false

0001163739

0001163739

2024-07-23

2024-07-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form 8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 23, 2024

NABORS INDUSTRIES LTD.

(Exact name of registrant as specified in

its charter)

| Bermuda |

|

001-32657 |

|

98-0363970 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

Crown House

4 Par-la-Ville Road

Second Floor

Hamilton, HM08 Bermuda |

|

N/A |

| (Address of principal executive offices) |

|

(Zip Code) |

(441) 292-1510

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of each class |

|

Trading Symbol(s) |

|

Name of exchange on which

registered |

| Common shares |

|

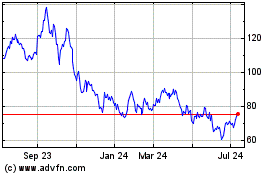

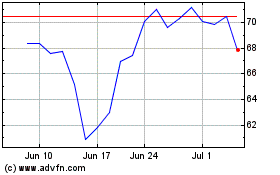

NBR |

|

NYSE |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial

Condition.

On July 23, 2024, Nabors

Industries Ltd. (“Nabors”) issued a press release announcing its results of operations for the three months ended June 30,

2024. A copy of that release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

On July 24, 2024, Nabors

will hold a conference call at 10:00 a.m. Central Time, regarding the Company’s financial results for the quarter ended June 30,

2024. Information about the call - including dial-in information, recording and replay of the call, and supplemental information - is

available on the Investor Relations page of www.nabors.com.

The information in this Item

2.02, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act, of 1934 or otherwise subject to liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NABORS INDUSTRIES LTD. |

| |

|

| Date: July 23, 2024 |

By: |

/s/ Mark D. Andrews |

| |

|

Name: Mark D. Andrews |

| |

|

Title: Corporate Secretary |

Exhibit 99.1

|

NEWS

RELEASE |

Nabors Announces

Second Quarter 2024 Results

HAMILTON,

Bermuda, July 23, 2024 /PRNewswire/ - Nabors

Industries Ltd. (“Nabors” or the “Company”) (NYSE: NBR) today reported second quarter 2024 operating revenues

of $735 million, compared to operating revenues of $734 million in the first quarter. The net loss attributable to Nabors shareholders

for the quarter was $32 million, compared to a net loss of $34 million in the first quarter. This equates to a loss of $4.29 per diluted

share, compared to a loss per diluted share of $4.54 in the first quarter. Second quarter adjusted EBITDA was $218 million, compared

to $221 million in the previous quarter.

Highlights

| o | Nabors

Lower 48 rigs continued to set the standard for performance on challenging wells. A major

operator in the Delaware Basin drilled its fastest four-mile lateral, utilizing a Nabors

PACE®-X rig and a package of NDS technology. A second large operator, in the Eagle Ford,

drilled a single-run, four-mile lateral in 14 days, using a Nabors PACE®-M1000 rig. |

| o | A

large operator in the Bakken committed to Nabors’ full automation suite across all

of its rigs, including SmartDRILL™ and SmartSLIDE®. With these installations, NDS

will reach record penetration of its automated directional drilling solution on Nabors rigs. |

| o | A

major operator committed funding to support the next generation of Nabors’ RZR red

zone robotics drillfloor automation module. This includes an installation on one of this

client’s rigs in the Permian, and the opportunity to scale up from there. |

| o | Kuwait

Oil Company formally awarded multiyear contracts for three high-specification rigs. The Company

plans to deploy existing in-country rigs for this opportunity. |

Anthony

G. Petrello, Nabors Chairman, CEO and President, commented, “Our second quarter operating results were better than we expected.

This performance was driven by growth and higher average daily margins in our International Drilling segment, as well as stronger performance

in our Drilling Solutions and Rig Technologies segments.

“Rig

count continued to grow in our International segment, as we started up previously awarded rigs. With a substantial number of additional

rig awards already in hand, across the Middle East and Latin America, we have a well-defined trajectory for international expansion over

the next couple of years. We have scheduled 19 deployments over the next 18 months. We also have identified additional opportunities

that could extend this growth path.

“Stable

pricing supported our results in the Lower 48 market. Our average rig count decreased somewhat compared to the prior quarter, essentially

in line with our expectation. Activity declines in the Northeast and South Texas were partially offset by increases in North Dakota and

our Western region. Results in our Drilling Solutions segment were above our target, reflecting growth in our International markets as

well as on third party rigs in the U.S.”

|

NEWS

RELEASE |

Segment

Results

The

U.S. Drilling segment reported second quarter adjusted EBITDA of $114.0 million, compared to $120.4 million in the first quarter. Nabors’

second quarter Lower 48 average rig count totaled 69, versus 72 in the first quarter. Daily adjusted gross margin in that market averaged

$15,600, down 2% as compared to the prior quarter.

International

Drilling adjusted EBITDA totaled $106.4 million, compared to $102.5 million in the first quarter. Average rig count increased to 84 from

81, driven by rig additions in Algeria and Saudi Arabia. Daily adjusted gross margin for the second quarter averaged $16,050, essentially

in line with the prior quarter.

Drilling

Solutions adjusted EBITDA was $32.5 million, compared to $31.8 million in the first quarter. This increase was essentially driven by

revenue growth on third-party Lower 48 and international rigs of 22% and 18%, respectively.

In

Rig Technologies, adjusted EBITDA increased to $7.3 million, versus $6.8 million in the first quarter. The increase was spread across

business lines including capital equipment, OEM repair, and energy transition.

Adjusted

Free Cash Flow

Adjusted

free cash flow was $57 million in the second quarter. Capital expenditures totaled $138 million, which included $56 million supporting

the newbuilds in Saudi Arabia. This compares to $112 million in the first quarter, including $35 million supporting the newbuilds.

William

Restrepo, Nabors CFO, stated, “Our overall results exceeded outlook. The emerging international market strength we

saw last year is now manifesting in rig additions for our International drilling segment. We expect our pipeline of scheduled international

deployments to drive an increase in rig count of at least 20% from the end of 2023 through the end of 2025. This includes rigs

in Algeria, Argentina, Kuwait, and Saudi Arabia. On top of these, we have multiple attractive opportunities. Our approach

to these opportunities will remain disciplined, ensuring they are consistent with our free cash flow commitments over the next few years.

“In

the U.S., our Lower 48 results were supported by continued high utilization of high-spec rigs and strong pricing. As we look ahead, we

see opportunities to add rigs and offset some of the attrition in the natural gas focused markets. We expect our rig count to increase

moderately for the balance of the year.

“We

achieved significant milestones to solidify our capital structure. During the second quarter, we increased the amount on our revolving

credit facility and extended it until 2029. More recently, we placed $550 million of notes due in 2031. With these proceeds, we intend

to retire the similar notes due in 2026. Once completed, our next maturity comes in mid-2027.

“The strong results drove our cash generation. Adjusted free cash flow for the first half of the year reached $65 million. This performance supports our previous full-year 2024 adjusted free cash flow target of $100-$200 million.”

|

NEWS

RELEASE |

Outlook

Nabors

expects the following metrics for the third quarter of 2024:

U.S.

Drilling

| o | Lower

48 average rig count of approximately 70 rigs |

| o | Lower

48 daily adjusted gross margin of $15,100-$15,200 |

| o | Alaska

and Gulf of Mexico combined adjusted EBITDA of approximately $20 million |

International

| o | Average

rig count up by approximately one rig versus the second quarter average |

| o | Daily

adjusted gross margin of $16,200-$16,300 |

Drilling

Solutions

| o | Adjusted

EBITDA up sequentially by approximately 6% |

Rig

Technologies

| o | Adjusted

EBITDA up sequentially by approximately $1.5 million |

Capital

Expenditures

| o | Capital

expenditures of $190-$200 million, with $80-$85 million for the newbuilds in Saudi Arabia |

| o | Full-year

capital expenditures of approximately $590 million, including funding for the recent rig

awards |

Adjusted

Free Cash Flow

| o | Full

year adjusted free cash flow of $100-$200 million |

Mr. Petrello

concluded, “These results, and our outlook, illustrate the success of our strategy. We remain committed to deploying the global

drilling industry’s leading technology. The growing adoption of these innovations by our client base across the globe gives us

confidence that we are on the right track. And as I’ve stated before, we expect the extraordinary strength of the international

markets to continue driving our growth over the coming years.”

