Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

May 17 2021 - 5:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2021

Commission File Number: 001-39169

Natura &Co Holding S.A.

(Exact name of registrant as specified

in its charter)

Avenida Alexandre Colares, No. 1188,

Sala A17-Bloco A

Parque Anhanguera

São Paulo, São Paulo 05106-000,

Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

NATURA &CO HOLDING S.A.

TABLE OF CONTENTS

|

ITEM

|

|

|

1.

|

Earnings release of Natura &Co Holding S.A. for the three-month period ended March

31, 2021.

|

|

2.

|

Earnings presentation of Natura &Co Holding S.A. for the three-month

period ended March 31, 2021.

|

|

|

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

NATURA &CO HOLDING S.A.

|

|

|

|

|

|

|

|

|

By:

|

/s/ José Antonio

de Almeida Filippo

|

|

|

Name:

|

José Antonio de Almeida Filippo

|

|

|

Title:

|

Principal Financial Officer

|

|

|

|

|

|

|

|

|

By:

|

/s/ Itamar Gaino

Filho

|

|

|

Name:

|

Itamar Gaino Filho

|

|

|

Title:

|

Chief Legal and Compliance Officer

|

Date: May 17, 2021

Item 1

Earnings release of Natura &Co Holding S.A. for the three-month period ended March 31, 2021.

São Paulo, May 12, 2021

Q1-21:

Natura &Co accelerates growth to +26%, ahead of CFT market1,

with EBITDA

increase of over 400%

Avon synergies raised in April

to between US$350 million to US$450 million;

improved indebtedness profile with

US$ 1 billion ESG bond issuance

|

|

·

|

Natura &Co’s consolidated net revenue reached R$9.5 billion in Q1, up 25.8% in BRL vs. Q1-20 (+8.1% at constant currency,

“CC”), ahead of the global CFT market, supported by direct-to-consumer

reach and further ramp-up in online sales.

|

|

|

·

|

Natura &Co Latam’s Q1 net revenue increased

by 24.6% in BRL (+15.9% at CC), driven by an outstanding performance in Hispanic Latam by both brands. The Natura brand’s

net revenue increased by 29.6% in BRL (+24.6% at CC), with strong +12.6% growth in Brazil and +60.4% in Hispanic Latam (+48.0% at CC),

driven by an increase in consultant count, higher volumes

and strong online sales growth. The Avon brand’s

net revenue increased by 20.0% in BRL (+8.1% at CC), supported by strong growth in Hispanic Latam of +35.1% in BRL (+15.0% at CC). Growth

was driven by core markets, with improved representative

productivity and strong performance in key beauty categories and the home segment.

In Brazil, Avon’s revenue was down -2.8%, impacted by the set-up for the implementation of the new commercial model. Natura &Co’s

clear CFT leadership in Latam was confirmed by Euromonitor, reaching market share of 12.5% in FY20, +0.7pp vs. prior year, with a strong

17.0% in Brazil, +1pp vs. 2019.

|

|

|

·

|

Avon International’s

Q1 net revenue grew 11.4% in BRL (-10.7% at CC). Avon gained market share2 vs. Q1-20 in Western Europe, driven by the UK,

and Asia Pacific, notably the Philippines. All regions improved share month after month, including the top 8 countries, despite the continued

impact of the Covid-19 second wave in key European markets and in core beauty categories such as color and fragrance. In the UK, Avon

continues to grow market share and became the 3rd brand3 in the beauty market, up from 10th one year

earlier. A new commercial model - Avon Growth Plan,

is being developed with pilots in place in the Nordics and in South Africa, aiming at increasing representative productivity. The new

harmonized earnings structure led to an improvement in the average representative base versus year-end 2020.

|

|

|

·

|

The Body

Shop’s Q1

net revenue increased by 47.7% in BRL (+10.7% at CC), driven by the UK and North America, and strong performance of At-Home (+251%) and

e-commerce (+119%) versus last year, which more than offset the impact of the pandemic’s second wave in retail.

|

|

|

·

|

Aesop

Q1

net revenue grew by an exceptional +71.9% in BRL (+30.6% at CC), driven by online sales growth of 102% vs. Q1-20 and growth in Asia and

the Americas. Asia sales grew by a remarkable 67%, supported by online channels, despite a surge in Covid cases in Japan and Malaysia.

|

|

|

·

|

Natura &Co digital

sales continued to grow in the quarter. Digitally-enabled sales, which includes online sales (e-commerce + social selling)

and relationship selling using our main digital apps reached 48% of total revenue, up from 33% in Q1-20.

|

|

|

·

|

Online sales, which

accounted for 12% of total sales in Q1-21, grew by +166% vs. Q1-20, supported by strong growth in all brands. At Natura, online sales

grew 253% and at Avon globally, +132% vs. Q1-20. Aesop’s total online sales reached 29% of revenue, up from 18% in the previous

year, and The Body Shop’s online and At-Home channels accounted for 51% of total sales, up from 20% in Q1-20.

|

|

|

·

|

Relationship selling

using apps advanced vs. Q1-20, with Avon e-brochure sales up by 175% globally. At Natura in Latin America, the average number of consultants

sharing content increased by more than 350%, and orders through the 1.3 million+ consultant online stores in the region grew by 80% vs.

Q1-20.

|

|

|

·

|

Natura &Co’s

Q1 adjusted3 EBITDA was R$963.2 million with margin of 10.2% (+260 bps), driven by margin expansion in Latin America and

Aesop. Reported EBITDA was R$829.1 million with margin of 8.8% (+690 bps).

|

|

|

·

|

Natura &Co Latam’s Q1 adjusted EBITDA margin was 12.2% (+530 bps). The Natura brand’s adjusted EBITDA margin increased 630

bps, thanks to revenue growth, operational leverage and synergies

captured in both Brazil and Hispanic Latam. The Avon brand’s adjusted EBITDA margin expanded 390 bps,

driven by Hispanic Latam, offsetting a contraction in Brazil as the new commercial model was being set up.

|

|

|

·

|

Avon International’s

Q1 adjusted EBITDA margin stood at 4.1% (-70 bps), primarily due to lower revenue (at CC) and higher investments in digital and commercial

areas as part of the strategy to drive market share and accelerate future growth, in line with its transformation plan.

|

|

|

·

|

The Body Shop’s

Q1 EBITDA margin was 14.7% (-30 bps), mainly due to the Japan head franchisee buyback effect. Excluding the Japan buyback, EBITDA

margin would have been 15.4%, +110 bps vs. last year, despite the pandemic’s impact on retail sales and channel mix.

|

|

|

·

|

Aesop’s Q1 EBITDA

margin reached 26.7% (+390bps), driven by revenue growth, cost efficiency and strong performance of e-commerce.

|

|

|

·

|

Underlying

net income reached R$60.2 million in Q1, up from a negative R$264.1 million, driven by strong EBITDA growth. Net income was R$(155.2)

million, a strong improvement compared to R$(820.8)

million in Q1-20.

|

|

|

·

|

Annual recurring target

synergies from the Avon integration were raised in April by $50 million to between US$350 million and US$450 million, driven by cost

synergies outside Latin America in manufacturing and distribution, to be achieved by 2024. Non-recurring costs to achieve higher synergies

also increased to US$230 million, up from US$190 million, to be incurred over the same period. In the quarter we achieved US$35.5 million

in synergies, in line with estimates, related to procurement, distribution and administrative, incurring US$21.0 million in costs to achieve.

