| PROSPECTUS Dated November 16, 2020 |

Pricing Supplement No. 9,343 to |

| PRODUCT SUPPLEMENT Dated November 16, 2020 |

Registration Statement Nos. 333-250103; 333-250103-01 |

| INDEX SUPPLEMENT Dated November 16, 2020 |

Dated June 8, 2023 |

| |

Rule 424(b)(2) |

Morgan

Stanley Finance LLC

STRUCTURED INVESTMENTS

Opportunities

in U.S. Equities

$2,207,000

Leveraged Buffered S&P 500®

Index-Linked Notes due January 16, 2025

Fully and Unconditionally Guaranteed

by Morgan Stanley

Principal at Risk Securities

The notes are

unsecured obligations of Morgan Stanley Finance LLC (“MSFL”) and are fully and unconditionally guaranteed by Morgan Stanley.

The notes will not bear interest. The amount that you

will be paid on your notes on the stated maturity date (January 16, 2025, subject to postponement) is based on the performance of the

S&P 500® Index as measured from the trade date (June 8, 2023) to and including the determination date (January 14,

2025, subject to postponement). If the final underlier level on the determination date is greater than the initial underlier level, the

return on your notes will be positive, subject to the maximum settlement amount ($1,196.00 for each $1,000 face amount of your notes).

If the underlier declines by up to 15.00% from the initial underlier level, you will receive the face amount of your notes. However,

if the underlier declines by more than 15.00% from the initial underlier level, the return on your notes will be negative. You could lose

your entire investment in the notes. The notes are notes issued as part of MSFL’s Series

A Global Medium-Term Notes program.

All payments are subject to our

credit risk. If we default on our obligations, you could lose some or all of your investment. These notes are not secured obligations

and you will not have any security interest in, or otherwise have any access to, any underlying reference asset or assets.

To determine your

payment at maturity, we will calculate the underlier return, which is the percentage increase or decrease in the final underlier level

from the initial underlier level. On the stated maturity date, for each $1,000 face amount of your notes, you will receive an amount in

cash equal to:

| ● | if the underlier return is positive (the final underlier level is greater than the initial underlier level), the sum

of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) 200% times (c) the underlier return, subject to

the maximum settlement amount; |

| ● | if the underlier return is zero or negative but not below -15.00% (the final underlier level is equal to

or less than the initial underlier level but not by more than 15.00%), $1,000; or |

| ● | if the underlier return is negative and is below -15.00% (the final underlier level is less than the initial

underlier level by more than 15.00%), the sum of (i) $1,000 plus (ii) the product of (a) approximately 1.1765 times

(b) the sum of the underlier return plus 15.00% times (c) $1,000. |

Under these circumstances, you will lose some or all of your

investment.

You should read the additional disclosure herein so that you may better

understand the terms and risks of your investment.

The estimated value on the trade

date is $993.20 per note. See “Estimated Value” on page 2.

| |

Price

to public(1) |

Agent’s

commissions |

Proceeds

to us(2) |

| Per note |

$1,000 |

$0 |

$1,000 |

| Total |

$2,207,000 |

$0 |

$2,207,000 |

(1) Morgan Stanley & Co. LLC (“MS & Co.”) will

sell all of the notes that it purchases from us to an unaffiliated dealer at the original issue price of 100.00%, or $1,000 per face amount

of notes. Such dealer will sell the notes to investors at the same price without a discount or commission. Investors that purchase and

hold the notes in fee-based accounts may be charged fees based on the amount of assets held in those accounts, including the notes. For

more information, see “Additional Information About the Notes—Supplemental information regarding plan of distribution; conflicts

of interest.”

(2) See “Additional Information

About the Notes—Use of proceeds and hedging” beginning on page 19.

The notes involve risks not associated

with an investment in ordinary debt securities. See “Risk Factors” beginning on page 10.

The Securities and Exchange Commission

and state securities regulators have not approved or disapproved these notes, or determined if this document or the accompanying product

supplement, index supplement and prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The notes are not deposits or savings

accounts and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency or instrumentality, nor are

they obligations of, or guaranteed by, a bank.

You should read this document together

with the related product supplement, index supplement and prospectus, each of which can be accessed via the hyperlinks below. Please also

see “Final Terms” on page 3 and “Additional Information About the Notes” on page 19.

MORGAN

STANLEY

|

About Your Prospectus

The notes are notes issued as part of MSFL’s Series A Global Medium-Term

Notes program. This prospectus includes this pricing supplement and the accompanying documents listed below. This pricing supplement constitutes

a supplement to the documents listed below and should be read in conjunction with such documents:

● Prospectus dated November 16, 2020

● Product Supplement dated November 16, 2020

● Index Supplement dated November 16, 2020

The information in this pricing supplement supersedes any conflicting

information in the documents listed above. In addition, some of the terms or features described in the listed documents may not apply

to your notes.

|

ESTIMATED VALUE

The Original Issue Price of each note is $1,000. This price includes

costs associated with issuing, selling, structuring and hedging the notes, which are borne by you, and, consequently, the estimated value

of the notes on the Trade Date is less than $1,000. We estimate that the value of each note on the Trade Date is $993.20.

What goes into the estimated value on the Trade Date?

In valuing the notes on the Trade Date, we take into account that the

notes comprise both a debt component and a performance-based component linked to the Underlier. The estimated value of the notes is determined

using our own pricing and valuation models, market inputs and assumptions relating to the Underlier, instruments based on the Underlier,

volatility and other factors including current and expected interest rates, as well as an interest rate related to our secondary market

credit spread, which is the implied interest rate at which our conventional fixed rate debt trades in the secondary market.

What determines the economic terms of the notes?

In determining the economic terms of the notes, including the Upside

Participation Rate, the Cap Level, the Maximum Settlement Amount and the Buffer Amount, we use an internal funding rate, which is likely

to be lower than our secondary market credit spreads and therefore advantageous to us. If the issuing, selling, structuring and hedging

costs borne by you were lower or if the internal funding rate were higher, one or more of the economic terms of the notes would be more

favorable to you.

What is the relationship between the estimated value on the Trade

Date and the secondary market price of the notes?

The price at which MS & Co. purchases the notes in the secondary

market, absent changes in market conditions, including those related to the Underlier, may vary from, and be lower than, the estimated

value on the Trade Date, because the secondary market price takes into account our secondary market credit spread as well as the bid-offer

spread that MS & Co. would charge in a secondary market transaction of this type and other factors. However, because the costs associated

with issuing, selling, structuring and hedging the notes are not fully deducted upon issuance, for a period of up to 3 months following

the issue date, to the extent that MS & Co. may buy or sell the notes in the secondary market, absent changes in market conditions,

including those related to the Underlier, and to our secondary market credit spreads, it would do so based on values higher than the estimated

value. We expect that those higher values will also be reflected in your brokerage account statements.