About Nabors Industries

Nabors Industries

(NYSE: NBR) is a leading provider of advanced technology for the energy industry. With presence in more than 20 countries, Nabors has

established a global network of people, technology and equipment to deploy solutions that deliver safe, efficient and responsible energy

production. By leveraging its core competencies, particularly in drilling, engineering, automation, data science and manufacturing, Nabors

aims to innovate the future of energy and enable the transition to a lower-carbon world. Learn more about Nabors and its energy technology

leadership: www.nabors.com.

|

NEWS

RELEASE |

Forward-looking

Statements

The

information included in this press release includes forward-looking statements within the meaning of the Securities Act of 1933 and the

Securities Exchange Act of 1934. Such forward-looking statements are subject to a number of risks and uncertainties, as disclosed by

Nabors from time to time in its filings with the Securities and Exchange Commission. As a result of these factors, Nabors' actual results

may differ materially from those indicated or implied by such forward-looking statements. The forward-looking statements contained

in this press release reflect management's estimates and beliefs as of the date of this press release. Nabors does not undertake

to update these forward-looking statements.

Non-GAAP

Disclaimer

This press release presents certain

“non-GAAP” financial measures. The components of these non-GAAP measures are computed by using amounts that are determined

in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Adjusted operating

income (loss) represents income (loss) from continuing operations before income taxes, interest expense, investment income (loss), and

other, net. Adjusted EBITDA is computed similarly, but also excludes depreciation and amortization expenses. In addition, adjusted EBITDA

and adjusted operating income (loss) exclude certain cash expenses that the Company is obligated to make. Net debt is calculated as total

debt minus the sum of cash, cash equivalents and short-term investments.

Adjusted free cash flow represents net

cash provided by operating activities less cash used for capital expenditures, net of proceeds from sales of assets. Management

believes that adjusted free cash flow is an important liquidity measure for the company and that it is useful to investors and management

as a measure of the company’s ability to generate cash flow, after reinvesting in the company for future growth, that could be

available for paying down debt or other financing cash flows, such as dividends to shareholders. Management believes that this non-GAAP

measure is useful information to investors when comparing our cash flows with the cash flows of other companies.

Each of these non-GAAP measures has

limitations and therefore should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. However,

management evaluates the performance of its operating segments and the consolidated Company based on several criteria, including Adjusted

EBITDA, adjusted operating income (loss), net debt, and adjusted free cash flow, because it believes that these financial measures accurately

reflect the Company’s ongoing profitability and performance. Securities analysts and investors also use these measures as

some of the metrics on which they analyze the Company’s performance. Other companies in this industry may compute these measures

differently. Reconciliations of consolidated adjusted EBITDA and adjusted operating income (loss) to income (loss) from continuing

operations before income taxes, net debt to total debt, and adjusted free cash flow to net cash provided by operations, which are their

nearest comparable GAAP financial measures, are included in the tables at the end of this press release. We do not provide a forward-looking

reconciliation of our outlook for Segment Adjusted EBITDA, Segment Gross Margin or Adjusted Free Cash Flow, as the amount and significance

of items required to develop meaningful comparable GAAP financial measures cannot be estimated at this time without unreasonable efforts.

These special items could be meaningful.

Investor Contacts:

William C. Conroy, CFA, Vice President of Corporate Development & Investor Relations, +1 281-775-2423 or via e-mail william.conroy@nabors.com,

or Kara Peak, Director of Corporate Development & Investor Relations, +1 281-775-4954 or via email kara.peak@nabors.com.

To request investor materials, contact Nabors' corporate headquarters in Hamilton, Bermuda at +441-292-1510 or via e-mail mark.andrews@nabors.com

NABORS INDUSTRIES LTD. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS)

(Unaudited)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

March 31, | | |

June 30, | |

| (In thousands, except per share amounts) | |

2024 | | |

2023 | | |

2024 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenues and other income: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating revenues | |

$ | 734,798 | | |

$ | 767,067 | | |

$ | 733,704 | | |

$ | 1,468,502 | | |

$ | 1,546,206 | |

| Investment income (loss) | |

| 8,181 | | |

| 11,743 | | |

| 10,201 | | |

| 18,382 | | |

| 21,609 | |

| Total revenues and other income | |

| 742,979 | | |

| 778,810 | | |

| 743,905 | | |

| 1,486,884 | | |

| 1,567,815 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Costs and other deductions: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Direct costs | |

| 440,225 | | |

| 455,531 | | |

| 437,077 | | |

| 877,302 | | |

| 917,860 | |

| General and administrative expenses | |

| 62,154 | | |

| 63,232 | | |

| 61,751 | | |

| 123,905 | | |

| 124,962 | |

| Research and engineering | |

| 14,362 | | |

| 13,281 | | |

| 13,863 | | |

| 28,225 | | |

| 28,355 | |

| Depreciation and amortization | |

| 160,141 | | |

| 159,698 | | |

| 157,685 | | |

| 317,826 | | |

| 322,729 | |

| Interest expense | |

| 51,493 | | |

| 46,164 | | |

| 50,379 | | |

| 101,872 | | |

| 91,305 | |

| Other, net | |

| 12,079 | | |

| (1,775 | ) | |

| 16,108 | | |

| 28,187 | | |

| (44,150 | ) |

| Total costs and other deductions | |

| 740,454 | | |

| 736,131 | | |

| 736,863 | | |

| 1,477,317 | | |

| 1,441,061 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income (loss) before income taxes | |

| 2,525 | | |

| 42,679 | | |

| 7,042 | | |

| 9,567 | | |

| 126,754 | |

| Income tax expense (benefit) | |

| 15,554 | | |

| 26,448 | | |

| 16,044 | | |

| 31,598 | | |

| 49,463 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

| (13,029 | ) | |

| 16,231 | | |

| (9,002 | ) | |

| (22,031 | ) | |

| 77,291 | |

| Less: Net (income) loss attributable to noncontrolling interest | |

| (19,226 | ) | |

| (11,620 | ) | |

| (25,331 | ) | |

| (44,557 | ) | |

| (23,456 | ) |

| Net income (loss) attributable to Nabors | |

$ | (32,255 | ) | |

$ | 4,611 | | |

$ | (34,333 | ) | |

$ | (66,588 | ) | |

$ | 53,835 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Earnings (losses) per share: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (4.29 | ) | |

$ | (0.31 | ) | |

$ | (4.54 | ) | |

$ | (8.83 | ) | |

$ | 4.05 | |

| Diluted | |

$ | (4.29 | ) | |

$ | (0.31 | ) | |

$ | (4.54 | ) | |

$ | (8.83 | ) | |

$ | 3.79 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted-average number of common shares outstanding: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 9,207 | | |

| 9,195 | | |

| 9,176 | | |

| 9,191 | | |

| 9,178 | |

| Diluted | |

| 9,207 | | |

| 9,195 | | |

| 9,176 | | |

| 9,191 | | |

| 10,141 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA | |

$ | 218,057 | | |

$ | 235,023 | | |

$ | 221,013 | | |

$ | 439,070 | | |

$ | 475,029 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted operating income (loss) | |

$ | 57,916 | | |

$ | 75,325 | | |

$ | 63,328 | | |

$ | 121,244 | | |

$ | 152,300 | |

NABORS INDUSTRIES LTD. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | |

June 30, | | |

March 31, | | |

December 31, | |

| (In thousands) | |

2024 | | |

2024 | | |

2023 | |

| ASSETS | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | |

| Cash and short-term investments | |

$ | 473,608 | | |

$ | 425,560 | | |

$ | 1,070,178 | |

| Accounts receivable, net | |

| 368,550 | | |

| 416,873 | | |

| 347,837 | |

| Other current assets | |

| 235,632 | | |

| 231,926 | | |

| 227,663 | |

| Total current assets | |

| 1,077,790 | | |

| 1,074,359 | | |

| 1,645,678 | |

| Property, plant and equipment, net | |

| 2,813,148 | | |

| 2,841,294 | | |

| 2,898,728 | |

| Other long-term assets | |

| 724,755 | | |

| 729,319 | | |

| 733,559 | |

| Total assets | |

$ | 4,615,693 | | |

$ | 4,644,972 | | |

$ | 5,277,965 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Current debt | |

