Certified Semi-annual Shareholder Report for Management Investment Companies (n-csrs)

July 01 2021 - 1:54PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22795

First Trust Intermediate Duration

Preferred & Income Fund

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

registrant’s telephone number, including

area code: 630-765-8000

Date of fiscal year end: October 31

Date of reporting period: April 30,

2021

Form N-CSR is to be used by management

investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that

is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission

may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the

information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to

the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB")

control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing

the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection

of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

|

(a)

|

|

The Report to Shareholders is attached herewith.

|

First Trust

Intermediate

Duration Preferred & Income Fund (FPF)

Semi-Annual

Report

For the Six

Months Ended

April 30,

2021

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

Semi-Annual Report

April 30, 2021

|

1

|

|

2

|

|

4

|

|

6

|

|

16

|

|

17

|

|

18

|

|

19

|

|

20

|

|

21

|

|

29

|

Caution Regarding

Forward-Looking Statements

This report contains

certain forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding the goals,

beliefs, plans or current expectations of First Trust Advisors L.P. (“First Trust” or the “Advisor”) and/or Stonebridge Advisors LLC (“Stonebridge” or the “Sub-Advisor”)

and their respective representatives, taking into account the information currently available to them. Forward-looking statements include all statements that do not relate solely to current or historical fact. For

example, forward-looking statements include the use of words such as “anticipate,” “estimate,” “intend,” “expect,” “believe,” “plan,”

“may,” “should,” “would” or other words that convey uncertainty of future events or outcomes.

Forward-looking

statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of First Trust Intermediate Duration Preferred & Income Fund (the

“Fund”) to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. When evaluating the information included in this report, you

are cautioned not to place undue reliance on these forward-looking statements, which reflect the judgment of the Advisor and/or Sub-Advisor and their respective representatives only as of the date hereof. We undertake

no obligation to publicly revise or update these forward-looking statements to reflect events and circumstances that arise after the date hereof.

Performance and Risk

Disclosure

There is no assurance

that the Fund will achieve its investment objectives. The Fund is subject to market risk, which is the possibility that the market values of securities owned by the Fund will decline and that the value of the

Fund’s shares may therefore be less than what you paid for them. Accordingly, you can lose money by investing in the Fund. See “Principal Risks” in the Additional Information section of this report

for a discussion of certain other risks of investing in the Fund.

Performance data quoted

represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.ftportfolios.com or speak with your financial advisor. Investment returns, net asset value and common share price will fluctuate and Fund shares, when sold,

may be worth more or less than their original cost.

The Advisor may also

periodically provide additional information on Fund performance on the Fund’s web page at www.ftportfolios.com.

How to Read This

Report

This report contains

information that may help you evaluate your investment in the Fund. It includes details about the Fund and presents data and analysis that provide insight into the Fund’s performance and investment approach.

By reading the portfolio

commentary by the portfolio management team of the Fund, you may obtain an understanding of how the market environment affected the Fund’s performance. The statistical information that follows may help you

understand the Fund’s performance compared to that of relevant market benchmarks.

It is important to keep

in mind that the opinions expressed by personnel of First Trust and Stonebridge are just that: informed opinions. They should not be considered to be promises or advice. The opinions, like the statistics, cover the

period through the date on the cover of this report. The material risks of investing in the Fund are spelled out in the prospectus, the statement of additional information, this report and other Fund regulatory

filings.

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

Semi-Annual Letter from the Chairman

and CEO

April 30, 2021

Dear Shareholders,

First Trust is pleased

to provide you with the semi-annual report for the First Trust Intermediate Duration Preferred & Income Fund (the “Fund”), which contains detailed information about the Fund for the six months ended

April 30, 2021.

I would like to begin my

remarks by saying that this is a time for all of us to be thankful. It is astounding to me that our scientists and extended health care community successfully discovered, developed, and distributed multiple effective

vaccines to treat the coronavirus (“COVID-19”) in the span of just 15 months. Suffice it to say that we are witnessing history in the making. We even received some good news recently with respect to

wearing masks in public, a polarizing act for many politicians and Americans. The Centers for Disease Control and Prevention released a new set of guidelines in mid-May for those individuals who have been fully

vaccinated. It essentially says fully vaccinated Americans can quit wearing their masks outdoors (even in crowds), in most indoor settings, and can drop social distancing altogether. This is a big step towards

expediting the reopening of the U.S. economy.

