Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

October 27 2023 - 10:37AM

Edgar (US Regulatory)

Nuveen

Missouri

Quality

Municipal

Income

Fund

Portfolio

of

Investments

August

31,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

LONG-TERM

INVESTMENTS

-

165.0% (97.8%

of

Total

Investments)

X

44,089,837

MUNICIPAL

BONDS

-

165.0% (97.8%

of

Total

Investments)

X

44,089,837

Consumer

Staples

-

4.3%

(2.6%

of

Total

Investments)

$

1,055

Missouri

Development

Finance

Board,

Solid

Waste

Disposal

Revenue

Bonds,

Procter

and

Gamble

Inc.,

Series

1999,

5.200%,

3/15/29,

(AMT)

No

Opt.

Call

$

1,153,453

Total

Consumer

Staples

1,153,453

Education

and

Civic

Organizations

-

14.5%

(8.6%

of

Total

Investments)

300

Curators

of

the

University

of

Missouri,

System

Facilities

Revenue

Bonds,

Series

2014A,

4.000%,

11/01/33

11/24

at

100.00

300,732

410

Missouri

Health

and

Educational

Facilities

Authority,

Educational

Facilities

Revenue

Bonds,

Kansas

City

University

of

Medicine

and

Biosciences,

Series

2013A,

5.000%,

6/01/33

9/23

at

100.00

410,320

600

Missouri

Health

and

Educational

Facilities

Authority,

Educational

Facilities

Revenue

Bonds,

Southwest

Baptist

University

Project,

Series

2012,

5.000%,

10/01/33

10/23

at

100.00

583,218

725

Missouri

Health

and

Educational

Facilities

Authority,

Educational

Facilities

Revenue

Bonds,

University

of

Central

Missouri,

Series

2013C-2,

5.000%,

10/01/34

10/23

at

100.00

725,297

1,000

Missouri

Health

and

Educational

Facilities

Authority,

Revenue

Bonds,

Saint

Louis

University,

Series

2015A,

4.000%,

10/01/42

10/25

at

100.00

939,140

500

Missouri

Health

and

Educational

Facilities

Authority,

Revenue

Bonds,

Saint

Louis

University,

Series

2019A,

5.000%,

10/01/46

4/29

at

100.00

522,045

115

Missouri

Health

and

Educational

Facilities

Authority,

Revenue

Bonds,

Webster

University,

Refunding

Series

2017,

4.000%,

4/01/34

4/27

at

100.00

103,186

210

Missouri

Southern

State

University,

Auxiliary

Enterprise

System

Revenue

Bonds,

Series

2019A,

4.000%,

10/01/39

-

AGM

Insured

10/29

at

100.00

199,296

100

Saline

County

Industrial

Development

Authority,

Missouri,

First

Mortgage

Revenue

Bonds,

Missouri

Valley

College,

Series

2017,

4.500%,

10/01/40

10/23

at

100.00

84,202

Total

Education

and

Civic

Organizations

3,867,436

Health

Care

-

29.9%

(17.7%

of

Total

Investments)

