Loma Negra Reports 1Q24 results Buenos Aires, May 9, 2024 – Loma Negra, (NYSE: LOMA; BYMA: LOMA), (“Loma Negra” or the “Company”), the leading cement producer in Argentina, today announced results for the three-month period ended March 31, 2024 (our “1Q24 Results”). 1Q24 Key Highlights Net sales revenues stood at Ps. 114,851 million (US$ 123 million), and decreased by 27.0% YoY, mainly explained by a decrease of 31,3% in the Cement segment sales volumes, with the other businesses following the same trend. Consolidated Adjusted EBITDA reached Ps. 25,961 million, decreasing 37.1% YoY in adjusted pesos, while in dollars it reached 42 million, down 33.9% from 1Q23. The Consolidated Adjusted EBITDA margin stood at 22.6%, contracting 360 basis points YoY from 26.2%. On a sequential basis, the margin remained almost flat despite the decrease in volume, contracting by only 21 basis points. Net Profit of Ps. 50,703 million, up 151.0% from Ps. 20,200 million in the same period of the previous year, mainly explained by the net total finance gain. Net Debt stood at Ps. 177.323 million (US$ 207 million), representing a Net Debt/LTM Adjusted EBITDA ratio of 1.30x compared with 1.40x in FY23. The Company has presented certain financial figures, Table 1b and Table 11, in U.S. dollars and Pesos without giving effect to IAS 29. The Company has prepared all other financial information herein by applying IAS 29. Commenting on the financial and operating performance for the first quarter of 2024, Sergio Faifman, Loma Negra’s Chief Executive Officer, noted: “We are starting a year full of new challenges, while the country is also entering a new stage in its quest for economic stabilization and growth. The stabilization plan being carried out by the new government after the sharp devaluation in December has quickly succeeded in significantly reducing inflation and achieving a fiscal surplus. However, economic activity remains in negative territory, affecting the construction industry. We understand that we are going through a transition period and that soon we will begin to see the positive effects of a normalized economy, setting the stage for sustainable growth. In this context, I’m glad to present our results for the first quarter. Despite the complexity of the situation, marked by a significant drop in shipments, we have managed to close a positive quarter for the company. This achievement was mainly supported by the pillars of LOMA’s robustness: our leadership position, backed by our production efficiency, expertise, and flexibility. Diving into the quarterly results, we managed to post an Adjusted EBITDA of US$42 million, maintaining a solid US$39 per ton, at a similar level when compared year-on-year and on a sequential basis. We have focused on protecting our profitability while maintaining a solid balance sheet. Looking ahead, we are cautiously optimistic that we have likely seen the worst part of this transition period in terms of activity levels, and we expect to see a gradual recovery in the upcoming quarters.”