For those who may not

know, we subscribe to the buy-and-hold philosophy of investing here at First Trust Advisors L.P., even though it means enduring lots of tough times. While the notion of being able to time the market is seductive on

its face, very few investors are skilled enough to make it work over time. I can think of no better example than the COVID-19 pandemic. The degree of uncertainty surrounding the onset of the virus alone was enough to

make the average investor want to run for cover. And if that was not enough, the 33.8% plunge in the S&P 500® Index (the “Index”) from February 19, 2020, through March 23, 2020 (23 trading days) was a real gut check

for most of us. But a funny thing happened on the way to another potential collapse of the market − it did not happen. In fact, thanks to the U.S. Federal government stepping up with trillions of dollars of

timely fiscal and monetary support, the stock market roared. From March 23, 2020 through May 14, 2021, the Index posted a total return of 90.14%, according to Bloomberg. What a shame for those investors who may have

moved some, or all, of their capital out of equities. What looked like a great time to de-risk turned out to be just the opposite.

The overall climate for

investing looks bright for a few reasons. First, U.S. real gross domestic product (“GDP”) growth is expected to grow by 6.4% year-over-year in 2021, according to the International Monetary Fund. The last

time the U.S. economy grew that fast was in 1984, when real GDP growth reached 7.2%. Second, corporate earnings are expected to recover from their 2020 slide. Bloomberg’s consensus year-over-year earnings growth

rate estimates for the Index for 2021 and 2022 were 33.17% and 12.87%, respectively, as of May 14, 2021. That is a significant rebound from the 12.44% decline in earnings in 2020. Third, inflation is rising, and that

is exactly what the Federal Reserve has been wanting for some time. Central banks around the world have spent years battling deflationary pressures, so a little bit of inflation is welcome at this stage of the

recovery. Lastly, the U.S. labor market is robust despite the talk about the millions of people who lost their jobs in the COVID-19 pandemic and are living off unemployment benefits. As of March 31, 2021, there were

8.12 million job openings in the U.S., the highest total since record-keeping began in December 2000, according to the Bureau of Labor Statistics. We need to get people back to work.

While it seems

fashionable to sell fear these days, we choose to follow the data. Remember, the Index has never failed to fully recoup the losses sustained in a market correction or bear market. Stay the course!

Thank you for giving

First Trust the opportunity to play a role in your financial future. We value our relationship with you and will report on the Fund again in six months.

Sincerely,

James A. Bowen

Chairman of the Board of Trustees

Chief Executive Officer of First Trust

Advisors L.P.

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

“AT A GLANCE”

As of April 30, 2021

(Unaudited)

|

Fund Statistics

|

|

|

Symbol on New York Stock Exchange

|

FPF

|

|

Common Share Price

|

$24.73

|

|

Common Share Net Asset Value (“NAV”)

|

$24.61

|

|

Premium (Discount) to NAV

|

0.49%

|

|

Net Assets Applicable to Common Shares

|

$1,495,313,156

|

|

Current Distribution per Common Share(1)

|

$0.1275

|

|

Current Annualized Distribution per Common Share

|

$1.5300

|

|

Current Distribution Rate on Common Share Price(2)

|

6.19%

|

|

Current Distribution Rate on NAV(2)

|

6.22%

|

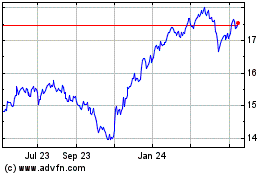

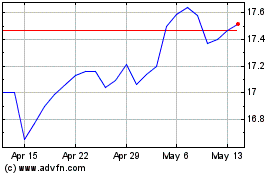

Common Share Price & NAV (weekly closing price)

|

Performance

|

|

|

|

|

|

|

|

|

Average Annual

Total Returns

|

|

|

6 Months

Ended

4/30/21

|

1 Year

Ended

4/30/21

|

5 Years

Ended

4/30/21

|

Inception

(5/23/13)

to 4/30/21

|

|

Fund Performance(3)

|

|

|

|

|

|

NAV

|

12.21%

|

27.38%

|

9.48%

|

8.70%

|

|

Market Value

|

18.51%

|

29.43%

|

9.53%

|

8.15%

|

|

Index Performance

|

|

|

|

|

|

ICE BofA Fixed Rate Preferred Securities Index

|

4.38%

|

10.65%

|

5.92%

|

5.81%

|

|

ICE BofA U.S. Capital Securities Index

|

3.78%

|

12.24%

|

6.83%

|

5.86%

|

|

Blended Index(4)

|

4.09%

|

11.46%

|

6.39%

|

5.86%

|

|

(1)

|

Most recent distribution paid or declared through 4/30/2021. Subject to change in the future.

|

|

(2)

|

Distribution rates are calculated by annualizing the most recent distribution paid or declared through the report date and then dividing by Common Share Price or NAV, as applicable, as of 4/30/2021.

