Van Kampen Trust for Investment Grade New York Municipals Announces Completion of Reorganization with Van Kampen New York Value

October 31 2005 - 3:29PM

Business Wire

Van Kampen Asset Management announced today that the proposed

reorganization of Van Kampen New York Value Municipal Income Trust

(NYSE/CHX: VNV) into Van Kampen Trust for Investment Grade New York

Municipals (NYSE/CHX: VTN) has been completed. In the

reorganization, shareholders of VNV received newly issued shares of

VTN. The conversion exchange rate (the rate by which one multiplies

the amount of VNV common shares to determine the number of VTN

common shares issued as part of the reorganization) was 0.936312,

and the exchange ratio between preferred shares of VNV and

preferred shares of VTN was one VNV preferred share into one VTN

preferred share. Van Kampen Asset Management is a subsidiary of Van

Kampen Investments Inc. ("Van Kampen"). Van Kampen is one of the

nation's largest investment management companies, with more than

$104 billion in assets under management or supervision, as of

September 30, 2005. With roots in money management dating back to

1927, Van Kampen has helped more than four generations of investors

work toward their financial goals. Van Kampen is a wholly owned

subsidiary of Morgan Stanley (NYSE: MWD). For more information,

visit Van Kampen's web site at www.vankampen.com. There is no

assurance that the Fund will achieve its investment objective. An

investment in the Fund should be made with an understanding of the

risks of investment primarily in debt securities. The Fund is

subject to the market risks, credit risks, and income risks which

generally are affected by changes in interest rates and credit

qualities. Accordingly, you can lose money investing in the Fund.

The Fund may invest in derivative instruments, which may magnify

volatility. Copyright (C)2005 Van Kampen Funds Inc. All rights

reserved. Member NASD/SIPC.

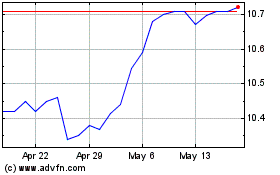

Invesco Trust for Invest... (NYSE:VTN)

Historical Stock Chart

From Jul 2024 to Jul 2024

Invesco Trust for Invest... (NYSE:VTN)

Historical Stock Chart

From Jul 2023 to Jul 2024