UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number: 001-34244

HUDBAY MINERALS INC.

(Translation of registrant’s name into English)

25 York Street, Suite 800

Toronto, Ontario

M5J 2V5, Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [X]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes [ ] No [X]

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____________________________

EXPLANATORY NOTE

On December 5, 2023, Hudbay Minerals Inc. (“Hudbay”) filed on the Canadian Securities Administrators’ System for Electronic Document Analysis and Retrieval (SEDAR) website at www.sedarplus.ca the following documents: (1) News Release - December 5, 2023, (2) Copper Mountain Mine NI 43-101 Technical Report, (3) Consent of Qualified Person, (4) Certificate of Qualified Person.

Copies of the filings are attached to this Form 6-K and incorporated herein by reference, as follows:

-

Exhibit 99.1 — News Release - December 5, 2023

-

Exhibit 99.2 — Copper Mountain Mine NI 43-101 Technical Report

-

Exhibit 99.3 — Consent of Qualified Person

-

Exhibit 99.4 — Certificate of Qualified Person

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

HUDBAY MINERALS INC. |

| |

(registrant) |

| |

|

|

| |

By: |

/s/ Mark Haber |

| |

Name: |

Mark Haber |

| |

Title: |

Executive Director, Legal and Corporate Secretary |

Date: December 6, 2023

3

EXHIBIT INDEX

The following exhibits are furnished as part of this Form 6-K:

4

|

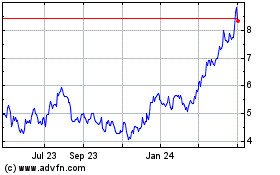

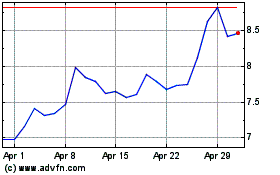

TSX, NYSE - HBM

2023 No. 26

|

| |

|

25 York Street, Suite 800

Toronto, Ontario

Canada M5J 2V5

tel 416 362-8181

fax 416 362-7844

hudbay,com |

News Release |

| |

|

| |

|

Hudbay Releases Copper Mountain Technical Report and Advances Mine Stabilization Plans

- Average annual copper production of 46,500 tonnes over the first five years with cash costs of $1.89i per pound, and 45,000 tonnes over the first 10 years with cash costs of $1.72i per pound.

- Represents an approximate 90% increase over 2022 production levels and 50% decrease from 2022 cash costs as a result of the implementation of Hudbay's operational efficiencies as part of its stabilization and optimization plans.

- Mine plan reflects Hudbay's plans to stabilize the operation by remobilizing idle haul trucks, opening additional mining faces and accelerating stripping over the next three years, optimizing ore feed to the plant and implementing plant improvement initiatives.

- On track to deliver more than $20 million in targeted annual operating efficiencies and $10 million in corporate synergies over the next three years.

- Efficient capital utilization with minimal capital investment required to expand the mill throughput to the permitted limit of 50,000 tonnes per day.

- Copper Mountain is expected to increase Hudbay's annual copper production by approximately 50% after 2025ii.

- Copper Mountain provides additional leverage to gold with approximately 49,500 ounces of annual gold production on average over the next 10 years.

- Mineral reserve estimates of 367 million tonnes at a copper grade of 0.25% and gold grade of 0.12 grams per tonne support a 21-year mine life and position Copper Mountain as the longest life producing asset in Hudbay's portfolio.

- Additional 140 million tonnes of measured and indicated resources at 0.21% copper and 0.10 grams per tonne gold and 370 million tonnes of inferred resources at 0.25% copper and 0.13 grams per tonne gold, exclusive of mineral reserves, provide significant upside potential for reserve conversion and extending mine life, with infill drilling planned for 2024.

- The technical report represents Hudbay's base case mine plan after acquisition and there are numerous technical studies underway to further enhance the production profile, reduce mining costs and continue process optimization.

Toronto, Ontario, December 5, 2023 - Hudbay Minerals Inc. ("Hudbay" or the "company") (TSX, NYSE: HBM) today announced that it has completed a National Instrument 43-101 technical report in respect of its 75%-owned Copper Mountain mine in British Columbia, Canada. This is Hudbay's first technical report for the Copper Mountain mine since acquiring Copper Mountain Mining Corporation ("CMMC") in June 2023. All dollar amounts are in US dollars, unless otherwise noted.

"We are pleased to release our first mine plan for Copper Mountain which demonstrates the meaningful copper production this long-life asset brings to our operating platform and the unique opportunity we have to leverage our efficient operating capabilities to drive value," said Peter Kukielski, Hudbay's President and Chief Executive Officer. "We have applied our proven reserve and resource estimation methodology to develop a prudent and reliable mine plan and are now positioned to implement several operating enhancements to transform Copper Mountain into a stable cash flow generator for our business. With the addition of Copper Mountain, we expect to maintain annual consolidated copper production above 150,000 tonnes through to the end of the decade and are better positioned to achieve our deleveraging objectives and deliver on future copper growth. This increased scale and diversification enhances the company's ability to prudently advance our organic growth pipeline of brownfield expansion and greenfield development opportunities in tier-one mining jurisdictions."

Mine Plan Summary

The Copper Mountain mine is located 21 kilometres south of the town of Princeton and 304 kilometres east of Vancouver, as shown in Figure 1. The operations include a series of open pits, an ore processing plant, a waste rock facility, a tailings management facility and other ancillary facilities that support the operations. Please refer to Figure 2 for a site layout map. All claims are controlled by Copper Mountain Mine (BC) Ltd., a joint venture held 75% by Hudbay and 25% by Mitsubishi Materials Corp.

The mine plan contemplates average annual copper production of 46,500 tonnes in the first five years, 45,000 in the first ten years and 37,000 tonnes over the 21-year mine life. Average cash costs and sustaining cash costs over the mine life are expected to be $1.84 and $2.53 per pound of copperi, respectively. The updated mine plan represents an approximate 90% increase in average annual copper production and a 50% decrease in cash costs over the first 10 years compared to 2022.

As shown in Figure 3, Copper Mountain increases Hudbay's expected consolidated annual copper production by approximately 50% and maintains the 150,000 tonne per year level beyond 2025.

A summary of key production and cost details can be found below. For further details, please refer to the detailed mine plan table in Exhibit 1.

| |

2024 |

2025 |

2026 |

2027 |

2028 |

2024-

2028

Avg. |

2029-

2033

Avg. |

2034-

2038

Avg. |

2039-

2043

Avg. |

LOM

Total |

| Contained Metal in Concentrate |

| Cu production |

tonnes

(000s) |

37 |

40 |

49 |

50 |

56 |

47 |

43 |

39 |

26 |

783 |

| Au production |

ounces

(000s) |

21 |

36 |

26 |

44 |

47 |

35 |

64 |

60 |

26 |

935 |

| Ag production |

ounces

(000s) |

378 |

334 |

500 |

434 |

477 |

425 |

235 |

213 |

226 |

5,590 |

| Capital Expenditures |

| Sustaining capital (after capitalized stripping)1 |

US$ millions |

$63 |

$122 |

$91 |

$59 |

$94 |

$86 |

$67 |

$55 |

$13 |

$1,106 |

| Discretionary capitalized stripping2 |

US$ millions |

$22 |

$42 |

$21 |

- |

- |

$17 |

- |

- |

- |

$85 |

| Growth capital |

US$ millions |

$3 |

$41 |

$69 |

$6 |

$7 |

$25 |

- |

- |

- |

$126 |

| Cash Costs |

| Cash costs, net of by-product credits3 |

US$/lb Cu |

$2.69 |

$1.89 |

$1.89 |

$1.90 |

$1.36 |

$1.89 |

$1.53 |

$1.75 |

$2.31 |

$1.84 |

| Sustaining cash costs, net of by-product credits (excl. discretionary stripping)3,4 |

US$/lb Cu |

$3.49 |

$3.40 |

$2.74 |

$2.45 |

$2.13 |

$2.76 |

$2.26 |

$2.46 |

$2.58 |

$2.53 |

Note: Totals may not add up correctly due to rounding. "LOM" refers to life-of-mine total.

1 Sustaining capital includes capitalized stripping.

2 Discretionary capitalized stripping relates to a portion of accelerated stripping activities over 2024-2026 to access higher grade ore but could be reduced or deferred to a later date based on further geotechnical evaluation and other considerations.

3 By-product credits calculated using the following commodity prices and foreign exchange assumptions: gold price of $1,940 per ounce for 2024, $1,900 per ounce for 2025, $1,800 per ounce for 2026, $1,764 per ounce for 2027, $1,725 per ounce for 2028 and $1,700 per ounce long-term; silver price of $24.00 per ounce for 2024, 2025 and 2026, $23.75 per ounce for 2027, $23.38 per ounce for 2028 and $23.00 per ounce long-term; C$/US$ exchange rate of 1.35 in 2024 and 1.33 in 2025 onwards.

