John Hancock Bank and Thrift Opportunity Fund Declares Year-End Managed Distribution

December 03 2004 - 4:39PM

PR Newswire (US)

John Hancock Bank and Thrift Opportunity Fund Declares Year-End

Managed Distribution BOSTON, Dec. 3 /PRNewswire-FirstCall/ -- John

Hancock Bank and Thrift Opportunity Fund (NYSE:BTO) declared its

year-end distribution pursuant to the fund's 10% managed

distribution policy today as follows: Declaration date: December 3,

2004 Ex-dividend date: December 9, 2004 Record date: December 13,

2004 Payment date: December 31, 2004 Source of Distribution Per

Share Dividend income $0.12627 Long-term capital gain $0.13139

Short-term capital gain $0.01234 Total $0.27000 The plan requires

the fund to make quarterly distributions of at least 2.5 percent of

the fund's net asset value as of the preceding calendar year-end,

or at least 10 percent annually. For the calendar year-ending 2004,

the plan requirements have been met. The last three managed

distributions were as follows: Declaration Date Per Share March 5,

2004 $0.27000 (long-term capital gain) June 4, 2004 $0.27000

(long-term capital gain) September 3, 2004 $0.27000 (long-term

capital gain) As of the fund's most recent semiannual reporting

period ended April 30, 2004, BTO had over $865 million in net

assets of which 54% was net unrealized appreciation of investments.

For individual taxable accounts, long-term capital gains are

subject to at a maximum Federal tax rate of 15%. For the 1- year

period ending October 31, 2004, BTO posted an average annual total

return at net asset value of 17.93%; 3-year, 19.07%; 5-year, 11.47%

and 10-year return, 17.76%. John Hancock Bank and Thrift

Opportunity Fund is a diversified, closed-end fund. The Fund seeks

long-term capital appreciation by normally investing at least 80%

of its assets in equity securities of U.S. regional banks and

thrifts and holding companies that primarily own or receive a

substantial portion of their income from regional banks or thrifts.

John Hancock Funds, a premier investment management company,

managed approximately $29 billion in open-end funds, closed-end

funds, private accounts, retirement plans and related party assets

for individual and institutional investors as of September 30,

2004. Additional information about the company can be found on the

website: http://www.jhfunds.com/. John Hancock Funds is a wholly

owned subsidiary of John Hancock Financial Services, Inc., a

subsidiary of Manulife Financial Corporation. Founded in 1862, John

Hancock Financial Services and its subsidiaries today offer a broad

range of financial products and services, including whole, term,

variable, and universal life insurance, as well as college savings

products, mutual funds, fixed and variable annuities, long-term

care insurance and various forms of business insurance. Manulife

Financial is a leading Canadian-based financial services group

serving millions of customers in 19 countries and territories

worldwide. Operating as Manulife Financial in Canada and most of

Asia, and primarily through John Hancock in the United States, the

Company offers clients a diverse range of financial protection

products and wealth management services through its extensive

network of employees, agents and distribution partners. Funds under

management by Manulife Financial and its subsidiaries were Cdn$346

billion (US$274 billion) as at September 30, 2004. Manulife

Financial Corporation trades as 'MFC' on the TSX, NYSE and PSE, and

under '0945' on the SEHK. Manulife Financial can be found on the

Internet at http://www.manulife.com/. DATASOURCE: John Hancock

Funds CONTACT: Kimberley Dietrich, +1-617-375-0311, or Investors:

+1-800-843-0090, both of John Hancock Web site:

http://www.manulife.com/

Copyright

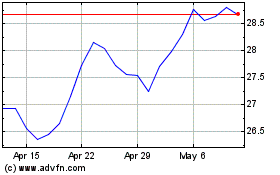

John Hancock Financial O... (NYSE:BTO)

Historical Stock Chart

From Jun 2024 to Jul 2024

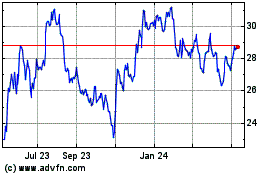

John Hancock Financial O... (NYSE:BTO)

Historical Stock Chart

From Jul 2023 to Jul 2024