Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

September 20 2017 - 3:09PM

Edgar (US Regulatory)

Table of Contents

Filed pursuant to Rule 424(b)(3)

Registration Statement No. 333-219756

PROSPECTUS

OPPENHEIMER HOLDINGS INC.

$200,000,000 6.75% Senior Secured Notes due 2022

The notes bear interest at the rate of 6.75% per year. Interest on the notes is payable on January 1 and July 1 of each year, beginning on January 1, 2018. The notes mature on July 1, 2022. We may redeem any of the notes beginning on July 1, 2019. The initial redemption price for the notes is 103.375% of their principal amount plus accrued and unpaid interest and additional interest, if any. In addition, at any time prior to July 1, 2019, we may redeem some or all of the notes at a price equal to 100% of the principal amount of the notes to be redeemed plus a “make-whole” premium, plus accrued and unpaid interest and additional interest, if any. On or prior to July 1, 2019, we may redeem up to 35% of the principal amount of the notes at a redemption price equal to 106.75% of the principal amount of the notes, plus accrued and unpaid interest and additional interest, if any, using the net cash proceeds from sales of certain types of capital stock. There is no sinking fund for, or mandatory redemption of, the notes. If a change of control occurs, we must give holders of the notes an opportunity to sell us their notes at a purchase price of 101% of the principal amount of such notes, plus accrued and unpaid interest and additional interest, if any, to the date of purchase. In addition, our obligations under the notes to comply with certain covenants will be suspended and cease to have any further effect from and after the first date when the rating of the notes is investment grade.

The notes are our senior obligations. The notes are unconditionally guaranteed by certain of our existing and certain of our future domestic subsidiaries. The notes and the guarantees with respect to the notes are secured by a first-priority security interest in substantially all of the assets of the company and the guarantors with certain exclusions. Most of our subsidiaries, including our broker dealer subsidiaries, investment advisor subsidiaries and certain of our operating subsidiaries, which generate substantially all of our revenue and net income and own substantially all of our assets, are not guarantors of the notes and certain of our subsidiaries, including our broker dealer subsidiaries, are not subject to many of the restrictive covenants in the indenture governing the notes.

No public market currently exists for the notes. We do not intend to list the notes on any securities exchange and, therefore, no active public market for the notes is anticipated to exist.

See “Risk Factors” beginning on page 16 for a discussion of certain risks you should consider before investing in the notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus is to be used by Oppenheimer & Co. Inc. in connection with offers and sales of the notes in market-making transactions effected from time to time. Oppenheimer & Co. Inc. may act as principal or agent in such transactions. Such sales will be made at prevailing market prices at the time of sale, at prices related thereto or at negotiated prices. We will not receive any of the proceeds from such sales.

The date of this prospectus is

September 20

, 2017.

Table of Contents

TABLE OF CONTENTS

Prospectus

You should rely only on the information contained or incorporated by reference into this prospectus or any prospectus supplement to this prospectus filed by us with the Securities and Exchange Commission, or the “SEC.” We have not authorized anyone to provide you with different or additional information. If anyone provides you with different or inconsistent information, you should not rely on it. This document may only be used where it is legal to sell these securities. You should not assume that the information in this prospectus, any prospectus supplement to this prospectus, or any document incorporated by reference is accurate as of any date other than their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

i

Table of Contents

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in or incorporated by reference in this prospectus include certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements contained in this prospectus or incorporated by reference that are not historical facts are identified as “forward-looking statements” for the purpose of the safe harbor provided by Section 21E of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), and Section 27A of the Securities Act of 1933, as amended (the “Securities Act”). Forward-looking statements are subject to uncertainties that could cause actual future events and results to differ materially from those expressed in the forward-looking statements. These forward-looking statements are based on estimates, projections, beliefs, and assumptions that we believe are reasonable but are not guarantees of future events and results. Actual future events and our results may differ materially from those expressed in these forward-looking statements as a result of a number of important factors.

Factors that could cause actual results to differ materially from those contemplated in our forward-looking statements include, among others:

·

transaction volume in the securities markets;

·

the volatility of the securities markets;

·

fluctuations in interest rates;

·

changes in regulatory requirements which could affect the cost and method of doing business and reduce returns;

·

fluctuations in currency rates;

·

general economic conditions, both domestic and international, including fluctuating oil prices;

·

changes in the rate of inflation and the related impact on the securities markets;

·

competition from existing financial institutions and other participants in the securities markets;

·

legal developments affecting the litigation experience of the securities industry and us, including developments arising from the failure of the Auction Rate Securities markets, the trading of low-priced securities, stepped up enforcement efforts by the SEC, Financial Crimes Enforcement Network, Financial Industry Regulatory Authority (“FINRA”) and other regulators and the results of pending litigation and regulatory proceedings involving us;

·

changes in foreign, federal and state tax laws which could affect the popularity of products sold by us or impose taxes on securities transactions;

·

applications and enforcement of the U.S. Department of Labor (“DOL”) retirement rules and regulations;

·

the effectiveness of efforts to reduce costs and eliminate overlap;

·

war and nuclear confrontation as well as political unrest and regime changes, health epidemics and economic crisis in foreign countries;

·

our ability to achieve our business plan;

·

corporate governance issues;

·

the impact of the credit crisis and tight credit markets on business operations;

·

the effect of bailout, financial reform and related legislation, including, without limitation, the Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), the Volcker Rule (as defined herein) and the rules and regulations thereunder and the new DOL rule (

see

“Management’s Discussion and Analysis of

ii

Table of Contents

Financial Condition and Results of Operations — Regulatory and Legal Environment” in our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2017 (our “Second Quarter 10-Q”));

·

the consolidation of the banking and financial services industry;

·

the effects of the economy on our ability to find and maintain financing options and liquidity;

·

credit, operations, legal and regulatory risks;

·

risks related to foreign operations, including those in the United Kingdom which may be affected by Britain’s June 23, 2016 referendum to exit the EU (“Brexit”);

·

risks related to the downgrade of U.S. long-term sovereign debt obligations and the sovereign debt of European nations;

·

risks related to the manipulation of the London Interbank Offered Rate (“LIBOR”) and concerns over high speed trading;

·

potential cyber security threats;

·

the effect of technological innovation on our industry and business;

·

risks related to the lowering by S&P Global Ratings (“S&P”) or Moody’s Investors Service, Inc. (“Moody’s”) of its rating on us and our long-term debt;

·

risks related to elections results, Congressional gridlock, government shutdowns and investigations, changes in or uncertainty surrounding regulations and threats of default by the federal government; and

·

the factors set forth under “Risk Factors” in this prospectus and other factors described in our filings with the Securities and Exchange Commission (the “SEC”), including under the section “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Second Quarter 10-Q.

We undertake no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

iii

Table of Contents

SUMMARY

This summary highlights selected information contained elsewhere or incorporated by reference in this prospectus. This summary may not contain all of the information that you should consider before buying any of the notes. You should read the following summary together with the more detailed information and consolidated financial statements and the notes to those statements incorporated into this prospectus by reference.

