Current Report Filing (8-k)

October 15 2020 - 5:01PM

Edgar (US Regulatory)

false 0001674168 0001674168 2020-10-15 2020-10-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 15, 2020

Hilton Grand Vacations Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-37794

|

|

81-2545345

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

6355 MetroWest Boulevard, Suite 180

Orlando, Florida

|

|

32835

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(407) 613-3100

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.01 par value per share

|

|

HGV

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.05.

|

Costs Associated with Exit or Disposal Activities.

|

On October 15, 2020, the Board of Directors of Hilton Grand Vacations Inc. (the “Company”) approved a workforce reduction plan in response to the continuing adverse impact of the COVID-19 pandemic and related government orders and mandates restricting travel and operations on the Company’s business and the travel and leisure industry in general. The reduction in force is expected to reduce the Company’s workforce by approximately 1,600 team members and better align the workforce with the evolving business needs.

The Company anticipates that such reductions will take effect starting on October 15, 2020 and be completed by October 31, 2020. The reduction in force is estimated to result in approximately $10 to $12 million in restructuring and related expenses and charges, primarily related to employee severance, benefit and related costs. The Company expects to incur a majority of these costs during the last quarter of 2020. All of the restructuring and related expenses and charges are expected to result in cash expenditures.

Cautionary Note Regarding Forward-Looking Statements

The statements in this Current Report on Form 8-K, including any exhibits hereto, may include forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “would,” “could,” or similar expressions indicate a forward-looking statement; however, not all forward-looking statements include these identifying words. These forward looking statements involve substantial risks and uncertainties that could cause the outcome to be materially different, including the material impact of the COVID-19 pandemic on the Company’s business, operating results and financial condition, the extent and duration of the impact of the COVID-19 pandemic on the hospitality industry and on global economic conditions, the cost and impact of our anticipated workforce reduction on our business and financial condition, as well as those factors that are discussed under the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s most recent Annual Report on Form 10-K, and any subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that may update or supplement such disclosure. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in the Company’s other filings with the Securities and Exchange Commission. Further, forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, except as required by law.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

HILTON GRAND VACATIONS INC.

|

|

|

|

|

By:

|

|

/s/ Daniel J. Mathewes

|

|

|

|

Daniel J. Mathewes

|

|

|

|

Executive Vice President and Chief Financial Officer

|

Date: October 15, 2020

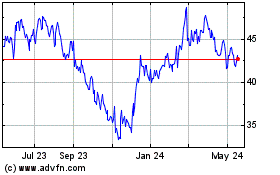

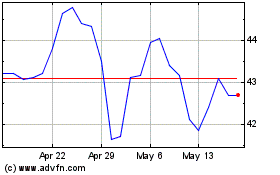

Hilton Grand Vacations (NYSE:HGV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hilton Grand Vacations (NYSE:HGV)

Historical Stock Chart

From Jul 2023 to Jul 2024