MS & Co. may, but is not obligated to, make a market in the notes,

and, if it once chooses to make a market, may cease doing so at any time.

SUMMARY INFORMATION

|

The Leveraged Buffered S&P 500® Index-Linked Notes,

which we refer to as the notes, are unsecured obligations of MSFL and are fully and unconditionally guaranteed by Morgan Stanley. The

notes will pay no interest, do not guarantee any return of principal at maturity and have the terms described in the accompanying product

supplement, index supplement and prospectus, as supplemented or modified by this document. The notes are notes issued as part of MSFL’s

Series A Global Medium-Term Notes program.

References to “we,” “us,” and “our”

refer to Morgan Stanley or MSFL, or Morgan Stanley and MSFL collectively, as the context requires.

|

Final Terms

Capitalized terms used but not defined herein have

the meanings assigned to them in the accompanying product supplement and prospectus. All references to “Buffer Rate,” “Cash

Settlement Amount,” “Closing Level,” “Determination Date,” “Face Amount,” “Final Underlier

Level,” “Initial Underlier Level,” “Maximum Settlement Amount,” “Original Issue Price,” “Stated

Maturity Date,” “Trade Date,” “Trading Day,” “Underlier,” “Underlier Return” and

“Upside Participation Rate” herein shall be deemed to refer to “downside factor,” “payment at maturity,”

“index closing value,” “valuation date,” “stated principal amount,” “final index value,”

“initial index value,” “maximum payment at maturity,” “issue price,” “maturity date,”

“pricing date,” “index business day,” “underlying index,” “index return” and “leverage

factor,” respectively, as used in the accompanying product supplement.

If the terms described herein are inconsistent with

those described in the accompanying product supplement or prospectus, the terms described herein shall control.

Issuer: Morgan Stanley Finance LLC

Guarantor: Morgan Stanley

Underlier: S&P 500® Index

Underlier Publisher: S&P Dow Jones Indices LLC

Notes: The accompanying product supplement refers to the notes

as the “PLUS.”

Specified currency: U.S. dollars (“$”)

Face Amount: Each note will have a Face Amount of $1,000; $2,207,000

in the aggregate for all the notes; the aggregate Face Amount of notes may be increased if the Issuer, at its sole option, decides to

sell an additional amount of the notes on a date subsequent to the date hereof.

Denominations: $1,000

and integral multiples thereof

Cash Settlement Amount (on the Stated Maturity Date): For each

$1,000 Face Amount of notes, we will pay you on the Stated Maturity Date an amount in cash equal to:

| · | if the Final Underlier Level is greater than or equal to the Cap Level, the Maximum Settlement

Amount; |

| · | if the Final Underlier Level is greater than the Initial Underlier Level but less than

the Cap Level, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the Upside Participation

Rate times (c) the Underlier Return; |

| · | if the Final Underlier Level is equal to or less than the Initial Underlier Level but

greater than or equal to the Buffer Level, $1,000; or |

| · | if the Final Underlier Level is less than the Buffer Level, the sum of (i) $1,000

plus (ii) the product of (a) $1,000 times (b) the Buffer Rate times (c) the sum

of the Underlier Return and the Buffer Amount. |

You will lose some or all of your investment

at maturity if the Final Underlier Level is less than the Buffer Level. Any payment of the Cash Settlement Amount is subject to the credit

of the Issuer.

Initial Underlier Level: 4,293.93

Final Underlier Level: The Closing Level of the Underlier on

the Determination Date, except in the limited circumstances described under “Description of PLUS—Postponement of Valuation

Date(s)” on

page S-47 of the accompanying product supplement, and subject to adjustment

as provided under “Description of PLUS—Discontinuance of Any Underlying Index or Basket Index; Alteration of Method of Calculation”

on page S-49 of the accompanying product supplement.

Underlier Return: The quotient of (i) the Final Underlier

Level minus the Initial Underlier Level divided by (ii) the Initial Underlier Level, expressed as a percentage

Upside Participation Rate: 200%

Cap Level: 4,714.73514, which is 109.80% of the Initial Underlier

Level

Maximum Settlement Amount: $1,196.00

for each $1,000 Face Amount of notes

Buffer Level: 3,649.8405, which is 85.00% of the Initial Underlier

Level

Buffer Amount: 15.00%

Buffer Rate: The quotient of the Initial Underlier Level

divided by the Buffer Level, which equals approximately 117.65%

Trade Date: June 8, 2023

Original Issue Date (Settlement Date): June 15, 2023 (5 Business

Days after the Trade Date)

Determination Date: January 14, 2025, subject to postponement

as described in the accompanying product supplement on page S-47 under “Description of PLUS—Postponement of Valuation Date(s).”

Stated Maturity Date: January 16, 2025 (2 Business Days after

the Determination Date), subject to postponement as described below.

Postponement of Stated Maturity Date: If the scheduled Determination

Date is not a Trading Day or if a market disruption event occurs on that day so that the Determination Date as postponed falls less than

two Business Days prior to the scheduled Stated Maturity Date, the Stated Maturity Date of the notes will be postponed to the second Business

Day following that Determination Date as postponed.

Closing Level: As described under “Description of PLUS—Some

Definitions—index closing value” on page S-39 of the accompanying product supplement

Business Day: As described under “Description of PLUS—Some

Definitions—business day” on page S-38 of the accompanying product supplement

Trading Day: As described under “Description of PLUS—Some

Definitions—index business day” on page S-39 of the accompanying product supplement. The product supplement refers to a Trading

Day as an “index business day.”

Market disruption event: The following replaces in its entirety

the section entitled “Description of PLUS—Some Definitions—market disruption event” on page S-39 of the accompanying

product supplement:

“Market disruption event” means, with respect to the Underlier:

(i) the occurrence or existence of:

| (a) | a suspension, absence or material limitation of trading of securities then constituting 20 percent or more, by weight, of the Underlier

(or the successor index) on the relevant exchanges for such securities for more than two hours of trading or during the one-half hour

period preceding the close of the principal trading session on such relevant exchange, or |

| (b) | a breakdown or failure in the price and trade reporting systems of any relevant exchange as a result of which the reported trading

prices for securities then constituting 20 percent or more, by weight, of the Underlier (or the successor index), or futures or options

contracts, if available, relating to the Underlier (or the successor index) or the securities then constituting 20 percent or more, by

weight, of the Underlier during the last one-half hour preceding the close of the principal trading session on such relevant exchange

are materially inaccurate, or |

| (c) | the suspension, material limitation or absence of trading on any major U.S. securities market for trading in futures or options contracts

or exchange-traded funds related to the Underlier (or the successor index), or in futures or options contracts, if available, relating

to securities then constituting 20 percent or more, by weight, of the Underlier (or the successor index) for more than two hours of trading

or during the one-half hour period preceding the close of the principal trading session on such market, |

in each case as determined by the calculation agent in its sole discretion;

and

(ii) a determination by the calculation agent in its sole discretion

that any event described in clause (i) above materially interfered with our ability or the ability of any of our affiliates to unwind

or adjust all or a material portion of the hedge position with respect to the notes.

