0000791963false00007919632021-01-292021-01-29

As filed with the Securities and Exchange Commission on January 26, 2024

___________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 26, 2024

OPPENHEIMER HOLDINGS INC.

(Exact name of registrant as specified in its charter)

Commission File Number 1-12043

| | | | | | | | |

| Delaware | | 98-0080034 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

85 Broad Street

New York, New York 10004

(Address of principal executive offices) (Zip Code)

(212) 668-8000

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CRF 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Class A Non-Voting Common Stock | OPY | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 2 – FINANCIAL INFORMATION

ITEM 2.02. Results of Operations and Financial Condition.

(a)On January 26, 2024, Oppenheimer Holdings Inc. (the “Company”) issued a press release announcing its fourth quarter and full year 2023 earnings. A copy of the January 26, 2024 press release is furnished as Exhibit 99.1 to this Report and is incorporated herein by reference.

The information contained in this Item 2.02 and the related exhibit attached hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information or such exhibit be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The information set forth in this Item 2.02 or any exhibit related to this Item 2.02 on this Form 8-K shall not be deemed an admission as to the materiality of any information in the referenced items.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

ITEM 9.01. Financial Statements and Exhibits.

(d)Exhibits:

The following exhibit is furnished (not filed) with this Current Report on Form 8-K:

99.1 Oppenheimer Holdings Inc.'s Press Release dated January 26, 2024

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Oppenheimer Holdings Inc.

| | |

Date: January 26, 2024

By: /s/ Brad M. Watkins

---------------------------------

Brad M. Watkins

Chief Financial Officer

(Duly Authorized Officer) |

EXHIBIT INDEX

| | | | | |

| Exhibit Number | Description |

| |

Exhibit 99.1

Oppenheimer Holdings Inc. Reports Fourth Quarter and Full Year 2023 Earnings

New York, January 26, 2024 – Oppenheimer Holdings Inc. (NYSE: OPY) (the "Company" or "Firm") today reported net income of $11.1 million or $1.07 basic earnings per share for the fourth quarter of 2023 compared with net income of $22.4 million or $2.04 basic earnings per share for the fourth quarter of 2022. Adjusted net income(a) was $16.1 million or $1.56 basic earnings per share for the fourth quarter of 2023, after excluding $5.0 million of expense related to a regulatory settlement. Revenue for the fourth quarter of 2023 was $308.3 million compared to revenue of $313.6 million for the fourth quarter of 2022, a decrease of 1.7%.

For the year ended December 31, 2023, the Company reported net income of $30.2 million or $2.81 basic earnings per share compared with net income of $32.4 million or $2.77 basic earnings per share for the year ended December 31, 2022. Adjusted net income(a) was $43.2 million or $4.02 basic earnings per share for the year ended December 31, 2023, after excluding $13.0 million of expense related to a regulatory settlement. Revenue for the year ended December 31, 2023 was $1.2 billion compared to revenue of $1.1 billion for the year ended December 31, 2022, an increase of 12.4%.

| | | | | | | | | | | | | | |

| Summary Operating Results (Unaudited) |

| ('000s, except per share amounts or otherwise indicated) |

| 4Q-23 | 4Q-22 | FY-23 | FY-22 |

| Revenue | $ | 308,289 | | $ | 313,580 | | $ | 1,248,825 | | $ | 1,110,941 | |

| Compensation Expense | $ | 193,196 | | $ | 197,683 | | $ | 782,396 | | $ | 740,827 | |

| Non-compensation Expense | $ | 97,261 | | $ | 85,625 | | $ | 419,659 | | $ | 324,560 | |

| Pre-Tax Income | $ | 17,832 | | $ | 30,272 | | $ | 46,770 | | $ | 45,554 | |

| Income Taxes Provision | $ | 6,236 | | $ | 7,885 | | $ | 16,498 | | $ | 13,444 | |

Net Income (1) | $ | 11,100 | | $ | 22,413 | | $ | 30,179 | | $ | 32,351 | |

Adjusted Net Income (1)(a) | $ | 16,100 | | N/A | $ | 43,179 | | N/A |

Earnings Per Share (Basic) (1) | $ | 1.07 | | $ | 2.04 | | $ | 2.81 | | $ | 2.77 | |