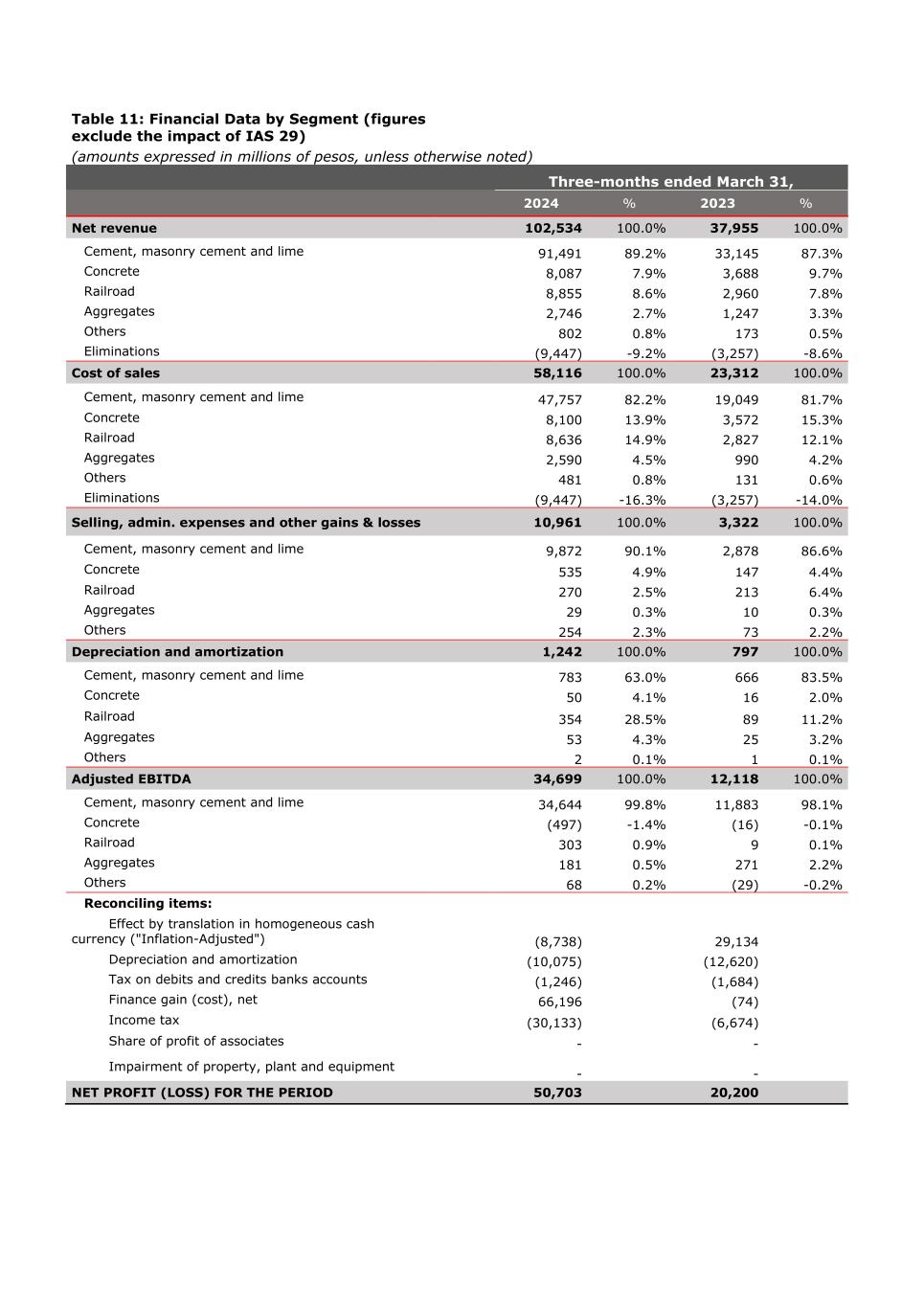

Table 1: Financial Highlights (amounts expressed in millions of pesos, unless otherwise noted) Three-months ended March 31, 2024 2023 % Chg. Net revenue 114,851 157,435 -27.0% Gross Profit 29,036 43,221 -32.8% Gross Profit margin 25.3% 27.5% -217 bps Adjusted EBITDA 25,961 41,252 -37.1% Adjusted EBITDA Mg. 22.6% 26.2% -360 bps Net Profit (Loss) 50,703 20,200 151.0% Net Profit (Loss) attributable to owners of the Company 50,752 20,448 148.2% EPS 86.9834 35.0390 148.2% Average outstanding shares (*) 583 584 0.0% Net Debt 177,323 88,660 100.0% Net Debt /LTM Adjusted EBITDA 1.30x 0.46x 1.84x (*) Net of shares repurchased Table 1b: Financial Highlights in Ps and in U.S. dollars (figures exclude the impact of IAS 29) In million Ps. Three-months ended March 31, 2024 2023 % Chg. Net revenue 102,534 37,955 170.1% Adjusted EBITDA 34,699 12,118 186.3% Adjusted EBITDA Mg. 33.8% 31.9% +191 bps Net Profit (Loss) 16,717 7,402 125.8% Net Debt 177,323 88,660 100.0% Net Debt /LTM Adjusted EBITDA 1.30x 0.46x 1.84x In million US$ Three-months ended March 31, 2024 2023 % Chg. Ps./US$, av 833.72 192.45 333.2% Ps./US$, eop 857.42 208.99 310.3% Net revenue 123 197 -37.6% Adjusted EBITDA 42 63 -33.9% Adjusted EBITDA Mg. 33.8% 31.9% +191 bps Net Profit (Loss) 20 38 -47.9% Net Debt 207 424 -51.3% Net Debt /LTM Adjusted EBITDA 1.30x 0.46x 1.84x

