0001401257false00014012572024-10-312024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 31, 2024

FORUM ENERGY TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

Delaware | | 001-35504 | | 61-1488595 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | |

| 10344 Sam Houston Park Drive | Suite 300 | Houston | TX | 77064 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | | FET | | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On October 31, 2024, Forum Energy Technologies, Inc. (the “Company”) issued a press release announcing earnings for the quarter ended September 30, 2024. A copy of the release is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

Exhibit 99.1 to this report contains “non-GAAP financial measures” as defined in Item 10 of Regulation S-K of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The non-GAAP financial measures reflect earnings before interest, taxes, depreciation and amortization expense (“EBITDA”), adjusted EBITDA, adjusted operating income, adjusted net income, adjusted net income per diluted share (“Adjusted Diluted EPS”), book to bill ratio and free cash flow, before acquisitions (“free cash flow”). A reconciliation of EBITDA, adjusted EBITDA, adjusted operating income, adjusted net income, Adjusted Diluted EPS, book to bill ratio and free cash flow to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”) is included as an attachment to the press release. The Company believes the presentation of EBITDA, adjusted EBITDA, adjusted operating income, adjusted net income, Adjusted Diluted EPS, book to bill ratio and free cash flow are useful to the Company's investors because (i) each of these financial metrics are useful to investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods or forecasting performance for future periods, primarily because management views the excluded items to be outside of the Company's normal operating results and (ii) EBITDA is an appropriate measure of evaluating the Company's operating performance and liquidity that reflects the resources available for strategic opportunities including, among others, investing in the business, strengthening the balance sheet, repurchasing the Company's securities and making strategic acquisitions. In addition, these benchmarks are widely used in the investment community.

The presentation of this additional information is not meant to be considered in isolation or as a substitute for the Company's financial results prepared in accordance with GAAP.

The information contained in this Current Report shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Exhibit Title or Description |

| | Press Release dated October 31, 2024. |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

Date: October 31, 2024 | FORUM ENERGY TECHNOLOGIES, INC.

| |

| /s/ John C. Ivascu | |

| John C. Ivascu | |

| Executive Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary | |

Forum Energy Technologies Announces

Third Quarter 2024 Results; Raises Free Cash Flow Guidance

•Revenue: $208 million, a 16% year-over-year increase

•Orders: $206 million and book-to-bill of 99%

•Net loss: $15 million, or $1.20 per diluted share

•Adjusted EBITDA: $26 million, up 55% year-over-year

•Operating cash flow and free cash flow: $26 million and $25 million, respectively

•Raises 2024 full year free cash flow guidance: $60 to $70 million

HOUSTON, TEXAS, October 31, 2024 - Forum Energy Technologies, Inc. (NYSE: FET) today announced third quarter 2024 revenue of $208 million, a 1% sequential increase. Orders increased 14% sequentially to $206 million, with a book-to-bill ratio of 99%. The third quarter 2024 net loss was $15 million, or $1.20 per diluted share, compared to a second quarter net loss of $7 million, or $0.54 per diluted share. The adjusted net loss for the quarter was $2 million, or $0.19 per diluted share, compared to the second quarter 2024 adjusted net loss of $0.07 per diluted share.1

Neal Lux, President and Chief Executive Officer, remarked, “FET will significantly bolster our balance sheet upon closing the recently announced offering of $100 million, 10.5% Senior Secured Bonds. Net proceeds and cash on hand will fully retire existing long-term debt and extend the maturity of our bonds to November 2029. We expect this transaction to enhance our ability to further reduce indebtedness, return cash to shareholders, and pursue strategic M&A opportunities.

“In addition, FET continues to deliver strong financial results. Our year-over-year revenue and adjusted EBITDA growth reflects the benefits of the Variperm acquisition. Furthermore, third quarter bookings increased 14% on strong demand for our capital equipment from Middle Eastern customers. Finally, our cash flow focus is paying off. During the quarter, we generated free cash flow of $25 million, up 14% from the prior quarter. Through the third quarter, FET delivered $48 million of free cash flow, which is nearly within our previous full-year guidance range. Given these strong results, we are raising our full year 2024 free cash flow guidance to between $60 and $70 million.

1 See Tables 1-6 for a reconciliation of GAAP to non-GAAP financial information, including a breakdown of adjusting items.

“Commodity prices remain volatile, driven by Middle East unrest, lower demand in China, and OPEC+ supply uncertainty. In the U.S., we expect oil and gas operators to remain disciplined with their capital budgets and production targets. Service company efficiency gains, enabled through the utilization of products supplied by manufacturers like FET, have accelerated planned 2024 drilling and completions activity. Therefore, we are forecasting budget exhaustion to moderate U.S. demand at year end. However, we expect this impact to be partially mitigated with international activity. Based on these dynamics, we expect fourth quarter 2024 revenue and adjusted EBITDA in the ranges of $190 to $210 million and $22 to $26 million, respectively.”