300

Boone

County,

Missouri,

Hospital

Revenue

Bonds,

Boone

Hospital

Center,

Refunding

Series

2016,

5.000%,

8/01/30

8/26

at

100.00

274,023

210

Bridgeton

Industrial

Development

Authority,

Missouri,

Senior

Housing

Revenue

Bonds,

The

Sarah

Community

Project,

Refunding

Series

2016,

4.000%,

5/01/33

5/25

at

100.00

210,704

400

Cape

Girardeau

County

Industrial

Development

Authority,

Missouri,

Health

Facilities

Revenue

Bonds,

Southeasthealth,

Series

2017A,

5.000%,

3/01/36

3/27

at

100.00

404,748

300

Hannibal

Industrial

Development

Authority,

Missouri,

Health

Facilities

Revenue

Bonds,

Hannibal

Regional

Healthcare

System,

Series

2017,

5.000%,

10/01/42

10/27

at

100.00

302,073

315

Joplin

Industrial

Development

Authority,

Missouri,

Health

Facilities

Revenue

Bonds,

Freeman

Health

System,

Series

2015,

5.000%,

2/15/35

2/24

at

100.00

315,724

250

Missouri

Health

and

Educational

Facilities

Authority,

Health

Facilities

Revenue

Bonds,

BJC

Health

System,

Series

2015A,

4.000%,

1/01/45

1/25

at

100.00

236,230

750

Missouri

Health

and

Educational

Facilities

Authority,

Health

Facilities

Revenue

Bonds,

BJC

Health

System,

Variable

Rate

Demand

Obligation

Series

2017D,

4.000%,

1/01/58,

(Mandatory

Put

1/01/48),

(UB)

(c)

1/28

at

100.00

685,485

1,730

Missouri

Health

and

Educational

Facilities

Authority,

Health

Facilities

Revenue

Bonds,

CoxHealth,

Series

2013A,

5.000%,

11/15/44

11/23

at

100.00

1,729,879

415

Missouri

Health

and

Educational

Facilities

Authority,

Health

Facilities

Revenue

Bonds,

CoxHealth,

Series

2015A,

5.000%,

11/15/32

11/25

at

100.00

423,088

390

Missouri

Health

and

Educational

Facilities

Authority,

Health

Facilities

Revenue

Bonds,

Mercy

Health,

Series

2012,

4.000%,

11/15/42

10/23

at

100.00

366,526

550

Missouri

Health

and

Educational

Facilities

Authority,

Health

Facilities

Revenue

Bonds,

Mercy

Health,

Series

2014F,

4.250%,

11/15/48

11/24

at

100.00

518,804

650

Missouri

Health

and

Educational

Facilities

Authority,

Health

Facilities

Revenue

Bonds,

Mercy

Health,

Series

2017C,

5.000%,

11/15/42

11/27

at

100.00

659,886

Nuveen

Missouri

Quality

Municipal

Income

Fund

(continued)

Portfolio

of

Investments

August

31,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

Health

Care

(continued)

$

1,000

Missouri

Health

and

Educational

Facilities

Authority,

Health

Facilities

Revenue

Bonds,

Mosaic

Health

System,

Series

2019A,

4.000%,

2/15/54

2/29

at

100.00

$

881,585

350

Missouri

Health

and

Educational

Facilities

Authority,

Revenue

Bonds,

Children's

Mercy

Hospital,

Series

2017A,

4.000%,

5/15/48

5/25

at

102.00

317,580

125

Missouri

Health

and

Educational

Facilities

Authority,

Revenue

Bonds,

Lake

Regional

Health

System,

Series

2021,

4.000%,

2/15/51

8/31

at

100.00

102,593

600

Saint

Louis

County

Industrial

Development

Authority,

Missouri,

Health

Facilities

Revenue

Bonds,

Ranken-Jordan

Project,

Refunding

&

Improvement

Series

2016,

5.000%,

11/15/46

11/25

at

100.00

552,570

Total

Health

Care

7,981,498

Housing/Single

Family

-

0.1%

(0.1%

of

Total

Investments)

45

Missouri

Housing

Development

Commission,

Single

Family

Mortgage

Revenue

Bonds,

First

Place

Homeownership

Loan

Program,

Series

2017A-2,

3.800%,

11/01/37

11/26

at

100.00

43,529

Total

Housing/Single

Family

43,529

Long-Term

Care

-

9.3%

(5.5%

of

Total

Investments)

100

Kirkwood

Industrial

Development

Authority,

Missouri,

Retirement

Community

Revenue

Bonds,

Aberdeen

Heights

Project,

Refunding

Series

2017A,

5.250%,

5/15/37

5/27

at

100.00

84,576

500

Missouri

Health

and

Educational

Facilities

Authority,

Revenue

Bonds,

Lutheran

Senior

Services

Projects,

Series

2014A,

5.000%,

2/01/44

2/24

at

100.00

470,125

Missouri

Health

and

Educational

Facilities

Authority,

Revenue

Bonds,

Lutheran

Senior

Services

Projects,

Series

2016A:

400

5.000%,

2/01/36

2/26

at

100.00

396,336

500

5.000%,

2/01/46

2/26

at

100.00

464,955

100

Missouri

Health

and

Educational

Facilities

Authority,

Revenue

Bonds,

Lutheran

Senior

Services

Projects,

Series

2019C,

4.000%,

2/01/48

2/29

at

100.00

78,289

Saint

Louis

County

Industrial

Development

Authority,

Missouri,

Revenue

Bonds,

Friendship

Village

of

Sunset

Hills,

Series

2012:

250

5.000%,

9/01/32

10/23

at

100.00

244,862

250

5.000%,

9/01/42

10/23

at

100.00

222,670

430

Saint

Louis

County

Industrial

Development

Authority,

Missouri,

Revenue

Bonds,

Friendship

Village

of

Sunset

Hills,

Series

2013A,

5.875%,

9/01/43

10/23

at

100.00

430,013

100

Saint

Louis

County

Industrial

Development

Authority,

Missouri,

Revenue

Bonds,

Saint

Andrew's

Resources

for

Seniors,

Series

2015A,

5.125%,

12/01/45

12/25

at

100.00

89,549

Total

Long-Term

Care

2,481,375

Tax

Obligation/General

-

29.8%

(17.6%

of

Total

Investments)

Clay

County

Public

School

District

53,

Liberty,

Missouri,

General

Obligation

Bonds,

Series

2018:

1,000

4.000%,

3/01/34

3/26

at

100.00

1,010,480

335

4.000%,

3/01/36

3/26

at

100.00

336,792

340

Clay

County

Reorganized

School

District

R-II

Smithville,

Missouri,

General

Obligation

Bonds,

Refunding

Series

2015,

4.000%,

3/01/36

3/27

at

100.00

342,893

350

Fenton

Missouri

Fire

Protection

District,

Missouri,

General

Obligation

Bonds,

Series

2019,

4.000%,

3/01/39

3/27

at

100.00

344,330

500

Fort

Zumwalt

School

District,

Callaway

County,

Missouri,

General

Obligation

Bonds,

Refunding

&

Improvement

Series

2015,

4.000%,

3/01/32

3/24

at

100.00

501,070

200

Fort

Zumwalt

School

District,

Callaway

County,

Missouri,

General

Obligation

Bonds,

Refunding

&

Improvement

Series

2018,

5.000%,

3/01/36

3/27

at

100.00

210,426

500

Hazelwood

School

District,

St.

Louis

County,

Missouri,

General

Obligation

Bonds,

Refunding

and

Improvement

Series

2023A,

5.000%,

3/01/42

-

BAM

Insured

3/32

at

100.00

535,340

500

Jefferson

City

School

District,

Missouri,

General

Obligation

Bonds,

Series

2023A,

5.500%,

3/01/43

3/32

at

100.00

552,480

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

Tax

Obligation/General

(continued)

$

225

Jefferson

County

School

District

R-1

Northwest,

Missouri,

General

Obligation

Bonds,

Direct

Deposit

Program

Series

2023,

5.000%,

3/01/43

3/31

at

100.00

$

237,382

1,000

Joplin

Schools,

Missouri,

General

Obligation

Bonds,

Refunding,

Direct

Deposit

Program

Series

2017,

4.000%,

3/01/32

3/27

at

100.00

1,022,150

300

Kansas

City,

Missouri,

General

Obligation

Bonds,

Refunding

&

Improvement

Series

2018A,

4.000%,

2/01/35

2/28

at

100.00

305,070

1,250

Saint

Charles

County

Francis

Howell

School

District,

Missouri,

General

Obligation

Bonds,

Series

2022,

5.000%,

3/01/42

3/31

at

100.00

1,334,425

225

Saint

Louis

County

Pattonville

School

District

R3,

Missouri,

General

Obligation

Bonds,

Series

2023,

5.250%,

3/01/42

3/31

at

100.00

244,573

1,000

Valley

Park

Fire

Protection

District,

Missouri,

General

Obligation

Bonds,

Series

2019,

4.000%,

3/01/39

3/27

at

100.00

983,800

Total

Tax

Obligation/General

7,961,211

Tax

Obligation/Limited

-

37.6%

(22.3%

of

Total

Investments)