In addition, recurring EBITDA margin at Avon International is expected to reach low-to-mid-teens by 2024, supported by a Transformation

Plan of US$163 million in non-recurring costs to drive growth and improve efficiencies.

|

1

Cosmetics, Fragrance and Toiletries market performance: Company estimate based on global peers’ net revenue vs prior year of approximately

+10.1% in Q1-21 (in reported FX), as reported by the companies or estimates published on Bloomberg for those who have not yet reported;

2 Sources: Euromonitor / Kantar / Nielsen.

3

Excluding effects that are not considered recurring nor comparable between the periods under analysis.

|

|

·

|

Robust

cash position of R$6.6 billion and significant deleveraging in Q1: Consolidated net debt-to-EBITDA ratio of 1.18x,

down from 3.93x in Q1-20. Natura Cosméticos S.A.

completed a US$1 billion Sustainability-Linked Bond (“ESG Bond”) issue on May 3, with a 4.125% coupon, maturing on

May 3, 2028, guaranteed by Natura &Co Holding S.A. The funds raised through this issuance will be used to refinance certain short-

and long-term debts of Natura Cosméticos, in line with the Group's liability management plan to improve its capital structure.

|

|

|

·

|

ESG agenda: The US$

1 billion ESG Bond issued by Natura Cosméticos S.A. (“Natura”) includes two sustainability performance targets (“SPTs”),

to be met by year-end 2026: i) reducing scopes 1, 2 and 3 of relative greenhouse gas (“GHG”) emissions intensity by another

13%, and ii) reaching 25% of post-consumer recycled (“PCR”) plastic in plastic product packaging. These SPTs are part of the

Commitment to Life - Sustainability Vision 2030 and support Natura &Co’s efforts to address the global climate crisis and adopt

full packaging circularity.

|

|

|

1.

|

Management commentary:

|

Roberto Marques, Executive Chairman

and CEO of Natura &Co, commented: “Natura &Co turned in another strong performance in the first quarter of 2021 while still

operating in a challenging health environment, with lockdowns and restrictions in certain key markets. We continue to place the health

and safety of our employees, representatives, consultants and partners at the forefront of our concerns, with initiatives to adapt to

a fast-moving situation.

Driven by the resilience of our business

model, our direct-to-consumer reach and further ramp-up in online sales, the Group continued to outperform the global CFT market, posting

very strong revenue growth of 26%. We saw double-digit growth in Reais across our brands, demonstrating the strength of our multi-channel

model. Natura &Co Latam had an outstanding performance, with both Natura and Avon contributing. The Body Shop continued to offset

store closures with very strong growth in online and the At-Home channel and Aesop had another spectacular quarter of growth, driven by

Asia and online.

Adjusted EBITDA margin was up by a very

solid 260 basis points, driven by revenue growth and an improvement in gross margin, underscoring our continued efficiency. Our Underlying

Net Income returned to positive territory this quarter.

The Avon transformation journey continues

to show progress, with the roll-out of the new commercial model underway and positive advances in market share and representative base,

even though key geographies and categories like make-up and fragrance are still heavily impacted by the pandemic, as well as representative

activity. We are progressing the new Transformation Plan that we presented at our recent Investor Day, supporting initiatives to drive

growth and optimize costs.

Our strong innovation pipeline released

exciting launches this quarter across all brands. We relaunched the entire Ekos range at Natura, a unique “bio-beauty” portfolio

that underscores our strong commitment to the Amazon. Avon’s R&D expertise in skin care technology is evidenced by the launch

of a vitamin D booster face cream in the Anew line. The Body Shop’s rejuvenation is revealed in the new contemporary version of

its icon White Musk fragrance, while Aesop launched a fragrance cabinet in Asia to heighten in-store customer experience.

Demonstrating our commitment to achieving

the sustainability targets that underpin our Commitment to Life - 2030 sustainability vision, we successfully completed in early May a

US$1 billion ESG bond issue that is linked to sustainability targets on greenhouse gas emissions and use of post-consumer recycled plastic

in plastic product packaging. This bond issue thus supports Natura &Co’s efforts to address the global climate crisis and move

towards full packaging circularity while also contributing to strengthening its balance sheet, which saw continued progress on deleveraging

in the quarter. In addition, on the back of international Women´s Day, Natura &Co, in partnership with consultants Mercer, presented

a comprehensive study showing that the unexplained pay gap at Group level is very small and we are closing it sooner than we had initially

targeted. This study exemplifies our commitment to transparency. In June we will disclose our annual progress on the environmental, social

and circular economy pillars and how we evolve on our 31 targets to create the best beauty group FOR the world.

We are extremely proud of and thankful

to our entire organization and network of consultants, representatives and partners. Our direct-to-consumer business model has shown resilience

once again this quarter. Our approach of putting people first, balancing environmental, social and economic interests for the benefit

of all stakeholders and aiming at positive impact while delivering sustainable growth and value creation, will continue to guide and inspire

us.”

The Company is closely monitoring the

evolution of the Covid-19 pandemic worldwide, particularly the recent new lockdown and restrictive measures adopted in parts of Europe.

The Crisis Committee created in Q2-20 continuously analyzes the situation and acts to minimize impacts, ensure continuity of operations,

protect cash and improve liquidity. Natura &Co also continues to be attentive to the health and safety of its employees, consultants

and representatives and customers.

Key impacts on the business

|

|

·

|

Lockdown restrictions: In the first quarter

of 2021, Natura &Co’s businesses were impacted by a second wave of the pandemic in certain markets. The shift to digital continued

across all our brands, allowing us to largely offset the impact of store closures, with online sales across the group up 166% vs. Q1-20.

|

|

|

·

|

Natura &Co Latam: 50% of all retail

stores, including franchisee stores, were opened in March, albeit with certain restrictions. The adoption of digital assets by consultants

continued to drive their performance.

|

|

|

·

|

Avon International:

The company was strongly impacted by two effects: i) stricter

lockdowns across key markets, especially in Central and Eastern Europe, and ii) a drop in sales of key beauty categories such as fragrances

and cosmetics. These effects were partly offset by the acceleration in the adoption of digital assets in key markets such as the UK.

|

|

|

·

|

The Body Shop: Retail sales were impacted

in important markets by mandatory store closures, especially in Europe. With only 68% of Company stores open in March, own-store like-for-like

sales decreased 54% vs. Q1-20. Strong performance in At Home and online channels more than offset the pandemic’s effect.

|

|

|

·

|

Aesop: The company was also impacted by

the new lockdowns in Europe, where retail like-for-like sales were down -1.5%. The shift in consumer behaviour to online more than offset

this decrease and total net sales posted remarkable growth in the quarter. Aesop benefited from its greater presence in Asia, which accounted

for more than 60% of its business, as the region was impacted earlier than Europe and reported a swifter recovery than other geographies.

|

The Group segmentation

is composed of:

|

|

·

|

Natura &Co Latam, which includes all the brands

in Latin America: Natura, Avon, The Body Shop and Aesop

|

|

|

·

|

Avon international, which includes all markets, excluding

Latin America

|

|

|

·

|

The Body Shop ex-Latin America, and

|

In addition, results and analysis for the

periods under comparison include the effects of the fair market value assessment as a result of the business combination with Avon as

per the Purchase Price Allocation – PPA.