$ | - | | |

$ | - | | |

$ | 629,621 | |

| Trade accounts payable | |

| 331,468 | | |

| 319,436 | | |

| 294,442 | |

| Other current liabilities | |

| 259,454 | | |

| 282,982 | | |

| 289,918 | |

| Total current liabilities | |

| 590,922 | | |

| 602,418 | | |

| 1,213,981 | |

| Long-term debt | |

| 2,514,169 | | |

| 2,512,175 | | |

| 2,511,519 | |

| Other long-term liabilities | |

| 247,587 | | |

| 256,956 | | |

| 271,380 | |

| Total liabilities | |

| 3,352,678 | | |

| 3,371,549 | | |

| 3,996,880 | |

| | |

| | | |

| | | |

| | |

| Redeemable noncontrolling interest in subsidiary | |

| 761,415 | | |

| 750,600 | | |

| 739,075 | |

| | |

| | | |

| | | |

| | |

| Equity: | |

| | | |

| | | |

| | |

| Shareholders' equity | |

| 250,371 | | |

| 286,338 | | |

| 326,614 | |

| Noncontrolling interest | |

| 251,229 | | |

| 236,485 | | |

| 215,396 | |

| Total equity | |

| 501,600 | | |

| 522,823 | | |

| 542,010 | |

| Total liabilities and equity | |

$ | 4,615,693 | | |

$ | 4,644,972 | | |

$ | 5,277,965 | |

NABORS INDUSTRIES LTD. AND SUBSIDIARIES

SEGMENT REPORTING

(Unaudited)

The

following tables set forth certain information with respect to our reportable segments and rig activity:

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

March 31, | | |

June 30, | |

| (In thousands, except rig activity) | |

2024 | | |

2023 | | |

2024 | | |

2024 | | |

2023 | |

| Operating revenues: | |

| | | |

| | | |

| | | |

| | | |

| | |

| U.S. Drilling | |

$ | 259,723 | | |

$ | 314,830 | | |

$ | 271,989 | | |

$ | 531,712 | | |

$ | 665,482 | |

| International Drilling | |

| 356,733 | | |

| 337,650 | | |

| 349,359 | | |

| 706,092 | | |

| 657,698 | |

| Drilling Solutions | |

| 82,961 | | |

| 76,855 | | |

| 75,574 | | |

| 158,535 | | |

| 151,898 | |

| Rig Technologies (1) | |

| 49,546 | | |

| 63,565 | | |

| 50,156 | | |

| 99,702 | | |

| 122,044 | |

| Other reconciling items (2) | |

| (14,165 | ) | |

| (25,833 | ) | |

| (13,374 | ) | |

| (27,539 | ) | |

| (50,916 | ) |

| Total operating revenues | |

$ | 734,798 | | |

$ | 767,067 | | |

$ | 733,704 | | |

$ | 1,468,502 | | |

$ | 1,546,206 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA: (3) | |

| | | |

| | | |

| | | |

| | | |

| | |

| U.S. Drilling | |

$ | 114,020 | | |

$ | 141,446 | | |

$ | 120,403 | | |

$ | 234,423 | | |

$ | 297,935 | |

| International Drilling | |

| 106,371 | | |

| 98,331 | | |

| 102,498 | | |

| 208,869 | | |

| 186,939 | |

| Drilling Solutions | |

| 32,468 | | |

| 32,756 | | |

| 31,787 | | |

| 64,255 | | |

| 64,670 | |

| Rig Technologies (1) | |

| 7,330 | | |

| 6,408 | | |

| 6,801 | | |

| 14,131 | | |

| 11,362 | |

| Other reconciling items (4) | |

| (42,132 | ) | |

| (43,918 | ) | |

| (40,476 | ) | |

| (82,608 | ) | |

| (85,877 | ) |

| Total adjusted EBITDA | |

$ | 218,057 | | |

$ | 235,023 | | |

$ | 221,013 | | |

$ | 439,070 | | |

$ | 475,029 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted operating income (loss): (5) | |

| | | |

| | | |

| | | |

| | | |

| | |

| U.S. Drilling | |

$ | 45,085 | | |

$ | 75,408 | | |

$ | 50,529 | | |

$ | 95,614 | | |

$ | 161,277 | |

| International Drilling | |

| 23,672 | | |

| 10,407 | | |

| 22,476 | | |

| 46,148 | | |

| 12,364 | |

| Drilling Solutions | |

| 27,319 | | |

| 28,351 | | |

| 26,893 | | |

| 54,212 | | |

| 55,489 | |

| Rig Technologies (1) | |

| 4,860 | | |

| 5,052 | | |

| 4,209 | | |

| 9,069 | | |

| 8,746 | |

| Other reconciling items (4) | |

| (43,020 | ) | |

| (43,893 | ) | |

| (40,779 | ) | |

| (83,799 | ) | |

| (85,576 | ) |

| Total adjusted operating income (loss) | |

$ | 57,916 | | |

$ | 75,325 | | |

$ | 63,328 | | |

$ | 121,244 | | |

$ | 152,300 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Rig activity: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average Rigs Working: (7) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Lower 48 | |

| 68.7 | | |

| 81.6 | | |

| 71.9 | | |

| 70.3 | | |

| 87.4 | |

| Other US | |

| 6.3 | | |

| 7.0 | | |

| 6.8 | | |

| 6.5 | | |

| 7.0 | |

| U.S. Drilling | |

| 75.0 | | |

| 88.6 | | |

| 78.7 | | |

| 76.8 | | |

| 94.4 | |

| International Drilling | |

| 84.4 | | |

| 77.1 | | |

| 81.0 | | |

| 82.7 | | |

| 76.8 | |

| Total average rigs working | |

| 159.4 | | |

| 165.7 | | |

| 159.7 | | |

| 159.5 | | |

| 171.2 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Daily Rig Revenue: (6),(8) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Lower 48 | |

$ | 35,334 | | |

$ | 36,751 | | |

$ | 35,468 | | |

$ | 35,402 | | |

$ | 36,593 | |

| Other US | |

| 68,008 | | |

| 65,860 | | |

| 64,402 | | |

| 66,135 | | |

| 68,263 | |

| U.S. Drilling (10) | |

| 38,076 | | |

| 39,049 | | |

| 37,968 | | |

| 38,020 | | |

| 38,940 | |

| International Drilling | |

| 46,469 | | |

| 48,106 | | |

| 47,384 | | |

| 46,917 | | |

| 47,319 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Daily Adjusted Gross Margin: (6),(9) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Lower 48 | |

$ | 15,598 | | |

$ | 16,890 | | |

$ | 16,011 | | |

$ | 15,809 | | |

$ | 16,784 | |

| Other US | |

| 38,781 | | |

| 35,932 | | |

| 35,184 | | |

| 36,912 | | |

| 36,520 | |

| U.S. Drilling (10) | |

| 17,544 | | |

| 18,394 | | |

| 17,667 | | |

| 17,607 | | |

| 18,246 | |

| International Drilling | |

| 16,050 | | |

| 16,276 | | |

| 16,061 | | |

| 16,056 | | |

| 15,754 | |

| (1) |

Includes our oilfield equipment manufacturing

activities. |

| |

|

| (2) |

Represents the elimination of inter-segment

transactions related to our Rig Technologies operating segment. |

| |

|

| (3) |

Adjusted EBITDA represents net income

(loss) before income tax expense (benefit), investment income (loss), interest expense, other, net and depreciation and amortization.

