0001515940false424B2In the event that the securities to which this prospectus relates are sold to or through agents, underwriters or dealers, the related prospectus supplement will disclose the applicable sales load, the estimated amount of total offering expenses (which may include offering expenses borne by third parties on behalf of the Fund), the offering price and the offering expenses borne by the Fund as a percentage of the offering price.You will pay a fee of $20.00, which includes any applicable brokerage commissions, in connection with purchases by the DRIP Administrator of common shares on the open market. You will also pay a fee of $31.95 and any applicable brokerage commissions if you direct the DRIP Administrator to sell your common shares held in a dividend reinvestment account. See “Dividend Reinvestment Plan.”The Adviser will receive a monthly Management Fee at an annual rate of 1.10% of the average daily value of the Fund’s Managed Assets. Consequently, since the Fund has borrowings outstanding, the Management Fee as a percentage of net assets attributable to Common Shares is higher than if the Fund did not utilize leverage.Assumes the use of leverage through a credit facility and MRPS representing 37.5% of Managed Assets at an annual interest rate expense to the Fund of 4.32%, which is based on the interest rate currently applicable under the Fund’s existing credit facility and the dividends payable on the MRPS at an annual dividend rate equal to 3.81%. The Fund may use other forms of leverage, which may be subject to different interest expenses than those estimated above. The actual amount of interest expense borne by the Fund will vary over time in accordance with the level of the Fund’s use of leverage and variations in market interest rates.The “Other Expenses” shown in the table above and related footnotes are based upon estimated expenses for the current fiscal year.The asset coverage per $1,000 of debt is calculated by subtracting the Fund’s liabilities and indebtedness not represented by senior securities from the Fund’s total assets, dividing the result by the aggregate amount of the Fund’s senior securities representing indebtedness then outstanding, and multiplying the result by 1,000.The asset coverage ratio for a class of senior securities representing stock is calculated by subtracting the Fund’s liabilities and indebtedness not represented by senior securities from the Fund’s total assets, dividing the result by the aggregate amount of the Fund’s senior securities representing indebtedness then outstanding plus the aggregate of the involuntary liquidation preference of senior securities representing stock. With respect to the MRPS, the asset coverage per unit figure is expressed in terms of dollar amounts per share of outstanding MRPS (based on a per share liquidation preference of $25).The liquidation value per unit approximates the market value of the MRPS. 0001515940 2023-01-23 2023-01-23 0001515940 2022-08-01 2022-10-31 0001515940 2022-05-01 2022-07-31 0001515940 2022-02-01 2022-04-30 0001515940 2021-11-01 2022-01-31 0001515940 2021-08-01 2021-10-31 0001515940 2021-05-01 2021-07-31 0001515940 2021-02-01 2021-04-30 0001515940 2020-11-01 2021-01-31 0001515940 kkr:CommonSharesMember 2023-01-23 2023-01-23 0001515940 kkr:PreferredSharesMember 2023-01-23 2023-01-23 0001515940 kkr:CreditFacilityWithStateStreetBankAndTrustMember 2021-11-01 2022-10-31 0001515940 kkr:SeriesAMandatoryRedeemablePreferredSharesMember 2021-11-01 2022-10-31 0001515940 kkr:CreditFacilityWithStateStreetBankAndTrustMember 2020-11-01 2021-10-31 0001515940 kkr:SeriesAMandatoryRedeemablePreferredSharesMember 2020-11-01 2021-10-31 0001515940 kkr:CreditFacilityWithStateStreetBankAndTrustMember 2019-11-01 2020-10-31 0001515940 kkr:SeriesAMandatoryRedeemablePreferredSharesMember 2019-11-01 2020-10-31 0001515940 kkr:CreditFacilityWithStateStreetBankAndTrustMember 2018-11-01 2019-10-31 0001515940 kkr:SeriesAMandatoryRedeemablePreferredSharesMember 2018-11-01 2019-10-31 0001515940 kkr:CreditFacilityWithStateStreetBankAndTrustMember 2017-11-01 2018-10-31 0001515940 kkr:CreditFacilityWithStateStreetBankAndTrustMember 2016-11-01 2017-10-31 0001515940 kkr:CreditFacilityWithStateStreetBankAndTrustMember 2015-11-01 2016-10-31 0001515940 kkr:CreditFacilityWithStateStreetBankAndTrustMember 2014-11-01 2015-10-31 0001515940 kkr:CreditFacilityWithStateStreetBankAndTrustMember 2013-11-01 2014-10-31 0001515940 kkr:CreditFacilityWithStateStreetBankAndTrustMember 2012-11-01 2013-10-31 0001515940 kkr:CommonSharesMember 2023-01-04 2023-01-04 0001515940 kkr:SeriesAMandatoryRedeemablePreferredSharesMember 2023-01-04 2023-01-04 iso4217:USD xbrli:pure xbrli:shares iso4217:USD xbrli:shares

The subscription period commences on January 23, 2023, and ends at 5:00 p.m., Eastern time, on the Expiration Date of February 16, 2023, unless otherwise extended.

The Fund has declared a regular monthly distribution to Common Shareholders in an amount of $0.105 per share payable on January 31, 2023, with a record date of January 13, 2023, which will not be payable with respect to Common Shares issued pursuant to the Offer. The Fund has also declared a regular monthly distribution to Common Shareholders in an amount of $0.1050 per share payable on February 28, 2023 with a record date of February 3, 2023, which will not be payable with respect to Common Shares that are issued pursuant to the Offer after February 3, 2023. The Fund has also declared a regular monthly distribution to Common Shareholders in an amount of $0.1215 per share payable on March 31, 2023, with a record date of March 10, 2023 and a regular monthly distribution to Common Shareholders in an amount of $0.1215 per share payable on April 28, 2023, with a record date of April 14, 2023. The increase in the Fund’s monthly distribution rate from $0.1050 per share to $0.1215 per share represents a 15.71% increase in the Fund’s monthly distribution.

For purposes of determining the maximum number of Common Shares a Rights holder may acquire pursuant to the Offer, broker-dealers, trust companies, banks or others whose Common Shares are held of record by Cede & Co., the nominee for the Depository Trust Company (“DTC”), or by any other depository or nominee, will be deemed to be the holders of the Rights that are held by Cede & Co. or such other depository or nominee on their behalf.

The Rights are transferable and, subject to notice of issuance, will be admitted for trading on the NYSE under the symbol “KIO RT” during the course of the Offer. The Rights are expected to trade on the NYSE through February 15, 2023, one business day prior to the Expiration Date of the Offer, unless extended. See “—Sale and Transferability of Rights.” The Common Shares, once issued, will be listed on the NYSE under the symbol “KIO.” The Rights will be evidenced by subscription certificates which will be mailed to Record Date Shareholders, except as discussed under “—Requirements for Foreign Shareholders.”

Rights may be exercised by filling in and signing the subscription certificate and mailing it in the envelope provided, or otherwise delivering the completed and signed subscription certificate to AST Fund Solutions, LLC, which serves as

the subscription agent for the Offer (the “Subscription Agent”), together with payment at the estimated Subscription Price for the Common Shares subscribed for. For a discussion of the method by which Rights may be exercised and Common Shares may be paid for, see “—Method for Exercising Rights” and “—Payment for Shares.”