Subject to change in the future.

|

|

(3)

|

Total return is based on the combination of reinvested dividend, capital gain, and return of capital distributions, if any, at prices obtained by the Dividend Reinvestment Plan and changes in NAV per

share for NAV returns and changes in Common Share Price for market value returns. Total returns do not reflect sales load and are not annualized for periods of less than one year. Past performance is not indicative of

future results.

|

|

(4)

|

The Blended Index consists of the following: ICE BofA Fixed Rate Preferred Securities Index (50%) and ICE BofA U.S. Capital Securities Index (50%). The Blended Index was added to reflect the diverse

allocation of institutional preferred and hybrid securities in the Fund’s Portfolio. The indexes do not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the

performance shown. Indexes are unmanaged and an investor cannot invest directly in an index. The Blended Index returns are calculated by using the monthly return of the two indices during each period shown above. At

the beginning of each month the two indices are rebalanced to a 50-50 ratio to account for divergence from that ratio that occurred during the course of each month. The monthly returns are then compounded for each

period shown above, giving the performance for the Blended Index for each period shown above.

|

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

“AT A GLANCE”

(Continued)

As of April 30, 2021

(Unaudited)

|

Industry Classification

|

% of Total

Investments

|

|

Banks

|

41.0%

|

|

Insurance

|

17.3

|

|

Capital Markets

|

8.9

|

|

Oil, Gas & Consumable Fuels

|

6.9

|

|

Food Products

|

5.0

|

|

Electric Utilities

|

4.7

|

|

Trading Companies & Distributors

|

2.7

|

|

Diversified Financial Services

|

2.5

|

|

Multi-Utilities

|

2.4

|

|

Diversified Telecommunication Services

|

2.1

|

|

Energy Equipment & Services

|

1.2

|

|

Transportation Infrastructure

|

1.2

|

|

Mortgage Real Estate Investment Trusts

|

1.1

|

|

Real Estate Management & Development

|

0.7

|

|

Gas Utilities

|

0.6

|

|

Equity Real Estate Investment Trusts

|

0.6

|

|

Wireless Telecommunication Services

|

0.4

|

|

Independent Power & Renewable Electricity Producers

|

0.4

|

|

Thrifts & Mortgage Finance

|

0.3

|

|

Total

|

100.0%

|

|

Top Ten Holdings

|

% of Total

Investments

|

|

Emera, Inc., Series 16-A

|

2.5%

|

|

AerCap Holdings N.V.

|

2.0

|

|

Barclays PLC

|

1.8

|

|

Credit Agricole S.A.

|

1.7

|

|

Land O’Lakes, Inc.

|

1.7

|

|

Wells Fargo & Co., Series L

|

1.6

|

|

Credit Suisse Group AG

|

1.4

|

|

Enbridge, Inc.

|

1.4

|

|

Societe Generale S.A.

|

1.4

|

|

Nordea Bank Abp

|

1.3

|

|

Total

|

16.8%

|

|

Credit Quality(5)

|

% of Total

Fixed-Income

Investments

|

|

A

|

0.4%

|

|

A-

|

0.3

|

|

BBB+

|

11.5

|

|

BBB

|

23.0

|

|

BBB-

|

23.8

|

|

BB+

|

24.5

|

|

BB

|

7.8

|

|

BB-

|

2.5

|

|

B+

|

1.3

|

|

B

|

0.6

|

|

Not Rated

|

4.3

|

|

Total

|

100.0%

|

|

Fund Allocation

|

% of Net Assets

|

|

Capital Preferred Securities

|

103.1%

|

|

$25 Par Preferred Securities

|

28.8

|

|

$100 Par Preferred Securities

|

3.9

|

|

$1,000 Par Preferred Securities

|

3.7

|

|

Foreign Corporate Bonds and Notes

|

1.3

|

|

$1,000,000 Par Preferred Securities

|

1.1

|

|

Corporate Bonds and Notes

|

0.5

|

|

Reverse Repurchase Agreements

|

(6.7)

|

|

Outstanding Loans

|

(37.3)

|

|

Net Other Assets and Liabilities(6)

|

1.6

|

|

Total

|

100.0%

|

|

(5)

|

The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including Standard &

Poor’s Ratings Group, a division of the McGraw Hill Companies, Inc., Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one

NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings

shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

|

(6)

|

Includes swap contracts.

|

Portfolio Commentary

First Trust Intermediate

Duration Preferred & Income Fund (FPF)

Semi-Annual Report

April 30, 2021

(Unaudited)

Advisor

First Trust Advisors L.P.

