Forum Energy Technologies, Inc. (NYSE: FET) (the “Company” or

“FET”) today announced the following preliminary selected Third

Quarter 2024 financial results, compared to the Second Quarter

2024.

- Revenue of approximately $208 million, compared to $205

million

- Bookings of approximately $205 million, compared to $180

million

- Adjusted EBITDA of approximately $26 million, compared to

$26 million

- Free Cash Flow (before acquisitions) of approximately $24

million, compared to $21 million

These preliminary Third Quarter 2024 revenue and Adjusted EBITDA

results are within our previously announced guidance ranges.

Provided below is a table reconciling GAAP to non-GAAP Second

Quarter 2024 financial information.

FET (Forum Energy Technologies) is a global manufacturing

company, serving the oil, natural gas, industrial and renewable

energy industries. With headquarters located in Houston, Texas, FET

provides value added solutions aimed at improving the safety,

efficiency, and environmental impact of its customers' operations.

For more information, please visit www.f-e-t.com.

Non-GAAP Financial Measures and Other Legal

Disclosures

The Company presents its financial results in accordance with

U.S. generally accepted accounting principles (“GAAP”). However,

management believes that non-GAAP measures are useful tools for

evaluating the Company’s overall financial performance. Not all

companies define these measures in the same way. In addition, these

non-GAAP financial measures are not a substitute for those prepared

in accordance with GAAP and should, therefore, be considered only

as a supplement.

The unaudited financial information presented above for the

Third Quarter 2024 reflects estimates based upon preliminary

information available to the Company as of the date hereof, is not

a comprehensive statement of the Company’s financial results or

position as of or for the quarter ended September 30, 2024, and has

not been audited or reviewed by the Company’s independent

registered public accounting firm. The Company’s consolidated

financial statements and operating data as of and for the quarter

ended September 30, 2024 may vary materially from the preliminary

financial information provided herein due to the completion of the

Company’s financial closing procedures, final adjustments and other

developments that may arise between now and the time the financial

results for the Third Quarter 2024 are finalized. Accordingly,

investors should not place undue reliance on these preliminary

estimates. The Company is not able to provide reconciliations of

Adjusted EBITDA and Free Cash Flow (before acquisitions) to the

most directly comparable measure in accordance with GAAP without

unreasonable effort because of the inherent difficulty in

forecasting and quantifying certain amounts necessary for such

reconciliations, including net income (loss), net cash provided by

operating activities and the components of such GAAP measures.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. All statements,

other than statements of historical facts, included in this press

release that address activities, events or developments that the

Company expects, believes or anticipates will or may occur in the

future are forward-looking statements. Without limiting the

generality of the foregoing, forward-looking statements contained

in this press release specifically include the expectations of

anticipated financial and operating results of the Company for the

Third Quarter 2024, including any statement about the Company’s

financial position, liquidity and capital resources, operations,

performance, returns and other estimated financial results included

in this press release.

These statements are based on certain assumptions and estimates

made by the Company based on management's experience and perception

of historical trends, current conditions, anticipated future

developments and other factors believed to be appropriate. Such

statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond the control of the Company,

which may cause actual results to differ materially from those

implied or expressed by the forward-looking statements. Among other

things, these include the risks described above and the volatility

of oil and natural gas prices, oilfield development activity

levels, the availability of raw materials and specialized

equipment, the Company’s ability to deliver backlog in a timely

fashion, the availability of skilled and qualified labor,

competition in the oil and natural gas industry, governmental

regulation and taxation of the oil and natural gas industry, the

Company’s ability to implement new technologies and services, the

availability and terms of capital, and uncertainties regarding

environmental regulations or litigation and other legal or

regulatory developments affecting the Company’s business, and other

important factors that could cause actual results to differ

materially from those projected or estimated as described in the

Company's filings with the U.S. Securities and Exchange

Commission.

Any forward-looking statement speaks only as of the date on

which such statement is made and the Company undertakes no

obligation to correct or update any forward-looking statement,

whether as a result of new information, future events or otherwise,

except as required by applicable law.

Forum Energy Technologies,

Inc.

Reconciliation of GAAP to

non-GAAP financial information

(in millions)

Three months ended June 30,

2024

Net loss

$

(6.7

)

Interest expense

8.7

Depreciation and amortization

14.0

Income tax expense

2.5

EBITDA

18.5

Restructuring and other costs

1.0

Transaction expenses

1.2

Inventory and other working capital

adjustments

—

Stock-based compensation expense

1.5

Loss on extinguishment of debt

0.5

Loss on foreign exchange, net (1)

3.1

Adjusted EBITDA (2)

$

25.8

Net cash provided by operating

activities

$

23.1

Capital expenditures for property and

equipment

(1.5

)

Payments related to sale of property and

equipment

(0.2

)

Free Cash Flow (before acquisitions)

(3)

$

21.4

(1)

Foreign exchange, net primarily relates to

cash and receivables denominated in U.S. dollars by some of the

Company’s non-U.S. subsidiaries that report in a local currency,

and therefore the loss (gain) has no economic impact in dollar

terms.

(2)

The Company believes that the presentation

of EBITDA and Adjusted EBITDA are useful to the Company’s investors

because (i) each of these financial metrics are useful to investors

to assess and understand operating performance, especially when

comparing those results with previous and subsequent periods or

forecasting performance for future periods, primarily because

management views the excluded items to be outside of the Company’s

normal operating results and (ii) EBITDA is an appropriate measure

of evaluating the company’s operating performance and liquidity

that reflects the resources available for strategic opportunities

including, among others, investing in the business, strengthening

the balance sheet, repurchasing the Company’s securities and making

strategic acquisitions. In addition, these benchmarks are widely

used in the investment community.

(3)

The Company believes Free Cash Flow

(before acquisitions) is an important measure because it

encompasses both profitability and capital management in evaluating

results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241014019092/en/

Rob Kukla Director of Investor Relations 281.994.3763

rob.kukla@f-e-t.com

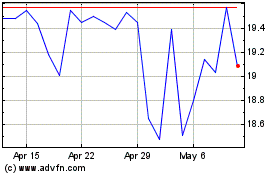

Forum Energy Technologies (NYSE:FET)

Historical Stock Chart

From Oct 2024 to Nov 2024

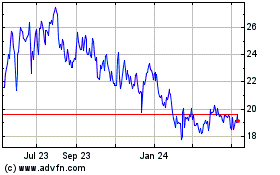

Forum Energy Technologies (NYSE:FET)

Historical Stock Chart

From Nov 2023 to Nov 2024