Kronos Worldwide, Inc. Reports Fourth Quarter 2022 Results

March 08 2023 - 4:15PM

Kronos Worldwide, Inc. (NYSE:KRO) today reported a net loss of

$19.9 million, or $.18 per share, in the fourth quarter of 2022

compared to net income of $31.6 million, or $.28 per share, in the

fourth quarter of 2021. For the full year of 2022, Kronos Worldwide

reported net income of $104.5 million, or $0.90 per share, compared

to net income of $112.9 million, or $.98 per share for the full

year of 2021. Net income decreased in the comparable 2022 periods

as compared to the same periods in 2021 primarily due to lower

income from operations resulting from the net effect of lower sales

volumes, higher production costs, including raw material and energy

costs, and higher average TiO2 selling prices. Comparability of our

results for both the fourth quarter and full year of 2022 was

significantly impacted by unabsorbed fixed production and other

costs associated with production curtailments at certain of our

European facilities as a result of reduced demand for certain of

our products occurring primarily in our European and export

markets, as discussed further below. Our results were also impacted

by the effects of changes in currency exchange rates.

Net sales of $342.4 million in the fourth

quarter of 2022 were $153.6 million, or 31%, lower than in the

fourth quarter of 2021. Net sales of $1.9 billion in the full year

of 2022 were consistent with net sales for the full year of 2021.

Net sales comparisons for both periods were impacted by the net

effects of lower sales volumes in all our markets, partially offset

by higher average TiO2 selling prices. TiO2 sales volumes were 40%

lower in the fourth quarter of 2022 as compared to the fourth

quarter of 2021 and our sales volumes in the full year of 2022 were

15% lower than in the full year of 2021. TiO2 sales volumes in the

fourth quarter and full year of 2022 compared to the same periods

in 2021 were impacted by weakening customer demand in our European

and export markets which began late in the third quarter and

continued throughout the fourth quarter. Average TiO2 selling

prices were 15% higher in the fourth quarter of 2022 as compared to

the fourth quarter of 2021 and 21% higher in the full year of 2022

as compared to the full year of 2021. Average TiO2 selling prices

at the end of the fourth quarter of 2022 were 16% higher than the

end of 2021. Fluctuations in currency exchange rates (primarily the

euro) also affected net sales comparisons, decreasing net sales by

approximately $23 million in the fourth quarter of 2022 and

approximately $106 million in the full year of 2022, as compared to

the same periods in 2021. The table at the end of this press

release shows how each of these items impacted net sales.

Our TiO2 segment loss (see description of

non-GAAP information below) in the fourth quarter of 2022 was $15.0

million as compared to our TiO2 segment profit of $55.6 million in

the fourth quarter of 2021. For the full year of 2022, our segment

profit was $175.9 million as compared to $202.2 million in the full

year of 2021. Segment profit decreased in both the fourth quarter

and full year of 2022 compared to the same periods in 2021

primarily due to the net effect of lower sales volumes, higher

production costs, (primarily raw material and energy costs), and

higher average TiO2 selling prices. In addition, cost of sales in

2022 includes unabsorbed fixed production and other manufacturing

costs of approximately $26 million associated with production

curtailments at certain of our European facilities during the

fourth quarter as we reduced TiO2 production volumes to align

inventory levels with lower demand. TiO2 production volumes were

35% lower in the fourth quarter of 2022 compared to the fourth

quarter of 2021 and 10% lower in the full year of 2022 compared to

the same period of 2021. As a result of fourth quarter

curtailments, we operated our production facilities at 89% of

practical capacity utilization in 2022 (100%, 95%, 93% and 65% in

the first, second, third and fourth quarters of 2022, respectively)

compared to full practical capacity in 2021 (97%, 100%, 100% and

100% in the first, second, third and fourth quarters of 2021,

respectively). Fluctuations in currency exchange rates (primarily

the euro) increased income from operations approximately $2 million

in the fourth quarter of 2022 as compared to the fourth quarter of

2021 and increased income from operations approximately $23 million

in the full year of 2022 as compared to the full year of 2021.

