|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 13D/A (Amendment No. 9)*

Under the Securities Exchange Act of 1934 |

HCI Group, Inc. |

(Name of Issuer) |

|

Common Stock, no par value |

(Title of Class of Securities) |

|

40416E103 |

(CUSIP Number) |

|

Paresh Patel 3802 Coconut Palm Drive

Tampa, Florida 33619 (813) 405-3600 |

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications) |

|

December 14, 2023 |

(Date of Event Which Requires Filing of this Statement) |

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

Page 1 of 6 Pages

CUSIP No. 40416E103 13D Page 2 of 6 Pages

|

|

|

|

1 |

NAMES OF REPORTING PERSONS Paresh Patel |

2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☐ |

3 |

SEC USE ONLY |

4 |

SOURCE OF FUNDS PF |

5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ☐ |

6 |

CITIZENSHIP OR PLACE OF ORGANIZATION United States of America |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE VOTING POWER 1,432,500 |

8 |

SHARED VOTING POWER 0 |

9 |

SOLE DISPOSITIVE POWER 1,412,500 |

10 |

SHARED DISPOSITIVE POWER 0 |

11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 1,432,500 |

12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐ |

13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 13.9% |

14 |

TYPE OF REPORTING PERSON IN |

CUSIP No. 40416E103 13D Page 3 of 6 Pages

Explanatory Note

The following constitutes Amendment No. 9 (“Amendment No. 9”) to the Schedule 13D filed by the undersigned on March 4, 2016, as amended by Amendment No. 1 thereto filed March 1, 2018, Amendment No. 2 filed February 8, 2019, Amendment No. 3 filed June 7, 2019, Amendment No. 4 filed December 13, 2019, Amendment No. 5 filed March 1, 2021, Amendment No. 6 filed March 29, 2022, Amendment No. 7 filed May 31, 2022, and Amendment No. 8 filed February 1, 2023. Capitalized terms used but not otherwise defined in this Amendment No. 9 shall have the meanings ascribed to such terms in the Schedule 13D. Except as otherwise provided herein, each Item of the Schedule 13D remains unchanged.

Item 3. Source and Amount of Funds or Other Consideration.

Item 3 of this Schedule 13D is hereby amended to add the following information:

This Amendment No. 9 is being filed to report that, as of December 14, 2023, the Reporting Person’s beneficially owned holdings of the Issuer’s Common Stock class of securities increased from 1,250,000 shares to 1,432,500 shares. The change resulted from a) inclusion of 27,500 shares pursuant to options that will vest within 60 days of the date that of filing of this Amendment No. 9, b) the purchase of 5,000 shares on December 6, 2023, and c) 150,000 shares pursuant to options that vested on December 14, 2023. Due to the issuance of 1,150,000 shares on December 11, 2023 pursuant to a public offering of the Issuer’s Common Stock, the Reporting Person’s beneficial ownership percentage did not change.

Item 5. Interest in Securities of the Issuer.

Item 5 of this Schedule 13D is hereby amended and restated as follows:

The ownership percentage set forth herein as of December 14, 2023 is based on 9,738,183 shares of Common Stock outstanding as of December 14, 2023 plus 590,000 shares of Common Stock representing the Reporting Person’s vested options to purchase 110,000 shares of Common Stock at an exercise price of $40.00 per share, expiring January 7, 2027; vested options to purchase 110,000 shares of Common Stock at an exercise price of $40.00 per share, expiring February 8, 2028; vested options to purchase 110,000 shares of Common Stock at an exercise price of $53.00 per share, expiring January 15, 2029; vested options to purchase 82,500 shares of Common Stock at an exercise price of $48.00 per share, expiring January 16, 2030, unvested options to purchase 27,500 shares of Common Stock at an exercise price of $48.00 per share that will vest within 60 days of the date of filing of this Amendment 9, expiring January 16, 2030, and vested options to purchase 150,000 shares of Common Stock at an exercise price of $70 per share, expiring September 15, 2033, representing a total of 10,328,183 shares of Common Stock deemed outstanding for purposes of calculating the Reporting Person’s ownership percentage as of December 14, 2023.