In this prospectus, except as otherwise indicated or as the content otherwise requires, the terms “Company,” “we,” “us,” and “our” refer to Oppenheimer Holdings Inc. and its consolidated subsidiaries. We refer to the directly and indirectly owned subsidiaries of Oppenheimer Holdings Inc. collectively as the “Operating Subsidiaries.”

Our Company

Company Overview

We, through our Operating Subsidiaries, are a leading middle-market investment bank and full service broker-dealer. With roots tracing back to 1881, we are engaged in a broad range of activities in the financial services industry, including retail securities brokerage, institutional sales and trading, investment banking (both corporate and public finance), research, market-making, trust services and investment advisory and asset management services. We own, directly or through our subsidiaries, Oppenheimer & Co. Inc. (“Oppenheimer”), a New York-based securities broker-dealer, Oppenheimer Asset Management Inc. (“OAM”), a New York-based investment adviser, Freedom Investments, Inc. (“Freedom”), a discount securities broker-dealer based in New Jersey, and Oppenheimer Trust Company (“Oppenheimer Trust”), a Delaware limited purpose bank. Our international businesses are carried on through Oppenheimer Europe Ltd. (United Kingdom), Oppenheimer Investments Asia Limited (Hong Kong), and Oppenheimer Israel (OPCO) Ltd. (Israel) (“OIL”).

For the six months ended June 30, 2017, our revenues were $429 million compared with revenues of $427 million for the six months ended June 30, 2016. For the fiscal year 2016, our revenues were approximately $858 million compared with revenues of $898 million for the fiscal year 2015.

For the twelve months ended June 30, 2017, our Consolidated Adjusted EBITDA and Consolidated Adjusted EBITDA margin were $18.0 million and 2.1%, respectively, compared with Consolidated Adjusted EBITDA and Consolidated Adjusted EBITDA margin of $19.2 million and 2.1%, respectively, for the twelve months ended June 30, 2016. For the fiscal year 2016, our Consolidated Adjusted EBITDA and Consolidated Adjusted EBITDA margin were $18.7 million and 2.1%, respectively, compared with Consolidated Adjusted EBITDA and Consolidated Adjusted EBITDA margin of $30.8 million and 3.3%, respectively, for the fiscal year 2015.

At June 30, 2017, our client assets under administration and assets under management were $81.2 billion and $26.1 billion, respectively, compared with client assets under administration and assets under management of $78.7 billion and $24.3 billion, respectively, at June 30, 2016. At December 31, 2016, our client assets under administration and assets under management were $77.2 billion and $24.8 billion, respectively, compared with client assets under administration and assets under management of $78.7 billion and $24.1 billion, respectively, at December 31, 2015.

At June 30, 2017, we employed 3,047 employees (2,969 full-time and 78 part-time), of whom approximately 1,132 were financial advisers. We are headquartered in New York, New York and incorporated under the laws of the state of Delaware.

Private Client

Through our Private Client division, we provide a comprehensive array of financial services. As of June 30, 2017, we provided our services from 94 offices in 24 states located throughout the United States, offices in Tel

1

Table of Contents

Aviv, Israel, Hong Kong, China, London, England, St. Helier, Isle of Jersey and Geneva, Switzerland. Clients include high-net-worth individuals and families, corporate executives, trusts and foundations and small and mid-sized businesses. Clients may choose a variety of ways to establish a relationship and conduct business including brokerage accounts with transaction-based pricing and/or investment advisory accounts with asset-based fee pricing. We provide the following private client services: Full-Service Brokerage, Wealth Planning and Margin Lending. The Private Client division generated revenues of $277.6 million and $504.2 million for the six months ended June 30, 2017 and the fiscal year 2016, respectively. Client assets under administration were $81.2 billion at June 30, 2017 compared with $77.2 billion at December 31, 2016.

Asset Management

Through OAM, our investment advisory affiliate, we manage our advisory programs and alternative investments business. The business includes discretionary and non-discretionary fee-based programs sponsored by Oppenheimer, OAM, Oppenheimer Investment Advisers (“OIA”) and Oppenheimer Investment Management LLC (“OIM”), as well as alternative investments sponsored through Advantage Advisers Multi Manager LLC and Oppenheimer Alternative Investment Management LLC.

OAM offers a wide range of tailored investment management solutions and services to high net worth private clients, institutions and investment advisers. These include, but are not limited to, portfolio management, manager research and due diligence, asset allocation advice and financial planning. Proprietary and third party investment management capabilities are offered through separately managed accounts, alternative investments and discretionary and non-discretionary portfolio management programs. Platform support functions include sales and marketing along with administrative services such as trade execution, client services, records management and client reporting. Clients investing in the OAM advisory program are charged fees based on the value of assets under management. Prior to January 1, 2017, advisory fees were allocated 22.5% to the Asset Management and 77.5% to the Private Client segments. Starting January 1, 2017, the Company determined it was appropriate to change the allocation to 10.0% to the Asset Management and 90.0% to the Private Client segments due to changes in the mix of the business over time and related costs.

Our asset management services include: Separate Managed Accounts, Mutual Fund Managed Accounts, Discretionary Advisory Accounts, Non-Discretionary Advisory Accounts, Alternative Investments, Portfolio Enhancement Program, Oppenheimer Investment Advisers and Oppenheimer Investment Management LLC. The Asset Management division generated revenues of $37.9 million and $92.9 million for the six months ended June 30, 2017 and the fiscal year 2016, respectively. At June 30, 2017, we had $26.1 billion of client assets under fee-based management programs compared to $24.8 billion at December 31, 2016.

Capital Markets

Our Capital Markets division generated revenues of $109.6 million and $254.9 million for the six months ended June 30, 2017 and the fiscal year 2016, respectively.

Investment Banking

Our investment banking group employs approximately 100 investment banking professionals throughout the United States as well as investment bankers in Europe and Israel. Our investment banking division provides strategic advisory services and capital markets products to emerging growth and middle market businesses as well as financial sponsors. The investment banking industry coverage groups focus on certain sectors including consumer and business services, energy, financial institutions and real estate, healthcare, industrial growth and services, and technology, media and communications. In our Mergers and Acquisitions division, we advise buyers and sellers on sales, divestitures, mergers, acquisitions, tender offers, privatizations, restructurings, spin-offs and joint ventures. In our Equities division, we provide capital raising solutions for corporate clients through initial public offerings, follow-on offerings, equity-linked offerings, private investments in public entities, and private placements. Our Leveraged Finance and Fixed Income group offers a full range of debt financing for emerging growth and middle market companies and financial sponsors as well as sovereign and corporate issuers in emerging market countries.

