InfraSource Services, Inc. (NYSE:IFS), one of the largest specialty

contractors servicing utility transmission and distribution

infrastructure in the United States, today announced its financial

results for the third quarter ended September 30, 2005. Third

Quarter Results Revenues for the third quarter 2005 increased $68.0

million, or 42%, to $229.9 million, compared to $161.9 million for

the same quarter in 2004. This increase was due to growth in

revenues from each of our electric, natural gas, and

telecommunication end markets. Net income for the third quarter

2005 was $6.6 million, or $0.16 per diluted share, including a gain

on disposition of discontinued operations, a reduction to insurance

reserves, and the write-off of due diligence costs associated with

an abandoned acquisition, versus net income of $5.1 million, or

$0.13 per diluted share, for the third quarter last year. Excluding

the items in the attached table, income as adjusted (non-GAAP) was

$6.0 million for the third quarter 2005 versus income as adjusted

of $5.6 million for the same quarter in 2004. Reconciliations of

net income to the non-GAAP financial measures income as adjusted,

EBITDA from continuing operations and EBITDA from continuing

operations as adjusted are included in the attached tables. EBITDA

from continuing operations for the third quarter 2005 was $19.5

million, including the insurance reserve adjustment and the

write-off of due diligence costs mentioned above, compared to $17.2

million for the third quarter 2004. Excluding the items in the

attached table, EBITDA from continuing operations as adjusted

increased $2.2 million, or 13%, to $19.6 million for the third

quarter 2005 versus $17.4 million for the third quarter a year ago.

The aforementioned gain on disposition of discontinued operations

relates to the previously announced dispositions of Electric

Services, Inc. and Utility Locate and Mapping Services, Inc. The

insurance reserve adjustment mentioned above is a result of updated

actuarial estimates reflecting favorable loss development in our

self insured retentions. The aforementioned write-off of due

diligence costs relates to an acquisition opportunity that the

Company pursued over the past year. In the third quarter, the

Company decided to not pursue this opportunity. These items will be

discussed in the Company's quarterly filing with the Securities and

Exchange Commission. Backlog & New Awards At the end of the

third quarter 2005, total backlog was $819 million, a 3% decrease

compared to the end of the second quarter 2005 and 17% less than at

the end of the third quarter 2004. This decline was anticipated due

to the backlog burn associated with multi-year natural gas master

service agreements that renew on a cycle of 2-3 years.

Approximately $150 to $170 million of this backlog is expected to

be performed during the balance of 2005, and approximately $400 to

$420 million is expected to be performed during the next calendar

year. Among the contracts awarded to us during the third quarter

2005 were 6 transmission line projects totaling $57 million and a

substation project of $19 million. We also performed approximately

$9 million of storm work related to power restoration efforts in

the Gulf region following Hurricanes Katrina and Rita. "We are

pleased with our results for the quarter, including our

contributions to the restoration efforts following Hurricanes

Katrina and Rita. We continue to believe that we are well

positioned to benefit from increased utility spending on electric

transmission infrastructure. The level of activity in our end

markets, as evidenced by the strength of our bidding activity,

particularly for electric transmission lines, remains high. Our

quarterly revenue and earnings will continue to depend on the

timing and scope of contract awards, especially those for large

transmission lines. Our backlog will depend on our contract awards

and the cycle of our natural gas master service agreement renewals"