(a) As of December 14, 2023, the Reporting Person directly owned (jointly with spouse) 447,000 shares of Common Stock, directly owned (personally) 338,000 shares of Common Stock, and directly owned 20,000 Restricted Shares (all of which the Reporting Person may vote and receive dividends and other distributions but may not assign, sell, transfer, pledge, encumber or otherwise alienate or hypothecate). The Reporting Person indirectly owned (via his IRA) 37,500 shares of Common Stock. The Reporting Person beneficially owns 562,500 shares of Common Stock issuable upon exercise of vested options and beneficially owns 27,500 shares of Common Stock issuable upon exercise of options that will vest within 60 days of the date of filing of this Amendment 9. The Common Stock beneficially owned by the Reporting Person represented 13.9% of the total number of shares of Common Stock outstanding as of December 14, 2023.

(b) The Reporting Person has and will continue to have the sole power to vote 822,500 shares of Common Stock (447,000 of which are jointly held with spouse), 20,000 Restricted Shares, and 590,000shares of Common Stock if and when the Reporting Person exercises the vested options. The Reporting Person has the sole power to dispose of 822,500 shares of Common Stock and 590,000 shares of Common Stock if and when the Reporting Person exercises the vested options. The Reporting Person, upon the vesting of all 20,000 Restricted Shares, will

CUSIP No. 40416E103 13D Page 4 of 6 Pages

have the sole power to dispose of such 20,000 Restricted Shares, in addition to the Common Stock held directly by him and the shares issuable upon exercise of the vested options as set forth immediately above.

(c) Transaction in the Issuer’s Common Stock effected within 60 days prior to the date of the filing of this Amendment 9 by the Reporting Person:

- Description: Purchase from Citizens JMP Securities, LLC, lead manager for the Issuer’s public offering of its Common Stock

- Transaction Date: December 6, 2023

- Quantity of securities: 5,000 shares of the Issuer’s Common Stock

- Price per share: $78.00

(d) Other than the Reporting Person, no other person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the Reporting Person’s shares of Common Stock, shares of Common Stock issuable to the Reporting Person upon exercise of the options or Restricted Shares; provided, however, that the Reporting Person may not assign, sell, transfer, pledge, encumber or otherwise alienate or hypothecate any of his 20,000 Restricted Shares until they are vested.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Item 6 of this Schedule 13D is hereby amended to add the following information:

The summary of the Nonqualified Stock Option Agreements, as set forth in Item 3, is incorporated herein by reference. The foregoing summary of these agreements is generalized, does not purport to be complete and, as such, is qualified in its entirety by the Nonqualified Stock Option Agreements set forth in Exhibits 99.4, 99.6, 99.8, 99.10, and 99.13 below and incorporated into this Item 6 by reference.

Other than as may be described in the Schedule 13D filed on March 4, 2016, the Schedule 13D/A filed on March 1, 2018, the Schedule 13D/A filed on February 8, 2019, the Schedule 13D/A filed on June 7, 2019, the Schedule 13D/A filed on December 13, 2020, the Schedule 13D/A filed on March 1, 2021, the Schedule 13D/A filed on March 29, 2022, the Schedule 13D/A filed on May 31, 2022, and the Schedule 13D/A filed on February 1, 2023, there are no contracts, arrangements, understandings or relationships between the Reporting Person and any person with respect to any securities of the Issuer, including, but not limited to, the transfer or voting of any of the securities, finder’s fees, joint ventures, loan or option agreements, puts or calls, guarantees of profits, division of profits or loss, or the giving or withholding of proxies.

Item 7. Material to be Filed as Exhibits.

