As filed with the Securities and Exchange Commission on June 11, 2024

Registration No. 333-278284

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FORUM ENERGY TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 61-1488595 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

10344 Sam Houston Park Drive, Suite 300

Houston, Texas 77064

(281) 949-2500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John C. Ivascu

Executive Vice President, General Counsel, Chief Compliance Officer

and Corporate Secretary

Forum Energy Technologies, Inc.

10344 Sam Houston Park Drive, Suite 300

Houston, Texas 77064

(281) 949-2500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Tull R. Florey

Gibson, Dunn & Crutcher LLP

811 Main Street, Suite 3000

Houston, Texas 77002

Telephone: (346) 718-6600

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective, as determined by market conditions and other factors.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large Accelerated Filer | | ☐ | | Accelerated Filer | | ☒ |

| Non-Accelerated Filer | | ☐ | | Smaller Reporting Company | | ☒ |

| | | | Emerging Growth Company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| | |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said section 8(a), may determine. |

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 11, 2024

Prospectus

1,946,038 Shares of Common Stock

The selling stockholders named in this prospectus (the “selling stockholders”), should they choose to do so after the effectiveness of the registration statement of which this prospectus forms a part, may offer up to 1,946,038 shares of common stock, $0.01 par value per share (the “Common Stock”), of Forum Energy Technologies, Inc. (the “Company”). Such shares were issued by the Company to the selling stockholders in connection with an acquisition by the Company pursuant to a stock purchase agreement by and among the Company, Variperm Holdings Ltd. (“Variperm”) and the other parties thereto, dated as of November 1, 2023 (the “Stock Purchase Agreement”). All of these shares of Common Stock are being sold by the selling stockholders named in this prospectus, or any of the selling stockholders’ respective transferees, pledgees, donees or successors-in-interest. The selling stockholders will receive all proceeds from the sale of the shares of Common Stock being offered in this prospectus. We will not receive any proceeds from the sale of shares by any of the selling stockholders. We are required to pay certain offering fees and expenses in connection with the registration of the selling stockholders’ securities and to indemnify the selling stockholders against certain liabilities. For more information related to the selling stockholders, please read “Selling Stockholders.”

This prospectus describes the general manner in which these securities may be offered and sold. If necessary, the specific manner in which these securities may be offered and sold will be described in one or more supplements to this prospectus. Any prospectus supplement may add, update or change information contained in this prospectus. You should carefully read this prospectus, and any applicable prospectus supplement, as well as the documents incorporated by reference herein or therein before you invest in any of our securities.

There can be no assurances that the selling stockholders will sell any or all of the securities offered under this prospectus. The selling stockholders may offer and sell our Common Stock to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis. In addition, the selling stockholders may offer and sell these securities from time to time, together or separately. If the selling stockholders use underwriters, dealers or agents to sell such securities, we will name them and describe their compensation in a prospectus supplement. The price to the public of those securities and the net proceeds the selling stockholders expect to receive from that sale will also be set forth in a prospectus supplement.

Our Common Stock is listed on the New York Stock Exchange (“NYSE”) under the symbol “FET.” The last reported sale price of our Common Stock on June 10, 2024, as reported by the NYSE, was $17.63 per share.

See the section entitled “Risk Factors” beginning on page 6 of this prospectus and any similar section contained in any applicable prospectus supplement to read about factors you should consider before buying our securities. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus is dated , 2024.

TABLE OF CONTENTS

You should rely only on the information contained or incorporated by reference in this prospectus and any prospectus supplement. We have not authorized any dealer, salesperson or other person to provide you with additional or different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus and any prospectus supplement are not an offer to sell or the solicitation of an offer to buy any securities other than the securities to which they relate and are not an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make an offer or solicitation in that jurisdiction. You should not assume that the information in this prospectus or any prospectus supplement or in any document incorporated by reference in this prospectus or any prospectus supplement is accurate as of any date other than the date of the document containing the information.

You should read carefully the entire prospectus, as well as the documents incorporated by reference in the prospectus and the applicable prospectus supplement, before making an investment decision.

Unless the context requires otherwise or unless otherwise noted, all references in this prospectus or any accompanying prospectus supplement to “FET,” “Forum,” “Company,” “we,” “us” or “our” are to Forum Energy Technologies, Inc. and, as applicable, its subsidiaries.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, the selling stockholders may, over time, offer and sell the securities described in this prospectus in one or more offerings or resales. This prospectus provides a general description of the securities. Each time the selling stockholders sell any of the securities described herein, the selling stockholders may provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add to, update or change the information contained in this prospectus. If there is any inconsistency between the information in this prospectus and any applicable prospectus supplement, you should rely on the information in the applicable prospectus supplement. Please carefully read this prospectus, any applicable prospectus supplement and any free-writing prospectus together with the information contained in the documents we refer to under the heading “Where You Can Find More Information.”

FORWARD-LOOKING STATEMENTS

Statements contained in this prospectus and the documents incorporated by reference herein that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such statements include those concerning our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans, and objectives of management. When used in this prospectus, the words “will,” “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words.