For the purpose of determining whether a market disruption event exists

at any time, if trading in a security included in the Underlier is suspended, absent or materially limited at that time, then the relevant

percentage contribution of that security to the value of the Underlier shall be based on a comparison of (x) the portion of the value

of the Underlier attributable to that security relative to (y) the overall value of the Underlier, in each case immediately before that

suspension or limitation.

For the purpose of determining whether a market disruption event has

occurred: (1) a limitation on the hours or number of days of trading will not constitute a market disruption event if it results from

an announced change in the regular business hours of the relevant exchange or market, (2) a decision to permanently discontinue trading

in the relevant futures or options contract or exchange-traded fund will not constitute a market disruption event, (3) a suspension of

trading in futures or options contracts or exchange-traded funds on the Underlier, or futures or options contracts, if available, relating

to securities then constituting 20 percent or more, by weight, of the Underlier, by the primary securities market trading in such contracts

or funds by reason of (a) a price change exceeding limits set by such securities exchange or market, (b) an imbalance of orders relating

to such contracts or funds, or (c) a disparity in bid and ask quotes relating to such contracts or funds will constitute a suspension,

absence or material limitation of trading in futures or options contracts or exchange-traded funds related to the Underlier and (4) a

“suspension, absence or material limitation of trading” on any relevant exchange or on the primary market on which futures

or options contracts or exchange-traded funds related to the Underlier are traded will not include any time when such securities market

is itself closed for trading under ordinary circumstances.

Trustee: The Bank of New York Mellon

Calculation Agent: MS & Co.

Issuer Notice To Registered Security Holders, the Trustee and the

Depositary: In the event that the Stated Maturity Date is postponed due to postponement of the Determination Date, the Issuer shall

give notice of such postponement and, once it has been determined, of the date to which the Stated Maturity Date has been rescheduled

(i) to each registered holder of the notes by mailing notice of such postponement by first class mail, postage prepaid, to such registered

holder’s last address as it shall appear upon the registry books, (ii) to the Trustee by facsimile confirmed by mailing such notice

to the Trustee by first class mail, postage prepaid, at its New York office and (iii) to The Depository Trust Company (the “depositary”)

by telephone or facsimile, confirmed by mailing such notice to the depositary by first class mail, postage prepaid. Any notice that is

mailed to a registered holder of the notes in the manner herein provided shall be conclusively presumed to have been duly given to such

registered holder, whether or not such registered holder receives the notice. The Issuer shall give such notice as promptly as possible,

and in no case later than (i) with respect to notice of postponement of the Stated Maturity Date, the Business Day immediately preceding

the scheduled Stated Maturity Date and (ii) with respect to notice of the date to which the Stated Maturity Date has been rescheduled,

the Business Day immediately following the actual Determination Date for determining the Final Underlier Level.

The Issuer shall, or shall cause the Calculation Agent to, (i) provide

written notice to the Trustee and to the depositary of the amount of cash, if any, to be delivered with respect to each Face Amount of

notes, on or prior to 10:30 a.m. (New York City time) on the Business Day preceding the Stated Maturity Date, and (ii) deliver the aggregate

cash amount due with respect to the notes, if any, to the Trustee for delivery to the depositary, as holder of the notes, on the Stated

Maturity Date.

CUSIP no.: 61774X6G3

ISIN: US61774X6G39

HYPOTHETICAL

EXAMPLES

The following table and chart

are provided for purposes of illustration only. They should not be taken as an indication or prediction of future investment results and

are intended merely to illustrate the impact that the various hypothetical Closing Levels of the Underlier on the Determination Date could

have on the Cash Settlement Amount.

The examples below are based on

a range of Final Underlier Levels that are entirely hypothetical; no one can predict what the level of the Underlier will be on any day

during the term of the notes, and no one can predict what the Final Underlier Level will be on the Determination Date. The Underlier has

at times experienced periods of high volatility — meaning that the level of the Underlier has changed considerably in relatively

short periods — and its performance cannot be predicted for any future period.

The information in the following

examples reflects hypothetical rates of return on the notes assuming that they are purchased on the Original Issue Date at the Face Amount

and held to the Stated Maturity Date. The value of the notes at any time after the Trade Date will vary based on many economic and market

factors, including interest rates, the volatility of the Underlier, our creditworthiness and changes in market conditions, and cannot

be predicted with accuracy. Any sale prior to the Stated Maturity Date could result in a substantial loss to you.

| Key

Terms and Assumptions |

|

| Face

Amount: |

$1,000 |

| Upside

Participation Rate: |

200.00% |

| Cap

Level: |

109.80% of the Initial Underlier Level |

| Maximum

Settlement Amount: |

$1,196.00 per $1,000 Face Amount of notes (119.600% of the Face Amount) |

| Minimum

Cash Settlement Amount: |

None |

| Buffer

Level: |

85.00% of the Initial Underlier Level |

| Buffer

Rate: |

Approximately 117.65% |

| Buffer

Amount: |

15.00% |

|

· Neither

a market disruption event nor a non-Trading Day occurs on the Determination Date.

· No

discontinuation of the Underlier or alteration of the method by which the Underlier is calculated.

· Notes

purchased on the Original Issue Date at the Face Amount and held to the Stated Maturity Date.

|

The actual performance of the Underlier over the term of the notes,

as well as the Cash Settlement Amount, if any, may bear little relation to the hypothetical examples shown below or to the historical

levels of the Underlier shown elsewhere in this document. For information about the historical levels of the Underlier during recent periods,

see “The Underlier” below.

The levels in the left column of the table below represent hypothetical

Final Underlier Levels and are expressed as percentages of the Initial Underlier Level. The amounts in the right column represent the

hypothetical Cash Settlement Amount, based on the corresponding hypothetical Final Underlier Level (expressed as a percentage of the Initial

Underlier Level), and are expressed as percentages of the Face Amount of notes (rounded to the nearest one-thousandth of a percent). Thus,

a hypothetical Cash Settlement Amount of 100% means that the value of the cash payment that we would deliver for each $1,000 Face Amount

of notes on the Stated Maturity Date would equal 100% of the Face Amount of notes, based on the corresponding hypothetical Final Underlier

Level (expressed as a percentage of the Initial Underlier Level) and the assumptions noted above. The numbers appearing in the table and

chart below may have been rounded for ease of analysis.

| Hypothetical Final Underlier Level |

Hypothetical Cash Settlement Amount |

| (as Percentage of Initial Underlier Level) |

(as Percentage of Face Amount) |

| 200.000% |

119.600% |

| 175.000% |

119.600% |

| 150.000% |

119.600% |

| 125.000% |

119.600% |

| 120.000% |

119.600% |

| 110.000% |

119.600% |

| 109.800% |

119.600% |

| 105.000% |

110.000% |

| 103.000% |

106.000% |

| 100.000% |

100.000% |

| 95.000% |

100.000% |

| 85.000% |

100.000% |

| 80.000% |

94.118% |

| 75.000% |

88.235% |

| 50.000% |

58.824% |

| 25.000% |

29.412% |

| 0.000% |

0.000% |

If, for example, the Final Underlier Level were determined to be 25.000%

of the Initial Underlier Level, the Cash Settlement Amount would be approximately 29.412% of the Face Amount of notes, as shown in the

table above. As a result, if you purchased your notes on the Original Issue Date at the Face Amount and held them to the Stated Maturity

Date, you would lose approximately 70.588% of your investment. If you purchased your notes at a premium to the Face Amount, you would

lose a correspondingly higher percentage of your investment.