Item 7 of this Schedule 13D is hereby amended and restated as follows:

|

|

EXHIBIT |

DOCUMENT |

99.1 |

Restricted Stock Award Contract, dated May 16, 2013, between the Issuer and the Reporting Person (incorporated by reference to Exhibit 10.34 to Current Report on Form 8-K filed by the Issuer with the SEC on May 21, 2013). |

|

|

99.2 |

Amendment to Restricted Stock Award Contract, dated March 2, 2016, between the Issuer and the Reporting Person (incorporated by reference to Exhibit 10.90 to Annual Report on Form 10-K for the year ended December 31, 2015, filed by the Issuer with the SEC on March 4, 2016). |

|

|

CUSIP No. 40416E103 13D Page 5 of 6 Pages

|

|

99.5 |

Restricted Stock Award Contract, dated February 8, 2018, between the Issuer and the Reporting Person (incorporated by reference to Exhibit 99.1 to Current Report on Form 8-K filed by the Issuer with the SEC on February 14, 2018). |

|

|

99.6 |

Nonqualified Stock Option Agreement, dated February 8, 2018, between the Issuer and the Reporting Person (incorporated by reference to Exhibit 99.2 to Current Report on Form 8-K filed by the Issuer with the SEC on February 14, 2018). |

|

|

99.7 |

Restricted Stock Award Contract, dated January 15, 2019, between the Issuer and the Reporting Person (incorporated by reference to Exhibit 99.1 to Current Report on Form 8-K filed by the Issuer with the SEC on January 22, 2019). |

|

|

99.8 |

Nonqualified Stock Option Agreement, dated January 15, 2019, between the Issuer and the Reporting Person (incorporated by reference to Exhibit 99.2 to Current Report on Form 8-K filed by the Issuer with the SEC on January 22, 2019). |

|

|

99.9 |

Restricted Stock Award Contract, dated January 16, 2020, between the Issuer and the Reporting Person (incorporated by reference to Exhibit 99.1 to Current Report on Form 8-K filed by the Issuer with the SEC on January 23, 2020). |

|

|

99.10 |

Nonqualified Stock Option Agreement, dated January 16, 2020, between the Issuer and the Reporting Person (incorporated by reference to Exhibit 99.2 to Current Report on Form 8-K filed by the Issuer with the SEC on January 23, 2020). |

|

|

99.11 |

Restricted Stock Award Contract, dated February 26, 2021, between the Issuer and the Reporting Person (incorporated by reference to Exhibit 10.50 to Current Report on Form 8-K filed by the Issuer with the SEC on March 4, 2021). |

|

|

99.12 |

HCI Group, Inc. 2012 Omnibus Incentive Plan, as amended (incorporated by reference to Exhibit 99.1 to the Form 8-K filed by the Issuer with the SEC on March 23, 2017). |

|

|

99.13 |

Nonqualified Stock Option Agreement, dated September 15, 2023, between the Issuer and the Reporting Person |

CUSIP No. 40416E103 13D Page 6 of 6 Pages

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

Date: December 27, 2023 |

/s/ Paresh Patel |

|

Paresh Patel |

|

|

Exhibit 99.13

HCI GROUP, INC.

NONQUALIFIED STOCK OPTION AGREEMENT

HCI Group, Inc. hereby grants to the Optionee an option to purchase the Number of Option Shares set forth below, in the manner and subject to the provisions of this Option Agreement. Capitalized terms used but not defined herein shall have the meanings given to them in the Plan.

|

|

|

|

(a) |

“Code” shall mean the Internal Revenue Code of 1986, as amended. (All references to Sections of the Code are to such Sections as they may from time to time be amended or renumbered.) |

|

|

|

|

(b) |

“Company” shall mean HCI Group, Inc., a Florida corporation, and any successor corporation thereto. |

|

|

|

|

(c) |

“Date of Option Grant” shall mean September 15, 2023. |

|

|

|

|

(d) |

“Exercise Price” shall mean $70.00 per share, as adjusted from time to time pursuant to the Plan. |

|

|

|

|

(e) |

“Number of Option Shares” shall mean 150,000 shares of Common Stock of the Company as adjusted from time to time pursuant to the Plan. |

|

|

|

|

(f) |

“Option Term Date” shall mean September 15, 2033. |

|

|

|

|

(g) |

“Optionee” shall mean Paresh Patel. |

|

|

|

|

(h) |

“Participating Company” shall mean (i) the Company and (ii) any present or future parent and/or subsidiary corporation of the Company while such corporation is a parent or subsidiary of the Company. For purposes of this Option Agreement, a parent corporation and a subsidiary corporation shall be as defined in Sections 424(e) and 424(f) of the Code. |