said David Helwig, Chief Executive Officer. Nine Months Financial

Review Revenues for the nine months ended September 30, 2005

increased $192.0 million, or 43%, to $642.2 million, compared to

$450.2 million for the same period in 2004. This increase was due

to growth in revenues from each of our electric, natural gas, and

telecommunication end markets, including organic growth and the

2004 acquisitions of EnStructure and Utili-Trax. This growth was

achieved despite the completion of the Path 15 project last year, a

substantial portion of which was recognized in the nine months

ended September 30, 2004. Net income for the nine months ended

September 30, 2005 was $7.9 million, or $0.20 per diluted share,

including an after-tax loss of $5.1 million related to the

previously announced underground construction project, versus net

income of $4.1 million, or $0.12 per diluted share, for the same

period last year. Excluding the items in the attached table, income

as adjusted was $7.8 million for the nine months ended September

30, 2005, including the underground project loss, versus income as

adjusted of $14.7 million for the same period in 2004. EBITDA from

continuing operations for the nine months ended September 30, 2005

was $42.8 million, including the $9.0 million pre-tax loss on the

aforementioned underground construction project, compared to $41.4

million for the nine months ended September 30, 2004. Excluding the

items in the attached table, EBITDA from continuing operations as

adjusted was $39.9 million for the nine months ended September 30,

2005, including the project loss, versus $49.9 million for the same

period a year ago. Conference Call InfraSource has scheduled a

conference call for November 2, 2005 at 9:00AM EDT to discuss the

results for the quarter. This conference call will be webcast live

on the InfraSource website at www.infrasourceinc.com by clicking on

the investors, webcasts & presentations links. A webcast replay

will be available immediately following the call at the same

location on the website through November 1, 2006. For those

investors who prefer to participate in the conference call by

phone, please dial (719) 457-2661. An audio replay of the

conference call will be available shortly after the call through

November 9, 2005 by calling (719) 457-0820 and using passcode

8082412. For more information, please contact Laura Martin at

Taylor Rafferty at (212) 889-4350. About InfraSource InfraSource

Services, Inc. (NYSE:IFS) is one of the largest specialty

contractors servicing utility transmission and distribution

infrastructure in the United States. InfraSource designs, builds,

and maintains transmission and distribution networks for utilities,

power producers, and industrial customers. Further information can

be found at www.infrasourceinc.com. - Tables to Follow - Safe

Harbor Statement Certain statements contained in this press release

are forward-looking statements. These forward-looking statements

are based upon our current expectations about future events. When

used in this press release, the words "believe," "anticipate,"

"intend," "estimate," "expect," "will," "should," "may," and

similar expressions, or the negative of such words and expressions,

are intended to identify forward-looking statements, although not

all forward-looking statements contain such words or expressions.

These forward-looking statements generally relate to our plans,

objectives and expectations for future operations and are based

upon management's current estimates and projections of future

results or trends. However, these statements are subject to a

number of risks and uncertainties affecting our business. You

should read this press release completely and with the

understanding that actual future results may be materially

different from what we expect as a result of these risks and

uncertainties and other factors, which include, but are not limited

to: (1) technological, structural and cyclical changes that could

reduce the demand for the services we provide; (2) loss of key

customers; (3) the impact of variations between actual and

estimated costs under our contracts, particularly our fixed-price

contracts; (4) our ability to successfully bid for and perform

large-scale project work; (5) work hindrance due to inclement

weather events; (6) the award of new contracts and the timing of

the performance of those contracts; (7) project delays or

cancellations; (8) the failure to meet schedule or performance

requirements of our contracts; (9) the uncertainty of

implementation of the recently enacted federal energy legislation;

(10) the presence of competitors with greater financial resources

and the impact of competitive products, services and pricing; (11)

successful integration of acquisitions into our business; (12)