(“First Trust” or the “Advisor”) serves as the investment advisor to the First Trust Intermediate Duration Preferred & Income Fund (the “Fund”). First Trust is responsible for

the ongoing monitoring of the Fund’s investment portfolio, managing the Fund’s business affairs and providing certain administrative services necessary for the management of the Fund.

Sub-Advisor

Stonebridge Advisors LLC

(“Stonebridge” or the “Sub-Advisor”) is the sub-advisor to the Fund and is a registered investment advisor based in Wilton, Connecticut. Stonebridge specializes in the management of preferred

and hybrid securities.

Stonebridge Advisors LLC

Portfolio Management Team

Scott T. Fleming –

Chief Executive Officer and President

Robert Wolf – Chief

Investment Officer, Senior Vice President and Senior Portfolio Manager

Eric Weaver – Senior

Vice President, Chief Strategist and Portfolio Manager

Commentary

Market Recap

The six-month period

ended April 30, 2021 was positive for the preferred and hybrid securities market across all market segments due to the global rollout of multiple coronavirus (“COVID-19”) vaccines and the subsequent

economic recovery. These developments, along with continued monetary policy support and additional fiscal stimulus measures, led to increased inflation expectations and the steepening of the US Treasury curve. Spreads

tightened across the preferred and hybrid securities market and higher beta securities outperformed as yields compressed between non-investment grade (“non-IG”) and investment grade (“IG”)

securities. The move higher in longer term rates weighed on longer duration securities within the preferred and hybrid securities market during the latter part of the period, but this was more than offset by income

and yield spread tightening. Also, positive fund flows and an uptick in redemptions helped to support secondary prices during the period. For the fiscal year to date, non-IG institutional securities were the top

performing segment of the preferred and hybrid securities market, returning 9.72%. European bank contingent convertible capital securities (“CoCos”), which are a subset of the institutional market, were

the second best performing segment, returning 6.70%, while the exchange-traded $25 par retail market and IG institutional market both performed similarly, returning 4.75% and 4.72%, respectively, during the period.

Performance Analysis

For the six-month period

ended April 30, 2021, the Fund produced a total return of 18.51% based on market price and 12.21% based on net asset value (“NAV”), outperforming the return of the Fund’s benchmark, which is a 50/50

blend of the ICE BofA Fixed Rate Preferred Securities Index (“P0P1”) and the ICE BofA U.S. Capital Securities Index (“C0CS”), of 4.09%. During the period, leverage as a percentage of total

adjusted net assets for the Fund remained fairly steady, ending the period at 30.56% and contributing approximately 3.97% to Fund performance. The Fund also employed an interest rate swap hedging strategy which

benefited from the rising interest rate environment and resulted in a 0.09% contribution to Fund performance.

The announcement of

multiple viable COVID-19 vaccines and the associated improvement in economic growth expectations contributed to the outperformance of non-IG securities during the period. In particular, the Fund benefited from its

exposure to U.S. pipelines and aircraft lessors, which both returned over 30% during the six-month period ended April 30, 2021. These were high conviction holdings in the Fund due to their strong credit fundamentals

and valuations entering the period. Stonebridge continues to believe that these industries have the potential for further upside given current valuations.

Another market segment

that benefited from the re-opening trade, as well as from the BREXIT deal that was signed between the United Kingdom and the European Union late in the fourth quarter of 2020, was non-U.S. bank additional tier-1

CoCos. These holdings returned nearly 7.5% for the Fund during the period, with outperformance within the United Kingdom, Spanish, Italian and Mexican banks in particular. Furthermore, when the interest rate curve

steepened significantly during the first quarter of 2021, these securities managed to outperform due to their low duration profile, variable rate structures and relatively wide spreads. Non-U.S. bank issuers largely

beat earnings expectations during the period, increasing capital cushions while still providing attractive income and rate protection for the Fund.

The Fund continues to

actively manage its exposure to $25 par retail securities, which were a significant contributor to the outperformance during the period. The Fund’s retail holdings returned over 8.80% during the period, led by

issuers benefiting from the re-opening economy within pipelines and real estate investment trusts, as well as from actively trading and taking advantage of pricing

Portfolio Commentary (Continued)

First Trust Intermediate

Duration Preferred & Income Fund (FPF)

Semi-Annual Report

April 30, 2021

(Unaudited)

dislocations. We

continue to believe that the retail market presents attractive relative valuation opportunities for the Fund, as prices tend to overshoot to the upside and downside depending on fund flows within the large, passive

exchange-traded funds that dominate that market.