4 Sustaining cash costs incorporate all costs included in cash costs plus sustaining capital expenditures, capitalized stripping, payments on capital leases, royalties and accretion and amortization of decommissioning obligations, and excludes discretionary capitalized stripping. Cash costs and sustaining cash costs are non-IFRS financial performance measures with no standardized definition under IFRS. For further details on why Hudbay believes cash costs are a useful performance indicator, please refer to the company's most recent Management's Discussion and Analysis for the period ended September 30, 2023.

Hudbay's Stabilization Plans

Since completing the acquisition of CMMC in June 2023, Hudbay has been focused on advancing its plans to stabilize the Copper Mountain mine over the next few years to improve reliability and drive sustainable long-term value. The technical report reflects Hudbay's base case stabilization plan including many elements as described further below.

Increased Mining Activities

The company has commenced a fleet ramp-up plan which remobilizes idle haul trucks. The fleet ramp up plan entails a ramp-up from 14 trucks to 26 trucks by the end of 2023, with 23 trucks ramped up to-date. Once the fleet ramp up plan is complete, Copper Mountain is expected to have improved flexibility in the mine with additional mining faces.

Accelerated Stripping to Access Higher Grades

As reflected in the technical report, the company is planning a campaign of accelerated stripping over the next three years to enable access to higher grade ore and to mitigate the substantially reduced stripping undertaken by Copper Mountain over the four years prior to completion of the acquisition (please refer to Figure 4). The accelerated stripping program is also expected to improve operating efficiencies and lower unit operating costs. A portion of the accelerated capitalized stripping costs is considered discretionary and could be reduced or deferred to a later date based on further geotechnical evaluation and other considerations.

Improved Mill Throughput and Recoveries

Hudbay's mine plan for Copper Mountain assumes a mill ramp up to its nominal capacity of 45,000 tonnes per day in 2025. An expansion to the permitted capacity of 50,000 tonnes per day is planned in 2027. The mine plan assumes approximately $23 million in growth capital spending over 2025 and 2026 in connection with the mill expansion. The company also plans to improve mill recoveries with a more consistent ore feed grade, changes to the flotation reagents and replacement of key pumps.

Operating Efficiencies and Corporate Synergies

Hudbay's stabilization plans as reflected in the technical report are expected to generate more than $20 million in annual operating efficiencies over the next three years, compared to Copper Mountain's performance in 2022, through improvements in copper recovery, higher throughput rates and lower combined unit operating costs. In addition, Hudbay has realized approximately $9 million of the targeted $10 million in annual corporate synergies and is on track to exceed the target. A full comparison of Hudbay's plan versus Copper Mountain's 2022 performance is presented in the following table.

|

|

Copper Mountain

2022A1

|

2024-2028

Avg.

|

Change

|

|

Mill throughput

|

tonnes per day

|

34,814

|

46,851

|

+12,037

|

|

Copper recovery

|

%

|

79.1%

|

84.5%

|

+5.4%

|

|

Corporate G&A

|

C$ millions

|

$17

|

$4

|

-$13

|

|

Total unit operating costs (after capitalized stripping)2

|

C$/tonne milled

|

$23.95

|

$17.06

|

-$6.89

|

|

Cash costs, net of by-product credits2

|

US$/lb Cu

|

$3.53

|

$1.89

|

-$1.64

|

|

Sustaining cash costs, net of by-product credits (excl. discretionary stripping)2,3

|

US$/lb Cu

|

$4.78

|

$2.76

|

-$2.02

|

1 2022 actuals as disclosed by CMMC on March 27, 2023. CMMC Financial Statements and Management's Discussion & Analysis for the applicable periods are available under CMMC's SEDAR+ profile at www.sedarplus.ca. 2022 total unit operating costs includes direct mining and milling costs, employee compensation and benefits, transportation costs and corporate and mine site administration expenses.

2 Cash costs, sustaining cash costs and unit operating costs are non-IFRS financial performance measures with no standardized definition under IFRS. For further details on why Hudbay believes cash costs and unit operating costs are useful performance indicators, please refer to the company's most recent Management's Discussion and Analysis for the period ended September 30, 2023.

3 By-product credits calculated using the following commodity prices and foreign exchange assumptions: gold price of $1,940 per ounce for 2024, $1,900 per ounce for 2025, $1,800 per ounce for 2026, $1,764 per ounce for 2027, $1,725 per ounce for 2028 and $1,700 per ounce long-term; silver price of $24.00 per ounce for 2024, 2025 and 2026, $23.75 per ounce for 2027, $23.38 per ounce for 2028 and $23.00 per ounce long-term; C$/US$ exchange rate of 1.35 in 2024 and 1.33 in 2025 onwards. Sustaining cash costs incorporates all costs included in cash costs plus sustaining capital expenditures, capitalized stripping, payments on capital leases, royalties and accretion and amortization of decommissioning obligations, and excludes discretionary capitalized stripping.

Mineral Reserve and Resource Estimates

The mine plan is based on a revised resource model and was constructed using the same methods applied at the Constancia, Copper World and Mason deposits. The mineral reserve estimates total 367 million tonnes at a copper grade of 0.25% and a gold grade of 0.12 grams per tonne, supporting a 21-year mine life. An additional 140 million tonnes of measured and indicated resources at 0.21% copper and 0.10 grams per tonne gold and 370 million tonnes of inferred resources at 0.25% copper and 0.13 grams per tonne gold, exclusive of mineral reserves, provide significant upside potential for reserve conversion and extending mine life. Infill drilling is planned for 2024 to target reserve conversion.

The current mineral reserve and resource estimates for Copper Mountain (effective as of December 1, 2023) are summarized below.

Copper Mountain Mine

Mineral Reserve and Resource

Estimates1,2,3,4 |

Tonnes |

Cu Grade

(%) |

Au Grade

(g/t) |

Ag Grade

(g/t) |

CuEq Grade

(%) |

| Reserves |

| Proven |

195,037,000 |

0.27 |

0.12 |

0.78 |

0.35 |

| Probable |

171,943,000 |

0.22 |

0.11 |

0.59 |

0.30 |

| Total proven and probable |

366,980,000 |

0.25 |

0.12 |

0.69 |

0.33 |

| Resources |

| Measured |

41,198,000 |

0.21 |

0.09 |

0.73 |

0.27 |

| Indicated |

96,615,000 |

0.21 |

0.11 |

0.68 |

0.29 |

| Total measured and indicated |

137,814,000 |

0.21 |

0.10 |

0.69 |

0.28 |

| Inferred |

371,319,000 |

0.25 |

0.13 |

0.61 |

0.34 |

Note: totals may not add up correctly due to rounding.

1 Mineral resource estimates are exclusive of mineral reserves. Mineral resources are not mineral reserves as they do not have demonstrated economic viability.

2 Mineral reserve estimates have been calculated using assumed long-term metal prices of $3.75 per pound copper, $1,650 per ounce gold and $22.00 per ounce silver. Mineral resource estimates have been calculated using assumed long-term metal prices of $4.00 per pound copper, $1,650 per ounce gold and $22.00 per ounce silver.

3 Mineral resource estimates tonnes and grades constrained to a Lerch Grossman revenue factor 1 pit shell.

4 Mineral reserves have an effective date of December 1, 2023, but were generated excluding the measured and indicated mineral resource estimates planned to be mined and milled in the month of December 2023. Mineral reserves are reported using an NSR cut-off value of $5.67 that meet a minimum 0.10% Cu grade.

Consistent with the expectations disclosed in the company's news release on November 7, 2023, the 2023 mineral reserve and mineral resource estimates are consistent with historical estimates published by CMMC until 2019, after adjusting for mining depletion and a re-classification of some of the indicated mineral resources to the inferred category, as well as incorporating high grade resources added through exploration since 2019. Hudbay's new 2023 resource estimates are closely aligned with production with both tonnage and grade reconciling positively within 3% to 4% of the credited mine production by the mill over the past three years.

Project Optimization and Upside Opportunities

There are several opportunities to further increase production, improve costs and extend mine life for Copper Mountain. While these opportunities have not been considered in the technical report as they are not yet at the level of required engineering, the company is advancing studies to evaluate the potential for these to be reflected in future mine plans.

- Conversion of Inferred Resources to Reserves - there is a significant amount of high-grade mineralization in the inferred category that has the potential to be converted to reserves, which would increase production, improve head grades over the next 10 years and extend mine life beyond 21 years. The company has plans for infill drilling in 2024 to target reserve conversion.

