Statement of Changes in Beneficial Ownership (4)

October 29 2021 - 3:28PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Scannell John |

2. Issuer Name and Ticker or Trading Symbol

MOOG INC.

[

MOGA/MOGB

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

CEO |

|

(Last)

(First)

(Middle)

SENECA ST & JAMISON RD |

3. Date of Earliest Transaction

(MM/DD/YYYY)

10/28/2021 |

|

(Street)

EAST AURORA, NY 14052

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common | 10/28/2021 | | M | | 27000 | A | $41.82 | 66194 | D | |

| Class A Common | 10/28/2021 | | F | | 18835 (1) | D | $77.16 | 47359 | D | |

| Class A Common | | | | | | | | 26057 | I | Spouse |

| Class B Common | | | | | | | | 11008 (2) | D | |

| Class B Common (3) | | | | | | | | 3157 | I | 401 (k) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| SAR (4) | $41.82 | 10/28/2021 | | M | | | 27000 | (5) | 11/30/2021 | Class A Common | 27000.0 | $0 | 0 | D | |

| SAR (4) | $36.41 | | | | | | | (5) | 11/27/2022 | Class A Common | 31791.0 | | 31791 | D | |

| SAR (4) | $61.69 | | | | | | | (5) | 11/11/2023 | Class A Common | 15000.0 | | 15000 | D | |

| SAR (4) | $74.38 | | | | | | | (5) | 11/11/2024 | Class A Common | 15000.0 | | 15000 | D | |

| SAR (6) | $63.04 | | | | | | | (5) | 11/17/2025 | Class A Common | 5000.0 | | 5000 | D | |

| SAR (6) | $65.9 | | | | | | | (5) | 11/17/2025 | Class B Common | 10000.0 | | 10000 | D | |

| SAR (6) | $71.648 | | | | | | | (5) | 11/15/2026 | Class B Common | 20000.0 | | 20000 | D | |

| SAR (6) | $82.31 | | | | | | | (5) | 11/14/2027 | Class B Common | 18543.0 | | 18543 | D | |

| SAR (6) | $80.19 | | | | | | | (5) | 11/13/2028 | Class B Common | 27949.0 | | 27949 | D | |

| SAR (6) | $85.95 | | | | | | | (5) | 11/12/2029 | Class B Common | 33969.0 | | 33969 | D | |

| SAR (6) | $73.39 | | | | | | | (5) | 11/17/2030 | Class B Common | 25130.0 | | 25130 | D | |

| Explanation of Responses: |

| (1) | This represents the difference between the number of SARs exercised (27,000) and the number of shares issued as a result of the exercise (8,165). The number of shares to be issued under a SAR exercise is determined by multiplying the number of SARs being exercised by the difference between the FMV on the date of exercise ($77.16) and the exercise price ($41.82). Additional shares are then withheld to satisfy the Company's tax withholding obligations. |

| (2) | Reflects 108 shares of Class B Common acquired under the Moog Inc. Employee Stock Purchase Plan on January 1, 2021 and 156 shares of Class B Common acquired under the Moog Inc. Employee Stock Purchase Plan on July 1, 2021. |

| (3) | Reflects shares held in Moog Inc. Retirement Savings Plan as of the most recent report to participants. |

| (4) | Stock Appreciation Rights (SAR) granted under the 2008 Stock Appreciation Rights Plan. |

| (5) | SARs become exercisable ratably over three years beginning on the first anniversary from the date of grant. |

| (6) | Stock Appreciation Rights (SAR) granted under the Moog Inc. 2014 Long Term Incentive Plan. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Scannell John

SENECA ST & JAMISON RD

EAST AURORA, NY 14052 | X |

| CEO |

|

Signatures

|

| /s/ Christopher P. Donnini, as Power of Attorney for John R. Scannell | | 10/29/2021 |

| **Signature of Reporting Person | Date |

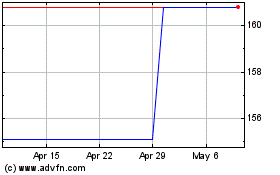

Moog (NYSE:MOG.B)

Historical Stock Chart

From Jun 2024 to Jul 2024

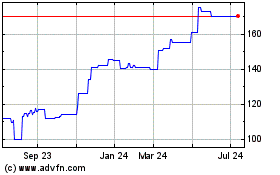

Moog (NYSE:MOG.B)

Historical Stock Chart

From Jul 2023 to Jul 2024