Forward-looking statements may include, but are not limited to, statements about the following subjects:

•our business strategy;

•our cash flows and liquidity and ability to refinance our debt;

•the volatility and impact of changes in oil and natural gas prices;

•the availability of raw materials and specialized equipment;

•our ability to accurately predict customer demand;

•customer order cancellations or deferrals;

•disputes over production levels among members of the Organization of Petroleum Exporting Countries and other oil and gas producing nations, which could result in increased volatility in prices for oil and natural gas that could affect the markets for our services;

•disruptions to the operations and business of our key customers, suppliers and other counterparties, including impacts affecting our supply chain and logistics;

•competition in the energy industry;

•the occurrence of cybersecurity incidents, attacks or other breaches to our technology systems;

•governmental regulation and taxation of the energy industry, including the application of tariffs by governmental authorities;

•environmental liabilities;

•political, social and economic issues affecting the countries in which we do business;

•changes in relative activities of U.S. and international operations;

•our ability to deliver our backlog in a timely fashion;

•our ability to implement new technologies and services;

•the availability, cost and terms of capital;

•general economic and political conditions;

•our ability to successfully manage our growth, including risks and uncertainties associated with integrating and retaining key employees of Variperm and any other businesses we acquire;

•the benefits of our acquisitions, including our ability to achieve desired synergies and operational efficiencies from the recently completed acquisition of Variperm;

•the availability of key management personnel;

•the availability of skilled and qualified labor;

•operating hazards inherent in our industry;

•the ability to establish and maintain effective internal control over financial reporting;

•financial strategy, budget, projections and operating results;

•uncertainty regarding our future operating results; and

•other plans, objectives, expectations and intentions contained in or incorporated by reference into this prospectus that are not historical.

Each forward‐looking statement speaks only as of the date of the particular statement, and we undertake no obligation to publicly update or revise any forward‐looking statements, except as required by law, and you should not place undue reliance on these forward-looking statements. Although we believe that our plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause actual results to differ materially from our plans, intentions or expectations.

We disclose important factors that could cause our actual results to differ materially from our expectations under the section entitled “Risk Factors” beginning on page 6 of this prospectus, as well as the other documents that we incorporate by reference into this prospectus and any applicable prospectus supplement, including our most recent Annual Report on Form 10-K and in any subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

WHERE YOU CAN FIND MORE INFORMATION

The SEC allows us to incorporate by reference the information we file with it, which means that we can disclose important information to you by referring you to another document that we have filed with the SEC. You should read the information incorporated by reference because it is an important part of this prospectus. We incorporate by reference the following information or documents that we have filed with the SEC:

•our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 5, 2024 (including the portions of our proxy statement for our 2024 annual meeting of stockholders incorporated by reference therein); •our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on May 3, 2024; •the description of our Common Stock contained in Exhibit 4.5 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed with the SEC on February 25, 2020, together with any amendment or report filed with the SEC updating such description. In addition, all documents filed by us after the date of the filing of the registration statement of which this prospectus forms a part and prior to the effectiveness of the registration statement, and all documents subsequently filed by us, with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (excluding any information “furnished” pursuant to Item 2.02 or Item 7.01 with the SEC on any Current Report on Form 8-K and other portions of documents that are “furnished,” but not “filed,” pursuant to applicable rules promulgated by the SEC, unless otherwise noted), prior to the completion or termination of the applicable offering under this prospectus and any applicable prospectus supplement, shall be deemed to be incorporated by reference into this prospectus.

We file annual, quarterly and other reports and other information with the SEC. The SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. You may inspect a copy of the registration statement through the SEC’s website. We make available free of charge on or through our Internet website, www.f-e-t.com, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Information contained on our Internet website is not a part of this prospectus and is not incorporated by reference into this prospectus (unless specifically incorporated by reference into this prospectus as described above).

You may obtain any of the documents incorporated by reference into this prospectus from the SEC through the SEC’s website at the address provided above. We will provide to each person, including any beneficial owner, to whom this prospectus is delivered a copy of any or all of the information that is incorporated by reference into this prospectus (excluding any exhibit to those documents, unless the exhibit is specifically incorporated by reference into such documents), at no cost, by visiting our Internet website at www.f-e-t.com, or by writing or calling us at the following address:

Forum Energy Technologies, Inc.

10344 Sam Houston Park Drive, Suite 300

Houston, Texas 77064

Attention: Investor Relations

Telephone: (281) 949-2500

THE COMPANY

We are a global manufacturing company serving the oil, natural gas, industrial and renewable energy industries. With headquarters in Houston, Texas, FET provides value added solutions aimed at improving the safety, efficiency, and environmental impact of our customers’ operations. Our highly engineered products include capital equipment and consumable products. FET’s customers include oil and natural gas operators, land and offshore drilling contractors, oilfield service companies, pipeline and refinery operators, and renewable energy and new energy companies. Consumable products are used by our customers in drilling, well construction and completion activities and at processing centers and refineries. Our capital products are directed at drilling rig equipment for constructing new or upgrading existing rigs, subsea construction and development projects, pressure pumping equipment, the placement of production equipment on new producing wells, downstream capital projects and capital equipment for renewable energy projects.

Our principal executive offices are located at 10344 Sam Houston Park Drive, Suite 300, Houston, Texas 77064, and our telephone number is (281) 949-2500.

RISK FACTORS

An investment in our securities involves a significant degree of risk. Before you invest in our securities you should carefully consider those risk factors included in our most recent Annual Report on Form 10-K, any subsequently filed Quarterly Reports on Form 10-Q and any subsequently filed Current Reports on Form 8-K, which are incorporated herein by reference, and those risk factors that may be included in any applicable prospectus supplement, together with all of the other information included in this prospectus, any prospectus supplement and the documents we incorporate by reference, in evaluating an investment in our securities. If any of the risks discussed in the foregoing documents were to occur, our business, financial condition, results of operations and cash flows could be materially adversely affected. Also, please read the cautionary statement in this prospectus under “Forward-Looking Statements.”