- Lower Stripping Costs - the company will carry out additional geotechnical investigations and pit slope stability tests in the area of Pit 3 to identify opportunities to maximize the use of double benching and reduce waste stripping that is currently classified as discretionary.

- Evaluation of Mining Technologies - Hudbay will pursue technology trade-offs between trolley assist haul trucks and conveying systems for ore and waste movement in an effort to reduce mining costs, improve mining productivity, and reduce greenhouse gas emissions.

- Continued Process Optimization - Hudbay continues to conduct metallurgical testing and simulations to optimize mill throughput and recoveries.

- Renewable Diesel - Hudbay is evaluating the application of renewable diesel at Copper Mountain, which has the potential to reduce costs, lower greenhouse gas emissions and be eligible for additional federal tax credits under Canada's Clean Fuel Regulations.

- Green Opportunities - the company plans to install a mast to collect wind data to be able to evaluate the potential for site renewable energy generation. This initiative is in addition to the existing net-zero initiatives already underway, including trolley assist haulage and a new electric shovel, which favourably position Copper Mountain in the lowest quartile of the greenhouse gas emissions curve for copper mines.

Non-IFRS Financial Performance Measures

Cash cost and sustaining cash cost per pound of copper produced are shown because the company believes they help investors and management assess the performance of its operations, including the margin generated by the operations and the company. Unit operating costs are shown because these measures are used by the company as a key performance indicator to assess the performance of its mining and processing operations. These measures do not have a meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. These measures should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS and are not necessarily indicative of operating profit or cash flow from operations as determined under IFRS. Other companies may calculate these measures differently. For further details on these measures, please refer to page 45 of Hudbay's management's discussion and analysis for the period ended September 30, 2023 available on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov.

Cautionary Note Regarding NI 43-101

The scientific and technical information contained in this news release has been approved by Olivier Tavchandjian, P. Geo, Hudbay's Senior Vice-President, Exploration and Technical Services. Mr. Tavchandjian is a qualified person pursuant to Canadian Securities Administrators' National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

A copy of the NI 43-101 technical report will be made available on Hudbay's SEDAR+ profile at www.sedarplus.ca and on Hudbay's EDGAR profile at www.sec.gov. This technical report is the current technical report in respect of the Copper Mountain mine and shall supersede and replace all prior technical reports relating to the Copper Mountain mine.

Cautionary Note to United States Investors

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. Canadian reporting requirements for disclosure of mineral properties are governed NI 43-101.

For this reason, information contained in this news release in respect of the Copper Mountain mine may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder. For further information on the differences between the disclosure requirements for mineral properties under the United States federal securities laws and NI 43-101, please refer to the company's annual information form, a copy of which has been filed under Hudbay's profile on SEDAR+ at www.sedarplus.ca and the company's Form 40-F, a copy of which has been filed under Hudbay's profile on EDGAR at www.sec.gov.

Cautionary Note Regarding Forward-Looking Information

This news release contains forward-looking information within the meaning of applicable Canadian and United States securities legislation. All information contained in this news release, other than statements of current and historical fact, is forward-looking information. Often, but not always, forward-looking information can be identified by the use of words such as "plans", "expects", "budget", "guidance", "scheduled", "estimates", "forecasts", "strategy", "target", "intends", "objective", "goal", "understands", "anticipates" and "believes" (and variations of these or similar words) and statements that certain actions, events or results "may", "could", "would", "should", "might" "occur" or "be achieved" or "will be taken" (and variations of these or similar expressions). All of the forward-looking information in this news release is qualified by this cautionary note.

Forward-looking information includes, but is not limited to, production, operating cost, capital cost and cash cost estimates, project design, including processing and tailings facilities, metal recoveries, mine life and production rates for the Copper Mountain mine, the potential to further enhance the economics of the project and optimize the design, the impact and effects of Hudbay's optimization and stabilization initiatives, statements regarding permitting matters, the relationships with the First Nations groups, local communities of interest, regulatory agencies and other key stakeholders, the expectations and plans for New Ingerbelle, the renegotiation of the participation agreements with the Upper Similkameen Indian Band and Lower Similkameen Indian Band, the costs associated with planned stripping, and the conceptual mine closure and reclamation plan. Forward-looking information is not, and cannot be, a guarantee of future results or events. Forward-looking information is based on, among other things, opinions, assumptions, estimates and analyses that, while considered reasonable by the company at the date the forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking information.

The material factors or assumptions that Hudbay identified and were applied by the company in drawing conclusions or making forecasts or projections set out in the forward-looking information include, but are not limited to:

• the company's ability to stabilize and optimize the Copper Mountain mine operations;

• the success of exploration and development activities at the Copper Mountain mine, including New Ingerbelle;

• the accuracy of geological, mining and metallurgical estimates;

• anticipated metals prices and the costs of production;

• the supply and demand for metals Hudbay produces;

• the supply and availability of all forms of energy and fuels at reasonable prices;

• no significant unanticipated operational or technical difficulties;

• the availability of additional financing, if needed;

• the availability of personnel for the company's exploration, development and operational projects and ongoing employee relations;

• maintaining applicable and necessary permits;

• maintaining good relations with the First Nations groups, local communities of interest, regulatory agencies and other key stakeholders, including the neighbouring communities and local governments in British Columbia;

• no significant unanticipated challenges with stakeholders at the Copper Mountain mine;

• no significant unanticipated events or changes relating to regulatory, environmental, health and safety matters;

• no contests over title to Hudbay's properties, including as a result of rights or claimed rights of Indigenous peoples or challenges to the validity of its unpatented mining claims;

• no offtake commitments in respect of production from the Copper Mountain mine, other than those contemplated herein;

• certain tax matters, including, but not limited to the mining tax regime in British Columbia; and

• no significant and continuing adverse changes in general economic conditions or conditions in the financial markets (including commodity prices and foreign exchange rates).

The risks, uncertainties, contingencies and other factors that may cause actual results to differ materially from those expressed or implied by the forward-looking information may include, but are not limited to, risks generally associated with the mining industry and the current geopolitical environment, such as economic factors (including future commodity prices, currency and interest rate fluctuations, energy and consumable prices, supply chain constraints and general cost escalation in the current inflationary environment), risks related to product delivery and financing, risks related to the ability for the company to successfully maintain all applicable and necessary permits, risks related to changes in government and government policy, risks related to changes in law, risks in respect of community relations, including but not limited to the relationships with First Nations groups, local communities of interest, regulatory agencies and other key stakeholders, risks related to contracts that were entered into in respect of the Copper Mountain mine, including but not limited to the renegotiation of the participation agreements with the Upper Similkameen Indian Band and Lower Similkameen Indian Band, risks related to the conceptual mine closure and reclamation plan, uncertainties related to the geology, continuity, grade and estimates of mineral reserves and resources, and the potential for variations in grade and recovery rates, as well as the risks discussed under the heading "Risk Factors" in the company's most recent annual information form and under the heading "Financial Risk Management" in the company's most recent management's discussion and analysis.

Should one or more risk, uncertainty, contingency or other factor materialize or should any factor or assumption prove incorrect, actual results could vary materially from those expressed or implied in the forward-looking information. Accordingly, you should not place undue reliance on forward-looking information. The company does not assume any obligation to update or revise any forward-looking information after the date of this news release or to explain any material difference between subsequent actual events and any forward-looking information, except as required by applicable law.

About Hudbay

Hudbay (TSX, NYSE: HBM) is a copper-focused mining company with three long-life operations and a world-class pipeline of copper growth projects in tier-one mining-friendly jurisdictions of Canada, Peru and the United States.

Hudbay's operating portfolio includes the Constancia mine in Cusco (Peru), the Snow Lake operations in Manitoba (Canada) and the Copper Mountain mine in British Columbia (Canada). Copper is the primary metal produced by the company, which is complemented by meaningful gold production. Hudbay's growth pipeline includes the Copper World project in Arizona, the Mason project in Nevada (United States), the Llaguen project in La Libertad (Peru) and several expansion and exploration opportunities near its existing operations.

The value Hudbay creates and the impact it has is embodied in its purpose statement: "We care about our people, our communities and our planet. Hudbay provides the metals the world needs. We work sustainably, transform lives and create better futures for communities." Hudbay's mission is to create sustainable value and strong returns by leveraging its core strengths in community relations, focused exploration, mine development and efficient operations.