Segment Results (unless otherwise noted, comparisons are third quarter 2024 versus second quarter 2024)

Drilling and Completions segment revenue was $124 million, a 6% increase, primarily related to higher project revenue recognized from ROVs, launch and recovery systems and wireline cable, partially offset by lower power end and hose sales. Orders were $130 million, an 18% increase, primarily due to international drilling-related capital equipment and handling tools demand. Segment adjusted EBITDA was $15 million, a 26% increase, resulting from higher revenue and favorable product mix. The Drilling and Completions segment focuses primarily on capital equipment and consumable products for global drilling operations, subsea, coiled tubing, wireline, and stimulation markets.

Artificial Lift and Downhole segment revenue was $84 million, a 5% decrease, primarily related to the decline in sales of casing hardware and valve products. Orders were $76 million, a 9% increase, due to elevated Production Equipment orders. Segment adjusted EBITDA was $17 million, a 12% decrease, mainly due to lower sales volumes within the Downhole and Production Equipment product lines. The Artificial Lift and Downhole segment engineers, manufactures, and supplies products for well construction, artificial lift, and oil and natural gas processing.

FET (Forum Energy Technologies) is a global manufacturing company, serving the oil, natural gas, industrial and renewable energy industries. With headquarters located in Houston, Texas, FET provides value added solutions aimed at improving the safety, efficiency, and environmental impact of our customers' operations. For more information, please visit www.f-e-t.com.

Forward Looking Statements and Other Legal Disclosure

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that the company expects, believes or anticipates will or may occur in the future are forward-looking statements. Without limiting the generality of the foregoing, forward-looking statements contained in this press release specifically include the expectations of plans, strategies, objectives and anticipated financial and operating results of the company, including any statement about the company's future financial position, liquidity and capital resources, operations, performance, acquisitions, returns, capital expenditure budgets, new product development activities, costs and other guidance included in this press release.

These statements are based on certain assumptions made by the company based on management's experience and perception of historical trends, current conditions, anticipated future developments and other factors believed to be appropriate. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the company, which may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Among other things, these include the volatility of oil and natural gas prices, oilfield development activity levels, the availability of raw materials and specialized equipment, the company's ability to deliver backlog in a timely fashion, the availability of skilled and qualified labor, competition in the oil and natural gas industry, governmental regulation and taxation of the oil and natural gas industry, the company's ability to implement new technologies and services, the availability and terms of capital, and uncertainties regarding environmental regulations or litigation and other legal or regulatory developments affecting the company's business, and other important factors that could cause actual results to differ materially from those projected as described in the company's filings with the U.S. Securities and Exchange Commission.

Any forward-looking statement speaks only as of the date on which such statement is made and the company undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law.

Company Contact

Rob Kukla

Director of Investor Relations

281.994.3763

rob.kukla@f-e-t.com

| | | | | | | | | | | | | | | | | | |

| Forum Energy Technologies, Inc. |

| Condensed consolidated statements of income (loss) |

| (Unaudited) |

| | |

| | Three months ended |

| | September 30, | | June 30, |

| (in millions, except per share information) | | 2024 | | 2023 | | 2024 |

| Revenue | | $ | 207.8 | | | $ | 179.3 | | | $ | 205.2 | |

| Cost of sales | | 142.1 | | | 128.3 | | | 142.1 | |

| Gross profit | | 65.7 | | | 51.0 | | | 63.1 | |

| Operating expenses | | | | | | |

| Selling, general and administrative expenses | | 56.3 | | | 45.5 | | | 53.7 | |

| Transaction expenses | | 0.6 | | | — | | | 1.2 | |

| Loss (gain) on disposal of assets and other | | (0.1) | | | (0.2) | | | 0.3 | |

| Total operating expenses | | 56.8 | | | 45.3 | | | 55.2 | |

| Operating income | | 8.9 | | | 5.7 | | | 7.9 | |

| Other expense (income) | | | | | | |

| Interest expense | | 7.7 | | | 4.5 | | | 8.7 | |

| Loss on extinguishment of debt | | 1.8 | | | — | | | 0.5 | |

| Foreign exchange losses (gains) and other, net | | 9.6 | | | (8.2) | | | 2.9 | |

