UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a party

other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under §240.14a-12 |

Fusion Acquisition

Corp. II

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check all boxes that

apply):

| ☒ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): August 24, 2023

FUSION ACQUISITION CORP. II

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40120 |

|

86-1352058 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

667 Madison Avenue,5th Floor

New York, New York |

|

10065 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (212) 763-0169

Not

Applicable

(Former name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Units, each consisting of one share of Class A common stock and one-third of one redeemable warrant |

|

FSNB.U |

|

New York Stock Exchange |

| Class A common stock, par value $0.0001 per share |

|

FSNB |

|

New York Stock Exchange |

| Redeemable warrants, each whole warrant exercisable for one share of Class A common stock, each at an exercise price of $11.50 per share |

|

FSNB WS |

|

None |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01.

Other Events.

On

August 24, 2023, Fusion Acquisition Corp. II (the “Company”) issued a press release announcing that it intends to adjourn,

without conducting any business, the special meeting of its stockholders (the “Special Meeting”) scheduled to occur at 11:00

a.m., Eastern time, on August 30, 2023, and to reconvene the Special Meeting at 11:00 a.m., Eastern time, on September 1, 2023. At the

Special Meeting, the Company’s stockholders will be asked to, among other things, approve amendments to the Company’s second

amended and restated certificate of incorporation (the “Charter”) to extend the time it has to complete an initial business

combination (the “Extension”) and to eliminate the limitation that the Company will not complete an initial business combination

if doing so would cause it to have net tangible assets of less than $5,000,001. The Special Meeting will be held in virtual format only

at https://www.cstproxy.com/fusionacqii/sm2023.

In

connection with the adjournment of the Special Meeting, the Company is extending the deadline for holders of its shares of Class A

common stock to exercise their right to redeem their shares for their pro rata portion of the funds available in the Company’s

trust account, or to withdraw any previously delivered demand for redemption, to 5:00 p.m., Eastern time, on August 30, 2023 (two business

days before the reconvened Special Meeting).

A

copy of the press release issued by the Company is attached as Exhibit 99.1 and is incorporated by reference into this Item 8.01.

Additional

Information and Where to Find It

The

Company has filed a definitive proxy statement (the “Extension Proxy Statement”) to be used at the Special Meeting. The Company

has mailed the Extension Proxy Statement to its stockholders of record as of August 14, 2023. Investors and security holders of the Company

are advised to read the Extension Proxy Statement and any supplements or amendments thereto, because these documents will contain important

information about the Company and the Extension. Stockholders are able to obtain copies of the Extension Proxy Statement and the other

documents filed by the Company with the Securities and Exchange Commission (the “SEC”) in connection with the Extension,

without charge, at the SEC’s website at www.sec.gov or by directing a request to: Fusion Acquisition Corp. II, 667 Madison Ave, 5th Floor,

New York, NY 10065.

Participants

in the Solicitation

The

Company and its directors and executive officers may be considered participants in the solicitation of proxies with respect to the Extension

under the rules of the SEC. Information about the directors and executive officers of the Company and a description of their interests

in the Company are set forth in the Extension Proxy Statement. These documents can be obtained free of charge from the sources indicated

above.

Non-Solicitation

The

disclosure herein is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in

respect of the potential transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of

the Company, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale

would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities

shall be made except by means of a definitive document.

Forward

Looking Statements

Certain

statements made in this Current Report on Form 8-K are “forward looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this Current Report on Form

8-K, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,”

“plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,”

“future,” “propose” and variations of these words or similar expressions (or the negative versions of such words

or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance,

conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many

of which are outside the Company’s control, that could cause actual results or outcomes to differ materially from those discussed in

the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include: the inability of

the Company to enter into a definitive agreement with respect to an initial business combination or to complete the contemplated transactions

with the potential target company within the time provided in its Charter; the level of redemptions submitted in connection with the

Special Meeting; the ability of the Company to meet the continued listing requirements of the New York Stock Exchange; costs related

to the Extension and a potential initial business combination; and those factors discussed under the heading “Risk Factors”

in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 and other documents of the Company filed,

or to be filed, with the SEC. The Company does not undertake any obligation to update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, except as required by law.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

FUSION

ACQUISITION CORP. II |

| |

|

|

| |

By: |

/s/

John James |

| |

|

Name: |

John

James |

| |

|

Title: |

Chief

Executive Officer |

| |

|

|

| Dated:

August 24, 2023 |

|

|

Exhibit

99.1

Fusion Acquisition Corp. II Announces Intent

to Adjourn Special Meeting

NEW YORK, August 24, 2023 — Fusion Acquisition Corp. II (NYSE:

FSNB) (“Fusion” or the “Company”), announced today that it intends to adjourn, without conducting any business,

the special meeting of its stockholders (the “Special Meeting”) to be held with respect to, among other things, the approval

of amendments to the Company’s second amended and restated certificate of incorporation (the “Charter”) to extend the

time it has to complete an initial business combination (the “Extension”) and to eliminate the limitation that the Company

will not complete an initial business combination if doing so would cause it to have net tangible assets of less than $5,000,001, which

is scheduled to occur at 11:00 a.m., Eastern time, on August 30, 2023, and to reconvene the Special Meeting at 11:00 a.m., Eastern time,

on September 1, 2023. The Special Meeting will be held in virtual format only at https://www.cstproxy.com/fusionacqii/sm2023.

In connection with the adjournment of the Special Meeting, the Company

is extending the deadline for holders of its shares of Class A common stock to exercise their right to redeem their shares for their

pro rata portion of the funds available in the Company’s trust account, or to withdraw any previously delivered demand for redemption,

to 5:00 p.m., Eastern time, on August 30, 2023 (two business days before the reconvened Special Meeting).

Stockholders of record as of August 14, 2023 are entitled to vote at

the Special Meeting. Stockholders who have not yet done so are encouraged to vote as soon as possible. If any such stockholders have questions

or need assistance in connection with the Special Meeting, please contact the Company’s proxy solicitor, Morrow Sodali LLC, by calling

(800) 662-5200, or banks and brokers can call collect at (203) 658-9400, or by emailing FSNB.info@investor.morrowsodali.com.

About Fusion Acquisition Corp. II

Fusion Acquisition Corp. II, founded and

led by Chief Executive Officer John James, is a blank-check company formed for the purpose of effecting a merger, capital stock exchange,

asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. Fusion’s board of

directors comprises Non-Executive Chairman Jim Ross, Chief Executive Officer John James, Chief Financial Officer Erik Thoresen, and directors

Kelly Driscoll and Ben Buettell.

Contact

Cody Slach

Gateway Investor Relations

(949) 574-3860

FUSION@gatewayir.com

Fusion Acquisition Corp II (NYSE:FSNB)

Historical Stock Chart

From Jun 2024 to Jul 2024

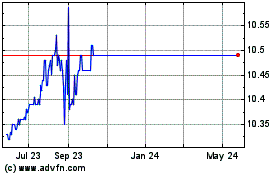

Fusion Acquisition Corp II (NYSE:FSNB)

Historical Stock Chart

From Jul 2023 to Jul 2024