- Quarterly Schedule of Portfolio Holdings of Registered Management Investment Company (N-Q)

March 29 2012 - 1:55PM

Edgar (US Regulatory)

|

|

|

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

|

|

|

FORM N-Q

|

|

|

|

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED

|

|

MANAGEMENT INVESTMENT COMPANIES

|

|

|

|

Investment Company Act file number

811-8568

|

|

|

|

John Hancock Bank and Thrift Opportunity Fund

|

|

(Exact name of registrant as specified in charter)

|

|

|

|

601 Congress Street, Boston, Massachusetts 02210

|

|

(Address of principal executive offices) (Zip code)

|

|

|

|

Salvatore Schiavone, Treasurer

|

|

|

|

601 Congress Street

|

|

|

|

Boston, Massachusetts 02210

|

|

|

|

(Name and address of agent for service)

|

|

|

|

Registrant's telephone number, including area code:

617-663-4497

|

|

|

|

Date of fiscal year end:

|

October 31

|

|

|

|

Date of reporting period:

|

January 31, 2012

|

ITEM 1. SCHEDULE OF INVESTMENTS

Bank and Thrift Opportunity Fund

As of 1-31-12 (Unaudited)

|

|

|

|

|

|

Shares

|

Value

|

|

|

|

Common Stocks 95.24%

|

|

$303,815,361

|

|

|

(Cost $315,445,878)

|

|

|

|

|

|

Financials 95.24%

|

|

303,815,361

|

|

|

Commercial Banks 78.46 %

|

|

|

|

1st United Bancorp, Inc. (I)

|

346,472

|

1,995,679

|

|

Ameris Bancorp (I)

|

243,266

|

2,607,812

|

|

Anchor Bancorp, Inc. (I)

|

88,416

|

729,432

|

|

Avenue Bank (I)(R)

|

300,000

|

1,329,828

|

|

Bank of Marin Bancorp

|

12,596

|

488,095

|

|

Bar Harbor Bankshares

|

34,552

|

1,036,560

|

|

BB&T Corp.

|

322,283

|

8,762,875

|

|

Bond Street Holdings LLC, Class A (I)(S)

|

291,804

|

5,252,472

|

|

Bridge Capital Holdings (I)

|

150,564

|

1,629,102

|

|

Bryn Mawr Bank Corp.

|

80,000

|

1,608,800

|

|

BSB Bancorp, Inc. (I)

|

39,555

|

428,776

|

|

California United Bank (I)

|

83,002

|

821,720

|

|

Camden National Corp.

|

36,776

|

1,265,094

|

|

Centerstate Banks, Inc.

|

395,460

|

2,787,993

|

|

Citizens Republic Bancorp, Inc. (I)

|

484,565

|

6,226,660

|

|

City Holding Company

|

39,363

|

1,398,961

|

|

Comerica, Inc.

|

287,393

|

7,952,164

|

|

Cullen/Frost Bankers, Inc.

|

251,048

|

13,975,842

|

|

DNB Financial Corp.

|

78,515

|

907,633

|

|

Eastern Virginia Bankshares, Inc. (I)

|

69,998

|

182,695

|

|

ECB Bancorp, Inc.

|

27,208

|

276,161

|

|

Evans Bancorp, Inc.

|

44,876

|

574,413

|

|

Fifth Third Bancorp

|

452,067

|

5,881,392

|

|

First Bancorp, Inc.

|

146,499

|

2,342,519

|

|

First California Financial Group, Inc. (I)

|

198,849

|

874,936

|

|

First Commonwealth Financial Corp.

|

86,937

|

481,631

|

|

First Horizon National Corp.

|

180,033

|

1,571,688

|

|

First Merchants Corp.

|

118,683

|

1,169,028

|

|

First Midwest Bancorp, Inc.

|

137,459

|

1,495,554

|

|

First Southern Bancorp, Inc., Class B (I)

|

78,390

|

705,510

|

|

FirstMerit Corp.

