Graco Beats EPS, Revenues Surge - Analyst Blog

October 25 2012 - 6:50AM

Zacks

Graco Inc. (GGG)

reported third quarter 2012 earnings per share of 60 cents, which

remained flat year over year but increased from 56 cents in the

previous quarter. The earnings in the reported quarter missed the

Zacks Consensus Estimate of 70 cents per share. Net income came in

at $37.1 million, up 1.4% year over year and 7.8% sequentially.

Revenues

Net sales came in at $256.5

million, up 12.8% year over year (15% on a constant currency

basis), but down 4.4% sequentially. This, however, missed the Zacks

Consensus Estimate of $271 million. The annual rise in the sales

was mostly driven by the company’s improved operations in its

Powder Finishing business.

On a segmental basis, the

Industrial segment sales ameliorated 24% from the year-earlier

quarter to $154.7 million. Revenues from the Contractor segment

sales were $74.9 million, down 4% from the year-ago quarter. The

Lubrication segment sales climbed up 7% from the year-ago quarter

to $26.9 million.

Geographically, sales were up 11%

year over year in the Americas on the back of the Industrial and

Lubrication segments’ sales which were increased by double-digit

during the quarter. Sales increased 4% in Asia Pacific carrying the

onuses of the company’s weak business condition. The European

market sales escalated about 28% (38% at consistent translation

rates), driven by the improved Lubrication and Contractor segments

sales.

Margins

Gross margin came in at 55% in the

reported quarter, declining from 56% in the year-ago quarter but up

from 52% in the previous quarter. The annual decline occurred owing

to non-recurring purchase, increased material costs, negative

currency translation and Powder Finishing operations’ reduced

margin rates, offsetting the price increase during the quarter.

Operating margin came down to 22%

from 25% in the previous year quarter but up from 19.6% in the

prior quarter. The Powder Finishing operations resulted in a surge

in operating expenses of nearly $8 million during the quarter.

The effective tax rate for the

reported quarter was 32%, which remains flat year over year.

Cash Flows

Year-to-date net cash provided by

operating activities was $132 million versus $109 million in the

previous year period.

Outlook

Management anticipates that its

businesses in China, India and Western Europe will face a downturn

owing to the prevailing uncertain economic condition. However, its

business in the Americas would experience a positive growth trend

in the upcoming quarter of 2012. Steady housing recovery in U.S. is

likely to drive Graco’s Contractor equipment business going

forward. Furthermore, according to the company, it will strengthen

its foothold through its diversified businesses and latest product

ranges.

Our

Recommendation

Graco currently has a Zacks #2

Rank, which implies a short-term (1-3 months) ‘Buy’ rating on the

stock.

GRACO INC (GGG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

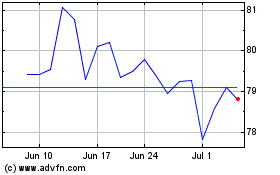

Graco (NYSE:GGG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Graco (NYSE:GGG)

Historical Stock Chart

From Jul 2023 to Jul 2024