|

|

|

|

(i) |

“Participating Company Group” shall mean at any point in time all corporations collectively which are then a Participating Company. |

|

|

|

|

(j) |

“Plan” shall mean the HCI Group, Inc. 2012 Omnibus Incentive Plan, as amended from time to time. |

|

|

2. |

Nonqualified Stock Option. This Option is intended to be a nonqualified stock option. The Optionee should consult with the Optionee’s own tax advisors regarding the tax effects of this Option. |

|

|

3. |

Administration. All questions of interpretation concerning this Option Agreement shall be determined by the Committee Any subsequent references herein to the Board or Board of Directors shall also mean the Committee, unless the powers of the Committee have been specifically limited, the committee shall have all of the powers of the Administrator granted in the Plan, subject to the terms of the Plan and any applicable limitations imposed by law. All determinations by the Board shall be final and binding upon all persons having an interest in the Option. Any officer of a Participating Company shall have the authority to act on behalf of the Company with respect to any matter, right, obligation or election which is the responsibility of or which is allocated to the Company herein, provided the officer has apparent authority with respect to such matter, right, obligation or election. |

4. |

Consideration. Consideration for this Option includes the Optionee’s prior and continuing promise to perform services to HCI Group, Inc. (the “Company”). The Board of Directors has determined that the consideration received for the Option and to be received for the Shares is adequate. |

|

|

5. |

Exercise and Vesting of the Option. |

|

|

|

|

(a) |

Right to Exercise. The Option shall vest and become exercisable to purchase up to the Number of Option Shares, in whole or in part, and subject to the termination provisions of Paragraph 6 hereof, anytime and from time to time, after the Fair Market Value exceeds $80 for 20 consecutive trading days. |

|

|

|

|

(b) |

Method of Exercise. The Option shall be exercised by written notice to the Company in the form of Exhibit A hereto stating the election to exercise the Option, the number of the Number of Option Shares for which the Option is being exercised and such other representations and agreements as to the Optionee’s investment intent with respect to such shares as may be required by the Company. The written notice must be signed by the Optionee and must be delivered in person or by certified or registered mail, return receipt requested, to the Chief Financial Officer of the Company, or other authorized representative of the Participating Company Group, prior to the termination of the Option as set forth in Paragraph 6 below, accompanied by (i) full payment of the exercise price for the number of shares being purchased and (ii) an executed copy, if required herein, of the then current form of joint escrow instructions referenced below. |

|

|

|

|

(c) |

Form of Payment of Option Price. Such payment shall be made in cash, check or cash equivalent, by delivery of shares of Common Stock owned by the Optionee valued at fair market value (as determined by the Board), or in any other form as may be permitted by the Board in its sole discretion. |

|

|

|

|

(d) |

Withholding. At the time the Option is exercised, in whole or in part, or at any time thereafter as requested by the Company, the Optionee hereby authorizes payroll withholding and otherwise agrees to make adequate provision for foreign, federal and state tax withholding obligations of the Company, if any, which arise in connection with the Option, including, without limitation, obligations arising upon (i) the exercise, in |

|

|

|

|

|

whole or in part, of the Option, (ii) the transfer, in whole or in part, of any shares acquired on exercise of the Option, (iii) the operation of any law or regulation providing for the imputation of interest, or (iv) the lapsing of any restriction with respect to any shares acquired on exercise of the Option. |

|

|

|

|

(e) |

Certificate Registration. The certificate or certificates for the shares as to which the Option shall be exercised shall be registered in the name of the Optionee, or, if applicable, the heirs of the Optionee. |

|

|

|

|

(f) |

Restrictions on Grant of the Option and Issuance of Shares. The grant of the Option and the issuance of the shares upon exercise of the Option shall be subject to compliance with all applicable requirements of federal or state law with respect to such securities. The Option may not be exercised if the issuance of shares upon such exercise would constitute a violation of any applicable federal or state securities laws or other law or regulations. In addition, no Option may be exercised unless (i) a registration statement under the Securities Act of 1933, as amended (the “Securities Act”), shall at the time of exercise of the Option be in effect with respect to the shares issuable upon exercise of the Option or (ii) in the opinion of legal counsel to the Company, the shares issuable upon exercise of the Option may be issued in accordance with the terms of an applicable exemption from the registration requirements of the Securities Act. |