USE OF PROCEEDS

We will not receive any proceeds from the sale by the selling stockholders of our Common Stock under this prospectus. Any proceeds from the sale of such shares of our Common Stock under this prospectus will be received by the selling stockholders. We will pay certain expenses in connection with the sale of shares of our Common Stock by the selling stockholders under this prospectus.

DESCRIPTION OF CAPITAL STOCK

General

As of the date of this prospectus, we are authorized to issue up to 18,500,000 shares of stock, including up to 14,800,000 shares of Common Stock and up to 3,700,000 shares of preferred stock, par value $0.01 per share (“Preferred Stock”). As of June 5, 2024, we had 12,283,670 shares of Common Stock and no shares of Preferred Stock issued and outstanding.

The following is a summary of the key terms and provisions of our equity securities. You should refer to the applicable provisions of our Third Amended and Restated Certificate of Incorporation (our “Certificate of Incorporation”), our Third Amended and Restated Bylaws (our “Bylaws”), the Delaware General Corporation Law (“DGCL”) and the documents we have incorporated by reference for a complete statement of the terms and rights of our capital stock.

Common Stock

Except as provided by law or in a preferred stock designation, holders of our Common Stock are entitled to one vote for each share held of record on all matters submitted to a vote of the stockholders. Because holders of our Common Stock have the exclusive right to vote for the election of directors and do not have cumulative voting rights, the holders of a majority of the shares of our Common Stock can elect all of the members of the board of directors of the Company (the “Board”) standing for election, subject to the rights, powers and preferences of any outstanding series of Preferred Stock that we may issue in the future. The holders of our Common Stock are entitled to receive:

•dividends as may be declared by the Board from time to time out of funds legally available for the payment of dividends; and

•if Forum is liquidated, dissolved or wound up, all of our assets available for distribution to holders of our Common Stock after satisfaction of all of our liabilities and the prior rights of any outstanding class of Preferred Stock, pro rata, based on the number of shares held.

Forum’s Common Stock carries no preemptive or other subscription rights to purchase shares of Common Stock and is not convertible, redeemable or assessable or entitled to the benefits of any sinking fund.

Preferred Stock

Subject to the provisions of our Certificate of Incorporation and legal limitations, the Board will have the authority, without further vote or action by our stockholders, to issue shares of Preferred Stock in one or more series and to fix the rights, preferences, privileges and restrictions of our Preferred Stock, including provisions related to dividends, conversion, voting, redemption, liquidation and the number of shares constituting the series or the designation of that series, which may be superior to those of our Common Stock.

The issuance of shares of Preferred Stock by the Board as described above, while providing desired flexibility in connection with possible acquisitions and other corporate purposes, may adversely affect the rights of the holders of our Common Stock. For example, Preferred Stock may rank prior to our Common Stock as to dividend rights, liquidation preference or both, may have full or limited voting rights and may be convertible into shares of our Common Stock. The issuance of shares of Preferred Stock may discourage third-party bids for our Common Stock or may otherwise adversely affect the market price of our Common Stock. In addition, Preferred Stock may enable the Board to make it more difficult or to discourage attempts to obtain control of us through a hostile tender offer, proxy contest, merger or otherwise, or to make changes in our management. Shares of Preferred Stock may be offered either separately or represented by depositary shares.

Anti-Takeover Effects of Delaware Law, Our Certificate of Incorporation and Our Bylaws

Some provisions of Delaware law, our Certificate of Incorporation and our Bylaws could make certain change of control transactions more difficult, including acquisitions of us by means of a tender offer, a proxy contest or otherwise, as well as removal of our incumbent directors. These provisions may also have the effect of preventing changes in our management. It is possible that these provisions could make it more difficult to accomplish or could deter transactions that stockholders may otherwise consider to be in their best interest or in his or her best interests, including transactions that might result in a premium over the market price for our Common Stock.

Business Combinations under Delaware Law

In our Certificate of Incorporation, we are subject to the provisions of Section 203 of the DGCL regulating corporate takeovers. In general, those provisions prohibit a Delaware corporation, including those whose securities are listed for trading on the NYSE, from engaging in any business combination with any interested stockholder for a period of three years following the date that the stockholder became an interested stockholder, unless:

•before the person became an interested stockholder, the Board approved either the business combination or the transaction in which the interested stockholder became an interested stockholder;

•upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of our voting stock outstanding at the time the transaction commenced (other than statutorily excluded shares); or

•on or after the date the interested stockholder attained that status, the business combination is approved by the Board and authorized at a meeting of stockholders by at least two-thirds of the outstanding voting stock that is not owned by the interested stockholder.

An interested stockholder is defined as a person who, together with any affiliates or associates of such person, beneficially owns, directly or indirectly, 15% or more of the outstanding voting shares of a Delaware corporation. The term “business combination” is broadly defined to include a broad array of transactions, including mergers, consolidations, sales or other dispositions of assets having a total value in excess of 10% of the consolidated assets of the corporation or all of the outstanding stock of the corporation, and some other transactions that would increase the interested stockholder’s proportionate share ownership in the corporation.

