PFD and PFO Announce New Regular Monthly Dividend Rate

July 20 2017 - 5:34PM

Business Wire

The Boards of Directors of Flaherty & Crumrine Preferred

Income Fund Incorporated (NYSE: PFD) and Flaherty &

Crumrine Preferred Income Opportunity Fund Incorporated (NYSE:

PFO) today announced new regular monthly dividends beginning in

August 2017.

The regular monthly dividend rate for PFD will be $0.082 per

share, which equates to an annual dividend of $0.984 per share.

This new monthly dividend represents a decrease of approximately

6.8% from the prior monthly dividend.

The regular monthly dividend rate for PFO will be $0.069 per

share, which equates to an annual dividend of $0.828 per share.

This new monthly dividend represents a decrease of approximately

5.5% from the prior monthly dividend.

R. Eric Chadwick, Chairman of the Board of each Fund, said “The

combination of increases in short-term interest rates and lower

portfolio income has led us to reduce dividend rates. Each Fund’s

common stock dividend continues to be enhanced by leverage, but

leverage expense has risen steadily with Fed rate hikes to a rate

of 2.2% today. At the same time, preferred-security yields have

moved significantly lower as global interest rates have remained

low and credit spreads have narrowed. Total returns on net asset

values have been excellent in recent years, but a consequence of

strong price performance is lower reinvestment yields for preferred

securities. Accordingly, we have reduced dividends to better

reflect the net income available for distribution to common stock

shareholders.”

The August monthly dividend will be paid on August 31, 2017 to

holders of record of each fund’s common stock on August 24, 2017.

The expected ex-dividend date is August 22, 2017. The tax breakdown

of all 2017 distributions will be available early next year, but at

this point the funds anticipate that all dividends paid in 2017

will consist of income earned by the fund and not contain capital

gains or returns of capital.

Past performance is not indicative of future performance. To the

extent any portion of the distribution is estimated to be sourced

from something other than income, such as return of capital, the

source would be disclosed on a Section 19(a)-1 letter located under

the “SEC Filings and News” section of the funds’ website,

www.preferredincome.com. A distribution rate that is largely

comprised of sources other than income may not be reflective of a

fund’s performance.

PFD was organized in 1991 and PFO was organized in 1992 as

closed-end funds which invest primarily in preferred securities.

Each Fund’s investment objective for holders of its common stock is

high current income consistent with preservation of capital. PFD

and PFO are managed by Flaherty & Crumrine Incorporated, an

independent investment adviser which was founded in 1983 to

specialize in the management of portfolios of preferred and related

securities. Flaherty & Crumrine also manages three other U.S.

closed-end funds: Flaherty & Crumrine Preferred Securities

Income Fund (NYSE: FFC); Flaherty & Crumrine Total Return Fund

(NYSE: FLC); and Flaherty & Crumrine Dynamic Preferred and

Income Fund (NYSE: DFP).

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170720006379/en/

PRESS AND ANALYST INQUIRIES:Flaherty & Crumrine

IncorporatedChad Conwell, 626-795-7300Pasadena, CaliforniaWebsite:

www.preferredincome.com

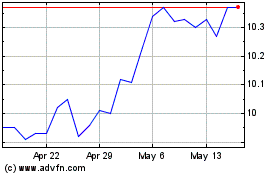

Flaherty & Crumrine Pref... (NYSE:PFD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Flaherty & Crumrine Pref... (NYSE:PFD)

Historical Stock Chart

From Nov 2023 to Nov 2024