The Subscription Price per Common Share will be determined based upon the Formula Price, a formula equal to 92.5% of the average of the last reported sales price of a Common Share of the Fund on the NYSE on the Expiration Date, as such date may be extended from time to time, and each of the four (4) preceding trading days. If, however, the Formula Price is less than 82% of the NAV per Common Share at the close of trading on the Expiration Date, then the Subscription Price will be 82% of the Fund’s NAV per Common Share at the close of trading on the NYSE on the Expiration Date. In each case, NAV will be calculated as of the close of trading on the NYSE on the applicable day. The Fund will pay a sales load on the Subscription Price.

Because the Expiration Date of the subscription period will be February 16, 2023 (unless the subscription period is extended), Rights holders will not know the Subscription Price at the time of exercise and will be required initially to pay for both the Common Shares subscribed for pursuant to the primary subscription and, if eligible, any additional Common Shares subscribed for pursuant to the Over-Subscription Privilege, at the estimated Subscription Price of $11.02 per Common Share. See “—Payment for Shares.” A Rights holder will have no right to rescind his subscription after the Subscription Agent has received a completed subscription certificate together with payment for the Common Shares subscribed for, except as provided under “—Notice of Net Asset Value Decline.” The Fund does not have the right to withdraw the Rights or to cancel the Offer after the Rights have been distributed.

The NAV per Common Share at the close of business on January 18, 2023, was $12.96, and the last reported sale price of a Common Share on the NYSE on that day was $11.91.

Record Date Shareholders who fully exercise all Rights issued to them (other than those Rights that cannot be exercised because they represent the right to acquire less than one Common Share) are entitled to subscribe for additional Common Shares which were not subscribed for by other holders of Rights at the same subscription price, subject to certain limitations and subject to allotment. This is known as the Over-Subscription Privilege. Investors who are not Record Date Shareholders, but who otherwise acquire Rights pursuant to the Offer, are not entitled to subscribe for any Common Shares pursuant to the Over-Subscription Privilege. If sufficient Common Shares are available, all Record Date Shareholders’ over-subscription requests will be honored in full. If subscriptions for Common Shares pursuant to the Over-Subscription Privilege exceed the Common Shares available, the available Common Shares will be allocated pro rata among those Record Date Shareholders who over-subscribe based on the number of Rights originally issued to them by the Fund. The allocation process may involve a series of allocations in order to ensure that the total number of Common Shares available for over-subscriptions is distributed on a pro rata basis.

Record Date Shareholders who are fully exercising their Rights during the subscription period should indicate, on the subscription certificate that they submit with respect to the exercise of the Rights issued to them, how many Common Shares they desire to acquire pursuant to the Over-Subscription Privilege.

Banks, broker-dealers, trustees and other nominee holders of Rights will be required to certify to the Subscription Agent, before any Over-Subscription Privilege may be exercised with respect to any particular beneficial owner, as to the aggregate number of Rights exercised during the subscription period and the number of Common Shares subscribed for pursuant to the Over-Subscription Privilege by such beneficial owner, and that such beneficial owner’s primary subscription was exercised in full. Nominee holder over-subscription forms will be distributed to banks, brokers, trustees and other nominee holders of Rights with the subscription certificates.

The Fund will not offer or sell any Common Shares that are not subscribed for during the subscription period or pursuant to the Over-Subscription Privilege.

The Fund has been advised that one or more of the directors, trustees, officers or employees of the Fund and/or Adviser may exercise all of the Rights initially issued to them and may request additional Common Shares pursuant to the Over-Subscription Privilege. An exercise of the Over-Subscription Privilege by such persons will increase their proportionate voting power and share of the Fund’s assets.

The Rights, subject to notice of issuance, will be admitted for trading on the NYSE under the symbol “KIO RT” during the course of the Offer. It is expected that trading in the Rights on the NYSE may be conducted until the close of trading on the NYSE on the last business day prior to the Expiration Date. The Fund will use its best efforts to ensure that an adequate trading market for the Rights will exist, although there can be no assurance that a market for the Rights will develop. Assuming a market exists for the Rights, the Rights may be purchased and sold through usual brokerage channels or sold through the Subscription Agent.

Rights that are sold will not confer any right to acquire any Common Shares pursuant to the Over-Subscription Privilege, if any, and any Record Date Shareholder who sells any Rights (other than those Rights that cannot be exercised because they represent the right to acquire less than one Common Share) will not be eligible to participate in the Over-Subscription Privilege, if any.

If the Dealer Manager declines to purchase the Rights of a Record Date Shareholder that have been duly submitted to the Subscription Agent for sale, the Subscription Agent will attempt to sell such Rights in the open market. If the Rights can be sold in such manner, all of such sales will be deemed to have been effected at the weighted-average price of all Rights sold by the Subscription Agent in such open market transactions throughout the subscription period. The proceeds from such sales will be held by the Subscription Agent in an account segregated from the Subscription Agent’s own funds pending distribution to the selling Record Date Shareholders. It is expected that the proceeds of such open market sales will be remitted by the Subscription Agent to the selling Record Date Shareholders within two (2) business days following the Expiration Date.

There can be no assurance that the Subscription Agent will be able to complete the sale of any Rights, and neither the Fund, the Dealer Manager nor the Subscription Agent have guaranteed any minimum sale price for the Rights. If a Record Date Shareholder does not utilize the services of the Subscription Agent and chooses to use another broker-dealer or other financial institution to sell Rights issued to that shareholder pursuant to the Offer, then the other broker-dealer or financial institution may charge a fee to sell the Rights.

Record Date Shareholders wishing to transfer all or a portion of their Rights (but not fractional Rights) should allow at least ten (10) business days prior to the Expiration Date for: (i) the transfer instructions to be received and processed by the Subscription Agent; (ii) a new subscription certificate to be issued and transmitted to the transferee or transferees with respect to transferred Rights and to the transferor with respect to retained Rights, if any; and (iii) the Rights evidenced by the new subscription certificate to be exercised or sold by the recipients of the subscription certificate. Neither the Fund nor the Subscription Agent nor the Dealer Manager shall have any liability to a transferee or transferor of Rights if subscription certificates are not received in time for exercise or sale prior to the Expiration Date.

Except for the fees charged by AST Fund Solutions, LLC, the information agent for the Offer (the “Information Agent”), the Subscription Agent and the Dealer Manager (which are expected to be paid by the Fund), all commissions, fees and other expenses (including brokerage commissions and transfer taxes) incurred or charged in connection with the purchase, sale or transfer of Rights will be for the account of the transferor of the Rights, and none of these commissions, fees or other expenses will be paid by the Fund, the Information Agent, the Adviser, the Subscription Agent or the Dealer Manager. Rights holders who wish to purchase, sell, exercise or transfer Rights through a broker, bank or other party should first inquire about any fees and expenses that the holder will incur in connection with the transactions.

The Fund anticipates that the Rights will be eligible for transfer through, and that the exercise of the primary subscription and the over-subscription may be effected through, the facilities of DTC or the Subscription Agent until 5:00 p.m., Eastern time, on the Expiration Date. Your broker, bank, trust company or other intermediary may impose a deadline for transferring Rights earlier than 5:00 p.m., Eastern time, on the Expiration Date.