2

Table of Contents

Equities Division

Our Institutional Equity Sales and Trading group provides execution services and access to all major U.S. equity exchanges and alternative execution venues, in addition to capital markets/origination, various arbitrage strategies, portfolio and electronic trading. Our Equity Research analysts cover 500 equity securities worldwide and provide regular research reports, notes and earnings updates and also sponsors numerous research conferences where the management of covered companies can meet with investors in a group format as well as in one-on-one meetings. Our Equity and Derivatives and Index Options groups offer extensive equity and index options strategies for investors seeking to manage risk and optimize returns within the equities market. We offer expertise in the sales, trading and analysis of U.S. domestic convertible bonds, convertible preferred shares and warrants, with a focus on minimizing transaction costs and maximizing liquidity in our Convertible Bonds group. We have a dedicated Event Driven Sales and Trading team focused on providing specialized advice and trade execution expertise to institutional clients with an interest in investment strategies such as: risk/merger arbitrage, Dutch tender offers, splits and spin-offs, recapitalizations, corporate reorganizations, and other event-driven trading strategies.

Debt Capital Markets

Our Fixed Income team offers trading and a high degree of sales support in highly rated corporate bonds, mortgage-backed securities, government and agency bonds and the sovereign and corporate debt of industrialized and emerging market countries, which may be denominated in currencies other than U.S. dollars. We also originate and underwrite securities for smaller corporations in the U.S. as well as sovereign and corporate issuers in emerging markets. In our Fixed Income Research group, our analysts and professionals focus on high yield corporate bond research in an effort to identify debt issues that provide a combination of high yield plus capital appreciation over the short to medium term. Our Public Finance department advises and raises capital for state and local governments, public agencies, private developers and other borrowers. We also have regionally based municipal bond trading desks serving retail financial advisers and clients within their regions in our Municipal Trading group, and we also maintain a dedicated institutional municipal bond sales and trading effort focused on serving mid-tier and national institutional accounts.

Proprietary Trading

In the regular course of our business, we take securities positions as a market maker and/or principal to facilitate customer transactions and for investment purposes. In making markets and when trading for our own account, we expose our own capital to the risk of fluctuations in market value. In 2010, Congress enacted the Dodd-Frank Act that proposes to prohibit proprietary trading by certain financial institutions (the “Volcker Rule”) except where facilitating customer trades. The Volcker Rule went into effect in July 2015 and does not impact our business or operations as it applies to banks and other subsidiaries of bank holding companies only.

Securities Lending

In connection with both our trading and brokerage activities, we borrow securities to cover short sales and to complete transactions in which customers have failed to deliver securities by the required settlement date and lend securities to other brokers and dealers for similar purposes. We earn interest on our cash collateral provided and pay interest on the cash collateral received less a rebate earned for lending securities.

Consolidated Subsidiaries

Oppenheimer & Co. Inc.

Oppenheimer is a registered broker-dealer in securities under the Exchange Act and transacts business both on and off various exchanges. Oppenheimer engages in a broad range of activities in the securities industry, including retail securities brokerage, institutional sales and trading, investment banking (both corporate and public finance), underwritings, research, market-making, and investment advisory and asset management services. Oppenheimer provides its services from offices located throughout the United States.

3

Table of Contents

Oppenheimer Asset Management Inc.

OAM is registered as an investment adviser with the SEC under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). OAM provides investment advice to clients through separate accounts and wrap fee programs.

Oppenheimer Trust Company of Delaware Inc.

Oppenheimer Trust offers a wide variety of trust services to clients of our Private Client division. This includes custody services, advisory services and specialized servicing options for clients. At December 31, 2016, Oppenheimer Trust held custodial assets of approximately $662.2 million. See “Business — Other Requirements” in our Annual Report on Form 10-K for the year ended December 31, 2016 (our “Form 10-K”).

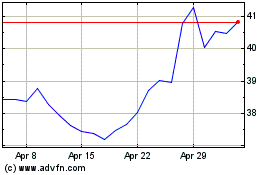

Interest Rates

Over the last several years, interest rates have been historically low. However, the Federal Reserve raised the target for federal funds rates by 25 basis points in each of December 2015, December 2016, March 2017, and June 2017. We offer several products which are sensitive to interest rate fluctuations, including cash sweep balances, margin lending, spread lending and firm investments. As of June 30, 2017, our FDIC-insured Bank Deposit program had a balance of $7.0 billion and customer margin debits were $847.5 million. We believe that rising interest rates will have a positive impact on our interest and fee revenues as shown in the chart below.

Interest and Fee Revenues ($mm)

Our Strengths

Diversified and Synergistic Business Model

We generate revenue across three differentiated business segments. Our Private Client division earns revenues based on transaction volumes and client assets under administration and interest earning assets related to clients, our Asset Management division earns revenue based on assets under management and our Capital Markets division earns revenues based on transaction and trading volumes. The different drivers of revenues for the three divisions provides us with a diversified revenue stream. In addition, we benefit from significant synergies between our three business segments. The Capital Markets division benefits from the leads, distribution capabilities and brand recognition of our Private Client division, while providing a strong research team and additional client opportunities for the Private Client division. The Asset Management division provides opportunities for us to monetize further fee streams from our Private Client division while providing more stable non-transactional revenues. Oppenheimer serves clients from 94 offices located in major cities and local communities in the United States, which limits our reliance on any one regional economy and provides clients with local high quality service with the benefits of a national full service business.

4

Table of Contents

Last Twelve Months June 30, 2017 Revenue ($859.9 million)

Increasing Shift toward More Predictable and Recurring Fee-based Revenues

Revenues from our Asset Management division consist of investment advisory and transactional fees for advisory services as well as from revenue sharing arrangements with registered and private alternative investment vehicles. Investment advisory fees are earned on all assets held in discretionary and non-discretionary asset-based programs. These fees are typically billed quarterly, in advance, and are calculated as a percent of assets under management at the end of the prior quarter. Management and incentive fees from revenue sharing arrangements in alternative investments are calculated on a pre-determined basis with registered and private investment companies. The investment advisory fees on products offered by our Asset Management division provide us with a recurring and predictable revenue stream. We have built a solid platform of support functions within our Asset Management division, such as sales and marketing and trade execution, to assist our financial advisers in providing financial wealth planning services. As a result, advisory fees have become an increasingly larger portion of our overall revenues in our Private Client and Asset Management divisions. For the twelve month period ended June 30, 2017, advisory fees from our managed product business as a percentage of our advisory fees plus commissions from our transaction-based business was 56.8%.

Advisory Fees as a Percentage of Wealth Management Advisory Fees and Commissions

Primarily an Agency Business Model

Our business strategy is built on an agency model, which means we derive our revenues mainly by charging our clients commissions and fees on transactions we execute and assets we manage on their behalf. We take little principal risk, and when we do so, it is generally in order to facilitate our client facing business.