Other areas of

outperformance for the Fund during the same period included newly issued securities and floaters. Due to security selection, the Fund managed to outperform the benchmark by 2.5% within securities issued in the fourth

quarter of 2020 and by 2.7% in securities issued in the first quarter of 2021. This continues to be an area of significant alpha generation for the Fund. Also, the Fund’s allocation to floating rate securities,

which are not held in the benchmark, benefited from the increase in Treasury yields as well as spread tightening during the period. Overall, this was a very strong period for the Fund and there were no notable areas

of relative underperformance.

Market and Fund Outlook

With the recent rise in

interest rates, we believe active management has been beneficial to investors and will continue to have an important role in portfolio positioning and Fund performance for the remainder of the year. Increased fiscal

and monetary support, both in the U.S. and globally, may speed up the economic recovery, which should continue to support credit spread tightening in the preferred and hybrid securities market. It may also lead to a

further rise in rates, and as a result, we believe that actively managing portfolios, including positioning in a higher percentage of variable-rate securities, will be advantageous. We favor securities on the 2-5-year

part of the curve and have increased weightings in high reset variable-rate securities, while avoiding weaker reset structures on the front-end of the curve and low coupon fixed-rate securities. We also believe that

the market will likely find technical support from investor inflows and limited net new supply as refinancing continues. Attractive valuations, combined with high yields and strong issuer credit fundamentals, will

likely drive outperformance of preferred and hybrid securities compared to other fixed-income asset classes in the coming months, in our opinion.

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

Portfolio of Investments

April 30, 2021

(Unaudited)

|

Shares

|

|

Description

|

|

Stated

Rate

|

|

Stated

Maturity

|

|

Value

|

|

$25 PAR PREFERRED SECURITIES – 28.8%

|

|

|

|

Banks – 5.6%

|

|

|

|

|

|

|

|

1,008

|

|

Atlantic Union Bankshares Corp., Series A

|

|

6.88%

|

|

(a)

|

|

$27,861

|

|

117,167

|

|

Bank of America Corp., Series LL

|

|

5.00%

|

|

(a)

|

|

3,193,973

|

|

426,080

|

|

Bank of America Corp., Series NN (b)

|

|

4.38%

|

|

(a)

|

|

10,818,171

|

|

334,484

|

|

Fifth Third Bancorp, Series A (b)

|

|

6.00%

|

|

(a)

|

|

8,897,274

|

|

56,961

|

|

First Midwest Bancorp, Inc., Series A (b)

|

|

7.00%

|

|

(a)

|

|

1,617,123

|

|

52,456

|

|

Fulton Financial Corp., Series A

|

|

5.13%

|

|

(a)

|

|

1,355,463

|

|

737,441

|

|

GMAC Capital Trust I, Series 2, 3 Mo. LIBOR + 5.79% (b) (c) (d)

|

|

5.98%

|

|

02/15/40

|

|

18,907,987

|

|

272,168

|

|

Pinnacle Financial Partners, Inc., Series B (b)

|

|

6.75%

|

|

(a)

|

|

7,541,775

|

|

1,285

|

|

Regions Financial Corp., Series A

|

|

6.38%

|

|

(a)

|

|

32,601

|

|

183,456

|

|

Regions Financial Corp., Series E

|

|

4.45%

|

|

(a)

|

|

4,531,363

|

|

438,536

|

|

Signature Bank, Series A

|

|

5.00%

|

|

(a)

|

|

11,248,449

|

|

57,102

|

|

Truist Financial Corp., Series R

|

|

4.75%

|

|

(a)

|

|

1,514,345

|

|

205,000

|

|

WesBanco, Inc., Series A (b) (e)

|

|

6.75%

|

|

(a)

|

|

5,885,550

|

|

278,658

|

|

Wintrust Financial Corp., Series E (b) (e)

|

|

6.88%

|

|

(a)

|

|

7,768,985

|

|

|

|

|

|

83,340,920

|

|

|

|

Capital Markets – 1.1%

|

|

|

|

|

|

|

|

103,953

|

|

Affiliated Managers Group, Inc. (c)

|

|

4.75%

|

|

09/30/60

|

|

2,664,315

|

|

196,334

|

|

Apollo Global Management, Inc., Series B (b)

|

|

6.38%

|

|

(a)

|

|

5,269,605

|

|

6,245

|

|

Brightsphere Investment Group, Inc.

