UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2023

Commission File Number: 001-36396

LEJU HOLDINGS LIMITED

Level G, Building G, No.8 Dongfeng South Road,

Chaoyang District, Beijing 100016

The People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Exhibit Index

Exhibit 99.1 – Press Release – Leju Reports First Half Year 2023 Results

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Leju Holdings Limited |

| |

|

| |

|

|

|

| |

By |

: |

/s/ Li Yuan |

| |

Name |

: |

Li Yuan |

| |

Title |

: |

Chief Financial Officer |

Date: August 31, 2023

Exhibit 99.1

Page 1

Leju Reports First Half Year 2023 Results

BEIJING, Aug. 31, 2023 /PRNewswire/ –

Leju Holdings Limited (“Leju” or the “Company”) (NYSE: LEJU), a leading e-commerce and online media platform for

real estate and home furnishing industries in China, today announced its unaudited financial results for the six months ended June 30,

2023.

First Half

2023 Financial Highlights

| · | Total revenues decreased by 6% year on year to $158.5 million. |

| · | Revenues from e-commerce services slightly decreased by 1% year on year to $131.2 million. |

| · | Revenues from online advertising services decreased by 26% year on year to $27.3 million. |

| · | Loss from operations was $23.5 million, compared to loss from operations of $64.8 million for the same

period of 2022. |

| · | Non-GAAP1

loss from operations was $17.3 million, compared to Non-GAAP loss from operations of $58.6 million for the same period of 2022. |

| · | Net loss attributable to Leju Holdings Limited shareholders was $19.4 million, or $1.42 loss per diluted

American depositary share (“ADS”), compared to net loss attributable to Leju Holdings Limited shareholders of $52.9 million,

or $3.86 loss per diluted ADS, for the same period of 2022. |

| · | Non-GAAP net loss attributable to Leju Holdings Limited shareholders was $14.6 million, or $1.06 loss

per diluted ADS, compared to non-GAAP net loss attributable to Leju Holdings Limited shareholders of $48.0 million, or $3.50 loss per

diluted ADS, for the same period of 2022. |

“China's real estate industry remained sluggish

during the first half of 2023, seeing a slight first-quarter rebound but then returning to a downward trend during the second quarter.

Combined with the ongoing difficulties experienced by China’s real estate developers, these factors have created significant challenges

for Leju's advertising and e-commerce operations,” said Mr. Geoffrey He, Leju’s Chief Executive Officer.

“Faced with these unprecedented market

difficulties, we have adjusted our product structure and business direction to ensure the stability of our business and

have been exploring new business opportunities. Responding to the significant changes in the supply and demand relationship of China’s

real estate market, starting from the second quarter, local governments in multiple regions across the country have introduced measures

to further optimize the real estate regulatory measures. Leju will take this opportunity to further consolidate our foundation and strive

for new development opportunities while ensuring healthy operations.”

First Half 2023 Results

Total revenues were $158.5 million,

a decrease of 6% from $169.4 million for the same period of 2022 mainly due to devaluation of the RMB. Total revenues demonstrated

in RMB were RMB1,124.4 million, an increase of 3% from RMB1,091.6 million for the same period of 2022.

1

Leju uses in this press release the following non-GAAP financial measures: (1) income (loss) from operations, (2) net income

(loss), (3) net income (loss) attributable to Leju shareholders, (4) net income (loss) attributable to Leju shareholders per basic ADS,

and (5) net income (loss) attributable to Leju shareholders per diluted ADS, each of which excludes share-based compensation expense,

amortization of intangible assets resulting from business acquisitions, and income tax impact on the share-based compensation expense

and amortization of intangible assets resulting from business combinations. See "About Non-GAAP Financial Measures" and "Unaudited

Reconciliation of GAAP and Non-GAAP Results" below for more information about the non-GAAP financial measures included in this press

release.

Page 2

Revenues from e-commerce services

were $131.2 million, a slight decrease of 1% from $132.7 million for the same period of 2022, primarily due to devaluation of the RMB.

Revenues from e-commerce services denominated in RMB were RMB931.0 million, an increase of 9% from RMB854.6 million for

the same period of 2022. The E-commerce revenue of discount coupons decreased to $20.3 million from $132.7 million for the same period

of 2022. The E-commerce revenue from the commission coupon business from the real estate developers was $110.9 million for the first half

2023 which commenced from the second half of 2022.