Rights are evidenced by subscription certificates that will be mailed to Record Date Shareholders (except as described under “—Requirements for Foreign Shareholders”) or, if their Common Shares are held by Cede & Co. or any other depository or nominee on their behalf, to Cede & Co. or such other depository or nominee. Rights may be exercised by completing and signing the subscription certificate and mailing it in the envelope provided, or otherwise delivering the completed and signed subscription certificate to the Subscription Agent, together with payment in full at the estimated Subscription Price for the Common Shares subscribed for by the Expiration Date as described under “—Payment For Shares.” Rights may also be exercised through the broker of a holder of Rights, who may charge the holder of Rights a servicing fee in connection with such exercise. Rights may also be exercised by contacting your broker, bank, trust company or other intermediary, which can arrange, on your behalf, to guarantee delivery of a properly completed and executed subscription certificate pursuant to a notice of guaranteed delivery by the close of business on the second business day after the Expiration Date. A fee may be charged for this service. Completed subscription certificates (or a notice of guaranteed delivery) and payments must be received by the Subscription Agent by 5:00 p.m., Eastern time, on the Expiration Date at the offices of the Subscription Agent at one of the addresses set forth under “—Subscription Agent.” Your broker, bank, trust company or other intermediary may impose a deadline for exercising Rights earlier than 5:00 p.m., Eastern time, on the Expiration Date. Fractional Common Shares will not be issued upon exercise of Rights.

Rights. In that case, the nominee will complete the subscription certificate on behalf of the investor and arrange for proper payment by one of the methods set forth under “—Payment for Shares.”

Banks, brokers, trustees and other nominee holders of Rights will be required to certify to the Subscription Agent, before any Over-Subscription Privilege may be exercised with respect to any particular beneficial owner who is a Record Date Shareholder, as to the aggregate number of Rights exercised during the subscription period and the number of Common Shares subscribed for pursuant to the Over-Subscription Privilege by the beneficial owner, and that the beneficial owner exercised all the Rights issued to it pursuant to the Offer.

The Fund will bear the expenses of the Offer and all such expenses will be borne indirectly by the Fund’s Common Shareholders, including those who do not exercise their Rights. These expenses include, but are not limited to, the Dealer Manager fee, reimbursement of the Dealer Manager’s expenses, the expenses of preparing, printing and mailing the prospectus and Rights subscription materials for the Offer (including reimbursement of expenses of the Dealer Manager, Selling Group Members, Soliciting Dealers and other brokers, dealers and financial institutions), SEC registration fees and the fees assessed by service providers (including the cost of the Fund’s counsel and independent registered public accounting firm) in connection with the Offer.

Completed subscription certificates must be sent together with proper payment of the estimated Subscription Price for all Common Shares subscribed for in the primary subscription and the Over-Subscription Privilege (for Record Date Shareholders) to the Subscription Agent by one of the methods described below. Alternatively, Rights holders may arrange for their financial intermediaries to send notices of guaranteed delivery by email to

The Offer may result in an increase in trading of the Common Shares, which may increase volatility in the market price of the Common Shares. The Offer may result in an increase in the number of shareholders wishing to sell their Common Shares, which would exert downward price pressure on the price of Common Shares.

It is possible that the Offer will not be fully subscribed. Under-subscription of the Offer could have an impact on the net proceeds of the Offer and whether the Fund achieves any benefits.

TAXATION

The discussion set forth herein does not constitute tax advice and potential investors are urged to consult their own tax advisers to determine the tax consequences of investing in the Fund.

Please refer to the “Tax Considerations” section in the Fund’s prospectus and the “Material U.S. Federal Income Considerations” section in the SAI for a description of the consequences of investing in the Common Shares of the Fund. Special tax considerations relating to the Offer are summarized below:

| |

• |

|

The value of a Right will not be includible in the income of a shareholder at the time the subscription right is issued. |

| |

• |

|

The basis of a Right issued to a shareholder will be zero, and the basis of the share with respect to which the Right was issued (the old share) will remain unchanged, unless either (a) the fair market value of the Right on the date of distribution is at least 15% of the fair market value of the old share, or (b) such shareholder affirmatively elects (in the manner set out in Treasury regulations under the Code) to allocate to the Right a portion of the basis of the old share. If either (a) or (b) applies, such shareholder must allocate basis between the old share and the Right in proportion to their fair market values on the date of distribution. |

| |

• |

|

The basis of a Right purchased in the market will generally be its purchase price. |

| |

• |

|

The holding period of a Right issued to a shareholder will include the holding period of the old share. |

| |

• |

|

No loss will be recognized by a shareholder if a Right distributed to such shareholder expires unexercised because the basis of the old share may be allocated to a Right only if the Right is exercised or sold. If a Right that has been purchased in the market expires unexercised, there will be a recognized loss equal to the basis of the Right. |

| |

• |

|

Any gain or loss on the sale or expiration of a Right will be a capital gain or loss if the Right is held as a capital asset (which in the case of a Right issued to Record Date Shareholders will depend on whether the old share is held as a capital asset), and will be a long term capital gain or loss if the holding period is deemed to exceed one year. |

| |

• |

|

No gain or loss will be recognized by a shareholder upon the exercise of a Right, and the basis of any Common Share acquired upon exercise (the new Common Share) will equal the sum of the basis, if any, of the Right(s) exercised therefor and the subscription prices for the new Common Share. The holding period for the new Common Share does not include the time during which the Right holder held the unexercised Right and will begin no later than the date following the date when the Right is exercised. |

The foregoing is a general and abbreviated summary of the provisions of the Code and the Treasury regulations in effect as they directly govern the taxation of the Fund and its Common Shareholders, with respect to U.S. federal income taxation only. Other foreign, state and local tax consequences may apply. Investors are urged to consult their own tax advisers to determine the tax consequences of investing in the Fund. These provisions are subject to change by legislative or administrative action, and any such change may be retroactive.

PLAN OF DISTRIBUTION

Distribution Arrangements

UBS Securities LLC will act as Dealer Manager for this Offer. Under the terms and subject to the conditions contained in the Dealer Manager Agreement among the Dealer Manager, the Fund and the Adviser, the Dealer Manager will provide financial structuring and solicitation services in connection with the Offer and will solicit

R-25

the exercise of Rights and participation in the Over-Subscription Privilege. The Offer is not contingent upon any number of Rights being exercised. The Dealer Manager will also be responsible for forming and managing a group of selling broker-dealers (each a “Selling Group Member” and collectively the “Selling Group Members”), whereby each Selling Group Member will enter into a Selling Group Agreement with the Dealer Manager to solicit the exercise of Rights and to sell Common Shares purchased by the Selling Group Member from the Dealer Manager. In addition, the Dealer Manager will enter into a Soliciting Dealer Agreement with other soliciting broker-dealers (each a “Soliciting Dealer” and collectively the “Soliciting Dealers”) to solicit the exercise of Rights. See “—Compensation to Dealer Manager” for a discussion of fees and other compensation to be paid to the Dealer Manager, Selling Group Members and Soliciting Dealers in connection with the Offer.

The Fund and the Adviser have each agreed to indemnify the Dealer Manager for losses arising out of certain liabilities, including liabilities under the Securities Act. The Dealer Manager Agreement also provides that the Dealer Manager will not be subject to any liability to the Fund in rendering the services contemplated by the Dealer Manager Agreement except for any act of willful misfeasance, bad faith or gross negligence of the Dealer Manager or reckless disregard by the Dealer Manager of its obligations and duties under the Dealer Manager Agreement.