|

116,586

|

1,829,234

|

|

FNB Corp.

|

767,513

|

8,995,252

|

|

Glacier Bancorp, Inc.

|

223,556

|

3,123,077

|

|

Hancock Holding Company

|

232,176

|

7,708,243

|

|

Heritage Commerce Corp. (I)

|

387,733

|

1,923,156

|

|

Heritage Financial Corp.

|

134,466

|

1,886,558

|

|

Heritage Oaks Bancorp (I)

|

650,719

|

2,570,340

|

|

Horizon Bancorp

|

22,537

|

405,666

|

|

Huntington Bancshares, Inc.

|

610,005

|

3,483,129

|

|

Independent Bank Corp. - MA

|

195,961

|

5,435,958

|

|

Intermountain Community Bancorp (I)

|

1,020,000

|

1,162,800

|

|

KeyCorp

|

216,866

|

1,685,049

|

|

M&T Bank Corp.

|

102,651

|

8,185,391

|

|

MainSource Financial Group, Inc.

|

9,968

|

93,600

|

|

MB Financial, Inc.

|

296,947

|

5,389,588

|

|

NewBridge Bancorp. (I)

|

148,543

|

586,745

|

|

Northrim BanCorp, Inc.

|

77,232

|

1,551,591

|

|

Pacific Continental Corp.

|

183,645

|

1,627,095

|

|

Park National Corp.

|

39,113

|

2,707,793

|

|

Park Sterling Corp. (I)

|

329,909

|

1,445,001

|

|

Peoples Bancorp, Inc.

|

64,573

|

1,011,213

|

|

PNC Financial Services Group, Inc.

|

232,272

|

13,685,466

|

Bank and Thrift Opportunity Fund

As of 1-31-12 (Unaudited)

|

|

|

|

|

|

Shares

|

Value

|

|

|

|

|

|

Financials (continued)

|

|

|

|

|

Prosperity Bancshares, Inc.

|

127,654

|

$5,298,918

|

|

Sandy Spring Bancorp, Inc.

|

54,695

|

998,731

|

|

Sierra Bancorp

|

140,000

|

1,278,200

|

|

Southcoast Financial Corp. (I)

|

70,854

|

102,738

|

|

Southwest Bancorp, Inc. (I)

|

156,326

|

1,305,322

|

|

State Bank Financial Corp. (I)

|

103,998

|

1,662,928

|

|

Sun Bancorp, Inc. (I)

|

283,677

|

828,337

|

|

SunTrust Banks, Inc.

|

437,631

|

9,002,070

|

|

SVB Financial Group (I)

|

212,782

|

12,349,867

|

|

Synovus Financial Corp.

|

2,079,408

|

3,618,170

|

|

Talmer Bancorp, Inc. (I)(S)

|

462,595

|

3,484,657

|

|

TCF Financial Corp.

|

429,138

|

4,308,546

|

|

TriCo Bancshares

|

202,536

|

3,025,888

|

|

Trustmark Corp.

|

123,537

|

2,911,767

|

|

U.S. Bancorp

|

359,665

|

10,149,746

|

|

Union First Market Bankshares Corp.

|

161,746

|

2,222,390

|

|

United Bancorp, Inc. (I)

|

317,968

|

1,033,396

|

|

Univest Corp. of Pennsylvania

|

19,000

|

281,580

|

|

Washington Banking Company

|

67,556

|

894,441

|

|

Washington Trust Bancorp, Inc.

|

123,905

|

3,059,214

|

|

Wells Fargo & Company

|

478,758

|

13,984,521

|

|

WesBanco, Inc.

|

99,295

|

1,981,928

|

|

Westamerica Bancorp.

|

30,499

|

1,416,679

|

|

Wilshire Bancorp, Inc. (I)

|

618,257

|

2,163,900

|

|

Zions Bancorporation

|

574,359

|

9,672,206

|

|

|

|

|

|

Diversified Financial Services 6.45 %

|

|

|

|

Bank of America Corp.

