UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 4)*

MariaDB plc

(Name of Issuer)

Ordinary Shares, $0.01 nominal value per share

(Title of Class of Securities)

G5920M100

(CUSIP Number)

|

Murat Akuyev, General Counsel

Runa Capital, Inc.

459 Hamilton Ave, Ste. 306

Palo Alto, CA 94301

646.629.9838 |

Kevin Sullivan

Heidi Steele

McDermott Will & Emery LLP

444 West Lake Street, Suite 4000

Chicago, IL 60606

312.371.2000 |

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

September 26, 2023

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or

13d-1(g), check the following box ☒

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §240.13d -7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

SCHEDULE 13D/A

| |

|

|

| CUSIP No. G5920M100 |

|

Page 2 of 10 Pages |

| |

|

|

| 1 |

NAME OF REPORTING PERSON. S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY) |

|

|

| |

|

|

|

| |

Runa Capital Fund II, L.P. |

|

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) |

☐ |

| |

|

(b) |

☒ |

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS (See Instructions) |

|

|

| |

|

|

|

| |

PF |

|

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

☐ |

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| |

|

|

|

| |

Cayman Islands |

|

|

| |

7 |

SOLE VOTING POWER |

| NUMBER |

|

|

| OF |

|

0 |

| SHARES |

8 |

SHARED VOTING POWER |

| BENEFICIALLY |

|

|

| OWNED |

|

2,557,043 |

| BY |

9 |

SOLE DISPOSITIVE POWER |

| EACH |

|

|

| REPORTING |

|

0 |

| PERSON |

10 |

SHARED DISPOSITIVE POWER |

| WITH |

|

|

| |

|

2,557,043 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| |

|

|

|

| |

2,557,043 |

|

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

|

☐ |

| |

|

|

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

|

|

|

| |

3.8%(1) |

|

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions) |

|

|

| |

|

|

|

| |

PN |

|

|

| |

|

|

|

|

|

|

|

| 1 |

Based on 67,705,445 ordinary shares, nominal value $0.01 per share (“Ordinary Shares”), outstanding as of August 31, 2023, as disclosed in Exhibit 99.1 to the Issuer’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on September 18, 2023. |

| |

|

|

| CUSIP No. G5920M100 |

|

Page 3 of 10 Pages |

| |

|

|

| 1 |

NAME OF REPORTING PERSON. S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY) |

|

|

| |

|

|

|

| |

Runa Capital II (GP) |

|

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) |

☐ |

| |

|

(b) |

☒ |

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS (See Instructions) |

|

|

| |

|

|

|

| |

PF |

|

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

☐ |

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| |

|

|

|

| |

Cayman Islands |

|

|

| |

7 |

SOLE VOTING POWER |

| NUMBER |

|

|

| OF |

|

0 |

| SHARES |

8 |

SHARED VOTING POWER |

| BENEFICIALLY |

|

|

| OWNED |

|

2,557,043 |

| BY |

9 |

SOLE DISPOSITIVE POWER |

| EACH |

|

|

| REPORTING |

|

0 |

| PERSON |

10 |

SHARED DISPOSITIVE POWER |

| WITH |

|

|

| |

|

2,557,043 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| |

|

|

|

| |

2,557,043 |

|

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

|

☐ |

| |

|

|

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

|

|

|

| |

3.8%1 |

|

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions) |

|

|

| |

|

|

|

| |

OO (Cayman Islands exempted company) |

|

|

| |

|

|

|

|

|

|

|

| 1 |

Based on 67,705,445 Ordinary Shares outstanding as of August 31, 2023, as disclosed in Exhibit 99.1 to the Issuer’s Current Report on Form 8-K filed with the SEC on September 18, 2023. |

| |

|

|

| CUSIP No. G5920M100 |

|

Page 4 of 10 Pages |

| |

|

|

| 1 |

NAME OF REPORTING PERSON. S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY) |

|

|

| |

|

|

|

| |

Runa Capital Opportunity Fund I, L.P. |

|

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) |

☐ |

| |

|

(b) |

☒ |

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS (See Instructions) |

|

|

| |

|

|

|

| |

PF |

|

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

☐ |

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| |

|

|

|

| |

Cayman Islands |

|

|

| |

7 |

SOLE VOTING POWER |

| NUMBER |

|

|

| OF |

|

0 |

| SHARES |

8 |

SHARED VOTING POWER |

| BENEFICIALLY |

|

|

| OWNED |

|

1,992,618 |

| BY |

9 |

SOLE DISPOSITIVE POWER |

| EACH |

|

|

| REPORTING |

|

0 |

| PERSON |

10 |

SHARED DISPOSITIVE POWER |

| WITH |

|

|

| |

|

1,992,618 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| |

|

|

|

| |

1,992,618 |

|

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

|

☐ |

| |

|

|

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

|

|

|

| |

2.9%1 |

|

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions) |

|

|

| |

|

|

|

| |

PN |

|

|

| |

|

|

|

|

|

|

|

| 1 |

Based on 67,705,445 Ordinary Shares outstanding as of August 31, 2023, as disclosed in Exhibit 99.1 to the Issuer’s Current Report on Form 8-K filed with the SEC on September 18, 2023. |

| |

|

|

| CUSIP No. G5920M100 |

|

Page 5 of 10 Pages |

| |

|

|

| 1 |

NAME OF REPORTING PERSON. S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY) |

|

|

| |

|

|

|

| |

Runa Capital Opportunity I (GP) |

|

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) |

☐ |

| |

|

(b) |

☒ |

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS (See Instructions) |

|

|

| |

|

|

|

| |

PF |

|

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

☐ |

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| |

|

|

|

| |

Cayman Islands |

|

|

| |

7 |

SOLE VOTING POWER |

| NUMBER |

|

|

| OF |

|

0 |

| SHARES |

8 |

SHARED VOTING POWER |

| BENEFICIALLY |

|

|

| OWNED |

|

2,711,969 |

| BY |

9 |

SOLE DISPOSITIVE POWER |

| EACH |

|

|

| REPORTING |

|

0 |

| PERSON |

10 |

SHARED DISPOSITIVE POWER |

| WITH |

|

|

| |

|

2,711,969 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| |

|

|

|

| |

2,711,969 |

|

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

|

☐ |

| |

|

|

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

|

|

|

| |

4.0%1 |

|

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions) |

|

|

| |

|

|

|

| |

OO (Cayman Islands exempted company) |

|

|

| |

|

|

|

|

|

|

|

| 1 |

Based on 67,705,445 Ordinary Shares outstanding as of August 31, 2023, as disclosed in Exhibit 99.1 to the Issuer’s Current Report on Form 8-K filed with the SEC on September 18, 2023. |