For further information, please contact:

Candace Brûlé

Vice President, Investor Relations

(416) 814-4387

investor.relations@hudbay.com

______________________________

i Cash costs and sustaining cash costs are non-IFRS financial performance measures with no standardized definition under IFRS. For further details on why Hudbay believes cash costs are a useful performance indicator, please refer to the company's most recent Management's Discussion and Analysis for the period ended September 30, 2023.

ii Based on copper production from most recent technical reports for Hudbay's Constancia, Snow Lake and Copper Mountain operations.

Exhibit 1: Detailed Mine Plan Information

| |

2024 |

2025 |

2026 |

2027 |

2028 |

2024-

2028

Avg. |

2029-

2033

Avg. |

2034-

2038

Avg. |

2039-

2043

Avg. |

LOM

Total |

| Mining |

| Ore mined |

tonnes

(000s) |

18,983 |

22,363 |

14,020 |

20,710 |

21,096 |

19,434 |

20,411 |

18,460 |

4,180 |

312,425 |

| Waste mined |

tonnes

(000s) |

82,832 |

91,637 |

86,480 |

63,290 |

48,904 |

74,629 |

47,589 |

44,940 |

6,154 |

866,559 |

| Strip ratio |

waste:

ore |

4.36 |

4.10 |

6.17 |

3.06 |

2.32 |

3.84 |

2.33 |

2.43 |

1.47 |

2.77 |

| Processing |

| Ore milled |

tonnes

(000s) |

15,008 |

16,425 |

17,520 |

18,250 |

18,300 |

17,101 |

18,260 |

18,260 |

18,260 |

366,980 |

| Daily ore milled |

tonnes

per day |

41,118 |

45,000 |

48,000 |

50,000 |

50,137 |

46,851 |

50,027 |

50,027 |

50,027 |

47,877 |

| Cu grade |

% |

0.30% |

0.29% |

0.33% |

0.32% |

0.36% |

0.32% |

0.27% |

0.24% |

0.17% |

0.25% |

| Au grade |

g/t |

0.07 |

0.10 |

0.07 |

0.11 |

0.12 |

0.10 |

0.16 |

0.15 |

0.07 |

0.12 |

| Ag grade |

g/t |

1.12 |

0.90 |

1.27 |

1.07 |

1.17 |

1.11 |

0.60 |

0.54 |

0.55 |

0.69 |

| Cu recovery |

% |

82.5% |

84.0% |

84.0% |

85.6% |

85.5% |

84.5% |

86.7% |

86.4% |

85.1% |

85.7% |

| Au recovery |

% |

65.0% |

65.0% |

65.0% |

67.9% |

67.8% |

66.5% |

69.6% |

69.0% |

66.0% |

68.3% |

| Ag recovery |

% |

70.0% |

70.0% |

70.0% |

69.2% |

69.2% |

69.6% |

66.5% |

67.1% |

69.7% |

68.5% |

| Contained Metal in Concentrate |

| Cu production |

tonnes (000s) |

37 |

40 |

49 |

50 |

56 |

47 |

43 |

39 |

26 |

783 |

| Au production |

ounces

(000s) |

21 |

36 |

26 |

44 |

47 |

35 |

64 |

60 |

26 |

935 |

| Ag production |

ounces

(000s) |

378 |

334 |

500 |

434 |

477 |

425 |

235 |

213 |

226 |

5,590 |

| Capital Expenditures (US$ millions)1 |

| Sustaining capital |

$46 |

$63 |

$50 |

$45 |

$36 |

$48 |

$27 |

$22 |

$13 |

$549 |

| Capitalized stripping |

$17 |

$59 |

$41 |

$14 |

$57 |

$38 |

$41 |

$33 |

- |

$558 |

| Sustaining capital (after capitalized stripping) |

$63 |

$122 |

$91 |

$59 |

$94 |

$86 |

$67 |

$55 |

$13 |

$1,106 |

| Discretionary capitalized stripping2 |

$22 |

$42 |

$21 |

- |

- |

$17 |

- |

- |

- |

$85 |

| Growth project capital |

$3 |

$41 |

$69 |

$6 |

$7 |

$25 |

- |

- |

- |

$126 |

| Total capital expenditures |

$88 |

$205 |

$181 |

$65 |

$101 |

$128 |

$67 |

$55 |

$13 |

$1,317 |

| Unit Operating Costs (C$ per tonne milled)3 |

| Mining4 |

|

$15.30 |

$16.33 |

$13.84 |

$12.06 |

$11.92 |

$13.78 |

$11.73 |

$11.32 |

$4.82 |

$10.21 |

| Milling |

|

$7.41 |

$6.77 |

$5.94 |

$5.70 |

$5.69 |

$6.25 |

$5.70 |

$5.70 |

$5.70 |

$5.85 |

| G&A |

|

$1.48 |

$1.35 |

$1.27 |

$1.22 |

$1.18 |

$1.29 |

$1.17 |

$1.14 |

$0.87 |

$1.13 |

| Total operating costs (before cap. stripping) |

$24.19 |

$24.45 |

$21.05 |

$18.98 |

$18.79 |

$21.32 |

$18.60 |

$18.16 |

$11.39 |

$17.19 |

| Total operating costs (after cap. stripping) |

$20.68 |

$16.27 |

$16.31 |

$17.96 |

$14.61 |

$17.06 |

$15.64 |

$15.73 |

$11.39 |

$14.86 |

| Cash Costs and Sustaining Cash Costs (US$/lb Cu) |

| Copper production |

million

lbs |

81.6 |

87.9 |

108.4 |

110.6 |

124.0 |

102.5 |

95.1 |

85.1 |

58.4 |

1,726.4 |

|

Cash costs3,5

|

|

$2.69

|

$1.89

|

$1.89

|

$1.90

|

$1.36

|

$1.89

|

$1.53

|

$1.75

|

$2.31

|

$1.84

|

|

Sustaining cash costs3,5 (excl. discretionary stripping)

|

$3.49

|

$3.40

|

$2.74

|

$2.45

|

$2.13

|

$2.76

|

$2.26

|

$2.46

|

$2.58

|

$2.53

|

|

Sustaining cash costs3,5 (incl. discretionary stripping)

|

$3.77

|

$3.87

|

$2.94

|

$2.45

|

$2.13

|

$2.93

|

$2.26

|

$2.46

|

$2.58

|

$2.58

|

Note: LOM refers to life-of-mine total.

1 Sustaining capital includes capitalized lease payments.

2 Discretionary capitalized stripping relates to a portion of accelerated stripping activities over 2024-2026 to access higher grade ore but could be reduced or deferred to a later date based on further geotechnical evaluation and other considerations.

3 Cash costs, sustaining cash costs and unit operating costs are non-IFRS financial performance measures with no standardized definition under IFRS. For further details on why Hudbay believes cash costs and unit operating costs are useful performance indicators, please refer to the company's most recent Management's Discussion and Analysis for the period ended September 30, 2023.

4 Mining cost before the impact of capitalized stripping.

5 By-product credits calculated using the following commodity prices and foreign exchange assumptions: gold price of $1,940 per ounce for 2024, $1,900 per ounce for 2025, $1,800 per ounce for 2026, $1,764 per ounce for 2027, $1,725 per ounce for 2028 and $1,700 per ounce long-term; silver price of $24.00 per ounce for 2024, 2025 and 2026, $23.75 per ounce for 2027, $23.38 per ounce for 2028 and $23.00 per ounce long-term; C$/US$ exchange rate of 1.35 in 2024 and 1.33 in 2025 onwards. Sustaining cash costs incorporates all costs included in cash cost plus sustaining capital expenditures, capitalized stripping, payments on capital leases, royalties and accretion and amortization of decommissioning obligations.

Figure 1: Copper Mountain Mine Location

The Copper Mountain mine is located in British Columbia, Canada, 21 kilometres by road south of the town of Princeton and 304 kilometres by road east of Vancouver.

Figure 2: Copper Mountain Site Layout

The operations consist of the Copper Mountain pit, the New Ingerbelle pit, an ore processing plant, a waste rock facility, a tailings management facility and other associated site infrastructure that support the operations.

Figure 3: Hudbay Consolidated Production Profile Graph

Copper Mountain is a meaningful contributor to Hudbay's consolidated copper production profile. The impact is significant after 2025 with increases of up to 50% in annual copper production to maintain the 150,000 tonnes per year level.

Source: Based on Hudbay previously issued copper production guidance for 2023 to 2025. Copper production in the years 2026 to 2028 is sourced from Hudbay's Constancia NI 43-101 technical report dated March 2021, Snow Lake NI 43-101 technical report dated March 2021 and Copper Mountain NI 43-101 technical report dated December 4, 2023. Production profile excludes potential future production from the Copper World project.