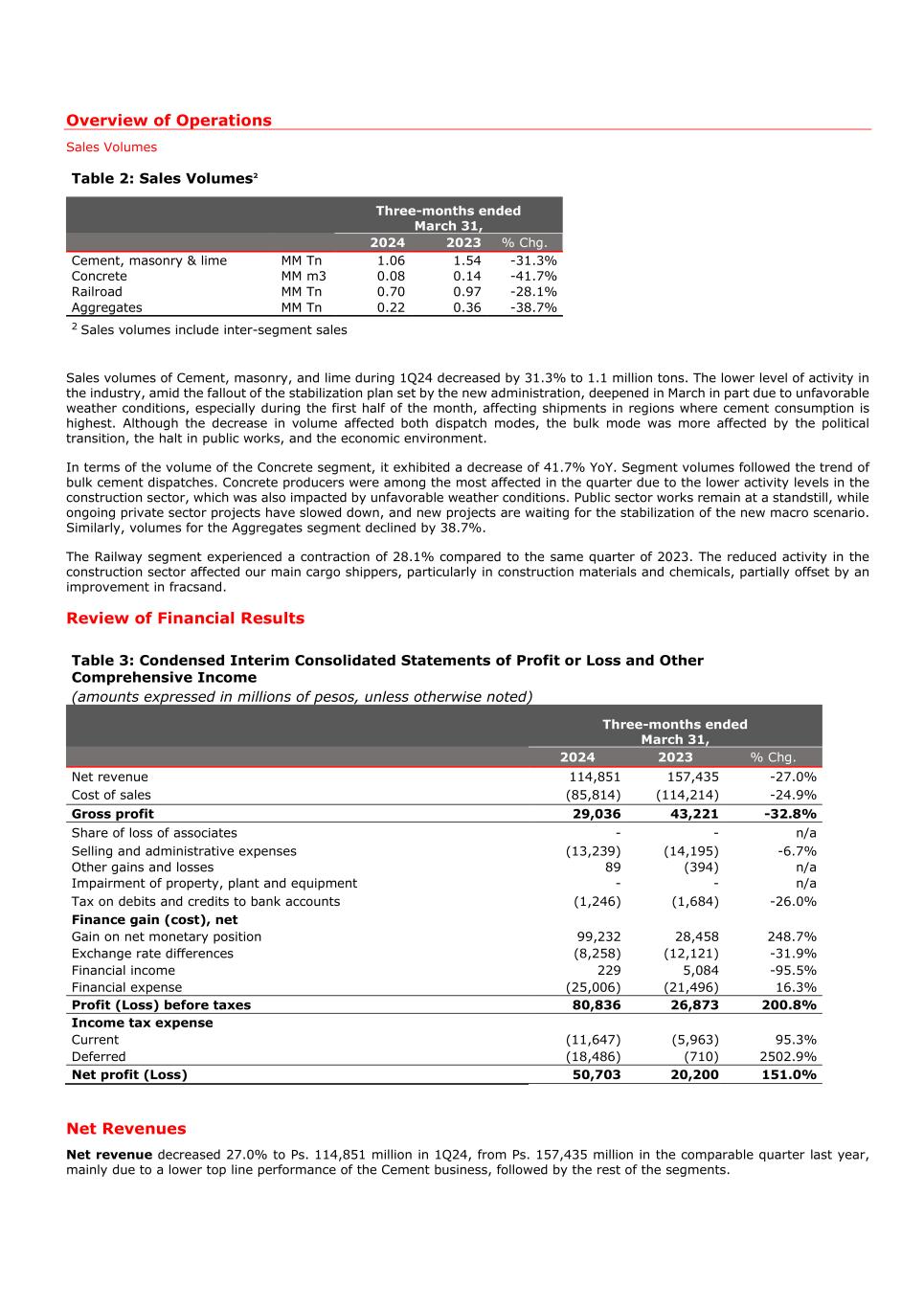

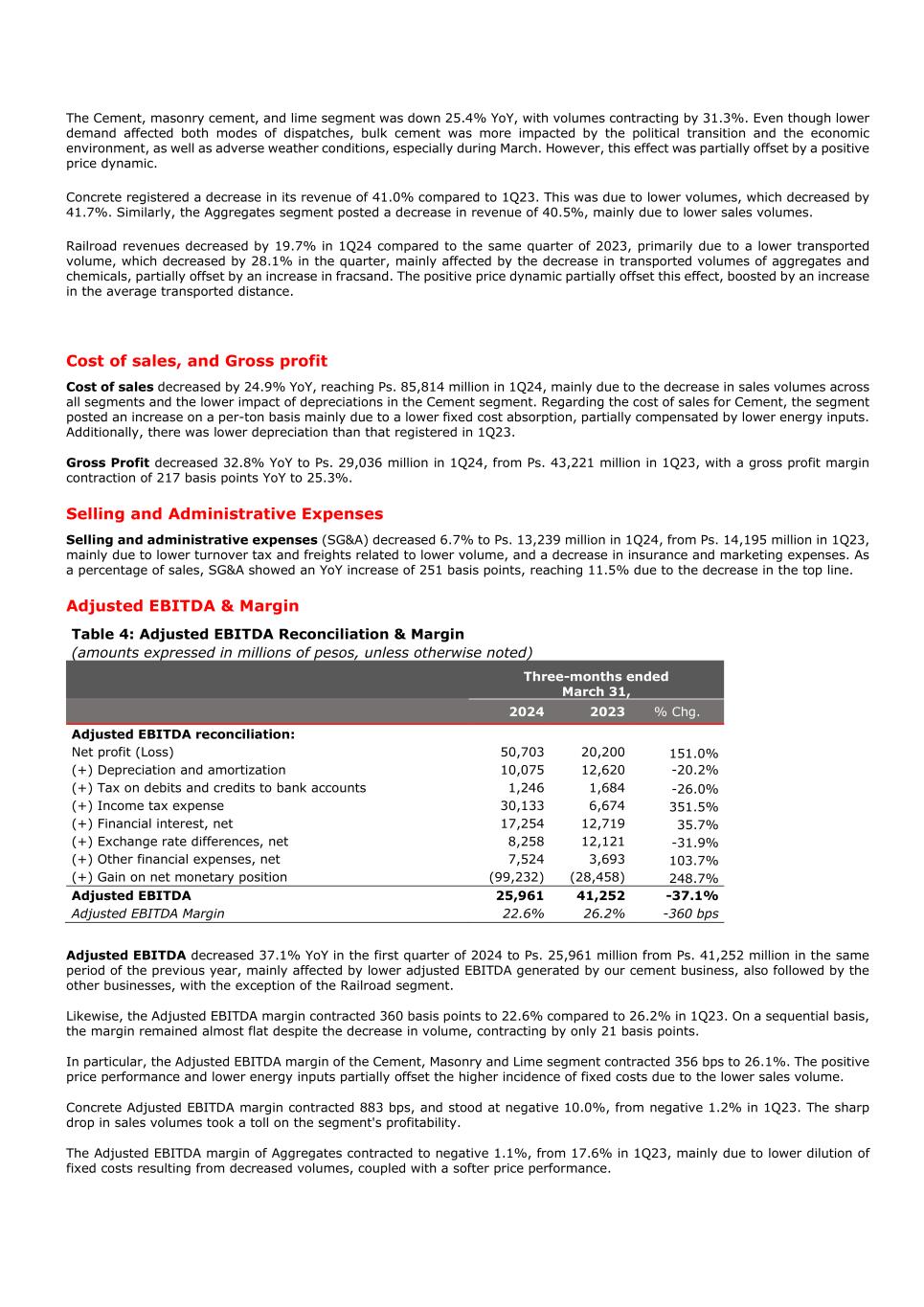

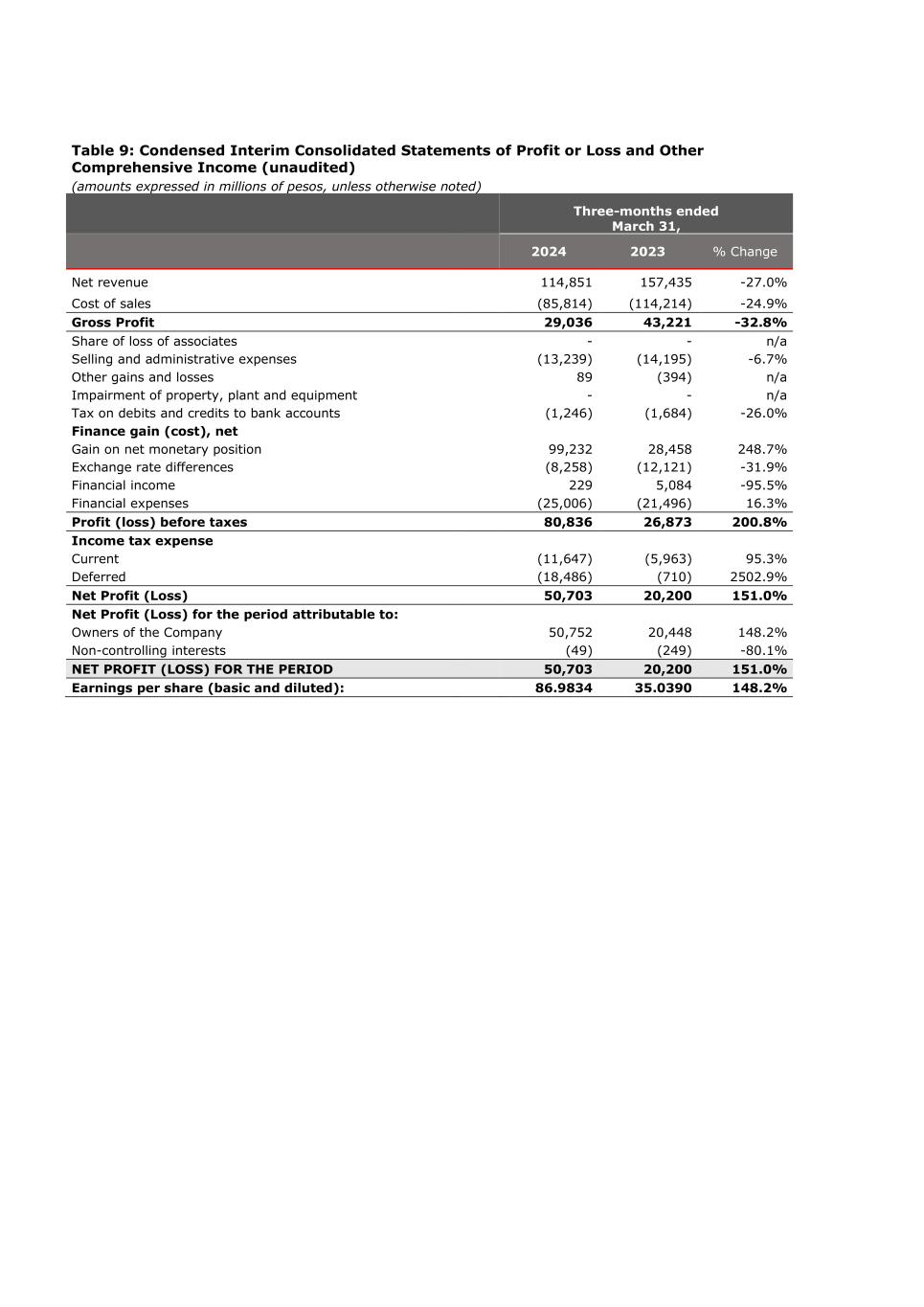

Overview of Operations Sales Volumes Table 2: Sales Volumes2 Three-months ended March 31, 2024 2023 % Chg. Cement, masonry & lime MM Tn 1.06 1.54 -31.3% Concrete MM m3 0.08 0.14 -41.7% Railroad MM Tn 0.70 0.97 -28.1% Aggregates MM Tn 0.22 0.36 -38.7% 2 Sales volumes include inter-segment sales Sales volumes of Cement, masonry, and lime during 1Q24 decreased by 31.3% to 1.1 million tons. The lower level of activity in the industry, amid the fallout of the stabilization plan set by the new administration, deepened in March in part due to unfavorable weather conditions, especially during the first half of the month, affecting shipments in regions where cement consumption is highest. Although the decrease in volume affected both dispatch modes, the bulk mode was more affected by the political transition, the halt in public works, and the economic environment. In terms of the volume of the Concrete segment, it exhibited a decrease of 41.7% YoY. Segment volumes followed the trend of bulk cement dispatches. Concrete producers were among the most affected in the quarter due to the lower activity levels in the construction sector, which was also impacted by unfavorable weather conditions. Public sector works remain at a standstill, while ongoing private sector projects have slowed down, and new projects are waiting for the stabilization of the new macro scenario. Similarly, volumes for