Adjusted Earnings Per Share (Basic) (1)(a) | $ | 1.56 | | N/A | $ | 4.02 | | N/A |

Earnings Per Share (Diluted) (1) | $ | 0.98 | | $ | 1.87 | | $ | 2.59 | | $ | 2.57 | |

Adjusted Earnings Per Share (Diluted) (1)(a) | $ | 1.42 | | N/A | $ | 3.71 | | N/A |

| Book Value Per Share | $ | 76.72 | | $ | 72.41 | | $ | 76.72 | | $ | 72.41 | |

Tangible Book Value Per Share (2) | $ | 59.54 | | $ | 56.91 | | $ | 59.54 | | $ | 56.91 | |

| (1) Attributable to Oppenheimer Holdings Inc. |

| (2) Represents preliminary book value less goodwill and intangible assets divided by number of shares outstanding |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Highlights

•Increased revenues for the full year 2023 due to record bank deposit sweep income and margin interest income and substantially higher fixed income sales and trading revenues than prior year

•Reduced net income and earnings per share for the fourth quarter largely reflected fewer investment banking transactions and regulatory charges

•Higher non-compensation expenses for the full year 2023 mostly attributable to the impact of significant legal costs and an accrual for a regulatory settlement

•Client assets under administration and under management were both at higher levels compared with the prior quarter and year end

•The Company repurchased 900,518 shares of Class A non-voting common stock during the full year 2023 at an average price of $39.00 per share under its previously announced share repurchase program and “Dutch Auction” tender offer, which resulted in 10,186,783 shares of Class A non-voting common stock remaining outstanding as of December 31, 2023

•Book value per share reached record levels at December 31, 2023 as a result of positive earnings and share repurchases

•The effective tax rate of 35.3% reflects the impact of a non-deductible $13.0 million regulatory settlement for the full year 2023. The adjusted effective tax rate(b) is 27.6% when this expense is excluded

Albert G. Lowenthal, Chairman and CEO commented, "The Company generated profitable results for the full year 2023 despite mixed macroeconomic conditions and significantly higher legal and regulatory costs. The costs of a particular legal matter (which we now believe is behind us from a financial point of view) and, the impact of a non-recurring accrual related to an SEC industry-wide focus on ‘off-channel communications’ was approximately $70 million for the year. But for these, the Company would have produced a decent return despite the ongoing drought in Investment Banking activity.

The year began with markets anticipating either a mild recession or a "soft landing" with nominal growth and high but declining inflation driven by a Federal Reserve ("FED") committed to interest rate increases. The economic outlook gradually improved as inflation receded, unemployment held steady and the FED signaled potential rate cuts in 2024. The financial markets improved along with the economic outlook, as what began as a narrow rally focused on generative A.I. stocks eventually broadened into an “everything rally” by the year’s end, with most major indices ending the year at or near their all-time highs in spite of continued geopolitical tensions in Ukraine and Gaza.

Throughout these evolving market conditions, our diversified businesses registered a year-over-year increase in total revenues. Higher short-term interest rates propelled record high full-year bank deposit sweep and margin interest income in our Wealth Management business as well as large increases in fixed income sales and trading revenues in our Capital Markets segment. The rising markets and addition of new client assets also drove improvements in the valuation of client assets under management throughout the year, though asset-based advisory fees did not fully recover to last year’s levels. Investment banking revenues continue to be adversely impacted by reduced corporate transactions and a moribund IPO environment.

We ended the year with a strong balance sheet and record high book value per share levels. Our Class A share count is significantly reduced from the prior year due to share repurchases during the year. While market conditions proved challenging at times, I am optimistic about the future as we strengthened our competitive posture through strategic additions to personnel and I am appreciative of the commitment and success of existing staff in providing exceptional service to our clients."