Our net income (loss) before interest expense,

income taxes and depreciation and amortization expense (EBITDA)

(see description of non-GAAP information below) in the fourth

quarter of 2022 was ($8.2) million compared to EBITDA of $62.6

million in the fourth quarter of 2021. For the full year of 2022,

the Company’s EBITDA was $202.5 million compared to $224.3 million

in the full year of 2021.

Other operating income, net in the full year of

2022 includes an insurance settlement gain of $2.7 million ($2.2

million, or $.02 per share, net of income tax expense) related to a

2020 business interruption insurance claim recognized in the third

quarter of 2022.

The statements in this release relating to

matters that are not historical facts are forward-looking

statements that represent management's beliefs and assumptions

based on currently available information. Although we believe that

the expectations reflected in such forward-looking statements are

reasonable, we cannot give any assurances that these expectations

will prove to be correct. Such statements by their nature involve

substantial risks and uncertainties that could significantly impact

expected results, and actual future results could differ materially

from those described in such forward-looking statements. While it

is not possible to identify all factors, we continue to face many

risks and uncertainties. The factors that could cause actual future

results to differ materially include, but are not limited to, the

following:

- Future supply and demand for our

products

- The extent of the dependence of

certain of our businesses on certain market sectors

- The cyclicality of our

business

- Customer and producer inventory

levels

- Unexpected or earlier-than-expected

industry capacity expansion

- Changes in raw material and other

operating costs (such as energy and ore costs)

- Changes in the availability of raw

materials (such as ore)

- General global economic and

political conditions that harm the worldwide economy, disrupt our

supply chain, increase material and energy costs or reduce demand

or perceived demand for our TiO2 products or impair our ability to

operate our facilities (including changes in the level of gross

domestic product in various regions of the world, natural

disasters, terrorist acts, global conflicts and public health

crises such as COVID-19)

- Operating interruptions (including,

but not limited to, labor disputes, leaks, natural disasters,

fires, explosions, unscheduled or unplanned downtime such as

disruptions in energy supplies, transportation interruptions,

cyber-attacks, certain regional and world events or economic

conditions and public health crises such as COVID-19)

- Competitive products and substitute

products

- Customer and competitor

strategies

- Potential consolidation of our

competitors

- Potential consolidation of our

customers

- The impact of pricing and

production decisions

- Competitive technology

positions

- Potential difficulties in upgrading

or implementing accounting and manufacturing software systems

- The introduction of trade barriers

or trade disputes

- Fluctuations in currency exchange

rates (such as changes in the exchange rate between the U.S. dollar

and each of the euro, the Norwegian krone and the Canadian dollar

and between the euro and the Norwegian krone), or possible

disruptions to our business resulting from uncertainties associated

with the euro or other currencies

- Our ability to renew or refinance

credit facilities

- Increases in interest rates

- Our ability to maintain sufficient

liquidity

- The ultimate outcome of income tax

audits, tax settlement initiatives or other tax matters, including

future tax reform

- Our ability to utilize income tax

attributes, the benefits of which may or may not have been

recognized under the more-likely-than-not recognition criteria

- Environmental matters (such as

those requiring compliance with emission and discharge standards

for existing and new facilities)

- Government laws and regulations and

possible changes therein including new environmental health and

safety or other regulations (such as those seeking to limit or

classify TiO2 or its use)

- Possible future litigation.

Should one or more of these risks materialize

(or the consequences of such a development worsen), or should the

underlying assumptions prove incorrect, actual results could differ

materially from those forecasted or expected. The Company disclaims

any intention or obligation to update or revise any forward-looking

statement whether as a result of changes in information, future

events or otherwise.