close out of certain of our projects may or may not occur as

anticipated or may be unfavorable to us; and (13) other factors

detailed from time to time in our reports and filings with the

Securities and Exchange Commission. Except as required by law, we

do not intend to update forward-looking statements even though our

situation may change in the future. INFRASOURCE SERVICES, INC. AND

SUBSIDIARIES Condensed Consolidated Statements of Operations

(Unaudited) (In thousands, except per share amounts) -0- *T Three

Three Nine Nine Months Months Months Months Ended Ended Ended Ended

September September September September 30, 2004 30, 2005 30, 2004

30, 2005 ---------- ---------- ---------- ---------- Contract

revenues $161,876 $229,880 $450,220 $642,180 Cost of revenues

136,194 197,769 377,205 570,622 ---------- ---------- ----------

---------- Gross Profit 25,682 32,111 73,015 71,558 ----------

---------- ---------- ---------- Selling, general and

administrative expenses 16,405 20,354 46,548 54,854 Merger related

costs (334) 66 (334) 218 Provision (recoveries) of uncollectible

accounts 104 61 (367) 145 Amortization of intangible assets 2,420

1,001 10,989 4,311 ---------- ---------- ---------- ----------

Income from operations 7,087 10,629 16,179 12,030 Interest income

228 132 350 354 Interest expense and amortization of debt discount

(1,969) (2,170) (8,161) (5,872) Loss on early extinguishment of

debt - - (5,549) - Other income, net 1,390 735 2,253 5,749

---------- ---------- ---------- ---------- Income before income

taxes 6,736 9,326 5,072 12,261 Income tax expense 2,760 4,021 2,029

5,255 ---------- ---------- ---------- ---------- Income from

continuing operations 3,976 5,305 3,043 7,006 Discontinued

operations: Income (loss) from discontinued operations (net of

income tax provision (benefit) of $282, $(359), $289, and $(625),

respectively) 483 (529) 461 (898) Gain on disposition of

discontinued operations (net of income tax provision of $413,

$1,432, $413 and $1,432, respectively) 593 1,790 593 1,790

---------- ---------- ---------- ---------- Net income $5,052

$6,566 $4,097 $7,898 ========== ========== ========== ==========

Basic income per share: Income from continuing operations $0.10

$0.14 $0.09 $0.18 Income (loss) from discontinued operations 0.01

(0.01) 0.01 (0.02) Gain on disposition of discontinued operations

0.02 0.04 0.02 0.04 ---------- ---------- ---------- ---------- Net

income $0.13 $0.17 $0.12 $0.20 ========== ========== ==========

========== Weighted average basic common shares outstanding 38,690

39,139 33,924 39,059 ========== ========== ========== ==========

Diluted income per share: Income from continuing operations $0.10

$0.13 $0.09 $0.18 Income (loss) from discontinued operations 0.01

(0.01) 0.01 (0.02) Gain on disposition of discontinued operations

0.02 0.04 0.02 0.04 ---------- ---------- ---------- ---------- Net

income $0.13 $0.16 $0.12 $0.20 ========== ========== ==========

========== Weighted average diluted common shares outstanding

39,653 40,090 34,918 40,008 ========== ========== ==========

========== *T INFRASOURCE SERVICES, INC. AND SUBSIDIARIES Condensed

Consolidated Balance Sheets (Unaudited) (In thousands, except share

amounts) -0- *T December September 31, 30, 2004 2005 ----------

--------- ASSETS Current assets: Cash and cash equivalents $21,222

$2,520 Restricted Cash 5,000 - Contract receivables (less

allowances for doubtful accounts of $3,305 and $2,868,

respectively) 104,840 138,731 Costs and estimated earnings in

excess of billings 59,640 105,933 Inventories 9,864 10,504 Deferred

income taxes 2,886 2,125 Other current assets 10,781 11,083 Current

assets - discontinued operations 10,699 - ---------- ---------

Total current assets 224,932 270,896 ---------- --------- Property

and equipment (less accumulated depreciation of $30,636 and

$49,511, respectively) 143,532 144,070 Goodwill 134,478 134,750

Intangible assets (less accumulated amortization of $14,950 and

$18,342, respectively) 6,795 2,484 Deferred charges and other

assets, net 11,766 11,851 Deferred income taxes 1,187 - Noncurrent

assets - discontinued operations 1,732 - ---------- --------- Total

assets $524,422 $564,051 ========== ========= Current liabilities:

Current portion of long-term debt and capital lease obligations

$900 $881 Note payable - related party - 1,000 Revolving credit

facility borrowings - 27,000 Other liabilities - related parties

3,904 9,400 Accounts payable 33,342 32,690 Accrued compensation and

benefits 17,525 22,608 Other current and accrued liabilities 19,570

22,048 Accrued insurance reserves 26,042 28,229 Billings in excess

of costs and estimated earnings 10,728 11,685 Deferred revenues

5,359 6,467 Current liabilities - discontinued operations 8,526 -

---------- --------- Total current liabilities 125,896 162,008

---------- --------- Long-term debt, net of current portion 83,878

83,219 Long-term debt - related party 1,000 - Deferred revenues

16,935 16,629 Other long-term liabilities - related parties 8,493 -

Deferred income taxes - 3,322 Other long-term liabilities 4,226

4,304 Non-current liabilities - discontinued operations 11 -

---------- --------- Total liabilities 240,439 269,482 ----------

--------- Commitments and contingencies Shareholders' equity:

Preferred stock, $.001 par value (authorized - 12,000,000 shares; 0

shares issued and outstanding) - - Common stock $.001 par value

(authorized - 120,000,000 shares; issued and outstanding -

38,942,728 and 39,283,591, respectively) 39 39 Treasury stock at

cost (0 and 29,870, respectively) - (137) Additional paid-in

capital 272,954 277,460 Deferred compensation (329) (2,115)

Retained earnings 10,911 18,809 Accumulated other comprehensive

income 408 513 ---------- --------- Total shareholders' equity

283,983 294,569 ---------- --------- Total liabilities and

shareholders' equity $524,422 $564,051 ========== ========= *T

INFRASOURCE SERVICES, INC. AND SUBSIDIARIES Reconciliation of GAAP

and Non-GAAP Financial Measures (Unaudited) (In thousands) We

believe investors' understanding of our operating performance is

enhanced by disclosing the following non-GAAP financial measures:

income as adjusted, EBITDA from continuing operations, and EBITDA

from continuing operations as adjusted. We present these non-GAAP

financial measures primarily as supplemental performance measures

because we believe they facilitate operating performance

comparisons from period to period and company to company as they

exclude items that we believe are not representative of our core

operations. In addition, we believe that these measures are used by

financial analysts as measures of financial performance of us and

other companies in our industry. These non-GAAP financial measures

have limitations as analytical tools, and you should not consider

them in isolation or as a substitute for analysis of our results as

reported under GAAP. We define income as adjusted as GAAP net

income, adjusted to exclude certain significant items (after-tax).

For the periods shown in this press release, the significant items

include discontinued operations, expenses associated with the

September 2003 acquisition of InfraSource Incorporated, income

relating to the reversal of a litigation judgment entered against

the Company in connection with a proposed 1999 acquisition,

amortization of intangibles arising from acquisitions, expenses

relating to our initial public offering, loss on early

extinguishment of debt, severance and personnel expenses associated

with the acquisitions of EnStructure and Utili-Trax, write-off of

due diligence costs associated with an abandoned acquisition, stock

compensation expenses associated with the issuance of common stock

and an insurance reserve adjustment relating to 2005 and prior

years. We define EBITDA from continuing operations as net income

before discontinued operations, income tax expense, interest

expense, interest income, depreciation and amortization for the

periods shown. We define EBITDA from continuing operations as

adjusted as EBITDA from continuing operations, adjusted for certain

significant items (pre-tax). For the periods shown in this press

release, the significant items include expenses associated with the

acquisition of InfraSource Incorporated, income relating to the

reversal of a litigation judgment entered against the Company in

connection with a proposed 1999 acquisition, expenses relating to

our initial public offering, loss on early extinguishment of debt,

severance and personnel expenses associated with the acquisitions

of EnStructure and Utili-Trax, write-off of due diligence costs

associated with an abandoned acquisition, stock compensation

expenses associated with the issuance of common stock and an

insurance reserve adjustment relating to 2005 and prior years.