Figure 4: Copper Mountain Mine Performance

Hudbay's mine plan incorporates accelerated stripping activities to help mitigate the impacts of substantially reduced stripping undertaken by Copper Mountain over the past four years. The accelerated stripping is expected to enable access to higher grade ore and improve the efficiency of the mine. Hudbay expects sustained improvements in mill throughput to achieve the design capacity of 45,000 tonnes per day and an expansion to the permitted limit of 50,000 tonnes per day in 2027.

Source: CMMC historical annual disclosure for the years 2018 to 2022 and Hudbay's Copper Mountain NI 43-101 technical report dated December 4, 2023 for the years 2024 to 2028.

CAUTIONARY NOTES

Cautionary Note Regarding Forward Looking Information

This Technical Report contains "forward-looking statements" and "forward-looking information" (collectively, "forward-looking information") within the meaning of applicable Canadian and United States securities legislation. All information contained in this Technical Report, other than statements of current and historical fact, is forward-looking information. Often, but not always, forward-looking information can be identified by the use of words such as "plans," "expects," "budget," "guidance," "scheduled," "estimates," "forecasts," "strategy," "target," "intends," "objective," "goal," "understands," "anticipates" and "believes" (and variations of these or similar words) and statements that certain actions, events or results "may," "could," "would," "should," "might" "occur" or "be achieved" or "will be taken" (and variations of these or similar expressions). All of the forward-looking information in this Technical Report is qualified by this cautionary note.

Forward-looking information includes, but is not limited to, production; operating cost; capital cost and cash cost estimates; project design, including processing and tailings facilities, metal recoveries, mine life and production rates for the Copper Mountain Mine; the potential to further enhance the economics of the project and optimize the design; the impact and effects of our optimization and stabilization initiatives; statements regarding permitting matters; the relationships with the First Nations groups, local communities of interest, regulatory agencies, and other key stakeholders; the expectations and plans for New Ingerbelle; the renegotiation of the participation agreements with the Upper Similkameen Indian Band and Lower Similkameen Indian Band; the costs associated with planned stripping; and the conceptual mine closure and reclamation plan. Forward-looking information is not, and cannot be, a guarantee of future results or events. Forward-looking information is based on, among other things, opinions, assumptions, estimates, and analyses that, while considered reasonable by Hudbay at the date the forward-looking information is provided, are inherently subject to significant risks, uncertainties, contingencies, and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking information.

The material factors or assumptions that Hudbay identified and were applied by Hudbay in drawing conclusions or making forecasts or projections set out in the forward-looking information include, but are not limited to:

-

Hudbay's ability to stabilize and optimize the Copper Mountain Mine operations

-

The success of exploration and development activities at the Copper Mountain Mine, including New Ingerbelle

-

The accuracy of geological, mining, and metallurgical estimates

-

Anticipated metals prices and the costs of production

-

The supply and demand for metals Hudbay produces

-

The supply and availability of all forms of energy and fuels at reasonable prices

-

No significant unanticipated operational or technical difficulties

-

The availability of additional financing, if needed

-

The availability of personnel for Hudbay's exploration, development, and operational projects and ongoing employee relations

-

Maintaining applicable and necessary permits

-

Maintaining good relations with the First Nations groups, local communities of interest, regulatory agencies and other key stakeholders, including the neighbouring communities and local governments in British Columbia

-

No significant unanticipated challenges with stakeholders at the Copper Mountain Mine

-

No significant unanticipated events or changes relating to regulatory, environmental, and health and safety matters

-

No contests over title to Hudbay's properties, including as a result of rights or claimed rights of Indigenous peoples or challenges to the validity of its unpatented mining claims

-

No off-take commitments in respect of production from the Copper Mountain Mine, other than those contemplated herein

-

Certain tax matters, including, but not limited to the mining tax regime in British Columbia

-

No significant and continuing adverse changes in general economic conditions or conditions in the financial markets (including commodity prices and foreign exchange rates).

The risks, uncertainties, contingencies, and other factors that may cause actual results to differ materially from those expressed or implied by the forward-looking information may include, but are not limited to, risks generally associated with the mining industry and the current geopolitical environment, such as economic factors (including future commodity prices, currency and interest rate fluctuations, energy and consumable prices, supply-chain constraints and general cost escalation in the current inflationary environment); risks related to product delivery and financing; risks related to the ability for Hudbay to successfully maintain all applicable and necessary permits; risks related to changes in government and government policy; risks related to changes in law; risks in respect of community relations, including but not limited to the relationships with First Nations groups, local communities of interest, regulatory agencies, and other key stakeholders; risks related to contracts that were entered into in respect of the Copper Mountain Mine, including but not limited to the renegotiation of the participation agreements with the Upper Similkameen Indian Band and Lower Similkameen Indian Band; risks related to the conceptual mine closure and reclamation plan; uncertainties related to the geology, continuity, grade, and estimates of Mineral Reserves and Mineral Resources, and the potential for variations in grade and recovery rates; as well as the risks discussed under the heading "Risk Factors" in Hudbay's most recent Annual Information Form (AIF) and under the heading "Financial Risk Management" in Hudbay's most recent Management Discussion and Analysis (MD&A).

Should one or more risk, uncertainty, contingency, or other factor materialize, or should any factor or assumption prove incorrect, actual results could vary materially from those expressed or implied in the forward-looking information. Accordingly, the reader should not place undue reliance on forward-looking information. Hudbay does not assume any obligation to update or revise any forward-looking information after the date of this technical report or to explain any material difference between subsequent actual events and any forward-looking information, except as required by applicable law.

Cautionary Note Regarding NI 43-101

The scientific and technical information contained in this Technical Report has been approved by Olivier Tavchandjian, P.Geo, Hudbay's Senior Vice-President, Exploration and Technical Services. Mr. Tavchandjian is a Qualified Person pursuant to Canadian Securities Administrators' National Instrument (NI) 43-101-Standards of Disclosure for Mineral Projects.

This technical report is the current technical report in respect of all the mineral properties that form part of the Copper Mountain Mine and shall supersede and replace all prior technical reports relating to the Copper Mountain Mine.

Non-IFRS Financial Performance Measures

Cash cost and sustaining cash cost per pound of copper produced are shown because Hudbay believes they help investors and management assess the performance of its operations, including the margin generated by the operations and Hudbay. Unit operating costs are shown because Hudbay uses these measures as a key performance indicator to assess the performance of its mining and processing operations. These measures do not have a meaning prescribed by the International Financial Reporting Standards (IFRS) and are therefore unlikely to be comparable to similar measures presented by other issuers. These measures should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS and are not necessarily indicative of operating profit or cash flow from operations as determined under IFRS. Other companies may calculate these measures differently. For further details on the non-IFRS performance measures Hudbay uses, please refer to page 45 of Hudbay's management's discussion and analysis for the period ended September 30, 2023 (available on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov).

Cautionary Note to United States Investors

This Technical Report has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. Canadian reporting requirements for disclosure of mineral properties are governed by NI 43-101.

For this reason, information contained in this Technical Report in respect of the Copper Mountain Mine may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder. For further information on the differences between the disclosure requirements for mineral properties under the United States federal securities laws and NI 43-101, please refer to Hudbay's AIF, a copy of which has been filed under Hudbay's profile on SEDAR+ at www.sedarplus.ca and Hudbay's Form 40-F, a copy of which has been filed on EDGAR at www.edgar.com.

SIGNATURE PAGE

This Technical Report titled NI 43-101 Technical Report Updated Mineral Resources & Reserves Estimate, Copper Mountain Mine, Princeton, British Columbia, and dated December 4, 2023, with an effective date of December 1, 2023, was prepared under the supervision and signed by the following author:

| Original Signed and Sealed |

|

Olivier Tavchandjian, Ph.D., P.Geo.

