Mirant Proposes to Acquire NRG for Approximately $8 Billion and Assumption of Debt

May 30 2006 - 7:35PM

PR Newswire (US)

- Mirant Corporation Proposes to Acquire NRG Energy, Inc. for

Approximately $57.16 in Cash and Mirant Stock Per NRG Share - a 33%

Premium (Based on the Closing Prices of Mirant and NRG on Tuesday,

May 30, 2006) ATLANTA, May 30 /PRNewswire-FirstCall/ -- Mirant

Corporation (NYSE:MIR) today announced that it has made a proposal

to acquire NRG Energy, Inc. (NYSE:NRG) at a premium of

approximately 33% to NRG's share price as of Tuesday, May 30, 2006.

The proposal would be immediately accretive to the pro forma free

cash flow per share of Mirant. Mirant has received a financing

commitment from JPMorgan of approximately $11.5 billion for the

transaction. NRG flatly rejected the proposal last week without

engaging in any discussions with Mirant. Mirant continues to

believe that the proposal creates significant value for the owners

of both companies and has decided to make its proposal public in

the letter below, sent today to NRG's board of directors. May 30,

2006 NRG Energy, Inc. Attention: Board of Directors Ladies and

Gentlemen: We were disappointed that you would reject so quickly on

behalf of your shareholders, without any discussion with us, our

acquisition proposal of May 10, 2006, which provides your

shareholders a substantial premium to their share price and the

opportunity to participate in the additional value creation we

expect from the combined company. We think that it is important for

your shareholders to be informed of such a compelling opportunity,

and, therefore, we are simultaneously releasing this letter to the

public. In the transaction we proposed, your shareholders would

receive, at their election, $57.50 per share in cash or Mirant

Corporation common stock at an exchange ratio of 2.25 Mirant shares

for each share of NRG common stock, based upon our understanding

that you have 137.5 million fully diluted shares outstanding. Your

shareholders' elections to receive the total of approximately $3.9

billion in cash (representing 50% of the total consideration) or

Mirant common stock would be subject to proration to preserve the

50/50 cash/stock mix in the deal. This transaction would provide a

blended value of approximately $57.16 per share of NRG common stock

and would represent a substantial premium of approximately 33% to

NRG's share price, based on the closing prices of Mirant and NRG on

Tuesday, May 30, 2006. In addition, your shareholders would receive

a premium of approximately 33% to your one year average trading

price and approximately 55% to your two year average trading price.

We think that a combination of Mirant and NRG would create an

enterprise with significant opportunities for expense and

operational synergies and a national footprint that is without

parallel. The combination would generate a number of specific and

compelling benefits. Our best estimate of the annual cost savings

from the reduction of overlapping functions is $150 million (based

on publicly available information), in addition to significant

opportunities for cost savings from the procurement and use of fuel

and in the application of emissions credits. The combination also

would diversify the risks associated with the assets and operations

of both companies. In addition, the combination would create the

largest independent power company in the United States with a

strong presence in four key regions (Texas, Mid- Atlantic,

Northeast and California). The combined company would have over

43,000 megawatts globally, with over 37,500 megawatts in the United

States. Approximately 32% of its domestic capacity would be

low-cost, baseload generating capacity. Finally, the combination

would enhance liquidity and value for the shareholders of both

companies. We estimate that the combined company would have

adjusted EBITDA for 2007 in excess of $3 billion. The transaction

would be immediately accretive to Mirant's pro forma free cash flow

per share. In short, we think that the combined company would

deliver superior returns to our combined shareholder base, with

benefits flowing to our respective customers, employees and other

constituencies as well. Mirant emerged from Chapter 11 on January

3, 2006, with what most observers characterize as the strongest

balance sheet in the industry. Since January 3, 2006, a total of

approximately 275 million of our shares have traded, representing

approximately 92% of our total outstanding shares. Our hedging

strategy has been effective in reducing risk while improving our

earnings profile. We currently expect that cash flows from

operations through 2011 will be sufficient to fund our forecasted

capital expenditures, including those for required environmental

controls. Finally, we have a new management team with extensive

experience in the industry. We think that now is the right time to

pursue a combination of our companies, and we are committed to

doing so on an expedited basis. Our proposal has been approved by

our Board of Directors, and we are prepared to begin negotiations

of the terms of our proposal with you immediately and to enter into

a definitive merger agreement and complete the transaction as soon

as possible. We have received a financing commitment from JPMorgan

of approximately $11.5 billion which, when combined with our

available cash, will fund the cash portion of the purchase

consideration for your common and, if necessary, preferred stock;