|

|

|

|

|

Profit

and Loss by Business

|

|

|

Consolidated

a

|

Natura

&Co Latam b

|

Avon

International

|

The

Body Shop

|

Aesop

|

|

R$

million

|

Q1-21c

|

Q1-20c

|

Ch.%

|

Q1-21c

|

Q1-20c

|

Ch.%

|

Q1-21c

|

Q1-20c

|

Ch.%

|

Q1-21

|

Q1-20

|

Ch.%

|

Q1-21

|

Q1-20

|

Ch.%

|

|

Gross Revenue

|

12,059.2

|

9,719.2

|

24.1

|

6,857.2

|

5,593.2

|

22.6

|

2,835.9

|

2,531.4

|

12.0

|

1,711.1

|

1,213.4

|

41.0

|

654.9

|

381.1

|

71.9

|

|

Net Revenue

|

9,455.1

|

7,518.0

|

25.8

|

5,185.9

|

4,162.3

|

24.6

|

2,363.5

|

2,121.5

|

11.4

|

1,319.7

|

893.2

|

47.7

|

585.9

|

340.9

|

71.9

|

|

COGS

|

(3,324.4)

|

(2,878.7)

|

15.5

|

(2,047.0)

|

(1,718.1)

|

19.1

|

(946.2)

|

(927.2)

|

2.0

|

(279.0)

|

(201.2)

|

38.7

|

(52.1)

|

(32.2)

|

62.1

|

|

Gross Profit

|

6,130.7

|

4,639.3

|

32.1

|

3,138.9

|

2,444.2

|

28.4

|

1,417.3

|

1,194.3

|

18.7

|

1,040.7

|

692.0

|

50.4

|

533.8

|

308.7

|

72.9

|

|

Selling, Marketing and Logistics Expenses

|

(4,255.0)

|

(3,523.2)

|

20.8

|

(2,089.9)

|

(1,852.4)

|

12.8

|

(1,068.9)

|

(935.3)

|

14.3

|

(799.1)

|

(540.3)

|

47.9

|

(297.1)

|

(195.2)

|

52.2

|

|

Administrative, R&D, IT and Projects Expenses

|

(1,506.6)

|

(1,228.0)

|

22.7

|

(642.6)

|

(571.1)

|

12.5

|

(470.0)

|

(388.7)

|

20.9

|

(234.9)

|

(176.7)

|

32.9

|

(154.9)

|

(91.5)

|

69.2

|

|

Corporate Expenses d

|

(110.9)

|

(30.2)

|

267.7

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Other Operating Income/ (Expenses), Net

|

8.7

|

(15.1)

|

(157.8)

|

10.6

|

2.7

|

289.9

|

(0.1)

|

(12.0)

|

(99.5)

|

(3.1)

|

(5.9)

|

(46.3)

|

1.5

|

0.1

|

-

|

|

Acquisition Related Expenses e

|

-

|

(298.3)

|

-

|

-

|

-

|

-

|

-

|

(0.0)

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Transformation/Integration costs

|

(134.1)

|

(25.1)

|

435.0

|

(55.9)

|

(10.5)

|

430.9

|

(75.1)

|

(14.5)

|

416.5

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Depreciation

|

696.4

|

625.8

|

11.3

|

213.3

|

221.9

|

(3.8)

|

219.0

|

183.9

|

19.1

|

190.7

|

164.4

|

16.0

|

73.2

|

55.7

|

31.5

|

|

EBITDA

|

829.1

|

145.3

|

470.7

|

574.4

|

234.7

|

144.7

|

22.3

|

27.7

|

(19.5)

|

194.2

|

133.6

|

45.4

|

156.5

|

77.8

|

101.3

|

|

Depreciation

|

(696.4)

|

(625.8)

|

11.3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Income/ (Expenses), Net

|

(227.9)

|

(227.6)

|

0.1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Before Taxes

|

(95.2)

|

(708.1)

|

(86.6)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax and Social Contribution

|

(90.1)

|

(94.8)

|

(5.0)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations f

|

28.7

|

(22.0)

|

(230.7)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Net Income

|

(156.6)

|

(824.9)

|

(81.0)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling Interest

|

1.4

|

4.1

|

(66.6)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income attributable

to controlling shareholders

|

(155.2)

|

(820.8)

|

(81.1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Margin

|

64.8%

|

61.7%

|

310 bps

|

60.5%

|

58.7%

|

180 bps

|

60.0%

|

56.3%

|

370 bps

|

78.9%

|

77.5%

|

140 bps

|

91.1%

|

90.6%

|

50

bps

|

|

Selling , Marketing and Logistics Exp ./ Net Revenue

|

45.0%

|

46.9%

|

(190) bps

|

40.3%

|

44.5%

|

(420) bps

|

45.2%

|

44.1%

|

110 bps

|

60.6%

|

60.5%

|

10 bps

|

50.7%

|

57.3%

|

(600) bps

|

|

Admin., R&D, IT, and Projects Exp ./ Net Revenue

|

15.9%

|

16.3%

|

(40) bps

|

12.4%

|

13.7%

|

(130) bps

|

19.9%

|

18.3%

|

160 bps

|

17.8%

|

19.8%

|

(200) bps

|

26.4%

|

26.9%

|

(50) bps

|

|

EBITDA Margin

|

8.8%

|

1.9%

|

690 bps

|

11.1%

|

5.6%

|

550 bps

|

0.9%

|

1.3%

|

(40) bps

|

14.7%

|

15.0 %

|

(30) bps

|

26.7%

|

22.8%

|

390 bps

|

|

Net Margin

|

(1.7)%

|

(11.0)%

|

930 bps

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

a

Consolidated results include Natura &Co Latam, Avon International, The Body Shop and Aesop, as well as the Natura subsidiaries in

the U.S., France and the Netherlands.

b

Natura &Co Latam: includes Natura, Avon, TBS Brazil and Hispanic Latam and Aesop Brazil

c

Includes PPA – Purchase Price Allocation effects

d

Expenses related to the management and integration of the Natura &Co Group

e

Avon-acquisition-related expenses

f

Related to business separation at Avon North America

Consolidated net revenue

growth in Q1-21

Q1-21 consolidated net revenue in increased

by 25.8% year-on-year (+8.1% at CC), driven by higher revenue across all segments.

|

|

·

|

Natura &Co Latam:

Net revenue rose by 24.6% in BRL in Q1 (+15.9% at CC)

|

|

|

·

|

Avon International:

Net revenue increased 11.4% in BRL in Q1 (-10.7% at CC)

|

|

|

·

|

The Body Shop: Net

revenue increased 47.7% in BRL in Q1 (+10.7% at CC)

|

|

|

·

|

Aesop: Net revenue

growth of 71.9% in BRL in Q4 (+30.6% at CC)

|

Gross margin

Consolidated gross margin in Q1-21 increased

to 64.8% (+310 bps) vs. Q1-20, supported by margin increase across all business segments:

Including PPA effects at Natura

&Co Latam and Avon International

|

|

Consolidated

|

Natura

&Co Latam

|

Avon

International

|

The

Body Shop

|

Aesop

|

|

R$

million

|

Q

1- 21

|

Q

1- 20

|

Ch.

%

|

Q

1- 21 a

|

Q

1- 20 b

|

Ch.

%

|

Q

1- 21 a

|

Q

1- 20 b

|

Ch.

%

|

Q

1- 21

|

Q

1- 20

|

Ch.

%

|

Q

1- 21

|

Q

1- 20

|

Ch.

%

|

|

Net Revenue

|

9,455.1

|

7,518.0

|

25.8

|

5,185.9

|

4,162.3

|

24.6

|

2,363.5

|

2,121.5

|

11.4

|

1,319.7

|

893.2

|

47.7

|

585.9

|

340.9

|

71.9

|

|

COGS

|

(3,324.4)

|

(2,878.7)

|

15.5

|

(2,047.0)

|

(1,718.1)

|

19.1

|

(946.2)

|

(927.2)

|

2.0

|

(279.0)

|

(201.2)

|

38.7

|

(52.1)

|

(32.2)

|

62.1

|

|

Gross Profit

|

6,130.7

|

4,639.3

|

32.1

|

3,138.9

|

2,444.2

|

28.4

|

1,417.3

|

1,194.3

|

18.7

|

1,040.7

|

692.0

|

50.4

|

533.8

|

308.7

|

72.9

|

|

Gross Margin

|

64.8%

|

61.7%

|

310 bps

|

60.5%

|

58.7%

|

180 bps

|

60.0%

|

56.3%

|

370 bps

|

78.9%

|

77.5%

|

140 bps

|

91.1%

|

90.6%

|

50 bps

|

Excluding PPA effects on COGS of R$(9.3)

million in Q1-21 and R$(105.9) million, adjusted consolidated gross margin reached 64.9% in Q1-21 (+180 bps), as shown below:

Without PPA effects in both periods

|

|

Consolidated

|

Natura

&Co Latam

|

Avon

International

|

The

Body Shop

|

Aesop

|

|

R$

million

|

Q

1- 21

|

Q

1- 20

|

Ch.

