Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

May 11 2021 - 7:01AM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-249649

PROSPECTUS SUPPLEMENT NO. 4

(To Prospectus Dated November 27, 2020)

Up to 132,637,517 Shares of Common Stock

Up to 19,185,637 Shares of Common Stock Issuable Upon Exercise of Warrants

Up to 7,555,183 Warrants

_________________________

This Prospectus Supplement No. 4 supplements and

amends the prospectus dated November 27, 2020 (the “Prospectus”) relating to the issuance by us of up to an aggregate

of up to 19,185,637 shares of our common stock, $0.0001 par value per share (“Common Stock”), which consists of (i) up

to 6,660,183 shares of Common Stock that are issuable upon the exercise of 6,660,183 warrants (the “Private Placement Warrants”)

originally issued in a private placement in connection with the initial public offering of Tortoise Acquisition Corp. (“TortoiseCorp”)

by the holders thereof, (ii) up to 875,000 shares of Common Stock that are issuable upon the exercise of 875,000 warrants (the “Forward

Purchase Warrants” and together with the Private Placement Warrants, the “Private Warrants”) originally issued in a

private placement at the closing of the Business Combination (as defined below) by the holders thereof other than the initial holder,

and (iii) up to 11,650,454 shares of Common Stock that are issuable upon the exercise of 11,650,454 warrants (the “Public Warrants”

and, together with the Private Warrants, the “Warrants”) originally issued in the initial public offering of TortoiseCorp

by the holders thereof.

The Prospectus and this Prospectus Supplement

No. 4 also relate to the offer and sale from time to time by the selling securityholders named in the Prospectus (the “Selling Securityholders”)

of (i) up to 132,637,517 shares of Common Stock (including up to 7,535,183 shares of Common Stock that may be issued upon exercise

of the Private Warrants and 20,000 shares of Common Stock that may be issued upon exercise of 20,000 Public Warrants), and (ii) up

to 7,555,183 Warrants, which consists of up to 7,535,183 Private Warrants and up to 20,000 Public Warrants.

On May 10, 2021, we filed with the U.S. Securities

and Exchange Commission the attached Current Report on Form 8-K, which is incorporated in the Prospectus.

This Prospectus Supplement No. 4 should be read

in conjunction with the Prospectus and is qualified by reference to the Prospectus except to the extent that the information in this Prospectus

Supplement No. 4 supersedes the information contained in the Prospectus.

Our Common Stock is listed on the New York Stock

Exchange (the “NYSE”) under the symbol “HYLN.” On May 10, 2021, the closing price of our Common Stock was $8.31.

Our Public Warrants were formerly listed on the NYSE under the symbol “HYLN WS.” On December 30, 2020, we redeemed all

of the outstanding Public Warrants and the NYSE filed a Form 25-NSE with respect to the Public Warrants; the formal delisting of

the Public Warrants became effective ten days thereafter.

Investing in our Common Stock involves a high

degree of risk. See “Risk Factors” beginning on page 4 of the Prospectus, as well as those risk factors contained in any amendments

or supplements to the Prospectus and the documents included or incorporated by reference herein or therein.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of the securities that may be offered under the Prospectus and this Prospectus

Supplement No. 3, nor have any of these organizations determined if this Prospectus Supplement No. 4 is truthful or complete. Any

representation to the contrary is a criminal offense.

_________________________

The date of this Prospectus Supplement No.

4 is May 10, 2021.

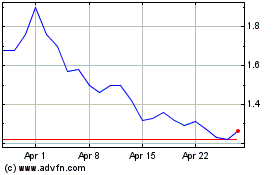

Hyliion (NYSE:HYLN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hyliion (NYSE:HYLN)

Historical Stock Chart

From Jul 2023 to Jul 2024