Bi-State

Development

Agency

of

the

Missouri-Illinois

Metropolitan

District,

Mass

Transit

Sales

Tax

Appropriation

Bonds,

Refunding

Combined

Lien

Series

2019:

1,500

4.000%,

10/01/36

10/29

at

100.00

1,510,335

1,160

4.000%,

10/01/48

10/29

at

100.00

1,101,536

230

Blue

Springs,

Missouri,

Special

Obligation

Tax

Increment

Bonds,

Adams

Farm

Project,

Special

Districts

Refunding

&

Improvement

Series

2015A,

4.750%,

6/01/30

6/24

at

100.00

226,598

145

Clay,

Jackson

&

Platte

Counties

Consolidated

Public

Library

District

3,

Missouri,

Certificates

of

Participation,

Mid-Continent

Public

Library

Project,

Series

2018,

4.000%,

3/01/35

3/26

at

100.00

146,472

250

Conley

Road

Transportation

District,

Missouri,

Transportation

Sales

Tax

Revenue

Bonds,

Series

2017,

5.125%,

5/01/41

5/25

at

100.00

240,320

297

Fulton,

Missouri,

Tax

Increment

Revenue

Bonds,

Fulton

Commons

Redevelopment

Project,

Series

2006,

5.000%,

6/01/28

(d)

10/23

at

100.00

94,943

Howard

Bend

Levee

District,

St.

Louis

County,

Missouri,

Levee

District

Improvement

Bonds,

Series

2013B:

250

4.875%,

3/01/33

10/23

at

100.00

235,565

200

5.000%,

3/01/38

10/23

at

100.00

185,768

300

Kansas

City

Industrial

Development

Authority,

Missouri,

Downtown

Redevelpment

District

Revenue

Bonds,

Series

2011A,

5.000%,

9/01/32

10/23

at

100.00

300,411

75

Kansas

City

Industrial

Development

Authority,

Missouri,

Sales

Tax

Revenue

Bonds,

Ward

Parkway

Center

Community

Improvement

District,

Senior

Refunding

&

Improvement

Series

2016,

4.250%,

4/01/26,

144A

No

Opt.

Call

72,864

500

Kansas

City,

Missouri,

Special

Obligation

Bonds,

Downtown

Arena

Project,

Refunding

&

Improvement

Series

2016E,

5.000%,

4/01/40

4/25

at

100.00

502,285

325

Kansas

City,

Missouri,

Special

Obligation

Bonds,

Downtown

Redevelopment

District,

Series

2014C,

5.000%,

9/01/33

10/23

at

100.00

325,198

Land

Clearance

for

Redevelopment

Authority

of

Kansas

City,

Missouri,

Project

Revenue

Bonds,

Convention

Center

Hotel

Project

-

TIF

Financing,

Series

2018B:

100

5.000%,

2/01/40,

144A

2/28

at

100.00

78,445

100

5.000%,

2/01/50,

144A

2/28

at

100.00

71,962

245

Missouri

Development

Finance

Board,

Infrastructure

Facilities

Revenue

Bonds,

City

of

Branson

-

Branson

Landing

Project,

Series

2015A,

4.000%,

6/01/34

10/23

at

100.00

245,093

Puerto

Rico

Sales

Tax

Financing

Corporation,

Sales

Tax

Revenue

Bonds,

Restructured

2018A-1:

200

4.550%,

7/01/40

7/28

at

100.00

195,004

350

0.000%,

7/01/46

7/28

at

41.38

97,482

97

0.000%,

7/01/51

7/28

at

30.01

20,048

500

4.750%,

7/01/53

7/28

at

100.00

468,735

117

5.000%,

7/01/58

7/28

at

100.00

113,537

252

Puerto

Rico

Sales

Tax

Financing

Corporation,

Sales

Tax

Revenue

Bonds,

Taxable

Restructured

Cofina

Project

Series

2019A-2,

4.329%,

7/01/40

7/28

at

100.00

239,299

50

Saint

Charles

County

Industrial

Development

Authority,

Missouri,

Sales

Tax

Revenue

Bonds,

Wentzville

Parkway

Regional

Community

Improvement

District

Project,

Series

2019B,

4.250%,

11/01/49,

144A

11/29

at

102.00

39,549

Nuveen

Missouri

Quality

Municipal

Income

Fund

(continued)

Portfolio

of

Investments

August

31,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

Tax

Obligation/Limited

(continued)

$

250

Saint

Louis

County

Industrial

Development

Authority,

Missouri,

Sales

Tax

Revenue

Bonds,

Chesterfield

Blue

Valley

Community

Improvement

District

Project,

Series

2014A,

5.250%,

7/01/44,

144A

7/24

at

100.00

$

216,122

500

Saint

Louis

Land

Clearance

for

Redevelopment

Authority,

Missouri,

Annual

Appropriation

Redevelopment

Revenue

Bonds,

National

Geospatial-

Intelligence

Agency

Offsite

Improvements,

Series

2022C,

5.125%,

6/01/46

6/30

at

100.00

498,095

Saint

Louis

Municipal

Finance

Corporation,

Missouri,

Leasehold

Revenue

Bonds,

Convention

Center,

Expansion

&

Improvement

Projects

Series

2020:

500

5.000%,

10/01/45

-

AGM

Insured

10/30

at

100.00

515,350

500

5.000%,

10/01/49

-

AGM

Insured

10/30

at

100.00

508,975

600

Springfield,

Missouri,

Special

Obligation

Bonds,

Sewer

System

Improvements

Project,

Series

2015,

4.000%,

4/01/35

4/25

at

100.00

601,320

125

Taney

County

Industrial

Development

Authority,

Missouri,

Sales

Tax

Revenue

Improvement

Bonds,

Big

Cedar

Infrastructure

Project

Series

2023,

6.000%,

10/01/49,

144A

10/30

at

100.00

121,310

450

The

Industrial

Development

Authority

of

the

City

of

Saint

Louis,

Missouri,

Development

Financing

Revenue

Bonds,

Ballpark

Village

Development

Project,

Series

2017A,

4.750%,

11/15/47

11/26

at

100.00

325,413

215

Transportation

Development

District,

Missouri,

Transportation

Sales

Tax

Revenue

Bonds,

Series

2017,

4.500%,

6/01/36

6/26

at

100.00

202,947

195

Universal

City

Industrial

Development

Authority,

Missouri,

Revenue

Bonds,

Tax

Increment

and

Special

District

Markets

at

Olive

Project

Series

2023A,

5.500%,

6/15/42

6/33

at

100.00

192,288

320

Wentzville,

Missouri,

Certificates

of

Participation,

Series

2023,

5.000%,

3/01/37

3/33

at

100.00

343,024

Total

Tax

Obligation/Limited

10,036,293

Transportation

-

14.2%

(8.4%

of

Total

Investments)

450

Kansas

City

Industrial

Development

Authority,

Missouri,

Airport

Special

Obligation

Bonds,

Kansas

City

International

Airport

Terminal

Modernization

Project,

Series

2019A,

5.000%,

3/01/44,

(AMT)

3/29

at

100.00

458,798

2,000

Kansas

City

Industrial

Development

Authority,

Missouri,

Airport

Special

Obligation

Bonds,

Kansas

City

International

Airport

Terminal

Modernization

Project,

Series

2019B,

5.000%,

3/01/46,

(AMT)

3/29

at

100.00

2,033,260

1,265

Saint

Louis,

Missouri,

Airport

Revenue

Bonds,

Lambert-St.