| |

|

|

| CUSIP No. G5920M100 |

|

Page 6 of 10 Pages |

| |

|

|

| 1 |

NAME OF REPORTING PERSON. S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY) |

|

|

| |

|

|

|

| |

Runa Ventures I Limited |

|

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) |

☐ |

| |

|

(b) |

☒ |

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS (See Instructions) |

|

|

| |

|

|

|

| |

PF |

|

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

☐ |

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| |

|

|

|

| |

Bermuda |

|

|

| |

7 |

SOLE VOTING POWER |

| NUMBER |

|

|

| OF |

|

0 |

| SHARES |

8 |

SHARED VOTING POWER |

| BENEFICIALLY |

|

|

| OWNED |

|

719,351 |

| BY |

9 |

SOLE DISPOSITIVE POWER |

| EACH |

|

|

| REPORTING |

|

0 |

| PERSON |

10 |

SHARED DISPOSITIVE POWER |

| WITH |

|

|

| |

|

719,351 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| |

|

|

|

| |

719,351 |

|

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

|

☐ |

| |

|

|

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

|

|

|

| |

1.1%1 |

|

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions) |

|

|

| |

|

|

|

| |

OO (Bermuda company) |

|

|

| |

|

|

|

|

|

|

|

| 1 |

Based on 67,705,445 Ordinary Shares outstanding as of August 31, 2023, as disclosed in Exhibit 99.1 to the Issuer’s Current Report on Form 8-K filed with the SEC on September 18, 2023. |

| |

|

|

| CUSIP No. G5920M100 |

|

Page 7 of 10 Pages |

| |

|

|

Item 1. Security and Issuer

This Amendment No. 4 (the “Amendment”)

hereby amends the Schedule 13D filed by the Reporting Persons with the Securities and Exchange Commission (the “SEC”) on September

12, 2023 (the “Original Schedule 13D”), as amended by Amendment No. 1 to the Original Schedule 13D filed by the Reporting

Persons with the SEC on September 18, 2023 (the “Amendment No. 1”), Amendment No. 2 to the Original Schedule 13D filed by

the Reporting Persons with the SEC on September 21, 2023 (“Amendment No. 2”) and Amendment No. 3 to the Original Schedule

13D filed by the Reporting Persons with the SEC on September 25, 2023 (the “Amendment No. 3”, and together with the Amendment,

Amendment No. 1 and Amendment No. 2, the “Schedule 13D”). The Amendment relates to the ordinary shares (the “Ordinary

Shares”) of MariaDB plc (the “Issuer” or the “Company”). The address of the Issuer is 699 Veterans Blvd.,

Redwood City, CA 94063 and its jurisdiction of incorporation is Ireland. The Reporting Persons previously reported their beneficial ownership

of Ordinary Shares on a Schedule 13G filed with the Securities and Exchange Commission on February 7, 2023. The Reporting Persons have

filed this Schedule 13D to provide the flexibility to potentially engage in the future in one or more of the activities described below

in Item 4. Capitalized terms used but not defined herein have the meanings given to such terms in the Schedule 13D. Except as set forth

herein, the Schedule 13D is unmodified.

Item 4. Purpose of the Transaction

Item 4 of the Schedule 13D is amended to add the following:

On September 28, 2023, the Reporting Persons made

a statement regarding corporate governance concerns at MariaDB and further steps the Reporting Persons may take to effect strategic change

at MariaDB (the “EGM Statement”), including calling an extraordinary general meeting (the “EGM”). The Reporting

Persons are considering calling an EGM of the Issuer to discuss their concerns in relation to the management of the Company and its strategic

direction. In an announcement filed hereto as Exhibit 99.6, the Reporting Person invited discussion with the shareholders of the Company

who share the Reporting Persons’ concerns and are prepared to join the Reporting Persons in requisitioning an EGM. The Reporting

Person noted that such an EGM could also consider resolutions to remove certain directors of the Company and/or to remove or restrict

the ability of the Board to issue new shares.

On September 26, 2023, in connection with the Reporting

Persons’ Possible Offer, the Reporting Persons made a further statement regarding the Possible Offer to announce additional terms

and conditions (as corrected in its entirety by a correction notice to such statement issued on September 27, 2023, the “Announcement”)

to the Commitment Letter issued to the board of directors of the MariaDB on September 24, 2023, which was previously filed as Exhibit

99.5 to Amendment No. 3 to the Original Schedule 13D.

In connection with the Possible Offer, on September

26, 2023, the Reporting Persons also made an Opening Position Disclosure under Rule 8.1(a) and (b) of the Irish Takeover Rules (the “Opening

Position Disclosure”), which discloses the Reporting Persons’ ownership position in the Company.

The foregoing descriptions

of the EGM Statement, the Announcement and the Opening Position Disclosure are qualified in their entirety by reference to the full text

of the EGM Statement, the Announcement and the Opening Position Disclosure, copies of which are attached hereto as Exhibit 99.6, Exhibit

99.7 and Exhibit 99.8, respectively, to this Amendment and are incorporated herein by reference.

There can be no assurance that a definitive

agreement with respect to the Possible Offer will be executed or, if executed, whether any transaction with respect to the Possible Offer

will be consummated. There is also no certainty as to whether, or when, the Issuer may respond to the Possible Offer, or as to the timetable

for execution of any definitive agreement. Neither the Offer nor this Schedule 13D is meant to be, nor should be construed as, an offer

to buy or the solicitation of an offer to sell any of the Issuer’s securities under U.S. securities laws.

| |

|

|

| CUSIP No. G5920M100 |

|

Page 8 of 10 Pages |

| |

|

|

The Reporting Persons may, directly or indirectly,

take such additional steps as they may deem appropriate to further the Possible Offer.

