Mirant to Complete Settlement with Pepco

August 07 2007 - 7:29PM

PR Newswire (US)

ATLANTA, Aug. 7 /PRNewswire-FirstCall/ -- Mirant Corporation

(NYSE:MIR) announced today that it has settled the challenge to its

2006 settlement of its disputes with Potomac Electric Power Company

(Pepco). The 2006 Pepco settlement therefore will become effective

in the third quarter of 2007, resulting in a 2007 pre-tax book gain

of approximately $370 million and an estimated federal tax

deduction of approximately $600 million related to the distribution

of Mirant common shares to Pepco and to a supplemental distribution

to other claims holders in Mirant's bankruptcy that is described

below. The 2006 Pepco settlement, once effective, will resolve all

remaining disputes between Pepco and Mirant in Mirant's bankruptcy

proceedings and will end Mirant's obligations to make any further

payments under out-of-market electricity supply contracts for which

Mirant became responsible in connection with its purchase of

Pepco's generation assets in 2000. Mirant also will receive from

Pepco cash reimbursements of $70 million for an advance payment

made by Mirant in 2006 under the 2006 Pepco settlement and

approximately $36 million for amounts paid by Mirant related to the

out-of-market contracts since May 31, 2006. Pepco will receive a

claim in Mirant's bankruptcy proceedings for $520 million. To

satisfy that claim, Mirant will distribute to Pepco shares reserved

by Mirant under its Plan of Reorganization to address unresolved

claims. The exact number of shares to be distributed will be

determined by Mirant after the 2006 Pepco settlement becomes

effective and will be based upon the then-current share price. The

challenge to the 2006 Pepco settlement was brought by some holders

of claims in Mirant's bankruptcy proceedings. Both the Bankruptcy

Court and the U.S. District Court approved the 2006 Pepco

settlement, and the challengers appealed to the United States Court

of Appeals for the Fifth Circuit. Mirant and those challengers have

reached a settlement and the parties shortly will request that the

Fifth Circuit dismiss the appeal, Upon the dismissal, the 2006

Pepco settlement will become effective. Under the settlement

reached with the claims holders, once the 2006 Pepco settlement has

become effective and Mirant has distributed to Pepco the shares due

it, Mirant will make a supplemental distribution under the Plan of

all but approximately 1 million of the reserved shares that remain

after the distribution of shares is made to Pepco on a pro rata

basis to the holders of allowed Mirant Debtor Class 3 - Unsecured

Claims in its bankruptcy proceedings. Calculated based upon the

closing price for Mirant's common stock on Tuesday, August 7, 2007,

of $39.63 per share, the number of reserved shares to be

distributed to Pepco under the 2006 Pepco settlement would be

approximately 13.5 million shares and the number of shares to be

distributed in the supplemental distribution under the Plan would

be approximately 6.3 million shares. These are estimates and the

actual amounts of the shares included in each of the two

distributions will depend on the closing price of Mirant's common

stock on the date on which the shares are distributed to Pepco.

Mirant expects that date to be within two weeks of the Fifth

Circuit's order dismissing the pending appeal. Regardless of

variances in the closing price of Mirant's common stock, the total

number of reserved shares included in both the distribution to

Pepco and the supplemental distribution will be approximately 19.8

million shares. Mirant expects to make the supplemental

distribution of shares to holders of allowed Mirant Debtor Class 3

- Unsecured Claims shortly after the number of shares to be

distributed to Pepco is set in accordance with the 2006 Pepco

settlement. The "reserved" shares, including the shares to be

distributed either to Pepco or as part of the supplemental

distribution, have been issued and included in the calculation of

shares outstanding and earnings per share since the Company emerged

from bankruptcy on January 3, 2006. As a result, the distributions

to Pepco and holders of allowed Mirant Debtor Class 3 - Unsecured

Claims will not dilute current shareholders. A summary of the

material terms of the 2006 Pepco settlement and the agreement

itself were filed with the Securities and Exchange Commission on

May 31, 2006, on a Form 8-K. The settlement agreement with those

holders of allowed claims who appealed the approval of the 2006

Pepco settlement was filed with the Securities and Exchange

Commission on August 7, 2007, on a Form 8-K. Mirant is a

competitive energy company that produces and sells electricity in

the United States, and the Caribbean. Mirant owns or leases

approximately 11,350 megawatts of electric generating capacity

globally. The company operates an asset management and energy

marketing organization from its headquarters in Atlanta. For more

information, visit http://www.mirant.com/. Cautionary Language

Regarding Forward-Looking Statements Some of the statements

included herein involve forward-looking information. Mirant

cautions that these statements involve known and unknown risks and

that there can be no assurance that such results will occur. There

are various important factors that could cause actual results to

differ materially from those indicated in the forward-looking

statements, such as, but not limited to, the net proceeds received

by Pepco from the disposition of the common stock distributed to it

under the settlement agreement could be more or less than expected,

and other factors described in Mirant's Quarterly Report on Form

10-Q for the quarter ended March 31, 2007 filed with the Securities

and Exchange Commission. Stockholder inquiries: 678 579 7777

DATASOURCE: Mirant Corporation CONTACT: Media, Felicia Browder,

+1-678-579-3111, ; Investor Relations, Mary Ann Arico,

+1-678-579-7553, , both of Mirant Corporation; Stockholder

inquiries, +1-678-579-7777 Web site: http://www.mirant.com/

Copyright

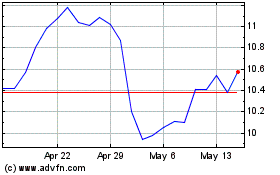

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jul 2023 to Jul 2024