| Total other (income) expense, net | | 19.1 | | | (3.7) | | | 12.1 | |

| Income (loss) before income taxes | | (10.2) | | | 9.4 | | | (4.2) | |

| Income tax expense | | 4.6 | | | 1.4 | | | 2.5 | |

Net income (loss) (1) | | $ | (14.8) | | | $ | 8.0 | | | $ | (6.7) | |

| | | | | | |

| Weighted average shares outstanding | | | | | | |

| Basic | | 12.3 | | | 10.2 | | | 12.3 | |

| Diluted | | 12.3 | | | 10.4 | | | 12.3 | |

| | | | | | |

| Earnings (loss) per share | | | | | | |

| Basic | | $ | (1.20) | | | $ | 0.78 | | | $ | (0.54) | |

| Diluted | | $ | (1.20) | | | $ | 0.77 | | | $ | (0.54) | |

| | | | | | |

(1) Refer to Table 1 for schedule of adjusting items. |

| | | | | | | | | | | | |

| Forum Energy Technologies, Inc. |

| Condensed consolidated statements of income (loss) |

| (Unaudited) |

| | |

| | Nine months ended |

| | September 30, |

| (in millions, except per share information) | | 2024 | | 2023 |

| Revenue | | $ | 615.4 | | | $ | 553.7 | |

| Cost of sales | | 422.8 | | | 399.3 | |

| Gross profit | | 192.6 | | | 154.4 | |

| Operating expenses | | | | |

| Selling, general and administrative expenses | | 164.7 | | | 135.4 | |

| Transaction expenses | | 7.7 | | | — | |

| Loss on disposal of assets and other | | 0.1 | | | 0.1 | |

| Total operating expenses | | 172.5 | | | 135.5 | |

| Operating income | | 20.1 | | | 18.9 | |

| Other expense | | | | |

| Interest expense | | 25.1 | | | 13.7 | |

| Loss on extinguishment of debt | | 2.3 | | | — | |

| Foreign exchange losses and other, net | | 13.9 | | | 1.1 | |

| Total other expense | | 41.3 | | | 14.8 | |

| Income (loss) before income taxes | | (21.2) | | | 4.1 | |

| Income tax expense | | 10.6 | | | 6.2 | |

Net income (loss) (1) | | $ | (31.8) | | | $ | (2.1) | |

| | | | |

| Weighted average shares outstanding | | | | |

| Basic | | 12.3 | | | 10.2 | |

| Diluted | | 12.3 | | | 10.2 | |

| | | | |

| Loss per share | | | | |

| Basic | | $ | (2.59) | | | $ | (0.21) | |

| Diluted | | $ | (2.59) | | | $ | (0.21) | |

| | | | |

(1) Refer to Table 2 for schedule of adjusting items. |

| | | | | | | | | | | |

| Forum Energy Technologies, Inc. |

| Condensed consolidated balance sheets |

| (Unaudited) |

| | | |

| September 30, | | December 31, |

| (in millions of dollars) | 2024 | | 2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 33.3 | | | $ | 46.2 | |

| Accounts receivable—trade, net | 163.1 | | | 146.7 | |

| Inventories, net | 286.9 | | | 299.6 | |

| Other current assets | 40.4 | | | 37.1 | |

| Total current assets | 523.7 | | | 529.6 | |

| Property and equipment, net of accumulated depreciation | 83.4 | | | 61.4 | |

| Operating lease assets | 54.1 | | | 55.4 | |

| Goodwill and other intangible assets, net | 307.9 | | | 168.0 | |

| Other long-term assets | 4.6 | | | 6.7 | |

| Total assets | $ | 973.7 | | | $ | 821.1 | |

| Liabilities and equity | | | |

| Current liabilities | | | |

| Current portion of long-term debt | $ | 69.4 | | | $ | 1.2 | |

| Other current liabilities | 201.6 | | | 203.1 | |

| Total current liabilities | 271.0 | | | 204.3 | |

| Long-term debt, net of current portion | 162.2 | | | 129.6 | |

| Other long-term liabilities | 97.0 | | | 74.5 | |

| Total liabilities | 530.2 | | | 408.4 | |

| Total equity | 443.5 | | | 412.7 | |

| Total liabilities and equity | $ | 973.7 | | | $ | 821.1 | |

| | | | | | | | | | | | |

| Forum Energy Technologies, Inc. |

| Condensed consolidated cash flow information |

| (Unaudited) |

| | | | |

| | Nine months ended September 30, |

| (in millions of dollars) | | 2024 | | 2023 |

| Cash flows from operating activities | | | | |

| Net loss | | $ | (31.8) | | | $ | (2.1) | |

| Depreciation and amortization | | 41.6 | | | 26.0 | |

| Inventory write down | | 3.3 | | | 1.9 | |

| Loss on extinguishment of debt | | 2.3 | | | — | |

| Other noncash items and changes in working capital | | 38.3 | | | (28.9) | |

| Net cash provided by (used in) operating activities | | 53.7 | | | (3.1) | |

| | | | |

| Cash flows from investing activities | | | | |

| Capital expenditures for property and equipment | | (5.7) | | | (5.5) | |

| Proceeds from sale of property and equipment | | 0.2 | | | 1.3 | |

| Payments related to business acquisition | | (150.4) | | | — | |

| Net cash used in investing activities | | (155.9) | | | (4.2) | |

| | | | |

| Cash flows from financing activities | | | | |

| Borrowings of debt | | 628.0 | | | 351.6 | |

| Repayments of debt | | (534.4) | | | (352.5) | |

| Repurchases of stock | | — | | | (3.5) | |

| Payment of withheld taxes on stock-based compensation plans | | (1.1) | | | (2.5) | |