Prior to the expiration of the Offer, the Dealer Manager may independently offer for sale Common Shares it has acquired through purchasing and exercising the Rights, at prices that may be different from the market price for such Common Shares or from the price to be received by the Fund upon the exercise of Rights. The Dealer Manager is authorized to buy and exercise Rights (for delivery of Common Shares prior to the expiration of the Offer), including unexercised Rights of Record Date Shareholders whose record addresses are outside the United States that are held by the Subscription Agent and for which no instructions are received, and to sell Common Shares to the public or to Selling Group Members at the offering price set by the Dealer Manager from time to time. In addition, the Dealer Manager has the right to buy Rights offered to it by the Subscription Agent from electing Record Date Shareholders, and the Dealer Manager may purchase such Rights as principal or act as agent on behalf of its clients for the resale of such Rights.

In order to seek to facilitate the trading market in the Rights for the benefit of

non-exercising

Common Shareholders, and the placement of the Common Shares to new or existing investors pursuant to the exercise of the Rights, the Dealer Manager Agreement provides for special arrangements with the Dealer Manager. Under these arrangements, the Dealer Manager is expected to purchase Rights on the NYSE. The number of Rights, if any, purchased by the Dealer Manager will be determined by the Dealer Manager in its sole discretion. The Dealer Manager is not obligated to purchase Rights or Common Shares as principal for its own account to facilitate the trading market for Rights or for investment purposes. Rather, its purchases are expected to be closely related to interest in acquiring Common Shares generated by the Dealer Manager through its marketing and soliciting activities. The Dealer Manager intends to exercise Rights purchased by it during the Subscription Period but prior to the Expiration Date. The Dealer Manager may exercise those Rights at its option on one or more dates, which are expected to be prior to the Expiration Date. The subscription price for the Common Shares issued through the exercise of Rights by the Dealer Manager prior to the Expiration Date will be the greater of 92.5% of the last reported sale price of a Common Share on the NYSE on the date of exercise or 82% of the Fund’s NAV per Common Share at the close of trading on the NYSE prior to the date of exercise. The price and timing of these exercises are expected to differ from those described herein for the Rights offering. The Subscription Price will be paid to the Fund and the dealer manager fee with respect to such proceeds will be paid by the Fund on the applicable settlement date(s) of such exercise(s).

In connection with the exercise of Rights and receipt of Common Shares, the Dealer Manager intends to offer those Common Shares for sale to the public and/or through Selling Group Members it has established. The Dealer Manager may set the price for those Common Shares at any price that it determines, in its sole discretion. The Dealer Manager has advised that the price at which such Common Shares are offered is expected to be at or slightly below the closing price of the Common Shares on the NYSE on the date the Dealer Manager exercises Rights. No portion of the amount paid to the Dealer Manager or to a Selling Group Member from the sale of

R-26

Common Shares in this manner will be paid to the Fund. If the sales price of the Common Shares is greater than the subscription price paid by the Dealer Manager for such Common Shares plus the costs to purchase Rights for the purpose of acquiring those Common Shares, the Dealer Manager will receive a gain. Alternatively, if the sales price of the Common Shares is less than the Subscription Price for such Common Shares plus the costs to purchase Rights for the purpose of acquiring those Common Shares, the Dealer Manager will incur a loss. The Dealer Manager will pay a concession to Selling Group Members in an amount equal to approximately 2.00% of the aggregate price of the Common Shares sold by the respective Selling Group Member. Neither the Fund nor the Adviser has a role in setting the terms, including the sales price, on which the Dealer Manager offers for sale and sells Common Shares it has acquired through purchasing and exercising Rights or the timing of the exercise of Rights or sales of Common Shares by the Dealer Manager. Persons who purchase Common Shares from the Dealer Manager or a Selling Group Member will purchase Common Shares at a price set by the Dealer Manager, which may be more or less than the Subscription Price, based on the Formula Price mechanism through which Common Shares will be sold in the Rights offering, and at a time set by the Dealer Manager, which is expected to be prior to the Expiration Date, and will not have the uncertainty of waiting for the determination of the Subscription Price on the Expiration Date.

The Dealer Manager may purchase Rights as principal or act as agent on behalf of its clients for the resale of such Rights. The Dealer Manager may realize gains (or losses) in connection with the purchase and sale of Rights and the sale of Common Shares, although such transactions are intended by the Dealer Manager to facilitate the trading market in the Rights and the placement of the Common Shares to new or existing investors pursuant to the exercise of the Rights. Any gains (or losses) realized by the Dealer Manager from the purchase and sale of Rights and the sale of Common Shares are independent of and in addition to its fee as Dealer Manager. The Dealer Manager has advised that any such gains (or losses) are expected to be immaterial relative to its fee as Dealer Manager.

Since neither the Dealer Manager nor persons who purchase Common Shares from the Dealer Manager or Selling Group Members were Record Date Shareholders, they would not be able to participate in the Over-Subscription Privilege.

There is no limit on the number of Rights the Dealer Manager can purchase or exercise. Common Shares acquired by the Dealer Manager pursuant to the exercise of Rights acquired by it will reduce the number of Common Shares available pursuant to the over-subscription privilege, perhaps materially, depending on the number of Rights purchased and exercised by the Dealer Manager.

Although the Dealer Manager can seek to facilitate the trading market for Rights as described above, investors can acquire Common Shares at the Subscription Price by acquiring Rights on the NYSE and exercising them in the method described above under “Terms of the Offer—Method for Exercise of Rights” and “Terms of the Offer—Payment for Shares.”

In the ordinary course of their businesses, the Dealer Manager and/or its affiliates may engage in investment banking or financial transactions with the Fund, the Adviser and their affiliates. In addition, in the ordinary course of their businesses, the Dealer Manager and/or its affiliates may, from time to time, own securities of the Fund or its affiliates.

The principal business address of the Dealer Manager is 1285 Avenue of the Americas, New York, New York 10019.

Compensation to Dealer Manager

Pursuant to the Dealer Manager Agreement, the Fund, has agreed to pay the Dealer Manager a fee for its financial structuring and solicitation services equal to 3.50% of the aggregate Subscription Price for Shares issued pursuant to the Offer and the Over-Subscription Privilege.

R-27

The Dealer Manager will reallow to Selling Group Members in the Selling Group to be formed and managed by the Dealer Manager selling fees equal to 2.00% of the Subscription Price for each Common Share issued pursuant to the Offer or the Over-Subscription Privilege as a result of their selling efforts. In addition, the Dealer Manager will reallow to Soliciting Dealers that have executed and delivered a Soliciting Dealer Agreement and have solicited the exercise of Rights, solicitation fees equal to 0.50% of the Subscription Price for each Common Share issued pursuant to the exercise of Rights as a result of their soliciting efforts, subject to a maximum fee based on the number of Common Shares held by such Soliciting Dealer through DTC on the Record Date. Fees will be paid to the broker-dealer designated on the applicable portion of the subscription certificates or, in the absence of such designation, to the Dealer Manager.

In addition, the Fund has agreed to pay the Dealer Manager an amount up to $150,000 as a partial reimbursement of its expenses incurred in connection with the Offer. The fees described above are

one-time

fees payable on each date on which the Fund issues Common Shares after the Expiration Date with respect to the Dealer Manager, and on or before the tenth (10

th

) business day following the day the Fund issues Common Shares after the Expiration Date with respect to a Selling Group Member or Soliciting Dealer. The Fund will also pay expenses relating to the printing or other production, mailing and delivery expenses incurred in connection with materials related to the Offer incurred by the Dealer Manager, Selling Group Members, Soliciting Dealers and other brokers, dealers and financial institutions in connection with their customary mailing and handling of materials related to the Offer to their customers. No other fees will be payable by the Fund or the Adviser to the Dealer Manager in connection with the Offer.

