Oppenheimer Frustrated At Elusive Auction-Rate Solution

February 11 2010 - 4:52PM

Dow Jones News

As many holders of auction-rate securities remain frustrated at

their inability to find a way to sell the instruments, Oppenheimer

& Co., which sold some of the shares, says it is frustrated,

too.

The Federal Reserve Board's decision to close down the Primary

Dealer Credit Facility appears to close off that facility as a

potential liquidity pool, Oppenheimer said in a February update

that some of its clients received.

Oppenheimer, a unit of Oppenheimer Holdings Inc. (OPY), had

hoped that the facility, or a subsequent facility, would remain in

place, it said in its update.

In an e-mail Thursday, the company said, "Oppenheimer is

disappointed that the primary dealer credit facility, which may

have provided liquidity to investors holding auction-rate

securities, has been closed. We will continue to try and find a

liquidity source for our clients holding acution-rate

securities."

Oppenheimer previously said it spent time, effort and money to

build a government-securities trading business to qualify as a

primary dealer in the hopes of attaining a liquidity facility from

the Federal Reserve Bank of New York.

In its update, Oppenheimer said it understands the frustration

of its clients whose funds are trapped by the continued failure of

the auction-rate securities market. "We remain equally frustrated

at our inability to find a liquidity solution, or a means to compel

issuers or underwriters to redeem or otherwise provide liquidity

for these securities," it said.

The once $330-billion auction-rate market froze in February 2008

as market participants stopped buying the securities as the credit

crisis intensified.

Oppenheimer has pursued "virtually every avenue we could to find

a solution to the problem," and can't offer potential solutions

other than the continued redemption by issuers and its continued

efforts to convince legislators and other government officials of

the need for a government-sanctioned solution to the liquidity

issue, it said in its most recent update.

The company has been pressing issuers to redeem or otherwise

liquidate auction-rate securities and has made a claim against

several of the lead underwriters, alleging that the underwriters

should be required to make any required restitution "since they

(along with the issuers) artificially supported the auctions," it

said.

Some issuers of auction-rate preferred securities, such as

Nuveen Investments (JNC), continue to actively pursue redemptions

with the issuance of alternative securities to replace the shares,

Oppenheimer noted.

In December, Nuveen announced that it had arranged up to $2.5

billion in liquidity support from three major financial

institutions for its leveraged municipal closed-end funds to issue

variable rate demand preferred shares, which include an

unconditional "put" feature backed by a major financial

institution.

Bill Adams, executive vice president at Nuveen, said Thursday

that the asset manager continues to make progress and expects to

issue the VRDPS through private offerings early this year.

Fifteen Nuveen funds have also issued MuniTerm Preferred shares,

a fixed-rate form of preferred stock with a mandatory redemption

period, totaling more than $600 million, which has permitted the

funds to redeem 50% to 100% of their ARPS, Adams said. In addition,

as many as 20 Nuveen funds have registered to issue MTPs, subject

to market conditions, he said.

Nuveen's funds had $15.4 billion of ARPS outstanding when the

markets seized up in 2008 and have redeemed $7.1 billion of that.

The company remains committed to its goal of refinancing 100% of

the APRS issued by its funds in a way that is to the long-term

benefit of the funds' common shareholders, Adams said.

Oppenheimer also said it will continue to work with regulators

to resolve outstanding issues and investigations, but added that

any resolution will depend on acknowledgment of its financial and

regulatory constraints and "the resulting limited amount of

liquidity available" to it to address the issue. "At present,

Oppenheimer does not have the financial capacity to repurchase,

within [Securities and Exchange Commission] capital requirements, a

significant amount of its clients' ARS without" a liquidity pool,

it said.

By Daisy Maxey; Dow Jones Newswires; 212 416 2237;

daisy.maxey@dowjones.com

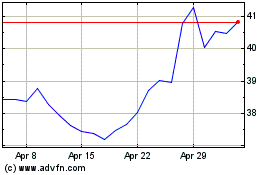

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Jul 2023 to Jul 2024