Revenues from online advertising services

were $27.3 million, a decrease of 26% from $36.8 million for the same period of 2022. Revenues from online advertising services

denominated in RMB were RMB193.4 million, a decrease of 18% from RMB237.0 million for the same period of 2022, primarily due to a decrease

in property developers’ demand for online advertising.

Cost of revenues was $10.9 million,

a decrease of 25% from $14.5 million for the same period of 2022, primarily due to decreased cost of advertising resources purchased from

media platforms, and decreased editorial personnel related costs.

Selling, general and administrative expenses

were $171.1 million, a decrease of 22% from $219.8 million for the same period of 2022, primarily due to the decreased bad debt provision

and marketing expenses.

Loss from operations was $23.5 million,

compared to loss from operation of $64.8 million for the same period of 2022. Non-GAAP loss from operations was $17.3 million,

compared to non-GAAP loss from operations of $58.6 million for the same period of 2022.

Net loss was $19.5 million, compared

to net loss of $52.8 million for the same period of 2022. Non-GAAP net loss was $14.6 million, compared to non-GAAP net

loss of $47.9 million for the same period of 2022.

Net loss attributable to Leju Holdings Limited

shareholders was $19.4 million, or $1.42 loss per diluted ADS, compared to net loss attributable to Leju Holdings Limited shareholders

of $52.9 million, or $3.86 loss per diluted ADS, for the same period of 2022. Non-GAAP net loss attributable to Leju Holdings Limited

shareholders was $14.6 million, or $1.06 loss per diluted ADS, compared to non-GAAP net loss attributable to Leju Holdings Limited

shareholders of $48.0 million, or $3.50 loss per diluted ADS, for the same period of 2022.

Cash Flow

As of June 30, 2023, the Company's cash

and cash equivalents and restricted cash balance was $106.2 million.

First half 2023 net cash used in operating

activities was $17.2 million, primarily comprised of non-GAAP net loss of $14.6 million, an increase in amounts due from related

parties of $2.2 million, a decrease in amounts due to related parties of $3.4 million, and a decrease in accrued payroll and welfare expenses

of $5.3 million, partially offset by an increase in other current liabilities and accrued expenses of $7.7 million.

About Leju

Leju Holdings Limited ("Leju") (NYSE:

LEJU) is a leading e-commerce and online media platform for real estate and home furnishing industries in China, offering real estate

e-commerce, online advertising and online listing services. Leju's integrated online platform comprises various mobile applications along

with local websites covering more than 380 cities, enhanced by complementary offline services to facilitate residential property transactions.

In addition to the Company's own websites, Leju operates the real estate and home furnishing websites of SINA Corporation, and maintains

a strategic partnership with Tencent Holdings Limited. For more information about Leju, please visit http://ir.leju.com.

Page 3

Safe Harbor: Forward-Looking Statements

This announcement contains forward-looking statements

within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities

Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects,"

"anticipates," "future," "intends," "plans," "believes," "estimates," "target,"

"going forward," "outlook" and similar statements. Leju may also make written or oral forward-looking statements in

its reports filed or furnished with the U.S. Securities and Exchange Commission, in its annual report to shareholders, in press releases

and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are

not historical facts, including statements about Leju's beliefs and expectations, are forward-looking statements that involve inherent

risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained, either expressly

or impliedly, in any of the forward-looking statements. Such factors include, but are not limited to, fluctuations in China's real estate

market; the highly regulated nature of, and government measures affecting, the real estate and internet industries in China; Leju's ability

to compete successfully against current and future competitors; its ability to continue to develop and expand its content, service offerings

and features, and to develop or incorporate the technologies that support them; its reliance on SINA and others with which it has developed,

or may develop in the future, strategic partnerships; substantial revenue contribution from a limited number of real estate markets; and

relevant government policies and regulations relating to the corporate structure, business and industry of Leju. Further information regarding

these and other risks, uncertainties or factors is included in the Company's filings with the U.S. Securities and Exchange Commission.

All information provided in this press release is current as of the date of the press release, and the Company does not undertake any

obligation to update any forward-looking statement as a result of new information, future events or otherwise, except as required under

applicable law.