THE OPTIONEE IS CAUTIONED THAT THE OPTION MAY NOT BE EXERCISABLE UNLESS THE FOREGOING CONDITIONS ARE SATISFIED. ACCORDINGLY, THE OPTIONEE MAY NOT BE ABLE TO EXERCISE THE OPTION WHEN DESIRED EVEN THOUGH THE OPTION IS VESTED.

As a condition to the exercise of the Option, the Company may require the Optionee to satisfy any qualifications that may be necessary or appropriate, to evidence compliance with any applicable law or regulation and to make any representation or warranty with respect thereto as may be requested by the Company.

|

|

|

|

(g) |

Fractional Shares. The Company shall not be required to issue fractional shares upon the exercise of the Option. |

|

|

6. |

Non-Transferability of the Option. The Option may be exercised during the lifetime of the Optionee solely by the Optionee and may not be assigned or transferred in any manner except by will or by the laws of descent and distribution. |

|

|

7. |

Duration of the Option. The Option shall terminate and may no longer be exercised on the Option Term Date as defined above. |

|

|

8. |

Rights as a Stockholder or Employee. The Optionee shall have no rights as a stockholder with respect to any shares covered by the Option until the date of the issuance of a certificate or certificates for the shares for which the Option has been exercised. No adjustment shall be made for dividends or distributions or other rights for which the record date is prior to the date such certificate or certificates are issued, except as provided in the Plan. Nothing in the Option shall confer upon the Optionee any right to be employed by, or to continue in the |

|

|

|

employment of, a Participating Company or interfere in any way with any right of the Participating Company Group to terminate the Optionee’s employment at any time. |

|

|

9. |

Legends. The Company may at any time place legends referencing any applicable federal or state securities law restriction on all certificates representing shares of stock subject to the provisions of this Option Agreement. The Optionee shall, at the request of the Company, promptly present to the Company any and all certificates representing shares of stock acquired pursuant to the Option in the possession of the Optionee in order to effectuate the provisions of this Paragraph. Unless otherwise specified by the Company, legends placed on such certificates may include, but shall not be limited to, the following: |

THE SHARES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND MAY NOT BE SOLD, TRANSFERRED, ASSIGNED OR HYPOTHECATED UNLESS THERE IS AN EFFECTIVE REGISTRATION STATEMENT UNDER SUCH ACT COVERING SUCH SHARES, THE SALE IS MADE IN ACCORDANCE WITH RULE 144 OR RULE 701 UNDER THE ACT, OR THE CORPORATION RECEIVES AN OPINION OF COUNSEL FOR THE HOLDER OF THESE SHARES REASONABLY SATISFACTORY TO THE CORPORATION, STATING THAT SUCH SALE, TRANSFER, ASSIGNMENT OR HYPOTHECATION IS EXEMPT FROM THE REGISTRATION AND PROSPECTUS DELIVERY REQUIREMENTS OF SUCH ACT.

|

|

10. |

Binding Effect. This Option Agreement shall inure to the benefit of and be binding upon the parties hereto and their respective heirs, executors, administrators, successors and assigns. |

|

|

11. |

Termination or Amendment. The Board may terminate or amend this Option Agreement at any time; provided, however, that no such termination or amendment may adversely affect the Option or any unexercised portion hereof without the consent of the Optionee, unless such amendment is required to comply with any change in law or tax and accounting rules, including the provisions of Code Section 409A. |

|

|

12. |

Integrated Agreement. This Option Agreement and the Plan constitutes the entire understanding and agreement of the Optionee and the Participating Company Group with respect to the subject matter contained herein, and there are no other agreements, understandings, restrictions, representations, or warranties among the Optionee and the Company with respect to the subject matter contained herein other than those as set forth or provided for herein. To the extent contemplated herein, the provisions of this Option Agreement shall survive any exercise of the Option and shall remain in full force and effect. |

|

|

13. |

Terms and Conditions of Plan. The terms and conditions included in the Plan are incorporated by reference herein, and to the extent that any conflict may exist between any term or provision of this Option Agreement and any term or provision of the Plan, the term or provision of the Plan shall control. |

|

|

14. |

Applicable Law. This Option Agreement shall be governed by the laws of the State of Florida as such laws are applied to agreements entered into and performed entirely within the State of Florida and without regard to the rules of such State regarding choice of laws. |

SEPARATE SIGNATURE PAGE TO HCI GROUP, INC.