the Aggregates segment declined by 38.7%. The Railway segment experienced a contraction of 28.1% compared to the same quarter of 2023. The reduced activity in the construction sector affected our main cargo shippers, particularly in construction materials and chemicals, partially offset by an improvement in fracsand. Review of Financial Results Table 3: Condensed Interim Consolidated Statements of Profit or Loss and Other Comprehensive Income (amounts expressed in millions of pesos, unless otherwise noted) Three-months ended March 31, 2024 2023 % Chg. Net revenue 114,851 157,435 -27.0% Cost of sales (85,814) (114,214) -24.9% Gross profit 29,036 43,221 -32.8% Share of loss of associates - - n/a Selling and administrative expenses (13,239) (14,195) -6.7% Other gains and losses 89 (394) n/a Impairment of property, plant and equipment - - n/a Tax on debits and credits to bank accounts (1,246) (1,684) -26.0% Finance gain (cost), net Gain on net monetary position 99,232 28,458 248.7% Exchange rate differences (8,258) (12,121) -31.9% Financial income 229 5,084 -95.5% Financial expense (25,006) (21,496) 16.3% Profit (Loss) before taxes 80,836 26,873 200.8% Income tax expense Current (11,647) (5,963) 95.3% Deferred (18,486) (710) 2502.9% Net profit (Loss) 50,703 20,200 151.0% Net Revenues Net revenue decreased 27.0% to Ps. 114,851 million in 1Q24, from Ps. 157,435 million in the comparable quarter last year, mainly due to a lower top line performance of the Cement business, followed by the rest of the segments.