|

|

5.13%

|

|

08/01/31

|

|

157,874

|

|

269,834

|

|

KKR Group Finance Co., IX LLC

|

|

4.63%

|

|

04/01/61

|

|

6,946,876

|

|

48,026

|

|

Legg Mason, Inc. (c)

|

|

5.45%

|

|

09/15/56

|

|

1,221,301

|

|

34,927

|

|

Oaktree Capital Group LLC, Series A (c)

|

|

6.63%

|

|

(a)

|

|

936,044

|

|

|

|

|

|

17,196,015

|

|

|

|

Diversified Financial Services – 0.9%

|

|

|

|

|

|

|

|

508,291

|

|

Equitable Holdings, Inc., Series A (b)

|

|

5.25%

|

|

(a)

|

|

13,256,229

|

|

|

|

Diversified Telecommunication Services – 1.3%

|

|

|

|

|

|

|

|

248,508

|

|

AT&T, Inc., Series C (b)

|

|

4.75%

|

|

(a)

|

|

6,319,558

|

|

292,505

|

|

Qwest Corp. (c)

|

|

6.50%

|

|

09/01/56

|

|

7,464,728

|

|

217,759

|

|

Qwest Corp. (b) (c)

|

|

6.75%

|

|

06/15/57

|

|

5,694,398

|

|

|

|

|

|

19,478,684

|

|

|

|

Electric Utilities – 1.9%

|

|

|

|

|

|

|

|

245,850

|

|

Brookfield BRP Holdings Canada, Inc.

|

|

4.63%

|

|

(a)

|

|

6,088,475

|

|

5,971

|

|

SCE Trust III, Series H (e)

|

|

5.75%

|

|

(a)

|

|

151,663

|

|

120,245

|

|

SCE Trust IV, Series J (e)

|

|

5.38%

|

|

(a)

|

|

3,018,150

|

|

51,468

|

|

SCE Trust V, Series K (e)

|

|

5.45%

|

|

(a)

|

|

1,312,949

|

|

165,546

|

|

Southern (The) Co. (c)

|

|

4.95%

|

|

01/30/80

|

|

4,396,902

|

|

541,750

|

|

Southern (The) Co., Series C (c)

|

|

4.20%

|

|

10/15/60

|

|

13,630,430

|

|

|

|

|

|

28,598,569

|

|

|

|

Equity Real Estate Investment Trusts – 0.8%

|

|

|

|

|

|

|

|

5,710

|

|

American Homes 4 Rent, Series D

|

|

6.50%

|

|

(a)

|

|

144,235

|

|

43,462

|

|

American Homes 4 Rent, Series E

|

|

6.35%

|

|

(a)

|

|

1,103,065

|

|

173,153

|

|

Global Net Lease, Inc., Series A (c)

|

|

7.25%

|

|

(a)

|

|

4,628,380

|

|

17,466

|

|

National Storage Affiliates Trust, Series A

|

|

6.00%

|

|

(a)

|

|

465,469

|

|

206,195

|

|

Vornado Realty Trust, Series N (b)

|

|

5.25%

|

|

(a)

|

|

5,482,725

|

|

|

|

|

|

11,823,874

|

|

|

|

Food Products – 1.9%

|

|

|

|

|

|

|

|

489,213

|

|

CHS, Inc., Series 2 (b) (e)

|

|

7.10%

|

|

(a)

|

|

13,472,926

|

|

546,059

|

|

CHS, Inc., Series 3 (b) (e)

|

|

6.75%

|

|

(a)

|

|

15,043,925

|

|

|

|

|

|

28,516,851

|

Page 6

See Notes to Financial Statements

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

Portfolio of Investments

(Continued)

April 30, 2021

(Unaudited)

|

Shares

|

|

Description

|

|

Stated

Rate

|

|

Stated

Maturity

|

|

Value

|

|

$25 PAR PREFERRED SECURITIES (Continued)

|

|

|

|

Gas Utilities – 0.4%

|

|

|

|

|

|

|

|

197,017

|

|

South Jersey Industries, Inc. (b) (c)

|

|

5.63%

|

|

09/16/79

|

|

$5,148,054

|

|

55,498

|

|

Spire, Inc., Series A (b)

|

|

5.90%

|

|

(a)

|

|

1,537,850

|

|

|

|

|

|

6,685,904

|

|

|

|

Independent Power & Renewable Electricity Producers – 0.3%

|

|

|

|

|

|

|

|

164,218

|

|

Brookfield Renewable Partners L.P., Series 17 (c)

|

|

5.25%

|

|

(a)

|

|

4,320,575

|

|

|

|

Insurance – 7.8%

|

|

|

|

|

|

|

|

501,024

|

|

Aegon Funding Co., LLC (b) (c)

|

|

5.10%

|

|

12/15/49

|

|

13,131,839

|

|

582,860

|

|

American Equity Investment Life Holding Co., Series A (b) (e)

|

|

5.95%

|

|

(a)

|

|

16,051,964

|

|

247,925

|

|

American Equity Investment Life Holding Co., Series B (b) (e)

|

|

6.63%

|

|

(a)

|

|

6,956,775

|

|

193,648

|

|

AmTrust Financial Services, Inc.