5

Table of Contents

Strong Strategic Position

Our business model combines the full service capabilities of our larger competitors while maintaining the flexibility and independence of a boutique investment firm. We are one of the few full service firms that continues to consistently service middle market companies across the United States and internationally. We have a long-standing history in the private client business dating back to 1881 and have a focus on the attractive segment of high net worth clients. We have a strong reputation in equity research and have an attractive niche position in middle-market banking and financial sponsor sectors. Oppenheimer is a leading market maker, making markets in over 800 stocks, with access to all international trading markets. Our full service boutique model positions us to compete for a broad range of business in both the retail and capital markets. Our independent and entrepreneurial culture is an advantage in recruiting financial advisors and other financial professionals. Our size allows us to adapt quickly in the changing market place and seek an attractive risk-adjusted return on capital, while being able to provide a full service offering. The loss of corporate independence by some of our competitors has improved our competitive position within middle market financial services and benefits our platforms for experienced financial advisors. In addition, because several of our products and services, such as margin lending and cash-based products, are significantly impacted by interest rates, any expected increases in interest rates would have a significant positive impact on fees earned.

Streamlined Operations to Quickly Respond to Changing Business Environment

While certain recent market environment and industry trends, including new regulatory standards and the move from active to passive as well as automated investments strategies, have created challenges for some of our businesses, we have undertaken several initiatives to streamline and leverage our human capital and other resources to best address the business opportunities that currently exist in each of our major operating divisions. For example, we have recently introduced a new technology platform to service our fee-based business and introduced portable technology to enable clients to access their portfolio information from all portable devices. We have also introduced significant new technology to better control and surveil our business to meet changing regulatory requirements. As a result, we are able to respond quickly to changes in the business and regulatory landscape and are well positioned to take advantage of strategic opportunities that the changing business environment may create.

Well Recognized Brand

We have an internationally recognized brand name. Our history dates back to 1881, successfully navigating two World Wars and numerous financial crises. We are one of the top independent U.S. full service securities brokerage firms by the number of financial advisors and are able to leverage our name recognition across all our divisions to generate new client business. Our Private Client division supports our middle market banking efforts, while our well-recognized equity research increases awareness across private client, capital markets and asset management clients.

Experienced & Committed Management Team

We have a strong and experienced senior management team with extensive securities industry experience and significant tenure of working together. Our top eleven senior managers have, on average, more than 13 years of experience at Oppenheimer and, on average, more than 29 years of overall industry experience.

Conservative Risk Position and Robust Risk Management Culture

We believe we maintain a conservative risk position with an average value at risk, or VaR, for the fiscal year 2016 of $885,000 and a year-end VaR of $962,000. Our assets consist primarily of cash and assets which can be readily converted into cash, to give us a strong liquidity position if it becomes necessary. We also have significant additional liquidity available through short-term funding sources such as bank loans, stock loans and repurchase agreements. We believe we have a robust risk management culture with a focus on managing market risk, credit risk, liquidity risk and operational risk. We have risk management policies and procedures overseen by our risk management committee, which is made up of many of our most senior officers. Oppenheimer seeks to manage its assets and the maturity profile of its obligations in order to be able to liquidate its assets prior to its

6

Table of Contents

obligations coming due, even in times of severe market dislocation. We seek to accomplish this by a strict balance sheet and regulatory capital management and staying focused on our core business. Oppenheimer computes its net capital requirements under the alternative method provided for in Rule 15c3-1 of the Exchange Act, which requires that Oppenheimer maintain net capital equal to two percent of aggregate customer-related debit items, as defined in Rule 15c3-3. As of June 30, 2017, Oppenheimer’s net capital as calculated under such Rule was $130.2 million or 11.62% of Oppenheimer’s aggregate debit items. This was $107.8 million in excess of the minimum required net capital at that date.

Our Strategy

We have a number of strategic efforts in place to increase revenue and profitability in our Private Client, Asset Management and Capital Markets divisions. We continue to execute on our near-term strategies of new business and product development, streamlining our infrastructure, and investing in our technology. In the longer term, we plan to grow our business both organically and with opportunistic acquisitions within our areas of expertise, including branch acquisitions. We also see significant opportunities to expand our international operations in our Private Client and Capital Markets divisions.

·

Private Client.

We intend to increase average production per financial advisor by leveraging the existing product platform through a greater percentage of our sales force, marketing and cross-selling our product offerings among our branch locations and enhancing our financial advisor technology. We will expand our sales force incrementally through efforts to recruit and retain top talent as well as through opportunistic acquisitions. We have and continue to add junior advisors to existing practices and engage with client family members in order to assure continuity and succession planning as well as to add increased capability and growth. We manage our recruitment costs and retention payments relative to competitors by taking advantage of our distinct culture and our favorable reputation with financial advisors frustrated with the large wire houses. We also intend to develop more products and services which target high net worth clients to attract new clients and leverage our existing relationships to increase our share of customer spending on financial services. We believe our earnings from this segment of our business will improve significantly in a higher interest rate environment.

·

Asset Management.

Our clients have access to a team of specialists with expertise across many disciplines, from hedge funds to mutual funds, from domestic investments to offshore opportunities. We integrate traditional and non-traditional portfolios into a unified solution while offering ready access to the best managers in the investment management universe, both within and outside the firm. We intend to deepen and broaden our product offerings and penetration in asset management. One of our strategic advantages is our diligence process for identifying new asset managers and asset management strategies. Our diligence analysts are directly available for clients, which differentiates us from our competitors when working with high net worth individuals and family offices. We are also looking at additional opportunities to bring successful hedge fund and private equity investments to our clients. In addition, we are expanding our sales and marketing team in asset management in an effort to increase growth in client assets through new clients and increasing share of managed assets from existing clients.

·

Capital Markets.

We intend to utilize our strong brand name to continue to develop our investment banking and research capabilities. Our institutional equities business is looking to grow through expansion of market share with existing clients by efficiently allocating resources across different products to focus on key targeted small to medium capitalization corporate clients. The increased penetration of institutional accounts will allow us to leverage our distribution capabilities. In investment banking, we intend to utilize our Private Client division for leads and continue to grow our emerging growth and middle-market banking and financial sponsor franchises. Longer term, we seek to increase our business footprint and reputation by hiring experienced bankers with diverse product and industry knowledge. In the taxable fixed income sector, we continue to expand our product line and selectively grow our middle markets desk.

7

Table of Contents

·

Pursuing Opportunistic Acquisitions.

We believe the Company is well positioned to make acquisitions of related businesses that can quickly and effectively be integrated into the existing business platform and help to grow revenues. We expect that the funds raised in this offering will enable us to execute on our strategy.