|

1,278,555

|

9,116,097

|

|

JPMorgan Chase & Company

|

307,556

|

11,471,839

|

|

|

|

|

|

Thrifts & Mortgage Finance 10.33 %

|

|

|

|

Berkshire Hill Bancorp, Inc.

|

358,903

|

8,118,386

|

|

Cheviot Financial Corp.

|

111,922

|

913,284

|

|

Citizens South Banking Corp.

|

343,181

|

1,338,406

|

|

First Defiance Financial Corp.

|

125,381

|

1,940,898

|

|

First Financial Holdings, Inc.

|

208,427

|

2,023,826

|

|

Flushing Financial Corp.

|

187,981

|

2,464,431

|

|

Heritage Financial Group, Inc.

|

95,762

|

1,100,305

|

|

Hingham Institution for Savings

|

80,000

|

4,120,000

|

|

Home Federal Bancorp, Inc.

|

125,986

|

1,298,916

|

|

Kaiser Federal Financial Group, Inc.

|

109,586

|

1,449,823

|

|

New York Community Bancorp, Inc.

|

365,166

|

4,633,957

|

|

Southern Missouri Bancorp, Inc.

|

29,822

|

665,031

|

|

WSFS Financial Corp.

|

73,787

|

2,871,052

|

|

|

|

|

|

|

Shares

|

Value

|

|

|

|

Preferred Securities 2.23%

|

|

$7,101,485

|

|

|

(Cost $6,186,438)

|

|

|

|

|

|

Financials 2.23%

|

|

7,101,485

|

|

|

Commercial Banks 0.85 %

|

|

|

|

First Republic Bank of San Francisco, 6.700%

|

20,000

|

501,000

|

|

First Southern Bancorp, Inc. (I)

|

134

|

457,268

|

|

Monarch Financial Holdings, Inc., Series B, 7.800%

|

38,925

|

1,022,560

|

Bank and Thrift Opportunity Fund

As of 1-31-12 (Unaudited)

|

|

|

|

|

|

|

|

|

|

Shares

|

Value

|

|

|

|

Financials (continued)

|

|

|

|

|

|

|

Zions Bancorporation, Series C, 9.500%

|

|

|

27,646

|

$724,878

|

|

|

|

|

|

|

|

Diversified Financial Services 1.38 %

|

|

|

|

|

|

Bank of America Corp., Series MER, 8.625%

|

|

|

123,599

|

3,107,279

|

|

Citigroup Capital XII (8.500% to 3-30-15, then 3 month LIBOR +

|

|

|

|

|

|

5.870%)

|

|

|

50,000

|

1,288,500

|

|

|

|

|

|

Maturity

|

Par value

|

|

|

Rate (%)

|

date

|

|

Value

|

|

|

|

Corporate Bonds 0.80%

|

|

|

|

$2,548,901

|

|

|

(Cost $2,358,014)

|

|

|

|

|

|

|

|

Financials 0.80%

|

|

|

|

2,548,901

|

|

|

Commercial Banks 0.80 %

|

|

|

|

|

|

Regions Financial Corp.

|

7.375

|

12/10/37

|

$1,869,000

|

1,656,401

|

|

Synovus Financial Corp.

|

5.125

|

06/15/17

|

1,000,000

|

892,500

|

|

|

|

|

|

Capital Preferred Securities 0.08%

|

|

|

|

$244,800

|

|

|

(Cost $262,949)

|

|

|

|

|

|

|

|

Financials 0.08%

|

|

|

|

244,800

|

|

|

Commercial Banks 0.08 %

|

|

|

|

|

|

Banponce Trust I, Series A

|

8.327

|

02/01/27

|

360,000

|

244,800

|

|

|

|

|

|

|

|

|

|

|

Shares

|

Value

|

|

|

|

Warrants 0.86%

|

|

|

|

$2,732,108

|

|

|

(Cost $3,657,203)

|

|

|

|

|

|

|

|

Financials 0.86%

|

|

|

|

2,732,108

|

|

|

Commercial Banks 0.71%

|

|

|

|

|

|

Bank of Marin Bancorp (Expiration Date: 12-5-18, Strike Price: $27.23) (I)

|

|

57,849

|

721,152

|

|

Comerica, Inc. (Expiration Date: 11-14-18, Strike Price: $29.40)