%

|

Q

1- 21

|

Q

1- 20

|

Ch.

%

|

Q

1- 21

|

Q

1- 20

|

Ch.

%

|

Q

1- 21

|

Q

1- 20

|

Ch.

%

|

Q

1- 21

|

Q

1- 20

|

Ch.

%

|

|

Net

Revenue

|

9,455.1

|

7,518.0

|

25.8

|

5,185.9

|

4,162.3

|

24.6

|

2,363.5

|

2,121.5

|

11.4

|

1,319.7

|

893.2

|

47.7

|

585.9

|

340.9

|

71.9

|

|

COGS

|

(3,315.1)

|

(2,772.8)

|

19.6

|

(2,043.5)

|

(1,663.4)

|

22.9

|

(940.5)

|

(876.0)

|

7.4

|

(279.0)

|

(201.2)

|

38.7

|

(52.1)

|

(32.2)

|

62.1

|

|

Gross

Profit

|

6,139.9

|

4,745.2

|

29.4

|

3,142.5

|

2,499.0

|

25.8

|

1,423.0

|

1,245.5

|

14.3

|

1,040.7

|

692.0

|

50.4

|

533.8

|

308.7

|

72.9

|

|

Gross Margin

|

64.9%

|

63.1%

|

180 bps

|

60.6%

|

60.0%

|

60 bps

|

60.2%

|

58.7%

|

150 bps

|

78.9%

|

77.5%

|

140 bps

|

91.1%

|

90.6%

|

50 bps

|

|

|

·

|

Natura &Co Latam’s

adjusted gross margin was 60.6% in Q1-21 (+60 bps), supported by strong increase at both the Natura and Avon brands in Hispanic Latam

mainly due to foreign currency tailwinds. These more than offset gross margin decrease at both brands in Brazil, mainly from higher raw

material prices and foreign currency headwinds.

|

|

|

·

|

Avon International’s

adjusted gross margin was 60.2% in Q1-21 (+150 bps), thanks to favorable price/mix and lower supply chain costs, mainly in Turkey, the

UK and South Africa markets, which more than offset foreign currency headwinds in certain markets.

|

|

|

·

|

The Body Shop’s

gross margin stood at 78.9% in Q1-21 (+140 bps), supported mainly by reduced discounts.

|

|

|

·

|

Aesop’s

gross margin was 91.1% in Q1-21 (+50 bps), supported

by online sales growth and regional mix, notably Asia.

|

Consolidated EBITDA

Reported EBITDA was R$829.1 million in

Q1-21 with margin of 8.8% (+690 bps vs. Q1-20). Adjusted EBITDA was R$963.2 million, with an adjusted margin of 10.2% (+260 bps), excluding

transformation costs in both years, and Avon-related acquisition costs and non-recurring PPA effects in 2020. The strong increase in adjusted

EBITDA and margin resulted from higher sales and operational leverage at Natura &Co Latam and Aesop.

|

|

Consolidated

EBITDA

|

|

R$

million

|

Q1-

21

|

Q1-

20

|

Ch.

%

|

|

Consolidated EBITDA

|

829.1

|

145.3

|

470.7

|

|

Transformation/ Integration costs (1)

|

134.1

|

25.1

|

435.0

|

|

(i) Transformation costs

|

75.6

|

14.5

|

419.9

|

|

(ii) Integration costs

|

58.6

|

10.5

|

456.0

|

|

Avon acquisition-related expenses (2)

|

-

|

298.3

|

-

|

|

Non-recurring PPA impact on EBITDA (3)

|

-

|

102.9

|

-

|

|

Adjusted EBITDA

|

963.2

|

571.5

|

68.5

|

|

Adjusted EBITDA Margin

|

10.2%

|

7.6%

|

260 bps

|

|

|

(1)

|

Transformation/Integration costs Include:

|

|

|

(i)

|

Transformation Plan costs of R$75.1 million at Avon International and R$0.5 million at corporate level

in Q1-21, and Avon International’s Open Up and Grow costs in Q1-20

|

|

|

(ii)

|

Integration costs (costs to achieve synergies) of R$55.9 million at Natura &Co Latam and R$2.7 million

at corporate level

|

|

|

(2)

|

Avon acquisition-related expenses: Non-recurring costs associated with Avon acquisition, in Q1-20

|

|

|

(3)

|

Non-recurring inventory PPA impacts in Q1-20: Non-cash, non-recurring inventory PPA impact, resulting

from a step up in inventory value (in the cost of goods sold), at both Natura &Co Latam and Avon International.

|

Financial income and expenses

Net

financial expenses were R$227.9 million in Q1-21, stable vs. Q1-20. The quarter saw lower interest expense resulting from the prepayment

of Avon’s US$900 million 2022 bonds in November 2020 and lower interest rates in Brazil. These effects were offset by an increase

in judicial contingency expenses, due mainly to reversal of tax provisions in 2020.

The following table details the main

changes in our financial income and expenses:

|

R$

million

|

Q

1- 21

|

Q

1- 20

|

Ch.

%

|

|

1. Borrowings & Financing , ST Investments and Op. FX Gains/Losses

|

(153.1)

|

(197.1)

|

(22.3)

|

|

2. Judicial Contingencies

|

(4.2)

|

38.6

|

(110.9)

|

|

3. Other Financial Income and Expenses

|

(70.6)

|

(69.1)

|

2.2

|

|

Lease Interest Expenses

|

(53.7)

|

(54.4)

|

(1.2)

|

|

Other

|

(16.9)

|

(14.7)

|

14.6

|

|

Financial Income and Expenses,

Net

|

(227.9)

|

(227.6)

|

0.1

|

Underlying Net Income (UNI)

Underlying Net Income was R$60.2 million

in Q1-21, reversing a loss of R$264.1 million last year, before Avon acquisition-related effects of R$215.3 million, which include: i)

transformation/integration costs of R$134.1 million and ii) PPA amortization effect of R$111.3 million; partially offset by iii) positive

discontinued operations expenses of R$28.7 million; and iv) positive non-controlling interests of R$1.4 million.

Reported net loss in Q1 decreased sharply

to R$155.2 million, a strong improvement from a loss of R$820.8 million in Q1-20, driven by higher EBITDA and lower income tax expense,

partially offset by higher depreciation of R$47.0 million and higher financial expenses of R$19.0 million. Income tax expense was down

5.0% in the quarter, despite higher earnings, largely due to a one-off higher expense in Q1-20 from the UK tax rate increase to 19% from

17%.

Free cash flow and cash position

We ended the quarter with a strong

cash position of R$6.6 billion (R$4.3 billion in cash, and R$2.3 billion in short-term deposits) in line with projections and well above

our minimum thresholds.

Cash flow was an outflow of R$1,204.6

million in Q1-21, consistent with our historical Q1 seasonality and further impacted by Covid-19 effects. Consumption in Q1 is mainly

related to working capital investments across all brands. Natura &Co Latam had higher inventory and accounts receivable, partially

offset by extended payables. Working capital at Avon International, The Body Shop and Aesop was also further impacted by FX effects from

the devaluation of the BRL and higher capex.

|

R$

million

|

Q1-21

|

Q1-20

|

Ch.

%

|

|

Net Income (Loss) Reported a

|

(155.2)

|

(820.8)

|

(81.1)

|

|

Depreciation and Amortization

|

696.4

|

625.8

|

11.3

|

|

Non-Cash/Others b

|

(124.0)

|

(253.0)

|

(51.0)

|

|

Internal Cash Generation

|

417.2

|

(448.0)

|

(193. 1)

|

|

Working Capital Decrease / (Increase)

|

(1,450.5)

|

(1,127.6)

|

28.6

|

|

Cash Generation (Use) Before Capex

|

(1,033.3)

|

(1,575.6)

|

(34.4)

|

|

Capex

|

(171.3)

|

(120.3)

|

42.4

|

|

Sale of Assets

|

-

|

-

|

-

|

|

Free Cash Flow

|

(1,204.6)

|

(1,695.9)

|

(29.0)

|

|

|

a

|

Attributable to the controlling shareholders

|

|

|

b

|

Includes the effects of deferred income tax, fixed

and intangible assets write-offs, FX on translation of working capital, fixed assets, etc.

|

Capital structure and liability

management

As

a subsequent event, the Group successfully concluded on May 3 a US$1 billion Sustainability-Linked

Bond (“ESG bond”) issue, with a 4.125% coupon, maturing on May 3, 2028, issued by Natura Cosméticos S.A.

and guaranteed by Natura &Co Holding S.A.