Certain legal matters will be passed on by Dechert LLP, counsel to the Fund, in connection with this Rights offering and the offering of the Common Shares. Certain legal matters will be passed on by Skadden, Arps, Slate, Meagher & Flom LLP, as special counsel to the Dealer Manager, in connection with the Offer.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Deloitte & Touche LLP serves as the independent registered public accounting firm of the Fund and audits the financial statements of the Fund. Deloitte & Touche LLP is located at 555 Mission Street, San Francisco, California 94105.

This prospectus supplement and the accompanying prospectus constitute part of a registration statement filed by the Fund with the SEC under the Securities Act and the 1940 Act. This prospectus supplement and the accompanying prospectus omit certain of the information contained in the registration statement, and reference is hereby made to the registration statement and related exhibits for further information with respect to the Fund and the Common Shares offered hereby. Any statements contained herein concerning the provisions of any document are not necessarily complete, and, in each instance, reference is made to the copy of such document filed as an exhibit to the registration statement or otherwise filed with the SEC. Each such statement is qualified in its entirety by such reference. The complete registration statement may be obtained from the SEC upon payment of the fee prescribed by its rules and regulations or free of charge through the SEC’s website (http://www.sec.gov).

R-28

KKR Income Opportunities Fund

Subscription Rights to Purchase Common Shares

KKR Income Opportunities Fund (the “Fund”) is a diversified,

closed-end

management investment company. The Fund’s primary investment objective is to seek a high level of current income with a secondary objective of capital appreciation. The Fund is not intended as, and you should not construe it to be, a complete investment program. There can be no assurance that the Fund will achieve its investment objectives or be able to structure its investment portfolio as anticipated.

The Fund seeks to achieve its investment objectives by employing a dynamic strategy of investing in a targeted portfolio of loans and fixed-income instruments of U.S. and

non-U.S.

issuers and implementing hedging strategies in order to seek to achieve attractive risk-adjusted returns. Under normal market conditions, the Fund invests at least 80% of its Managed Assets (as defined herein) in loans and fixed-income instruments or other instruments, including derivative instruments, with similar economic characteristics (the “80% Policy”). “Managed Assets” means the total assets of the Fund (including any assets attributable to borrowings for investment purposes) minus the sum of the Fund’s accrued liabilities (other than liabilities representing borrowings for investment purposes). The Fund invests primarily in first- and second-lien secured loans, unsecured loans and high-yield corporate debt instruments of varying maturities. The instruments in which the Fund invests may be rated investment grade or below investment grade by a nationally recognized statistical rating organization, or unrated. The Fund’s investments in below investment grade loans, below investment grade fixed-income instruments and debt instruments of financially troubled companies are considered speculative with respect to the issuer’s capacity to pay interest and repay principal. These investments are commonly referred to as “high-yield” or “junk” instruments. The Fund seeks to tactically and dynamically allocate capital across companies’ capital structures where KKR Credit Advisors (US) LLC (the “Adviser”) believes its due diligence process has identified compelling investment opportunities, including where the Adviser has identified issuer distress, event-driven misvaluations of securities or capital market inefficiencies. See “Investment Objectives and Investment Strategies.”

We may offer, from time to time, in one or more offerings, the Fund’s common shares and/or preferred shares of beneficial interest, each with a par value of $0.001 per share, and/or subscription rights to purchase common shares, which we refer to collectively as the “securities.” Securities may be offered at prices and on terms to be set forth in one or more supplements to this prospectus (each a “prospectus supplement”). You should read this prospectus and the applicable prospectus supplement carefully before you invest in our securities.

Our securities may be offered directly to one or more purchasers, including existing shareholders in a rights offering, through agents designated from time to time by us, to or through underwriters or dealers,

to or through a market maker into an existing trading market, or through a combination of methods of sale. The prospectus supplement relating to any sale of preferred shares will set forth the liquidation preference and information about the dividend period, dividend rate, any call protection or

non-call

period, and other matters. The prospectus supplement relating to the offering will identify any agents or underwriters involved in the sale of our securities, and will set forth any applicable purchase price, fee, commission or discount arrangement between us and our agents or underwriters, or among our underwriters, or the basis upon which such amount may be calculated. The prospectus supplement relating to any offering of subscription rights will set forth the number of shares issuable upon the exercise of each right (or number of rights) and the other terms of such rights offering. We may not sell any of our securities through agents, underwriters or dealers without delivery of a prospectus supplement describing the method and terms of the particular offering.

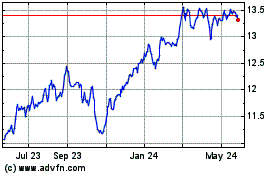

The Fund’s common shares are listed on the New York Stock Exchange (the “NYSE”) under the trading or “ticker” symbol “KIO.” On January 4, 2023 the last reported sale price of the Fund’s common shares was $11.11. The net asset value of the Fund’s common shares at the close of business on January 4, 2023 was $12.39 per share.

Shares of

closed-end

funds often trade at a discount from net asset value. This creates a risk of loss for an investor purchasing shares in a public offering.

Investing in the Fund’s shares involves certain risks. See “

Risk Factors” of this prospectus for factors that should be considered before investing in shares of the Fund.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus may not be used to consummate sales of shares by us through agents, underwriters or dealers unless accompanied by a prospectus supplement.

This prospectus, together with the applicable prospectus supplement, sets forth concisely information about the Fund you should know before investing. Please read this prospectus carefully before deciding whether to invest and retain it for future reference. A Statement of Additional Information (the “SAI”) dated January 13, 2023, has been filed with the SEC. This prospectus incorporates by reference the entire SAI. The SAI is available along with other Fund-related materials are available on the EDGAR database on the SEC’s Internet site (http://www.sec.gov), and copies of this information may be obtained, after paying a duplicating fee, by electronic request at publicinfo@sec.gov.

You may also request a free copy of the SAI, annual and semi-annual reports to shareholders, and additional information about the Fund, and may make other shareholder inquiries, by calling (855)

862-6092,

by writing to the Fund or visiting the Fund’s website (https://www.kkrfunds.com/kio/). The information contained in, or accessed through, the Fund’s website is not part of this prospectus.

The Fund’s shares do not represent a deposit or obligation of, and are not guaranteed by or endorsed by, any bank or other insured depositary institution, and are not federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency.

| |

|

|

|

|

| |

|

|

1 |

|

| |

|

|

6 |

|

| |

|

|

8 |

|

| |

|

|

9 |

|

| |

|

|

9 |

|

| |

|

|

10 |

|

| |

|

|

10 |

|

| |

|

|

30 |

|

| |

|

|

30 |

|

| |

|

|

30 |

|

| |

|

|

35 |

|

| |

|

|

38 |

|

| |

|

|

39 |

|

| |

|

|

40 |

|

| |

|

|

40 |

|

| |

|

|

50 |

|

| |

|

|

54 |

|

| |

|

|

55 |

|

| |

|

|

55 |

|

| |

|

|

58 |

|

| |

|

|

58 |

|

| |

|

|

59 |

|

| |

|

|

60 |

|

| |

|

|

60 |

|

| |

|

|

60 |

|

You should rely only on the information contained in or incorporated by reference into this prospectus and the applicable prospectus supplement. Neither the Fund nor the underwriters have authorized anyone to provide you with different information. The Fund is not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus and the applicable prospectus supplement is accurate as of any date other than the date of this prospectus and the applicable prospectus supplement. The Fund’s business, financial condition, results of operations and prospects may have changed since that date.

