Mirant Announces Plan to Repurchase Common Stock and Sell International Businesses

July 11 2006 - 9:00AM

PR Newswire (US)

* Immediate launch of a modified "Dutch Auction" tender offer for

up to 43 million shares of Mirant common stock for an aggregate

purchase price of up to $1.25 billion ATLANTA, July 11

/PRNewswire-FirstCall/ -- Mirant Corporation (NYSE:MIR) today

announced a strategic plan to enhance shareholder value. The

elements of Mirant's plan are (1) the immediate launch of a

modified "Dutch Auction" tender offer for up to 43 million shares

of Mirant common stock, using available cash and cash to be

distributed to Mirant upon completion of a term loan to be entered

into by Mirant's Philippines business, and (2) the commencement of

auction processes to sell Mirant's Philippines and Caribbean

businesses. As Mirant generates cash through these sales, it plans

to continue returning cash to its shareholders. Mirant Chairman and

Chief Executive Officer Edward R. Muller said, "Our strategic plan

reflects our continued commitment to enhance shareholder value,

both through the return of cash to our shareholders and through our

continuing U.S. business." Share Repurchases Mirant's Board of

Directors has authorized the repurchase of up to 43 million shares

of Mirant common stock for an aggregate purchase price of up to

$1.25 billion. The repurchase will be made through a modified

"Dutch Auction" tender offer in which Mirant's shareholders will be

given the opportunity, subject to certain conditions, to sell all

or a portion of their shares of Mirant common stock to Mirant at a

price not less than $25.75 and not more than $29.00 per share. The

tender offer will commence tomorrow and will be funded through a

combination of cash on hand and cash distributed to Mirant upon

completion of a term loan to be entered into by Mirant's

Philippines business. Sales of International Businesses Mirant also

is commencing auction processes to sell its Philippines and

Caribbean businesses. Certain of the sales will be subject to

regulatory and other approvals and consents. The planned sales will

result in these businesses being reported as "discontinued

operations" beginning in the third quarter of 2006. The sales are

expected to close by mid-2007. As Mirant generates cash from these

sales, it plans to continue returning cash to its shareholders

while maximizing the value of its net operating loss carryforwards.

Mirant's financial advisor for the sale of the Philippines business

will be Credit Suisse. JPMorgan will serve as financial advisor for

the sale of the Caribbean businesses. Mirant has ownership

interests in three generating facilities in the Philippines: Sual,

Pagbilao and Ilijan. Its net ownership interest in these three

generating facilities to be sold is 2,203 MW. The Philippines

business contributed $370 million in adjusted EBITDA in 2005. In

light of its decision to sell its Philippines business, Mirant has

adjusted its plan to recapitalize the business. The

recapitalization will now consist of a $700 million term loan for

which Mirant has obtained a commitment from Credit Suisse. The term

loan will be prepayable at par. Mirant's net ownership interest in

the Caribbean businesses comprises 1,050 MW. The ownership includes

controlling interests in two vertically integrated utilities: an

80% interest in Jamaica Public Service Company Limited and a 55%

interest in Grand Bahama Power Company. Mirant also owns a 39%

interest in the Power Generation Company of Trinidad and Tobago

(PowerGen), and a 25.5% interest in Curacao Utilities Company. In

2005, the Caribbean businesses contributed $156 million in adjusted

EBITDA. Continuing Business The continuing business of Mirant will

consist of its 14,161 MWs in the United States. Mirant expects to

generate sufficient cash from its continuing business to meet all

of its capital requirements, including planned environmental

capital expenditures. Estimated Available Cash Proceeds for the

tender offer will come from available cash on hand of $885 million

and cash to be distributed to Mirant upon completion of the $700

million term loan to be entered into by Mirant's Philippines

business. The remainder of the term loan will be used to pay off

existing debt in the Philippines. Estimated Available Cash (in

millions) Estimated consolidated cash & cash equivalents as of

June 30, 2006 $1,765 Less restricted international cash (403) Less

restricted cash at New York subsidiaries (72) Less restricted

Mirant North America cash (105) Total available cash at Mirant

Corporation 1,185 Less cash reserved for the Pepco settlement (100)