Senior Vice President, Exploration and Technical Services

Hudbay Minerals Inc. |

|

Contents

| 1 Summary |

1-1 |

| |

|

| 1.1 Property Description and Location |

1-1 |

| |

|

| 1.2 Accessibility, Climate, Local Resources, Infrastructure, and Physiography |

1-3 |

| |

|

| 1.3 History |

1-3 |

| |

|

| 1.4 Geological Setting and Mineralization |

1-4 |

| |

|

| 1.5 Deposit Types |

1-4 |

| |

|

| 1.6 Exploration |

1-5 |

| |

|

| 1.7 Drilling |

1-5 |

| |

|

| 1.8 Sample Preparation, Analyses, and Security |

1-6 |

| |

|

| 1.9 Data Verification |

1-6 |

| |

|

| 1.10 Mineral Processing and Metallurgical Testwork |

1-7 |

| 1.10.1 Comminution |

1-7 |

| 1.10.2 Flotation |

1-7 |

| 1.10.3 Concentrate Characterization |

1-8 |

| |

|

| 1.11 Mineral Resource Estimate |

1-8 |

| |

|

| 1.12 Mineral Reserve Estimate |

1-10 |

| |

|

| 1.13 Mining Methods and Production Schedules |

1-11 |

| |

|

| 1.14 Recovery Methods |

1-15 |

| |

|

| 1.15 CMM Infrastructure |

1-15 |

| |

|

| 1.16 Market Studies and Contracts |

1-16 |

| |

|

| 1.17 Environmental Studies, Permitting, and Social or Community Impacts |

1-16 |

| 1.17.1 Permitting |

1-16 |

| 1.17.2 Environmental, Social Setting, and Community Engagement |

1-17 |

| 1.17.3 Conceptual Mine Closure and Reclamation |

1-17 |

| |

|

| 1.18 Capital and Operating Costs |

1-17 |

| 1.18.1 Capital Costs |

1-17 |

| 1.18.2 Operating Costs |

1-19 |

| |

|

| 1.19 Economic Analysis |

1-19 |

| |

|

| 1.20 Conclusions |

1-20 |

| |

|

| 1.21 Recommendations |

1-20 |

| |

|

| 2 Introduction |

2-1 |

| |

|

| 2.1 Qualified Person |

2-1 |

| |

|

| 2.2 Source of Information |

2-1 |

| |

|

| 2.3 Unit of Measure Abbreviations Used in Report |

2-2 |

| |

|

| 3 Reliance on Other Experts |

3-1 |

| |

|

| 4 Property Description and Location |

4-1 |

| |

|

| 4.1 Location |

4-1 |

| |

|

| 4.2 Land Use, Mineral Tenure, and Surface Rights |

4-2 |

| |

|

| 4.3 Environmental Property Liabilities |

4-7 |

| 4.4 Royalties |

4-7 |

| |

|

| 5 Accessibility, Climate, Local Resources, Infrastructure, and Physiography |

5-1 |

| |

|

| 5.1 Accessibility |

5-1 |

| |

|

| 5.2 Climate |

5-1 |

| |

|

| 5.3 Local Resources |

5-1 |

| |

|

| 5.4 Infrastructure |

5-1 |

| |

|

| 5.5 Physiography |

5-3 |

| |

|

| 6 History |

6-1 |

| |

|

| 6.1 Copper Mountain Mine Area and Mining History |

6-1 |

| |

|

| 6.2 Exploration and Mineral Resource Estimates History |

6-3 |

| |

|

| 7 Geological Setting and Mineralization |

7-1 |

| |

|

| 7.1 Regional Geology |

7-1 |

| |

|

| 7.2 CMM Geology |

7-1 |

| 7.2.1 Lithologies |

7-4 |

| 7.2.2 Structure |

7-5 |

| 7.2.3 Geochronology |

7-6 |

| |

|

| 7.3 Deposit Geology |

7-7 |

| 7.3.1 Alteration |

7-7 |

| 7.3.2 Mineralization |

7-7 |

| 7.3.3 Weathering |

7-9 |

| |

|

| 8 Deposit Types |

8-1 |

| |

|

| 8.1 Alkalic Porphyry Deposits |

8-1 |

| |

|

| 9 Exploration |

9-1 |

| |

|

| 9.1 Geological and Geochemical Mapping |

9-1 |

| |

|

| 9.2 Geophysics |

9-1 |

| 9.2.1 Airborne Surveys |

9-1 |

| 9.2.2 Ground Surveys |

9-1 |

| |

|

| 9.3 Exploration Potential |

9-3 |

| |

|

| 10 Drilling |

10-1 |

| |

|

| 10.1 Drill Summary |

10-1 |

| |

|

| 10.2 Drilling Methods |

10-5 |

| |

|

| 10.3 Geological Logging |

10-6 |

| |

|

| 10.4 Recovery |

10-6 |

| |

|

| 10.5 Collar Surveys |

10-6 |

| |

|

| 10.6 Downhole Surveys |

10-6 |

| |

|

| 10.7 RC and Percussion Drilling |

10-7 |

| |

|

| 10.8 Geotechnical and Hydrological Drilling |

10-7 |

| |

|

| 10.9 Drill Coverage |

10-8 |

| |

|

| 10.10 Comments on Drilling |

10-8 |

| 11 Sample Preparation, Analyses, and Security |

11-1 |

| |

|

| 11.1 Sampling Methods |

11-1 |

| 11.1.1 Historical Drilling |

11-1 |

| 11.1.2 Diamond and Reverse-Circulation Drilling |

11-1 |

| |

|

| 11.2 Density (Specific Gravity) Determinations |

11-2 |

| |

|

| 11.3 Analytical and Test Laboratories |

11-3 |

| 11.3.1 Laboratory Accreditation |

11-4 |

| |

|

| 11.4 Sample Preparation and Analysis |

11-4 |

| |

|

| 11.5 Quality Assurance and Quality Control |

11-4 |

| 11.5.1 Historical Data (Pre-2007) |

11-6 |

| 11.5.2 2007-2023 QA/QA Control Program |

11-6 |

| |

|

| 11.6 Check and Re-Assay Programs |

11-11 |

| 11.6.1 Check Assays |

11-11 |

| 11.6.2 External Check-Assays Results |

11-12 |

| 11.6.3 Re-Assays |

11-12 |

| |

|

| 11.7 Sample Security |

11-13 |

| |

|

| 11.8 Sample Storage |

11-13 |

| |

|

| 11.9 Comments on Sample Preparation, Analyses, and Security |

11-14 |

| |

|

| 12 Data Verification |

12-1 |

| |

|

| 12.1 Internal Verification |

12-1 |

| 12.1.1 Collars |

12-2 |

| 12.1.2 Downhole Surveys |

12-2 |

| 12.1.3 Assays |

12-3 |

| 12.1.4 Database Corrections |

12-4 |

| 12.1.5 Data Security |

12-5 |

| 12.1.6 Site Visits |

12-5 |

| |

|

| 12.2 Comments on Data Verification |

12-5 |

| |

|

| 13 Mineral Processing and Metallurgical Testing |

13-1 |

| |

|

| 13.1 Comminution |

13-1 |

| 13.1.1 Copper Mountain Main and North Pit |

13-1 |

| 13.1.2 New Ingerbelle |

13-1 |

| |

|

| 13.2 Flotation |

13-2 |

| 13.2.1 Copper Mountain Main and North Pit |

13-2 |

| 13.2.2 New Ingerbelle |

13-3 |

| 13.2.3 Precious Metal Recoveries |

13-5 |

| |

|

| 14 Mineral Resource Estimates |

14-1 |

| |

|

| 14.1 Drilling Database |

14-1 |

| |

|

| 14.2 Density |

14-7 |

| |

|

| 14.3 Gold and Silver Regressions |

14-8 |

| |

|

| 14.4 Compositing |

14-8 |

| |

|

| 14.5 Exploratory Data Analysis |

14-8 |

| |

|

| 14.6 Grade Capping |

14-9 |

| |

|

| 14.7 Variography |

14-9 |

| |

|

| 14.8 Grade Estimation and Interpolation Methods |

14-10 |

| 14.9 Grade Estimation Validation |

14-11 |

| |

|

| 14.10 Visual Inspection |

14-11 |

| |

|

| 14.11 Global-Bias Checks |

14-14 |

| |

|

| 14.12 Smoothing Assessment |

14-16 |

| |

|

| 14.13 Smoothing Correction |

14-16 |

| |

|

| 14.14 Classification of Mineral Resource |

14-18 |

| |

|

| 14.15 Post-Processing of Dykes, Mined-Out Areas, and Backfill |

14-19 |

| |

|

| 14.16 Reasonable Prospects for Economic Extraction and Mineral Resource Estimates |