About Non-GAAP Financial Measures

To supplement Leju’s consolidated financial

results presented in accordance with United States Generally Accepted Accounting Principles ("GAAP"), Leju uses in this press

release the following non-GAAP financial measures: (1) income (loss) from operations, (2) net income (loss), (3) net income

(loss) attributable to Leju shareholders, (4) net income (loss) attributable to Leju shareholders per basic ADS, and (5) net

income (loss) attributable to Leju shareholders per diluted ADS, each of which excludes share-based compensation expense, amortization

of intangible assets resulting from business acquisitions, and income tax impact on the share-based compensation expense and amortization

of intangible assets resulting from business combinations. The presentation of these non-GAAP financial measures is not intended to be

considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. For more information

on these non-GAAP financial measures, please see the table captioned "Unaudited Reconciliation of GAAP and Non-GAAP Results"

set forth at the end of this press release.

Leju believes that these non-GAAP financial measures

provide meaningful supplemental information to investors regarding its operating performance by excluding share-based compensation expense

and amortization of intangible assets resulting from business acquisitions, which may not be indicative of Leju’s operating performance.

These non-GAAP financial measures also facilitate management’s internal comparisons to Leju’s historical performance and assist

its financial and operational decision making. A limitation of using these non-GAAP financial measures is that share-based compensation

expense and amortization of intangible assets resulting from business acquisitions may continue to exist in Leju’s business for

the foreseeable future. Management compensates for these limitations by providing specific information regarding the GAAP amounts excluded

from each non-GAAP measure. The accompanying tables provide more details on the reconciliation between non-GAAP financial measures and

their most comparable GAAP financial measures.

Page 4

For investor and media inquiries please contact:

Ms. Christina Wu

Leju Holdings Limited

Phone: +86 (10) 5895-1062

E-mail: ir@leju.com

Page 5

LEJU HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands of U.S. dollars)

| | |

December 31, | | |

June 30, | |

| | |

2022 | | |

2023 | |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

| 123,378 | | |

| 100,689 | |

| Restricted cash | |

| 4,271 | | |

| 5,530 | |

| Accounts receivable, net | |

| 3,408 | | |

| 2,909 | |

| Prepaid expenses and other current assets | |

| 6,111 | | |

| 7,663 | |

| Customer deposits | |

| 3,860 | | |

| — | |

| Amounts due from related parties | |

| 2,476 | | |

| 4,648 | |

| Total current assets | |

| 143,504 | | |

| 121,439 | |

| Property and equipment, net | |

| 14,204 | | |

| 12,698 | |

| Intangible assets, net | |

| 12,458 | | |

| 7,136 | |

| Right-of-use assets | |

| 18,943 | | |

| 11,010 | |

| Deferred tax assets, net | |

| 25,457 | | |

| 24,537 | |

| Other non-current assets | |

| 1,545 | | |

| 1,149 | |

| Total assets | |

| 216,111 | | |

| 177,969 | |

| | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Short-term borrowings | |

| 718 | | |

| — | |

| Accounts payable | |

| 654 | | |

| 325 | |

| Accrued payroll and welfare expenses | |

| 12,728 | | |

| 6,917 | |

| Income tax payable | |

| 25,203 | | |

| 21,729 | |

| Other tax payable | |

| 9,695 | | |

| 8,321 | |

| Amounts due to related parties | |

| 4,805 | | |

| 1,441 | |

| Advances from customers | |

| 43,100 | | |

| 47,965 | |

| Lease liabilities, current | |

| 5,038 | | |

| 2,833 | |

| Accrued marketing and advertising expenses | |

| 29,988 | | |

| 34,589 | |

| Other current liabilities | |

| 12,265 | | |

| 9,538 | |

| Total current liabilities | |

| 144,194 | | |

| 133,658 | |

| Lease liabilities, non-current | |

| 15,439 | | |

| 9,188 | |

| Deferred tax liabilities | |

| 3,518 | | |

| 2,182 | |

| Total liabilities | |

| 163,151 | | |

| 145,028 | |

| Shareholders’ Equity | |

| | | |

| | |

| Ordinary shares ($0.001 par value): 1,000,000,000 shares authorized 137,172,601 and 137,839,249 shares issued and outstanding, as of December 31, 2022 and June 30, 2023, respectively | |