Adjusted EBITDA is a non-GAAP financial measure and should not be used in isolation or as a substitute for the amounts reported in

accordance with GAAP. In addition, adjusted EBITDA excludes certain cash expenses that the Company is obligated to make. However,

management evaluates the performance of its operating segments and the consolidated Company based on several criteria, including

adjusted EBITDA and adjusted operating income (loss), because it believes that these financial measures accurately reflect the Company’s

ongoing profitability and performance. Securities analysts and investors use this measure as one of the metrics on which

they analyze the Company’s performance. Other companies in this industry may compute these measures differently. A

reconciliation of this non-GAAP measure to net income (loss), which is the most closely comparable GAAP measure, is provided in the

table set forth immediately following the heading "Reconciliation of Non-GAAP Financial Measures to Net Income (Loss)". |

| |

|

| (4) |

Represents the elimination of inter-segment

transactions and unallocated corporate expenses. |

| |

|

| (5) |

Adjusted operating income (loss) represents

net income (loss) before income tax expense (benefit), investment income (loss), interest expense and other, net. Adjusted

operating income (loss) is a non-GAAP financial measure and should not be used in isolation or as a substitute for the amounts reported

in accordance with GAAP. In addition, adjusted operating income (loss) excludes certain cash expenses that the Company is obligated

to make. However, management evaluates the performance of its operating segments and the consolidated Company based on several criteria,

including adjusted EBITDA and adjusted operating income (loss), because it believes that these financial measures accurately reflect

the Company’s ongoing profitability and performance. Securities analysts and investors use this measure as one of

the metrics on which they analyze the Company’s performance. Other companies in this industry may compute these

measures differently. A reconciliation of this non-GAAP measure to net income (loss), which is the most closely comparable

GAAP measure, is provided in the table set forth immediately following the heading "Reconciliation of Non-GAAP Financial Measures

to Net Income (Loss)". |

| |

|

| (6) |

Rig revenue days represents the number

of days the Company's rigs are contracted and performing under a contract during the period. These would typically include

days in which operating, standby and move revenue is earned. |

| |

|

| (7) |

Average rigs working represents a measure

of the average number of rigs operating during a given period. For example, one rig operating 45 days during a quarter

represents approximately 0.5 average rigs working for the quarter. On an annual period, one rig operating 182.5 days represents

approximately 0.5 average rigs working for the year. Average rigs working can also be calculated as rig revenue days during

the period divided by the number of calendar days in the period. |

| |

|

| (8) |

Daily rig revenue represents operating revenue, divided

by the total number of revenue days during the quarter. |

| |

|

| (9) |

Daily adjusted gross margin represents

operating revenue less direct costs, divided by the total number of rig revenue days during the quarter. |

| |

|

| (10) |

The U.S. Drilling segment includes the

Lower 48, Alaska, and Gulf of Mexico operating areas. |

NABORS INDUSTRIES LTD. AND SUBSIDIARIES

Reconciliation of Earnings per Share

(Unaudited)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

March 31, | | |

June 30, | |

| (in thousands, except per share amounts) | |

2024 | | |

2023 | | |

2024 | | |

2024 | | |

2023 | |

| BASIC EPS: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) (numerator): | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income (loss), net of tax | |

$ | (13,029 | ) | |

$ | 16,231 | | |

$ | (9,002 | ) | |

$ | (22,031 | ) | |

$ | 77,291 | |

| Less: net (income) loss attributable to noncontrolling interest | |

| (19,226 | ) | |

| (11,620 | ) | |

| (25,331 | ) | |

| (44,557 | ) | |

| (23,456 | ) |

| Less: distributed and undistributed earnings allocated to unvested shareholders | |

| — | | |

| — | | |

| — | | |

| — | | |

| (1,869 | ) |

| Less: accrued distribution on redeemable noncontrolling interest in subsidiary | |

| (7,283 | ) | |

| (7,436 | ) | |

| (7,283 | ) | |

| (14,566 | ) | |

| (14,790 | ) |

| Numerator for basic earnings per share: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted income (loss), net of tax - basic | |

$ | (39,538 | ) | |

$ | (2,825 | ) | |

$ | (41,616 | ) | |

$ | (81,154 | ) | |

$ | 37,176 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted-average number of shares outstanding - basic | |

| 9,207 | | |

| 9,195 | | |

| 9,176 | | |

| 9,191 | | |

| 9,178 | |

| Earnings (losses) per share: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Basic | |

$ | (4.29 | ) | |

$ | (0.31 | ) | |

$ | (4.54 | ) | |

$ | (8.83 | ) | |

$ | 4.05 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| DILUTED EPS: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted income (loss) from continuing operations, net of tax - basic | |

$ | (39,538 | ) | |

$ | (2,825 | ) | |

$ | (41,616 | ) | |

$ | (81,154 | ) | |

$ | 37,176 | |

| Add: after tax interest expense of convertible notes | |

| — | | |

| — | | |

| — | | |

| — | | |

| 1,272 | |

| Add: effect of reallocating undistributed earnings of unvested shareholders | |

| — | | |

| — | | |

| — | | |

| — | | |

| 10 | |

| Adjusted income (loss), net of tax - diluted | |

$ | (39,538 | ) | |

$ | (2,825 | ) | |

$ | (41,616 | ) | |

$ | (81,154 | ) | |

$ | 38,458 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted-average number of shares outstanding - basic | |

| 9,207 | | |

| 9,195 | | |

| 9,176 | | |

| 9,191 | | |

| 9,178 | |

| Add: if converted dilutive effect of convertible notes | |

| — | | |

| — | | |

| — | | |

| — | | |

| 918 | |

| Add: dilutive effect of potential common shares | |

| — | | |

| — | | |

| — | | |

| — | | |

| 45 | |

| Weighted-average number of shares outstanding - diluted | |

| 9,207 | | |

| 9,195 | | |

| 9,176 | | |

| 9,191 | | |

| 10,141 | |

| Earnings (losses) per share: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Diluted | |

$ | (4.29 | ) | |

$ | (0.31 | ) | |

$ | (4.54 | ) | |

$ | (8.83 | ) | |

$ | 3.79 | |

NABORS

INDUSTRIES LTD. AND SUBSIDIARIES

NON-GAAP

FINANCIAL MEASURES

RECONCILIATION

OF ADJUSTED EBITDA BY SEGMENT TO ADJUSTED OPERATING INCOME (LOSS) BY SEGMENT

(Unaudited)

(In thousands)

| | |

Three Months Ended June 30, 2024 | |

| | |

U.S.

Drilling | | |

International

Drilling | | |

Drilling

Solutions | | |

Rig

Technologies | | |

Other

reconciling

items | | |

Total | |

| Adjusted operating income (loss) | |

$ | 45,085 | | |

$ | 23,672 | | |

$ | 27,319 | | |

$ | 4,860 | | |

$ | (43,020 | ) | |

$ | 57,916 | |

| Depreciation and amortization | |

| 68,935 | | |

| 82,699 | | |

| 5,149 | | |

| 2,470 | | |

| 888 | | |

| 160,141 | |

| Adjusted EBITDA | |

$ | 114,020 | | |

$ | 106,371 | | |

$ | 32,468 | | |

$ | 7,330 | | |

$ | (42,132 | ) | |

$ | 218,057 | |

| | |

Three Months Ended June 30, 2023 | |

| | |

U.S.

Drilling | | |

International

Drilling | | |

Drilling

Solutions | | |

Rig

Technologies | | |

Other

reconciling

items | | |

Total | |

| Adjusted operating income (loss) | |

$ | 75,408 | | |

$ | 10,407 | | |

$ | 28,351 | | |

$ | 5,052 | | |

$ | (43,893 | ) | |

$ | 75,325 | |

| Depreciation and amortization | |

| 66,038 | | |

| 87,924 | | |

| 4,405 | | |

| 1,356 | | |

| (25 | ) | |

| 159,698 | |

| Adjusted EBITDA | |

$ | 141,446 | | |

$ | 98,331 | | |

$ | 32,756 | | |

$ | 6,408 | | |

$ | (43,918 | ) | |

$ | 235,023 | |

| | |

Three Months Ended March 31, 2024 | |

| | |

U.S.

Drilling | | |

International

Drilling | | |

Drilling

Solutions | | |

Rig

Technologies | | |

Other

reconciling

items | | |

Total | |

| Adjusted operating income (loss) | |

$ | 50,529 | | |

$ | 22,476 | | |

$ | 26,893 | | |

$ | 4,209 | | |

$ | (40,779 | ) | |

$ | 63,328 | |

| Depreciation and amortization | |

| 69,874 | | |

| 80,022 | | |

| 4,894 | | |

| 2,592 | | |

| 303 | | |

| 157,685 | |

| Adjusted EBITDA | |

$ | 120,403 | | |

$ | 102,498 | | |

$ | 31,787 | | |

$ | 6,801 | | |

$ | (40,476 | ) | |

$ | 221,013 | |

| | |

Six Months Ended June 30, 2024 | |

| | |

U.S.