Certificate of Incorporation and Bylaws

Among other things, our Certificate of Incorporation and Bylaws:

•establish advance notice procedures with regard to stockholder proposals relating to the nomination of candidates for election as directors or new business to be brought before meetings of our stockholders. These procedures provide that notice of stockholder proposals must be timely given in writing to our corporate secretary prior to the meeting at which the action is to be taken. Generally, to be timely, notice must be delivered to our secretary at our principal executive offices not less than 90 days nor more than 120 days prior to the first anniversary date of the annual meeting for the preceding year. Our Bylaws specify the requirements as to form and content of all stockholders’ notices. These requirements may preclude stockholders from bringing matters before the stockholders at an annual or special meeting to the extent they do not comply with the requirements in these advance notice procedures;

•provide the Board the ability to authorize the issuance of undesignated Preferred Stock. This makes it possible for the Board to issue, without stockholder approval, Preferred Stock with voting or other rights or preferences that could impede the success of any attempt to change control of us;

•provide that the authorized number of directors may be changed only by resolution of the Board;

•provide that all vacancies, including newly created directorships, may, except as otherwise required by law, be filled by the affirmative vote of a majority of directors then in office, even if less than a quorum;

•provide that any action required or permitted to be taken by the stockholders must be effected at a duly called annual or special meeting of stockholders and may not be effected by any consent in writing in lieu of a meeting of such stockholders, subject to the rights of the holders of any series of Preferred Stock;

•provide that our Certificate of Incorporation and Bylaws may be amended by the affirmative vote of the holders of at least two-thirds of our then outstanding Common Stock;

•provide that special meetings of our stockholders may only be called by the Board, the chief executive officer, the president, the secretary, the chairman of the board or by stockholders holding a majority of the outstanding shares entitled to vote generally in the election of directors;

•provide for the Board to be divided into three classes of directors, with each class as nearly equal in number as possible, serving staggered three year terms, other than directors who may be elected by holders of Preferred Stock, if any. This system of electing and removing directors may tend to discourage a third party from making a tender offer or otherwise attempting to obtain control of us, because it generally makes it

more difficult for stockholders to replace a majority of the directors; and

•provide that a member of the Board may only be removed for cause and only by the affirmative vote of the holders of at least two-thirds of our then outstanding Common Stock.

Amendment of the Bylaws

The Board may amend or repeal the Bylaws and adopt new bylaws by the affirmative vote of the Board. The stockholders may amend or repeal the Bylaws and adopt new bylaws by the affirmative vote of the holders of at least two-thirds of our then outstanding Common Stock at any annual meeting or special meeting for which notice of the proposed amendment, repeal or adoption was contained in the notice for such special meeting.

Limitation of Liability and Indemnification of Officers and Directors

Our directors will not be personally liable to us or our stockholders for monetary damages for breach of fiduciary duty as a director, except, if required by Delaware law, for liability:

•for any breach of the duty of loyalty to us or our stockholders;

•for acts or omissions not in good faith or involving intentional misconduct or a knowing violation of law;

•for unlawful payment of a dividend or unlawful stock purchases or redemptions; or

•for any transaction from which the director derived an improper personal benefit.

As a result, neither we nor our stockholders have the right, through stockholders’ derivative suits on our behalf, to recover monetary damages against a director for breach of fiduciary duty as a director, including breaches resulting from grossly negligent behavior, except in the situations described above. We have entered into indemnification agreements with each of our other current directors and officers.

Transfer Agent and Registrar

The transfer agent and registrar for our Common Stock is American Stock Transfer & Trust Company, LLC.

Market Information

Our Common Stock is listed on the New York Stock Exchange under the symbol “FET.”

SELLING STOCKHOLDERS

This prospectus relates to 1,946,038 shares of our Common Stock, which were issued by the Company to the selling stockholders in connection with an acquisition by the Company pursuant to the Stock Purchase Agreement. The filing of the registration statement of which this prospectus forms a part is pursuant to our obligations under the Investor Rights Agreement, dated as of January 4, 2024 (the “Investor Rights Agreement”), among the Company and the selling stockholders, which was executed in connection with the closing of the transactions contemplated by the Stock Purchase Agreement. We agreed to pay certain offering fees and expenses in connection with the registration of the selling stockholders’ securities and to indemnify the selling stockholders against certain liabilities.

The information contained in the table below in respect of the selling stockholders (including the number of shares of Common Stock beneficially owned and the number of shares of Common Stock offered) has been obtained from the selling stockholders and has not been independently verified by us. We may supplement this prospectus from time to time in the future to update or change this list of selling stockholders and the number of shares of Common Stock that may be offered and sold by any of the selling stockholders. The registration for resale of the shares of Common Stock does not necessarily mean that the selling stockholders will sell all or any of these shares. In addition, the selling stockholders may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, shares of Common Stock in transactions exempt from the registration requirements of the Securities Act, after the date on which it provided the information set forth in the table below.

The information set forth in the following table regarding the beneficial ownership after resale of the shares of Common Stock is based upon the assumption that each of the selling stockholders will sell all of the shares of Common Stock beneficially owned by it that are covered by this prospectus. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to shares of Common Stock and the right to acquire such voting or investment power within 60 days through the exercise of any option, warrant or other right. Except as described in the footnotes to the following table, the selling stockholders named in the table have not held any position or office or had any other material relationship with us or our affiliates during the three years prior to the date of this prospectus. The inclusion of any shares of Common Stock in the footnotes of this table does not constitute an admission of beneficial ownership for the selling stockholders named below. Unless otherwise indicated below, the address of each beneficial owner listed below is c/o 3424 26th St NE #7, Calgary, AB T1Y 4T7, Canada.