The funds raised through this issuance

will be used to refinance certain short- and long-term debts of Natura Cosméticos, including its US$ 750 million, 5.375% bond maturing

in 2023, in line with the Group's liability management plan to improve its capital structure.

Under the terms of the bond, from and

including November 3, 2027, the interest rate payable on the notes shall be increased by 65 basis points per annum unless the Sustainability

Performance Targets (“SPTs”) have been satisfied, as confirmed by an external verifier. The year 2019 served as baseline for

the SPTs.

On April 21, rating agencies assigned

credit ratings to Natura &Co Holding S.A. (previously not rated), on a global and national scale, as follows:

|

Natura

&Co Holding S.A.

|

|

Agency

|

Global

Scale

|

National

Scale

|

Outlook

|

|

Standard & Poor’s

|

BB

|

brAAA

|

Stable

|

|

Fitch Ratings

|

BB

|

AA+ (bra)

|

Positive

|

|

Moody’s

|

Ba3

|

-

|

Stable

|

In addition, Moody’s assigned

a Ba2 rating with a positive outlook to the Natura Cosméticos subsidiary, and Fitch Ratings improved the company’s outlook

to positive from stable. All other ratings related to the Group companies remained unchanged. A table with all ratings is available in

section 8 of this document, Fixed Income.

Strong deleveraging at both Natura

&Co Holding and Natura Cosméticos and Leverage Guidance

Natura

&Co Holding’s consolidated net debt-to-EBITDA ratio stood at 1.18x in Q1-21, significantly

down from 3.93x in Q1-20, including the effects of IFRS-16 (excluding IFRS-16: 1.37x in Q1-21 vs. 4.91x in Q1-20).

On April 15, the Company prepaid R$500

million in promissory notes issued by Natura &Co Holding and R$250 million by Natura Cosméticos.

Also, in April, we published the Group’s

guidance on consolidated net debt-to-EBITDA ratio of equal to or less than 1.0x by 2023. This ratio is a cap rather than a target given

the expected cash generation and higher EBITDA over the period.

Natura Cosméticos’ net

debt-to-EBITDA ratio stood at 0.82x in Q1-21, down from 2.02x in Q1-20, including the effects of IFRS-16 (excluding IFRS-16: 1.08x in

Q1-21, down from 2.70x in Q1-20, significantly below pre The Body Shop acquisition levels).

|

|

Natura

Cosmèticos S.A.

|

Natura

&Co Holding S.A.

|

|

R$

million

|

Q1-21

|

Q1-20

|

Q1-21

|

Q1-20

|

|

Short-Term

|

2,481.4

|

787.2

|

3,234.5

|

1,942.5

|

|

Long-Term

|

6,460.9

|

8,343.2

|

10,301.9

|

16,610.4

|

|

Gross Debt a

|

8,942.3

|

9,130.4

|

13,536.4

|

18,553.0

|

|

Foreign currency hedging (Swaps) b

|

(2,006.3)

|

(1,618.7)

|

(2,006.3)

|

(1,618.7)

|

|

Total Gross Debt

|

6,936.0

|

7,511.7

|

11,530.1

|

16,934.3

|

|

(-) Cash, Cash Equivalents and Short-Term Investment

|

(3,818.4)

|

(2,447.1)

|

(6,576.4)

|

(4,566.3)

|

|

(=) Net Debt

|

3,117.6

|

5,064.6

|

4,953.8

|

12,368.0

|

|

|

|

|

|

|

|

Indebtedness ratio excluding IFRS 16 effects

|

|

|

|

|

|

Net Debt/EBITDA

|

1.08x

|

2.70x

|

1.37x

|

4.91x

|

|

Total Debt/EBITDA

|

2.40x

|

4.00x

|

3.20x

|

6.72x

|

|

|

|

|

|

|

|

Indebtedness ratio including IFRS 16 effects

|

|

|

|

|

|

Net Debt/EBITDA

|

0.82x

|

2.02x

|

1.18x

|

3.93x

|

|

Total Debt/EBITDA

|

1.82x

|

3.00x

|

2.75x

|

5.37x

|

|

a Gross debt excludes PPA impacts of R$474.5 million and excludes lease

agreements

|

|

b Foreign currency debt hedging instruments, excluding mark-to-market effects

|

|

|

4.

|

Performance by segment

|

Natura &Co Latam: The Natura

brand posts strong double-digit growth in Brazil and Hispanic Latam; The Avon brand grows strongly in Hispanic Latam while a new commercial

model is implemented in Brazil

Net

revenue at Natura &Co Latam increased by 24.6% in Q1-21 in BRL (+15.9% at CC), driven by the Natura brand‘s strong 29.6% growth

(+12.6% Brazil;+60.4% Hispanic Latam), while the Avon brand was up 20.0% (-2.8% in Brazil; +35.1% in Hispanic

Latam). Natura &Co’s clear CFT leadership in Latin America was confirmed by Euromonitor, reaching market share of 12.5% in FY20,

+0.7pp vs. prior year. In Brazil we maintained our leadership, with a strong 17.0% (+1pp vs. 2019). In the five Hispanic countries where

both Natura and Avon brands operate, market share reached 11.2% (+1.3pp).

The Natura brand was valued at US$1.7

billion and ranked as the world’s strongest brand in the cosmetics sector, according to Brand Finance, based on factors such as

marketing investment, customer awareness, employee satisfaction, corporate reputation and revenue forecasts.

The Natura brand posted strong performance

both in Brazil and in Hispanic Latam, which attests to the strength of our digital social selling model and a robust innovation pipeline.

The Avon brand reported a second consecutive quarter of growth in Hispanic Latam, this time with acceleration in sales driven by key markets

such as Mexico, its largest single market, as well as Argentina, Chile and Peru. In Brazil, the Avon brand’s revenue was down 2.8%,

as the preparation for the new commercial model implementation caused a further reduction in the number of representatives, as occurred

at Natura in 2017.

Avon’s integration in Latam is

on track, with important progress in procurement, customer and financial services, distribution and digital. There were significant advances

in IT systems at Avon Brazil, to enable the set up and implementation of the new commercial model.

The Natura brand in Brazil had a strong

quarter, with continued advances in brand preference. Growth was driven by continued digital social selling penetration, an increase in

the average number of consultants of +14.2% vs. Q1-20 (and -3.5% vs. Q4-20), reaching 1,184,000, and higher volumes of most categories

such as body care, face care, fragrances and soaps. Consultant activity level was stable in the quarter, and volumes increased slightly.

|

The

Natura consultant loyalty index in Brazil remained strong, and business leader loyalty was also significantly higher vs. last year. Productivity

per consultant was down 3.5% in the quarter, after 17 consecutive quarters of growth since the successful implementation of our segmented

relationship selling model in mid-2017. This results from an increase in our consultant base since Q3-20 (+14.2% vs Q1-20). This temporarily

dilutes productivity as new consultants are in the early stages of building up their activity. Over time, we expect these consultants

to progress to higher-productivity segments of our commercial model, such as Silver, Gold and Diamond. In the quarter, the number of

consultants in top-tier segments remained strong.

|

|

Natura relaunched its iconic Ekos line,

with formulations that include 3 times more bio-actives from the Amazon forest, substantially improving product performance. This “bio-beauty”

line is comprised of 96% natural ingredients and will contribute to increase income of the Amazon supplying communities who help keep

the forest standing. Ekos has engaged a new ambassador, Brazilian model and environmental activist Gisele Bündchen, to represent

a more conscious beauty and contribute to defending urgent causes related to our planet.