If the Final Underlier Level were determined to be 150.000% of the Initial

Underlier Level, the Cash Settlement Amount would be capped at the Maximum Settlement Amount (expressed as a percentage of the Face Amount),

or 119.600% of each $1,000 Face Amount of notes, as shown in the table above. As a result, if you purchased the notes on the Original

Issue Date at the Face Amount and held them to the Stated Maturity Date, you would not benefit from any increase in the Final Underlier

Level above the Cap Level of 109.800% of the Initial Underlier Level.

Payoff Diagram

The following chart shows a graphical illustration of the hypothetical

Cash Settlement Amount (expressed as a percentage of the Face Amount of notes), if the Final Underlier Level (expressed as a percentage

of the Initial Underlier Level) were any of the hypothetical levels shown on the horizontal axis. The chart shows that any hypothetical

Final Underlier Level (expressed as a percentage of the Initial Underlier Level) of less than the Buffer Level of 85.00% (the section

left of the 85.00% marker on the horizontal axis) would result in a hypothetical Cash Settlement Amount of less than 100% of the Face

Amount of notes (the section below the 100% marker on the vertical axis), and, accordingly, in a loss of principal to the holder of the

notes. The chart also shows that any hypothetical Final Underlier Level (expressed as a percentage of the Initial Underlier Level) of

greater than 109.800% (the section right of the Cap Level of 109.800% marker on the horizontal axis) would result in a capped return on

your investment and a Cash Settlement Amount equal to the Maximum Settlement Amount.

RISK FACTORS

| This section describes the material risks relating to the notes. For further discussion of these and other risks, you should read the section entitled “Risk Factors” in the accompanying product supplement and prospectus. We also urge you to consult your investment, legal, tax, accounting and other advisers in connection with your investment in the notes. |

RISKS RELATING TO AN INVESTMENT IN THE NOTES

The Notes Do Not Pay Interest Or Guarantee The

Return Of Any Of Your Principal

The terms of the notes differ from those of ordinary debt securities

in that the notes do not pay interest and do not guarantee any return of principal at maturity. If the Final Underlier Level has declined

by an amount greater than the Buffer Amount of 15.00% from the Initial Underlier Level, you will receive for each note that you hold a

Cash Settlement Amount that is less than the Face Amount of each note by an amount proportionate to the decline in the level of the Underlier

below 85.00% of the Initial Underlier Level times the Buffer Rate of approximately 117.65%. As there is no minimum Cash Settlement Amount

on the notes, you could lose your entire initial investment.

Also, the market price of your notes prior to the Stated Maturity Date

may be significantly lower than the purchase price you pay for your notes. Consequently, if you sell your notes before the Stated Maturity

Date, you may receive significantly less than the amount of your investment in the notes.

The Appreciation Potential Of The Notes Is Limited

By The Maximum Settlement Amount

The appreciation potential of the notes is limited by the Maximum Settlement

Amount of $1,196.00 per note, or 119.600% of the Face

Amount. Although the Upside Participation Rate provides 200% exposure to any increase in the Final Underlier Level over the Initial Underlier

Level, because the Cash Settlement Amount will be limited to 119.600% of the Face Amount for the notes, any increase in the Final Underlier

Level over the Initial Underlier Level by more than 9.80% of the Initial Underlier Level will not further increase the return on the notes.

If You Purchase Your Notes At A Premium To The

Face Amount, The Return On Your Investment Will Be Lower Than The Return On Notes Purchased At The Face Amount, And The Impact Of Certain

Key Terms Of The Notes Will Be Negatively Affected

The Cash Settlement Amount will not be adjusted based on the issue price

you pay for the notes. If you purchase notes at a price that differs from the Face Amount of notes, then the return on your investment

in such notes held to the Stated Maturity Date will differ from, and may be substantially less than, the return on notes purchased at

the Face Amount. If you purchase your notes at a premium to the Face Amount and hold them to the Stated Maturity Date, the return on your

investment in the notes will be lower than it would have been had you purchased the notes at the Face Amount or at a discount to the Face

Amount. In addition, the impact of the Buffer Level and the Cap Level on the return on your investment will depend upon the price you

pay for your notes relative to the Face Amount. For example, if you purchase your notes at a premium to the Face Amount, the Cap Level

will reduce your potential percentage return on the notes to a greater extent than would have been the case for notes purchased at the

Face Amount or at a discount to the Face Amount. Similarly, the Buffer Level will provide less protection of the investment amount for

notes purchased at a premium to the Face Amount than for notes purchased at the Face Amount or a discount to the Face Amount.

The Market Price Will Be Influenced By Many Unpredictable

Factors

Several factors, many of which are beyond our control, will influence

the value of the notes in the secondary market and the price at which MS & Co. may be willing to purchase or sell the notes in the

secondary market, including: the level of the Underlier, volatility (frequency and magnitude of changes in value) of the Underlier and

dividend yield of the Underlier, interest and yield rates, time remaining to maturity, geopolitical conditions and economic, financial,

political and regulatory or judicial events that affect the Underlier or equities markets generally and which may affect the Final Underlier

Level of the Underlier and any actual or anticipated changes in our credit ratings or credit spreads. The level of the

Underlier may be, and has been, volatile, and we can give you no assurance

that the volatility will lessen. See “The Underlier” below. You may receive less, and possibly significantly less, than the

Face Amount per note if you try to sell your notes prior to maturity.

The Notes Are Subject To Our Credit Risk, And

Any Actual Or Anticipated Changes To Our Credit Ratings Or Credit Spreads May Adversely Affect The Market Value Of The Notes

You are dependent on our ability to pay all amounts due on the notes

at maturity, and therefore you are subject to our credit risk. If we default on our obligations under the notes, your investment would

be at risk and you could lose some or all of your investment. As a result, the market value of the notes prior to maturity will be affected

by changes in the market’s view of our creditworthiness. Any actual or anticipated decline in our credit ratings or increase in

the credit spreads charged by the market for taking our credit risk is likely to adversely affect the market value of the notes.