The Reporting Persons and their respective representatives

may engage, from time to time, in discussions with the Issuer’s management and/or the Issuer’s board of directors of (the

“Board”), including any special committees of the Board, and/or their respective advisors, regarding, among other things,

the Issuer’s business, strategies, management, governance, operations, performance, financial matters, capital structure, corporate

expenses, financings, status of projects, market positioning and strategic and other transactions (including transactions involving one

or more of the Reporting Persons and/or their respective affiliates and/or portfolio companies and/or other stockholders of the Issuer),

and may engage and/or intend to engage, from time to time, in discussions with other current or prospective holders of Ordinary Shares

and/or other equity, debt, notes, instruments or securities, or rights convertible into or exchangeable or exercisable for Ordinary Shares

or such other equity, debt, notes, instruments or securities, of the Issuer (collectively, “Securities”), industry analysts,

research analysts, rating agencies, existing or potential strategic partners, acquirers or competitors, financial sponsors, investment

firms, investment professionals, capital and potential capital sources (including co-investors), shareholders, providers of letters of

credit and surety bonds, operators, financial, and other consultants and advisors and other third parties regarding such matters (in each

case, including with respect to providing or potentially providing capital to the Issuer or to existing or potential strategic partners

or acquirers of the Issuer, including in connection with an acquisition or other strategic transaction involving one or more of the Reporting

Persons and/or their respective affiliates and/or portfolio companies and/or other stockholders of the Issuer) as well as other matters

set forth in clauses (a)-(j) of Item 4 of Schedule 13D. These discussions may encompass a broad range of matters relating to the Issuer,

including, among other things, the Issuer’s business, operations, finances, financings, management, organizational documents, ownership,

capital and corporate structure, dividend policy, corporate governance, the Board and committees thereof, management and director incentive

programs, strategic alternatives and transactions, including the sale of the Issuer, its Securities or one or more of its subsidiaries

or their respective businesses or assets or a business combination or other strategic transaction involving the Issuer or one or more

of its subsidiaries (and potentially involving one or more of the Reporting Persons and/or their respective affiliates and/or portfolio

companies and/or other shareholders of the Issuer), and any regulatory or legal filings, clearances, approvals or waivers, or Issuer or

Board consents, relating to the foregoing. The Reporting Persons may exchange information with the Issuer or other persons or entities

pursuant to confidentiality or similar agreements and may enter into expense reimbursement agreements with the Issuer and others. The

Reporting Persons intend to consider, explore and develop plans, make proposals and negotiate agreements with respect to or relating to,

among other things, the foregoing matters and may take other steps seeking to bring about changes with respect to the Issuer as well as

pursue other plans or proposals that relate to or could result in any of the matters set forth in clauses (a)-(j) of Item 4 of Schedule

13D. The Reporting Persons may also take steps to explore or prepare for various plans, proposals or actions, or propose transactions,

regarding any of the foregoing matters, before forming an intention to engage in any such plans, proposals or actions or proceed with

any such transactions.

| |

|

|

| CUSIP No. G5920M100 |

|

Page 9 of 10 Pages |

| |

|

|

The Reporting Persons intend to review their investment

in the Issuer on an ongoing basis. Depending on various factors, the Reporting Persons may in the future take such actions with respect

to their investment in the Issuer as they deem appropriate, including the actions and matters described in the preceding paragraph, acquiring,

or causing to be acquired, additional Securities, including taking a control position in one or more of the Securities, or disposing of,

or causing to be disposed, some or all of the Securities beneficially owned by them, in the public market, in privately negotiated transactions

or otherwise, modifying or seeking to modify the terms of any Securities held by them, including through refinancing such Securities,

entering into derivatives transactions and other agreements or instruments that increase or decrease the Reporting Persons’ economic

exposure with respect to their investment in the Issuer, forming joint ventures with the Issuer or with third parties with respect to

the Issuer, its assets or Securities or its subsidiaries, providing debt or equity financing or other forms of capital to the Issuer or

to potential strategic partners or acquirers of the Issuer, pledging their interest in Securities as a means of obtaining liquidity or

as credit support for loans or other extensions of credit, entering into strategic or other transactions involving the Issuer, its assets

or Securities or its subsidiaries or their assets and one or more of the Reporting Persons and/or their affiliates and/or portfolio companies

and/or other shareholders of the Issuer, including transactions involving a take-private transaction of the Issuer or acquisition by the

Issuer or its subsidiaries of all or a portion of the securities or assets of a portfolio company of the Reporting Persons and/or their

affiliates, or forming, making or undertaking other purposes, plans or proposals regarding the Issuer or any of its Securities or its

subsidiaries, businesses or assets. If the Reporting Persons were to acquire additional Securities, the Reporting Persons’ ability

to influence the Issuer’s management, the Board or the policies of the Issuer may increase.

Except as set forth above, the Reporting Persons

have no present plans or intentions which would result in or relate to any of the transactions described in subparagraphs (a) through

(j) of Item 4 of Schedule 13D. However, the Reporting Persons reserve the right to change their plans at any time, as they deem appropriate,

and in light of their ongoing evaluation of numerous factors, including, among other things, the price levels of the Ordinary Shares,

general market and economic conditions, ongoing evaluation of the Issuer’s business, financial condition, operations and prospects,

the relative attractiveness of alternative business and investment opportunities, Reporting Persons’ need for liquidity, and other

future developments.