|

|

7.25%

|

|

06/15/55

|

|

4,298,986

|

|

210,480

|

|

AmTrust Financial Services, Inc.

|

|

7.50%

|

|

09/15/55

|

|

4,651,608

|

|

63,510

|

|

Aspen Insurance Holdings Ltd. (c)

|

|

5.63%

|

|

(a)

|

|

1,679,840

|

|

343,285

|

|

Aspen Insurance Holdings Ltd. (b)

|

|

5.63%

|

|

(a)

|

|

8,928,843

|

|

262,085

|

|

Assurant, Inc. (b)

|

|

5.25%

|

|

01/15/61

|

|

6,890,215

|

|

224,190

|

|

Athene Holding Ltd., Series A (b) (c) (e)

|

|

6.35%

|

|

(a)

|

|

6,396,141

|

|

107,962

|

|

Athene Holding Ltd., Series C (b) (e)

|

|

6.38%

|

|

(a)

|

|

3,040,210

|

|

81,045

|

|

Axis Capital Holdings Ltd., Series E (b)

|

|

5.50%

|

|

(a)

|

|

2,062,595

|

|

184,720

|

|

CNO Financial Group, Inc. (c)

|

|

5.13%

|

|

11/25/60

|

|

4,714,054

|

|

584,250

|

|

Delphi Financial Group, Inc., 3 Mo. LIBOR + 3.19% (d)

|

|

3.39%

|

|

05/15/37

|

|

12,561,375

|

|

15,993

|

|

Enstar Group Ltd., Series D (c) (e)

|

|

7.00%

|

|

(a)

|

|

460,758

|

|

178,741

|

|

Global Indemnity Group LLC (c)

|

|

7.88%

|

|

04/15/47

|

|

4,690,164

|

|

143,132

|

|

National General Holdings Corp., Series C

|

|

7.50%

|

|

(a)

|

|

3,624,102

|

|

193,528

|

|

Phoenix Cos. (The), Inc.

|

|

7.45%

|

|

01/15/32

|

|

3,273,042

|

|

408,795

|

|

Prudential Financial, Inc. (c)

|

|

4.13%

|

|

09/01/60

|

|

10,493,768

|

|

41,567

|

|

Selective Insurance Group, Inc., Series B

|

|

4.60%

|

|

(a)

|

|

1,039,591

|

|

87,092

|

|

W.R. Berkley Corp. (c)

|

|

5.10%

|

|

12/30/59

|

|

2,293,132

|

|

238

|

|

W.R. Berkley Corp.

|

|

4.25%

|

|

09/30/60

|

|

6,024

|

|

|

|

|

|

117,245,026

|

|

|

|

Mortgage Real Estate Investment Trusts – 0.5%

|

|

|

|

|

|

|

|

23,458

|

|

AGNC Investment Corp., Series C (c) (e)

|

|

7.00%

|

|

(a)

|

|

603,574

|

|

221,445

|

|

AGNC Investment Corp., Series F (c) (e)

|

|

6.13%

|

|

(a)

|

|

5,319,109

|

|

77,579

|

|

Annaly Capital Management, Inc., Series F (e)

|

|

6.95%

|

|

(a)

|

|

1,964,300

|

|

|

|

|

|

7,886,983

|

|

|

|

Multi-Utilities – 2.0%

|

|

|

|

|

|

|

|

91,851

|

|

Algonquin Power & Utilities Corp. (b) (c) (e)

|

|

6.88%

|

|

10/17/78

|

|

2,535,088

|

|

89,578

|

|

Algonquin Power & Utilities Corp., Series 19-A (c) (e)

|

|

6.20%

|

|

07/01/79

|

|

2,483,102

|

|

208,075

|

|

Brookfield Infrastructure Partners L.P., Series 13 (c)

|

|

5.13%

|

|

(a)

|

|

5,349,608

|

|

675,875

|

|

Integrys Holding, Inc. (c) (e)