The

Natura brand’s strong growth in Hispanic Latam was supported by all markets, notably Argentina, Chile and Peru, with productivity

increase and expansion of the consultant base (+19.4%), which reached 850,000. The quarter ended with

a significantly higher consultant loyalty index in the region, up 530 bps vs. Q1-20. We also launched Natura’s e-commerce in Mexico,

completing the brand’s e-commerce platforms in the region.

Avon’s strong net revenue in Hispanic

Latam was supported by a higher activity level and higher representative productivity, which helped offset the 5.5% decline in average

number of representatives. Growth was driven by Fashion and Home and most beauty categories, such as body care, fragrances and face care.

Color continues to be impacted by the pandemic effects.

The Avon brand’s revenue in Brazil

was down 2.8% in Q1-21 vs. Q1-20, as a result of the implementation of the new segmented commercial model. As occurred at the Natura brand

when its channel was revitalized in 2017, this structural change caused a further drop in the number of representatives (of

4.7% in Q1-21), but once the representative

base stabilizes and representatives progress towards higher segment levels based on higher sales, we expect productivity growth to resume.

Volume was slightly up in the quarter, picking up in March.

The Avon brand was a major sponsor of

the 21st edition of the reality show Big Brother Brazil, which ran from late January through May 4, 2021, strengthening the

brand’s power and improving consumer perception. The brand engaged with the show’s audience in various online and offline

platforms, to promote social diversity. In the quarter we saw e-commerce sales nearly triple, along with an increase of 400,000 followers

on Instagram and nearly 100,000 on Twitter, with record breaking numbers of impressions in both social media channels. The brand reached

the number one position in share of social media voice (SOV) on Twitter, with 10 trending topics.

Natura

Brazil’s online sales (e-commerce + social selling) were up 150% vs Q1-20, notably driven by consultants’ online stores.

At the end of Q1-21 we surpassed 1.3 million Natura consultant online stores (Latin America), with an

80% year-on-year increase in the number of orders. At Avon, e-brochure

sales continued to post significant growth, of +96% in Brazil in Q1-21 vs. Q1-20.

In the retail channel, all our Natura

and The Body Shop stores faced continued restrictions. We ended the quarter with over 700 stores, including 70 Natura own stores, over

140 The Body Shop stores and over 500 Natura franchised stores.

The &Co Pay platform, rolled-out

at Natura Brazil in Q4-20 continued to expand, with an 80% increase in the number of accounts in Q1. We have enabled new features to improve

consultant experience, including credit top-up for mobile phones and public transportation passes. &Co Pay is an enabler of digital

and financial inclusion for our consultants and reps.

Natura &Co Latam: Financial

analysis

Reported EBITDA was R$574.4 million

with margin of 11.1% (+550 bps). Adjusted EBITDA, excluding transformation costs, surged 119.2%, to R$630.3 million, vs. R$287.5 million

in Q1-20, with adjusted EBITDA margin of 12.2% (+530 bps), thanks to strong revenue growth and operational leverage at the Natura brand

in Brazil and in Hispanic Latam, and the Avon brand in Hispanic Latam.

A reconciliation between EBITDA and

adjusted EBITDA is presented below:

|

R$

million

|

Q1-21

|

Q1-20

|

Ch.

%

|

|

EBITDA

|

574.4

|

234.7

|

144.7

|

|

Transformation/Integration costs

|

55.9

|

10.5

|

430.9

|

|

Non-recurring PPA impacts on EBITDA

|

-

|

42.3

|

-

|

|

Adjusted EBITDA

|

630.3

|

287.5

|

119.2

|

|

Adjusted EBITDA Margin

|

12.2%

|

6.9%

|

530 bps

|

Excluding PPA effects on SG&A expenses,

Selling, Marketing & Logistics expenses represented 39.7% of net revenue (-400 bps), mainly resulting from operational leverage from

strong revenue increase at both brands.

Excluding PPA effects, Administrative,

R&D, IT and Project Expenses reached 12.5% of net revenue (-100 bps) in the quarter, largely driven by net revenue growth at both

brands.

|

R$

million

|

Q1-21

|

PPA

impacts

|

Q1-21

ex-PPA

|

Q1-20

|

PPA

impacts

|

Q1-20

ex-PPA

|

Ch.

%

w/ PPA

|

Ch.

%

ex-PPA 1

|

|

Selling, Marketing and Logistics Expenses

|

(2,089.9)

|

(32.9)

|

(2,057.0)

|

(1,852.4)

|

(32.0)

|

(1,820.5)

|

12.8

|

13.0

|

|

Administrative, R&D, IT and Projects Expenses

|

(642.6)

|

4.6

|

(647.2)

|

(571.1)

|

(10.4)

|

(560.7)

|

12.5

|

15.4

|

|

SG&A Expenses

|

(2,732.5)

|

(28.3)

|

(2,704.1)

|

(2,423.6)

|

(42.4)

|

(2,381.2)

|

12.7

|

13.6

|

|

|

|

|

Selling, Marketing and Logistics Exp./ Net Revenue

|

40.3%

|

-

|

39.7%

|

44.5%

|

-

|

43.7%

|

(420) bps

|

(400) bps

|

|

Admin., R&D, IT, and Projects Exp./ Net Revenue

|

12.4%

|

-

|

12.5%

|

13.7%

|

-

|

13.5%

|

(130) bps

|

(100) bps

|

Avon International: Market share

gain in Western Europe driven by the UK

Avon

gained market share in Q1-21 vs. Q1-20 in Western Europe, driven by the UK, and in Asia Pacific driven

by the Philippines. All regions improved share month after month, including Avon’s top 8 countries, despite the continued impact

of the Covid-19 second wave in key European markets. Avon UK’s market share increased for the 4th consecutive quarter,

this time by nearly 1pp vs. Q1-20, becoming the 3rd brand in the beauty market (last 12 months), up from 10th one

year earlier. This strong performance was driven by gains in color, a core category, as well as

in fragrance and skin care.

Avon’s revenue in the quarter

still reflected the second wave of the pandemic, especially in Central and Eastern Europe, which underwent further lockdowns with a greater

impact in color and fragrance categories, as well as in representative offline activity. We continued to see continued representative

productivity improvement as result of recovery actions, which was offset by lower activity in Europe and Africa.

Gross

margin in the period was up by a healthy 150 bps, excluding PPA effects, thanks to favorable price/mix

and lower supply chain costs, mainly in Turkey, the UK and South Africa markets, despite volume decline and currency headwinds in certain

markets. This attests to the potential operational leverage once the business resumes revenue growth.

Avon actions to strengthen fundamentals

continued, and the business is now running on a simplified commercial model, with monthly campaigns across all markets. This has contributed

to a 26% reduction in printing of sales catalogue and a 13% decline in catalogue costs, in line with the goal of harmonizing campaign

planning and reducing costs.

Launches

in the quarter included the Hydra Pro Vita-D Moisturizer, another innovation in the hero skin care line Anew. This “sunshine in

a jar” is Avon’s first face cream to harness the skin-boosting power of Vitamin D, which is activated by the Pro Vita-D technology,

locking in hydration for a 72-hour moisture. Avon’s Protinol was recognized with an Edison Award™,

one of the highest accolades a company can receive in the name of innovation and business success. Protinol™ is a skin science breakthrough

that helps strengthen skin with a dual-collagen boost.

Net revenue of the Avon brand, including

Latin America and Avon International, grew 15.7% in BRL in Q1 (-1.7% at CC).

Avon International: Financial analysis

Avon

International’s reported EBITDA was R$22.3 million in Q1-21 and adjusted EBITDA was R$97.4 million. Reported EBITDA margin was 0.9%

and adjusted EBITDA margin was 4.1% (-70 bps), due to the impact of lower revenue (-10.7% at CC) and higher strategic investments in digital

and commercial areas to accelerate future growth, which offset higher gross margin.

