Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

August 31 2022 - 9:05AM

Edgar (US Regulatory)

Prospectus and Statement of Additional Information Supplement

|

JOHN HANCOCK ASSET-BASED LENDING FUND

JOHN HANCOCK BOND TRUST |

JOHN HANCOCK INVESTMENT TRUST

JOHN HANCOCK INVESTMENT TRUST II |

| JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND |

JOHN HANCOCK INVESTORS TRUST |

| JOHN HANCOCK CAPITAL SERIES |

JOHN HANCOCK MUNICIPAL SECURITIES TRUST |

|

JOHN HANCOCK CURRENT INTEREST

JOHN HANCOCK FINANCIAL OPPORTUNITIES FUND

JOHN HANCOCK FUNDS II

JOHN HANCOCK FUNDS III |

JOHN HANCOCK PREMIUM DIVIDEND FUND

JOHN HANCOCK SOVEREIGN BOND FUND

JOHN HANCOCK STRATEGIC SERIES

JOHN HANCOCK TAX-ADVANTAGED GLOBAL SHAREHOLDER YIELD FUND |

Supplement dated August 31, 2022 to the current Prospectus

and Statement of Additional Information (the SAI), as may be supplemented

In December 2020, the Securities and Exchange Commission

adopted Rule 2a-5 (the “Valuation Rule”) under the Investment Company Act of 1940 (“1940 Act”), providing a framework

for fund valuation practices and addressing the particular role of boards of directors with respect to the fair value of such fund’s

investments. Among other things, the Valuation Rule permits a fund’s board to designate a fund’s investment adviser to perform

the fund’s fair value determinations, subject to board oversight and certain reporting and other requirements. Compliance with the

Valuation Rule is required by September 8, 2022.

The Board of Trustees of the Trusts (each, a “Board”

and collectively, the “Boards”) listed above, as of September 1, 2022 (the “Effective Date”), have each designated

John Hancock Investment Management LLC (the “Advisor”) as the valuation designee to perform fair value functions in accordance

with the Advisor’s Valuation Policies and Procedures (the “Valuation Policy”), relating to the assets held by each fund

of each Trust on any day that a fund’s NAV is determined. The Advisor undertakes such process in accordance with its Valuation Policy

and related procedures that the Advisor maintains and may update from time to time. Each Board has, as of the Effective Date, delegated

the fair valuation responsibility to the Advisor, subject to its oversight, and the Advisor’s use of its Valuation Policy replaces

any and all references to the contrary.

You should read this supplement in conjunction with the Prospectus and

SAI and retain it for your future reference.

Manulife, Manulife Investment Management, Stylized M Design, and Manulife

Investment Management & Stylized M Design are trademarks of The Manufacturers Life Insurance Company and are used by its affiliates

under license.

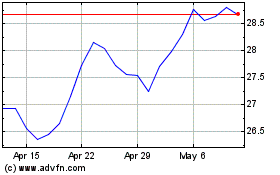

John Hancock Financial O... (NYSE:BTO)

Historical Stock Chart

From Jun 2024 to Jul 2024

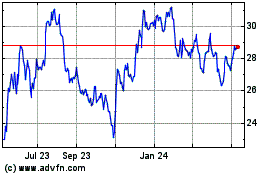

John Hancock Financial O... (NYSE:BTO)

Historical Stock Chart

From Jul 2023 to Jul 2024