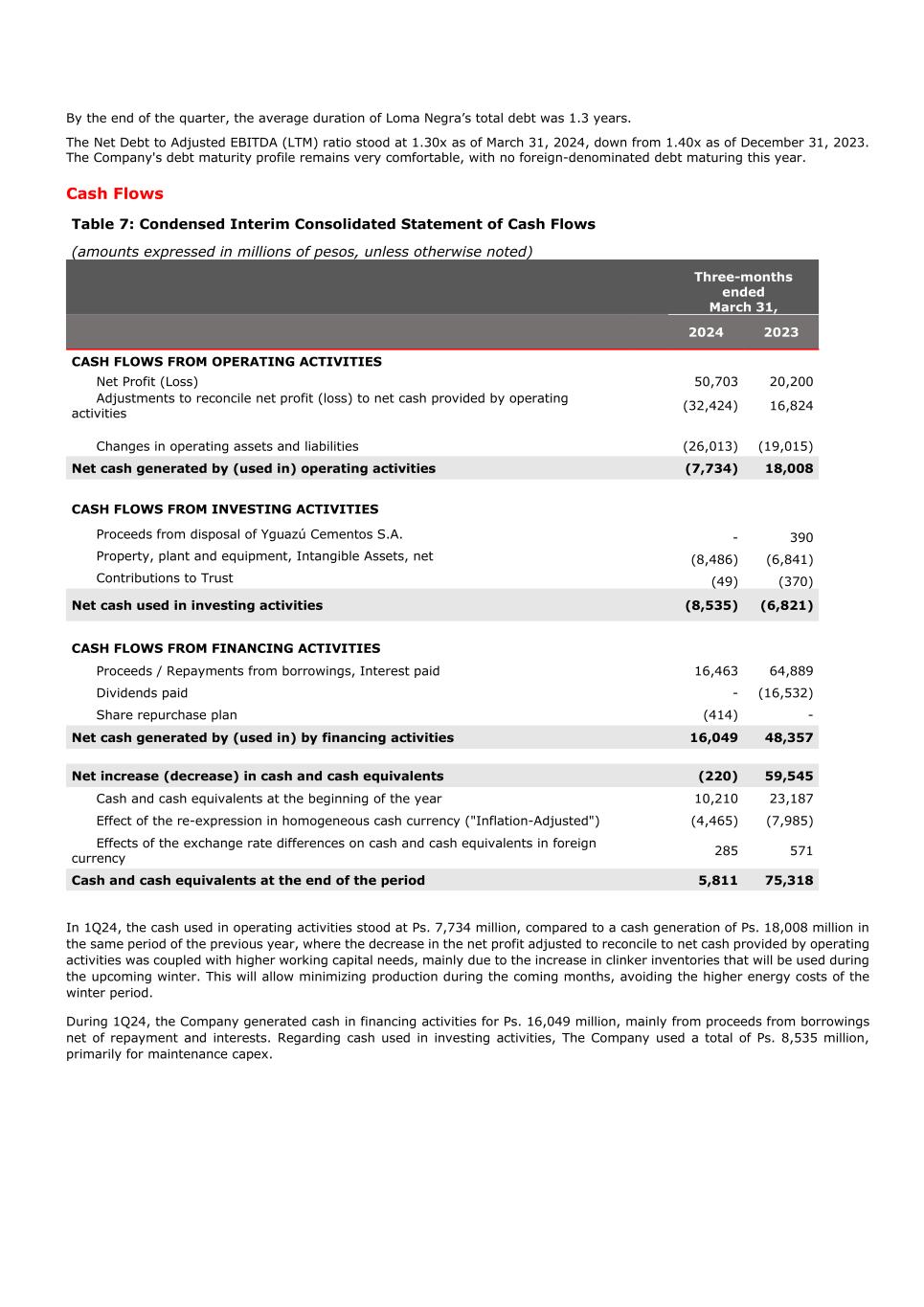

The Cement, masonry cement, and lime segment was down 25.4% YoY, with volumes contracting by 31.3%. Even though lower demand affected both modes of dispatches, bulk cement was more impacted by the political transition and the economic environment, as well as adverse weather conditions, especially during March. However, this effect was partially offset by a positive price dynamic. Concrete registered a decrease in its revenue of 41.0% compared to 1Q23. This was due to lower volumes, which decreased by 41.7%. Similarly, the Aggregates segment posted a decrease in revenue of 40.5%, mainly due to lower sales volumes. Railroad revenues decreased by 19.7% in 1Q24 compared to the same quarter of 2023, primarily due to a lower transported volume, which decreased by 28.1% in the quarter, mainly affected by the decrease in transported volumes of aggregates and chemicals, partially offset by an increase in fracsand. The positive price dynamic partially offset this effect, boosted by an increase in the average transported distance. Cost of sales, and Gross profit Cost of sales decreased by 24.9% YoY, reaching Ps. 85,814 million in 1Q24, mainly due to the decrease in sales volumes across all segments and the lower impact of depreciations in the Cement segment. Regarding the cost of sales for Cement, the segment posted an increase on a per-ton basis mainly due to a lower fixed cost absorption, partially compensated by lower energy inputs. Additionally, there was lower depreciation than that registered in 1Q23. Gross Profit decreased 32.8% YoY to Ps. 29,036 million in 1Q24, from Ps. 43,221 million in 1Q23, with a gross profit margin contraction of 217 basis points YoY to 25.3%. Selling and Administrative Expenses Selling and administrative expenses (SG&A) decreased 6.7% to Ps. 13,239 million in 1Q24, from Ps. 14,195 million in 1Q23, mainly due to lower turnover tax and freights related to lower volume, and a decrease in insurance and marketing expenses. As a percentage of sales, SG&A showed an YoY increase of 251 basis points, reaching 11.5% due to the decrease in the top line. Adjusted EBITDA & Margin Table 4: Adjusted EBITDA Reconciliation & Margin (amounts expressed in millions of pesos, unless otherwise noted) Three-months ended March 31, 2024 2023 % Chg. Adjusted EBITDA reconciliation: Net profit (Loss) 50,703 20,200 151.0% (+) Depreciation and amortization 10,075 12,620 -20.2% (+) Tax on debits and credits to bank accounts 1,246 1,684 -26.0% (+) Income tax expense 30,133 6,674 351.5% (+) Financial interest, net 17,254 12,719 35.7% (+) Exchange rate differences, net 8,258 12,121 -31.9% (+) Other financial expenses, net 7,524 3,693 103.7% (+) Gain on net monetary position (99,232) (28,458) 248.7% Adjusted EBITDA 25,961 41,252 -37.1% Adjusted EBITDA Margin 22.6% 26.2% -360 bps Adjusted EBITDA decreased 37.1% YoY in the first quarter of 2024 to Ps. 25,961 million from Ps. 41,252 million in the same period of the previous year, mainly affected by lower adjusted EBITDA generated by our cement business, also followed by the other businesses, with the exception of the Railroad segment. Likewise, the Adjusted EBITDA margin contracted 360 basis points to 22.6% compared to 26.2% in 1Q23. On a sequential basis, the margin remained almost flat despite the decrease in volume, contracting by only 21 basis points. In particular, the Adjusted EBITDA margin of the Cement, Masonry and Lime segment contracted 356 bps to 26.1%. The positive price performance and lower energy inputs partially offset the higher incidence of fixed costs due to the lower sales volume. Concrete Adjusted EBITDA margin contracted 883 bps, and stood at negative 10.0%, from negative 1.2% in 1Q23. The sharp drop in sales volumes took a toll on the segment's profitability. The Adjusted EBITDA margin of Aggregates contracted to negative 1.1%, from 17.6% in 1Q23, mainly due to lower dilution of fixed costs resulting from decreased volumes, coupled with a softer price performance.

Finally, the Adjusted EBITDA margin of the Railroad segment improved 161 bps to 0.4% in the first quarter, from negative 1.2% in 1Q23, primarily due to the positive price performance and a better result in other gains that deflected the cost increase. Finance Costs-Net Table 5: Finance Gain (Cost), net (amounts expressed in millions of pesos, unless otherwise noted) Three-months ended March 31, 2024 2023 % Chg. Exchange rate differences (8,258) (12,121) -31.9% Financial income 229 5,084 -95.5% Financial expense (25,006) (21,496) 16.3% Gain on net monetary position 99,232 28,458 248.7% Total Finance Gain (Cost), Net 66,196 (74) n/a During 1Q24, the Company reported a total Net Financial Gain of Ps. 66,196 million compared to a total net financial cost of Ps. 74 million in 1Q23, primarily resulting from the inflation adjustment on the net monetary position. This effect was partially offset by a higher net financial expense due to the increased debt position and lower financial income resulting from the decreased cash position. Net Profit and Net Profit Attributable to Owners of the Company Net Profit of Ps. 50,7 billion in 1Q24 compared to a net profit of Ps. 20,2 billion in the same period of the previous year. The higher total financial gain, primarily due to the positive effect of inflation on the net monetary position is the main reason for the variation, which was partially offset by the lower operational result and higher income tax expense. Net Profit Attributable to Owners of the Company stood at Ps. 50,7 billion. During the quarter, the Company reported a gain per common share of Ps. 86.9834 and an ADR gain of Ps. 434.9171, compared to a gain per common share of Ps. 35.0390 and a gain per ADR of Ps. 175.1950 in 1Q23. Capitalization Table 6: Capitalization and Debt Ratio (amounts expressed in millions of pesos, unless otherwise noted) As of March 31, As of December, 31 2024 2023 2023 Total Debt 183,134 163,978 223,446 - Short-Term Debt 65,914 34,405 56,441 - Long-Term Debt 117,219 129,573 167,005 Cash, Cash Equivalents and Investments (5,811) (75,318) (10,210) Total Net Debt 177,323 88,660 213,235 Shareholder's Equity 496,494 567,779 446,104 Capitalization 679,627 731,758 669,550 LTM Adjusted EBITDA 136,863 194,530 152,154 Net Debt /LTM Adjusted EBITDA 1.30x 0.46x 1.40x As of March 31, 2024, total Cash, Cash Equivalents, and Investments were Ps. 5,811 million compared with Ps. 75,318 million as of March 31, 2023. Total debt at the close of the quarter stood at Ps. 183,134 million, composed by Ps. 65,914 million in short-term borrowings, including the current portion of long-term borrowings (or 36% of total borrowings), and Ps. 117,219 million in long-term borrowings (or 64% of total borrowings). At the close of the first quarter of 2024, 65% (or Ps. 118,767 million) of Loma Negra’s total debt was denominated in U.S. dollars, and 35% (or Ps. 64,367 million) was in Pesos. As of March 31, 2024, 21% of the Company's consolidated loans accrued interest at a variable rate, primarily based on BADLAR, as it is debt in pesos. The remaining 79% accrues interest at a fixed rate in foreign currency.