(I)(J)

|

|

93,762

|

548,508

|

|

Horizon Bancorp (Expiration Date: 12-19-18, Strike Price: $17.68) (I)

|

|

118,860

|

801,493

|

|

TCF Financial Corp. (Expiration Date: 11-14-18, Strike Price: $16.93) (I)

|

|

71,775

|

144,268

|

|

Valley National Bancorp (Expiration Date: 11-14-18, Strike Price: $16.92) (I)(J)

|

33,222

|

44,181

|

|

|

|

|

|

|

|

Diversified Financial Services 0.11%

|

|

|

|

|

|

Citigroup, Inc. (Expiration Date: 1-4-19; Strike Price: $106.10) (I)

|

|

1,045,183

|

360,588

|

|

|

|

|

|

|

|

Thrifts & Mortgage Finance 0.04%

|

|

|

|

|

|

Washington Federal, Inc. (Expiration Date: 11-14-18, Strike Price: $17.57)

(I)(J)

|

27,297

|

111,918

|

|

|

|

|

|

|

|

|

|

Maturity

|

Par value

|

|

|

|

Yield

|

date

|

|

Value

|

|

|

|

Certificates of Deposit 0.02%

|

|

|

|

$62,676

|

|

|

(Cost $62,676)

|

|

|

|

|

|

|

|

Country Bank for Savings

|

1.640

|

08/28/12

|

$1,879

|

1,879

|

|

First Bank Richmond

|

2.226

|

12/05/13

|

19,076

|

19,076

|

|

First Bank System, Inc.

|

0.992

|

04/01/13

|

4,809

|

4,818

|

|

Framingham Cooperative Bank

|

1.147

|

09/08/13

|

3,862

|

3,862

|

|

Home Bank

|

0.867

|

12/04/13

|

18,442

|

18,442

|

Bank and Thrift Opportunity Fund

As of 1-31-12 (Unaudited)

|

|

|

|

|

|

|

|

|

Maturity

|

Par value

|

|

|

|

Yield

|

date

|

|

Value

|

|

|

|

Midstate Federal Savings and Loan

|

1.189

|

05/27/12

|

$1,935

|

$1,935

|

|

Milford Bank

|

0.995

|

06/04/13

|

1,853

|

1,853

|

|

Milford Federal Savings and Loan Association

|

0.349

|

04/20/12

|

2,005

|

2,005

|

|

Mount Mckinley Savings Bank

|

0.400

|

12/03/12

|

1,689

|

1,689

|

|

Newburyport Bank

|

1.250

|

10/22/12

|

2,010

|

2,010

|

|

Newton Savings Bank

|

0.999

|

05/30/13

|

1,891

|

1,892

|

|

OBA Federal Savings and Loan

|

0.750

|

06/15/13

|

1,307

|

1,307

|

|

Plymouth Savings Bank

|

0.600

|

04/21/13

|

1,908

|

1,908

|

|

|

|

|

|

|

Par value

|

Value

|

|

|

|

Short-Term Investments 0.38%

|

|

|

|

$1,224,000

|

|

|

(Cost $1,224,000)

|

|

|

|

|

|

|

|

Repurchase Agreement 0.38%

|

|

|

|

1,224,000

|

|

|

Repurchase Agreement with State Street Corp. dated 1-31-12 at

|

|

|

|

|

|

0.010% to be repurchased at $1,224,000 on 2-1-12, collateralized

|

|

|

|

|

by $1,255,000 Federal Home Loan Mortgage Corp., 1.000% due 3-

|

|

|

|

|

8-17 (valued at $1,251,863, including interest)

|

|

|

1,224,000

|

1,224,000

|

|

|

|

|

|

Total investments (Cost $329,197,158)† 99.61%

|

|

|

|

$317,729,331

|

|

|

|

|

Other assets and liabilities, net 0.39%

|

|

|

|

$1,250,088

|

|

|

|

|

Total net assets 100.00%

|

|

|

|

$318,979,419

|

|

The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the Fund.