FORWARD-LOOKING STATEMENTS

This prospectus contains or incorporates by reference forward-looking statements. These statements describe the Fund’s plans, strategies, and goals and our beliefs and assumptions concerning future economic and other conditions and the outlook for the Fund, based on currently available information. Forward-looking statements can be identified by the words “may,” “will,” “intend,” “expect,” “estimate,” “continue,” “plan,” “anticipate,” and similar terms and the negative of such terms are used in an effort to identify forward-looking statements, although some forward-looking statements may be expressed differently. By their nature, all forward-looking statements involve risks and uncertainties, and actual results could differ materially from those contemplated by the forward-looking statements. Several factors that could materially affect our actual results are the performance of the portfolio of securities we hold, the price at which our shares will trade in the public markets and other factors discussed in our periodic filings with the SEC. The forward-looking statements contained in or incorporated by reference into this Prospectus are excluded from the safe harbor protection provided by Section 27A of the Securities Act.

This is only a summary. This summary does not contain all of the information that you should consider before investing in the Fund’s securities. You should review the more detailed information contained in this prospectus and in the Statement of Additional Information (the “SAI”).

KKR Income Opportunities Fund is a diversified,

closed-end

management investment company organized as a statutory trust under the laws of the State of Delaware on March 17, 2011. Throughout this prospectus, we refer to KKR Income Opportunities Fund as the “Fund” or as “we.”

The Fund’s outstanding common shares of beneficial interest, par value of $0.001 per share, are listed on the New York Stock Exchange (“NYSE”) under the trading or “ticker” symbol “KIO,” and any newly issued common shares issued will trade under the same symbol. As of January 4, 2023, the Fund had outstanding 20,340,315 common shares. On January 4, 2023, the last reported sale price of the Fund’s common shares on the NYSE was $11.11 per share. The net asset value (“NAV”) of the Fund’s common shares at the close of business on January 4, 2023 was $12.39 per share.

We may offer, from time to time, in one or more offerings, our common shares and/or preferred shares, $0.001 par value per share, or our subscription rights to purchase our common shares, which we refer to collectively as the “securities.” We may issue either transferable or

non-transferable

subscription rights. The preferred shares are expected to be fixed rate preferred shares. In connection with a rights offering, we may sell our common shares at a price below the NAV per share and, if the subscription price in any such offering is less than the NAV per share of our common shares, then you may experience an immediate dilution of the aggregate NAV of your shares. The securities may be offered at prices and on terms to be set forth in one or more supplements to this prospectus (each a “prospectus supplement”). You should read this prospectus and the applicable prospectus supplement carefully before you invest in our securities. Our securities may be offered directly to one or more purchasers, through agents designated from time to time by us, to or through underwriters or dealers,

to or through a market maker into an existing trading market, or through a combination of methods of sale. The prospectus supplement relating to the offering will identify any agents, underwriters or dealers involved in the sale of our securities, and will set forth any applicable purchase price, fee, commission or discount arrangement between us and our agents or underwriters, or among our underwriters, or the basis upon which such amount may be calculated. The prospectus supplement relating to any sale of preferred shares will set forth the liquidation preference and information about the dividend period, dividend rate, any call protection or

non-call

period and other matters. The prospectus supplement relating to any offering of subscription rights will set forth the number of shares issuable upon the exercise of each right (or number of rights) and the other terms of such rights offering. We may not sell any of our securities through agents, underwriters or dealers without delivery of a prospectus supplement describing the method and terms of the particular offering.

1

During temporary defensive periods, including during the period when the proceeds of the offering of common shares are being invested, the Fund may deviate from its investment objectives and investment strategies. During such periods, the Fund may invest all or a portion of its assets in certain short-term (less than one year to maturity) and medium-term (not greater than five years to maturity) debt securities or hold cash and cash equivalents. The short- and medium-term debt securities in which the Fund may invest include (i) obligations of the U.S. government, its agencies or instrumentalities; (ii) bank deposits and bank obligations (including certificates of deposit, time deposits and bankers’ acceptances) of U.S. or foreign banks denominated in any currency; (iii) floating rate securities and other instruments denominated in any currency issued by various governments or international development agencies; (iv) finance company and corporate commercial paper and other short-term corporate debt obligations of U.S. or foreign corporations; (v) repurchase agreements with banks and broker- dealers with respect to such securities; and (vi) shares of money market funds and money market instruments. See “Investment Objectives and Investment Strategies—Portfolio Composition—Temporary Investments” and “Use of Proceeds” below.

The Fund is permitted to obtain leverage using any form or combination of financial leverage instruments, including through funds borrowed from banks or other financial institutions (

, a credit facility), margin facilities, the issuance of preferred shares or notes and leverage attributable to reverse repurchase agreements, dollar rolls or similar transactions. The Fund currently employs leverage through a credit facility and outstanding Series A Mandatory Redeemable Preferred Shares (“MRPS”). As of December 31, 2022, the Fund had approximately $99,431,119 in outstanding borrowings under the credit facility and 2,000,000 MRPS outstanding with a total liquidation value of $50,000,000. See “Preferred Shares.” In the future, the Fund may use forms of leverage other than and/or in addition to a credit facility and preferred shares. The Fund may use leverage opportunistically and may choose to increase or decrease its leverage, or use different types or combinations of leveraging instruments, at any time based on the Fund’s assessment of market conditions and the investment environment. There can be no assurance that the Fund will use leverage or that its leveraging strategy will be successful during any period in which it is employed. See “Risk Factors.”

The Fund is authorized to issue an unlimited number of shares of beneficial interest, par value $0.001 per share, in multiple classes and series thereof as determined from time to time by the Board. The Board has authorized issuance of an unlimited number of common shares. Each share has equal voting, dividend, distribution and liquidation rights. The common shares are not redeemable and have no preemptive, conversion or cumulative voting rights. In the event of liquidation, each common share is entitled to its proportion of the Fund’s assets after payment of debts and expenses. As of January 4, 2023, 20,340,315 common shares of the Fund were outstanding.

On October 15, 2019, the Fund issued 2,000,000 MRPS with a total liquidation value of $50,000,000. The final redemption date of the MRPS is October 31, 2029. The Fund makes quarterly dividend payments on the MRPS at an annual dividend rate of 3.81%.

The Fund is authorized to issue an unlimited number of shares that have been classified by the Board as preferred shares, par value $0.001 per share. The terms of each series of preferred shares may be fixed by the Board and may materially limit and/or qualify the rights of holders of the Fund’s common shares. If the Board determines

2

that it may be advantageous to the holders of the Fund’s common shares for the Fund to utilize additional leverage, the Fund may issue additional series of fixed rate preferred shares (“Fixed Rate Preferred Shares”). Any Fixed Rate Preferred Shares issued by the Fund will pay distributions at a fixed rate, which may be reset after an initial period. Any borrowings may be at fixed or floating rates. Leverage creates a greater risk of loss as well as a potential for more gains for the common shares than if leverage were not used. See “Risk Factors.” The Fund may borrow money to the extent permitted by applicable law in accordance with its investment restrictions.

