Mirant Announces Investor Communications Plan

June 16 2006 - 9:25AM

PR Newswire (US)

ATLANTA, June 16 /PRNewswire-FirstCall/ -- Mirant Corporation

(NYSE:MIR) today announced a continuation of communications with

shareholders including one-on-one meetings to be held in New York

and Boston late next week. Mirant Chairman and Chief Executive

Officer Edward R. Muller said, "The discussions we have had with

shareholders over the past several weeks have been beneficial and

played a role in the decision to withdraw our NRG acquisition

proposal. The NRG proposal was unique in its value creation for

shareholders; however, our analysis of other company acquisitions

shows that they would not create value and, as a result, are not

being considered. "We reiterate that progress continues in the

efforts to recapitalize our business in the Philippines. We expect

to close the transaction in July. "We always value communication

with our shareholders and look forward to a productive dialogue in

the coming weeks and months regarding the creation of shareholder

value." The meetings will be held in New York on Wednesday, June

21st and Thursday, June 22nd and in Boston on Friday, June 23rd and

will include as many large shareholders as possible. Mirant is a

competitive energy company that produces and sells electricity in

the United States, the Caribbean, and the Philippines. Mirant owns

or leases approximately 17,300 megawatts of electric generating

capacity globally. The company operates an asset management and

energy marketing organization from its headquarters in Atlanta. For

more information, please visit http://www.mirant.com/ . Some of the

statements included herein involve forward-looking information.

Mirant cautions that these statements involve known and unknown

risks and that there can be no assurance that such results will

occur. There are various important factors that could cause actual

results to differ materially from those indicated in the

forward-looking statements, such as, but not limited to,

legislative and regulatory initiatives regarding deregulation,

regulation or restructuring of the electric utility industry;

changes in state, federal and other regulations (including rate

regulations); changes in, or changes in the application of,

environmental and other laws and regulations to which Mirant and

its subsidiaries and affiliates are or could become subject; the

failure of Mirant's assets to perform as expected; Mirant's pursuit

of potential business strategies, including the acquisition of

additional assets or the disposition or alternative utilization of

existing assets; changes in market conditions, including

developments in energy and commodity supply, demand, volume and

pricing or the extent and timing of the entry of additional

competition in the markets of Mirant's subsidiaries and affiliates;

increased margin requirements, market volatility or other market

conditions that could increase Mirant's obligations to post

collateral beyond amounts which are expected; Mirant's inability to

access effectively the over- the-counter and exchange-based

commodity markets or changes in commodity market liquidity or other

commodity market conditions, which may affect Mirant's ability to

engage in asset management and proprietary trading activities as

expected; Mirant's inability to enter into intermediate and

long-term contracts to sell power and procure fuel, including its

transportation, on terms and prices acceptable to Mirant; weather

and other natural phenomena, including hurricanes and earthquakes;

war, terrorist activities or the occurrence of a catastrophic loss;

environmental regulations that restrict Mirant's ability to operate

its business; deterioration in the financial condition of Mirant's

customers or counterparties and the resulting failure to pay

amounts owed to Mirant or to perform obligations or services due to

Mirant; the disposition of the pending litigation described in

Mirant's Form 10-K for the year ended December 31, 2005, and Form

10-Q for the quarter ended March 31, 2006, filed with the

Securities and Exchange Commission; political factors that affect

Mirant's international operations, such as political instability,

local security concerns, tax increases, expropriation of property,

cancellation of contract rights and environmental regulations; the

inability of Mirant's operating subsidiaries to generate sufficient

cash flow and Mirant's inability to access that cash flow to enable

Mirant to make debt service and other payments; the resolution of

claims and obligations that were not resolved during Mirant's

Chapter 11 proceedings that may have a material adverse effect on

Mirant's results of operations and other factors discussed in

Mirant's Form 10-K for the year ended December 31, 2005, and its

Form 10-Q for the quarter ended March 31, 2006. DATASOURCE: Mirant

Corporation CONTACT: Media contact, David Reno, Jonathan

Gasthalter, Brooke Morganstein of Citigate Sard Verbinnen,

+1-212-687-8080; or Investor Relations contacts, Mary Ann Arico,

+1-678-579-7553, or , or Sarah Stashak, +1-678-579-6940, or , both

of Mirant Corporation, or Stockholder inquiries, +1-678-579-7777

Web site: http://www.mirant.com/

Copyright

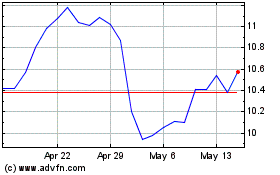

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From May 2024 to Jun 2024

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jun 2023 to Jun 2024