Item 7. Materials to be Filed as Exhibits

| 99.1 |

|

Joint Filing Agreement (previously

filed with the Original Schedule 13D) |

| 99.2 |

|

Letter to the Issuer dated September 7, 2023 (previously filed with the Original Schedule 13D) |

| 99.3 |

|

Statement Under Irish Takeover Rules Regarding Possible Offer for MariaDB plc (previously filed with the Amendment No. 1 to Schedule 13D) |

| 99.4 |

|

Letter to the Issuer dated September 20, 2023 (previously filed with Amendment No. 2) |

| 99.5 |

|

Commitment Letter, dated September 22, 2023, by and between Runa Capital Fund II, L.P., represented by its general partner Runa Capital II (GP), and MariaDB plc (previously filed with Amendment No. 3) |

| 99.6 |

|

Statement by Runa Regarding Corporate Governance Concerns

at MariaDB plc and Shareholder Engagement |

| 99.7 |

|

Statement Regarding Possible Offer for MariaDB plc |

| 99.8 |

|

Opening Position Disclosure Under Rule 8.1(a) and (b) of The Irish Takeover Panel Act, 1997, Takeover Rules, 2022 by an Offeror or an Offeree |

SCHEDULE 13D/A

| |

|

|

| CUSIP No. G5920M100 |

|

Page 10 of 10 Pages |

| |

|

|

SIGNATURE

After reasonable inquiry and to the best of the knowledge and belief

of the undersigned, the undersigned certifies that the information set forth in this Amendment to the Statement on Schedule 13D is true,

complete and correct.

| September 29, 2023 |

|

| |

|

| |

Runa Capital Fund II, L.P. |

| |

|

| |

By: Runa Capital II (GP) |

| |

(General Partner) |

| |

|

| |

By: |

/s/ Gary Carr |

| |

Name: |

Gary Carr |

| |

Title: |

Director |

| |

|

|

| |

Runa Capital II (GP) |

| |

|

| |

By: |

/s/ Gary Carr |

| |

Name: |

Gary Carr |

| |

Title: |

Director |

| |

|

|

| |

Runa Capital Opportunity Fund I, L.P. |

| |

|

| |

By: Runa Capital Opportunity I (GP) |

| |

(General Partner) |

| |

|

| |

By: |

/s/ Gary Carr |

| |

Name: |

Gary Carr |

| |

Title: |

Director |

| |

|

|

| |

Runa Capital Opportunity I (GP) |

| |

|

| |

By: |

/s/ Gary Carr |

| |

Name: |

Gary Carr |

| |

Title: |

Director |

| |

|

|

| |

Runa Ventures I Limited |

| |

|

| |

By: Runa Capital Opportunity I (GP) |

| |

(Managing Shareholder) |

| |

|

| |

By: |

/s/ Gary Carr |

| |

Name: |

Gary Carr |

Exhibit 99.6

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION

IN WHOLE OR IN PART IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS

OF THAT JURISDICTION.

THIS ANNOUNCEMENT DOES NOT CONSTITUTE AN ANNOUNCEMENT OF A FIRM

INTENTION TO MAKE AN OFFER UNDER RULE 2.7 OF THE IRISH TAKEOVER PANEL ACT, 1997, TAKEOVER RULES, 2022 ( “IRISH TAKEOVER RULES”)

AND THERE CAN BE NO CERTAINTY THAT ANY OFFER WILL BE MADE, OR AS TO THE TERMS ON WHICH ANY OFFER MAY BE MADE.

For immediate release

28 September 2023

Runa Capital

II (GP) (“Runa”)

Statement by

Runa regarding corporate governance concerns at MariaDB plc and shareholder engagement

Runa has, for a number of years, expressed serious

concerns regarding the management of (“MariaDB” or the “Company”) by its directors (the “Board”).

In that context, Runa has advocated for changes to the Company’s strategic direction, including a rationalization of the Company’s

budget and potentially changes in senior roles in the Company. Recently, Runa became aware that the Company intended to engage in a highly

dilutive equity transaction to fund its capital needs. Runa believes that such transaction would result in substantial and damaging dilution

to shareholders and would not be in the interests of the Company or its shareholders.

As a result, Runa is considering what further

steps it may take to effect strategic change at MariaDB. Runa is considering calling an extraordinary general meeting of the Company (“EGM”)

to discuss its concerns in relation to the management of the Company and its strategic direction. Runa invites discussion with MariaDB

shareholders who share its concerns and are prepared to join it in requisitioning an EGM. Runa notes that such an EGM could also consider

resolutions to remove certain directors of the Company and/ or to remove or restrict the ability of the Board to issue new shares.

As previously announced, Runa has made an all

cash proposal to the Board to acquire, together with Runa’s investment affiliates, 100% of the issued share capital of the Company

not already owned by Runa, at a price of US$0.56 per share (the “Possible Offer”).

Runa confirms that it is willing to evaluate the

possibility of other MariaDB shareholders having the ability to retain or increase economic exposure to the Company post completion of

any offer. Runa invites feedback from MariaDB shareholders who might be interested in having such an ability and Runa is open to considering

various mechanisms to facilitate that. Runa continues to reserve the right to vary the form and / or mix of the offer consideration and

vary the transaction structure and there can be no certainty that any offer will be made, or as to the terms on which any offer may be

made.

Runa will keep all options open in regard to its

ongoing engagement with the Company and remains open to working constructively with the Company for the benefit of all Company shareholders.

However to date, the Company has not engaged substantively with Runa on its Possible Offer.

A further announcement will be made as and when

appropriate.

Enquiries:

|

Runa Capital

Davy (Financial Adviser to Runa Capital)

Brian Garrahy/Anthony Farrell

Tel: +353 1 679 7788 |

Important Notices

Responsibility Statement

The directors of Runa accept responsibility for

the information contained in this announcement. To the best of the knowledge and belief of the directors (who have taken all reasonable

care to ensure that such is the case), the information contained in this announcement is in accordance with the facts and does not omit

anything likely to affect the import of such information.

Further Information

This announcement does not constitute an offer

to sell or invitation to purchase any securities. The release, publication or distribution of this announcement in certain jurisdictions

may be restricted by law and therefore persons in such jurisdictions into which this announcement is released, published or distributed

should inform themselves about and observe such restrictions.

Publication on Website

In accordance with Rule 26.1 of the Irish Takeover

Rules, a copy of this announcement will be available on Runa’s website: https://runacap.com promptly and in any event by no later

than 12 noon on the business day following this announcement. The content of this website is not incorporated into and does not form part

of this announcement.

