UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

☐

|

Definitive Additional Materials

|

|

|

☒

|

Soliciting Material under §240.14a-12

|

Monmouth Real Estate Investment Corporation

(Name of Registrant as Specified In Its Charter)

Blackwells Capital LLC

Jason Aintabi

Craig M. Hatkoff

Jennifer M. Hill

Todd S. Schuster

Allison Nagelberg

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

Blackwells Capital LLC (“Blackwells”),

together with the other participants named herein, has filed a preliminary proxy statement and accompanying GREEN proxy card with the

Securities and Exchange Commission (the “SEC”), to be used to solicit votes for the election of its slate of highly-qualified

director candidates at the 2021 annual meeting of stockholders (including any other meeting of stockholders held in lieu thereof, and

adjournments, postponements, reschedulings or continuations thereof, the “Annual Meeting”) of Monmouth Real Estate Investment

Corporation, a Maryland corporation (the “Company”), and for the approval of six business proposals to be presented at the

Annual Meeting.

On May 5, 2021, after the close of business, the following

article was published by Crain’s Chicago Business:

Will Sam Zell's big bet on industrial real estate pay off?

The billionaire financier is jumping into an especially hot property

sector, but he insists he’s not too late to the party.

Crain’s Chicago Business

By Alby Gallun

5 May 2021

If there’s anything Sam Zell doesn’t like to do, it’s

running with the herd. “When everyone is going left, look right,” is a favorite saying of his.

So why would one of the most famous contrarians in finance pile into

a frothy industrial real estate market that’s already awash in capital from other investors? Some real estate pros are asking that

question after hearing about plans by a Zell-led company, Chicago-based Equity Commonwealth, to take over a New Jersey-based industrial

landlord, Monmouth Real Estate Investment, in a $3.4 billion deal.

The industrial market is flourishing during a pandemic that has crushed

other sectors, especially retail and hotels. With more people shopping online, demand for warehouse space is booming as retail, logistics

and e-commerce firms like Amazon expand their supply chains. Property values are also soaring—not exactly a stylistic fit for an

investor like Zell who seeks out-of-favor assets.

“One could argue if Sam Zell came around and put a stake in

the ground on retail or returning into the office, that may have more meaning than being arguably a little late to the industrial party,”

Michael Bilerman, an analyst at Citi, said on a conference call today with Zell and other Equity Commonwealth executives.

Zell wouldn’t concede the point, saying “I don’t

think we’re too late” in an industrial sector “that has a very significant amount of room yet to grow.” It’s

too early to buy retail property and it’s hard to find attractive deals in the office sector, he said on the call. Plus, Equity

Commonwealth is sitting on a big pile of cash to expand its industrial portfolio.

“Yes, the industrial space is very crowded at the moment,”

Zell said. “But I don't think it's crowded with too many people with $5 billion of buying capability and cash on the balance sheet.

And it's going to be up to us to take advantage of that set of circumstances.”

The Monmouth acquisition may remind some of another big deal in a

hot real estate market: the $7.2 billion takeover in 2001 of Spieker Properties by Equity Office, an office real estate investment trust

led by Zell.

Zell faced a lot of criticism from analysts and investors for buying

Spieker, which had a heavy concentration of office buildings in tech-heavy markets, just as the tech market was crashing. Zell managed

to write a happy ending to that story. He burnished his reputation as a savvy market timer by selling Equity Office in a $39 billion blockbuster

deal in 2007, as the economy and office market were peaking.

That’s one reason few investors are willing to bet against

Zell, a 79 year old with a $5.4 billion fortune, according to Forbes. Nicknamed the “Grave Dancer,” he’s best known

as a buyer of distressed assets, but Zell describes himself as a “professional opportunist,” an investor with a much broader

repertoire.

He saw an opportunity in 2014 when he teamed up with an investor

group to take over the leadership of a company called Commonwealth REIT. The Newtown, Mass.-based office landlord faced criticism for

poor management and conflicts of interest that depressed its share price. Dissident shareholders tossed out the board and brought in Zell

and longtime lieutenant David Helfand to run the company.