14-19 |

| |

|

| 14.17 Reconciliation |

14-20 |

| |

|

| 14.18 Conclusion |

14-22 |

| |

|

| 15 Mineral Reserve Estimates |

15-1 |

| |

|

| 15.1 Dilution and Mining Recovery |

15-1 |

| |

|

| 15.2 Geotechnical Considerations |

15-1 |

| |

|

| 15.3 Pit Optimization |

15-2 |

| |

|

| 15.4 Mineral Reserve Statement |

15-2 |

| |

|

| 15.5 Factors that may Materially Affect Mineral Reserves |

15-2 |

| |

|

| 16 Mining Methods |

16-1 |

| |

|

| 16.1 Mining Overview |

16-1 |

| |

|

| 16.2 Pit and Waste-Rock Storage Area Design Criteria |

16-1 |

| |

|

| 16.3 Pit Dewatering |

16-5 |

| |

|

| 16.4 Life-of-Mine Production Schedule and Sequence |

16-5 |

| 16.4.1 Sequence, Dilution, and Mill-Feed Cut-Off Strategy |

16-5 |

| 16.4.2 Dilution and Mill-Feed Cut-Off Strategy |

16-5 |

| 16.4.3 New Ingerbelle Development |

16-6 |

| 16.4.4 Production Schedule |

16-7 |

| |

|

| 16.5 Mine Equipment |

16-9 |

| |

|

| 17 Recovery Methods |

17-1 |

| |

|

| 17.1 Process Plant Description |

17-1 |

| 17.1.1 Crushing Circuit |

17-1 |

| 17.1.2 Grinding and Classification |

17-3 |

| 17.1.3 Flotation Circuit |

17-3 |

| 17.1.4 Copper-Concentrate Dewatering |

17-4 |

| 17.1.5 Reagents and Consumables |

17-4 |

| |

|

| 17.2 50 kt/d Debottlenecking |

17-5 |

| 17.2.1 Comminution Circuit |

17-6 |

| 17.2.2 Flotation Circuit |

17-6 |

| |

|

| 18 Infrastructure |

18-1 |

| |

|

| 18.1 Power Supply |

18-3 |

| 18.1.1 Copper Mountain Mine Power Reticulation |

18-4 |

| |

|

| 18.2 Water Supply and Management |

18-4 |

| 18.2.1 Existing Water Management Systems |

18-5 |

| |

|

| 18.3 Other Services |

18-6 |

| 18.3.1 Process Plant Maintenance |

18-6 |

| 18.3.2 Fleet Maintenance |

18-7 |

| 18.3.3 Fuel Storage and Distribution |

18-7 |

| 18.3.4 Administration Facilities |

18-7 |

| 18.3.5 Warehousing |

18-7 |

| 18.3.6 Waste Rock Facility |

18-7 |

| 18.3.7 Tailings Management Facility |

18-8 |

| |

|

| 18.4 New Ingerbelle Pit Activation |

18-8 |

| 18.4.1 New Ingerbelle Maintenance Services |

18-8 |

| 18.4.2 New Ingerbelle Pit Access |

18-8 |

| 18.4.3 New Ingerbelle Power Reticulation |

18-10 |

| 18.4.4 New Ingerbelle Water-Management Installations |

18-12 |

| 18.4.5 New Ingerbelle Waste Rock Facility |

18-12 |

| |

|

| 19 Market Studies and Contracts |

19-1 |

| |

|

| 19.1 Copper Concentrate |

19-1 |

| |

|

| 19.2 Related Contracts |

19-1 |

| |

|

| 19.3 Logistics |

19-2 |

| |

|

| 20 Environmental Studies, Permitting, and Social or Community Impact |

20-1 |

| |

|

| 20.1 Permitting |

20-1 |

| 20.1.1 Existing Major Permits |

20-1 |

| 20.1.2 Other Potential Permits |

20-3 |

| |

|

| 20.2 Environmental Studies and Monitoring Programs |

20-4 |

| 20.2.1 Meteorology |

20-4 |

| 20.2.2 Air Quality and Greenhouse Gas Emissions |

20-4 |

| 20.2.3 Hydrology, Hydrogeology, and Water Quality |

20-4 |

| 20.2.4 Waste Rock Geochemistry |

20-5 |

| 20.2.5 Fish and Aquatics |

20-5 |

| 20.2.6 Wildlife and Vegetation |

20-6 |

| 20.2.7 Archaeology |

20-6 |

| 20.2.8 Environmental Disclosure |

20-6 |

| |

|

| 20.3 Social and Community |

20-6 |

| 20.3.1 Employment and Economy |

20-7 |

| 20.3.2 Land Use |

20-8 |

| 20.3.3 Engagement |

20-10 |

| |

|

| 20.4 Conceptual Mine Closure and Reclamation |

20-11 |

| |

|

| 21 Capital and Operating Costs |

21-1 |

| |

|

| 21.1 Capital Costs |

21-1 |

| 21.1.1 Project Capital |

21-1 |

| 21.1.2 Sustaining Capital and Capitalized Stripping |

21-2 |

| |

|

| 21.2 Operating Costs |

21-4 |

| 22 Economic Analysis |

22-1 |

| |

|

| 23 Adjacent Properties |

23-1 |

| |

|

| 24 Other Relevant Data and Information |

24-1 |

| |

|

| 25 Interpretation and Conclusions |

25-1 |

| |

|

| 26 Recommendations |

26-1 |

| |

|

| 27 References, Abbreviations, and Units of Measure |

27-1 |

| |

|

| 27.1 References |

27-1 |

| |

|

| 27.2 Abbreviations and Units of Measure |

27-9 |

Tables

| Table 1-1: Copper Mountain Mineral Resource Estimates Inclusive of Mineral Reserves Effective as of December 1, 2023 |

1-9 |

| Table 1-2: Copper Mountain Mineral Resource Estimates Exclusive of Mineral Reserves Effective as of December 1, 2023 |

1-9 |

| Table 1-3: Reconciliation between the 2019, 2022, and 2023 Copper Mountain Mineral Resource Estimates |

1-10 |

| Table 1-4: Copper Mountain Mine Mineral Reserves, Effective as of December 1, 2023 |

1-11 |

| Table 1-5: Copper Mountain LOM Mine Schedule-2024-2044 |

1-14 |

| Table 1-6: Production Ramp-Up Schedule |

1-15 |

| Table 1-7: Major Permits at Copper Mountain Mine |

1-16 |

| Table 1-8: Copper Mountain Mine-Summary of LOM Capital Cost ($ 000s) |

1-18 |

| Table 1-9: Copper Mountain Mine-Summary of LOM Operating Costs ($/t) |

1-19 |

| Table 1-10: Operating Costs and Sustaining Costs per Pound (US$/lb) |

1-19 |

| Table 3-1: Reliance on Other Experts |

3-1 |

| Table 4-1: Crown Grants |

4-4 |

| Table 4-2: Mineral Claims |

4-5 |

| Table 4-3: Mining Leases |

4-7 |

| Table 6-1: Reconciliation between the 2019, 2022, and 2023 Copper Mountain Mineral Resource Estimates |

6-4 |

| Table 10-1: Summary of Historical Drill Hole Data for the Copper Mountain Project |

10-2 |

| Table 10-2: Summary of Recent Drill Hole Data for the Copper Mountain Project |

10-3 |

| Table 11-1: Sample Preparation and Analytical Laboratories |

11-3 |

| Table 11-2: Laboratory Location and Accreditation |

11-4 |

| Table 11-3: Summary of CMM QA/QC from 2007 to 2023 |

11-5 |

| Table 11-4: Blank and CRM Insertion Procedures from 2007 to 2023 |

11-7 |

| Table 11-5: CRMs Used from 2007-2023 |

11-8 |

| Table 11-6: Summary of CRM Performance for Drill Programs 2007-2023 |

11-9 |

| Table 11-7: Summary of Blank Performance for Drill Programs 2007-2023 |

11-10 |

| Table 11-8: Summary of CRM Performance for Copper Mountain Mine Laboratory 2012-2022 |

11-11 |

| Table 11-9: Summary of External Check Assays 2012-2022 for Cu% by AA Method |

11-12 |

| Table 11-10: Summary of Half-Core Duplicate Check-Assays 2021-2022 for Cu% by AA Method |

11-13 |

| Table 12-1: Summary of Survey by Hole Type |

12-3 |

| Table 12-2: Survey Type in Recent Drill Holes (2007-2023) |

12-3 |

| Table 12-3: Assay Database Summary by Element, Period, and Laboratory |

12-4 |

| Table 13-1: Main and North Pit Hardness |

13-1 |

| Table 13-2: New Ingerbelle Hardness Testwork Results |

13-1 |

| Table 13-3: Historical Ingerbelle Flotation Performance |

13-4 |

| Table 14-1: Drill-Hole Summary |

14-1 |

| Table 14-2: Drill-Hole Summary per Deposit |

14-2 |

| Table 14-3: Mineralized Envelopes Code Equivalency |

14-2 |

| Table 14-4: Specific Gravity by Mineralization Domains |

14-7 |

| Table 14-5: Copper Mountain and New Ingerbelle Capping Thresholds |

14-9 |

| Table 14-6: East Deposit Variogram Parameters |

14-9 |

| Table 14-7: Search Ellipse Parameters |

14-10 |

| Table 14-8: Global Statistics |

14-15 |

| Table 14-9: Summary of Smoothing Correction |

14-17 |

| Table 14-10: Resource Classification Proportion Pre- and Post-Processing |

14-19 |

| Table 14-11: Copper Mountain Mineral Resource Estimates Inclusive of Mineral Reserves Effective as of December 1, 2023 |