As of June 5, 2024, there were 12,283,670 shares of our Common Stock issued and outstanding.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name of selling stockholder | | Shares of Common Stock

beneficially owned prior to the

offering | | | Shares of Common

Stock to be offered | | | Shares of Common Stock

beneficially owned after the offering | |

| | Number | | | Percentage | | | Number | | | Percentage | |

Variperm Energy Services Partnership (1) | | | 1,034,343 | | | | 8.4% | | | | 1,034,343 | | | | — | | | | —% | |

CBDD Investments, LLC (2) | | | 528,423 | | | | 4.3% | | | | 528,423 | | | | — | | | | —% | |

| CPPIB Credit Investments Inc. (3) | | | 228,590 | | | | 1.9% | | | | 228,590 | | | | — | | | | —% | |

| Nationwide Mutual Insurance Company (4) | | | 68,070 | | | | * | | | | 68,070 | | | | — | | | | —% | |

James Nurcombe | | | 31,194 | | | | * | | | | 31,194 | | | | — | | | | —% | |

| | | | | | | | | | | | | | | | | | | | |

Entities affiliated with Shenkman Capital Management, Inc. (5) | | | 31,201 | | | | * | | | | 31,201 | | | | — | | | | —% | |

| Jamie Olson | | | 18,881 | | | | * | | | | 18,881 | | | | — | | | | —% | |

| Elise Robertson | | | 5,336 | | | | * | | | | 5,336 | | | | — | | | | —% | |

_______________

(1) SCF LP (“SCF LP”) is a partner of Variperm Energy Services Partnership (“VESP”) and as a result of its equity ownership in VESP, has the power to appoint over 50% of the the board of directors of VESP. SCF-VIII-G.P., Limited Partnership (“SCF GP”) is the sole general partner of SCF LP and SCF GP LLC (together with SCF LP, SCF GP, the “SCF Entities”) is the sole general partner of SCF GP. Each of the SCF Entities may therefore be deemed to share voting and dispositive power over the securities held by VESP and may also be deemed to be the beneficial owners of such securities. Please see the “Conflicts of Interest and Related Person Transactions” section of the proxy statement filed on Schedule 14A for our 2023 annual meeting of stockholders, which is incorporated herein by reference, for a description of material relationships and transactions between us and the SCF Entities and their affiliates during the three years prior to the date of this prospectus. The address of VESP and the SCF Entities is 600 Travis Street, Suite 6600, Houston, Texas 77002.

(2) Charlesbank Equity Fund VIII, Limited Partnership (“CB VIII”) is the manager of CBDD Investments, LLC (“CBDD”). Charlesbank Equity Fund VIII GP, Limited Partnership (“CB VIII GP”) is the general partner of CB VIII. Charlesbank Capital Partners, LLC (together with CB VIII and CB VIII GP, the “Charlesbank Entities”) is the general partner of CB VIII GP. Each of the Charlesbank Entities may therefore be deemed to beneficially own the securities of the Company held directly by CBDD. The address of CBDD and the Charlesbank Entities is c/o Charlesbank Capital Partners, 200 Clarendon Street, Floor 54, Boston, Massachusetts 02116.

(3) Canada Pension Plan Investment Board (“CPPIB”) has sole voting and dispositive power over the shares of our Common Stock held by CPPIB Credit Investments Inc. (“CPPIB Credit”) and may be deemed to be the beneficial owner of such shares. The address of CPPIB and CPPIB Credit is One Queen Street East, Suite 2500, Toronto, Ontario, M5C 2W5, Canada.

(4) The address of Nationwide Mutual Insurance Company is One Nationwide Plaza, Columbus, Ohio 43215.

(5) Consists of (i) 20,218 shares of our Common Stock owned directly by Four Points Multi-Strategy Master Fund Inc., (ii) 8,104 shares of our Common Stock owned directly by Electronic Data Systems Retirement Plan and (iii) 2,879 shares of our Common Stock owned directly by DXC UK Pension Scheme. Shenkman Capital Management, Inc. (“Shenkman”), as investment manager, investment adviser or sub-adviser of the aforementioned entities, may be deemed to be the beneficial owner of the shares of our Common Stock held by these selling stockholders. Such shares of our commons stock may be deemed to be beneficially owned by Mark R. Shenkman by virtue of him being the indirect principal owner of Shenkman. The foregoing should not be construed as an admission that Mr. Shenkman or any of the entities listed above is the beneficial owner of any shares of our Common Stock other than the securities owned directly by such person (if any). The address for Shenkman and the aforementioned entities is 151 West 42nd Street, 29th Floor, New York, New York 10036.

PLAN OF DISTRIBUTION

The shares of Common Stock are being registered to permit the selling stockholders (which as used herein means the individuals and entities listed in the table included herein under “Selling Stockholders” and the pledgees, donees, transferees, assignees, successors and others who later come to hold any of the shares of Common Stock being offered in this prospectus as a result of a transfer not involving a public sale) to offer and sell the shares of Common Stock from time to time after the date of this prospectus. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale or at negotiated prices.

We will not receive any of the proceeds from the offering by the selling stockholders of the shares of Common Stock. However, pursuant to the Investor Rights Agreement, Forum will pay the Registration Expenses (as defined therein) associated with the registration and sale of the shares of Common Stock by the selling stockholders. The selling stockholders will pay, on a pro rata basis, any Selling Expenses (as defined in the Investor Rights Agreement), which include underwriting fees, discounts and selling commissions.

The selling stockholders may use any one or more of the following methods when disposing of the shares of Common Stock or interests therein:

•on the NYSE or any other national securities exchange or U.S. inter-dealer system of a registered national securities association on which the Common Stock may be listed or quoted at the time of sale;

•an over-the-counter sale or distribution;

•ordinary brokerage transactions and transactions in which a broker-dealer solicits purchasers;

•one or more underwritten offerings;

•block trades in which a broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction, or in crosses in which the same broker acts as an agent on both sides;

•purchases by a broker-dealer as principal and resale by the broker-dealer for its own account pursuant to this prospectus;

•an exchange distribution and/or secondary distribution in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•short sales, whether through a broker-dealer or themselves, and delivery of shares of our Common Stock to close out short positions;

•through distributions by any selling stockholder to its general or limited partners, members, managers affiliates, employees, directors or stockholders;

•“at-the-market” offerings into an existing trading market in accordance with Rule 415(a)(4) under the Securities Act;

•in options transactions;

•through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; and

•in any combination of the above or by any other legally available means available to and requested by the selling stockholders.