They quickly moved the business to Chicago and renamed it Equity

Commonwealth, an adopted sibling for Zell’s other two REITs, Equity Residential, a big apartment landlord, and Equity Lifestyle

Properties, a mobile-home park owner.

Since then, Equity Commonwealth has been selling off buildings and

amassing a war chest for a big acquisition. It only owns four office properties today. After the pandemic sent the economy and real estate

market into the dumps last spring, many investors pondered the possibility of a major distressed deal.

That’s why some may have been surprised by the Monmouth deal.

The REIT owns 120 properties totaling 24.5 million square feet, including nine in Illinois, and it’s not struggling with low occupancies

or bad debt.

But Monmouth has obvious parallels to Commonwealth circa 2014. Its

management and board also are facing criticism for insider-friendly arrangements and poor stock performance. Two shareholders have been

agitating for change.

One of them, Blackwells Capital, a New York-based hedge-fund manager,

made an unsolicited $18-per-share cash offer for the Monmouth in December. Even though it’s hard to find value in the industrial

market today, a takeover could create value for Monmouth shareholders merely by putting its portfolio under new management.

Still, Blackwells could complicate matters for Zell by sweetening

its bid for Monmouth. Equity Commonwealth’s friendly all-stock deal works out to $19.40 per share, or $19.58 including an extra

dividend payment. Blackwells criticized the offer as “wholly inadequate” and said it will “consider its options”

after reviewing merger documents.

That raises the prospect of a bidding war for Monmouth, something

that Equity Commonwealth executives almost certainly have gamed out. Monmouth shares closed today at $19.35, up 6 percent but below Equity

Commonwealth’s offer, suggesting that investors don’t expect higher bids. Many may be wondering how much Zell is willing to

pay to join the herd.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

BLACKWELLS STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ THE

PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS

WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION

WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO BLACKWELLS.

The participants in the proxy solicitation are Blackwells, Jason Aintabi,

Craig M. Hatkoff, Jennifer M. Hill, Allison Nagelberg, and Todd S. Schuster (collectively, the “Participants”).

As of the date hereof, Blackwells beneficially owns 304,400 shares of the

Company’s common stock, par value $0.01 per share (the “Common Stock”), including 124,300 shares of Common Stock underlying

call options exercisable within sixty (60) days of the date hereof. As of the date hereof, Mr. Aintabi beneficially owns 3,386,425 shares

of Common Stock, including (i) 304,400 shares of Common Stock owned by Blackwells, of which Mr. Aintabi may be deemed the beneficial owner,

as Managing Partner of Blackwells, and (ii) 3,067,025 shares of Common Stock beneficially owned by BW Coinvest Management I LLC, which

Mr. Aintabi, as the owner and President & Secretary of Blackwells Asset Management LLC, the owner and sole member of BW Coinvest Management

I LLC, may be deemed to beneficially own. As of the date hereof, Ms. Nagelberg is the beneficial owner of 64,199.9401 shares of Common

Stock, and Mr. Schuster is the beneficial owner of 80,248 shares of Common Stock. Neither Ms. Hill nor Mr. Hatkoff owns any shares of

Common Stock as of the date hereof. Collectively, the Participants beneficially own in the aggregate approximately 3,530,872.9401 shares

of Common Stock, including 124,300 shares of Common Stock underlying call options exercisable within sixty (60) days of the date hereof,

representing approximately 3.59% of the outstanding shares of Common Stock.

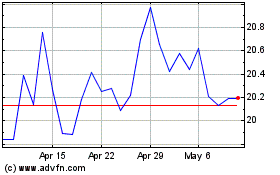

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Jun 2024 to Jul 2024

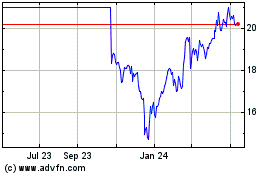

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Jul 2023 to Jul 2024