P10, Inc. (NYSE: PX), a leading private markets solutions

provider, today announced Enhanced Community Development, a part of

P10 subsidiary Enhanced Capital Group LLC, was awarded a $65

million allocation from the New Markets Tax Credits (NMTC) program

administered by the U.S. Treasury Department's Community

Development Financial Institutions Fund. Under the program, the

U.S. Treasury Department allocated a total of $5 billion to 104

Community Development Entities for the 2023 round.

“Enhanced Community Development is continuing to meet the needs

of underserved communities around the country,” said Luke

Sarsfield, P10 Chairman and Chief Executive Officer. “Enhanced

Capital’s team brings a mission-driven focus to their investments,

providing financing solutions that generate positive social

outcomes in the lower-middle market. This federal NMTC allocation

further strengthens their ability to create opportunities that have

a lasting impact.”

Enhanced Community Development has deployed $750 million in

federal and state NMTC investments across the United States,

supporting over 130 projects and fostering economic activity in

low-income communities. Previous NMTC-funded projects include

manufacturing companies, healthcare facilities, educational

institutions, and community centers that serve the needs of

economically disadvantaged populations.

"We are incredibly honored to receive this $65 million

allocation, which enables us to significantly increase the impact

on the communities that need it most," said Richard Montgomery,

Managing Partner at Enhanced Capital. "The New Markets Tax Credit

program is a powerful tool for creating meaningful change in areas

often overlooked by many investors and traditional sources of

capital."

The NMTC program, created by Congress in 2000, is designed to

drive economic revitalization in underserved communities by

attracting private capital investment through federal tax credit

incentives. The program has facilitated the deployment of more than

$63 billion in low-income communities across the U.S., resulting in

the creation or retention of over 894,000 jobs and the construction

or rehabilitation of nearly 260 million square feet of commercial

real estate.1

For more information on Enhanced Community Development and its

work in revitalizing underserved communities, please visit

www.enhancedcapital.com.

About P10P10 is a leading multi-asset class

private markets solutions provider in the alternative asset

management industry. P10’s mission is to provide its investors

differentiated access to a broad set of investment solutions that

address their diverse investment needs within private markets. As

of June 30, 2024, P10 has a global investor base of more than

3,700 investors across 50 states, 60 countries, and six continents,

which includes some of the world’s largest pension funds,

endowments, foundations, corporate pensions, and financial

institutions. Visit www.p10alts.com.

About Enhanced Community Development:Enhanced

Community Development (ECD), a subsidiary of Enhanced Capital, is a

federally designated Community Development Entity focused on the

financing needs of businesses and developments located in or

serving low-income communities. ECD proudly participates in the

federal New Markets Tax Credit (NMTC) Program and a variety of

state NMTC Programs. ECD is an Equal Opportunity Provider. Since

2006, ECD has deployed $750 million in federal and state NMTC

allocation to job-creating businesses and organizations in

economically distressed communities.

About Enhanced Capital:Enhanced Capital Group,

LLC is a leading impact investment firm with over 24 years of

experience investing in Climate Finance, Impact Real Estate, and

Small Business Lending. From inception in 1999 through June 30th,

2024, inclusive of proprietary assets and assets managed by

affiliates, Enhanced Capital has raised a total of $6.0 billion. Of

the total assets under management, impact assets represent $3.8

billion invested in over 950 projects and businesses throughout 40

states, Washington DC, and Puerto Rico and does not include

investments made by non-impact affiliates.

For more information, visit www.enhancedcapital.com.

Forward-Looking StatementsSome of the

statements in this release may constitute “forward-looking

statements” within the meaning of Section 27A of the

Securities Act of 1933, Section 21E of the Securities Exchange

Act of 1934 and the Private Securities Litigation Reform Act of

1995. Words such as “will,” “expect,” “believe,” “estimate,”

“continue,” “anticipate,” “intend,” “plan” and similar expressions

are intended to identify these forward-looking statements.

Forward-looking statements discuss management’s current

expectations and projections relating to our financial position,

results of operations, plans, objectives, future performance, and

business. The inclusion of any forward-looking information in this

release should not be regarded as a representation that the future

plans, estimates, or expectations contemplated will be achieved.

Forward-looking statements reflect management’s current plans,

estimates, and expectations, and are inherently uncertain. All

forward-looking statements are subject to known and unknown risks,

uncertainties, assumptions and other important factors that may

cause actual results to be materially different; global and

domestic market and business conditions; successful execution of

business and growth strategies and regulatory factors relevant to

our business; changes in our tax status; our ability to maintain

our fee structure; our ability to attract and retain key employees;

our ability to manage our obligations under our debt agreements;

our ability to make acquisitions and successfully integrate the

businesses we acquire; assumptions relating to our operations,

financial results, financial condition, business prospects and

growth strategy; and our ability to manage the effects of events

outside of our control. The foregoing list of factors is not

exhaustive. For more information regarding these risks and

uncertainties as well as additional risks that we face, you should

refer to the “Risk Factors” included in our annual report on

Form 10-K for the year ended December 31, 2023,

filed with the U.S. Securities and Exchange

Commission (“SEC”) on March 13, 2024, and in our

subsequent reports filed from time to time with the SEC. The

forward-looking statements included in this release are made only

as of the date hereof. We undertake no obligation to update or

revise any forward-looking statement as a result of new information

or future events, except as otherwise required by law.

Ownership LimitationsP10’s Certificate of

Incorporation contains certain provisions for the protection of tax

benefits relating to P10’s net operating losses. Such provisions

generally void transfers of shares that would result in the

creation of a new 4.99% shareholder or result in an existing 4.99%

shareholder acquiring additional shares of P10, and it expires at

the third anniversary of the IPO, October 2024.

Disclaimer:Enhanced Capital Group, LLC, and its

affiliates, is an Equal Opportunity Provider. The information

presented is for discussion purposes only and is neither an offer

to sell nor a solicitation of any offer to buy any securities,

investment product, or investment advisory services. This is not an

offering or the solicitation of an offer to purchase an interest in

a fund.

P10 Investor Contact:info@p10alts.com

P10 Media Contact:Taylor

Donahuepro-p10@prosek.com

1 “The U.S. Department of the Treasury Announces $5 Billion in

New Markets Tax Credits,” Department of the Treasury, September 19,

2024. https://www.cdfifund.gov/news/603

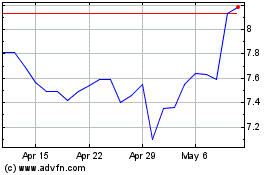

P10 (NYSE:PX)

Historical Stock Chart

From Oct 2024 to Nov 2024

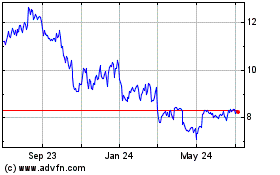

P10 (NYSE:PX)

Historical Stock Chart

From Nov 2023 to Nov 2024