14-20 |

| Table 14-12: Copper Mountain Mineral Resource Estimates Exclusive of Mineral Reserves Effective as of December 1, 2023 |

14-20 |

| Table 14-13: December 2020 to October 2023 Mineral Reserve Estimates vs. Plant Reconciled Results |

14-21 |

| Table 14-14: Reconciliation between the 2019, 2022, and 2023 Copper Mountain Mineral Resource Estimates |

14-21 |

| Table 15-1: Copper Mountain Mine Mineral Reserves, December 1, 2023 |

15-3 |

| Table 16-1: Pit Wall Slope Parameters |

16-3 |

| Table 16-2: Copper Mountain Mine WRF Design Criteria |

16-4 |

| Table 16-3: Copper Mountain Mine Planning Parameters |

16-5 |

| Table 16-4: Copper Mountain LOM Mine Schedule-2024-2044 |

16-8 |

| Table 16-5: Copper Mountain Mine Pit Equipment Fleet, Peak Production |

16-9 |

| Table 17-1: Production Ramp-Up Schedule |

17-5 |

| Table 17-2: Process Design Criteria |

17-7 |

| Table 18-1: Site Power Demand Summary |

18-4 |

| Table 20-1: Major Permits at Copper Mountain Mine |

20-1 |

| Table 21-1: LOM Capital Projects Expenditures ($ 000s) |

21-1 |

| Table 21-2: LOM Sustaining Capital and Capitalized Stripping Expenditures ($ 000s) |

21-3 |

| Table 21-3: On-Site Operating Costs ($/t Milled) |

21-4 |

| Table 21-4: Operating Costs-Mining/Activity ($/t Moved) |

21-4 |

| Table 21-5: Operating Costs-Mining/Components ($/t Moved) |

21-5 |

| Table 21-6: Operating Costs-Milling and G&A ($/t Milled) |

21-5 |

| Table 21-7: Operating Costs and Sustaining Costs per Pound (US$/lb) |

21-6 |

Figures

| Figure 1-1: Copper Mountain Mine Land Tenure |

1-2 |

| Figure 1-2: Copper Mountain and New Ingerbelle Ultimate Pits |

1-12 |

| Figure 4-1: Copper Mountain Mine Location |

4-1 |

| Figure 4-2: Copper Mountain Mine Land Tenure |

4-3 |

| Figure 5-1: Copper Mountain Mine Site |

5-2 |

| Figure 6-1: Locations and Names of Historical and Current Mining Zones and Areas |

6-2 |

| Figure 7-1: Terranes of British Columbia Showing the Copper Mountain Deposit Location |

7-2 |

| Figure 7-2: Geology of the Copper Mountain Area |

7-3 |

| Figure 7-3: Schematic Representation of a Geological SW-NE Cross-Section Across Copper Mountain |

7-4 |

| Figure 7-4: Contoured Blastholes in the CM Main Pit at November 2019 Mining Surface |

7-9 |

| Figure 9-1: Total Magnetic Intensity |

9-2 |

| Figure 9-2: Location of IP Survey Lines |

9-3 |

| Figure 10-1: Isometric View of Drill Hole in the CM Main and CM North Zones |

10-5 |

| Figure 13-1: Monthly Copper Recovery |

13-2 |

| Figure 13-2: Rougher Flotation Co-Collector Testwork on Copper Mountain Main Pit Samples |

13-3 |

| Figure 13-3: Rougher Flotation Testwork on New Ingerbelle Composites |

13-4 |

| Figure 13-4: Monthly Gold Recovery |

13-5 |

| Figure 13-5: Monthly Silver Recovery |

13-6 |

| Figure 14-1: Plan View of the Geological Model |

14-3 |

| Figure 14-2: Plan View of the Mineralized Domains |

14-4 |

| Figure 14-3: New Ingerbelle Mineralization |

14-4 |

| Figure 14-4: Copper Mountain North Mineralization |

14-5 |

| Figure 14-5: Copper Mountain Central East Mineralization |

14-5 |

| Figure 14-6: Copper Mountain Central Mineralization |

14-6 |

| Figure 14-7: Copper Mountain South Central Mineralization |

14-6 |

| Figure 14-8: Copper Mountain South Mineralization |

14-7 |

| Figure 14-9: Ore Percentage Example |

14-10 |

| Figure 14-10:New Ingerbelle-OK Model and Copper Grade Composites N-S Section View |

14-11 |

| Figure 14-11:Copper Mountain North-OK Model and Copper Grade Composites N-S Section View |

14-12 |

| Figure 14-12:Copper Mountain Central East-OK Model and Copper Grade Composites N-S Section View |

14-12 |

| Figure 14-13:Copper Mountain Central and South Central-OK Model and Copper Grade Composites N-S Section View |

14-13 |

| Figure 14-14:Copper Mountain South-OK Model and Copper Grade Composites N-S Section View |

14-13 |

| Figure 14-15:Resource Classification at the CMM Deposits |

14-18 |

| Figure 14-16:Copper Mountain 2022 Block Model vs. Hudbay Grade Shells |

14-22 |

| Figure 16-1: Copper Mountain and New Ingerbelle Ultimate Pits |

16-2 |

| Figure 16-2: Geotechnical Zones |

16-4 |

| Figure 16-3: Annual Material Movement |

16-9 |

| Figure 17-1: Process Plant 45 kt/d Flowsheet |

17-2 |

| Figure 18-1: BC Hydro Transmission Map |

18-3 |

| Figure 18-2: Overall 25 kV Distribution System |

18-5 |

| Figure 18-3: Site Water Management Schematic |

18-6 |

| Figure 18-4: Proposed Equipment Bridge Crossing the Similkameen River |

18-9 |

| Figure 18-5: New Ingerbelle Proposed Power Supply and Reticulation |

18-11 |

| Figure 19-1: Global Copper Production and Primary Demand |

19-1 |

| Figure 20-1: Copper Mountain Permitted Mine Area |

20-2 |

| Figure 20-2: Community Boundaries and Setting in Relation to Copper Mountain Mine |

20-7 |

| Figure 20-3: Ingerbelle Land Tenure |

20-9 |

1 Summary

This Technical Report has been prepared for Hudbay Minerals Inc. (Hudbay) to support the public disclosure of updated Mineral Resource and Mineral Reserve estimates and an updated life-of-mine (LOM) plan for the Copper Mountain Mine (CMM). This Technical Report conforms to National Instrument (NI) 43-101 Standards of Disclosure for Mineral Projects.

Hudbay acquired Copper Mountain Mining Corporation (CMMC) in June 2023 and indirectly holds a 75% interest in Copper Mountain Mine (BC) Ltd. (CMML) and the CMM. The remaining 25% interest in CMML and the CMM is held by Mitsubishi Materials Corp. (MMC).

Hudbay is an integrated Canadian mining company with assets in North and South America, principally focused on the discovery, production, and marketing of base metals and precious metals. Hudbay's objective is to maximize shareholder value through efficient operations, organic growth, and accretive acquisitions while maintaining its financial strength.

Hudbay's operations at the CMM include a series of open pits, an ore processing plant, waste rock facilities (WRF), a tailings management facility (TMF), and other ancillary facilities that support the operations.

After 15 years of care and maintenance, CMMC restarted operations at the CMM in mid-2011. Operations have continued since 2011 without major interruptions. As of the date of this Technical Report, the CMM is in steady-state production.

The Qualified Person (QP) who supervised the preparation of this Technical Report is Hudbay's Olivier Tavchandjian, P.Geo., Senior Vice-President, Exploration and Technical Services.

Unless the context suggests otherwise, references to "Hudbay" refer to Hudbay Minerals Inc. and its direct and indirect subsidiaries, including but without limitation, CMML.

1.1 Property Description and Location

The CMM is 21 km by road south of Princeton and 180 km east of Vancouver, British Columbia (B.C.). The CMM property consists of 135 Crown-granted mineral claims, 145 located mineral claims, 14 mining leases, 12 fee simple properties, and 7 cell claims, which together cover 6,354 ha (63.5 km2). All claims are controlled by CMML, a joint venture held 75% by Hudbay and 25% by MMC. The claims straddle the Similkameen River, with New Ingerbelle on the river's west side and the Copper Mountain Main (CM Main) and Copper Mountain North (CM North) Pits on the east. The Hope-Princeton Highway (Highway 3) passes immediately west of the property (Figure 1-1).

Figure 1-1: Copper Mountain Mine Land Tenure

Source: CMMC (2022).