| | | | | | | | | | | | | | |

| Segment Results (Unaudited) |

| ('000s, except per share amounts or otherwise indicated) |

| 4Q-23 | 4Q-22 | FY-23 | FY-22 |

| Private Client |

| Revenue | $ | 203,834 | | $ | 201,748 | | $ | 801,754 | | $ | 675,680 | |

| Pre-Tax Income | $ | 53,945 | | $ | 49,331 | | $ | 194,444 | | $ | 142,250 | |

| Assets Under Administration (billions) | $ | 118.2 | | $ | 105.0 | | $ | 118.2 | | $ | 105.0 | |

| | | | |

| Asset Management |

| Revenue | $ | 21,446 | | $ | 22,940 | | $ | 88,433 | | $ | 99,242 | |

| Pre-Tax Income | $ | 6,125 | | $ | 9,837 | | $ | 24,091 | | $ | 35,753 | |

| Asset Under Management (billions) | $ | 43.9 | | $ | 36.8 | | $ | 43.9 | | $ | 36.8 | |

| | | | |

| Capital Markets |

| Revenue | $ | 81,457 | | $ | 90,549 | | $ | 345,897 | | $ | 337,821 | |

| Pre-Tax Loss | $ | (18,179) | | $ | (11,328) | | $ | (62,961) | | $ | (25,696) | |

Fourth Quarter Results

Private Client

Private Client reported revenue of $203.8 million for the fourth quarter of 2023, 1.0% higher compared with a year ago. Pre-tax income was $53.9 million, an increase of 9.4% compared with a year ago. Productivity of our financial advisors improved although financial advisor headcount declined to 931 at the end of the fourth quarter of 2023 compared to 968 at the end of the fourth quarter of 2022.

Revenue:

•Retail commissions increased 8.6% from a year ago primarily driven by higher client activity

•Advisory fees increased 5.8% from a year ago due to higher valuations of assets under management ("AUM")

•Bank deposit sweep income for the fourth quarter of 2023 decreased $12.1 million from a year ago due to lower cash sweep balances

•Interest revenue increased 10.6% from a year ago due to higher short-term interest rates

•Other revenue increased 35.2% compared with a year ago primarily due to an increase of COLI asset values and insurance proceeds when compared to the prior year quarter

Total Expenses:

•Compensation expenses were flat compared with a year ago

•Non-compensation expenses decreased 4.6% compared with a year ago

| | | | | | | | |

| ('000s, except otherwise indicated) |

| 4Q-23 | 4Q-22 |

| | |

| Revenue | $ | 203,834 | | $ | 201,748 | |

| Commissions | $ | 50,098 | | $ | 46,128 | |

| Advisory Fees | $ | 81,023 | | $ | 76,574 | |

| Bank Deposit Sweep Income | $ | 37,534 | | $ | 49,590 | |

| Interest | $ | 20,875 | | $ | 18,880 | |

| Other | $ | 14,304 | | $ | 10,576 | |

| | |

| Total Expenses | $ | 149,889 | | $ | 152,417 | |

| Compensation | $ | 112,200 | | $ | 112,919 | |

| Non-compensation | $ | 37,689 | | $ | 39,498 | |

| | |

| Pre-Tax Income | $ | 53,945 | | $ | 49,331 | |

| | |

| Compensation Ratio | 55.0 | % | 56.0 | % |

| Non-compensation Ratio | 18.5 | % | 19.6 | % |

| Pre-Tax Margin | 26.5 | % | 24.5 | % |

| | |

| Assets Under Administration (billions) | $ | 118.2 | | $ | 105.0 | |

| Cash Sweep Balances (billions) | $ | 3.4 | | $ | 5.5 | |

Asset Management

Asset Management reported revenue of $21.4 million for the fourth quarter of 2023, 6.5% lower compared with a year ago primarily due to the reduced value of positions held in private equity investments, partially offset by higher advisory fees based on increased AUM levels. Pre-tax income was $6.1 million, a decrease of 37.7% compared with a year ago.

Revenue:

•Advisory fee revenue increased 5.7% from a year ago due to increased management fees resulting from the higher net value of AUM during the fourth quarter of 2023

•Other revenue decreased $2.8 million from a year ago primarily due to an decrease in the fair value of positions held in private equity investments

Assets under Management (AUM):

▪AUM were $43.9 billion at December 31, 2023, which is the basis for advisory fee billings for January 2024

▪The increase in AUM from December 31, 2022 to December 31, 2023 was comprised of higher asset values of $6.0 billion on existing client holdings and a net contribution of assets of $1.1 billion

Total Expenses:

•Compensation expenses were up 42.0% driven primarily by larger incentive compensation accrual adjustments in the prior year