Investment Advisory Agreement

Pursuant to an investment advisory agreement, the Adviser will receive an annual fee, payable monthly by the Fund, in an amount equal to 1.10% of the Fund’s average daily Managed Assets (the “Management Fee”).

During periods when the Fund is using leverage, the Management Fee paid to the Adviser will be higher than if the Fund did not use leverage because the Management Fee paid is calculated on the basis of the Fund’s Managed Assets, which includes the assets purchased through leverage. See “Risk Factors.”

U.S. Bancorp Fund Services, LLC (the “Administrator”), located at 615 East Michigan Street, Milwaukee, Wisconsin 53202, serves as administrator to the Fund. Under the administration agreement, the Administrator is responsible for calculating the NAV of the common shares and generally managing the administrative affairs of the Fund.

The Administrator is entitled to receive a monthly fee based on the average daily value of the Fund’s net assets, subject to a minimum annual fee, plus

expenses. See “Management of the Fund—The Administrator.”

The Fund currently makes regular monthly cash distributions of all or a portion of its net investment income to shareholders of common shares (“Common Shareholders”). The Fund distributes to Common Shareholders at least annually all or substantially all of its net investment income after the payment of interest, fees and dividends, if any, owed with respect to any outstanding forms of leverage utilized by the Fund. The Fund intends to pay any capital gains distributions at least annually. If the Fund realizes a long-term capital gain, it will be required to allocate such gain between the common shares and any preferred shares issued by the Fund in proportion to the total distributions paid to each class for the year in which the income is realized. See “Distributions.”

Various factors affect the level of the Fund’s income, including the asset mix, the average maturity of the Fund’s portfolio, the amount of leverage utilized by the Fund and the Fund’s use of hedging. To permit the Fund to maintain a more stable monthly distribution, the Fund may, from time to time, distribute less than the entire amount of income earned in a particular period. The undistributed income would be available to supplement future distributions. As a result, the distributions paid by the Fund for any particular monthly period may be more or less than the amount of income actually earned by the Fund during that period. Undistributed income will add to the Fund’s NAV (and indirectly benefit the Adviser and the Administrator by increasing their fees) and, correspondingly, distributions from the Fund’s income will reduce the Fund’s NAV. See “Distributions.”

In accordance with the Fund’s Amended and Restated Declaration of Trust (the “Declaration of Trust”) and as required by the 1940 Act, all preferred shares of the Fund, including the MRPS, must have the same seniority with respect to distributions. Accordingly, no full distribution will be declared or paid on any series of preferred

3

shares of the Fund for any dividend period, or part thereof, unless full cumulative dividends and distributions due have been declared and made on all outstanding preferred shares of the Fund. Any partial distributions on such preferred shares will be made as nearly pro rata as possible in proportion to the respective amounts of distributions accumulated but unmade on each such series of preferred shares on the relevant dividend payment date.

In the event that for any calendar year the total distributions on the Fund’s preferred shares exceed the Fund’s current and accumulated earnings and profits allocable to such shares, the excess distributions will generally be treated as a

tax-free

return of capital (to the extent of the shareholder’s tax basis in the shares). The amount treated as a

tax-free

return of capital will reduce a shareholder’s adjusted tax basis in the preferred shares, thereby increasing the shareholder’s potential taxable gain or reducing the potential taxable loss on the sale of the shares. Any amount in excess of a shareholder’s remaining outstanding basis will constitute gain to such shareholder.

The Fund has elected to be treated and has qualified, and intends to continue to qualify annually to be treated for U.S. federal income tax purposes, as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, the Fund generally will not pay corporate-level federal income taxes on any net ordinary income or capital gains that it currently distributes to its Common Shareholders. To qualify and maintain its qualification as a RIC for U.S. federal income tax purposes, the Fund must meet specified

and asset diversification requirements and distribute annually at least 90% of its net ordinary income and realized net short-term capital gains in excess of realized net long-term capital losses, if any. See “Tax Considerations.”

Dividend Reinvestment Plan

Pursuant to the Dividend Reinvestment Plan (the “DRIP”), income dividends and/or capital gain distributions to Common Shareholders will automatically be reinvested in additional common shares of the Fund by U.S. Bancorp Fund Services, LLC (the “DRIP Administrator”). A Common Shareholder may terminate participation in the DRIP at any time by notifying the DRIP Administrator before the record date of the next distribution through the Internet, by telephone or in writing. Common Shareholders whose common shares are held in the name of a broker or other nominee and who wish to elect to receive any dividends and distributions in cash must contact their broker or nominee. All distributions to Common Shareholders who do not participate in the DRIP, or have elected to terminate their participation in the DRIP, will be paid by check mailed directly to the record holder by or under the direction of the DRIP Administrator when the Board declares a distribution. See “Dividend Reinvestment Plan.”

The Fund’s outstanding common shares are listed on the NYSE under the trading or “ticker” symbol “KIO.” See “Description of the Securities.”

Common shares of

closed-end

investment companies often trade at prices lower than their NAV. The Fund’s common shares have historically traded at a discount to the Fund’s NAV. Common shares of

closed-end

investment companies may trade during some periods at prices higher than their NAV and during other periods at prices lower than their NAV. The Fund cannot assure you that its common shares will trade at a price higher than or equal to NAV. The Fund’s NAV will be reduced immediately following an offering by the sales load and the amount of the offering expenses paid by the Fund.

4

In addition to NAV, the market price of the Fund’s common shares may be affected by such factors as the Fund’s dividend and distribution levels and stability, market liquidity, market supply and demand, unrealized gains, general market and economic conditions, and other factors. See “Risk Factors” and “Description of the Securities.”

The common shares are designed primarily for long term investors, and you should not purchase common shares of the Fund if you intend to sell them shortly after purchase. Preferred shares may also trade at premiums to or discounts from their liquidation preference for a variety of reasons, including changes in interest rates.

Custodian, Dividend Paying Agent, Transfer Agent and Registrar

U.S. Bank, N.A. serves as custodian (the “Custodian”) for the Fund. U.S. Bancorp Fund Services, LLC also provides accounting services to the Fund. U.S. Bancorp Fund Services, LLC also serves as the Fund’s dividend paying agent, transfer agent and registrar. See “Custodian, Dividend Paying Agent, Transfer Agent and Registrar.”

Investing in the Fund involves risks, including the risk that you may receive little or no return on your investment or that you may lose part or all of your investment. Please refer to the section of

the Fund’s most recent annual report on Form N-CSR entitled “Risk Factors,” which is incorporated by reference herein, for a discussion of the risks of investing in the Fund.

5

SUMMARY OF COMMON SHAREHOLDER FEES AND EXPENSES

The following tables are intended to assist you in understanding the various costs and expenses directly or indirectly associated with investing in our common shares as a percentage of net assets attributable to common shares. Amounts are for the current fiscal year.