Corporate Structure

8

Table of Contents

SUMMARY DESCRIPTION OF THE NOTES

The following is a brief summary of some of the terms of this offering. For a more complete description of the terms of the notes, see “Description of the notes” included elsewhere in this prospectus.

|

Issuer

|

|

Oppenheimer Holdings Inc.

|

|

|

|

|

|

Securities

|

|

Up to $200.0 million aggregate principal amount of 6.75% Senior Secured Notes due 2022.

|

|

|

|

|

|

Maturity

|

|

July 1, 2022.

|

|

|

|

|

|

Interest

|

|

6.75% per annum, payable semi-annually in arrears on January 1 and July 1 of each year, beginning on January 1, 2018.

|

|

|

|

|

|

Subsidiary Guarantees

|

|

All payments on the notes, including principal and interest, are jointly and severally and fully and unconditionally guaranteed on a senior secured basis by E.A. Viner International Co. and Viner Finance Inc. and future subsidiaries required to guarantee the notes pursuant to the “Future Subsidiary Guarantees” covenant (the “Subsidiary Guarantors”). See “Description of the Notes — Covenants — Future subsidiary guarantees.”

|

|

|

|

|

|

|

|

Most of our subsidiaries, including our broker-dealer subsidiaries, investment adviser subsidiaries and certain of our operating subsidiaries, which generate substantially all of our revenue and net income and own substantially all of our assets, will not be guarantors of the notes.

|

|

|

|

|

|

|

|

As of June 30, 2017, our non-guarantor subsidiaries represented 100% of our total assets and, for the year ended December 31, 2016, represented 100% of our total revenues. In addition, our non-guarantor subsidiaries incurred a net loss from continuing operations of $28.4 million for the year ended December 31, 2016.

|

|

|

|

|

|

Collateral

|

|

The notes and the subsidiary guarantees are secured by a first-priority security interest in substantially all of the Company’s and the Subsidiary Guarantors’ existing and future tangible and intangible assets, subject to certain exceptions and permitted liens. See “Description of the Notes — Security.”

|

|

|

|

|

|

Optional Redemption

|

|

We may redeem the notes at any time on or after July 1, 2019. The redemption price for the notes (expressed as a percentage of principal amount), will be as follows, plus accrued and unpaid interest and additional interest, if any, to, but not including, the redemption date:

|

|

If Redeemed During the 12-Month Period Commencing July 1,

|

|

Redemption Price

|

|

|

2019

|

|

103.375

|

%

|

|

2020

|

|

101.6875

|

%

|

|

2021 and thereafter

|

|

100.000

|

%

|

|

|

|

In addition, at any time prior to July 1, 2019, we may redeem the notes at our option, in whole at any time or in part from time to time, at a redemption price equal to 100% of the principal amount of the notes redeemed plus a “make-whole” premium and accrued and unpaid interest and additional interest, if any.

|

|

|

|

|

|

|

|

In addition, at any time prior to July 1, 2019, we may redeem up to 35% of the principal amount of the notes with the net cash proceeds of one or more sales of our capital stock (other than disqualified stock) at a redemption price of

|

9

Table of Contents

|

|

|

106.75% of their principal amount, plus accrued and unpaid interest and additional interest, if any; provided that at least 65% of the original aggregate principal amount of notes issued on the closing date remains outstanding after each such redemption and notice of any such redemption is sent within 90 days of each such sale of capital stock.

|

|

|

|

|

|

Change of Control

|

|

Upon a change of control we may be required to make an offer to purchase the notes. The purchase price will equal 101% of the principal amount of the notes on the date of purchase, plus accrued and unpaid interest and additional interest, if any. We may not have sufficient funds available at the time of a change of control to make any required debt payment (including repurchases of the notes).

|

|

|

|

|

|

Ranking

|

|

The notes are our general senior obligations and rank effectively senior in right of payment to all unsecured and unsubordinated obligations of the Company or the relevant Subsidiary Guarantor, to the extent of the value of the collateral owned by the Company or such Subsidiary Guarantor (and, to the extent of any unsecured remainder after payment of the value of the collateral, rank equally in right of payment with such unsecured and unsubordinated indebtedness of the Company). The notes also rank senior in right of payment to any subordinated debt of the Company or such Subsidiary Guarantor. The notes are secured on a first-priority basis by the collateral, subject to certain exceptions and permitted liens and it is intended that pari passu lien indebtedness, if any, will be secured on an equal and ratable basis. The notes are effectively junior in right of payment to all existing and future indebtedness, claims of holders of preferred stock and other liabilities (including trade payables) of subsidiaries of the Company that are not guarantors, including all Regulated Subsidiaries (as defined below) and unrestricted subsidiaries.

|

|

|

|

|

|

|

|

As of June 30, 2017, our long-term debt was comprised of the notes.

|

|

|

|

|

|

|

|

We currently derive substantially all of our revenue from the operations of our Regulated Subsidiaries. As our obligations under the notes are not guaranteed by our Regulated Subsidiaries, creditors of a Regulated Subsidiary, including trade creditors, customers, and preferred stockholders, if any, of such Regulated Subsidiary generally have priority with respect to the assets and earnings of such Regulated Subsidiary over the claims of the holders. The notes, therefore, are effectively subordinated to the claims of creditors, including trade creditors, customers and preferred stockholders, if any, of our Regulated Subsidiaries. As of June 30, 2017, our Regulated Subsidiaries had $2.1 billion outstanding in such liabilities.

|

|

|

|

|

|

Certain Covenants

|

|

The Company agreed to covenants that limit the ability of the Company and its restricted subsidiaries and, in certain limited cases, its Regulated Subsidiaries, among other things, to:

|

|

|

|

|

|

|

|

·

incur additional debt and issue preferred stock;

|

|

|

|

|

|

|

|

·

pay dividends, acquire shares of capital stock, make payments on subordinated debt or make investments;

|

|

|

|

|

|

|

|

·

place limitations on distributions from Regulated Subsidiaries or restricted subsidiaries;

|

|

|

|

|

|

|

|

·

issue guarantees;

|

|

|

|

|

|

|

|

·

sell or exchange assets;

|

10

Table of Contents

|

|

|

·

enter into transactions with shareholders and affiliates;

|

|

|

|

|

|

|

|

·

create liens; and

|

|

|

|

|

|

|

|

·

effect mergers.

|

|

|

|

|

|

|

|

These covenants are subject to important exceptions and qualifications, which are described under the heading “Description of the Notes — Covenants” in this prospectus. These exceptions and qualifications include, among other things, a variety of provisions that are intended to allow us to continue to conduct our brokerage operations in the ordinary course of business. In addition, if and for so long as the notes have an investment grade debt rating from both S&P and Moody’s and no default has occurred and is continuing under the indenture, we will not be subject to certain of the covenants listed above. See “Description of the notes.”

|

|

|

|

|

|

|

|

Pursuant to the indenture, the following covenants apply to us and our restricted subsidiaries, but generally do not apply, or apply only in part, to our Regulated Subsidiaries:

|

|

|

|

|

|

|

|

·

limitation on indebtedness and issuances of preferred stock, which restricts our ability to incur additional indebtedness or to issue preferred stock;

|

|

|

|

|

|

|

|

·

limitations on restricted payments, which generally restricts our ability to declare certain dividends or distributions or to make certain investments;

|

|

|

|

|

|

|

|

·

limitation on dividend and other payment restrictions affecting restricted subsidiaries or Regulated Subsidiaries, which generally prohibits restrictions on the ability of certain of our subsidiaries to pay dividends or make other transfers;

|

|

|

|

|

|

|

|

·

future Subsidiary Guarantors, which prohibits certain of our subsidiaries from guaranteeing our indebtedness or indebtedness of any restricted subsidiary unless the notes are comparably guaranteed;

|

|

|

|

|

|

|

|

·

limitation on transactions with shareholders and affiliates, which generally requires transactions among our affiliated entities to be conducted on an arm’s-length basis;

|

|

|

|

|

|

|

|

·

limitation on liens, which generally prohibits us and our restricted subsidiaries from granting liens unless the notes are comparably secured; and

|

|

|

|

|

|

|

|

·

limitation on asset sales, which generally prohibits us and certain of our subsidiaries from selling assets or certain securities or property of significant subsidiaries under certain circumstances.