•Non-compensation expenses increased 6.8% when compared with a year ago due to higher external portfolio management costs which are directly related to the assets being managed and higher communications and technology expenses

| | | | | | | | |

| ('000s, except otherwise indicated) |

| 4Q-23 | 4Q-22 |

| | |

| Revenue | $ | 21,446 | | $ | 22,940 | |

| Advisory Fees | $ | 24,236 | | $ | 22,936 | |

| Other | $ | (2,790) | | $ | 4 | |

| | |

| Total Expenses | $ | 15,321 | | $ | 13,103 | |

| Compensation | $ | 5,363 | | $ | 3,776 | |

| Non-compensation | $ | 9,958 | | $ | 9,327 | |

| | |

| Pre-Tax Income | $ | 6,125 | | $ | 9,837 | |

| | |

| Compensation Ratio | 25.0 | % | 16.5 | % |

| Non-compensation Ratio | 46.4 | % | 40.7 | % |

| Pre-Tax Margin | 28.6 | % | 42.9 | % |

| | |

| AUM (billions) | $ | 43.9 | | $ | 36.8 | |

Capital Markets

Capital Markets reported revenue of $81.5 million for the fourth quarter of 2023, 10.0% lower compared with a year ago. Pre-tax loss was $18.2 million compared with a pre-tax loss of $11.3 million a year ago.

Revenue:

Investment Banking

•Advisory fees earned from investment banking activities decreased 49.3% compared with a year ago driven by an industry-wide slowdown in M&A transactions

•Equity and fixed income underwriting fees were relatively flat with the prior year due to continued industry-wide softness in capital raising activities

Sales and Trading

•Equities sales and trading decreased 6.0% compared with a year ago due to lower client activity levels

•Fixed income sales and trading increased 21.4% compared to the prior year primarily due to an increase in trading income attributable to higher volumes

Total Expenses:

•Compensation expenses decreased 20.3% compared with the prior year primarily due to lower incentive compensation

•Non-compensation expenses increased 43.8% compared with a year ago mainly due to an increase in interest expense in financing trading inventories

| | | | | | | | |

| ('000s) | | |

| 4Q-23 | 4Q-22 |

| | |

| Revenue | $ | 81,457 | | $ | 90,549 | |

| | |

| Investment Banking | $ | 20,704 | | $ | 32,476 | |

| Advisory Fees | $ | 12,740 | | $ | 25,110 | |

| Equities Underwriting | $ | 5,837 | | $ | 5,533 | |

| Fixed Income Underwriting | $ | 1,781 | | $ | 1,541 | |

| Other | $ | 346 | | $ | 292 | |

| | |

| Sales and Trading | $ | 60,170 | | $ | 57,039 | |

| Equities | $ | 31,092 | | $ | 33,082 | |

| Fixed Income | $ | 29,078 | | $ | 23,957 | |

| | |

| Other | $ | 583 | | $ | 1,034 | |

| | |

| Total Expenses | $ | 99,636 | | $ | 101,877 | |

| Compensation | $ | 58,346 | | $ | 73,163 | |

| Non-compensation | $ | 41,290 | | $ | 28,714 | |

| | |

| Pre-Tax Loss | $ | (18,179) | | $ | (11,328) | |

| | |

| Compensation Ratio | 71.6 | % | 80.8 | % |

| Non-compensation Ratio | 50.7 | % | 31.7 | % |

| Pre-Tax Margin | (22.3) | % | (12.5) | % |

Private Client

Private Client reported revenue of $801.8 million for the year ended December 31, 2023, 18.7% higher compared with the prior year. Pre-tax income was $194.4 million, an increase of 36.7% from the prior year.

•Retail commissions decreased slightly from the prior year, due to lower overall client activity, though transaction volumes improved later in the year

•Advisory fees decreased 2.2% from the prior year due to lower billable AUM during the year

•Bank deposit sweep income for the full year was a record high and increased $68.2 million or 65.3% from the prior year due to higher short-term interest rates, partially offset by lower cash sweep balances

•Interest revenue increased 64.1% from the prior year due to record full year margin interest income attributable to higher short-term interest rates

•Other revenue increased significantly compared with the prior year primarily due to increases in the cash surrender value of Company-owned life insurance policies, which fluctuates based on changes in fair value of the policies' underlying investments

Total Expenses:

•Compensation expenses increased 5.7% from the prior year primarily due to higher deferred compensation costs

•Non-compensation expenses increased 33.6% from the prior year primarily due to the impact of significant legal costs

| | | | | | | | |

| ('000s) |

| FY-23 | FY-22 |

| Revenue | $ | 801,754 | | $ | 675,680 | |

| Commissions | $ | 186,496 | | $ | 190,614 | |

| Advisory Fees | $ | 319,191 | | $ | 326,240 | |

| Bank Deposit Sweep Income | $ | 172,807 | | $ | 104,558 | |

| Interest | $ | 85,105 | | $ | 51,866 | |

| Other | $ | 38,155 | | $ | 2,402 | |

| Total Expenses | $ | 607,310 | | $ | 533,430 | |

| Compensation | $ | 399,185 | | $ | 377,671 | |

| Non-compensation | $ | 208,125 | | $ | 155,759 | |

| | |

| Pre-Tax Income | $ | 194,444 | | $ | 142,250 | |

| | |

| Compensation Ratio | 49.8 | % | 55.9 | % |

| Non-compensation Ratio | 26.0 | % | 23.1 | % |

| Pre-Tax Margin | 24.3 | % | 21.1 | % |

| Assets Under Administration (billions) | $ | 118.2 | | $ | 105.0 | |

| Cash Sweep Balances (billions) | $ | 3.4 | | $ | 5.5 | |

Asset Management

Asset Management reported revenue of $88.4 million for the year ended December 31, 2023, 10.9% lower compared with the prior year. Pre-tax income was $24.1 million, a decrease of 32.6% compared with the prior year.

Revenue:

•Advisory fee revenue decreased 3.0% from the prior year primarily due to lower management fees from advisory programs attributable to reduced billable AUM levels and lower incentive fees from alternative investments during the year

•Other revenue decreased $7.8 million from a year ago primarily due to a decrease in the fair value of positions held in private equity investments

Assets under Management (AUM):

▪AUM were $43.9 billion at December 31, 2023, which is the basis for advisory fee billings for January 2024

▪The increase in AUM from December 31, 2022 to December 31, 2023 was comprised of higher asset values of $6.0 billion on existing client holdings and a net contribution of assets of $1.1 billion

Total Expenses:

•Compensation expenses and non-compensation expenses were relatively flat when compared to the prior year

| | | | | | | | |

| ('000s) |

| FY-23 | FY-22 |

| | |

| Revenue | $ | 88,433 | | $ | 99,242 | |

| Advisory Fees | $ | 96,259 | | $ | 99,224 | |

| Other | $ | (7,826) | | $ | 18 | |

| | |

| Total Expenses | $ | 64,342 | | $ | 63,489 | |

| Compensation | $ | 24,846 | | $ | 24,261 | |

| Non-compensation | $ | 39,496 | | $ | 39,228 | |

| | |

| Pre-Tax Income | $ | 24,091 | | $ | 35,753 | |

| | |

| Compensation Ratio | 28.1 | % | 24.4 | % |

| Non-compensation Ratio | 44.7 | % | 39.5 | % |

| Pre-Tax Margin | 27.2 | % | 36.0 | % |

| | |

| AUM (billions) | $ | 43.9 | | $ | 36.8 | |

Capital Markets

Capital Markets reported revenue of $345.9 million for the year ended December 31, 2023, 2.4% higher compared with the prior year. Pre-tax loss was $63.0 million compared with pre-tax loss of $25.7 million for the prior year.

Revenue:

Investment Banking

•Advisory fees earned from investment banking activities decreased 17.7% compared with the prior year driven by an industry-wide slowdown in M&A transactions

•Equities underwriting fees increased 37.9% compared with the prior year due to higher new issuance volumes and deal sizes, primarily during the third quarter

•Fixed income underwriting fees were down 25.9% compared with the prior year primarily driven by less overall new issuance activity

Sales and Trading

•Equities sales and trading decreased 9.1% compared with the prior year due to reduced volumes as a result of lower market volatility

•Fixed income sales and trading increased 35.1% compared with the prior year driven by higher trading income attributable to higher volumes

Total Expenses:

•Compensation expenses were slightly higher than the prior year due to opportunistic hires and inflationary pressures on wages as well as higher deferred compensation costs