Drilling | | |

International

Drilling | | |

Drilling

Solutions | | |

Rig

Technologies | | |

Other

reconciling

items | | |

Total | |

| Adjusted operating income (loss) | |

$ | 95,614 | | |

$ | 46,148 | | |

$ | 54,212 | | |

$ | 9,069 | | |

$ | (83,799 | ) | |

$ | 121,244 | |

| Depreciation and amortization | |

| 138,809 | | |

| 162,721 | | |

| 10,043 | | |

| 5,062 | | |

| 1,191 | | |

| 317,826 | |

| Adjusted EBITDA | |

$ | 234,423 | | |

$ | 208,869 | | |

$ | 64,255 | | |

$ | 14,131 | | |

$ | (82,608 | ) | |

$ | 439,070 | |

| | |

Six Months Ended June 30, 2023 | |

| | |

U.S.

Drilling | | |

International

Drilling | | |

Drilling

Solutions | | |

Rig

Technologies | | |

Other

reconciling

items | | |

Total | |

| Adjusted operating income (loss) | |

$ | 161,277 | | |

$ | 12,364 | | |

$ | 55,489 | | |

$ | 8,746 | | |

$ | (85,576 | ) | |

$ | 152,300 | |

| Depreciation and amortization | |

| 136,658 | | |

| 174,575 | | |

| 9,181 | | |

| 2,616 | | |

| (301 | ) | |

| 322,729 | |

| Adjusted EBITDA | |

$ | 297,935 | | |

$ | 186,939 | | |

$ | 64,670 | | |

$ | 11,362 | | |

$ | (85,877 | ) | |

$ | 475,029 | |

NABORS INDUSTRIES LTD. AND SUBSIDIARIES

NON-GAAP FINANCIAL MEASURES

RECONCILIATION OF ADJUSTED GROSS MARGIN BY SEGMENT TO ADJUSTED OPERATING INCOME (LOSS) BY SEGMENT

(Unaudited)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

March 31, | | |

June 30, | |

| (In thousands) | |

2024 | | |

2023 | | |

2024 | | |

2024 | | |

2023 | |

| Lower 48 - U.S. Drilling | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted operating income (loss) | |

$ | 32,841 | | |

$ | 60,496 | | |

$ | 39,264 | | |

$ | 72,105 | | |

$ | 134,567 | |

| Plus: General and administrative costs | |

| 4,390 | | |

| 5,209 | | |

| 4,823 | | |

| 9,213 | | |

| 10,264 | |

| Plus: Research and engineering | |

| 909 | | |

| 1,189 | | |

| 964 | | |

| 1,873 | | |

| 2,708 | |

| GAAP Gross Margin | |

| 38,140 | | |

| 66,894 | | |

| 45,051 | | |

| 83,191 | | |

| 147,539 | |

| Plus: Depreciation and amortization | |

| 59,332 | | |

| 58,533 | | |

| 59,733 | | |

| 119,065 | | |

| 118,041 | |

| Adjusted gross margin | |

$ | 97,472 | | |

$ | 125,427 | | |

$ | 104,784 | | |

$ | 202,256 | | |

$ | 265,580 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other - U.S. Drilling | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted operating income (loss) | |

$ | 12,244 | | |

$ | 14,912 | | |

$ | 11,265 | | |

$ | 23,509 | | |

$ | 26,710 | |

| Plus: General and administrative costs | |

| 306 | | |

| 323 | | |

| 325 | | |

| 631 | | |

| 668 | |

| Plus: Research and engineering | |

| 45 | | |

| 132 | | |

| 47 | | |

| 92 | | |

| 259 | |

| GAAP Gross Margin | |

| 12,595 | | |

| 15,367 | | |

| 11,637 | | |

| 24,232 | | |

| 27,637 | |

| Plus: Depreciation and amortization | |

| 9,602 | | |

| 7,504 | | |

| 10,142 | | |

| 19,744 | | |

| 18,616 | |

| Adjusted gross margin | |

$ | 22,197 | | |

$ | 22,871 | | |

$ | 21,779 | | |

$ | 43,976 | | |

$ | 46,253 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| U.S. Drilling | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted operating income (loss) | |

$ | 45,085 | | |

$ | 75,408 | | |

$ | 50,529 | | |

$ | 95,614 | | |

$ | 161,277 | |

| Plus: General and administrative costs | |

| 4,696 | | |

| 5,532 | | |

| 5,148 | | |

| 9,844 | | |

| 10,932 | |

| Plus: Research and engineering | |

| 954 | | |

| 1,321 | | |

| 1,011 | | |

| 1,965 | | |

| 2,967 | |

| GAAP Gross Margin | |

| 50,735 | | |

| 82,261 | | |

| 56,688 | | |

| 107,423 | | |

| 175,176 | |

| Plus: Depreciation and amortization | |

| 68,934 | | |

| 66,037 | | |

| 69,875 | | |

| 138,809 | | |

| 136,657 | |

| Adjusted gross margin | |

$ | 119,669 | | |

$ | 148,298 | | |

$ | 126,563 | | |

$ | 246,232 | | |

$ | 311,833 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| International Drilling | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted operating income (loss) | |

$ | 23,672 | | |

$ | 10,407 | | |

$ | 22,476 | | |

$ | 46,148 | | |

$ | 12,364 | |

| Plus: General and administrative costs | |

| 15,434 | | |

| 14,089 | | |

| 14,415 | | |

| 29,849 | | |

| 28,424 | |

| Plus: Research and engineering | |

| 1,404 | | |

| 1,821 | | |

| 1,508 | | |

| 2,912 | | |

| 3,606 | |

| GAAP Gross Margin | |

| 40,510 | | |

| 26,317 | | |

| 38,399 | | |

| 78,909 | | |

| 44,394 | |

| Plus: Depreciation and amortization | |

| 82,700 | | |

| 87,924 | | |

| 80,022 | | |

| 162,722 | | |

| 174,576 | |

| Adjusted gross margin | |

$ | 123,210 | | |

$ | 114,241 | | |

$ | 118,421 | | |

$ | 241,631 | | |

$ | 218,970 | |

Adjusted gross margin by

segment represents adjusted operating income (loss) plus general and administrative costs, research and engineering costs and

depreciation and amortization.

NABORS

INDUSTRIES LTD. AND SUBSIDIARIES

RECONCILIATION

OF NON-GAAP FINANCIAL MEASURES TO NET INCOME (LOSS)

(Unaudited)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

March 31, | | |

June 30, | |

| (In thousands) | |

2024 | | |

2023 | | |

2024 | | |

2024 | | |

2023 | |

| Net income (loss) | |

$ | (13,029 | ) | |

$ | 16,231 | | |

$ | (9,002 | ) | |

$ | (22,031 | ) | |

$ | 77,291 | |

| Income tax expense (benefit) | |

| 15,554 | | |

| 26,448 | | |

| 16,044 | | |

| 31,598 | | |

| 49,463 | |

| Income (loss) from continuing operations before income taxes | |

| 2,525 | | |

| 42,679 | | |

| 7,042 | | |

| 9,567 | | |

| 126,754 | |

| Investment (income) loss | |

| (8,181 | ) | |

| (11,743 | ) | |

| (10,201 | ) | |

| (18,382 | ) | |

| (21,609 | ) |

| Interest expense | |

| 51,493 | | |

| 46,164 | | |

| 50,379 | | |

| 101,872 | | |

| 91,305 | |

| Other, net | |

| 12,079 | | |

| (1,775 | ) | |

| 16,108 | | |

| 28,187 | | |

| (44,150 | ) |

| Adjusted operating income (loss) (1) | |

| 57,916 | | |

| 75,325 | | |

| 63,328 | | |

| 121,244 | | |

| 152,300 | |

| Depreciation and amortization | |

| 160,141 | | |

| 159,698 | | |

| 157,685 | | |

| 317,826 | | |

| 322,729 | |

| Adjusted EBITDA (2) | |

$ | 218,057 | | |

$ | 235,023 | | |

$ | 221,013 | | |

$ | 439,070 | | |

$ | 475,029 | |

(1) Adjusted operating income (loss) represents net income

(loss) before income tax expense (benefit), investment income (loss), interest expense, and other, net. Adjusted operating income

(loss) is a non-GAAP financial measure and should not be used in isolation or as a substitute for the amounts reported in accordance

with GAAP. In addition, adjusted operating income (loss) excludes certain cash expenses that the Company is obligated to make. However,

management evaluates the performance of its operating segments and the consolidated Company based on several criteria, including

adjusted EBITDA and adjusted operating income (loss), because it believes that these financial measures accurately reflect the Company’s

ongoing profitability and performance. Securities analysts and investors use this measure as one of the metrics on which

they analyze the Company’s performance. Other companies in this industry may compute these measures differently.