| Deferred financing costs | | (3.1) | | | — | |

| Net cash provided by (used in) financing activities | | 89.4 | | | (6.9) | |

| | | | |

| Effect of exchange rate changes on cash | | (0.1) | | | 0.3 | |

| Net decrease in cash, cash equivalents and restricted cash | | $ | (12.9) | | | $ | (13.9) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Forum Energy Technologies, Inc. |

| Supplemental schedule - Segment information |

| (Unaudited) |

| | | | |

| | As Reported | | As Adjusted (3) |

| | Three months ended | | Three months ended |

| (in millions of dollars) | | September 30, 2024 | | September 30, 2023 | | June 30, 2024 | | September 30, 2024 | | September 30, 2023 | | June 30, 2024 |

| Revenue | | | | | | | | | | | | |

| Drilling and Completions | | $ | 123.6 | | | $ | 118.9 | | | $ | 117.0 | | | $ | 123.6 | | | $ | 118.9 | | | $ | 117.0 | |

| Artificial Lift and Downhole | | 84.2 | | | 60.4 | | | 88.2 | | | 84.2 | | | 60.4 | | | 88.2 | |

| Eliminations | | — | | | — | | | — | | | — | | | — | | | — | |

| Total revenue | | $ | 207.8 | | | $ | 179.3 | | | $ | 205.2 | | | $ | 207.8 | | | $ | 179.3 | | | $ | 205.2 | |

| | | | | | | | | | | | |

| Operating income (loss) | | | | | | | | | | | | |

| Drilling and Completions | | $ | 7.0 | | | $ | 3.9 | | | $ | 2.9 | | | $ | 7.3 | | | $ | 3.7 | | | $ | 3.6 | |

| Operating Margin % | | 5.7 | % | | 3.3 | % | | 2.5 | % | | 5.9 | % | | 3.1 | % | | 3.1 | % |

| Artificial Lift and Downhole | | 10.8 | | | 8.5 | | | 13.5 | | | 10.8 | | | 8.8 | | | 13.5 | |

| Operating Margin % | | 12.8 | % | | 14.1 | % | | 15.3 | % | | 12.8 | % | | 14.6 | % | | 15.3 | % |

| Corporate | | (8.4) | | | (6.9) | | | (7.0) | | | (8.3) | | | (6.3) | | | (6.8) | |

| Total segment operating income | | 9.4 | | | 5.5 | | | 9.4 | | | 9.8 | | | 6.2 | | | 10.3 | |

Other items not in segment operating income (1) | | (0.5) | | | 0.2 | | | (1.5) | | | — | | | 0.2 | | | (0.2) | |

| Total operating income | | $ | 8.9 | | | $ | 5.7 | | | $ | 7.9 | | | $ | 9.8 | | | $ | 6.4 | | | $ | 10.1 | |

| Operating Margin % | | 4.3 | % | | 3.2 | % | | 3.8 | % | | 4.7 | % | | 3.6 | % | | 4.9 | % |

| | | | | | | | | | | | |

EBITDA (2) | | | | | | | | | | | | |

| Drilling and Completions | | $ | 4.5 | | | $ | 18.4 | | | $ | 4.4 | | | $ | 14.5 | | | $ | 11.6 | | | $ | 11.5 | |

| EBITDA Margin % | | 3.6 | % | | 15.5 | % | | 3.8 | % | | 11.7 | % | | 9.8 | % | | 9.8 | % |

| Artificial Lift and Downhole | | 17.2 | | | 10.2 | | | 19.3 | | | 17.4 | | | 10.1 | | | 19.7 | |

| EBITDA Margin % | | 20.4 | % | | 16.9 | % | | 21.9 | % | | 20.7 | % | | 16.7 | % | | 22.3 | % |

| Corporate | | (10.6) | | | (5.7) | | | (5.2) | | | (6.1) | | | (5.1) | | | (5.4) | |

| Total EBITDA | | $ | 11.1 | | | $ | 22.9 | | | $ | 18.5 | | | $ | 25.8 | | | $ | 16.6 | | | $ | 25.8 | |

| EBITDA Margin % | | 5.3 | % | | 12.8 | % | | 9.0 | % | | 12.4 | % | | 9.3 | % | | 12.6 | % |

| | | | | | | | | | | | |

(1) Includes gain/(loss) on disposal of assets and other. |

(2) The Company believes that the presentation of EBITDA is useful to the Company's investors because EBITDA is an appropriate measure for evaluating the Company's operating performance and liquidity that reflects the resources available for strategic opportunities including, among others, investing in the business, strengthening the balance sheet, repurchasing the Company's securities and making strategic acquisitions. In addition, EBITDA is a widely used benchmark in the investment community. See the attached separate schedule for the reconciliation of GAAP to non-GAAP financial information. |

(3) Refer to Table 1 for schedule of adjusting items. |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| Forum Energy Technologies, Inc. |

| Supplemental schedule - Segment information |

| (Unaudited) |

| | | | |

| | As Reported | | As Adjusted (3) |

| | Nine months ended | | Nine months ended |

| (in millions of dollars) | | September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| Revenue | | | | | | | | |