|

|

|

|

|

|

|

|

Under certain circumstances, however, the covenants under “Description of the Notes — Covenants — Limitation on indebtedness and issuances of preferred stock,” “— Limitation on restricted payments,” “— Limitation on dividend and other payment restrictions affecting restricted subsidiaries or regulated subsidiaries,” “— Future subsidiary guarantees,” “— Limitation on transactions with shareholders and affiliates,” and “— Limitation on asset sales” may apply to our Regulated Subsidiaries, depending on the nature of the transaction in question, whether a Regulated Subsidiary is incurring any Indebtedness (as defined in the indenture) and a variety of other factors.

|

11

Table of Contents

|

|

|

For purposes of the covenants, Regulated Subsidiaries refers to any direct or indirect subsidiary of the Company that is registered, licensed or qualified as (i) a broker dealer pursuant to Section 15 of the Exchange Act, (ii) a broker dealer or underwriter under any foreign securities law, (iii) a banking or insurance subsidiary regulated under state, federal or foreign laws, or (iv) an investment advisor or relying advisor pursuant to the Advisers Act or under state or foreign laws and (v) OIL. Restricted subsidiaries generally include any of our subsidiaries that are not Regulated Subsidiaries and that have not been designated by our board of directors as unrestricted.

|

|

|

|

|

|

|

|

As of June 30, 2017, our Regulated Subsidiaries represented 92.83% of our total assets. For the six months ended June 30, 2017 and the year ended December 31, 2016, our Regulated Subsidiaries represented 100.85% and 100.31% of our total revenues, respectively, and incurred a net loss from continuing operations of $2.2 million and $9.2 million, respectively.

|

|

|

|

|

|

Risk Factors

|

|

You should carefully consider the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth in the section entitled “Risk Factors — Risks Relating to the Notes” for an explanation of certain risks of investing in the notes. For a description of risks related to our industry and business, see “Risk Factors — Risks Relating to the Business.”

|

12

Table of Contents

SUMMARY CONSOLIDATED HISTORICAL FINANCIAL DATA

The summary consolidated historical financial data set forth below for each of the years ended December 31, 2016, 2015 and 2014 has been primarily derived from our audited consolidated financial statements. The summary consolidated historical financial data set forth below for the six months ended June 30, 2017 and June 30, 2016 has been primarily derived from our unaudited consolidated financial statements. The following data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated historical financial statements and the related notes contained in our annual report on Form 10-K for the year ended December 31, 2016, and our quarterly report on Form 10-Q for the quarters ended March 31, 2017 and June 30, 2017, as filed with the SEC on April 28, 2017 and July 28, 2017, respectively, which are incorporated by reference into this prospectus.

|

|

|

Six Months Ended June 30,

|

|

Year Ended December 31,

|

|

|

|

|

2017

|

|

2016

|

|

2016

|

|

2015(1)

|

|

2014(1)

|

|

|

|

|

(Dollars in thousands)

|

|

|

Consolidated Statements of Operation:

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUE:

|

|

|

|

|

|

|

|

|

|

|

|

|

Commissions

|

|

$

|

170,569

|

|

$

|

196,424

|

|

$

|

377,317

|

|

$

|

417,559

|

|

$

|

469,829

|

|

|

Advisory Fees

|

|

142,192

|

|

132,130

|

|

269,119

|

|

280,247

|

|

281,680

|

|

|

Investment banking

|

|

33,407

|

|

31,264

|

|

81,011

|

|

102,540

|

|

125,598

|

|

|

Interest

|

|

23,394

|

|

25,049

|

|

47,649

|

|

49,032

|

|

47,505

|

|

|

Principal transactions, net

|

|

10,675

|

|

14,195

|

|

20,481

|

|

15,180

|

|

27,515

|

|

|

Other

|

|

48,908

|

|

27,968

|

|

62,202

|

|

33,243

|

|

29,008

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

429,145

|

|

427,030

|

|

857,779

|

|

897,801

|

|

981,135

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXPENSES:

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and related expenses

|

|

286,535

|

|

290,216

|

|

584,710

|

|

610,820

|

|

654,396

|

|

|

Communications and technology

|

|

36,105

|

|

35,318

|

|

70,390

|

|

66,549

|

|

66,750

|

|

|

Occupancy and equipment costs

|

|

30,433

|

|

29,887

|

|

60,791

|

|

62,842

|

|

62,671

|

|

|

Clearing and exchange fees

|

|

11,770

|

|

13,120

|

|

25,126

|

|

26,022

|

|

24,709

|

|

|

Interest

|

|

12,210

|

|

9,839

|

|

19,437

|

|

16,329

|

|

16,956

|

|

|

Other

|

|

60,754

|

|

61,236

|

|

119,217

|

|

117,667

|

|

138,463

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total expenses

|

|

437,807

|

|

439,616

|

|

879,671

|

|

900,229

|

|

963,945

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes from continuing operations

|

|

(8,662

|

)

|

(12,586

|

)

|

(21,892

|

)

|

(2,428

|

)

|

17,190

|

|

|

Income taxes

|

|

(1,961

|

)

|

(6,439

|

)

|

(12,262

|

)

|

406

|

|

12,134

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) from continuing

operations

|

|

(6,701

|

)

|

(6,147

|

)

|

(9,630

|

)

|

(2,834

|

)

|

5,056

|

|

|

Income from discontinued operations

|

|

1,065

|

|

14,709

|

|

17,339

|

|

9,139

|

|

8,546

|

|

|

Income Taxes

|

|

425

|

|

5,760

|

|

7,218

|

|

3,407

|

|

4,041

|

|

|

Net income from discontinued operations

|

|

640

|

|

8,949

|

|

10,121

|

|

5,732

|

|

4,505

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$

|

(6,061

|

)

|

$

|

2,802

|

|

$

|

491

|

|

$

|

2,898

|

|

$

|

9,561

|

|

|

Less net income attributable to non controlling interest, net of tax

|

|

105

|

|

1,461

|

|

1,652

|

|

936

|

|

735

|

|

|

Net income (loss) attributable to Oppenheimer Holdings Inc.