Less reserved corporate cash (200) Total available cash for

distribution as of June 30, 2006 885 Plus available cash to be

distributed to Mirant Corporation upon completion of the

Philippines term loan 376 Total estimated available cash for

distribution $1,261 Details of Tender Offer The modified "Dutch

Auction" tender offer for shares of Mirant common stock will

commence tomorrow and will expire on August 21, 2006, at 5:00 p.m.,

New York City time, unless extended by Mirant. Under the tender

offer, Mirant's shareholders will have the opportunity to tender

all or a portion of their shares at a price not less than $25.75

and not more than $29.00 per share. Based on the number of shares

tendered and the prices specified by the tendering shareholders,

Mirant will determine the single per share price within the

specified range that will allow it to buy 43 million shares, or

such lesser number of shares that are properly tendered. If

shareholders properly tender more than 43 million shares at or

below the determined price per share, Mirant will purchase shares

tendered by such shareholders, at the determined price per share,

on a pro rata basis based upon the number of shares each

shareholder tenders. All shares that have been tendered and not

purchased will be promptly returned to the shareholder.

Shareholders whose shares are purchased in the offer will be paid

the determined purchase price per share net in cash, without

interest, after the expiration of the offer period. The tender

offer is not contingent upon any minimum number of shares being

tendered. The offer is, however, subject to certain terms and

conditions that will be specified in the offer to purchase to be

distributed to shareholders, including obtaining the necessary

financing for the offer through the term loan to be entered into by

Mirant's Philippines business. JPMorgan will serve as dealer

manager for the tender offer. Innisfree M&A Incorporated will

serve as information agent and Mellon Investor Services will act as

depositary. Neither Mirant nor its Board of Directors, dealer

manager, depositary or information agent is making any

recommendation to shareholders as to whether to tender or refrain

from tendering their shares into the tender offer. Shareholders

must decide how many shares they will tender, if any, and the price

within the stated range at which they will offer their shares for

purchase to Mirant. This press release is for informational

purposes only and is not an offer to buy or the solicitation of an

offer to sell any shares of Mirant's common stock. The solicitation

of offers to buy shares of Mirant common stock will be made only

pursuant to the offer to purchase and related materials that Mirant

will send to its shareholders shortly. Shareholders should read

those materials carefully because they will contain important

information, including the various terms of, and conditions to, the

tender offer. Shareholders will be able to obtain the offer to

purchase and related materials at no charge at the SEC's website at

http://www.sec.gov/ or from our information agent, Innisfree

M&A Incorporated. We urge shareholders to read those materials

carefully when they become available prior to making any decisions

with respect to the tender offer. Conference Call and Webcast

Mirant is hosting a conference call to discuss the matters

described in the press release. The call will be held from 11:00

a.m. to noon Eastern Daylight Time today, July 11, 2006. To listen

to the webcast and view the accompanying slide presentation, log on

to Mirant's website at http://www.mirant.com/. Analysts are invited

to participate in the call by dialing 866.850.2201 and referencing

confirmation code 3755170. International callers should call

718.354.1362 and reference confirmation code 3755170. The call will

be available for replay shortly after completion of the live event

on the "Investor" section of the Mirant website or by dialing

866.239.0765 and referencing replay code 3755140. Mirant is a

competitive energy company that produces and sells electricity in

the United States, the Caribbean, and the Philippines. Mirant owns

or leases approximately 17,300 megawatts of electric generating

capacity globally. The company operates an asset management and

energy marketing organization from its headquarters in Atlanta. For

more information, please visit http://www.mirant.com/. Regulation G

Reconciliations Appendix Table 1 Adjusted Net Income & Adjusted

EBITDA Year-end December 31, 2005 (in millions) Businesses to be

Sold Sub United Philippines Caribbean Total States Total Net income

(loss) (1) $112 $59 $171 $(1,478) $(1,307) Mark-to-market losses -

- - 17 17 Other impairment loss and restructuring - 23 23 Loss

(Gain) on sales of assets, net (1) - (1) 19 18 Gain on sale of

investments, net - (45) (45) Impairment losses on minority owned

affiliates 23 23 - 23 Other, net 1 (5) (4) 63 59 Reorganization

items, net - - - 72 72 Income from discontinued operations, net - -

- 7 7 Cumulative effect of a change in accounting principle - 16 16

Adjusted net income (loss) $135 $54 $189 $(1,306) $(1,117)

Provision (benefit) for income taxes 131 6 137 (14) 123 Interest,

net 25 53 78 1,402 1,480 Amortization of transition power

agreements - - - (14) (14) Depreciation and amortization 79 43 122

185 307 Adjusted EBITDA $370 $156 $526 $253 $779 Adjusted net

income and adjusted EBITDA are non-GAAP financial measures.