Drilling and Completions | | $ | 359.7 | | | $ | 376.0 | | | $ | 359.7 | | | $ | 376.0 | |

| Artificial Lift and Downhole | | 255.7 | | | 177.7 | | | 255.7 | | | 177.7 | |

| Eliminations | | — | | | — | | | — | | | — | |

| Total revenue | | $ | 615.4 | | | $ | 553.7 | | | $ | 615.4 | | | $ | 553.7 | |

| | | | | | | | |

| Operating income (loss) | | | | | | | | |

Drilling and Completions | | $ | 14.5 | | | $ | 15.5 | | | $ | 16.7 | | | $ | 16.2 | |

| Operating Margin % | | 4.0 | % | | 4.1 | % | | 4.6 | % | | 4.3 | % |

| Artificial Lift and Downhole | | 36.0 | | | 24.1 | | | 36.0 | | | 24.6 | |

| Operating Margin % | | 14.1 | % | | 13.6 | % | | 14.1 | % | | 13.8 | % |

| Corporate | | (22.6) | | | (20.5) | | | (22.1) | | | (19.7) | |

| Total segment operating income | | 27.9 | | | 19.1 | | | 30.6 | | | 21.1 | |

Other items not in segment operating income(1) | | (7.8) | | | (0.2) | | | 0.1 | | | 0.7 | |

| Total operating income | | $ | 20.1 | | | $ | 18.9 | | | $ | 30.7 | | | $ | 21.8 | |

| Operating Margin % | | 3.3 | % | | 3.4 | % | | 5.0 | % | | 3.9 | % |

| | | | | | | | |

EBITDA (2) | | | | | | | | |

Drilling and Completions | | $ | 22.1 | | | $ | 36.3 | | | $ | 39.7 | | | $ | 38.8 | |

| EBITDA Margin % | | 6.1 | % | | 9.7 | % | | 11.0 | % | | 10.3 | % |

| Artificial Lift and Downhole | | 54.3 | | | 27.7 | | | 55.2 | | | 28.8 | |

| EBITDA Margin % | | 21.2 | % | | 15.6 | % | | 21.6 | % | | 16.2 | % |

| Corporate | | (30.9) | | | (20.2) | | | (17.1) | | | (16.0) | |

| Total EBITDA | | $ | 45.5 | | | $ | 43.8 | | | $ | 77.8 | | | $ | 51.6 | |

| EBITDA Margin % | | 7.4 | % | | 7.9 | % | | 12.6 | % | | 9.3 | % |

| | | | | | | | |

(1) Includes gain/(loss) on disposal of assets, and other. |

(2) The Company believes that the presentation of EBITDA is useful to the Company's investors because EBITDA is an appropriate measure for evaluating the Company's operating performance and liquidity that reflects the resources available for strategic opportunities including, among others, investing in the business, strengthening the balance sheet, repurchasing the Company's securities and making strategic acquisitions. In addition, EBITDA is a widely used benchmark in the investment community. See the attached separate schedule for the reconciliation of GAAP to non-GAAP financial information. |

(3) Refer to Table 2 for schedule of adjusting items. |

| | | | | | | | | | | | | | | | | | |

| Forum Energy Technologies, Inc. |

| Supplemental schedule - Orders information |

| (Unaudited) |

| | |

| | Three months ended |

| (in millions of dollars) | | September 30, 2024 | | September 30, 2023 | | June 30, 2024 |

| Orders | | | | | | |

| Drilling and Completions | | $ | 129.5 | | | $ | 139.9 | | | $ | 110.1 | |

| Artificial Lift and Downhole | | 76.3 | | | 58.9 | | | 70.0 | |

| Total orders | | $ | 205.8 | | | $ | 198.8 | | | $ | 180.1 | |

| | | | | | |

| Revenue | | | | | | |

| Drilling and Completions | | $ | 123.6 | | | $ | 118.9 | | | $ | 117.0 | |

| Artificial Lift and Downhole | | 84.2 | | | 60.4 | | | 88.2 | |

| | | | | | |

| Total revenue | | $ | 207.8 | | | $ | 179.3 | | | $ | 205.2 | |

| | | | | | |

Book to bill ratio (1) | | | | | | |

| Drilling and Completions | | 1.05 | | | 1.18 | | | 0.94 | |

| Artificial Lift and Downhole | | 0.91 | | | 0.98 | | | 0.79 | |

| Total book to bill ratio | | 0.99 | | | 1.11 | | | 0.88 | |

| | | | | | |

(1) The book-to-bill ratio is calculated by dividing the dollar value of orders received in a given period by the revenue earned in that same period. The Company believes that this ratio is useful to investors because it provides an indication of whether the demand for our products is strengthening or declining. A ratio of greater than one is indicative of improving market demand, while a ratio of less than one would suggest weakening demand. In addition, the Company believes the book-to-bill ratio provides more meaningful insight into future revenues for our business than other measures, such as order backlog, because the majority of the Company's products are activity based consumable items or shorter cycle capital equipment, neither of which are typically ordered by customers far in advance. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Forum Energy Technologies, Inc. |