As A Finance Subsidiary, MSFL Has No Independent

Operations And Will Have No Independent Assets

As a finance subsidiary, MSFL has no independent operations beyond the

issuance and administration of its securities and will have no independent assets available for distributions to holders of the notes

if they make claims in respect of such notes in a bankruptcy, resolution or similar proceeding. Accordingly, any recoveries by such holders

will be limited to those available under the related guarantee by Morgan Stanley and that guarantee will rank pari passu with all

other unsecured, unsubordinated obligations of Morgan Stanley. Holders will have recourse only to a single claim against Morgan Stanley

and its assets under the guarantee. Holders of the notes should accordingly assume that in any such proceedings they could not have any

priority over and should be treated pari passu with the claims of other unsecured, unsubordinated creditors of Morgan Stanley,

including holders of Morgan Stanley-issued securities.

The Amount Payable On The Notes Is Not Linked

To The Level Of The Underlier At Any Time Other Than The Determination Date

The Final Underlier Level will be based on the Closing Level on the

Determination Date, subject to adjustment for non-Trading Days and certain market disruption events. Even if the level of the Underlier

appreciates prior to the Determination Date but then drops by the Determination Date, the Cash Settlement Amount may be less, and may

be significantly less, than it would have been had the Cash Settlement Amount been linked to the level of the Underlier prior to such

drop. Although the actual level of the Underlier on the Stated Maturity Date or at other times during the term of the notes may be higher

than the Final Underlier Level, the Cash Settlement Amount will be based solely on the Closing Level on the Determination Date.

Investing In The Notes Is Not Equivalent To Investing

In The Underlier

Investing in the notes is not equivalent to investing in the Underlier

or its component stocks. Investors in the notes will not have voting rights or rights to receive dividends or other distributions or any

other rights with respect to stocks that constitute the Underlier.

The Rate We Are Willing To Pay For Securities

Of This Type, Maturity And Issuance Size Is Likely To Be Lower Than The Rate Implied By Our Secondary Market Credit Spreads And Advantageous

To Us. Both The Lower Rate And The Inclusion Of Costs Associated With Issuing, Selling, Structuring And Hedging The Notes In The Original

Issue Price Reduce The Economic Terms Of The Notes, Cause The Estimated Value Of The Notes To Be Less Than The Original Issue Price And

Will Adversely Affect Secondary Market Prices

Assuming no change in market conditions or any other relevant factors,

the prices, if any, at which dealers, including MS & Co., may be willing to purchase the notes in secondary market transactions will

likely be significantly lower than the Original Issue Price, because secondary market prices will exclude the issuing, selling, structuring

and hedging-related costs that are included in the Original Issue Price and borne by you and because the secondary market prices will

reflect our secondary market credit spreads and the bid-offer spread that any dealer would charge in a secondary market transaction of

this type as well as other factors.

The inclusion of the costs of issuing, selling, structuring and hedging

the notes, including a fee payable by our affiliate MS & Co. for the use of the electronic platform of SIMON Markets LLC, which is

a broker-

dealer in which an affiliate of Goldman Sachs & Co. LLC, a dealer

participating in the distribution of the notes, holds an indirect minority equity interest, in the Original Issue Price and the lower

rate we are willing to pay as issuer make the economic terms of the notes less favorable to you than they otherwise would be.

However, because the costs associated with issuing, selling, structuring

and hedging the notes are not fully deducted upon issuance, for a period of up to 3 months following the issue date, to the extent that

MS & Co. may buy or sell the notes in the secondary market, absent changes in market conditions, including those related to the Underlier,

and to our secondary market credit spreads, it would do so based on values higher than the estimated value, and we expect that those higher

values will also be reflected in your brokerage account statements.

The Estimated Value Of The Notes Is Determined

By Reference To Our Pricing And Valuation Models, Which May Differ From Those Of Other Dealers And Is Not A Maximum Or Minimum Secondary

Market Price

These pricing and valuation models are proprietary and rely in part

on subjective views of certain market inputs and certain assumptions about future events, which may prove to be incorrect. As a result,

because there is no market-standard way to value these types of securities, our models may yield a higher estimated value of the notes

than those generated by others, including other dealers in the market, if they attempted to value the notes. In addition, the estimated

value on the Trade Date does not represent a minimum or maximum price at which dealers, including MS & Co., would be willing to purchase

your notes in the secondary market (if any exists) at any time. The value of your notes at any time after the date hereof will vary based

on many factors that cannot be predicted with accuracy, including our creditworthiness and changes in market conditions. See also “The

Market Price Will Be Influenced By Many Unpredictable Factors” above.

The Notes Will Not Be Listed On Any Securities

Exchange And Secondary Trading May Be Limited

The notes will not be listed on any securities exchange. Therefore,

there may be little or no secondary market for the notes. MS & Co. may, but is not obligated to, make a market in the notes and, if

it once chooses to make a market, may cease doing so at any time. When it does make a market, it will generally do so for transactions

of routine secondary market size at prices based on its estimate of the current value of the notes, taking into account its bid/offer

spread, our credit spreads, market volatility, the notional size of the proposed sale, the cost of unwinding any related hedging positions,

the time remaining to maturity and the likelihood that it will be able to resell the notes. Even if there is a secondary market, it may

not provide enough liquidity to allow you to trade or sell the notes easily. Since other broker-dealers may not participate significantly

in the secondary market for the notes, the price at which you may be able to trade your notes is likely to depend on the price, if any,

at which MS & Co. is willing to transact. If, at any time, MS & Co. were to cease making a market in the notes, it is likely that

there would be no secondary market for the notes. Accordingly, you should be willing to hold your notes to maturity.

The Calculation Agent, Which Is A Subsidiary

Of Morgan Stanley And An Affiliate Of MSFL, Will Make Determinations With Respect To The Notes

As calculation agent, MS & Co. will determine the Initial Underlier

Level and the Final Underlier Level and will calculate the Cash Settlement Amount you receive at maturity, if any. Moreover, certain determinations

made by MS & Co. in its capacity as calculation agent, may require it to exercise discretion and make subjective judgments, such as

with respect to the occurrence or non-occurrence of market disruption events and the selection of a successor index or calculation of

the Final Underlier Level in the event of a market disruption event or discontinuance of the Underlier. These potentially subjective determinations

may adversely affect the Cash Settlement Amount at maturity, if any. For further information regarding these types of determinations,

see “Description of PLUS—Postponement of Valuation Date(s)” and “—Calculation Agent and Calculations”

in the accompanying product supplement. In addition, MS & Co. has determined the estimated value of the notes on the Trade Date.