A selling stockholder may, from time to time, pledge or grant a security interest in some of the shares of Common Stock owned by it and, if the selling stockholder defaults in the performance of its secured obligations, the pledgees or secured parties may offer and sell the shares, from time to time, under this prospectus, or under an amendment or supplement to this prospectus amending the list of the selling stockholders to include the pledgees, transferees or other successors-in-interest as selling stockholders under this prospectus. In connection with the sale of shares of Common Stock or interests therein, a selling stockholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of shares of Common Stock in the course of hedging the positions they assume. A selling stockholder may also sell shares of Common Stock short and deliver these securities to close out their short positions, or loan or pledge shares of Common Stock to broker-dealers that in turn may sell these securities. A selling stockholder may also enter into option or other transactions with broker-dealers or other financial institutions or one or more derivative securities that require the delivery to such broker-dealer or other financial institution of the shares of Common Stock, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction). A selling stockholder also may transfer the shares of Common Stock in other circumstances, in which case the transferees, pledgees or other successors-in-interest will be the selling beneficial owners for purposes of this prospectus.

The selling stockholders also may resell a portion of the shares of Common Stock in open market transactions in reliance upon Rule 144 under the Securities Act, provided that they meet the criteria and conform to the requirements of that rule, or pursuant to other available exemptions from the registration requirements of the Securities Act.

The selling stockholders and any underwriters, broker-dealers or agents that participate in the sale of shares of Common Stock or interests therein may be “underwriters” within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares of Common Stock may constitute underwriting discounts and commissions under the Securities Act. If the selling stockholders are “underwriters” within the meaning of Section 2(11) of the Securities Act, then the selling stockholders will be subject to the prospectus delivery requirements of the Securities Act. Underwriters and their controlling persons, dealers and agents may be entitled, under agreements entered into by such underwriters, controlling persons, dealers or agents and the selling stockholders, to indemnification against and contribution toward specific civil liabilities, including liabilities under the Securities Act.

To the extent required, the shares of Common Stock to be sold, the respective purchase prices and public offering prices, the names of any agents, dealers or underwriters and any applicable discounts, commissions, concessions or other compensation with respect to a particular offering will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

To facilitate the offering of the shares of Common Stock offered by the selling stockholders, certain persons participating in the offering may engage in transactions that stabilize, maintain or otherwise affect the price of the Common Stock. This may include over-allotments or short sales, which involve the sale by persons participating in the offering of more shares than were sold to them. In these circumstances, these persons would cover such over-allotments or short positions by making purchases in the open market or by exercising their over-allotment option(s), if any. In addition, these persons may stabilize or maintain the price of the Common Stock by bidding for or purchasing shares of Common Stock in the open market or by imposing penalty bids, whereby selling concessions allowed to dealers participating in the offering may be reclaimed if shares sold by them are repurchased in connection with stabilization transactions. The effect of these transactions may be to stabilize or maintain the market price of the Common Stock at a level above that which might otherwise prevail in the open market. These transactions may be discontinued at any time.

LEGAL MATTERS

The validity of the securities described in this prospectus will be passed upon for us by Gibson, Dunn & Crutcher LLP, Houston, Texas. If the securities are being distributed through underwriters or agents, the validity of the securities will be passed upon for the underwriters or agents by counsel identified in the related prospectus supplement. Matters relating to the securities will be passed for the selling stockholders by each of the selling stockholders’ own respective counsel.

EXPERTS

The financial statements of Forum Energy Technologies, Inc. as of December 31, 2023 and 2022, and for each of the two years in the period ended December 31, 2023, incorporated by reference in this prospectus, and the effectiveness of Forum Energy Technologies, Inc.’s internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports. Such financial statements are incorporated by reference in reliance upon the reports of such firm given their authority as experts in accounting and auditing.

The financial statements of Variperm Holdings Ltd. as of December 31, 2023 and 2022, and for each of the two years in the period ended December 31, 2023, incorporated by reference in this prospectus by reference to Forum Energy Technologies, Inc.’s Current Report on Form 8-K filed on June 11, 2024, have been audited by Deloitte LLP, an independent auditor, as stated in their report. Such financial statements are incorporated by reference in reliance upon the report of such firm given their authority as experts in auditing and accounting.

Part II

Information Not Required in Prospectus

| | | | | |

| Item 14. | Other Expenses of Issuance and Distribution |

The following table sets forth the costs and expenses payable by Forum in connection with the sale of securities being registered hereby. All amounts are estimates, except the registration fee.

| | | | | | | | | | | | |

| Item | | Amount | |

SEC registration fee | | $ | 5,391 | |

Accounting fees and expenses | | | * | |

Legal fees and expenses | | | * | |

Trustees’ fees and expenses | | | * | |

Printing and engraving expenses | | | * | |

Listing fees | | | * | |

Miscellaneous | | | * | |

| | | | |

Total | | $ | * | |

| | | | |

_____________

* These fees are calculated based on the number of issuances and amount of securities offered and accordingly cannot be estimated at this time.

| | | | | |

| Item 15. | Indemnification of Officers and Directors |

Delaware General Corporation Law

Section 145(a) of the DGCL provides that a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with the action, suit or proceeding if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful.