LIBOR London Interbank Offered Rate

(I) Non-income producing security.

(J) These securities are issued under the U.S. Treasury Department’s Capital Purchase Program.

(R) Direct placement securities are restricted to resale and the Fund has limited rights to registration under the Securities Act of 1933.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Value as a

|

|

|

|

Original

|

|

Beginning

|

Ending

|

percentage

|

|

|

|

Acquisition

|

|

share

|

share

|

of Fund's

|

Value as of

|

|

Issuer, description

|

date

|

Acquisition cost

|

amount

|

amount

|

net assets

|

1-31-12

|

|

|

Avenue Bank

|

1-29-07

|

$3,000,000

|

300,000

|

300,000

|

0.42%

|

$1,329,828

|

(S) These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration.

† At 1-31-12, the aggregate cost of investment securities for federal income tax purposes was $329,212,703. Net unrealized depreciation aggregated $11,483,372, of which $29,033,710 related to appreciated investment securities and $40,517,082 related to depreciated investment securities.

Security valuation.

Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00

P

.

M

., Eastern Time. The Fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities. Level 2 includes securities valued using significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the Fund’s own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The following is a summary of the values by input classification of the Fund’s investments as of January 31, 2012

,

by major security category or type:

|

|

|

|

|

|

|

|

|

|

Level 2

|

Level 3

|

|

|

Total Market

|

|

Significant

|

Significant

|

|

|

Value at

|

Level 1 Quoted

|

Observable

|

Unobservable

|

|

|

01/31/12

|

Price

|

Inputs

|

Inputs

|

|

|

Common Stocks

|

|

|

|

|

|

Commercial Banks

|

$250,289,110

|

$239,059,353

|

$6,415,272

|

$4,814,485

|

|

Diversified Financial Services

|

20,587,936

|

20,587,936

|

—

|

—

|

|

Thrifts & Mortgage Finance

|

32,938,315

|

32,938,315

|

—

|

—

|

|

Preferred Securities

|

|

|

|

|

|

Commercial Banks

|

2,705,706

|

2,248,438

|

—

|

457,268

|

|

Diversified Financial Services

|

4,395,779

|

4,395,779

|

—

|

—

|

|

Corporate Bonds

|

|

|

|

|

|

Commercial Banks

|

2,548,901

|

—

|

2,548,901

|

—

|

|

Capital Preferred Securities

|

|

|

|

|

|

Commercial Banks

|

244,800

|

—

|

244,800

|

—

|

|

Warrants

|

2,732,108

|

1,209,463

|

1,522,645

|

—

|

|

Certificates of Deposit

|

62,676

|

—

|

62,676

|

—

|

|

Short-Term Investments

|

1,224,000

|

—

|

1,224,000

|

—

|

|

Total Investments in Securities

|

$317,729,331

|

$300,439,284

|

$12,018,294

|

$5,271,753

|

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. During the period ended January 31, 2012, there were no significant transfers into or out of Level 1, Level 2 or Level 3.