NONQUALIFIED STOCK OPTION AGREEMENT

|

|

|

|

|

|

HCI GROUP, INC. |

|

|

By: |

|

/s/ Gregory Politis |

|

|

Gregory Politis |

|

|

Chairman of the Compensation Committee |

The Optionee represents that the Optionee is familiar with the terms and provisions of this Option Agreement and hereby accepts the Option Agreement subject to all of the terms and provisions thereof. The Optionee hereby agrees to accept as binding, conclusive and final all decisions or interpretations of the Board of Directors of the Company made in good faith upon any questions arising under this Option Agreement.

The undersigned hereby acknowledges receipt of a copy of the Plan.

|

|

|

|

|

|

|

|

|

|

Date: September 19, 2023 |

|

/s/ Paresh Patel |

|

|

|

|

Paresh Patel |

|

|

EXHIBIT A

[Date]

HCI Group, Inc.

5300 West Cypress Street

Tampa, Florida 33607

Attn: Chief Financial Officer

|

|

|

|

Re: |

Exercise of Non-Qualified Stock Option |

Dear Sirs:

Pursuant to the terms and conditions of the Non-Qualified Stock Option Agreement dated as of September 19, 2023, (the “Agreement”), between Paresh Patel (“Optionee”) and HCI Group, Inc., Inc. (the “Company”), the Optionee hereby agrees to purchase shares (the “Shares”) of the Common Stock of the Company and tender payment in full for such shares in accordance with the terms of the Agreement.

In connection with such purchase, Optionee represents, warrants and agrees as follows:

|

|

|

|

1. |

The Optionee is not acquiring the Shares based upon any representation, oral or written, by any person with respect to the future value of, or income from, the Shares, but rather upon independent examination and judgment as to the prospects of the Company. |

|

|

|

|

2. |

The Optionee has had complete access to and the opportunity to review all material documents related to the business of the Company, has examined all such documents as the Optionee desired, is familiar with the business and affairs of the Company and realizes that any purchase of the Shares is a speculative investment and that any possible profit therefrom is uncertain. |

|

|

|

|

3. |

The Optionee has had the opportunity to ask questions of and receive answers from the Company and its executive officers and to obtain all information necessary for the Optionee to make an informed decision with respect to the investment in the Company represented by the Shares. |

|

|

|

|

4. |

The Optionee is able to bear the economic risk of any investment in the Shares, including the risk of a complete loss of the investment, and the Optionee acknowledges that he or she may need to continue to bear the economic risk of the investment in the Shares for an indefinite period. |

|

5. |

The Optionee has not relied upon the Company or an employee or agent of the Company with respect to any tax consequences related to exercise of this Option or the disposition of the Shares. The Optionee assumes full responsibility for all such tax consequences and the filing of all tax returns and elections the Optionee may be required to or find desirable to file in connection therewith. |

|

|

Very truly yours, |

|

Paresh Patel |

|

1520 Gulf Blvd, Apt. 1706, |

Clearwater, FL 33767 |

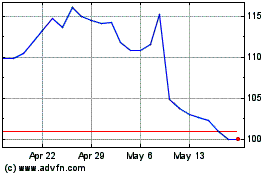

HCI (NYSE:HCI)

Historical Stock Chart

From Jun 2024 to Jul 2024

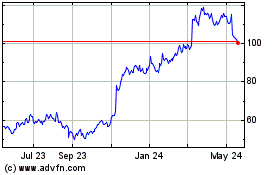

HCI (NYSE:HCI)

Historical Stock Chart

From Jul 2023 to Jul 2024