A reconciliation between EBITDA and

adjusted EBITDA is presented below:

|

R$

million

|

Q1-21

|

Q1-20

|

Ch.

%

|

|

EBITDA

|

22.3

|

27.7

|

(19.5)

|

|

Transformation/Integration costs

|

75.1

|

14.5

|

416.5

|

|

Non-recurring PPA impact on EBITDA

|

-

|

60.6

|

-

|

|

Adjusted EBITDA

|

97.4

|

102.9

|

(5.4)

|

|

Adjusted EBITDA Margin

|

4.1%

|

4.8%

|

(70) bps

|

Excluding PPA effects on SG&A expenses,

Selling, Marketing & Logistics expenses reached 43.5% of net revenue (+90 bps), largely due to lower revenue and higher investments

in the commercial area to accelerate growth.

Excluding PPA effects, Administrative,

R&D, IT and Project expenses reached 16.5% of net revenue (+120 bps) in the quarter, mainly due to lower revenue and foreign currency

impacts.

|

R$

million

|

Q1-21

|

PPA

impacts

|

Q1-21

ex-PPA

|

Q1-20

|

PPA

impacts

|

Q1-20

ex-PPA

|

Ch.

%

w/ PPA

|

Ch.

%

ex-PPA

|

|

Selling, Marketing and Logistics Expenses

|

(1,068.9)

|

(40.6)

|

(1,028.3)

|

(935.3)

|

(31.7)

|

(903.6)

|

14.3

|

13.8

|

|

Administrative, R&D, IT and Projects Expenses

|

(470.0)

|

(79.1)

|

(390.8)

|

(388.7)

|

(63.2)

|

(325.5)

|

20.9

|

20 1

|

|

SG&A Expenses

|

(1,538.9)

|

(119.8)

|

(1,419.1)

|

(1,323.9)

|

(94.9)

|

(1,229.1)

|

16.2

|

15.5

|

|

|

|

|

|

|

|

|

|

|

|

Selling, Marketing and Logistics Exp./ Net Revenue

|

45.2%

|

-

|

43.5%

|

44.1%

|

-

|

42.6%

|

110 bps

|

90 bps

|

|

Admin., R&D, IT, and Projects Exp./ Net Revenue

|

19.9%

|

-

|

16.5%

|

18.3%

|

-

|

15.3%

|

160 bps

|

120 bps

|

The Body Shop:

Solid revenue growth driven by At-Home and Online

The Body Shop posted net revenue of

R$1,319.7 million in Q1-21, up by 47.7% in BRL (+10.7% at CC), largely driven by direct channels as customers continue to engage and transact

with us digitally. At-Home sales grew by 251% and e-commerce grew 119%, coupled with lower discounts. Together, both channels represented

51% of total sales in the period and more than offset lost retail sales. UK and North America were the key drivers of revenue expansion

this quarter, followed by APAC, despite lower franchise sales mainly in Indonesia, partially offsetting strong double-digit growth in

Australia. Revenue was also supported by the acquisition of The Body Shop head franchisee in Japan, which is now included as own store

revenue vs. franchise last year. Excluding the Japan buyback effect, revenue at CC improved by 6%.

Only 68% of own stores were open in

March (vs. 78% in December 2020 and 25% by the end of Q1-20), with the UK under lockdown in Q1 and other markets in Europe either re-entering

lockdowns or operating with reduced hours. This resulted in strong negative like-for-like retail sales. Online sales were amplified by

the new global company website, which enhanced consumer experience and significantly increased the number of new customers. As part of

our strategy to expand our omnichannel model in North America, we grew our At-Home channel to over 9,000 consultants.

New launches in the quarter included

the Dry Body Oil from the Hemp range. It is enriched with hemp seed oil from France for a fast-absorbing and non-sticky feel, leaving

the skin with a natural, healthy-looking glow.

The Body Shop brand joined the Brand

Finance Cosmetics Top 50 ranking in 2021, with a valuation of US$725 million, up +22%, and was highlighted as one of the fastest-growing

brands.

EBITDA in Q1-21 reached R$194.2 million,

with EBITDA margin of 14.7% (-30 bps), due to channel mix effects. EBITDA and EBITDA margin improved significantly in At-Home and online

channels, driven by higher volumes, offsetting declines in retail. Excluding Japan’s results from both years, Q1-21 pro forma EBITDA

margin would have been 70 bps higher than reported margin, and 110 bps higher than Q1-20’s margin.

The quarter ended with 1,019 own stores

and 1,557 franchise stores (total of 2,576 stores), with 129 net store closures (own and franchise) since Q1-20. The increase in own stores

is mainly explained by the Japan operation buyback. In the last 12 months, we rolled out the new concept store to 12 existing stores,

of which 3 within the quarter. The chart below shows the store count evolution:

|

Store

|

The

Body Shop store count

|

|

Q1-21

|

Q4-20

|

Q1-20

|

Change

vs. Q4-20

|

Change

vs. Q1-20

|

|

Own

|

1,019

|

1,049

|

977

|

(30)

|

42

|

|

Franchise

|

1,557

|

1,590

|

1,728

|

(33)

|

(171)

|

|

Total

|

2,576

|

2,639

|

2,705

|

(63)

|

(129)

|

Aesop:

Exceptional growth driven by online and Asia

Aesop posted exceptional net revenue

growth of 71.9% in Q1-21 in BRL and +30.6% in constant currency, driven by another quarter of very fast growth in online sales, which

increased by 102% vs Q1-20 and represented 29% of total sales. Aesop saw growth in all regions. Performance was particularly strong in

Asia, with sales up 67% (at CC). Retail revenue grew by 6% globally, supported by strong like-for-like growth in Asia, while stores remained

closed across Europe, in Canada and parts of Australia.

Aesop launched a fragrance cabinet in

the Aesop Parnas store in South Korea and will roll out the same concept in other stores and countries to elevate the in-store experience

for customers in this key category.

Q1-21 EBITDA more than doubled to R$

156.5 million with EBITDA margin of 26.7% (+390 bps), driven by sales growth, higher EBITDA, notably in Asia, and cost efficiency.

Signature stores totalled 250 in the

quarter, up 3 units vs both Q4-20 and Q1-20 reflecting a slowdown in the store roll out plan due to Covid-19. A store count table is provided

below:

|

Doors

|

Aesop

door count

|

|

Q1-21

|

Q4-20

|

Q1-20

|

Change

vs. Q4-20

|

Change

vs Q1-20

|

|

Signature stores

|

250

|

247

|

247

|

3

|

3

|

|

Department

|

92

|

91

|

91

|

1

|

1

|

|

Total

|

342

|

338

|

338

|

4

|

4

|

|

|

5.

|

Social and environmental performance

|

(all actions refer to Natura &Co

Group, unless stated otherwise)

On the sustainability front, Natura &Co

continued to make strides towards achieving our 31 goals for our 2030 “Commitment to Life” sustainability vision announced

last year.