Section 145(b) of the DGCL provides that a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses (including attorneys’ fees) actually and reasonably incurred by the person in connection with the defense or settlement of the action or suit if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation and except that no indemnification shall be made in respect of any claim, issue or matter as to which the person shall have been adjudged to be liable to the corporation unless and only to the extent that the Delaware Court of Chancery or the court in which the action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, the person is fairly and reasonably entitled to indemnity for the expenses which the Delaware Court of Chancery or such other court shall deem proper.

Section 145(c) of the DGCL provides that to the extent that a present or former director or officer of a corporation has been successful on the merits or otherwise in defense of any action, suit or proceeding referred to in Section 145(a) and (b), or in defense of any claim, issue or matter therein, the person shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by the person in connection therewith.

Section 145(d) of the DGCL provides that any indemnification under Section 145(a) and (b) (unless ordered by a court) shall be made by the corporation only as authorized in the specific case upon a determination that indemnification of the present or former director, officer, employee or agent is proper in the circumstances because the person has met the applicable standard of conduct set forth in Section 145(a) and (b). The determination shall be made, with respect to a person who is a director or officer at the time of such determination, (1) by a majority vote of the directors who are not parties to such action, suit or proceeding, even though less than a quorum, (2) by a committee of such directors designated by majority vote of such directors, even though less than a quorum, (3) if there are no such directors, or if such directors so direct, by independent legal counsel in a written opinion, or (4) by the stockholders.

Section 145(e) of the DGCL provides that expenses (including attorneys’ fees) incurred by an officer or director in defending any civil, criminal, administrative or investigative action, suit or proceeding may be paid by the corporation in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of the director or officer to repay such amount if it shall ultimately be determined that the person is not entitled to be indemnified by the corporation as authorized in Section 145. The expenses (including attorneys’ fees) incurred by former directors and officers or other employees and agents may be so paid upon those terms and conditions, if any, as the corporation deems appropriate.

Section 145(f) of the DGCL provides that the indemnification and advancement of expenses provided by, or granted pursuant to, Section 145 shall not be deemed exclusive of any other rights to which those seeking indemnification or advancement of expenses may be entitled under any bylaw, agreement, vote of stockholders or disinterested directors or otherwise.

Section 145(g) of the DGCL provides that a corporation shall have the power to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against the person and incurred by the person in any such capacity, or arising out of the person’s status as such, whether or not the corporation would have the power to indemnify the person against such liability under Section 145.

Section 145(k) of the DGCL provides that the indemnification and advancement of expenses provided by, or granted in accordance with, Section 145 shall, unless otherwise provided when authorized or ratified, continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of the heirs, executors and administrators of such a person.

Certificate of Incorporation

The Certificate of Incorporation provides that a director will not be liable to the Company or its stockholders for monetary damages, to the fullest extent permitted by the DGCL, for breach of fiduciary duty as a director. In addition, if the DGCL is amended to authorize the further elimination or limitation of the liability of directors, then the liability of a director of the Company, in addition to the limitation on personal liability provided for in the Certificate of Incorporation, will be limited to the fullest extent permitted by the amended DGCL. The Certificate of Incorporation also contains indemnification rights for the directors and officers. Specifically, the Certificate of Incorporation provides that the Company shall indemnify its officers and directors to the fullest extent authorized by the DGCL.

Certain Other Arrangements

The Company has obtained directors’ and officers’ insurance to cover its directors, officers and some employees for certain liabilities. Each of the Company’s current and former directors and certain officers are indemnified pursuant to an indemnification agreement and to the fullest extent possible under law against all losses pertaining to certain actions taken by them, or failures to act. Pursuant to these agreements, if an officer or director makes a claim of indemnification to the Company, either a majority of the independent directors or independent legal counsel selected by the independent directors must review the relevant facts and make a determination whether the officer or director has met the standards of conduct under Delaware law that would permit (under Delaware law) and require (under the indemnification agreement) the Company to indemnify the officer or director.

| | | | | | | | | | | |

Exhibit

Number | | Description | |

| | |

| 2.1 | | Stock Purchase Agreement, dated as of November 1, 2023, by and among Forum Energy Technologies, Inc., Forum Canada ULC, Variperm Holdings Ltd., Variperm Energy Services Partnership, Jamie Olson, Elise Robertson, Slotting RemainCo Limited Partnership and Variperm Energy Services Partnership as the Sellers’ Representative (incorporated herein by reference to Exhibit 2.1 on the Company’s Current Report on Form 8-K, filed on November 3, 2023) (File No. 1-35504). | |

| | | |

| 4.1 | | | |

| | |

| 4.2 | | | |

| | |

| 4.3 | | | |

| | |

| 4.4 | | | |

| | | |

| 4.5 | | | |

| | |

| 5.1** | | | |

| | |

| 23.1** | | | |

| | | |

| 23.2** | | | |

| | | |

| 23.3** | | Consent of Gibson, Dunn & Crutcher LLP (included in Exhibit 5.1). | |

| | |

| 24.1* | | Power of Attorney (included on the signature page of the initial filing of this Registration Statement). | |

| | | |

| 107* | | | |

________________

* Previously filed.