Louis

International

Airport,

Series

2017C,

5.000%,

7/01/47

-

AGM

Insured

7/27

at

100.00

1,295,056

Total

Transportation

3,787,114

U.S.

Guaranteed

-

3.1%

(1.9%

of

Total

Investments)

(e)

335

Guam

A.B.

Won

Pat International

Airport

Authority,

Revenue

Bonds,

Series

2013B,

5.500%,

10/01/33,

(Pre-refunded

10/01/23)

-

AGM

Insured

10/23

at

100.00

335,509

510

Missouri

Health

and

Educational

Facilities

Authority,

Revenue

Bonds,

A.T.

Still

University

of

Health

Sciences,

Series

2014,

5.000%,

10/01/39,

(Pre-

refunded

10/01/23)

10/23

at

100.00

510,577

Total

U.S.

Guaranteed

846,086

Utilities

-

22.2%

(13.1%

of

Total

Investments)

250

Camden

County

Public

Water

Supply

District

4,

Missouri,

Certificates

of

Participation,

Series

2017,

5.000%,

1/01/47

1/25

at

100.00

251,835

150

Franklin

County

Public

Water

Supply

District

3,

Missouri,

Certificates

of

Participation,

Series

2017,

4.000%,

12/01/37

12/24

at

100.00

150,494

160

Kansas

City,

Missouri,

Sanitary

Sewer

System

Revenue

Bonds,

Improvement

Series

2018A,

4.000%,

1/01/35

1/28

at

100.00

162,805

500

Kansas

City,

Missouri,

Sanitary

Sewer

System

Revenue

Bonds,

Improvement

Series

2023A,

4.000%,

1/01/48

1/33

at

100.00

476,410

Metropolitan

St.

Louis

Sewerage

District,

Missouri,

Wastewater

System

Revenue

Bonds,

Refunding

Improvement

Series

2022B:

500

5.000%,

5/01/47

5/32

at

100.00

537,795

500

5.250%,

5/01/52

5/32

at

100.00

545,560

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

Utilities

(continued)

$

500

Missouri

Development

Finance

Board,

Infrastructure

Facilities

Revenue

Bonds,

City

of Independence

Annual

Appropriation

Electric

System,

Refunding

Series

2022,

5.000%,

6/01/34

-

AGM

Insured

6/32

at

100.00

$

563,560

500

Missouri

Environmental

Improvement

and

Energy

Resources

Authority,

Water

Facility

Revenue

Bonds,

Tri-County

Water

Authority,

Series

2015,

5.000%,

1/01/40

1/25

at

100.00

507,765

350

Missouri

Joint

Municipal

Electric

Utility

Commission,

Power

Project

Revenue

Bonds,

Plum

Point

Project,

Refunding

Series

2014A,

5.000%,

1/01/32

1/25

at

100.00

353,916

500

Missouri

Joint

Municipal

Electric

Utility

Commission,

Power

Project

Revenue

Bonds,

Plum

Point

Project,

Refunding

Series

2015A,

4.000%,

1/01/35

1/26

at

100.00

504,345

500

Missouri

Joint

Municipal

Electric

Utility

Commission,

Power

Supply

System

Revenue

Bonds,

MoPEP

Facilities,

Series

2018,

5.000%,

12/01/43

6/27

at

100.00

509,125

585

Saint

Charles

County

Public

Water

Supply

District

2,

Missouri,

Certificates

of

Participation,

Refudning

Series

2016C,

5.000%,

12/01/32

12/25

at

100.00

601,795

550

Saint

Charles

County

Public

Water

Supply

District

2,

Missouri,

Certificates

of

Participation,

Series

2018,

4.000%,

12/01/39

12/25

at

100.00

548,856

260

Stone

County

Public

Water

Supply

District

2,

Missouri,

Certificates

of

Participation,

Series

2021B,

4.000%,

12/01/51

12/28

at

100.00

217,581

Total

Utilities

5,931,842

Total

Municipal

Bonds

(cost

$45,356,756)