Pre-conditions to and terms of the Possible

Offer and conditions to any offer

Any announcement of a firm intention to make an

offer by Runa under Rule 2.7 of the Irish Takeover Rules remains subject to satisfaction of or waiver of certain pre-conditions, including

satisfactory completion of customary due diligence, negotiation and execution of a definitive transaction agreement containing mutually

agreed upon terms (including representations, warranties, covenants and conditions) for a transaction of this nature and an expenses reimbursement

agreement in customary form, approval of, and a unanimous and unqualified recommendation in the Rule 2.7 announcement by, the Board to

the Company’s shareholders to accept Runa’s offer and final approval of the Runa Investment Committees.

Any offer for the Company under Rule 2.7 of the

Irish Takeover Rules would be subject to terms and conditions that are typical for a transaction of that nature including, amongst other

things, receipt of any necessary regulatory and competition clearances.

In accordance with Rule 2.5 of the Irish Takeover

Rules, Runa reserves the right to vary the form and / or mix of the offer consideration and vary the transaction structure. Runa also

reserves the right to amend the terms of any offer (including making the offer on less favourable terms or at a lower price than US$0.56

per share): (a) with the recommendation or consent of the Board; (b) if MariaDB announces, declares or pays any dividend or any other

distribution or return of value to its shareholders after the date of this announcement, in which case Runa reserves the right to make

an equivalent adjustment to its proposed offer; (c) following the announcement by MariaDB of a whitewash transaction pursuant to the Irish

Takeover Rules; or (d) if a third party announces a firm intention to make an offer for MariaDB on less favourable terms or at a lower

price than US$0.56 per share.

Disclosure Requirements under the Irish Takeover

Rules

Under Rule 8.3(a) of the Irish Takeover Rules,

any person who is ‘interested’ in 1% or more of any class of ‘relevant securities’ of the Company or a securities exchange offeror (being

any offeror other than an offeror which has announced that its offer is, or is likely to be, solely in cash) must make an ‘opening position

disclosure’ following the commencement of the ‘offer period’ and, if later, following the announcement in which any securities exchange

offeror is first identified. An ‘opening position disclosure’ must contain, among other things, details of the person’s ‘interests’ and

‘short positions’ in any ‘relevant securities’ of each of (i) the Company and (ii) any securities exchange offeror(s). An ‘opening position

disclosure’ by a person to whom Rule 8.3(a) applies must be made by no later than 3:30 pm (Irish time) on the day that is ten ‘business

days’ following the commencement of the ‘offer period’ and, if appropriate, by no later than 3:30 pm (Irish time) on the day

that is ten ‘business days’ following the announcement in which any securities exchange offeror is first identified.

Under Rule 8.3(b) of the Irish Takeover Rules,

if any person is, or becomes, ‘interested’ (directly or indirectly) in 1% or more of any class of ‘relevant securities’

of the Company, all ‘dealings’ in any ‘relevant securities’ of the Company or any securities exchange offeror

(including by means of an option in respect of, or a derivative referenced to, any such ‘relevant securities’) must be publicly

disclosed by not later than 3:30 pm (Irish time) on the ‘business day’ following the date of the relevant transaction. This

requirement will continue until the ‘offer period’ ends. If two or more persons cooperate on the basis of any agreement either

express or tacit, either oral or written, to acquire an ‘interest’ in ‘relevant securities’ of the Company, they

will be deemed to be a single person for the purpose of Rule 8.3 of the Irish Takeover Rules. A disclosure table, giving details of the

companies in whose ‘relevant securities’ ‘dealings’ should be disclosed can be found on the Irish Takeover Panel’s

website at www.irishtakeoverpanel.ie.

If two or more persons co-operate on the basis

of an agreement or understanding, whether express or tacit, either oral or written, to acquire or control an interest in relevant securities

of an offeree company or a securities exchange offeror, they will be deemed to be a single person for the purpose of Rule 8.3 of the Irish

Takeover Rules.

Opening Position Disclosures must also be made

by the offeree company and by any offeror and Dealing Disclosures must also be made by the offeree company, by any offeror and by any

persons acting in concert with any of them (see Rules 8.1 and 8.2 of the Irish Takeover Rules).

In general, interests in securities arise when

a person has long economic exposure, whether conditional or absolute, to changes in the price of the securities. In particular, a person

will be treated as having an ‘interest’ by virtue of the ownership or control of securities, or by virtue of any option in

respect of, or derivative referenced to, securities.

Terms in quotation marks are defined in the Irish

Takeover Rules, which can be found on the Irish Takeover Panel’s website.

Details of the offeree and offeror companies in

respect of whose relevant securities Opening Position Disclosures and Dealing Disclosures must be made can be found in the Disclosure

Table on the Takeover Panel’s website at www.irishtakeoverpanel.ie, including details of the number of relevant securities in issue, when

the offer period commenced and when any offeror was first identified. If you are in any doubt as to whether or not you are required to

disclose a ‘dealing’ under Rule 8, please consult the Irish Takeover Panel’s website at www.irishtakeoverpanel.ie or contact

the Irish Takeover Panel at telephone number +353 1 678 9020.

Additional information

In connection with the possible requisitioning

of an EGM, Runa expects to file certain materials with the Securities and Exchange Commission (the “SEC”), including,

among other materials, a proxy statement on Schedule 14A (in preliminary and then definitive form). This communication is not intended

to be, and is not, a substitute for such filings or for any other document that Runa may file with the SEC in connection with the possible

requisitioning of an EGM. Investors and securityholders of the Company are urged to read the documents filed with the SEC carefully and

in their entirety (if and when they become available) before making an investment decision because they will contain important information

about the Company and the EGM. Such documents will be available free of charge through the website maintained by the SEC at www.sec.gov

or by directing a request to Runa at murat@runacap.com, telephone number +1.646.629.9838 or https://runacap.com. Any materials filed by

Runa with the SEC that are required to be mailed to shareholders of the Company will also be mailed to such shareholders. This communication

has been prepared in accordance with U.S. securities law, Irish law and the Irish Takeover Rules.