|

|

(6,166

|

)

|

1,341

|

|

(1,161

|

)

|

1,962

|

|

8,826

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

(6,061

|

)

|

2,802

|

|

491

|

|

2,898

|

|

9,561

|

|

|

Other comprehensive income (loss), net of tax(2)

|

|

|

|

|

|

|

|

|

|

|

|

13

Table of Contents

|

|

|

Six Months Ended June 30,

|

|

Year Ended December 31,

|

|

|

|

|

2017

|

|

2016

|

|

2016

|

|

2015(1)

|

|

2014(1)

|

|

|

|

|

(Dollars in thousands)

|

|

|

Currency translation adjustment

|

|

2,204

|

|

219

|

|

220

|

|

17

|

|

(2,627

|

)

|

|

Comprehensive income (loss)

|

|

(3,857

|

)

|

3,021

|

|

711

|

|

2,915

|

|

6,934

|

|

|

Net income attributable to noncontrolling interests

|

|

105

|

|

1,461

|

|

1,652

|

|

936

|

|

735

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income (loss) for the period

|

|

$

|

(3,962

|

)

|

$

|

1,560

|

|

$

|

(941

|

)

|

$

|

1,979

|

|

$

|

6,199

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

Amounts have been recast to reflect discontinued operations.

(2)

Total other comprehensive income is attributable to Oppenheimer Holdings Inc. No other comprehensive income is attributable to noncontrolling interests.

|

|

|

As of June 30,

|

|

As of December 31,

|

|

|

|

|

2017

|

|

2016

|

|

2016

|

|

2015

|

|

2014

|

|

|

|

|

(Dollars in thousands)

|

|

|

Consolidated Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

116,582

|

|

$

|

107,537

|

|

$

|

64,913

|

|

$

|

63,364

|

|

$

|

63,807

|

|

|

Total assets

|

|

2,607,519

|

|

2,575,729

|

|

2,236,930

|

|

2,698,004

|

|

2,791,479

|

|

|

Total liabilities

|

|

2,106,405

|

|

2,053,617

|

|

1,723,596

|

|

2,172,922

|

|

2,257,747

|

|

|

Total stockholders’ equity

|

|

501,114

|

|

522,112

|

|

513,334

|

|

525,082

|

|

533,732

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of and For the Twelve

Months Ended June 30,

|

|

Year Ended December 31,

|

|

|

|

|

2017

|

|

2016

|

|

2016

|

|

2015

|

|

2014

|

|

|

|

|

(Dollars in thousands)

|

|

|

Other Financial Data

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Adjusted EBITDA(1)(2)

|

|

17,979

|

|

19,237

|

|

18,674

|

|

30,821

|

|

53,327

|

|

|

Long-term Debt

|

|

200,000

|

|

150,000

|

|

150,000

|

|

150,000

|

|

150,000

|

|

|

Long-term Debt to Consolidated Adjusted EBITDA(2)

|

|

11.1

|

|

7.8

|

|

8.0

|

|

4.9

|

|

2.8

|

|

(1)

Consolidated Adjusted EBITDA is a measure of operating performance that is not defined under GAAP. We define Consolidated Adjusted EBITDA as net income (loss) attributable to Oppenheimer Holdings Inc. before interest expense, income taxes, depreciation expense and amortization expense, adjusted to exclude share-based compensation expense which is not settled in cash and extraordinary or unusual items. Our definitions and calculations of Consolidated Adjusted EBITDA may differ from the Consolidated Adjusted EBITDA or analogous calculations of other companies in our industry, and may limit is usefulness as a comparative measure.

The following table shows the reconciliation of our Consolidated Adjusted EBITDA from GAAP net income attributable to Oppenheimer Holdings Inc.:

|

|

|

For the Twelve Months

Ended June 30,

|

|

For the Year Ended December 31,

|

|

|

|

|

2017

|

|

2016

|

|

2016

|

|

2015

|

|

2014

|

|

|

|

|

(Dollars in thousands)

|

|

|

Net Income (Loss) Attributable to Oppenheimer Holdings Inc.:

|

|

$

|

(8,668

|

)

|

$

|

(2,711

|

)

|

$

|

(1,161

|

)

|

$

|

1,962

|

|

$

|

8,826

|

|

|

Add:

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Expense(a)

|

|

13,553

|

|

13,125

|

|

13,125

|

|

13,125

|

|

14,292

|

|

|

Income Taxes

|

|

(6,208

|

)

|

(3,560

|

)

|

(6,221

|

)

|

3,257

|

|

15,515

|

|

|

Depreciation Expense

|

|

6,590

|

|

6,605

|

|

6,788

|

|

7,188

|

|

7,748

|

|

|

Amortization Expense

|

|

1,326

|

|

645

|

|

959

|

|

636

|

|

1,252

|

|

|

Consolidated EBITDA

|

|

6,593

|

|

14,104

|

|

13,490

|

|

26,168

|

|

47,633

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14

Table of Contents

|

|

|

For the Twelve Months

Ended June 30,

|

|

For the Year Ended December 31,

|

|

|

|

|

2017

|

|

2016

|

|

2016

|

|

2015

|

|

2014

|

|

|

|

|

(Dollars in thousands)

|

|

|

Share-Based Compensation Expense(b)

|

|

4,986

|

|

5,133

|

|

5,184

|

|

4,653

|

|

5,694

|

|

|

Extraordinary or Unusual Items(c)

|

|

6,400

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Consolidated Adjusted EBITDA

|

|

$

|

17,979

|

|

$

|

19,237

|

|

$

|

18,674

|

|

$

|

30,821

|

|

$

|

53,327

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Interest expense on long-term debt.

(b) Charges associated with restricted stock and stock option award.

(c) Includes charges related to value-added tax (VAT) assessment levied by the Israel VAT Authority in the amount of $6.4 million for the period August 2008 to March 31, 2017.

(2)

For the as adjusted calculation, the 2017 Consolidated Adjusted EBITDA represents historical Consolidated Adjusted EBITDA and has not been adjusted for the interest expense on long-term debt giving effect to this offering.

15

Table of Contents

RISK FACTORS

Any investment in the notes involves a high degree of risk. You should consider carefully the following information about these risks, together with the other information contained or incorporated by reference in this prospectus, including risks contained in our most recent annual report on Form 10-K, any subsequent quarterly or annual reports on Form 10-Q or Form 10-K or any current reports on Form 8-K, before buying any of the notes. If any of the following risks actually occur, our business, financial condition, prospects, results of operations or cash flow could be materially and adversely affected. Additional risks or uncertainties not currently known to us, or that we currently deem immaterial, may also impair our business operations. We cannot assure you that any of the events discussed in the risk factors below will not occur. If any such event does occur, you may lose all or part of your original investment in the notes.

Risks Relating to the Business

The Company may continue to be adversely affected by the failure of the Auction Rate Securities Market.