44,089,837

Total

Long-Term

Investments

(cost

$45,356,756)

44,089,837

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

SHORT-TERM

INVESTMENTS

-

3.8%(2.2%

of

Total

Investments)

X

1,000,000

MUNICIPAL

BONDS

-

3.8% (2.2%

of

Total

Investments)

X

1,000,000

Health

Care

-

3.8%

(2.2%

of

Total

Investments)

$

1,000

Missouri

Health

and

Educational

Facilities

Authority,

Health

Facilities

Revenue

Bonds,

SSM

Health

Care,

Variable

Rate

Series

2018F,

2.600%,

6/01/36,

(Mandatory

Put

9/08/23)

(f)

9/23

at

100.00

$

1,000,000

Total

Health

Care

1,000,000

Total

Municipal

Bonds

(cost

$1,000,000)

1,000,000

Total

Short-Term

Investments

(cost

$1,000,000)

1,000,000

Total

Investments

(cost

$46,356,756)

-

168.8%

45,089,837

Floating

Rate

Obligations

-

(2.2)%

(

600,000

)

MFP

Shares,

Net

-

(66.7)%

(g)

(

17,805,445

)

Other

Assets

&

Liabilities,

Net

-

0.1%

29,713

Net

Assets

Applicable

to

Common

Shares

-

100%

$

26,714,105

Nuveen

Missouri

Quality

Municipal

Income

Fund

(continued)

Portfolio

of

Investments

August

31,

2023

(Unaudited)

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Municipal

Bonds

$

–

$

44,089,837

$

–

$

44,089,837

Short-Term

Investments:

Municipal

Bonds

–

1,000,000

–

1,000,000

Total

$

–

$

45,089,837

$

–

$

45,089,837

(a)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(b)

Optional

Call

Provisions:

Dates

(month

and

year)

and

prices

of

the

earliest

optional

call

or

redemption.

There

may

be

other

call

provisions

at

varying

prices

at

later

dates.

Certain

mortgage-backed

securities

may

be

subject

to

periodic

principal

paydowns.

(c)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

inverse

floating

rate

transactions.

(d)

Defaulted

security.

A

security

whose

issuer

has

failed

to

fully

pay

principal

and/or

interest

when

due,

or

is

under

the

protection

of

bankruptcy.

(e)

Backed

by

an

escrow

or

trust

containing

sufficient

U.S.

Government

or

U.S.

Government

agency

securities,

which

ensure

the

timely

payment

of

principal

and

interest.

(f)

Investment

has

a

maturity

of

greater

than

one

year,

but

has

variable

rate

and/or

demand

features

which

qualify

it

as

a

short-term

investment.

The

rate

disclosed,

as

well

as

the

reference

rate

and

spread,

where

applicable,

is

that

in

effect

as

of

the

end

of

the

reporting

period.

This

rate

changes

periodically

based

on

market

conditions

or

a

specified

market

index.

(g)

MFP

Shares,

Net

as

a

percentage

of

Total

Investments

is

39.5%.

144A

Investment

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

investments

may

only

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

AMT

Alternative

Minimum

Tax

UB

Underlying

bond

of

an

inverse

floating

rate

trust

reflected

as

a

financing

transaction.

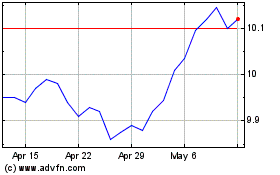

Nuveen Missouri Quality ... (NYSE:NOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Nuveen Missouri Quality ... (NYSE:NOM)

Historical Stock Chart

From Jul 2023 to Jul 2024