Mirant Announces Share Repurchase Program

September 28 2006 - 5:45PM

PR Newswire (US)

ATLANTA, Sept. 28 /PRNewswire-FirstCall/ -- Mirant Corporation

(NYSE:MIR) announced today that its Board of Directors has

authorized a $100 million share repurchase program. The company

intends, from time to time until September 30, 2007, as business

conditions warrant, to purchase common stock on the open market or

in negotiated transactions. August 21, 2006, marked the expiration

of the company's recent "Dutch auction" self tender offer, in which

the company repurchased 43,000,000 shares of common stock for an

aggregate of approximately $1.23 billion. As of September 8, 2006,

Mirant had approximately 257 million shares of common stock (basic)

outstanding and approximately $1 billion in cash and short-term

investments. Mirant is a competitive energy company that produces

and sells electricity in the United States, the Caribbean, and the

Philippines. Mirant owns or leases approximately 17,300 megawatts

of electric generating capacity globally. The company operates an

asset management and energy marketing organization from its

headquarters in Atlanta. For more information, please visit

http://www.mirant.com/. Some of the statements included herein

involve forward-looking information. Mirant cautions that these

statements involve known and unknown risks and that there can be no

assurance that such results will occur. There are various important

factors that could cause actual results to differ materially from

those indicated in the forward-looking statements, such as, but not

limited to, the impact of market and business conditions from time

to time on the company's determinations whether to repurchase

shares under the repurchase program, and other factors discussed in

Mirant's Form 10-K for the year ended December 31, 2005, and its

Form 10-Q for the quarter ended June 30, 2006. Mirant undertakes no

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise.

Stockholder inquiries: 678 579 7777 DATASOURCE: Mirant Corporation

CONTACT: Media, Camille Evans, +1-678-579-5677, or , or Investor

Relations, Mary Ann Arico, +1-678-579-7553, or , or Sarah Stashak,

+1-678-579-6940, or , all of Mirant Corporation, or Stockholder

inquiries, +1-678-579-7777 Web site: http://www.mirant.com/

Copyright

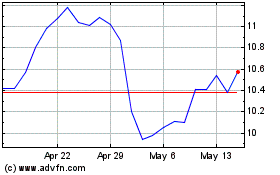

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jul 2023 to Jul 2024