Davy Corporate Finance Unlimited Company (“Davy”),

which is authorised and regulated in Ireland by the Central Bank of Ireland, is acting exclusively as financial adviser for Runa Capital

and no one else in connection with the matters referred to in this announcement and will not be responsible to anyone other than Runa

Capital for providing the protections afforded to clients of Davy or for providing advice in connection with the matters referred to in

this announcement.

Participants in Solicitation

This communication is not a solicitation of a

proxy from any investor or shareholder. However, Runa and certain of its directors, executive officers and other members of its management

and employees may be deemed to be participants in the solicitation of proxies in connection with the proposal under the rules of the SEC.

Information regarding Runa’s directors and executive officers may be found in the Schedule 13D of Runa, and amendments thereto,

filed with the SEC with respect to the ordinary shares of the Company. These documents can be obtained free of charge from the sources

indicated above. Additional information regarding the interests of these participants, which may, in some cases, be different than those

of the Company’s shareholders generally, will also be included in the materials that Runa intends to file with the SEC when they

become available.

Non-Solicitation

This communication is not intended to, and does

not, constitute or form part of (1) any offer or invitation to purchase or otherwise acquire, subscribe for, tender, exchange, sell or

otherwise dispose of any securities, (2) the solicitation of an offer or invitation to purchase or otherwise acquire, subscribe for, sell

or otherwise dispose of any securities or (3) the solicitation of any vote or approval in any jurisdiction pursuant to this communication

or otherwise, nor will there be any acquisition or disposition of the securities referred to in this communication in any jurisdiction

in contravention of applicable law or regulation.

Exhibit 99.7

Correction Notice to statement re possible

offer for MariaDB plc (“MariaDB” or the “Company”) Increased proposal to provide up to US$20 million in bridge

financing

Runa Capital II (GP) (“Runa”) today

announces that its release issued on Tuesday, September 26, 2023 should have included a statement in accordance with Rule 2.5 of the Irish

Takeover Rules. The corrected press release is set forth in its entirety below.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION

IN WHOLE OR IN PART IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS

OF THAT JURISDICTION.

THIS ANNOUNCEMENT DOES NOT CONSTITUTE AN ANNOUNCEMENT

OF A FIRM INTENTION TO MAKE AN OFFER UNDER RULE 2.7 OF THE IRISH TAKEOVER PANEL ACT, 1997, TAKEOVER RULES, 2022 (“IRISH TAKEOVER

RULES”) AND THERE CAN BE NO CERTAINTY THAT ANY OFFER WILL BE MADE, OR AS TO THE TERMS ON WHICH ANY OFFER MAY BE MADE.

For immediate release

26 September 2023

Runa Capital

II (GP) (“Runa”)

Further statement

re possible offer for MariaDB plc (“MariaDB” or the “Company”)

Increased proposal

to provide up to US$20 million in bridge financing

On 15 September 2023, Runa announced that it made

an all cash proposal to the directors of MariaDB (the “Board”) to acquire, together with Runa’s investment affiliates,

100% of the issued share capital of the Company not already owned by Runa, at a price of US$0.56 per share (the “Possible Offer”).

In that announcement, Runa noted the impending default of the Company under its senior debt and indicated that it was prepared, as an

interim measure, to extend to the Company a US$5 million bridge loan on terms to be agreed between the parties.

Runa is pleased to announce that on 24 September

2023, Runa issued a commitment letter to the Board of MariaDB pursuant to which Runa Capital Fund II, L.P., represented by its general

partner Runa Capital II (GP) (the “Fund”), committed to provide up to $20.0 million to the Company in exchange for

senior secured notes issued by MariaDB (the “Notes”) (the “Commitment”), with $15.0 million being

issued on closing of the financing and up to an additional $5.0 million to be issued upon mutual agreement of the Company and the Fund,

subject to the terms and conditions set forth in the commitment letter (the “Commitment Letter”). The Commitment Letter

and its terms will expire if not fully executed by the Company on or prior to 29 September 2023.

The Commitment requires that the provided funds

be used solely to fund amounts that are due and payable and required to be paid by the Company to European Investment Bank (“EIB”)

under the term loan tranche issued to the Company in 2019 (the “EIB Loan”). The Fund’s obligation to fund the

Commitment shall be subject to (i) the Company’s good faith and active engagement with Runa Capital II (GP), Runa Capital Fund II,

L.P., Runa Capital Opportunity I (GP), Runa Capital Opportunity Fund I, L.P., and Runa Ventures I Limited (collectively, the “Sponsor”)

with respect to the Possible Offer (ii) a written demand from EIB for payment by the Company under the EIB Loan, (iii) EIB’s unconditional

written consent to the issuance of the Notes, and (iv) the execution of documentation for the issuance of the Notes that is reasonably

satisfactory the Fund.

Further terms and conditions of the loans

The Commitment provided to the Company by Runa

envisaged the following additional terms and conditions:

The Notes and all obligations related

thereto shall be: (i) junior only to the EIB Loan (to the extent the EIB Loan remains outstanding) and (ii) senior to all other classes

of securities and any other Company indebtedness of any kind. The Notes shall be secured by first priority security interests in the assets

of the Company and its affiliates, except that the liens securing the Notes will be junior to and subordinated to the liens securing the

EIB Loan (to the extent the EIB Loan remains outstanding).

| 2. | Interest rate and maturity |

The interest rate on the Notes shall

be 12.5% (non-default) and shall mature 364 days after closing of the financing, but shall be payable earlier upon (i) a change of control

(or issuance of equity representing more than 50% of the outstanding shares of the Company) or (ii) an event of default under the EIB

Loan.

Runa (or one of its affiliates) will

be granted fully-vested warrants to purchase ordinary shares of the Company (or, if the Company consummates a preferred shares financing,

preferred shares) in amount equal to the maximum number of such warrants that may be issued at a below market price without a shareholder

approval, which is currently estimated to be 676,892. The exercise price of the warrants will be $0.01 per share.