Management and some members of the investment community utilize

adjusted net income and adjusted EBITDA to measure financial

performance on an ongoing basis. These measures are not recognized

in accordance with GAAP and should not be viewed as an alternative

to GAAP measures of performance. In evaluating these adjusted

measures, the reader should be aware that in the future Mirant may

incur expenses similar to the adjustments set forth above. (1) Net

income and adjusted EBITDA for the businesses to be sold excludes

corporate overhead expenses historically allocated to these

businesses. These amounts were $14 million for the Philippines

business, and $13 million for the Caribbean businesses. Cautionary

Language Regarding Forward Looking Statements Some of the

statements included herein involve forward-looking information.

Mirant cautions that these statements involve known and unknown

risks and that there can be no assurance that such results will

occur. There are various important factors that could cause actual

results to differ materially from those indicated in the

forward-looking statements, such as, but not limited to, our

subsidiary's ability to close the term loan facility and our

ability to cause our subsidiaries to distribute cash to us to use

in the tender offer; our ability to sell our businesses on terms

that we are willing to accept; legislative and regulatory

initiatives regarding deregulation, regulation or restructuring of

the electric utility industry; changes in state, federal and other

regulations (including rate regulations); changes in, or changes in

the application of, environmental and other laws and regulations to

which Mirant and its subsidiaries and affiliates are or could

become subject; the failure of Mirant's assets to perform as

expected; changes in market conditions, including developments in

energy and commodity supply, demand, volume and pricing or the

extent and timing of the entry of additional competition in the

markets of Mirant's subsidiaries and affiliates; increased margin

requirements, market volatility or other market conditions that

could increase Mirant's obligations to post collateral beyond

amounts which are expected; Mirant's inability to access

effectively the over-the-counter and exchange-based commodity

markets or changes in commodity market liquidity or other commodity

market conditions, which may affect Mirant's ability to engage in

asset management and proprietary trading activities as expected;

Mirant's inability to enter into intermediate and long-term

contracts to sell power and procure fuel, including its

transportation, on terms and prices acceptable to Mirant; weather

and other natural phenomena, including hurricanes and earthquakes;

war, terrorist activities or the occurrence of a catastrophic loss;

environmental regulations that restrict Mirant's ability to operate

its business; deterioration in the financial condition of Mirant's

customers or counterparties and the resulting failure to pay

amounts owed to Mirant or to perform obligations or services due to

Mirant; the disposition of the pending litigation described in

Mirant's Form 10-K for the year ended December 31, 2005, and Form

10-Q for the quarter ended March 31, 2006, filed with the

Securities and Exchange Commission; political factors that affect

Mirant's international operations, such as political instability,

local security concerns, tax increases, expropriation of property,

cancellation of contract rights and environmental regulations; the

inability of Mirant's operating subsidiaries to generate sufficient

cash flow and Mirant's inability to access that cash flow to enable

Mirant to make debt service and other payments; the resolution of

claims and obligations that were not resolved during Mirant's

Chapter 11 proceedings that may have a material adverse effect on

Mirant's results of operations and other factors discussed in

Mirant's Form 10-K for the year ended December 31, 2005, and its

Form 10-Q for the quarter ended March 31, 2006. Shareholder

inquiries: 678 579 7777 DATASOURCE: Mirant Corporation CONTACT:

Philippines Asset Sales: Credit Suisse/Singapore, Jason Fisher,

+65-6212-3811, , or Credit Suisse, Raymond Wood, +1-212-325-2845, ;

Caribbean Asset Sales: JPMorgan, Carlos Cerini, +1-212-622-8946, ,

or Scott T. Deghetto, +1-212-622-6924, ; Information Agent:

Innisfree M&A Incorporated, Shareholders Call Toll-Free,

1-877-750-5836, or Banks and Brokers Call Collect, +1-212-750-5833;

Media contact, David Reno, or Jonathan Gasthalter, or Brooke

Morganstein, Citigate Sard Verbinnen, +1-212-687-8080; Investor

Relations, Mary Ann Arico, +1-678-579-7553, , or Sarah Stashak,

+1-678-579-6940, ; Shareholder inquiries, +1-678-579-7777 Web site:

http://www.mirant.com/

Copyright

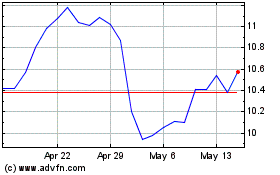

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jul 2023 to Jul 2024