Hedging And Trading Activity By Our Affiliates

Could Potentially Adversely Affect The Value Of The Notes

One or more of our affiliates and/or third-party dealers expect to carry

out hedging activities related to the notes (and possibly to other instruments linked to the Underlier or its component stocks), including

trading in the stocks that constitute the Underlier as well as in other instruments related to the Underlier. As a result, these entities

may be unwinding or adjusting hedge positions during the term of the notes, and the hedging strategy may involve greater and more frequent

dynamic adjustments to the hedge as the Determination Date approaches. Some of our affiliates also trade the stocks that constitute the

Underlier and other financial instruments related to the Underlier on a regular basis as part of their general broker-dealer and other

businesses. Any of these hedging or trading activities on or prior to the Trade Date could potentially increase the Initial Underlier

Level, and, therefore, could increase the level at or above which the Underlier must close on the Determination Date so that investors

do not suffer a loss on their initial investment in the notes. Additionally, such hedging or trading activities during the term of the

notes, including on the Determination Date, could adversely affect the level of the Underlier on the Determination Date, and, accordingly,

the Cash Settlement Amount an investor will receive at maturity, if any. Furthermore, if the dealer from which you purchase notes is to

conduct trading and hedging activities for us in connection with the notes, that dealer may profit in connection with such trading and

hedging activities and such profit, if any, will be in addition to the compensation that the dealer receives for the sale of the notes

to you. You should be aware that the potential to earn a profit in connection with hedging activities may create a further incentive for

the dealer to sell the notes to you, in addition to the compensation they would receive for the sale of the notes.

We May Sell An Additional Aggregate Face Amount

Of Notes At A Different Issue Price

At our sole option, we may decide to sell an additional aggregate Face

Amount of notes subsequent to the date hereof. The issue price of the notes in the subsequent sale may differ substantially (higher or

lower) from the issue price you paid as provided on the cover of this document.

The U.S. Federal Income Tax Consequences Of An

Investment In The Notes Are Uncertain

Please read the discussion under “Tax Considerations” in

this document and the discussion under “United States Federal Taxation” in the accompanying product supplement (together,

the “Tax Disclosure Sections”) concerning the U.S. federal income tax consequences of an investment in the notes. If the Internal

Revenue Service (the “IRS”) were successful in asserting an alternative treatment, the timing and character of income on the

notes might differ significantly from the tax treatment described in the Tax Disclosure Sections. There is a risk that the IRS may seek

to treat all or a portion of the gain on the notes as ordinary income. For example, due to the terms of the notes and current market conditions,

there is a risk that the IRS could seek to recharacterize the notes as debt instruments. In that event, U.S. Holders would be required

to accrue into income original issue discount on the notes every year at a “comparable yield” determined at the time of issuance

and recognize all income and gain in respect of the notes as ordinary income. The risk that financial instruments providing for buffers,

triggers or similar downside protection features, such as the notes, would be recharacterized as debt is greater than the risk of recharacterization

for comparable financial instruments that do not have such features. We do not plan to request a ruling from the IRS regarding the tax

treatment of the notes, and the IRS or a court may not agree with the tax treatment described in the Tax Disclosure Sections.

In 2007, the U.S. Treasury Department and the IRS released a notice

requesting comments on the U.S. federal income tax treatment of “prepaid forward contracts” and similar instruments. The notice

focuses in particular on whether to require holders of these instruments to accrue income over the term of their investment. It also asks

for comments on a number of related topics, including the character of income or loss with respect to these instruments; whether short-term

instruments should be subject to any such accrual regime; the relevance of factors such as the exchange-traded status of the instruments

and the nature of the underlying property to which the instruments are linked; the degree, if any, to which income (including any mandated

accruals) realized by non-U.S. investors should be subject to withholding tax; and whether these instruments are or should be subject

to the “constructive ownership” rule, which very generally can operate to recharacterize certain long-term capital gain as

ordinary income and impose an interest charge. While the notice requests comments on appropriate transition rules and effective dates,

any Treasury regulations or other guidance promulgated after consideration of these issues could materially and adversely affect the tax

consequences of an investment in the notes, possibly with retroactive effect. Both U.S. and Non-U.S. Holders should consult their tax

advisers regarding the U.S. federal income tax consequences of an investment in the notes, including possible alternative treatments,

the issues presented by this notice and any tax consequences arising

under the laws of any state, local or non-U.S. taxing jurisdiction.

RISKS RELATING TO THE UNDERLIER

The Underlier Reflects The Price Return Of The

Stocks Composing The Underlier, Not A Total Return

The return on the notes is based on the performance of the Underlier,

which reflects the changes in the market prices of the stocks composing the Underlier. It is not, however, linked to a “total return”

version of the Underlier, which, in addition to reflecting those price returns, would also reflect all dividends and other distributions

paid on the stocks composing the Underlier. The return on the notes will not include such a total return feature.

Adjustments To The Underlier Could Adversely

Affect The Value Of The Notes

The publisher of the Underlier may add, delete or substitute the stocks

constituting the Underlier or make other methodological changes that could change the level of the Underlier. The publisher of the Underlier

may discontinue or suspend calculation or publication of the Underlier at any time. In these circumstances, the calculation agent will

have the sole discretion to substitute a successor index that is comparable to the discontinued Underlier and is permitted to consider

indices that are calculated and published by the calculation agent or any of its affiliates. If the calculation agent determines that

there is no appropriate successor index, the Cash Settlement Amount on the notes will be an amount based on the closing prices at maturity

of the securities composing the Underlier at the time of such discontinuance, without rebalancing or substitution, computed by the calculation

agent in accordance with the formula for calculating the Underlier last in effect prior to discontinuance of the Underlier.

Past Performance is No Guide to Future Performance

The actual performance of the Underlier over the term of the notes,

as well as the amount payable at maturity, may bear little relation to the historical Closing Levels of the Underlier or to the hypothetical

return examples set forth herein. We cannot predict the future performance of the Underlier.

THE UNDERLIER

The S&P 500® Index, which is calculated, maintained

and published by S&P Dow Jones Indices LLC (“S&P”), consists of stocks of 500 component companies selected to provide

a performance benchmark for the U.S. equity markets. The calculation of the S&P 500® Index is based on the relative

value of the float adjusted aggregate market capitalization of the 500 component companies as of a particular time as compared to the

aggregate average market capitalization of 500 similar companies during the base period of the years 1941 through 1943. For additional

information about the S&P 500® Index, see the information set forth under “S&P 500® Index”

in the accompanying index supplement.

In addition, information about the Underlier may be obtained from other

sources including, but not limited to, the Underlier Publisher’s website (including information regarding (i) the Underlier’s

top ten constituents and (ii) the Underlier’s sector weightings). We are not incorporating by reference into this document the website

or any material it includes. Neither the issuer nor the agent makes any representation that such publicly available information regarding

the Underlier is accurate or complete.