| 137 | | |

| 138 | |

| Additional paid-in capital | |

| 803,301 | | |

| 804,235 | |

| Accumulated deficit | |

| (738,602 | ) | |

| (758,038 | ) |

| Accumulated other comprehensive loss | |

| (11,601 | ) | |

| (13,046 | ) |

| Total Leju Holdings Limited shareholders’ equity | |

| 53,235 | | |

| 33,289 | |

| Non-controlling interests | |

| (275 | ) | |

| (348 | ) |

| Total equity | |

| 52,960 | | |

| 32,941 | |

| TOTAL LIABILITIES AND EQUITY | |

| 216,111 | | |

| 177,969 | |

Page 6

LEJU HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS

(In thousands of U.S. dollars, except share

data and per share data)

| |

|

Six months ended |

|

| |

|

June 30, |

|

| |

|

2022 |

|

|

2023 |

|

| Revenues |

|

|

|

|

|

|

| E-commerce |

|

|

132,654 |

|

|

|

131,260 |

|

| Online advertising |

|

|

36,783 |

|

|

|

27,272 |

|

| Listing |

|

|

11 |

|

|

|

— |

|

| Total net revenues |

|

|

169,448 |

|

|

|

158,532 |

|

| Cost of revenues |

|

|

(14,474 |

) |

|

|

(10,913 |

) |

| Selling, general and administrative expenses |

|

|

(219,762 |

) |

|

|

(171,122 |

) |

| Other operating income, net |

|

|

25 |

|

|

|

5 |

|

| Loss from operations |

|

|

(64,763 |

) |

|

|

(23,498 |

) |

| Interest income, net |

|

|

1,515 |

|

|

|

545 |

|

| Other income, net |

|

|

801 |

|

|

|

23 |

|

| Loss before taxes and loss from equity in affiliates |

|

|

(62,447 |

) |

|

|

(22,930 |

) |

| Income tax benefits |

|

|

9,642 |

|

|

|

3,439 |

|

| Loss before loss from equity in affiliates |

|

|

(52,805 |

) |

|

|

(19,491 |

) |

| Loss from equity in affiliates |

|

|

— |

|

|

|

— |

|

| Net loss |

|

|

(52,805 |

) |

|

|

(19,491 |

) |

| Less: net income attributable to non-controlling interests |

|

|

47 |

|

|

|

(56 |

) |

| Net loss attributable to Leju Holdings Limited shareholders |

|

|

(52,852 |

) |

|

|

(19,435 |

) |

| |

|

|

|

|

|

|

|

|

| Loss per ADS: |

|

|

|

|

|

|

|

|

| Basic |

|

|

(3.86 |

) |

|

|

(1.42 |

) |

| Diluted |

|

|

(3.86 |

) |

|

|

(1.42 |

) |

| ADS used in computation of loss per ADS: |

|

|

|

|

|

|

|

|

| Basic |

|

|

13,691,216 |

|

|

|

13,726,961 |

|

| Diluted |

|

|

13,691,216 |

|

|

|

13,726,961 |

|

The conversion of Renminbi ("RMB") amounts into reporting currency USD amounts is based on the rate of USD1 = RMB7.2258 on June 30, 2023 and USD1 = RMB7.0928 for the six months ended June 30, 2023

Page 7

LEJU HOLDINGS LIMITED

UNAUDITED CONDENSED

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (LOSS)

(In thousands of U.S. dollars)

| | |

Six months ended | |

| | |

June 30, | |

| | |

2022 | | |

2023 | |

| Net loss | |

| (52,805 | ) | |

| (19,491 | ) |

| Other comprehensive loss, net of tax of nil | |

| | | |

| | |

| Foreign currency translation adjustment | |

| (5,341 | ) | |

| (1,463 | ) |

| | |

| | | |

| | |

| Comprehensive loss | |

| (58,146 | ) | |

| (20,954 | ) |

| | |

| | | |

| | |

| Less: Comprehensive income (loss) attributable to non-controlling interest | |

| 8 | | |

| (73 | ) |

| | |

| | | |

| | |

| Comprehensive loss attributable to Leju Holdings Limited shareholders | |

| (58,154 | ) | |

| (20,881 | ) |

Page 8

LEJU HOLDINGS LIMITED

Unaudited Reconciliation of GAAP and Non-GAAP

Results

(In thousands of U.S. dollars, except share

data and per ADS data)