Common Shareholder Transaction Expenses

|

|

|

|

|

| Sales Load Paid By You (as a percentage of the offering price) |

|

|

— |

% (1) |

| Offering Expenses borne by the Fund (as a percentage of the offering price) |

|

|

— |

% (1) |

| Dividend Reinvestment Plan Fees (per open market purchase transaction fee) |

$ |

|

20.00 |

(2) |

| Dividend Reinvestment Plan Fees (per sale transaction fee) |

$ |

|

31.95 |

(2) |

|

|

|

|

|

|

|

|

|

Percentage of Net Assets Attributable to Common Shares (Assumes Leverage is Used) (4) |

|

| |

|

|

|

|

| |

|

|

1.78 |

|

Interest Expenses and Payments on Borrowing |

|

|

2.50 |

|

| |

|

|

0.58 |

|

|

|

|

|

|

| |

|

|

4.86 |

% |

|

|

|

|

|

| (1) |

In the event that the securities to which this prospectus relates are sold to or through agents, underwriters or dealers, the related prospectus supplement will disclose the applicable sales load, the estimated amount of total offering expenses (which may include offering expenses borne by third parties on behalf of the Fund), the offering price and the offering expenses borne by the Fund as a percentage of the offering price. |

| (2) |

You will pay a fee of $20.00, which includes any applicable brokerage commissions, in connection with purchases by the DRIP Administrator of common shares on the open market. You will also pay a fee of $31.95 and any applicable brokerage commissions if you direct the DRIP Administrator to sell your common shares held in a dividend reinvestment account. See “Dividend Reinvestment Plan.” |

| (3) |

The Adviser will receive a monthly Management Fee at an annual rate of 1.10% of the average daily value of the Fund’s Managed Assets. Consequently, since the Fund has borrowings outstanding, the Management Fee as a percentage of net assets attributable to common shares is higher than if the Fund did not utilize leverage. |

| (4) |

Assumes the use of leverage through a credit facility and MRPS representing 37.5% of Managed Assets at an annual interest rate expense to the Fund of 4.32%, which is based on the interest rate currently applicable under the Fund’s existing credit facility and the dividends payable on the MRPS at an annual dividend rate equal to 3.81%. The Fund may use other forms of leverage, which may be subject to different interest expenses than those estimated above. The actual amount of interest expense borne by the Fund will vary over time in accordance with the level of the Fund’s use of leverage and variations in market interest rates. |

| (5) |

The “Other Expenses” shown in the table above and related footnotes are based upon estimated expenses for the current fiscal year. |

6

The following example illustrates the expenses that you would pay on a $1,000 investment in common shares, assuming (1) total net annual expenses of 4.86% of net assets attributable to common shares and (2) a 5% annual return.* The actual amounts in connection with the offering will be set forth in the prospectus supplement, if applicable.

| * |

The example should not be considered a representation of future expenses. Actual expenses may be greater or less than those shown. The example assumes that the estimated “Other Expenses” set forth in the Total Annual Expenses table are accurate and that all dividends and distributions are reinvested at NAV. Actual expenses may be greater or less than those assumed. Moreover, the Fund’s actual rate of return may be greater or less than the hypothetical 5% return shown in the example. |

7

The selected data below sets forth the per share operating performance and ratios for the periods presented. The financial information was derived from and should be read in conjunction with the Financial Statements of the Fund and Notes thereto, which are incorporated by reference into this prospectus and the SAI. The financial information for the last five fiscal years ended October 31 has been audited by Deloitte & Touche LLP, the Fund’s independent registered public accounting firm, whose unqualified report on such financial statements appears in the Fund’s annual report to shareholders for the year ended October 31, 2022, which is incorporated by reference into the SAI. You may also request a free copy of the report by calling (855)

862-6092,

by writing to the Fund or visiting the Fund’s website (https://www.kkrfunds.com/kio/).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per share operating performance (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, beginning of year |

|

$ |

16.78 |

|

|

$ |

14.86 |

|

|

$ |

15.57 |

|

|

$ |

17.24 |

|

|

$ |

18.38 |

|

|

$ |

17.67 |

|

|

$ |

17.11 |

|

|

$ |

18.98 |

|

|

$ |

19.56 |

|

|

$ |

19.06 |

|

(Loss) income from investment operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

1.35 |

|

|

|

1.40 |

|

|

|

1.39 |

|

|

|

1.49 |

|

|

|

1.51 |

|

|

|

1.59 |

|

|

|

1.61 |

|

|

|

1.47 |

|

|

|

1.48 |

|

|

|

0.27 |

|

Net realized and unrealized (losses) gains |

|

|

(4.40 |

) |

|

|

1.78 |

|

|

|

(0.60 |

) |

|

|

(1.66 |

) |

|

|

(0.07 |

) |

|

|

0.71 |

|

|

|

0.45 |

|

|

|

(1.69 |

) |

|

|

(0.40 |

) |

|

|

0.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total from investment operations |

|

|

(3.05 |

) |

|

|

3.18 |

|

|

|

0.79 |

|

|

|

(0.17 |

) |

|

|

1.44 |

|

|

|

2.30 |

|

|

|

2.06 |

|

|

|

(0.22 |

) |

|

|

1.08 |

|

|

|

0.63 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

(1.26 |

) |

|

|

(1.26 |

) |

|

|

(1.50 |

) |

|

|

(1.50 |

) |

|

|

(1.55 |

) |

|

|

(1.59 |

) |

|

|

(1.50 |

) |

|

|

(1.65 |

) |

|

|

(1.66 |

) |

|

|

(0.13 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

(1.26 |

) |

|

|

(1.26 |

) |

|

|

(1.50 |

) |

|

|

(1.50 |

) |

|

|

(1.55 |

) |

|

|

(1.59 |

) |

|

|

(1.50 |

) |

|

|

(1.65 |

) |

|

|

(1.66 |

) |

|

|

(0.13 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dilutive effect of rights offering |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1.03 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, end of year |

|

$ |

12.47 |

|

|

$ |

16.78 |

|

|

$ |

14.86 |

|

|

$ |

15.57 |

|

|

$ |

17.24 |

|

|

$ |

18.38 |

|

|

$ |

17.67 |

|

|

$ |

17.11 |

|

|

$ |

18.98 |

|

|

$ |

19.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

(27.01 |

)% |

|

|

36.24 |

% |

|

|

(3.58 |

)% |

|

|

7.55 |

% |

|

|

2.84 |

% |

|

|

18.08 |

% |

|

|

17.10 |

% |

|

|

(6.50 |

)% |

|

|

7.95 |

% |

|

|

(10.07 |

)%*** |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratios to average net assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

3.56 |

% |

|

|

3.12 |

% |

|

|

3.73 |

% |

|

|

3.38 |

% |

|

|

3.17 |

% |

|

|

2.74 |

% |

|

|

2.68 |

% |

|

|

2.46 |

% |

|

|

2.29 |

% |

|

|

2.32 |

%** |

| |

|

|

9.08 |

% |

|

|

8.49 |

% |

|

|

9.65 |

% |

|

|

9.07 |

% |

|

|

8.63 |

% |

|

|

8.74 |

% |

|

|

9.79 |

% |

|

|

8.23 |

% |

|

|

7.57 |

% |

|

|

5.36 |

%** |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

$ |

11.08 |

|

|

$ |

16.67 |

|

|

$ |

13.25 |

|

|

$ |

15.39 |

|

|

$ |

15.77 |

|

|

$ |

16.87 |

|

|

$ |

15.68 |

|

|

$ |

14.82 |

|

|

$ |

17.58 |

|

|

$ |

17.86 |

|

| |

|

|

(11.15 |

)% |

|

|

(0.66 |

)% |

|

|

(10.83 |

)% |

|

|

(1.16 |

)% |

|

|

(8.53 |

)% |

|

|

(8.22 |

)% |

|

|

(11.26 |

)% |

|

|

(13.38 |

)% |

|

|

(7.38 |

)% |

|

|

(8.69 |

)% |

Net assets, end of year (000’s) |

|

$ |

253,597 |

|

|

$ |

341,267 |

|