If the transaction closes, the Company

will pay all reasonable fees, costs and expenses incurred in connection with the transaction, whether incurred before or after closing

of the financing. In addition, the Company will pay Runa an origination fee of 0.5% of the loan amount.

| 5. | Disclosure of alternative financing proposals |

Prior to closing of the financing, the

Company shall disclose all alternative financing proposals and any relationships or other connections between directors and executive

officers of the Company and any other party to other financing arrangements.

Enquiries:

Davy Corporate Finance (Financial Adviser to Runa Capital)

Brian Garrahy

Tel: +353 1 679 7788

Important Notices

Responsibility Statement

The directors of Runa accept responsibility for

the information contained in this announcement. To the best of the knowledge and belief of the directors (who have taken all reasonable

care to ensure that such is the case), the information contained in this announcement is in accordance with the facts and does not omit

anything likely to affect the import of such information.

Further Information

This announcement does not constitute an offer

to sell or invitation to purchase any securities. The release, publication or distribution of this announcement in certain jurisdictions

may be restricted by law and therefore persons in such jurisdictions into which this announcement is released, published or distributed

should inform themselves about and observe such restrictions.

Publication on Website

In accordance with Rule 26.1 of the Irish Takeover

Rules, a copy of this announcement will be available on Runa’s website: www.runacap.com promptly and in any event by no later than

12 noon on the business day following this announcement. The content of this website is not incorporated into and does not form part of

this announcement.

Pre-conditions to and terms of the Possible

Offer and conditions to any offer

Any announcement of a firm intention to make an

offer by Runa under Rule 2.7 of the Irish Takeover Rules remains subject to satisfaction of or waiver of certain pre-conditions, including

satisfactory completion of customary due diligence, negotiation and execution of a definitive transaction agreement containing mutually

agreed upon terms (including representations, warranties, covenants and conditions) for a transaction of this nature and an expenses reimbursement

agreement in customary form, approval of, and a unanimous and unqualified recommendation in the Rule 2.7 announcement by, the Board to

the Company’s shareholders to accept Runa’s offer and final approval of the Runa Investment Committees.

Any offer for the Company under Rule 2.7 of the

Irish Takeover Rules would be subject to terms and conditions that are typical for a transaction of that nature including, amongst other

things, receipt of any necessary regulatory and competition clearances.

In accordance with Rule 2.5 of the Irish Takeover

Rules, Runa reserves the right to vary the form and / or mix of the offer consideration and vary the transaction structure. Runa also

reserves the right to amend the terms of any offer (including making the offer on less favourable terms or at a lower price than US$0.56

per share): (a) with the recommendation or consent of the Board; (b) if MariaDB announces, declares or pays any dividend or any other

distribution or return of value to its shareholders after the date of this announcement, in which case Runa reserves the right to make

an equivalent adjustment to its proposed offer; (c) following the announcement by MariaDB of a whitewash transaction pursuant to the Irish

Takeover Rules; or (d) if a third party announces a firm intention to make an offer for MariaDB on less favourable terms or at a lower

price than US$0.56 per share.

Disclosure Requirements under the Irish Takeover

Rules

Under Rule 8.3(a) of the Irish Takeover Rules,

any person who is ‘interested’ in 1% or more of any class of ‘relevant securities’ of the Company or a securities exchange offeror (being

any offeror other than an offeror which has announced that its offer is, or is likely to be, solely in cash) must make an ‘opening position

disclosure’ following the commencement of the ‘offer period’ and, if later, following the announcement in which any securities exchange

offeror is first identified. An ‘opening position disclosure’ must contain, among other things, details of the person’s ‘interests’ and

‘short positions’ in any ‘relevant securities’ of each of (i) the Company and (ii) any securities exchange offeror(s). An ‘opening position

disclosure’ by a person to whom Rule 8.3(a) applies must be made by no later than 3:30 pm (Irish time) on the day that is ten ‘business

days’ following the commencement of the ‘offer period’ and, if appropriate, by no later than 3:30 pm (Irish time) on the day

that is ten ‘business days’ following the announcement in which any securities exchange offeror is first identified.

Under Rule 8.3(b) of the Irish Takeover Rules,

if any person is, or becomes, ‘interested’ (directly or indirectly) in 1% or more of any class of ‘relevant securities’

of the Company, all ‘dealings’ in any ‘relevant securities’ of the Company or any securities exchange offeror

(including by means of an option in respect of, or a derivative referenced to, any such ‘relevant securities’) must be publicly

disclosed by not later than 3:30 pm (Irish time) on the ‘business day’ following the date of the relevant transaction. This

requirement will continue until the ‘offer period’ ends. If two or more persons cooperate on the basis of any agreement either

express or tacit, either oral or written, to acquire an ‘interest’ in ‘relevant securities’ of the Company, they

will be deemed to be a single person for the purpose of Rule 8.3 of the Irish Takeover Rules. A disclosure table, giving details of the

companies in whose ‘relevant securities’ ‘dealings’ should be disclosed can be found on the Irish Takeover Panel’s

website at www.irishtakeoverpanel.ie.

If two or more persons co-operate on the basis

of an agreement or understanding, whether express or tacit, either oral or written, to acquire or control an interest in relevant securities

of an offeree company or a securities exchange offeror, they will be deemed to be a single person for the purpose of Rule 8.3 of the Irish

Takeover Rules.

Opening Position Disclosures must also be made

by the offeree company and by any offeror and Dealing Disclosures must also be made by the offeree company, by any offeror and by any

persons acting in concert with any of them (see Rules 8.1 and 8.2 of the Irish Takeover Rules).

In general, interests in securities arise when

a person has long economic exposure, whether conditional or absolute, to changes in the price of the securities. In particular, a person

will be treated as having an ‘interest’ by virtue of the ownership or control of securities, or by virtue of any option in

respect of, or derivative referenced to, securities.

Terms in quotation marks are defined in the Irish

Takeover Rules, which can be found on the Irish Takeover Panel’s website.

Details of the offeree and offeror companies in

respect of whose relevant securities Opening Position Disclosures and Dealing Disclosures must be made can be found in the Disclosure

Table on the Takeover Panel’s website at www.irishtakeoverpanel.ie, including details of the number of relevant securities in issue, when

the offer period commenced and when any offeror was first identified. If you are in any doubt as to whether or not you are required to

disclose a ‘dealing’ under Rule 8, please consult the Irish Takeover Panel’s website at www.irishtakeoverpanel.ie or contact

the Irish Takeover Panel at telephone number +353 1 678 9020.