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value. Transfers into or out of Level 3 represent the beginning value of any security or instrument where a change in the level has occurred from the beginning to the end of the period.

|

|

|

|

|

|

|

|

|

|

Preferred

|

|

|

|

|

Common Stocks

|

Securities

|

Total

|

|

|

Balance as of 10-31-11

|

|

$4,284,675

|

$497,681

|

$4,782,356

|

|

Realized gain (loss)

|

|

-

|

-

|

-

|

|

Changed in unrealized appreciation

|

|

|

|

|

|

(depreciation)

|

|

529,810

|

(40,413)

|

489,397

|

|

Purchases

|

|

-

|

-

|

-

|

|

Sales

|

|

-

|

-

|

-

|

|

Transfers into Level 3

|

|

-

|

-

|

-

|

|

Transfers out of Level 3

|

|

-

|

-

|

-

|

|

Balance as of 1-31-12

|

|

$4,814,485

|

$457,268

|

$5,271,753

|

|

Change in unrealized at period end*

|

|

$529,810

|

($40,413)

|

$489,397

|

*Change in unrealized appreciation (depreciation) attributable to level 3 securities held at the period end.

In order to value the securities, the Fund uses the following valuation techniques. Equity securities held by the Fund are valued at the last sale price or official closing price on the principal securities exchange on which they trade. In the event there were no sales during the day or closing prices are not available, then securities are valued using the last quoted bid or evaluated price. Debt obligations are valued based on the evaluated prices provided by an independent pricing service, which utilizes both dealer-supplied and electronic data processing techniques, taking into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data. Certain securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Certain short-term securities are valued at amortized cost. Other portfolio securities and assets, where market quotations are not readily available, are valued at fair value, as determined in good faith by the Fund’s Pricing Committee, following procedures established by the Board of Trustees.

Repurchase agreements.

The Fund may enter into repurchase agreements. When the Fund enters into a repurchase agreement, it receives collateral which is held in a segregated account by the Fund’s custodian. The collateral amount is marked-to-market and monitored on a daily basis to ensure that the collateral held is in an amount not less than the principal amount of the repurchase agreement plus any accrued interest. In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the collateral value may decline.

For additional information on the Fund's significant accounting policies, please refer to the Fund's most recent semiannual or annual shareholder report.

ITEM 2. CONTROLS AND PROCEDURES.

(a) Based upon their evaluation of the registrant's disclosure controls and procedures as conducted within 90 days of the filing date of this Form N-Q, the registrant's principal executive officer and principal accounting officer have concluded that those disclosure controls and procedures provide reasonable assurance that the material information required to be disclosed by the registrant on this report is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms.

(b) There were no changes in the registrant's internal control over financial reporting that occurred during the registrant's last fiscal quarter that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting.

ITEM 3. EXHIBITS.

Separate certifications for the registrant's principal executive officer and principal accounting officer, as required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

John Hancock Bank and Thrift Opportunity Fund

|

|

|

|

By:

|

/s/ Keith F. Hartstein

|

|

|

------------------------------

|

|

|

Keith F. Hartstein

|

|

|

President and Chief Executive Officer

|

|

|

|

|

|

Date:

|

March 26, 2012

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

|

|

|

By:

|

Keith F. Hartstein

|

|

|

-------------------------------

|

|

|

Keith F. Hartstein

|

|

|

President and Chief Executive Officer

|

|

|

|

|

|

Date:

|

March 26, 2012

|

|

|

|

|

|

By:

|

/s/ Charles A. Rizzo

|

|

|

-------------------------------

|

|

|

Charles A. Rizzo

|

|

|

Chief Financial Officer

|

|

|

|

|

|

Date:

|

March 26, 2012

|

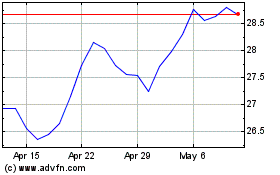

John Hancock Financial O... (NYSE:BTO)

Historical Stock Chart

From Jun 2024 to Jul 2024

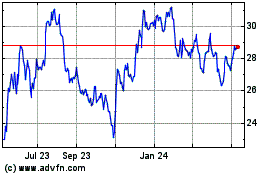

John Hancock Financial O... (NYSE:BTO)

Historical Stock Chart

From Jul 2023 to Jul 2024