** Filed herewith.

(a)The undersigned registrant hereby undertakes:

(1)To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii)To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

(iii)To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2)That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4)That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i)Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii)Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which the prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5)That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the

underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii)Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii)The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv)Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b)The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Houston, State of Texas, on June 11, 2024.

| | | | | | | | |

| | |

| FORUM ENERGY TECHNOLOGIES, INC. |

| |

| By: | | /s/ Neal A. Lux |

| Name: | | Neal A. Lux |

| Title: | | President and Chief Executive Officer |

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities held on June 11, 2024.

| | | | | | | | |

| Signature | | Title |

| | |

| * | | President and Chief Executive Officer |

| Neal A. Lux | | (principal executive officer) |

| | |

| * | | Executive Vice President and Chief Financial Officer |

| D. Lyle Williams, Jr. | | (principal financial officer) |

| | |

| * | | Senior Vice President and Chief Accounting Officer |

| Katherine C. Keller | | (principal accounting officer) |

| | |

| * | | Chairman of the Board |

| C. Cristopher Gaut | | |

| | |

| * | | Director |

| Evelyn M. Angelle | | |

| | |

| * | | Director |

| Leslie A. Beyer | | |

| | |

| * | | Director |

| John A. Carrig | | |

| | |

| * | | Director |

| Michael McShane | | |

| | |

| * | | Director |

| Louis A. Raspino | | |

| | |

| * | | Director |

| Paul E. Rowsey III | | |

| | |

*By: /s/ John C. Ivascu |

John C. Ivascu Attorney-in-fact |

Exhibit 5.1

Gibson, Dunn & Crutcher LLP

811 Main Street

Houston, TX 77002-6117

Tel 346.718.6600

gibsondunn.com

June 11, 2024

Forum Energy Technologies, Inc.

10344 Sam Houston Park Drive, Suite 300

Houston, Texas 77064

Re: Forum Energy Technologies, Inc.

Registration Statement on Form S-3

Ladies and Gentlemen:

We have acted as counsel to Forum Energy Technologies, Inc., a Delaware corporation (the “Company”), in connection with the preparation and filing with the U.S. Securities and Exchange Commission (the “Commission”) of a Registration Statement on Form S-3 (the “Registration Statement”) under the Securities Act of 1933, as amended (the “Securities Act”), relating to the registration under the Securities Act of the proposed offering and sale from time to time pursuant to Rule 415 under the Securities Act by the selling stockholders named therein, together or separately, of up to 1,946,038 shares (the “Shares”) of the Company’s common stock, par value $0.01 per share.

In arriving at the opinion expressed below, we have examined originals, or copies certified or otherwise identified to our satisfaction as being true and complete copies of the originals, of such documents, corporate records, certificates of officers of the Company and of public officials and other instruments as we have deemed necessary or advisable to enable us to render the opinion expressed below. In our examination, we have assumed, without independent investigation, the genuineness of all signatures, the legal capacity and competency of all natural persons, the authenticity of all documents submitted to us as originals and the conformity to original documents of all documents submitted to us as copies. As to any facts material to this opinion, we have relied to the extent we deemed appropriate and without independent investigation upon statements and representations of officers and other representatives of the Company and others.

Based upon the foregoing, and subject to the assumptions, exceptions, qualifications and limitations set forth herein, we are of the opinion that the Shares are validly issued, fully paid and non-assessable.

We render no opinion herein as to matters involving the laws of any jurisdiction other than the Delaware General Corporation Law. We are not admitted to practice in the State of Delaware; however, we are generally familiar with the Delaware General Corporation Law as currently in effect and have made such inquiries as we consider necessary to render this

Abu Dhabi – Beijing – Brussels – Century City – Dallas – Denver – Dubai – Frankfurt – Hong Kong – Houston – London – Los Angeles Munich – New York – Orange County – Palo Alto – Paris – Riyadh – San Francisco – Singapore – Washington, D.C.

Forum Energy Technologies, Inc.

June 11, 2024

Page 2

opinion. This opinion is limited to the effect of the current state of the laws of the State of Delaware, to the limited extent set forth above, and the facts as they currently exist. We assume no obligation to revise or supplement this opinion in the event of future changes in such laws or the interpretations thereof or such facts.

We consent to the filing of this opinion as an exhibit to the Registration Statement, and we further consent to the use of our name under the caption “Legal Matters” in the Registration Statement and the prospectus that forms a part thereof. In giving these consents, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission promulgated thereunder.

Very truly yours,

/s/ Gibson, Dunn & Crutcher LLP

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement on Form S-3 of our reports dated March 5, 2024 (May 8, 2024 as to the reclassification of segment information as described in Note 17) relating to the consolidated financial statements of Forum Energy Technologies, Inc. and the effectiveness of Forum Energy Technologies, Inc.’s internal control over financial reporting, appearing in the Annual Report on Form 10-K of Forum Energy Technologies, Inc. for the year ended December 31, 2023. We also consent to the reference to us under the heading "Experts" in such Registration Statement.

/s/ Deloitte & Touche LLP

Houston, Texas

June 11, 2024

CONSENT OF INDEPENDENT AUDITORS

We consent to the incorporation by reference in this Registration Statement No. 333-278284 on Form S-3 of our report dated June 6, 2024, relating to the financial statements of Variperm Holdings Ltd. appearing in the Current Report on Form 8-K of Forum Energy Technologies, Inc. dated June 10, 2024. We also consent to the reference to us under the heading “Experts” in such Registration Statement.

/s/ Deloitte LLP

Chartered Professional Accountants

Calgary, Canada

June 11, 2024

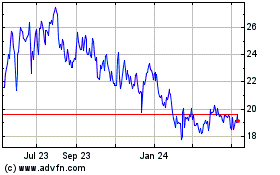

Forum Energy Technologies (NYSE:FET)

Historical Stock Chart

From Nov 2024 to Dec 2024

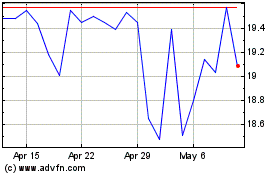

Forum Energy Technologies (NYSE:FET)

Historical Stock Chart

From Dec 2023 to Dec 2024