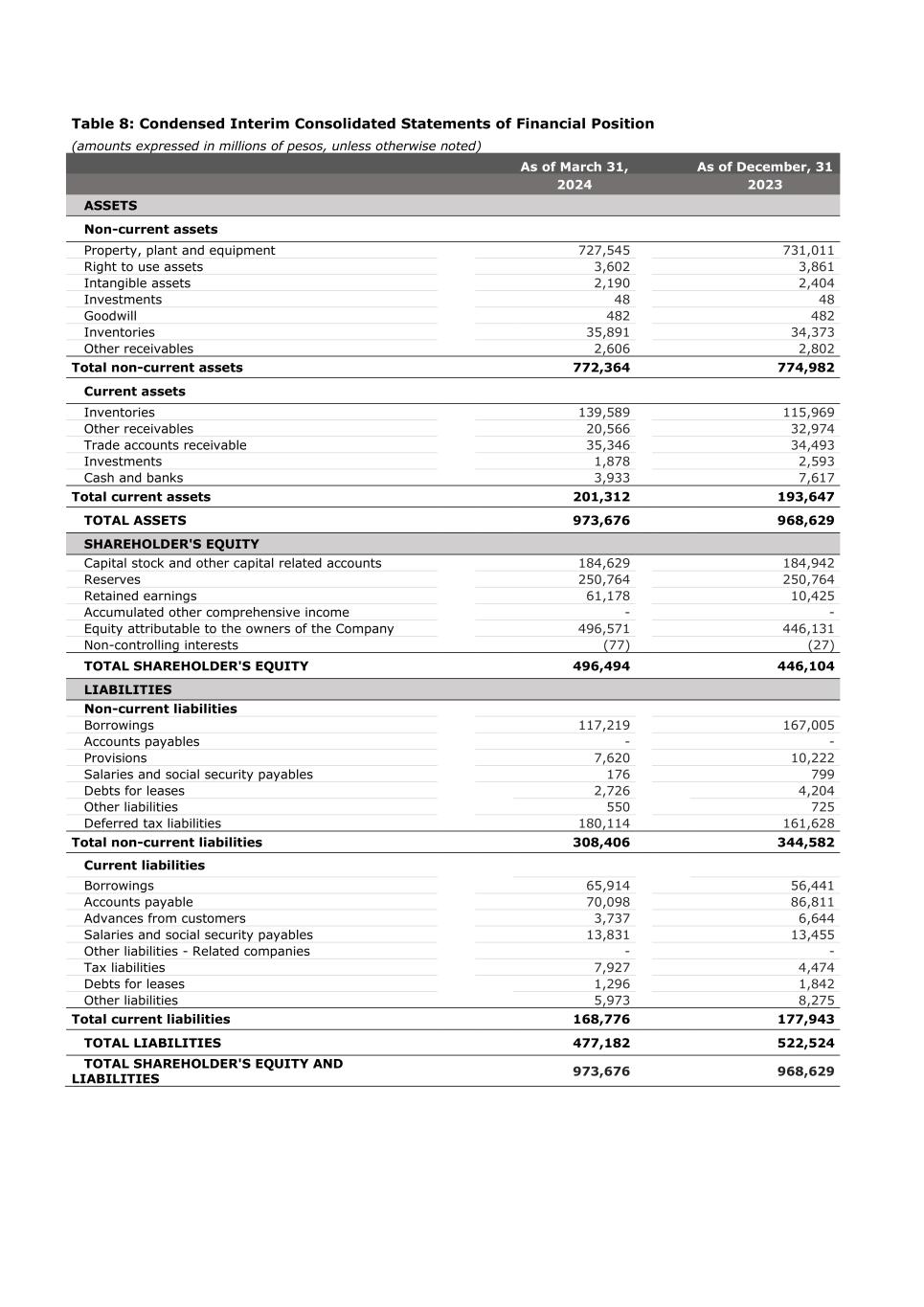

By the end of the quarter, the average duration of Loma Negra’s total debt was 1.3 years. The Net Debt to Adjusted EBITDA (LTM) ratio stood at 1.30x as of March 31, 2024, down from 1.40x as of December 31, 2023. The Company's debt maturity profile remains very comfortable, with no foreign-denominated debt maturing this year. Cash Flows Table 7: Condensed Interim Consolidated Statement of Cash Flows (amounts expressed in millions of pesos, unless otherwise noted) Three-months ended March 31, 2024 2023 CASH FLOWS FROM OPERATING ACTIVITIES Net Profit (Loss) 50,703 20,200 Adjustments to reconcile net profit (loss) to net cash provided by operating activities (32,424) 16,824 Changes in operating assets and liabilities (26,013) (19,015) Net cash generated by (used in) operating activities (7,734) 18,008 CASH FLOWS FROM INVESTING ACTIVITIES Proceeds from disposal of Yguazú Cementos S.A. - 390 Property, plant and equipment, Intangible Assets, net (8,486) (6,841) Contributions to Trust (49) (370) Net cash used in investing activities (8,535) (6,821) CASH FLOWS FROM FINANCING ACTIVITIES Proceeds / Repayments from borrowings, Interest paid 16,463 64,889 Dividends paid - (16,532) Share repurchase plan (414) - Net cash generated by (used in) by financing activities 16,049 48,357 Net increase (decrease) in cash and cash equivalents (220) 59,545 Cash and cash equivalents at the beginning of the year 10,210 23,187 Effect of the re-expression in homogeneous cash currency ("Inflation-Adjusted") (4,465) (7,985) Effects of the exchange rate differences on cash and cash equivalents in foreign currency 285 571 Cash and cash equivalents at the end of the period 5,811 75,318 In 1Q24, the cash used in operating activities stood at Ps. 7,734 million, compared to a cash generation of Ps. 18,008 million in the same period of the previous year, where the decrease in the net profit adjusted to reconcile to net cash provided by operating activities was coupled with higher working capital needs, mainly due to the increase in clinker inventories that will be used during the upcoming winter. This will allow minimizing production during the coming months, avoiding the higher energy costs of the winter period. During 1Q24, the Company generated cash in financing activities for Ps. 16,049 million, mainly from proceeds from borrowings net of repayment and interests. Regarding cash used in investing activities, The Company used a total of Ps. 8,535 million, primarily for maintenance capex.

