Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

October 22 2024 - 6:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act of 1934

For the month of October, 2024

Commission File Number 001-15216

HDFC BANK LIMITED

(Translation of registrant’s name into English)

HDFC Bank House, Senapati Bapat Marg,

Lower Parel, Mumbai. 400 013, India

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

HDFC BANK LIMITED |

|

|

|

|

(Registrant) |

|

|

|

|

| Date: October 21, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

/s/ Ajay Agarwal |

|

|

|

|

Name: Ajay Agarwal |

|

|

|

|

Title: Company Secretary and Head – Group

Oversight |

EXHIBIT INDEX

The following documents (bearing the exhibit number listed below) are furnished herewith and are made a part of this report pursuant to the General

Instructions for Form 6-K.

Exhibit No. 99

Description

Quantum of Offer for Sale of equity shares

of HDB Financial Services Limited (“HDBFS”) by HDFC Bank Limited (“Bank”), in its proposed Initial Public Offering (“IPO”)

Exhibit 99

October 21, 2024

New York Stock Exchange

11, Wall Street,

New York,

NY 10005s

USA

Dear Sir/ Madam,

Sub: Quantum of Offer for Sale of

equity shares of HDB Financial Services Limited (“HDBFS”) by HDFC Bank Limited (“Bank”), in its proposed Initial Public Offering (“IPO”)

We wish to inform you that the Board of Directors of the Bank at its meeting held on October 19, 2024, inter alia, considered and approved the

Offer for Sale (“OFS”) of such number of equity shares of face value of ₹ 10/- each of HDBFS aggregating up to ₹ 10,000 crore (Rupees Ten thousand crore only) held by the Bank (subject to any revisions to such amount as may be permissible under

applicable law), in the proposed IPO, subject to applicable law, market conditions, receipt of necessary approvals/ regulatory clearances and other considerations.

Accordingly, the IPO will be for such number of equity shares of face value of ₹ 10/- each of HDBFS aggregating up to ₹ 12,500 crore (Rupees Twelve thousand Five

hundred crore only) comprising of a fresh issue of such number of equity shares of face value of ₹ 10/- each of HDBFS aggregating up

to ₹ 2,500 crore (Rupees Two thousand Five hundred crore only) and an OFS of such number of equity shares of face value of ₹ 10/- each of HDBFS aggregating up to

₹ 10,000 crore (Rupees Ten thousand crore only).

The price and other details of the proposed IPO will be determined in due course by the competent body. Please note that post the proposed IPO, HDBFS would

continue to be a subsidiary of the Bank, in compliance with the provisions of the applicable regulations.

We request you to kindly note the above and

arrange to make the necessary announcement.

This is for your information and appropriate dissemination.

Yours faithfully,

For HDFC Bank Limited

Sd/-

Ajay Agarwal

Company Secretary and Head – Group Oversight

Encl.:

a/a.

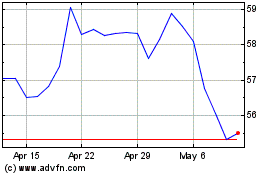

HDFC Bank (NYSE:HDB)

Historical Stock Chart

From Oct 2024 to Nov 2024

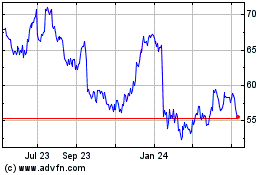

HDFC Bank (NYSE:HDB)

Historical Stock Chart

From Nov 2023 to Nov 2024