Information as of market close on June 8, 2023:

| Bloomberg Ticker Symbol: |

SPX |

| Current Index Value: |

4,293.93 |

| 52 Weeks Ago: |

4,115.77 |

| 52 Week High (on 8/16/2022): |

4,305.20 |

| 52 Week Low (on 10/12/2022): |

3,577.03 |

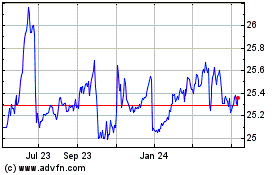

The following graph sets forth the daily Closing Levels of the Underlier

for each quarter in the period from January 1, 2018 through June 8, 2023. The Closing Level of the Underlier on June 8, 2023 was 4,293.93.

We obtained the information in the graph below from Bloomberg Financial Markets without independent verification. The Underlier has at

times experienced periods of high volatility. The actual performance of the Underlier over the term of the notes, as well as the amount

payable at maturity, may bear little relation to the historical Closing Levels of the Underlier or to the hypothetical return examples

set forth herein. We cannot predict the future performance of the Underlier. You should not take the historical levels of the Underlier

as an indication of its future performance, and no assurance can be given as to the Closing Level of the Underlier on the Determination

Date.

|

S&P 500® Index

Daily Index Closing Values

January 1, 2018 to June 8, 2023

|

| |

|

|

| |

|

|

“Standard & Poor’s®,” “S&P®,”

“S&P 500®,” “Standard & Poor’s 500” and “500” are trademarks of Standard

and Poor’s Financial Services LLC. See “S&P 500® Index” in the accompanying index supplement.

TAX CONSIDERATIONS

Although there is uncertainty regarding the U.S. federal income tax

consequences of an investment in the notes due to the lack of governing authority, in the opinion of our counsel, Davis Polk & Wardwell

LLP, under current law, and based on current market conditions, it is more likely than not that a note will be treated as a single financial

contract that is an “open transaction” for U.S. federal income tax purposes.

Assuming this treatment of the notes is respected and subject to the

discussion in “United States Federal Taxation” in the accompanying product supplement, the following U.S. federal income tax

consequences should result based on current law:

| § | A U.S. Holder should not be required to recognize taxable income over the

term of the notes prior to settlement, other than pursuant to a sale or exchange. |

| § | Upon sale, exchange or settlement of the notes, a U.S. Holder should recognize

gain or loss equal to the difference between the amount realized and the U.S. Holder’s tax basis in the notes. Such gain or loss

should be long-term capital gain or loss if the investor has held the notes for more than one year, and short-term capital gain or loss

otherwise. |

There is a risk that the Internal Revenue Service (the “IRS”)

may seek to treat all or a portion of the gain on the notes as ordinary income. For example, due to the terms of the notes and current

market conditions, there is a risk that the IRS could seek to recharacterize the notes as debt instruments. In that event, U.S. Holders

would be required to accrue into income original issue discount on the notes every year at a “comparable yield” determined

at the time of issuance and recognize all income and gain in respect of the notes as ordinary income.

In 2007, the U.S. Treasury Department and the IRS released a notice

requesting comments on the U.S. federal income tax treatment of “prepaid forward contracts” and similar instruments. The notice

focuses in particular on whether to require holders of these instruments to accrue income over the term of their investment. It also asks

for comments on a number of related topics, including the character of income or loss with respect to these instruments; whether short-term

instruments should be subject to any such accrual regime; the relevance of factors such as the exchange-traded status of the instruments

and the nature of the underlying property to which the instruments are linked; the degree, if any, to which income (including any mandated

accruals) realized by non-U.S. investors should be subject to withholding tax; and whether these instruments are or should be subject

to the “constructive ownership” rule, which very generally can operate to recharacterize certain long-term capital gain as

ordinary income and impose an interest charge. While the notice requests comments on appropriate transition rules and effective dates,

any Treasury regulations or other guidance promulgated after consideration of these issues could materially and adversely affect the tax

consequences of an investment in the notes, possibly with retroactive effect.

As discussed in the accompanying product supplement, Section 871(m)

of the Internal Revenue Code of 1986, as amended, and Treasury regulations promulgated thereunder (“Section 871(m)”) generally

impose a 30% (or a lower applicable treaty rate) withholding tax on dividend equivalents paid or deemed paid to Non-U.S. Holders with

respect to certain financial instruments linked to U.S. equities or indices that include U.S. equities (each, an “Underlying Security”).

Subject to certain exceptions, Section 871(m) generally applies to securities that substantially replicate the economic performance of

one or more Underlying Securities, as determined based on tests set forth in the applicable Treasury regulations (a “Specified Security”).

However, pursuant to an IRS notice, Section 871(m) will not apply to securities issued before January 1, 2025 that do not have a delta

of one with respect to any Underlying Security. Based on our determination that the notes do not have a delta of one with respect to any

Underlying Security, our counsel is of the opinion that the notes should not be Specified Securities and, therefore, should not be subject

to Section 871(m).

Our determination is not binding on the IRS, and the IRS may disagree

with this determination. Section 871(m) is complex and its application may depend on your particular circumstances, including whether

you enter into other transactions with respect to an Underlying Security. If withholding is required, we will not be required to pay any

additional amounts with respect to the amounts so withheld. You should consult your tax adviser regarding the potential application of

Section 871(m) to the notes.

Both U.S. and non-U.S. investors considering an investment in the

notes should read the discussion under “Risk Factors” in this document and the discussion under “United States Federal

Taxation” in the accompanying product supplement and consult their tax advisers regarding all aspects of the U.S. federal income

tax consequences of an investment in the notes, including possible alternative treatments, the

issues presented by the aforementioned notice and any tax consequences

arising under the laws of any state, local or non-U.S. taxing jurisdiction.

The discussion in the preceding paragraphs under “Tax considerations”

and the discussion contained in the section entitled “United States Federal Taxation” in the accompanying product supplement,

insofar as they purport to describe provisions of U.S. federal income tax laws or legal conclusions with respect thereto, constitute the

full opinion of Davis Polk & Wardwell LLP regarding the material U.S. federal tax consequences of an investment in the notes.

ADDITIONAL INFORMATION

ABOUT THE NOTES

No interest or dividends: The notes will not pay interest or

dividends.

No listing: The notes will not be listed on any securities exchange.

No redemption: The notes will not be subject to any redemption

right.

Purchase at amount other than Face

Amount: The amount we will pay you on the Stated Maturity Date for your notes will not be adjusted

based on the issue price you pay for your notes, so if you acquire notes at a premium (or discount) to the Face Amount and hold them to

the Stated Maturity Date, it could affect your investment in a number of ways. The return on your investment in such notes will be lower

(or higher) than it would have been had you purchased the notes at the Face Amount. Also, the Buffer Level would not offer the same measure

of protection to your investment as would be the case if you had purchased the notes at the Face Amount. Additionally, the Cap Level would

be triggered at a lower (or higher) percentage return than indicated below, relative to your initial investment. See “Risk Factors—If

You Purchase Your Notes At A Premium To The Face Amount, The Return On Your Investment Will Be Lower Than The Return On Notes Purchased

At The Face Amount, And The Impact Of Certain Key Terms Of The Notes Will Be Negatively Affected” beginning on page 10 of this document.