Commitment to Life highlights

|

|

·

|

To Address the Climate Crisis:

|

|

|

o

|

We are consolidating the organizational footprints for scopes 1 and 2, and calculating the footprint for

scope 3. The Carbon Trust consultancy will support us in this task and will also aid us in calculating the science-based targets for the

1.5°C pathway, in line with Science Based Target initiative (SBTi) requirements

|

|

|

o

|

We defined carbon emission reduction targets as part of the KPIs related to the scorecard of our 2021

bonus compensation for the Group and the four brands

|

|

|

o

|

Natura Brazil reduced 72% of scope 2 GHG emissions with the acquisition of renewable electric energy with

zero GHG emissions from wind power in all Brazil operations

|

|

|

o

|

The Body Shop has installed automatic meter readers (AMRs) to measure energy consumption in 295 stores

and is expanding AMRs across all company sites

|

|

|

·

|

To defend Human Rights and to be Human-Kind:

|

|

|

o

|

13% is our raw gap between the average pay of all women & men, irrespective of role, location and

experience according to an equitable pay study carried out with the Mercer consultancy

|

|

|

o

|

0.9% is our unexplained gap – that which cannot be explained by legitimate factors. We will act

to close our gender pay gap this year to achieve this well ahead of our 2023 Commitment to Life goal

|

|

|

·

|

To embrace Circularity and Regeneration:

|

|

|

o

|

Natura has achieved 93% natural ingredients in formulas

|

|

|

o

|

Aesop recycled PET tracking at 85.92% of total PET consumption

|

|

|

o

|

Our 2021 bonus compensation scorecard also includes a target related to increase recycled plastic consumption

|

The power of the “&”

|

|

o

|

Natura was recognized as a “humanized” company top performance, according to Humanizadas,

a partner of Conscious Capitalism in Brazil

|

|

|

o

|

B Corp: During B Corp month in March, we celebrated Natura &Co becoming the world’s largest

B Corp, showcasing our efforts to balance profit and purpose

|

|

|

o

|

Avon marked International Women’s Day (March 8) with the launch of the My Story Matters gallery

- to create a place for women to speak up, share their stories and celebrate their achievements - to unite and inspire each other. The

platform was launched to celebrate the achievements of women around the world. So far, the platform has gathered 435,000 stories

|

|

|

o

|

Avon also took part in anti-racism events as part of the March 21 International Day for the Elimination of

Racial Discrimination. In association with The Office of the High Commissioner for Human Rights (OHCHR)

|

|

|

·

|

Investments and donations:

|

|

|

o

|

Natura &Co donated 4 million BRL to the Conectar group in Brazil, for hospital supplies and purchase

of vaccines

|

|

|

o

|

Natura & Co together with eleven other companies, donated more than 5,000 oxygen concentrators in

Brazil

|

|

|

o

|

Aesop awarded of $300,000 AUD to organizations focused on literacy and education

|

|

|

6.

|

Capital Markets and Stock Performance

|

On February 8, the Company concluded

a share repurchase program for a total of 631,358 common shares, acquired at market prices in the Brazilian stock exchange, to fulfil

its restricted share and stock options programs.

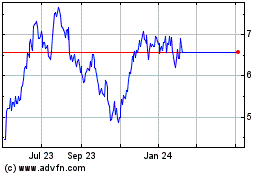

NTCO3 shares traded at R$48.14 at the

end of Q1-21 on the B3 stock exchange, -8.3% in the quarter. Average Daily Trading Volume (ADTV) for the quarter was R$352.4 million,

+5.1% vs Q1-20. NTCO traded at US$16.99 at the end of Q1-21 on NYSE, -15.1% in the quarter.

On March 31, 2021, the Company’s

market capitalization was R$66.3 billion, vs. R$30.5 billion on March 31, 2020, an increase of 116.5%, and the Company’s capital

was comprised of 1,376,654,532common shares, vs. 1,188,271,016 in 2020.

Below is the performance of NTCO3 and

NTCO in the quarter:

Below is a table with details of all

public debt instruments outstanding per issuer as of March 31, 2021:

|

Issuer

|

Type

|

Issuance

|

Maturity

|

Principal

(million)

|

Nominal

Cost

(per year)

|

|

Natura Cosmèticos S.A.

|

Bonds - 1st issue

|

02/01/2018

|

02/01/2023

|

US$ 750.0 (1)

|

5.375%

|

|

Natura Cosmèticos S.A.

|

Debenture - 7th issue

|

09/25/2017

|

09/25/2021

|

BRL 1,827.3

|

DI + 1.75% per year

|

|

|

|

|

09/21/2021

|

BRL 308.3

|

110.5% DI tax

|

|

Natura Cosmèticos S.A.

|

Debenture - 9th issue

|

09/21/2018

|

09/21/2022

|

BRL 302.7

|

112% DI tax

|

|

|

|

08/28/2019

|

08/26/2024

|

BRL 400.0

|

DI + 1.00 per year

|

|

Natura Cosmèticos S.A.

|

Debenture - 10th issue 1st series

|

08/29/2019

|

08/26/2024

|

BRL 95.7

BRL 686.2

BRL 394.5

|

DI + 1.15 per year

DI + 1.15 per year

DI + 1.15 per year

|

|

Natura Cosmèticos S.A.

|

Promissory Notes - 1st issue

|

05/04/2020

|

05/04/2021

|

BRL 250.0

|

DI + 3.25% per year

|

|

Avon Products, Inc.

|

Unsecured Bonds

|

03/12/2013

|

03/15/2023

|

US$ 461.9

|

6.5000%(2)

|

|

Avon Products, Inc.

|

Unsecured Bonds

|

03/12/2013

|

03/15/2043

|

US$ 216 .1

|

8.450%(2)

|

|

Natura &Co Holding

|

Promissory Notes - 2nd issue

|

05/04/2020

|

05/04/2021

|

BRL 500.0

|

DI + 3.25% per year

|

|

(1) Principal and interests fully hedged (swapped to BRL). For more information, see

the explanatory notes to the Company’s financial statements.

|

|

(2) Coupon based on current credit ratings, governed by interest rate adjustment clause.

|

On April 15, the Company prepaid R$500

million in promissory notes issued by Natura &Co Holding and R$250 million by Natura Cosméticos.

Ratings

On April 21, rating agencies assigned

credit ratings to Natura &Co Holding S.A. (previously not rated), on a global and national scale. Further, the Natura Cosméticos

subsidiary earned a Ba2 rating from Moody’s on global scale, with a stable outlook, and Fitch Ratings improved Natura Cosméticos’

outlook to positive, from stable.

Below is a table with our current credit

ratings:

|

Natura &Co Holding S.A.

|

|

Agency

|

Global

Scale

|

National

Scale

|

Outlook

|

|

Standard & Poor's

|

BB

|

brAAA

|

Stable

|

|

Fitch Ratings

|

BB

|

AA+ (bra)

|

Positive

|

|

Moody's

|

Ba3

|

-

|

Stable

|

|

Natura

Cosmèticos S.A.

|

|

Agency

|

Global

Scale

|

National

Scale

|

Outlook

|

|

Standard & Poor's

|

BB

|

brAAA

|

Stable

|

|

Fitch Ratings

|

BB

|

AA+ (bra)

|

Positive

|

|

Moody's

|

Ba2

|

-

|

Stable

|

|

Avon

International

|

|

Agency

|

Global

Scale

|

National

Scale

|

Outlook

|

|

Standard & Poor's

|

BB-

|

-

|

Stable

|

|

Fitch Ratings

|

BB

|

-

|

Positive

|

|

Moody's

|

Ba3

|

-

|

Stable

|

|

|

|

|

|

|

Ratings updated on April 21, 2021

|

Consolidated Balance Sheet

|

ASSETS

(R$ million)

|

Mar-21

|

Dec-20

|

|

LIABILITIES

AND SHAREHOLDER'S EQUITY (R$ million)

|

Mar-21

|

Dec-20

|

|

CURRENT ASSETS

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

Cash and cash equivalents

|

4,326.4

|

5,821.7

|

|

Loans, financing and debentures

|

3,234.5

|

3,805.6

|

|

Securities

|

2,249.7

|

2,520.6

|

|

Leasing

|

1,120.8

|

1,059.7

|

|

Trade receivables

|

3,370.1

|

3,597.5

|

|

Trade payables and forfait operations

|

6,555.2

|

6,774.2

|

|

Inventories

|

5,342.7

|

4,544.3

|

|

Payroll, profit sharing and social changes

|

1,242.5

|

1,340.7

|

|

Recoverable taxes

|

1,176.3

|

1,071.3

|

|

Tax liabilities

|

658.5

|

785.4

|

|

Income tax and social contribution

|

200.4

|

242.1

|

|

Income tax and social contribution

|

372.5

|

441.3

|

|

Derivatives

|

112.2

|

139.9

|

|

Derivative financial instruments