Because these measures facilitate internal comparison of our

historical financial position and operating performance on a more

consistent basis, we also use these measures for business planning

and analysis purposes, in measuring our performance relative to

that of our competitors and/or in evaluating acquisition

opportunities. -0- *T Three Three Months Months Ended Ended

September September 30, 2004 30, 2005 ---------- ---------- Net

income (GAAP) $5,052 $6,566 Income from discontinued operations

(net of tax) (1,076) (1,261) Merger related expenses (197) 38

Amortization of intangible assets relating to purchase accounting

1,428 569 EnStructure / Utili-Trax severance and personnel expenses

277 - Abandoned acquisition due diligence costs - 976 Stock

compensation expenses - 144 Insurance reserve adjustment 68 (1,079)

---------- ---------- Income as adjusted (a non-GAAP financial

measure) $5,552 $5,953 ========== ========== *T INFRASOURCE

SERVICES, INC. AND SUBSIDIARIES Reconciliation of GAAP and Non-GAAP

Financial Measures (Unaudited) (In thousands) -0- *T Three Three

Months Months Ended Ended September September 30, 2004 30, 2005

---------- ---------- Net income (GAAP) $5,052 $6,566 Income from

discontinued operations (net of tax) (1,076) (1,261) Income tax

expense 2,760 4,021 Interest expense 1,969 2,170 Interest income

(228) (132) Depreciation 6,263 7,117 Amortization of intangible

assets 2,420 1,001 ---------- ---------- EBITDA from continuing

operations (a non-GAAP financial measure) 17,160 19,482 ----------

---------- Merger related expenses (334) 66 EnStructure /

Utili-Trax severance and personnel expenses 470 - Abandoned

acquisition due diligence costs - 1,715 Stock compensation expenses

- 254 Insurance reserve adjustment 115 (1,897) ----------

---------- EBITDA from continuing operations as adjusted (a

non-GAAP financial measure) $17,411 $19,620 ========== ==========

*T INFRASOURCE SERVICES, INC. AND SUBSIDIARIES Reconciliation of

GAAP and Non-GAAP Financial Measures (Unaudited) (In thousands) -0-

*T Nine Nine Months Months Ended Ended September September 30, 2004

30, 2005 ---------- ---------- Net income (GAAP) $4,097 $7,898

Income from discontinued operations (net of tax) (1,054) (892)

Merger related expenses (200) 125 Litigation judgment reversal -

(2,163) Amortization of intangible assets relating to purchase

accounting 6,593 2,463 IPO related expenses 1,457 - Loss on early

extinguishment of debt 3,329 - EnStructure / Utili-Trax severance

and personnel expenses 282 - Abandoned acquisition due diligence

costs - 980 Stock compensation expenses - 145 Insurance reserve

adjustment 191 (754) ---------- ---------- Income as adjusted (a

non-GAAP financial measure) $14,695 $7,802 ========== ==========

Nine Nine Months Months Ended Ended September September 30, 2004

30, 2005 ---------- ---------- Net income (GAAP) $4,097 $7,898

Income from discontinued operations (net of tax) (1,054) (892)

Income tax expense 2,029 5,255 Interest expense 8,161 5,872

Interest income (350) (354) Depreciation 17,577 20,714 Amortization

of intangible assets 10,989 4,311 ---------- ---------- EBITDA from

continuing operations (a non-GAAP financial measure) 41,449 42,804

---------- ---------- Merger related expenses (334) 218 Litigation

judgment reversal - (3,785) IPO related expenses 2,429 - Loss on

early extinguishment of debt 5,549 - EnStructure / Utili-Trax

severance and personnel expenses 470 - Abandoned acquisition due

diligence costs - 1,715 Stock compensation expenses - 254 Insurance

reserve adjustment 319 (1,319) ---------- ---------- EBITDA from

continuing operations as adjusted (a non-GAAP financial measure)

$49,882 $39,887 ========== ========== *T

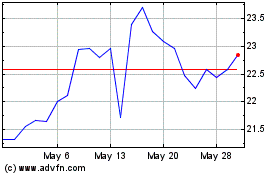

Intercorp Financial Serv... (NYSE:IFS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Intercorp Financial Serv... (NYSE:IFS)

Historical Stock Chart

From Nov 2023 to Nov 2024