(2) Adjusted EBITDA represents net income (loss) before income

tax expense (benefit), investment income (loss), interest expense, other, net and depreciation and amortization. Adjusted EBITDA

is a non-GAAP financial measure and should not be used in isolation or as a substitute for the amounts reported in accordance with

GAAP. In addition, adjusted EBITDA excludes certain cash expenses that the Company is obligated to make. However, management evaluates

the performance of its operating segments and the consolidated Company based on several criteria, including adjusted EBITDA and adjusted

operating income (loss), because it believes that these financial measures accurately reflect the Company’s ongoing profitability

and performance. Securities analysts and investors use this measure as one of the metrics on which they analyze the Company’s

performance. Other companies in this industry may compute these measures differently.

NABORS INDUSTRIES LTD. AND SUBSIDIARIES

RECONCILIATION OF NET DEBT TO TOTAL DEBT

(Unaudited)

| | |

June 30, | | |

March 31, | | |

December 31, | |

| (In thousands) | |

2024 | | |

2024 | | |

2023 | |

| Current debt | |

$ | - | | |

$ | - | | |

$ | 629,621 | |

| Long-term debt | |

| 2,514,169 | | |

| 2,512,175 | | |

| 2,511,519 | |

| Total Debt | |

| 2,514,169 | | |

| 2,512,175 | | |

| 3,141,140 | |

| Less: Cash and short-term investments | |

| 473,608 | | |

| 425,560 | | |

| 1,070,178 | |

| Net Debt | |

$ | 2,040,561 | | |

$ | 2,086,615 | | |

$ | 2,070,962 | |

NABORS INDUSTRIES LTD. AND SUBSIDIARIES

RECONCILIATION OF ADJUSTED FREE CASH FLOW TO

NET CASH PROVIDED BY OPERATING ACTIVITIES

(Unaudited)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

March 31, | | |

June 30, | |

| (In thousands) | |

2024 | | |

2024 | | |

2024 | |

| Net cash provided by operating activities | |

$ | 181,659 | | |

$ | 107,239 | | |

$ | 288,898 | |

| Add: Capital expenditures, net of proceeds from sales of assets | |

| (125,010 | ) | |

| (99,125 | ) | |

| (224,135 | ) |

| Adjusted free cash flow | |

$ | 56,649 | | |

$ | 8,114 | | |

$ | 64,763 | |

Adjusted free cash flow represents net cash provided by operating activities

less cash used for capital expenditures, net of proceeds from sales of assets. Management believes that adjusted free cash

flow is an important liquidity measure for the company and that it is useful to investors and management as a measure of the company’s

ability to generate cash flow, after reinvesting in the company for future growth, that could be available for paying down debt or other

financing cash flows, such as dividends to shareholders. Adjusted free cash flow does not represent the residual cash flow

available for discretionary expenditures. Adjusted free cash flow is a non-GAAP financial measure that should be considered

in addition to, not as a substitute for or superior to, cash flow from operations reported in accordance with GAAP.

Exhibit 99.2

| NABORS INDUSTRIES LTD. July 24, 2024

2Q 2024 Earnings

Presentation |

| N A B O R S . C O M

We often discuss expectations regarding our future markets, demand for our products and services, and

our performance in our annual, quarterly, and current reports, press releases, and other written and oral

statements. Such statements, including statements in this document that relate to matters that are not

historical facts, are “forward-looking statements” within the meaning of the safe harbor provisions of

Section 27A of the U.S. Securities Act of 1933 and Section 21E of the U.S. Securities Exchange Act of

1934. These “forward-looking statements” are based on our analysis of currently available competitive,

financial and economic data and our operating plans. They are inherently uncertain, and investors

should recognize that events and actual results could turn out to be significantly different from our

expectations.

Factors to consider when evaluating these forward-looking statements include, but are not limited to: • geopolitical events, pandemics (including COVID-19) and other macro-events and their

respective and collective impact on our operations as well as oil and gas markets and prices; • fluctuations and volatility in worldwide prices of and demand for oil and natural gas; • fluctuations in levels of oil and natural gas exploration and development activities; • fluctuations in the demand for our services; • competitive and technological changes and other developments in the oil and gas and oilfield

services industries; • our ability to renew customer contracts in order to maintain competitiveness; • the existence of operating risks inherent in the oil and gas and oilfield services industries; • the possibility of the loss of one or a number of our large customers; • the amount and nature of our future capital expenditures and how we expect to fund our capital

expenditures; • The occurrence of cybersecurity incidents, attacks and other breaches to our information technology

systems; • the impact of long-term indebtedness and other financial commitments on our financial and

operating flexibility; • our access to and the cost of capital, including the impact of a further downgrade in our credit

rating, covenant restrictions, availability under our revolving credit facility, and future issuances of

debt or equity securities and the global interest rate environment; • our dependence on our operating subsidiaries and investments to meet our financial obligations;

Forward Looking Statements

NABORS INDUSTRIES

2

• our ability to retain skilled employees; • our ability to complete, and realize the expected benefits of, strategic transactions; • changes in tax laws and the possibility of changes in other laws and regulation; • the possibility of changes to U.S. trade policies and regulations including the imposition of trade

embargoes or sanctions; and • global views on and the regulatory environment related to energy transition and our ability to

implement our energy transition initiatives; • potential long-lived asset impairments • the possibility of changes to U.S. trade policies and regulations including the imposition of trade

embargoes, sanctions or tariffs; and • general economic conditions, including the capital and credit markets.

Our businesses depend, to a large degree, on the level of spending by oil and gas companies for

exploration, development and production activities. Therefore, sustained lower oil or natural gas prices

that have a material impact on exploration, development or production activities could also materially

affect our financial position, results of operations and cash flows.

The above description of risks and uncertainties is by no means all-inclusive but is designed to highlight

what we believe are important factors to consider. For a discussion of these factors and other risks and

uncertainties, please refer to our filings with the Securities and Exchange Commission ("SEC"), including

those contained in our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, which are

available at the SEC's website at www.sec.gov. We undertake no obligation to publicly update or revise

any forward-looking statement as a result of new information, future events or otherwise, except as

otherwise required by law.