| Reconciliation of GAAP to non-GAAP financial information |

| (Unaudited) |

| Table 1 - Adjusting items |

| |

| Three months ended |

| September 30, 2024 | | September 30, 2023 | | June 30, 2024 |

| (in millions, except per share information) | Operating income | | EBITDA (1) | | Net income (loss) | | Operating income | | EBITDA (1) | | Net income (loss) | | Operating income | | EBITDA (1) | | Net income (loss) |

| As reported | $ | 8.9 | | | $ | 11.1 | | | $ | (14.8) | | | $ | 5.7 | | | $ | 22.9 | | | $ | 8.0 | | | $ | 7.9 | | | $ | 18.5 | | | $ | (6.7) | |

| % of revenue | 4.3 | % | | 5.3 | % | | | | 3.2 | % | | 12.8 | % | | | | 3.8 | % | | 9.0 | % | | |

| Restructuring and other costs | 0.3 | | | 0.3 | | | 0.3 | | | 0.8 | | | 0.8 | | | 0.8 | | | 1.0 | | | 1.0 | | | 1.0 | |

| Transaction expenses | 0.6 | | | 0.6 | | | 0.6 | | | — | | | — | | | — | | | 1.2 | | | 1.2 | | | 1.2 | |

| Inventory and other working capital adjustments | — | | | — | | | — | | | (0.1) | | | (0.1) | | | (0.1) | | | — | | | — | | | — | |

| Stock-based compensation expense | — | | | 2.2 | | | — | | | — | | | 1.2 | | | — | | | — | | | 1.5 | | | — | |

| Loss on extinguishment of debt | — | | | 1.8 | | | 1.8 | | | — | | | — | | | — | | | — | | | 0.5 | | | 0.5 | |

Loss on foreign exchange, net (2) | — | | | 9.8 | | | 9.8 | | | — | | | (8.2) | | | (8.2) | | | — | | | 3.1 | | | 3.1 | |

| | | | | | | | | | | | | | | | | |

As adjusted (1) | $ | 9.8 | | | $ | 25.8 | | | $ | (2.3) | | | $ | 6.4 | | | $ | 16.6 | | | $ | 0.5 | | | $ | 10.1 | | | $ | 25.8 | | | $ | (0.9) | |

| % of revenue | 4.7 | % | | 12.4 | % | | | | 3.6 | % | | 9.3 | % | | | | 4.9 | % | | 12.6 | % | | |

| | | | | | | | | | | | | | | | | |

| Diluted shares outstanding as reported | | | | | 12.3 | | | | | | | 10.4 | | | | | | | 12.3 | |

| Diluted shares outstanding as adjusted | | | | | 12.3 | | | | | | | 10.4 | | | | | | | 12.3 | |

| | | | | | | | | | | | | | | | | |

| Diluted EPS - as reported | | | | | $ | (1.20) | | | | | | | $ | 0.77 | | | | | | | $ | (0.54) | |

| Diluted EPS - as adjusted | | | | | $ | (0.19) | | | | | | | $ | 0.05 | | | | | | | $ | (0.07) | |

| | | | | | | | | | | | | | | | | |

(1) The Company believes that the presentation of EBITDA, adjusted EBITDA, adjusted operating loss, adjusted net loss and adjusted diluted EPS are useful to the Company's investors because (i) each of these financial metrics are useful to investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods or forecasting performance for future periods, primarily because management views the excluded items to be outside of the Company's normal operating results and (ii) EBITDA is an appropriate measure of evaluating the company's operating performance and liquidity that reflects the resources available for strategic opportunities including, among others, investing in the business, strengthening the balance sheet, repurchasing the Company's securities and making strategic acquisitions. In addition, these benchmarks are widely used in the investment community. See the attached separate schedule for the reconciliation of GAAP to non-GAAP financial information.

|

(2) Foreign exchange, net primarily relates to cash and receivables denominated in U.S. dollars by some of our non-U.S. subsidiaries that report in a local currency, and therefore the loss (gain) has no economic impact in dollar terms. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Forum Energy Technologies, Inc. |

| Reconciliation of GAAP to non-GAAP financial information |

| (Unaudited) |

| Table 2 - Adjusting items |

| |

| Nine months ended |

| September 30, 2024 | | September 30, 2023 |

| (in millions, except per share information) | Operating income | | EBITDA (1) | | Net income (loss) | | Operating income | | EBITDA (1) | | Net income (loss) |

| As reported | $ | 20.1 | | | $ | 45.5 | | | $ | (31.8) | | | $ | 18.9 | | | $ | 43.8 | | | $ | (2.1) | |

| % of revenue | 3.3 | % | | 7.4 | % | | | | 3.4 | % | | 7.9 | % | | |

| Restructuring and other costs | 2.9 | | | 2.9 | | | 2.9 | | | 3.4 | | | 3.4 | | | 3.4 | |

| Transaction expenses | 7.7 | | | 7.7 | | | 7.7 | | | — | | | — | | | — | |

| Inventory and other working capital adjustments | — | | | — | | | — | | | (0.5) | | | (0.5) | | | (0.5) | |

| Stock-based compensation expense | — | | | 5.2 | | | — | | | — | | | 3.3 | | | — | |

| Loss on extinguishment of debt | — | | | 2.3 | | | 2.3 | | | — | | | — | | | — | |