Use of proceeds and hedging: The proceeds from the sale of the

notes will be used by us for general corporate purposes. We will receive, in aggregate, $1,000 per note issued. The costs of the notes

borne by you and described on page 2 comprise the cost of issuing, structuring and hedging the notes.

On or prior to the Trade Date, we will hedge our anticipated exposure

in connection with the notes, by entering into hedging transactions with our affiliates and/or third-party dealers. We expect our hedging

counterparties to take positions in stocks of the Underlier, futures and options contracts on the Underlier, and any component stocks

of the Underlier listed on major securities markets or positions in any other available securities or instruments that they may wish to

use in connection with such hedging. Such purchase activity could increase the level of the Underlier on the Trade Date, and therefore

increase the level at or above which the Underlier must close on the Determination Date so that investors do not suffer a loss on their

initial investment in the notes. In addition, through our affiliates, we are likely to modify our hedge position throughout the term of

the notes, including on the Determination Date, by purchasing and selling the stocks constituting the Underlier, futures or options contracts

on the Underlier or its component stocks listed on major securities markets or positions in any other available securities or instruments

that we may wish to use in connection with such hedging activities. As a result, these entities may be unwinding or adjusting hedge positions

during the term of the notes, and the hedging strategy may involve greater and more frequent dynamic adjustments to the hedge as the Determination

Date approaches. We cannot give any assurance that our hedging activities will not affect the level of the Underlier, and, therefore,

adversely affect the value of the notes or the payment you will receive at maturity, if any. For further information on our use of proceeds

and hedging, see “Use of Proceeds and Hedging” in the accompanying product supplement.

Additional considerations: Client accounts over which Morgan

Stanley, Morgan Stanley Wealth Management or any of their respective subsidiaries have investment discretion are not permitted to purchase

the notes, either directly or indirectly.

Supplemental information regarding plan of distribution; conflicts

of interest: MS & Co., acting as our agent, will sell all of the notes that it purchases from us to an unaffiliated dealer at

the original issue price of 100.00%, or $1,000 per Face Amount of notes. Such dealer will sell the notes to investors at the same price

without a discount or commission. MS & Co., the agent for this offering, is our affiliate. Because MS & Co. is both our affiliate

and a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”), the underwriting arrangements for this offering

must comply with the requirements of FINRA Rule 5121 regarding a FINRA member firm’s distribution of the securities of an affiliate

and related conflicts of interest. In accordance with FINRA Rule 5121, MS & Co. may not make sales in offerings of the notes to any

of its discretionary accounts without the prior written approval of the customer.

MS & Co. is an affiliate of MSFL and a wholly owned subsidiary of

Morgan Stanley, and it and other affiliates of ours expect to make a profit by selling, structuring and, when applicable, hedging the

notes.

MS & Co. will conduct this offering in compliance with the requirements

of FINRA Rule 5121 of the Financial Industry Regulatory Authority, Inc., which is commonly referred to as FINRA, regarding a FINRA member

firm’s distribution of the notes of an affiliate and related conflicts of interest. MS & Co. or any of our other affiliates

may not make sales in this offering to any discretionary account. See “Plan of Distribution (Conflicts of Interest)” and “Use

of Proceeds and Hedging” in the accompanying product supplement.

Settlement: We expect to deliver the notes against payment for

the notes on the Original Issue Date, which will be the fifth scheduled Business Day following the Trade Date. Under Rule 15c6-1 of the

Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two Business Days, unless

the parties to a trade expressly agree otherwise. Accordingly, if the Original Issue Date is more than two Business Days after the Trade

Date, purchasers who wish to transact in the notes more than two Business Days prior to the Original Issue Date will be required to specify

alternative settlement arrangements to prevent a failed settlement.

WHERE YOU CAN

FIND MORE INFORMATION

MSFL and Morgan Stanley have filed a registration statement (including

a prospectus, as supplemented by the product supplement and the index supplement) with the Securities and Exchange Commission, or SEC,

for the offering to which this communication relates. You should read the prospectus in that registration statement, the product supplement,

the index supplement and any other documents relating to this offering that MSFL and Morgan Stanley have filed with the SEC for more complete

information about MSFL, Morgan Stanley and this offering. You may get these documents without cost by visiting EDGAR on the SEC web site

at.www.sec.gov. Alternatively, MSFL and/or Morgan Stanley will arrange to send you the product supplement, index supplement and prospectus

if you so request by calling toll-free 800-584-6837.

You may access these documents on the SEC web site at.www.sec.gov.as

follows:

Prospectus dated November 16, 2020

Product Supplement dated November 16, 2020

Index Supplement dated November 16, 2020

Terms used but not defined in this document are defined in the product

supplement, in the index supplement or in the prospectus.

VALIDITY OF

THE NOTES

In the opinion of Davis Polk & Wardwell LLP, as special counsel

to MSFL and Morgan Stanley, when the notes offered by this pricing supplement have been executed and issued by MSFL, authenticated by

the trustee pursuant to the MSFL Senior Debt Indenture (as defined in the accompanying prospectus) and delivered against payment as contemplated

herein, such notes will be valid and binding obligations of MSFL and the related guarantee will be a valid and binding obligation of Morgan

Stanley, enforceable in accordance with their terms, subject to applicable bankruptcy, insolvency and similar laws affecting creditors’

rights generally, concepts of reasonableness and equitable principles of general applicability (including, without limitation, concepts

of good faith, fair dealing and the lack of bad faith), provided that such counsel expresses no opinion as to (i) the effect of

fraudulent conveyance, fraudulent transfer or similar provision of applicable law on the conclusions expressed above and (ii) any provision

of the MSFL Senior Debt Indenture that purports to avoid the effect of fraudulent conveyance, fraudulent transfer or similar provision

of applicable law by limiting the amount of Morgan Stanley’s obligation under the related guarantee. This opinion is given as of

the date hereof and is limited to the laws of the State of New York, the General Corporation Law of the State of Delaware and the Delaware

Limited Liability Company Act. In addition, this opinion is subject to customary assumptions about the trustee’s authorization,

execution and delivery of the MSFL Senior Debt Indenture and its authentication of the notes and the validity, binding nature and enforceability

of the MSFL Senior Debt Indenture with respect to the trustee, all as stated in the letter of such counsel dated November 16, 2020, which

is Exhibit 5-a to the Registration Statement on Form S-3 filed by Morgan Stanley on November 16, 2020.

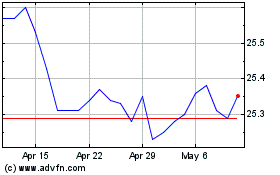

Morgan Stanley (NYSE:MS-E)

Historical Stock Chart

From Oct 2024 to Nov 2024

Morgan Stanley (NYSE:MS-E)

Historical Stock Chart

From Nov 2023 to Nov 2024