In an effort to provide investors with

additional information regarding the Company's results of

operations as determined by accounting principles generally

accepted in the United States of America (GAAP), the Company has

disclosed certain non-GAAP information which the Company believes

provides useful information to investors:

- The Company discloses segment

profit, which is used by the Company’s management to assess the

performance of the Company’s TiO2 operations. The Company believes

disclosure of segment profit provides useful information to

investors because it allows investors to analyze the performance of

the Company’s TiO2 operations in the same way that the Company’s

management assesses performance. The Company defines segment profit

as net income before income tax expense and certain general

corporate items. These general corporate items include corporate

expense and the components of other income (expense) except for

trade interest income; and

- The Company discloses EBITDA, which

is also used by the Company’s management to assess the performance

of the Company’s TiO2 operations. The Company believes disclosure

of EBITDA provides useful information to investors because it

allows investors to analyze the performance of the Company’s TiO2

operations in the same way that the Company’s management assesses

performance. The Company defines EBITDA as net income before

interest expense, income taxes and depreciation and amortization

expense.

Kronos Worldwide, Inc. is a major international producer of

titanium dioxide products.

Investor Relations

Contact: Bryan

A. HanleySenior Vice President & TreasurerTel: (972)

233-1700

KRONOS WORLDWIDE, INC.CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (In millions, except per share and metric

ton data)

| |

|

Three months ended |

|

Year ended |

| |

|

December 31, |

|

December 31, |

| |

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

| |

|

(unaudited) |

|

|

|

|

|

|

| Net sales |

|

$ |

496.0 |

|

|

$ |

342.4 |

|

|

$ |

1,939.4 |

|

|

$ |

1,930.2 |

|

| Cost of sales |

|

|

377.5 |

|

|

|

305.1 |

|

|

|

1,493.2 |

|

|

|

1,539.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin |

|

|

118.5 |

|

|

|

37.3 |

|

|

|

446.2 |

|

|

|

391.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and

administrative expense |

|

|

63.8 |

|

|

|

47.7 |

|

|

|

248.9 |

|

|

|

231.3 |

|

| Other operating income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Currency transactions, net |

|

|

.4 |

|

|

|

(5.6 |

) |

|

|

1.6 |

|

|

|

11.5 |

|

|

Other income, net |

|

|

.5 |

|

|

|

- |

|

|

|

3.2 |

|

|

|

3.4 |

|

|

Corporate expense |

|

|

(3.6 |

) |

|

|

(3.7 |

) |

|

|

(15.0 |

) |

|

|

(15.1 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations |

|

|

52.0 |

|

|

|

(19.7 |

) |

|

|

187.1 |

|

|

|

159.6 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade interest income |

|

|

- |

|

|

|

1.0 |

|

|

|

.1 |

|

|

|

1.2 |

|

|

Other interest and dividend income |

|

|

.2 |

|

|

|

2.0 |

|

|

|

.3 |

|

|

|

3.9 |

|

|

Marketable equity securities |

|

|

.8 |

|

|

|

(.5) |

|

|

|

2.0 |

|

|

|

(1.0 |

) |

|

Other components of net periodic pension and OPEB

cost |

|

|

(3.6 |

) |

|

|

(3.7 |

) |

|

|

(16.5 |

) |

|

|

(12.9 |

) |

|

Interest expense |

|

|

(4.6 |

) |

|

|

(3.9 |

) |

|

|

(19.6 |

) |

|

|

(16.9 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes |

|

|

44.8 |

|

|

|

(24.8 |

) |

|

|

153.4 |

|

|

|

133.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense

(benefit) |

|

|

13.2 |

|

|

|

(4.9 |

) |

|

|

40.5 |

|

|

|

29.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

31.6 |

|

|

$ |

(19.9 |

) |

|

$ |

112.9 |

|

|

$ |

104.5 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per basic

and diluted share |

|

$ |

.28 |

|

|

$ |

(.18) |

|

|

$ |

.98 |

|

|

$ |

.90 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares used

in the calculation of net income per share |

|

|

115.5 |

|

|

|

115.4 |

|

|

|

115.5 |

|

|

|

115.5 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| TiO2 data - metric tons in