| | |

Six months ended | |

| | |

June 30, | |

| | |

2022 | | |

2023 | |

| GAAP loss from operations | |

| (64,763 | ) | |

| (23,498 | ) |

| Share-based compensation expense | |

| 929 | | |

| 895 | |

| Amortization of intangible assets resulting from business acquisitions | |

| 5,279 | | |

| 5,279 | |

| Non-GAAP loss from operations | |

| (58,555 | ) | |

| (17,324 | ) |

| | |

| | | |

| | |

| GAAP net loss | |

| (52,805 | ) | |

| (19,491 | ) |

| Share-based compensation expense | |

| 929 | | |

| 895 | |

| Amortization of intangible assets resulting from business acquisitions | |

| 5,279 | | |

| 5,279 | |

| Income tax benefit: | |

| | | |

| | |

| Current | |

| — | | |

| — | |

| Deferred2 | |

| (1,320 | ) | |

| (1,320 | ) |

| Non-GAAP net loss | |

| (47,917 | ) | |

| (14,637 | ) |

| | |

| | | |

| | |

| Net loss attributable to Leju Holdings Limited shareholders | |

| (52,852 | ) | |

| (19,435 | ) |

| Share-based compensation expense (net of non-controlling interests) | |

| 929 | | |

| 895 | |

| Amortization of intangible assets resulting from business acquisitions (net of non-controlling interests) | |

| 5,279 | | |

| 5,279 | |

| Income tax benefit: | |

| | | |

| | |

| Current | |

| — | | |

| — | |

| Deferred | |

| (1,320 | ) | |

| (1,320 | ) |

| Non-GAAP net loss attributable to Leju Holdings Limited shareholders | |

| (47,964 | ) | |

| (14,581 | ) |

| | |

| | | |

| | |

| GAAP net loss per ADS — basic | |

| (3.86 | ) | |

| (1.42 | ) |

| | |

| | | |

| | |

| GAAP net loss per ADS —diluted | |

| (3.86 | ) | |

| (1.42 | ) |

| | |

| | | |

| | |

| Non-GAAP net loss per ADS —basic | |

| (3.50 | ) | |

| (1.06 | ) |

| | |

| | | |

| | |

| Non-GAAP net loss per ADS —diluted | |

| (3.50 | ) | |

| (1.06 | ) |

| | |

| | | |

| | |

| ADS used in calculating basic GAAP/non-GAAP net loss attributable to Leju Holdings Limited shareholders per ADS | |

| 13,691,216 | | |

| 13,726,961 | |

| | |

| | | |

| | |

| ADS used in calculating diluted GAAP/non-GAAP net loss attributable to Leju Holdings Limited shareholders per ADS | |

| 13,691,216 | | |

| 13,726,961 | |

2 Amount represents the realization of deferred tax liabilities

recognized for the temporary difference between the tax basis of intangible assets recognized from acquisitions and their reported amounts

in the financial statements. The income tax impact on the share-based compensation expense is nil.

Page 9

LEJU HOLDINGS LIMITED

SELECTED OPERATING DATA

| | |

Six months ended | |

| | |

June 30, | |

| | |

2022 | | |

2023 | |

| Operating data for e-commerce services | |

| | | |

| | |

| Number of discount coupons issued to prospective purchasers (number of transactions) | |

| 31,456 | | |

| 12,973 | |

| Number of discount coupons redeemed (number of transactions) | |

| 35,262 | | |

| 12,438 | |

| Number of commission coupons issued to prospective purchasers (number of transactions) | |

| — | | |

| 17,010 | |

| Number of commission coupons redeemed (number of transactions) | |

| — | | |

| 17,010 | |

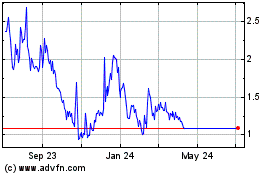

Leju (NYSE:LEJU)

Historical Stock Chart

From Jan 2025 to Feb 2025

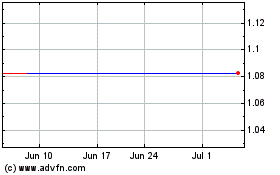

Leju (NYSE:LEJU)

Historical Stock Chart

From Feb 2024 to Feb 2025