•Non-compensation expenses were 36.1% higher compared with the prior year mainly due to an increase in interest expense in financing trading inventories

| | | | | | | | |

| ('000s) | | |

| FY-23 | FY-22 |

| | |

| Revenue | $ | 345,897 | | $ | 337,821 | |

| | |

| Investment Banking | $ | 111,734 | | $ | 117,101 | |

| Advisory Fees | $ | 69,623 | | $ | 84,569 | |

| Equities Underwriting | $ | 33,904 | | $ | 24,583 | |

| Fixed Income Underwriting | $ | 6,594 | | $ | 8,898 | |

| Other | $ | 1,613 | | $ | (949) | |

| | |

| Sales and Trading | $ | 231,867 | | $ | 217,712 | |

| Equities | $ | 128,216 | | $ | 141,013 | |

| Fixed Income | $ | 103,651 | | $ | 76,699 | |

| | |

| Other | $ | 2,296 | | $ | 3,008 | |

| | |

| Total Expenses | $ | 408,858 | | $ | 363,517 | |

| Compensation | $ | 269,330 | | $ | 260,974 | |

| Non-compensation | $ | 139,528 | | $ | 102,543 | |

| | |

| Pre-Tax Loss | $ | (62,961) | | $ | (25,696) | |

| | |

| Compensation Ratio | 77.9% | 77.3% |

| Non-compensation Ratio | 40.3% | 30.4% |

| Pre-Tax Margin | (18.2)% | (7.6)% |

Other Matters

•The Board of Directors announced a quarterly dividend in the amount of $0.15 per share for the fourth quarter of 2023 payable on February 23, 2024 to holders of Class A non-voting and Class B voting common stock of record on February 9, 2024

•Compensation expense as a percentage of revenue was 62.7% during the 2023 year versus 66.7% for the prior year primarily due to higher interest-sensitive revenues that are not directly correlated with compensation

•Non-compensation expenses increased 29.3% from the prior year primarily due to the impact of significant legal costs and an accrual for a regulatory settlement

•The effective tax rate for the 2023 year was 35.3% compared with 29.5% for the prior year primarily due to the impact of a non-deductible $13.0 million regulatory settlement

| | | | | | | | |

| (In millions, except number of shares and per share amounts) |

| FY-23 | FY-22 |

| Capital | | |

Stockholders' Equity (1) | $ | 789.2 | | $ | 794.2 | |

Regulatory Net Capital (2) | $ | 453.6 | | $ | 432.5 | |

Regulatory Excess Net Capital (2) | $ | 435.0 | | $ | 408.3 | |

| | |

| Common Stock Repurchases | | |

| Share Repurchase Program |

| Repurchases | $ | 17.6 | | $ | 60.6 | |

| Number of Shares | 463,335 | | 1,684,287 | |

| Average Price Per Share | $ | 38.07 | | $ | 36.00 | |

| "Dutch Auction" Tender Offer |

| Repurchases | $ | 17.49 | | $ | — | |

| Number of Shares | 437,183 | | — | |

| Average Price Per Share | $ | 40.00 | | $ | — | |

| | |

| Period End Shares | 10,286,448 | 10,968,221 |

| Effective Tax Rate | 35.3 | % | 29.5 | % |

| | |

(1) Attributable to Oppenheimer Holdings Inc. |

(2) Attributable to Oppenheimer & Co. Inc. broker-dealer |

Notes

(a) Adjusted net income and earnings per share attributable to Oppenheimer Holdings Inc. (a non-GAAP financial measure) excludes $5.0 million and $13.0 million of expense related to a regulatory settlement that was recognized during the fourth quarter of 2023 and year-ended December 31, 2023, respectively. Refer to the schedule on page 8 for additional explanation of non-GAAP financial measures and a reconciliation of adjusted net income and earnings per share to U.S. GAAP.

(b) Adjusted effective tax rate (a non-GAAP financial measure) excludes $13.0 million of expense related to a regulatory settlement that was recognized during the year-ended December 31, 2023. Refer to the schedule on page 8 for additional explanation of non-GAAP financial measures and a reconciliation of the adjusted effective tax rate to U.S. GAAP.