1Q24 Earnings Conference Call When: 10:00 a.m. U.S. ET (12:00 p.m. BAT), May 10, 2024 Dial-in: 0800-444-2930 (Argentina), 1-833-255-2824 (U.S.), 1-866-605-3852 (Canada), 1-412-902-6701 (International) Password: Loma Negra Call Webcast: https://event.choruscall.com/mediaframe/webcast.html?webcastid=LWBQYPBx Replay: A telephone replay of the conference call will be available until May 17, 2024. The replay can be accessed by dialing 1-877-344-7529 (U.S. toll free), or 1-412-317-0088 (International). The passcode for the replay is 9762627. The audio of the conference call will also be archived on the Company’s website at www.lomanegra.com Definitions Adjusted EBITDA is calculated as net profit plus financial interest, net plus income tax expense plus depreciation and amortization plus exchange rate differences plus other financial expenses, net plus tax on debits and credits to bank accounts, plus share of loss of associates, plus net Impairment of Property, plant and equipment, and less income from discontinued operation. Loma Negra believes that excluding tax on debits and credits to bank accounts from its calculation of Adjusted EBITDA is a better measure of operating performance when compared to other international players. Net Debt is calculated as borrowings less cash, cash equivalents and short-term investments. About Loma Negra Founded in 1926, Loma Negra is the leading cement company in Argentina, producing and distributing cement, masonry cement, aggregates, concrete and lime, products primarily used in private and public construction. Loma Negra is a vertically-integrated cement and concrete company, with nationwide operations, supported by vast limestone reserves, strategically located plants, top-of-mind brands and established distribution channels. Loma Negra is listed both on BYMA and on NYSE in the U.S., where it trades under the symbol “LOMA”. One ADS represents five (5) common shares. For more information, visit www.lomanegra.com. Note The Company presented some figures converted from Pesos to U.S. dollars for comparison purposes. The exchange rate used to convert Pesos to U.S. dollars was the reference exchange rate (Communication “A” 3500) reported by the Central Bank for U.S. dollars. The information presented in U.S. dollars is for the convenience of the reader only. Certain figures included in this report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be arithmetic aggregations of the figures presented in previous quarters. Rounding: We have made rounding adjustments to reach some of the figures included in this annual report. As a result, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them. Disclaimer This release contains forward-looking statements within the meaning of federal securities law that are subject to risks and uncertainties. These statements are only predictions based upon our current expectations and projections about possible or assumed future results of our business, financial condition, results of operations, liquidity, plans and objectives. In some cases, you can identify forward-looking statements by terminology such as “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “potential,” “seek,” “forecast,” or the negative of these terms or other similar expressions. The forward-looking statements are based on the information currently available to us. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements, including, among others things: changes in general economic, political, governmental and business conditions globally and in Argentina, changes in inflation rates, fluctuations in the exchange rate of the peso, the level of construction generally, changes in cement demand and prices, changes in raw material and energy prices, changes in business strategy and various other factors. You should not rely upon forward-looking statements as predictions of future events. Although we believe in good faith that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Any or all of Loma Negra’s forward-looking statements in this release may turn out to be wrong. You should consider these forward-looking statements in light of other factors discussed under the heading “Risk Factors” in the prospectus filed with the Securities and Exchange Commission on October 31, 2017 in connection with Loma Negra’s initial public offering. Therefore, readers are cautioned not to place undue reliance on these forward- looking statements. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this release to conform these statements to actual results or to changes in our expectations. IR Contacts Marcos I. Gradin, Chief Financial Officer and Investor Relations Diego M. Jalón, Investor Relations Manager +54-11-4319-3050 investorrelations@lomanegra.com --- Financial Tables Follow ---

Table 8: Condensed Interim Consolidated Statements of Financial Position (amounts expressed in millions of pesos, unless otherwise noted) As of March 31, As of December, 31 2024 2023 ASSETS Non-current assets Property, plant and equipment 727,545 731,011 Right to use assets 3,602 3,861 Intangible assets 2,190 2,404 Investments 48 48 Goodwill 482 482 Inventories 35,891 34,373 Other receivables 2,606 2,802 Total non-current assets 772,364 774,982 Current assets Inventories 139,589 115,969 Other receivables 20,566 32,974 Trade accounts receivable 35,346 34,493 Investments 1,878 2,593 Cash and banks 3,933 7,617 Total current assets 201,312 193,647 TOTAL ASSETS 973,676 968,629 SHAREHOLDER'S EQUITY Capital stock and other capital related accounts 184,629 184,942 Reserves 250,764 250,764 Retained earnings 61,178 10,425 Accumulated other comprehensive income - - Equity attributable to the owners of the Company 496,571 446,131 Non-controlling interests (77) (27) TOTAL SHAREHOLDER'S EQUITY 496,494 446,104 LIABILITIES Non-current liabilities Borrowings 117,219 167,005 Accounts payables - - Provisions 7,620 10,222 Salaries and social security payables 176 799 Debts for leases 2,726 4,204 Other liabilities 550 725 Deferred tax liabilities 180,114 161,628 Total non-current liabilities 308,406 344,582 Current liabilities Borrowings 65,914 56,441 Accounts payable 70,098 86,811 Advances from customers 3,737 6,644 Salaries and social security payables 13,831 13,455 Other liabilities - Related companies - - Tax liabilities 7,927 4,474 Debts for leases 1,296 1,842 Other liabilities 5,973 8,275 Total current liabilities 168,776 177,943 TOTAL LIABILITIES 477,182 522,524 TOTAL SHAREHOLDER'S EQUITY AND LIABILITIES 973,676 968,629

