lavonne Zdunich, CPA, CA

Director, Investor Relations

403.716.4500

800, 525 - 8th Avenue S.W.

Calgary, Alberta, Canada T2P 1G1

Website: www.precisiondrilling.com

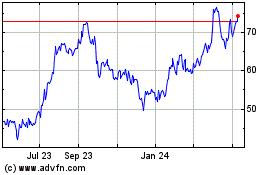

Precision Drilling (NYSE:PDS)

Historical Stock Chart

From Oct 2024 to Nov 2024

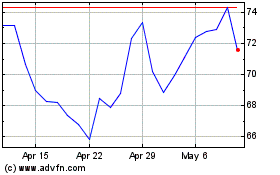

Precision Drilling (NYSE:PDS)

Historical Stock Chart

From Nov 2023 to Nov 2024