Loss on foreign exchange, net (2) | — | | | 14.2 | | | 14.2 | | | — | | | 1.6 | | | 1.6 | |

| | | | | | | | | | | |

As adjusted (1) | $ | 30.7 | | | $ | 77.8 | | | $ | (4.7) | | | $ | 21.8 | | | $ | 51.6 | | | $ | 2.4 | |

| % of revenue | 5.0 | % | | 12.6 | % | | | | 3.9 | % | | 9.3 | % | | |

| | | | | | | | | | | |

| Diluted shares outstanding as reported | | | | | 12.3 | | | | | | | 10.2 | |

| Diluted shares outstanding as adjusted | | | | | 12.3 | | | | | | | 10.2 | |

| | | | | | | | | | | |

| Diluted EPS - as reported | | | | | $ | (2.59) | | | | | | | $ | (0.21) | |

| Diluted EPS - as adjusted | | | | | $ | (0.38) | | | | | | | $ | 0.24 | |

| | | | | | | | | | | |

(1) The Company believes that the presentation of EBITDA, adjusted EBITDA, adjusted operating loss, adjusted net loss and adjusted diluted EPS are useful to the Company's investors because (i) each of these financial metrics are useful to investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods or forecasting performance for future periods, primarily because management views the excluded items to be outside of the Company's normal operating results and (ii) EBITDA is an appropriate measure of evaluating the company's operating performance and liquidity that reflects the resources available for strategic opportunities including, among others, investing in the business, strengthening the balance sheet, repurchasing the Company's securities and making strategic acquisitions. In addition, these benchmarks are widely used in the investment community. See the attached separate schedule for the reconciliation of GAAP to non-GAAP financial information. |

|

(2) Foreign exchange, net primarily relates to cash and receivables denominated in U.S. dollars by some of our non-U.S. subsidiaries that report in a local currency, and therefore the loss (gain) has no economic impact in dollar terms. |

| | | | | | | | | | | | | | | | | |

| Forum Energy Technologies, Inc. |

| Reconciliation of GAAP to non-GAAP financial information |

| (Unaudited) |

| Table 3 - Adjusting Items |

| | | | | |

| Three months ended |

| (in millions of dollars) | September 30, 2024 | | September 30, 2023 | | June 30, 2024 |

EBITDA reconciliation (1) | | | | | |

| Net income (loss) | $ | (14.8) | | | $ | 8.0 | | | $ | (6.7) | |

| Interest expense | 7.7 | | | 4.5 | | | 8.7 | |

| Depreciation and amortization | 13.6 | | | 9.0 | | | 14.0 | |

| Income tax expense | 4.6 | | | 1.4 | | | 2.5 | |

| EBITDA | $ | 11.1 | | | $ | 22.9 | | | $ | 18.5 | |

| | | | | |

(1) The Company believes adjusted EBITDA is useful to investors because it is an appropriate measure of evaluating operating performance and liquidity. It reflects the resources available for strategic opportunities including, among others, investing in the business, strengthening the balance sheet, repurchasing the Company’s securities, and making strategic acquisitions. In addition, adjusted EBITDA is a widely used benchmark in the investment community. |

| | | | | | | | | | | |

| Forum Energy Technologies, Inc. |

| Reconciliation of GAAP to non-GAAP financial information |

| (Unaudited) |

| |

| Table 4 - Adjusting Items |

| Nine months ended |

| (in millions of dollars) | September 30, 2024 | | September 30, 2023 |

EBITDA reconciliation (1) | | | |

| Net income (loss) | $ | (31.8) | | | $ | (2.1) | |

| Interest expense | 25.1 | | | 13.7 | |

| Depreciation and amortization | 41.6 | | | 26.0 | |

| Income tax expense | 10.6 | | | 6.2 | |

| EBITDA | $ | 45.5 | | | $ | 43.8 | |

| | | |

(1) The Company believes adjusted EBITDA is useful to investors because it is an appropriate measure of evaluating operating performance and liquidity. It reflects the resources available for strategic opportunities including, among others, investing in the business, strengthening the balance sheet, repurchasing the Company’s securities, and making strategic acquisitions. In addition, adjusted EBITDA is a widely used benchmark in the investment community. |

| | | | | | | | | | | | | | | | | |

| | |

| | |

| | |

| | | |

| Forum Energy Technologies, Inc. |

| Reconciliation of GAAP to non-GAAP financial information |

| (Unaudited) |

| Table 5 - Adjusting items |

| | | | | |

| Three months ended |

| (in millions of dollars) | September 30, 2024 | | September 30, 2023 | | June 30, 2024 |