Table 9: Condensed Interim Consolidated Statements of Profit or Loss and Other Comprehensive Income (unaudited) (amounts expressed in millions of pesos, unless otherwise noted) Three-months ended March 31, 2024 2023 % Change Net revenue 114,851 157,435 -27.0% Cost of sales (85,814) (114,214) -24.9% Gross Profit 29,036 43,221 -32.8% Share of loss of associates - - n/a Selling and administrative expenses (13,239) (14,195) -6.7% Other gains and losses 89 (394) n/a Impairment of property, plant and equipment - - n/a Tax on debits and credits to bank accounts (1,246) (1,684) -26.0% Finance gain (cost), net Gain on net monetary position 99,232 28,458 248.7% Exchange rate differences (8,258) (12,121) -31.9% Financial income 229 5,084 -95.5% Financial expenses (25,006) (21,496) 16.3% Profit (loss) before taxes 80,836 26,873 200.8% Income tax expense Current (11,647) (5,963) 95.3% Deferred (18,486) (710) 2502.9% Net Profit (Loss) 50,703 20,200 151.0% Net Profit (Loss) for the period attributable to: Owners of the Company 50,752 20,448 148.2% Non-controlling interests (49) (249) -80.1% NET PROFIT (LOSS) FOR THE PERIOD 50,703 20,200 151.0% Earnings per share (basic and diluted): 86.9834 35.0390 148.2%

Table 10: Condensed Interim Consolidated Statement of Cash Flows (amounts expressed in millions of pesos, unless otherwise noted) Three-months ended March 31, 2024 2023 CASH FLOWS FROM OPERATING ACTIVITIES Net Profit (Loss) 50,703 20,200 Adjustments to reconcile net profit to net cash provided by operating activities Income tax expense 30,133 6,674 Depreciation and amortization 10,075 12,620 Provisions 1,029 1,771 Exchange rate differences 8,089 8,446 Interest expense 17,349 16,288 Loss on transactions with securities - - Gain on disposal of property, plant and equipment (17) 112 Gain on net monetary position (99,232) (28,458) Impairment of trust fund 49 (751) Share-based payment 101 121 Changes in operating assets and liabilities Inventories (22,139) (7,243) Other receivables 8,438 5,737 Trade accounts receivable (15,237) (9,631) Advances from customers (2,199) (609) Accounts payable 11,980 (2,064) Salaries and social security payables 4,919 1,668 Provisions (51) (253) Tax liabilities (7,139) (3,453) Other liabilities (1,922) 1,042 Income tax paid (2,663) (4,210) Net cash generated by (used in) operating activities (7,734) 18,008 CASH FLOWS FROM INVESTING ACTIVITIES Proceeds from disposal of Yguazú Cementos S.A. - 390 Proceeds from disposal of Property, plant and equipment 314 285 Payments to acquire Property, plant and equipment (8,799) (7,003) Payments to acquire Intangible Assets - (123) Acquire investments - - Proceeds from maturity investments - - Contributions to Trust (49) (370) Net cash generated by (used in) investing activities (8,535) (6,821) CASH FLOWS FROM FINANCING ACTIVITIES Proceeds from non-convertible negotiable obligations - 107,067 Proceeds from borrowings 80,375 7,266 Loss on transactions with securities - - Interest paid (18,588) (11,000) Dividends paid - (16,532) Debts for leases (382) (367) Repayment of borrowings (44,942) (38,077) Share repurchase plan (414) - Net cash generated by (used in) financing activities 16,049 48,357 Net increase (decrease) in cash and cash equivalents (220) 59,545 Cash and cash equivalents at the beginning of the period 10,210 23,187 Effect of the re-expression in homogeneous cash currency ("Inflation- Adjusted") (4,465) (7,985) Effects of the exchange rate differences on cash and cash equivalents in foreign currency 285 571 Cash and cash equivalents at the end of the period 5,811 75,318

Table 11: Financial Data by Segment (figures exclude the impact of IAS 29) (amounts expressed in millions of pesos, unless otherwise noted) Three-months ended March 31, 2024 % 2023 % Net revenue 102,534 100.0% 37,955 100.0% Cement, masonry cement and lime 91,491 89.2% 33,145 87.3% Concrete 8,087 7.9% 3,688 9.7% Railroad 8,855 8.6% 2,960 7.8% Aggregates 2,746 2.7% 1,247 3.3% Others 802 0.8% 173 0.5% Eliminations (9,447) -9.2% (3,257) -8.6% Cost of sales 58,116 100.0% 23,312 100.0% Cement, masonry cement and lime 47,757 82.2% 19,049 81.7% Concrete 8,100 13.9% 3,572 15.3% Railroad 8,636 14.9% 2,827 12.1% Aggregates 2,590 4.5% 990 4.2% Others 481 0.8% 131 0.6% Eliminations (9,447) -16.3% (3,257) -14.0% Selling, admin. expenses and other gains & losses 10,961 100.0% 3,322 100.0% Cement, masonry cement and lime 9,872 90.1% 2,878 86.6% Concrete 535 4.9% 147 4.4% Railroad 270 2.5% 213 6.4% Aggregates 29 0.3% 10 0.3% Others 254 2.3% 73 2.2% Depreciation and amortization 1,242 100.0% 797 100.0% Cement, masonry cement and lime 783 63.0% 666 83.5% Concrete 50 4.1% 16 2.0% Railroad 354 28.5% 89 11.2% Aggregates 53 4.3% 25 3.2% Others 2 0.1% 1 0.1% Adjusted EBITDA 34,699 100.0% 12,118 100.0% Cement, masonry cement and lime 34,644 99.8% 11,883 98.1% Concrete (497) -1.4% (16) -0.1% Railroad 303 0.9% 9 0.1% Aggregates 181 0.5% 271 2.2% Others 68 0.2% (29) -0.2% Reconciling items: Effect by translation in homogeneous cash currency ("Inflation-Adjusted") (8,738) 29,134 Depreciation and amortization (10,075) (12,620) Tax on debits and credits banks accounts (1,246) (1,684) Finance gain (cost), net 66,196 (74) Income tax (30,133) (6,674) Share of profit of associates - - Impairment of property, plant and equipment - - NET PROFIT (LOSS) FOR THE PERIOD 50,703 20,200