Davy Corporate Finance Unlimited Company (“Davy”),

which is authorised and regulated in Ireland by the Central Bank of Ireland, is acting exclusively as financial adviser for Runa Capital

and no one else in connection with the matters referred to in this announcement and will not be responsible to anyone other than Runa

Capital for providing the protections afforded to clients of Davy or for providing advice in connection with the matters referred to in

this announcement.

Exhibit 99.8

FORM 8.1(a) & (b)

(Opening Position Disclosure)

IRISH TAKEOVER PANEL

OPENING POSITION DISCLOSURE UNDER RULE 8.1(a)

AND (b) OF

THE IRISH TAKEOVER PANEL ACT, 1997, TAKEOVER RULES, 2022

BY AN OFFEROR OR AN OFFEREE

| (a) Full name of discloser: |

Runa Capital II (GP) |

|

(b) Owner

or controller of interests and short positions disclosed, if different from 1(a):

The naming of nominee or vehicle companies is insufficient.

For a trust, the trustee(s), settlor and beneficiaries must be named.

|

1. Runa Capital Fund II, L.P., represented by its general partner Runa Capital II (GP);

2. Runa Capital Opportunity Fund I, L.P., represented by its general partner Runa Capital Opportunity I (GP);

3. Runa Ventures I Limited, represented by its managing shareholder Runa Capital Opportunity I (GP) |

|

(c) Name

of offeror/offeree in relation to whose relevant securities this form relates:

Use a separate form for each offeror/offeree

|

MariaDB plc |

| (d) Is the discloser the offeror or the offeree? |

OFFEROR |

|

(e) Date

position held:

The latest practicable date prior to the disclosure |

September 26, 2023 |

|

(f) In

addition to the company in 1(c) above, is the discloser also making disclosures in respect of any other party to the offer?

If it is a cash offer or possible cash offer, state “N/A”

|

NO

If YES, specify which:

|

| 2. | INTERESTS AND SHORT POSITIONS |

If there are interests and positions to

disclose in more than one class of relevant securities of the offeror or offeree named in 1(c), copy table 2 for each additional class

of relevant security.

Interests and short positions in the relevant

securities of the offeror or offeree to which the disclosure relates (Note 1)

Class of relevant security: (Note 2)

| | |

Interests | | |

Short positions | |

| | |

Number | | |

% | | |

Number | | |

% | |

| (1) Relevant securities owned and/or controlled: | |

| 5,269,012 | | |

| 7.8 | | |

| | | |

| | |

| (2) Cash-settled derivatives: | |

| 0 | | |

| | | |

| 0 | | |

| | |

| (3) Stock-settled derivatives (including options) and agreements to purchase/ sell: | |

| 0 | | |

| | | |

| 0 | | |

| | |

| Total: | |

| 5,269,012 | | |

| 7.8 | | |

| 0 | | |

| | |

All interests and all short positions should

be disclosed.

Details of options including rights to

subscribe for new securities and any open stock-settled derivative positions (including traded options), or agreements to purchase or

sell relevant securities, should be given on a Supplemental Form 8.

| 3. | INTERESTS AND SHORT POSITIONS OF PERSONS ACTING IN CONCERT WITH THE PARTY MAKING

THE DISCLOSURE |

| Details of any interests and short positions (including directors’ and other employee options) of any person acting in concert with the party making the disclosure: |

| None. |

Details of any open stock-settled derivative

positions (including traded options), or agreements to purchase or sell relevant securities, should be given on a Supplemental Form 8.

| (b) | Indemnity and other dealing arrangements |

| Details of any indemnity or option arrangement, or any agreement or understanding, formal or informal, relating to relevant securities which may be an inducement to deal or refrain from dealing entered into by the party to the offer making the disclosure or any person acting in concert with it: |

| |

| Irrevocable commitments and letters of intent should not be included. If there are no such agreements, arrangements or understandings, state “none” |

| None. |

| (b) | Agreements, arrangements or understandings relating to options or derivatives |

| Full details of any agreement, arrangement or understanding between the person disclosing and any other person relating to the voting rights of any relevant securities under any option referred to on this form or relating to the voting rights or future acquisition or disposal of any relevant securities to which any derivative referred to on this form is referenced. If none, this should be stated. |

| None. |

| Is a Supplemental Form 8 attached? |

YES/NO |

| |

No |

| Date of disclosure: |

September 26, 2023 |

| Contact name: |

Murat Akuyev, General Counsel, Runa Capital, Inc. |

| Telephone number: |

+1.646.629.9838 |

Public disclosures under Rule 8.1 of the

Rules must be made to a Regulatory Information Service.

Ap12

NOTES ON FORM 8.1(a) and (b)

1. See

the definition of “interest in a relevant security” in Rule 2.5 of Part A of the Rules and see Rule 8.6(a) of Part B of the

Rules.

2. See

the definition of “relevant securities” in Rule 2.1 of Part A of the Rules.

3. If

details included in a disclosure under Rule 8 are incorrect, they should be corrected as soon as practicable in a subsequent disclosure.

Such disclosure should state clearly that it corrects details disclosed previously, identify the disclosure or disclosures being corrected,

and provide sufficient detail for the reader to understand the nature of the corrections. In the case of any doubt, the Panel should be

consulted.

For full details of disclosure requirements,

see Rule 8 of the Rules. If in doubt, consult the Panel.

References in these notes to “the

Rules” are to the Irish Takeover Panel Act, 1997, Takeover Rules, 2022.

4

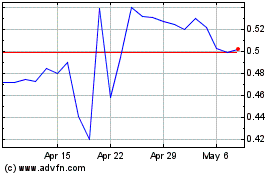

MariaDB (NYSE:MRDB)

Historical Stock Chart

From Jun 2024 to Jul 2024

MariaDB (NYSE:MRDB)

Historical Stock Chart

From Jul 2023 to Jul 2024