refinance your senior credit facilities; and fund the purchase of

your 7.250% Senior Notes and 7.375% Senior Notes pursuant to a

change of control offer at a price equal to 101% of the aggregate

principal amount, plus accrued and unpaid interest. The

indebtedness of our subsidiaries, including Mirant Americas

Generation, LLC and Mirant North America, LLC, would remain in

place. We expect that due diligence can be completed quickly. In

addition, given the complementary geographies of our respective

operations, we expect that all regulatory approvals will be

obtained expeditiously. With your cooperation, we think that we can

close the transaction in 2006. We expect your shareholders to

respond enthusiastically to this transaction: current shareholders

who wish to exit will have the opportunity to do so at an

attractive premium; those shareholders who choose to continue as

investors in the combined company will receive both an attractive

premium and have the opportunity to participate in the additional

value creation we expect from the combination. We believe ardently

in the wisdom and strategic value of this transaction and the

benefits it offers to our combined shareholders and stakeholders.

This matter has the highest priority for us. Sincerely, Edward R.

Muller Chairman and Chief Executive Officer Mirant is a competitive

energy company that produces and sells electricity in the United

States, the Caribbean, and the Philippines. Mirant owns or leases

approximately 17,300 megawatts of electric generating capacity

globally. The company operates an asset management and energy

marketing organization from its headquarters in Atlanta. For more

information, please visit http://www.mirant.com/. Some of the

statements included herein involve forward-looking information.

Mirant cautions that these statements involve known and unknown

risks and that there can be no assurance that such results will

occur. There are various important factors that could cause actual

results to differ materially from those indicated in the

forward-looking statements, such as, but not limited to,

legislative and regulatory initiatives regarding deregulation,

regulation or restructuring of the electric utility industry;

changes in state, federal and other regulations (including rate

regulations); changes in, or changes in the application of,

environmental and other laws and regulations to which Mirant and

its subsidiaries and affiliates are or could become subject; the

failure of Mirant's assets to perform as expected; Mirant's pursuit

of potential business strategies, including the acquisition of

additional assets or the disposition or alternative utilization of

existing assets; changes in market conditions, including

developments in energy and commodity supply, demand, volume and

pricing or the extent and timing of the entry of additional

competition in the markets of Mirant's subsidiaries and affiliates;

increased margin requirements, market volatility or other market

conditions that could increase Mirant's obligations to post

collateral beyond amounts which are expected; Mirant's inability to

access effectively the over- the-counter and exchange-based

commodity markets or changes in commodity market liquidity or other

commodity market conditions, which may affect Mirant's ability to

engage in asset management and proprietary trading activities as

expected; Mirant's inability to enter into intermediate and

long-term contracts to sell power and procure fuel, including its

transportation, on terms and prices acceptable to Mirant; weather

and other natural phenomena, including hurricanes and earthquakes;

war, terrorist activities or the occurrence of a catastrophic loss;

environmental regulations that restrict Mirant's ability to operate

its business; deterioration in the financial condition of Mirant's

customers or counterparties and the resulting failure to pay

amounts owed to Mirant or to perform obligations or services due to

Mirant; the disposition of the pending litigation described in

Mirant's Form 10-K for the year ended December 31, 2005 and Form

10-Q for the quarter ended March 31, 2006 filed with the Securities

and Exchange Commission; political factors that affect Mirant's

international operations, such as political instability, local

security concerns, tax increases, expropriation of property,

cancellation of contract rights and environmental regulations; the

inability of Mirant's operating subsidiaries to generate sufficient

cash flow and Mirant's inability to access that cash flow to enable

Mirant to make debt service and other payments; the resolution of

claims and obligations that were not resolved during Mirant's

Chapter 11 proceedings that may have a material adverse effect on

Mirant's results of operations and other factors discussed in

Mirant's Form 10-K for the year ended December 31, 2005, and its

Form 10-Q for the quarter ended March 31, 2006. Stockholder

inquiries: 678 579 7777 DATASOURCE: Mirant CONTACT: Media, David

Reno, Jonathan Gasthalter, or Brooke Morganstein of Citigate Sard

Verbinnen, +1-212-687-8080; or Mirant Investor Relations, Mary Ann

Arico, +1-678-579-7553, or , or Sarah Stashak, +1-678-579-6940, or

; or Stockholder inquiries, +1-678 579 7777 Web site:

http://www.mirant.com/

Copyright

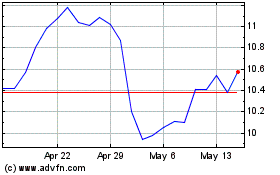

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jul 2023 to Jul 2024