Non-GAAP Financial Measures

This presentation refers to certain “non-GAAP” financial measures, such as adjusted EBITDA, net debt,

adjusted gross margin and adjusted free cash flow. The components of these non-GAAP measures are

computed by using amounts that are determined in accordance with accounting principles generally

accepted in the United States of America (“GAAP”). Reconciliations of non-GAAP measures to the most

comparable GAAP measures are provided in the Appendix at the end of this presentation. |

| N A B O R S . C O M

36%

47%

11%

7%

1H 2024 Revenue by Segment

U.S. Drilling International Drilling

Drilling Solutions Rig Technologies

3

The Industry’s Most Innovative Technology

NABORS INDUSTRIES

Integrated

Drilling and

Technology

Solutions

Drilling

Operations

Drilling

Solutions

Rig

Technologies

Energy

Transition

Working in tandem to generate superior drilling performance |

| N A B O R S . C O M 4

Drivers of Growth

Capitalizing on

global expansion

Leveraging our

broad

international

footprint

Expanding our

customer base

Growing NDS

revenue on

Nabors U.S., third

party, and

international rigs

Driving healthy

margins in

Lower 48 Drilling

Demonstrating

the value of our

best-in-class high-spec fleet

Reducing carbon

intensity

Energy

transition and

sustainability

expansion

Innovating

advances in

drilling

Setting the

industry standard

in automation and

robotics

Focused on Advanced Technology to Drive Solutions |

| N A B O R S . C O M

Recent Highlights

NABORS INDUSTRIES

5

Expanding Drilling Solutions and Rig Technologies

content on third party rigs

Deployed 3 rigs in Algeria and 2 rigs in Saudi Arabia YTD

Additional deployments planned in Algeria, Saudi Arabia

and Argentina later this year

Lower 48 rig market generating 2Q daily margins of

~$15,600, holding above prior market cycle highs

Nabors

First international deployment of PowerTAP in

Argentina, incorporates frequency converter for

international market

Note: For the reconciliations of adjusted EBITDA, adjusted gross margin, net debt and adjusted free cash flow to

the most comparable non-GAAP measures see non-GAAP reconciliations in Appendix |

| N A B O R S . C O M

Performance

excellence in the

Lower 48

6

Expanding &

enhancing our

International

business

Five Key Value Drivers

1

Advancing

technology &

innovation with

demonstrated

results

Progress on our

commitment to

de-lever

2 3

Leading in

Sustainability

and the Energy

Transition

4 5 |

| N A B O R S . C O M

$-

$4,000

$8,000

$12,000

$16,000

$20,000

Daily Gross Margin(1)

$-

$10,000

$20,000

$30,000

$40,000

$50,000

Daily Rig Revenue(1)

1

Growing

International results as

we expand our fleet

Focus on Improving International Rig Economics

Resilience Leading to Growth in Our International Segment

7

(1) Daily rig revenue and adjusted daily gross margin for drilling rigs only, does not include Nabors Drilling Solutions |

| N A B O R S . C O M $0

$5,000

$10,000

$15,000

$20,000

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q

2022 2023 2024

Daily Gross Margin(1)

$30,000

$40,000

$50,000

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q

2022 2023 2024

Daily Rig Revenue(1)

1

Working to

enhance both

the top and

bottom line

Focus on Improving International Rig Economics

Resilience Leading to Growth in Our International Segment

8

(1) Daily rig revenue and adjusted daily gross margin for drilling rigs only, does not include Nabors Drilling Solutions |

| N A B O R S . C O M

1

40

45

50

55

60

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1QA 2QA 3QF 4QF 1QF 2QF 3QF 4QF

2022A 2023A 2024 2025

SANAD Estimated Average Rig Count Potential*

Significant Rig Growth Trajectory in Saudi Arabia

Resilience Leading to Growth in Our International Segment

9

• Seven operating and two more scheduled in 2024

• To date 15 total rigs scheduled for deployment • Total of 50 rigs to be deployed over 10 years

• Capital expense funded organically by SANAD

• 6-year initial contracts, payout within 5 years,

plus 4-year renewal at market rate

Newbuild Program Generating Revenue

• These estimates are based on current market conditions and expectations are

based on information received from third parties, which are subject to change.

The estimates do not represent guidance or projections. |

| N A B O R S . C O M

1

Significant Opportunity for Additional

International Rigs by YE 2025

10

Actively pursuing

multiple

opportunities in

addition to

contracts in-hand

* These estimates are based on current market conditions and expectations are based on information received from

third parties, which are subject to change. The estimates do not represent guidance or projections.

Resilience Leading to Growth in Our International Segment

Contracted

Potential awards,

negotiations and tenders

Awarded/Contracted

International Drilling Opportunity Set Rig Count*

Working |

| N A B O R S . C O M

$-

$5,000

$10,000

$15,000

$20,000

Daily Gross Margin(1)

$-

$10,000

$20,000

$30,000

$40,000

Daily Rig Revenue(1)

2

L48 Daily Revenue and Margin above All

Prior Cycle Highs

Performance Excellence In The Lower-48

11

Powerful

daily revenue and

margins leading to free

cash flow

(1) Daily rig revenue and adjusted daily gross margin for drilling rigs only, does not include Nabors Drilling Solutions |

| N A B O R S . C O M $0

$5,000

$10,000

$15,000

$20,000

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q

2022 2023 2024

Daily Gross Margin(1)

$0

$10,000

$20,000

$30,000

$40,000

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q

2022 2023 2024

Daily Rig Revenue(1)

2

Resilient Performance in Volatile Commodity

Market

Performance Excellence In The Lower-48

12

Driving greater

value capture

(1) Daily rig revenue and adjusted daily gross margin for drilling rigs only, does not include Nabors Drilling Solutions |

| N A B O R S . C O M 0%

10%

20%

30%

40%

50%

60%

70%

$-

$50

$100

$150

$200

$250

$300

$350

NDS Revenue, Adjusted EBITDA & Adjusted Gross Margin %

Revenue Adjusted EBITDA Adjusted GM %

NDS Margin Gains Fueled by Increasing

Penetration and Improving Service-line Mix

Improving Outlook For Our Technology & Innovation

13

Adjusted gross

margin of

50%

in 1H 2024

3

• 1Q 2024 Annualized |

| N A B O R S . C O M

U.S. - NBR

Rigs

42%

U.S. -

Third

Party Rigs

20%

International

38%

1H 2024 Revenue Mix

0%

200%

400%

2016 2017 2018 2019 2020 2021 2022 2023 1H 2024

NDS - U.S. Third Party Revenue Growth

0%

400%

800%

1200%

2016 2017 2018 2019 2020 2021 2022 2023 1H 2024

NDS - International Revenue Growth

NDS Targeting Third Party and International

Markets

Improving Outlook For Our Technology & Innovation

14

3

• 1H 2024 Annualized |

| N A B O R S . C O M

Third-Party Drilling Contractor Breaks Records

Utilizing Nabors Automation

Improving Outlook For Our Technology & Innovation

15

Leveraging Nabors SmartROS® and SmartDRILL®

application, the third-party drilling contactor

successfully improved connection times while breaking

both company and basin records.

Drilled 4,200 feet in 24 hours in the Mowry

34.2% average connection time savings

82% utilization average across all record lateral

sections

Fastest Niobrara well in Powder River Basin

3 Fastest wells in Operator company history

Results

3

Well 1 Well 2 Well 3

SmartDRILL Off SmartDRILL On

SmartDRILL vs. Manual Connection Times Connection Time (mins)

-29%

-38% -32% |

| N A B O R S . C O M

$-

$1.0

$2.0

$3.0

$4.0

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q

2018 2019 2020 2021 2022 2023 2024 Billions

Net Debt

Significant Headway Improving Leverage

Progress on Our Commitment to De-lever

16

$1.8 billion Net Debt(1) reduction since 1Q 2018

$1.8 billion

(1) Net Debt is a non-GAAP metric; see reconciliations in the Appendix

4 |

| N A B O R S . C O M

Our Energy Transition and Sustainability Strategy

17

Improve

Nabors’

environmental

footprint

Collaborate

with peers to

reduce carbon

output in our

industry

Partner in

adjacent

markets that

leverage our

talent and

technologies

Invest in

companies

developing

green

technologies |

| N A B O R S . C O M

Leading in Sustainability and the Energy Transition

Energy Innovation vs.