thousands: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales volumes |

|

|

136 |

|

|

|

82 |

|

|

|

563 |

|

|

|

481 |

|

|

Production volumes |

|

|

141 |

|

|

|

91 |

|

|

|

545 |

|

|

|

492 |

|

KRONOS WORLDWIDE, INC.RECONCILIATION OF INCOME

(LOSS) FROMOPERATIONS TO SEGMENT PROFIT(In millions)

| |

|

Three months ended |

|

|

Year ended |

| |

|

December 31, |

|

|

December 31, |

| |

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

| |

|

(unaudited) |

|

|

|

|

|

|

|

|

| Income (loss) from

operations |

|

$ |

52.0 |

|

|

$ |

(19.7) |

|

|

$ |

187.1 |

|

|

$ |

159.6 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade interest income |

|

|

- |

|

|

|

1.0 |

|

|

|

.1 |

|

|

|

1.2 |

|

Corporate expense |

|

|

3.6 |

|

|

|

3.7 |

|

|

|

15.0 |

|

|

|

15.1 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit (loss) |

|

$ |

55.6 |

|

|

$ |

(15.0) |

|

|

$ |

202.2 |

|

|

$ |

175.9 |

RECONCILIATION OF NET INCOME (LOSS) TO EBITDA(In

millions)

| |

|

Three months ended |

|

|

Year ended |

| |

|

December 31, |

|

|

December 31, |

| |

|

2021 |

|

2022 |

|

|

2021 |

|

2022 |

| |

|

(unaudited) |

|

|

|

|

|

|

| Net income (loss) |

|

$ |

31.6 |

|

$ |

(19.9) |

|

|

$ |

112.9 |

|

$ |

104.5 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation expense |

|

|

13.2 |

|

|

12.7 |

|

|

|

51.3 |

|

|

51.7 |

|

Interest expense |

|

|

4.6 |

|

|

3.9 |

|

|

|

19.6 |

|

|

16.9 |

|

Income tax expense (benefit) |

|

|

13.2 |

|

|

(4.9) |

|

|

|

40.5 |

|

|

29.4 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

$ |

62.6 |

|

$ |

(8.2) |

|

|

$ |

224.3 |

|

$ |

202.5 |

IMPACT OF PERCENTAGE CHANGE IN NET SALES

| |

|

Three months ended |

|

Year ended |

|

| |

|

December 31, |

|

December 31, |

|

| |

|

2022 vs. 2021 |

|

2022 vs. 2021 |

|

| |

|

(unaudited) |

|

|

|

| Percentage change in net

sales: |

|

|

|

|

|

|

TiO2 product pricing |

|

15 |

% |

|

21 |

% |

|

|

TiO2 sales volume |

|

(40 |

) |

|

(15 |

) |

|

|

TiO2 product mix/other |

|

(1 |

) |

|

(1 |

) |

|

|

Changes in currency exchange rates |

|

(5 |

) |

|

(5 |

) |

|

| |

|

|

|

|

|

|

Total |

|

(31 |

)% |

|

- |

% |

|

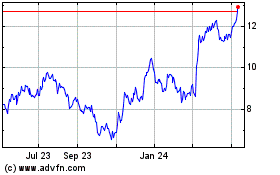

Kronos Worldwide (NYSE:KRO)

Historical Stock Chart

From Jan 2025 to Feb 2025

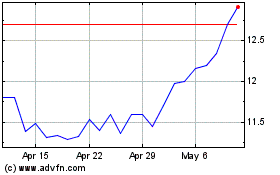

Kronos Worldwide (NYSE:KRO)

Historical Stock Chart

From Feb 2024 to Feb 2025