6.9% Fixed Cash Pay Rate Demonstrates Access

to Capital and Enduring Value of Hospital Real Estate

Medical Properties Trust, Inc. (the “Company” or “MPT”) (NYSE:

MPW) today announced the completion of approximately £631 million

($800 million) in new non-recourse, non-amortizing secured

financing backed by certain properties in its U.K. portfolio. The

lending group comprises a consortium of global institutional,

insurance and pension investors led by Song Capital, a European

real estate investment firm.

Edward K. Aldag, Jr., Chairman, President and Chief Executive

Officer said, “In the first five months of the year, we have raised

$2.4 billion of liquidity, comfortably exceeding our initial full

year liquidity target of $2.0 billion, as sophisticated third-party

investors continue to recognize the value embedded in our leading

portfolio of hospital real estate assets. The terms of this most

recent financing prove our ability to borrow at long-term fixed

costs well inside market-implied rates on our outstanding debt and

significantly extend the overall duration of our debt

maturities.”

The transaction includes 27 of the 36 facilities MPT leases to

Circle Health (“Circle”) in the U.K. and is being executed at a

conservatively underwritten loan-to-value ratio in the low-40%

range – implying an approximate 20% increase in value since MPT

acquired the majority of the underlying properties approximately

four years ago, even during a period of cap rate expansion and

rising interest rates. The loan carries a fixed cash pay rate of

6.9% over the 10-year term excluding debt issuance costs.

The Company intends to use the proceeds to repay outstanding

debt, including the Company’s £105 million secured term loan

maturing in December 2024, borrowings under its revolving credit

facility, and a portion of its GBP term loan maturing in early

2025, as well as for other general corporate purposes.

Goodwin Procter (UK) LLP acted as legal adviser for MPT.

Slaughter and May, CBRE and Rothschild & Co advised Song

Capital.

About Medical Properties Trust, Inc.

Medical Properties Trust, Inc. is a self-advised real estate

investment trust formed in 2003 to acquire and develop net-leased

hospital facilities. From its inception in Birmingham, Alabama, the

Company has grown to become one of the world’s largest owners of

hospital real estate with 436 facilities and approximately 43,000

licensed beds in nine countries and across three continents as of

March 31, 2024. MPT’s financing model facilitates acquisitions and

recapitalizations and allows operators of hospitals to unlock the

value of their real estate assets to fund facility improvements,

technology upgrades and other investments in operations. For more

information, please visit the Company’s website at

www.medicalpropertiestrust.com.

Forward-Looking Statements

This press release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements can generally be identified by

the use of forward-looking words such as “may”, “will”, “would”,

“could”, “expect”, “intend”, “plan”, “estimate”, “target”,

“anticipate”, “believe”, “objectives”, “outlook”, “guidance” or

other similar words, and include statements regarding our

strategies, objectives, future expansion and development

activities, asset sales and other liquidity transactions, expected

returns on investments and expected financial performance.

Forward-looking statements involve known and unknown risks and

uncertainties that may cause our actual results or future events to

differ materially from those expressed in or underlying such

forward-looking statements, including, but not limited to: (i) the

risk that Steward’s bankruptcy restructuring does not result in MPT

recovering deferred rent or its other investments in Steward at

full value, within a reasonable time period or at all; (ii)

macroeconomic conditions, including due to geopolitical conditions

and instability, which may lead to a disruption of or lack of

access to the capital markets, disruptions and instability in the

banking and financial services industries, rising inflation and

movements in currency exchange rates; (iii) the risk that

previously announced or contemplated property sales, loan

repayments, and other capital recycling transactions do not occur

as anticipated or at all; (iv) the risk that MPT is not able to

attain its leverage, liquidity and cost of capital objectives

within a reasonable time period or at all; (v) MPT’s ability to

obtain debt financing on attractive terms or at all, as a result of

changes in interest rates and other factors, which may adversely

impact its ability to pay down, refinance, restructure or extend

its indebtedness as it becomes due, or pursue acquisition and

development opportunities; (vi) the ability of our tenants,

operators and borrowers to satisfy their obligations under their

respective contractual arrangements with us; (vii) the economic,

political and social impact of, and uncertainty relating to, the

potential impact from health crises (like COVID-19), which may

adversely affect MPT’s and its tenants’ business, financial

condition, results of operations and liquidity; (viii) our success

in implementing our business strategy and our ability to identify,

underwrite, finance, consummate and integrate acquisitions and

investments; (ix) the nature and extent of our current and future

competition; (x) international, national and local economic, real

estate and other market conditions, which may negatively impact,

among other things, the financial condition of our tenants, lenders

and institutions that hold our cash balances, and may expose us to

increased risks of default by these parties; (xi) factors affecting

the real estate industry generally or the healthcare real estate

industry in particular; (xii) our ability to maintain our status as

a REIT for income tax purposes in the U.S. and U.K.; (xiii) federal

and state healthcare and other regulatory requirements, as well as

those in the foreign jurisdictions where we own properties; (xiv)

the value of our real estate assets, which may limit our ability to

dispose of assets at attractive prices or obtain or maintain equity

or debt financing secured by our properties or on an unsecured

basis; (xv) the ability of our tenants and operators to operate

profitably and generate positive cash flow, remain solvent, comply

with applicable laws, rules and regulations in the operation of our

properties, to deliver high-quality services, to attract and retain

qualified personnel and to attract patients; (xvi) potential

environmental contingencies and other liabilities; (xvii) the risk

that the expected sale of three Connecticut hospitals currently

leased to Prospect does not occur at the agreed upon terms or at

all; (xviii) the risk that MPT is unable to monetize its investment

in Prospect at full value within a reasonable time period or at

all; (xix) the cooperation of our joint venture partners, including

adverse developments affecting the financial health of such joint

venture partners or the joint venture itself; (xx) the risks and

uncertainties of litigation or other regulatory proceedings; (xxi)

the risk that the completion and filing of the Company’s Quarterly

Report on Form 10-Q for the quarter ended March 31, 2024 (the

“Quarterly Report”) will take longer than expected, including the

risk that additional information may arise during its preparation;

and (xxii) the timing of the Company regaining compliance with the

NYSE’s continued listing standards.

The risks described above are not exhaustive and additional

factors could adversely affect our business and financial

performance, including the risk factors discussed under the section

captioned “Risk Factors” in our most recent Annual Report on Form

10-K, as may be updated in our other filings with the SEC.

Forward-looking statements are inherently uncertain and actual

performance or outcomes may vary materially from any

forward-looking statements and the assumptions on which those

statements are based. Readers are cautioned to not place undue

reliance on forward-looking statements as predictions of future

events. We disclaim any responsibility to update such

forward-looking statements, which speak only as of the date on

which they were made.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240523572008/en/

Drew Babin, CFA, CMA Senior Managing Director of Corporate

Communications Medical Properties Trust, Inc. (646) 884-9809

dbabin@medicalpropertiestrust.com

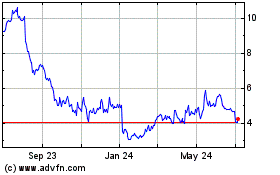

Medical Properties (NYSE:MPW)

Historical Stock Chart

From Oct 2024 to Nov 2024

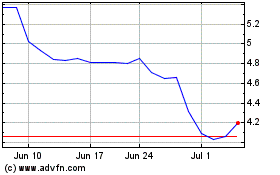

Medical Properties (NYSE:MPW)

Historical Stock Chart

From Nov 2023 to Nov 2024