Company Information

Oppenheimer Holdings Inc., through its operating subsidiaries, is a leading middle market investment bank and full service broker-dealer that is engaged in a broad range of activities in the financial services industry, including retail securities brokerage, institutional sales and trading, investment banking (corporate and public finance), equity and fixed income research, market-making, trust services, and investment advisory and asset management services. With roots tracing back to 1881, the Company is headquartered in New York and has 90 retail branch offices in the United States and institutional businesses located in London, Tel Aviv, and Hong Kong.

Forward-Looking Statements

This press release includes certain "forward-looking statements" relating to anticipated future performance. For a discussion of the factors that could cause future performance to be different than anticipated, reference is made to Factors Affecting "Forward-Looking Statements" and Part 1A – Risk Factors in the Company's Annual Report on Form 10-K for the year ended December 31, 2022 and Factors Affecting "Forward-Looking Statements" in Part I, Item 2 in the Company's Quarterly Report on Form 10-Q for the quarter ended September 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Oppenheimer Holdings Inc. |

| Consolidated Income Statements (Unaudited) |

| ('000s, except number of shares and per share amounts) | | | | | | | | | | |

| | | | | | | | |

| | For the Three Months Ended

December 31, | | For the Year Ended

December 31, |

| | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| REVENUE | | | | | | | | | | | |

| Commissions | $ | 90,074 | | | $ | 88,075 | | | 2.3 | | $ | 349,248 | | | $ | 370,382 | | | (5.7) |

| Advisory fees | 105,465 | | | 99,517 | | | 6.0 | | 415,679 | | | 425,615 | | | (2.3) |

| Investment banking | 22,311 | | | 34,013 | | | (34.4) | | 117,665 | | | 127,529 | | | (7.7) |

| Bank deposit sweep income | 37,534 | | | 49,590 | | | (24.3) | | 172,807 | | | 104,558 | | | 65.3 |

| Interest | 25,859 | | | 22,046 | | | 17.3 | | 104,550 | | | 60,713 | | | 72.2 |

| Principal transactions, net | 18,712 | | | 10,907 | | | 71.6 | | 65,347 | | | 21,031 | | | 210.7 |

| Other | 8,334 | | | 9,432 | | | (11.6) | | 23,529 | | | 1,113 | | | 2,014.0 |

| Total revenue | 308,289 | | | 313,580 | | | (1.7) | | 1,248,825 | | | 1,110,941 | | | 12.4 |

| EXPENSES | | | | | | | | | | | |

| Compensation and related expenses | 193,196 | | | 197,683 | | | (2.3) | | 782,396 | | | 740,827 | | | 5.6 |

| Communications and technology | 23,508 | | | 21,493 | | | 9.4 | | 91,321 | | | 85,474 | | | 6.8 |

| Occupancy and equipment costs | 16,380 | | | 15,196 | | | 7.8 | | 66,002 | | | 59,897 | | | 10.2 |

| Clearing and exchange fees | 6,687 | | | 6,643 | | | 0.7 | | 24,928 | | | 25,566 | | | (2.5) |

| Interest | 18,246 | | | 10,688 | | | 70.7 | | 68,599 | | | 23,846 | | | 187.7 |

| Other | 32,440 | | | 31,605 | | | 2.6 | | 168,809 | | | 129,777 | | | 30.1 |

| Total expenses | 290,457 | | | 283,308 | | | 2.5 | | 1,202,055 | | | 1,065,387 | | | 12.8 |

| | | | | | | | | | | | |

| Pre-tax Income | 17,832 | | | 30,272 | | | (41.1) | | 46,770 | | | 45,554 | | | 2.7 |

| Income taxes provision | 6,236 | | | 7,885 | | | (20.9) | | 16,498 | | | 13,444 | | | 22.7 |

| Net Income | $ | 11,596 | | | $ | 22,387 | | | (48.2) | | $ | 30,272 | | | $ | 32,110 | | | (5.7) |

| | | | | | | | | | | | |

Less: Net income (loss) attributable to

non-controlling interest, net of tax | 496 | | | (26) | | | * | | 93 | | | (241) | | | * |