Energy Exclusion

Remove tradeoffs between

energy sources

A Shared Path Forward

Leading in Sustainability and the Energy Transition

18

Capitalize on

Strengths and

Adjacencies

Add value to adjacent industries

Collaboration is Key

to Success

Leverage collective strengths to

accelerate progress

5 |

| N A B O R S . C O M

Alternative Energy

Emissions Monitoring

Pursuing

Multiple

Decarbonization

Pathways

Green Fuels

Energy Storage

Leading in Sustainability and the Energy Transition

Nabors Initiatives to Lower Emissions

19

Engine Optimization

5 |

| N A B O R S . C O M

Leading in Sustainability and the Energy Transition

Emissions

Monitoring

Energy

Storage

Alternative

Energy

Our Venture

Portfolio

Future energy system needs

clean, dispatchable and

scalable energy solutions

20

5 Leading in Sustainability and the Energy Transition |

| N A B O R S . C O M 21

Ubiquitous

Ability to create

heat reservoirs by

drilling into deep

rock formations

Innovative Drilling Technologies

Reducing cost per energy-unit produced by using and combining

new technologies

Baseload

Reliable and

available 24/7

Renewable

Subsurface heat

replenished

naturally

Nabors and its predecessor entities have been

continuously innovating in the energy sector for

over 100 years

Technological advancements are

enabling wide-scale commercial

geothermal development

Leading in Sustainability and the Energy Transition

Geothermal Market Technology Advancements

5 |

| Appendix

22 |

| N A B O R S . C O M

Rig Utilization and Availability, June 30, 2024

23

Rig Fleet(1) 316

Rigs on Revenue(1) 161

Utilization(1) 51%

Total U.S. Offshore

12

3

25%

15

4

27%

Alaska International

129

85

66%

112

69

62%

U.S. Lower-48

High Spec(2)

(1) As of June 30, 2024

(2) Excludes non-high spec rigs in the Lower 48 |

| N A B O R S . C O M

June 30, March 31, June 30,

2023 2024 2024

Net income (loss) $16,231 ($9,002) ($13,029)

Income tax expense (benefit) 26,448 16,044 15,554

Income (loss) from continuing operations before income taxes $42,679 $7,042 $2,525

Investment (income) loss (11,743) (10,201) (8,181)

Interest Expense 46,164 50,379 51,493

Other, net (1,775) 16,108 12,079

Adjusted Operating Income (loss) 75,325 63,328 57,916

Depreciation and Amortization 159,698 157,685 160,141

Adjusted EBITDA $235,023 $221,013 $218,057

(In Thousands)

Three Months Ended

Reconciliation of Non-GAAP Financial Measures to Net

Income (Loss)

24

Adjusted EBITDA represents net income (loss) before, income taxes, investment income (loss), interest expense, other, net and depreciation and amortization.

Adjusted EBITDA is a non-GAAP financial measure and should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. In

addition, adjusted EBITDA excludes certain cash expenses that the Company is obligated to make. However, management evaluates the performance of its

operating segments and the consolidated Company based on several criteria, including adjusted EBITDA and adjusted operating income (loss), because it believes

that these financial measures accurately reflect the Company’s ongoing profitability and performance. Securities analysts and investors use this measure as one of

the metrics on which they analyze the Company’s performance. Other companies in this industry may compute these measures differently. A reconciliation of this

non-GAAP measure to net income (loss), which is the most closely comparable GAAP measure, is provided in the table below. |

| N A B O R S . C O M

June 30, March 31, June 30,

2023 2024 2024

Lower 48 - U.S. - Drilling

Adjusted operating income 60,496 $ 39,264 $ 32,841 $

Plus: General and administrative costs 5,209 4,823 4,390 Plus: Research and engineering 1,189 964 909 GAAP Gross Margin 66,894 45,051 38,140 Plus: Depreciation and amortization 58,533 59,733 59,332 Adjusted gross margin 125,427 $ 104,784 $ 97,472 $

Other - U.S. - Drilling

Adjusted operating income 14,912 $ 11,265 $ 12,244 $

Plus: General and administrative costs 323 325 306 Plus: Research and engineering 132 47 45 GAAP Gross Margin 15,367 11,637 12,595 Plus: Depreciation and amortization 7,504 10,142 9,602 Adjusted gross margin 22,871 $ 21,779 $ 22,197 $

U.S. - Drilling

Adjusted operating income 75,408 $ 50,529 $ 45,085 $

Plus: General and administrative costs 5,532 5,148 4,696 Plus: Research and engineering 1,321 1,011 954 GAAP Gross Margin 82,261 56,688 50,735 Plus: Depreciation and amortization 66,037 69,875 68,934 Adjusted gross margin 148,298 $ 126,563 $ 119,669 $

(In Thousands)

Three Months Ended

Reconciliation of U.S. Drilling Segment Adjusted Gross Margin

to U.S. Drilling Segment Adjusted Operating Income

25

Adjusted gross margin by segment represents adjusted operating income (loss) plus general and administrative costs, research and engineering costs and

depreciation and amortization. |

| N A B O R S . C O M

June 30, March 31, December 31,

2024 2024 2023

Current Debt - - $629,621

Long-Term Debt $2,514,169 $2,512,175 $2,511,519

Total Debt $2,514,169 $2,512,175 $3,141,140

Cash & Short-term Investments $473,608 $425,560 $1,070,178

Net Debt $2,040,561 $2,086,615 $2,070,962

(In Thousands)

Reconciliation of Net Debt to Total Debt

26

Net debt is computed by subtracting the sum of cash, cash equivalents and short-term investments from total debt. This non-GAAP measure has limitations and

therefore should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. However, management evaluates the performance

of its operating segments and the consolidated Company based on several criteria, including net debt, because it believes that this financial measure accurately

measures the Company’s liquidity. In addition, securities analysts and investors use this measure as one of the metrics on which they analyze the company’s

performance. Other companies in this industry may compute this measure differently. A reconciliation of net debt to total debt, which is the nearest comparable

GAAP financial measure, is provided in the table below. |

| N A B O R S . C O M

(In Thousands) Three Months Ended June 30, 2024

U.S. Drilling

International Drilling Drilling Solutions Rig Technologies

Other reconciling

items Total

Adjusted operating income (loss) 45,085 $ 23,672 $ 27,319 $ 4,860 $ (43,020) $ 57,916 $

Depreciation and amortization 68,935 82,699 5,149 2,470 888 160,141

Adjusted EBITDA 114,020 $ 106,371 $ 32,468 $ 7,330 $ (42,132) $ 218,057 $

(In Thousands) Three Months Ended March 31, 2024

U.S. Drilling

International Drilling Drilling Solutions Rig Technologies

Other reconciling

items Total

Adjusted operating income (loss) 50,529 $ 22,476 $ 26,893 $ 4,209 $ (40,779) $ 63,328 $

Depreciation and amortization 69,874 80,022 4,894 2,592 303 157,685

Adjusted EBITDA 120,403 $ 102,498 $ 31,787 $ 6,801 $ (40,476) $ 221,013 $

(In Thousands) Three Months Ended June 30, 2023

U.S. Drilling

International Drilling Drilling Solutions Rig Technologies

Other reconciling

items Total

Adjusted operating income (loss) 75,408 $ 10,407 $ 28,351 $ 5,052 $ (43,893) $ 75,325 $

Depreciation and amortization 66,038 87,924 4,405 1,356 (25) 159,698

Adjusted EBITDA 141,446 $ 98,331 $ 32,756 $ 6,408 $ (43,918) $ 235,023 $

Reconciliation of Adjusted EBITDA by Segment to

Adjusted Operating Income (Loss) by Segment

27

Adjusted EBITDA by segment represents adjusted income (loss) plus depreciation and amortization. |

| N A B O R S . C O M

Three Months Ended

June 30

2024

Net cash provided by operating activities $181,659

Add: Capital expenditures, net of proceeds from sales of assets (125,010)

Adjusted free cash flow 56,649 $

(In Thousands)

Reconciliation of Adjusted Free Cash Flow to Net Cash

Provided by Operating Activities

28

Adjusted free cash flow represents net cash provided by operating activities less cash used for capital expenditures, net of proceeds from sales of assets.

Management believes that adjusted free cash flow is an important liquidity measure for the company and that it is useful to investors and management as a

measure of the company’s ability to generate cash flow, after reinvesting in the company for future growth, that could be available for paying down debt or to

return to shareholders through dividend payments or share repurchases. Adjusted free cash flow does not represent the residual cash flow available for

discretionary expenditures. Adjusted free cash flow is a non-GAAP financial measure that should be considered in addition to, not as a substitute for or superior to,

cash flow from operations reported in accordance with GAAP. |

| NABORS INDUSTRIES LTD.

NABORS.COM

NABORS CORPORATE SERVICES

515 W. Greens Road

Suite 1200

Houston, TX 77067-4525

@ n a b o r s g l o b a l

Contact Us:

William C. Conroy, CFA

VP - Corporate Development and

Investor Relations

William.Conroy@nabors.com

Kara K. Peak

Director - Corporate Development and

Investor Relations

Kara.Peak@nabors.com |

| X |