Free cash flow, before acquisitions, reconciliation (1) | | | | | |

| Net cash provided by (used in) operating activities | $ | 25.6 | | | $ | 26.4 | | | $ | 23.1 | |

| Capital expenditures for property and equipment | (1.3) | | | (2.7) | | | (1.5) | |

| Proceeds from (Payments related to) sale of property and equipment | 0.2 | | | 0.2 | | | (0.2) | |

| Free cash flow, before acquisitions | $ | 24.5 | | | $ | 23.9 | | | $ | 21.4 | |

| | | | | |

(1) The Company believes free cash flow, before acquisitions is an important measure because it encompasses both profitability and capital management in evaluating results. |

| | | | | | | | | | | |

|

|

|

| |

| Forum Energy Technologies, Inc. |

| Reconciliation of GAAP to non-GAAP financial information |

| (Unaudited) |

| Table 6 - Adjusting items |

| | | |

| Nine months ended |

| (in millions of dollars) | September 30, 2024 | | September 30, 2023 |

Free cash flow, before acquisitions, reconciliation (1) | | | |

| Net cash provided by (used in) operating activities | $ | 53.7 | | | $ | (3.1) | |

| Capital expenditures for property and equipment | (5.7) | | | (5.5) | |

| Proceeds from sale of property and equipment | 0.2 | | | 1.3 | |

| Free cash flow, before acquisitions | $ | 48.2 | | | $ | (7.3) | |

| | | |

(1) The Company believes free cash flow, before acquisitions is an important measure because it encompasses both profitability and capital management in evaluating results. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Forum Energy Technologies, Inc. |

| Supplemental schedule - Product line revenue |

| (Unaudited) |

| | | | | | | | | |

| | Three months ended |

| (in millions of dollars) | | September 30, 2024 | | September 30, 2023 | | June 30, 2024 |

| Revenue | | $ | % | | $ | % | | $ | % |

| Drilling | | $ | 35.8 | | 17.2 | % | | $ | 41.8 | | 23.3 | % | | $ | 35.5 | | 17.3 | % |

| Subsea | | 20.9 | | 10.1 | % | | 14.7 | | 8.2 | % | | 16.8 | | 8.2 | % |

| Stimulation and Intervention | | 38.0 | | 18.3 | % | | 32.5 | | 18.1 | % | | 37.2 | | 18.1 | % |

| Coiled Tubing | | 28.9 | | 13.9 | % | | 29.9 | | 16.7 | % | | 27.5 | | 13.4 | % |

| Drilling and Completions | | 123.6 | | 59.5 | % | | 118.9 | | 66.3 | % | | 117.0 | | 57.0 | % |

| | | | | | | | | |

| Downhole | | 50.6 | | 24.4 | % | | 23.5 | | 13.1 | % | | 53.1 | | 25.9 | % |

| Production Equipment | | 18.0 | | 8.7 | % | | 21.7 | | 12.1 | % | | 18.1 | | 8.8 | % |

| Valve Solutions | | 15.6 | | 7.4 | % | | 15.2 | | 8.5 | % | | 17.0 | | 8.3 | % |

| Artificial Lift and Downhole | | 84.2 | | 40.5 | % | | 60.4 | | 33.7 | % | | 88.2 | | 43.0 | % |

| Eliminations | | — | | — | % | | — | | — | % | | — | | — | % |

| | | | | | | | | |

| Total revenue | | $ | 207.8 | | 100.0 | % | | $ | 179.3 | | 100.0 | % | | $ | 205.2 | | 100.0 | % |

v3.24.3

Cover Page

|

Oct. 31, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 31, 2024

|

| Entity Registrant Name |

FORUM ENERGY TECHNOLOGIES, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35504

|

| Entity Tax Identification Number |

61-1488595

|

| Entity Address, Address Line One |

10344 Sam Houston Park Drive

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77064

|

| City Area Code |

281

|

| Local Phone Number |

949-2500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

FET

|

| Security Exchange Name |

NYSE

|

| Emerging Growth Company |

false

|

| Entity Central Index Key |

0001401257

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

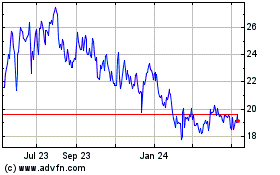

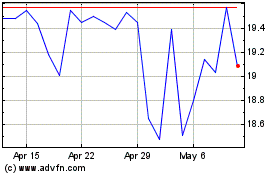

Forum Energy Technologies (NYSE:FET)

Historical Stock Chart

From Jan 2025 to Feb 2025

Forum Energy Technologies (NYSE:FET)

Historical Stock Chart

From Feb 2024 to Feb 2025