Net income attributable to

Oppenheimer Holdings Inc. | $ | 11,100 | | | $ | 22,413 | | | (50.5) | | $ | 30,179 | | | $ | 32,351 | | | (6.7) |

| | | | | | | | | | | | |

| Earnings per share attributable to Oppenheimer Holdings Inc. | | | | | | | | |

| Basic | $ | 1.07 | | | $ | 2.04 | | | (47.5) | | $ | 2.81 | | | $ | 2.77 | | | 1.4 |

| Diluted | $ | 0.98 | | | $ | 1.87 | | | (47.6) | | $ | 2.59 | | | $ | 2.57 | | | 0.8 |

| | | | | | | | | | | | |

| Weighted average number of common shares outstanding | | | | | | | | |

| Basic | 10,326,996 | | | 10,967,276 | | | (5.8) | | 10,736,166 | | | 11,666,194 | | | (8.0) |

| Diluted | 11,305,198 | | | 11,969,012 | | | (5.5) | | 11,645,708 | | | 12,607,752 | | | (7.6) |

| | | | | | | | | | | | |

| Period end number of common shares outstanding | 10,286,448 | | | 10,968,221 | | | (6.2) | | 10,286,448 | | | 10,968,221 | | | (6.2) |

* Percentage not meaningful |

Explanation of Non-GAAP Financial Measures

The Company included certain non-GAAP financial measures within this Earnings Release to supplement the U.S. GAAP financial information. Adjusted results begin with information prepared in accordance with U.S. GAAP, and such results are adjusted to exclude certain items. Specifically, we included non-GAAP measures that adjust the Company’s net income, earnings per share and effective tax rate to exclude the expense associated with a non-recurring regulatory settlement. The Company believes that these non-GAAP financial measures provide additional useful information for investors because they permit investors to view the financial measures on a basis consistent with how management views the operating performance of the Firm. These non-GAAP financial measures, when presented in conjunction with comparable U.S. GAAP measures, also are useful to investors when comparing the Company’s results across different financial reporting periods on a consistent basis.

The following tables reconcile our non-GAAP financial measures to their respective U.S. GAAP measures. These non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation from, as a substitute for, or superior to the analysis of U.S. GAAP financial measures.

Net Income Attributable to Oppenheimer Holdings Inc. and Earnings Per Share U.S. GAAP Reconciliation

Reconciliation of net income attributable to Oppenheimer Holdings Inc. to adjusted net income attributable to Oppenheimer Holdings Inc., reconciliation of basic earnings per share to adjusted basic earnings per share, and reconciliation of diluted earnings per share to adjusted diluted earnings per share are as follows:

| | | | | | | | | | | |

| ('000s, except per share amounts) | For the Three Months Ended | | For the Year Ended |

| December 31, 2023 | | December 31, 2023 |

| Net income attributable to Oppenheimer Holdings Inc. (U.S. GAAP) | $ | 11,100 | | | $ | 30,179 | |

| Net income impact of regulatory settlement | 5,000 | | | 13,000 | |

| Adjusted net income attributable to Oppenheimer Holdings Inc. (non-GAAP) | $ | 16,100 | | | $ | 43,179 | |

| | | |

| Basic earnings per share (U.S. GAAP) | $ | 1.07 | | | $ | 2.81 | |

| Basic earnings per share impact of regulatory settlement | $ | 0.49 | | | $ | 1.21 | |

| Adjusted basic earnings per share (non-GAAP) | $ | 1.56 | | | $ | 4.02 | |

| | | |

| Diluted earnings per share (U.S. GAAP) | $ | 0.98 | | | $ | 2.59 | |

| Diluted earnings per share impact of regulatory settlement | $ | 0.44 | | | $ | 1.12 | |

| Adjusted diluted earnings per share (non-GAAP) | $ | 1.42 | | | $ | 3.71 | |

Effective Tax Rate U.S. GAAP Reconciliation

The table below reconciles our effective tax rate to the adjusted effective tax rate:

| | | | | |

| For the Year Ended |

| December 31, 2023 |

| Effective tax rate (U.S. GAAP) | 35.3 | % |

| Tax rate impact of regulatory settlement | (7.7) | % |

| Adjusted effective tax rate (non-GAAP) | 27.6 | % |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

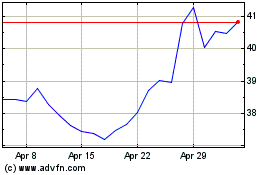

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Apr 2024 to May 2024

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From May 2023 to May 2024