In February 2008, the market for auction rate securities (“ARS”) began experiencing disruptions due to the failure of auctions for preferred stocks issued to leverage closed end funds, municipal bonds backed by tax exempt issuers, and student loans backed by pools of student loans guaranteed by U.S. government agencies. This failure followed an earlier failure of a smaller market of ARS that were backed by mortgage and other forms of derivatives in the summer of 2007. These auction failures developed as a result of auction managers or dealers, typically large commercial or investment banks, deciding not to commit their own capital when there was insufficient demand from bidders to meet the supply of sales from sellers. The failure of the ARS market has prevented clients of the Company from liquidating holdings in these positions or, in many cases, posting these securities as collateral for loans. The Company had operated in an agency capacity in this market and held and continues to hold ARS in its proprietary accounts and, as a result of this and the Company’s ongoing repurchases from customers discussed below, is exposed to these liquidity issues as well. There have been no recent issuer redemptions of ARS, and there is no guarantee that any future ARS issuer redemptions will occur and, if so, that the Company’s clients’ ARS will be redeemed.

Regulators have concluded, in many cases, that firms that operate in the securities industry, initially those that underwrote and supported the auctions for ARS, should be compelled to purchase them from retail customers. Underwriters and broker-dealers in such securities have settled with various regulators and have purchased ARS from their retail clients. The Company may be at a competitive disadvantage to those of its competitors that have already completed purchases of ARS from their clients.

In February 2010, Oppenheimer finalized settlements with each of the New York Attorney General’s office (“NYAG”) and the Massachusetts Securities Division (“MSD” and, together with the NYAG, the “Regulators”) concluding investigations and administrative proceedings concerning Oppenheimer’s marketing and sale of ARS. Pursuant to the settlements with the Regulators, Oppenheimer agreed to extend offers to repurchase ARS from certain of its clients subject to certain terms and conditions. In addition to the settlements with the Regulators, Oppenheimer has also reached settlements of and received adverse awards in legal proceedings with various clients where the Company is obligated to purchase ARS. The ultimate amount of ARS to be repurchased by the Company under the settlements with the Regulators or legal settlements and awards cannot be predicted with any certainty and will be impacted by redemptions by issuers and legal and other actions by clients during the relevant period which cannot be predicted.

See

“Management’s Discussion and Analysis of Financial Condition and Results of Operations — Regulatory and Legal Environment — Other Regulatory Matters” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Off-Balance Sheet Arrangements” in our Second Quarter 10-Q for additional details.

If the ARS market remains frozen, the Company may likely be further subject to claims by its clients. There can be no guarantee that the Company will be successful in defending any future actions against it. Any such failure could have a material adverse effect on the results of operations and financial condition of the Company, including its cash position.

See

“Legal Proceedings” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Regulatory and Legal Environment — Other Regulatory Matters” in our Second Quarter 10-Q.

16

Table of Contents

The Company’s customers held at Oppenheimer approximately $76.5 million of ARS at December 31, 2016, exclusive of amounts that were owned by Qualified Institutional Buyers (“QIBs”), transferred to the Company or purchased by customers after February 2008, or transferred from the Company to other securities firms after February 2008. The Company does not presently have the capacity to purchase all of the ARS held by all of its former or current clients who purchased such securities prior to the market’s failure in February 2008 over a short period of time. If the Company was to be required to purchase all of the ARS held by all former or current clients who purchased such securities prior to the market’s failure in February 2008 over a short period of time, these purchases would have a material adverse effect on the Company’s results of operations and financial condition including its cash position. Neither of the settlements with the Regulators requires the Company to do so. The Company does not currently believe that it is legally obligated to make any such purchases except for those purchases it has agreed with the Regulators to make as previously disclosed. If Oppenheimer defaults on either agreement with the Regulators, the Regulators may terminate their agreements and may reinstitute the previously pending administrative proceedings. In addition, there can be no guarantee that other regulators won’t seek to compel the Company to repurchase a greater amount of ARS than called for by the settlements with the Regulators.

See

“Legal Proceedings” in our Second Quarter 10-Q.

The Company has sought, with very limited success, financing from a number of sources to try to find a means for all its clients to find liquidity from their ARS holdings and will continue to do so. There can be no assurance that the Company will be successful in finding a liquidity solution for all its clients’ ARS holdings.

Damage to our reputation could damage our businesses.

Maintaining our reputation is critical to our attracting and maintaining customers, investors and employees. If we fail to deal with, or appear to fail to deal with, various issues that may give rise to reputational risk, we could significantly harm our business prospects. These issues include, but are not limited to, any of the risks discussed in this section, appropriately dealing with potential conflicts of interest, legal and regulatory requirements, employee misconduct, ethical issues, money-laundering, privacy, record keeping, sales and trading practices, failure to sell securities we have underwritten at the anticipated price levels, and the proper identification of the legal, reputational, credit, liquidity, and market risks inherent in our products. A failure to deliver appropriate standards of service and quality, or a failure or perceived failure to treat customers and clients fairly, can result in customer dissatisfaction, litigation and heightened regulatory scrutiny, all of which can lead to lost revenue, higher operating costs and harm to our reputation. Further, negative publicity regarding us, whether or not true, may also result in harm to our prospects. Increasingly, the internet, through investor blogs or other sites, is being used to publish information that is untrue, significantly skewed or in some cases slanderous about companies and individuals that are published anonymously and are difficult to refute. Such stories can negatively impact the reputation of companies that are the subject of such attacks.

See

“— The precautions the Company takes to prevent and detect employee misconduct may not be effective and the Company could be exposed to unknown and unmanaged risks or losses.”

The Company is subject to extensive securities regulation and the failure to comply with these regulations could subject it to monetary penalties or sanctions.

The securities industry and the Company’s business are subject to extensive regulation by the SEC, state securities regulators and other governmental regulatory authorities. The Company is also regulated by industry self-regulatory organizations, including FINRA, the National Futures Association (“NFA”), and the Municipal Securities Rulemaking Board (“MSRB”). The Company may be adversely affected by changes in the interpretation or enforcement of existing laws and rules by these governmental authorities and self-regulatory organizations. The regulatory environment is subject to change and the Company may be adversely affected as a result of new or revised legislation or regulations imposed by the SEC, other federal or state governmental regulatory authorities, or self-regulatory organizations. In response to the financial crisis of 2008-2009, the regulatory environment to which the Company is subjected is expected to further intensify as additional rules and regulations are adopted by the Company’s regulators. These new regulations will likely increase costs related to compliance and may in other ways adversely affect the performance of the Company.

Market and economic conditions over the past several years have directly led to a demand by the public for changes in the way the financial services industry is regulated, including a call for more stringent legislation and regulation in the United States and abroad. The Dodd-Frank Act enacted sweeping changes and an unprecedented

17

Table of Contents

increase in the supervision and regulation of the financial services industry (

see

“Business — Regulation” in our Form 10-K). The ultimate impact that the Dodd-Frank Act and implementing regulations will have on us, the financial industry and the economy at large cannot be quantified until all of the implementing regulations called for under the legislation have been finalized and fully implemented. We are evaluating the impact of the U.S. Department of Labor (“DOL”) fiduciary rule on our business (

see