|

|

6.00%

|

|

08/01/73

|

|

17,640,337

|

|

82,087

|

|

Sempra Energy

|

|

5.75%

|

|

07/01/79

|

|

2,247,542

|

|

|

|

|

|

30,255,677

|

|

|

|

Oil, Gas & Consumable Fuels – 1.5%

|

|

|

|

|

|

|

|

12,418

|

|

DCP Midstream L.P., Series C (e)

|

|

7.95%

|

|

(a)

|

|

301,757

|

|

35,235

|

|

Energy Transfer L.P., Series C (e)

|

|

7.38%

|

|

(a)

|

|

846,697

|

|

1,879

|

|

Energy Transfer L.P., Series D (e)

|

|

7.63%

|

|

(a)

|

|

45,585

|

|

537,695

|

|

Energy Transfer L.P., Series E (e)

|

|

7.60%

|

|

(a)

|

|

13,055,235

|

|

194,804

|

|

NuStar Energy L.P., Series A (e)

|

|

8.50%

|

|

(a)

|

|

4,593,478

|

|

135,233

|

|

NuStar Logistics L.P., 3 Mo. LIBOR + 6.73% (c) (d)

|

|

6.92%

|

|

01/15/43

|

|

3,269,934

|

|

|

|

|

|

22,112,686

|

See Notes to Financial Statements

Page 7

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

Portfolio of Investments

(Continued)

April 30, 2021

(Unaudited)

|

Shares

|

|

Description

|

|

Stated

Rate

|

|

Stated

Maturity

|

|

Value

|

|

$25 PAR PREFERRED SECURITIES (Continued)

|

|

|

|

Real Estate Management & Development – 1.0%

|

|

|

|

|

|

|

|

242,025

|

|

Brookfield Property Partners L.P., Series A (c)

|

|

5.75%

|

|

(a)

|

|

$5,735,992

|

|

360,341

|

|

Brookfield Property Partners L.P., Series A2 (b) (c)

|

|

6.38%

|

|

(a)

|

|

9,102,214

|

|

|

|

|

|

14,838,206

|

|

|

|

Thrifts & Mortgage Finance – 0.5%

|

|

|

|

|

|

|

|

257,280

|

|

New York Community Bancorp, Inc., Series A (b) (e)

|

|

6.38%

|

|

(a)

|

|

7,144,666

|

|

|

|

Trading Companies & Distributors – 0.7%

|

|

|

|

|

|

|

|

159,475

|

|

Air Lease Corp., Series A (b) (e)

|

|

6.15%

|

|

(a)

|

|

4,283,498

|

|

176,498

|

|

WESCO International, Inc., Series A (b) (e)

|

|

10.63%

|

|

(a)

|

|

5,602,047

|

|

|

|

|

|

9,885,545

|

|

|

|

Wireless Telecommunication Services – 0.6%

|

|

|

|

|

|

|

|

75,137

|

|

United States Cellular Corp. (c)

|

|

6.25%

|

|

09/01/69

|

|

1,991,130

|

|

258,451

|

|

United States Cellular Corp. (b)

|

|

5.50%

|

|

03/01/70

|

|

6,611,177

|

|

|

|

|

|

8,602,307

|

|

|

|

Total $25 Par Preferred Securities

|

|

431,188,717

|

|

|

|

(Cost $409,510,776)

|

|

|

|

|

|

|

|

$100 PAR PREFERRED SECURITIES – 3.9%

|

|

|

|

Banks – 3.6%

|

|

|

|

|

|

|

|

80,000

|

|

AgriBank FCB (e)

|

|

6.88%

|

|

(a)

|

|

8,740,000

|

|

179,000

|

|

CoBank ACB, Series F (b) (e)

|

|

6.25%

|

|

(a)

|

|

19,287,250

|

|

82,220

|

|

CoBank ACB, Series G (b)

|

|

6.13%

|

|

(a)

|

|

8,628,989

|

|

54,250

|

|

CoBank ACB, Series H (b) (e)

|

|

6.20%

|

|

(a)

|

|

5,859,000

|

|

102,000

|

|

Farm Credit Bank of Texas (b) (e) (f)

|

|

6.75%

|

|

(a)

|

|

11,220,000

|

|

|

|

|

|

53,735,239

|

|

|

|

Food Products – 0.3%

|

|

|

|

|

|

|

|

48,000

|

|

Dairy Farmers of America, Inc. (f)

|

|

7.88%

|

|

(a)

|

|

4,824,000

|

|

|

|

Total $100 Par Preferred Securities

|

|

58,559,239

|

|

|

|

(Cost $55,735,846)

|

|

|

|

|

|

|

|

$1,000 PAR PREFERRED SECURITIES – 3.7%

|

|

|

|

Banks – 2.8%

|

|

|

|

|

|

|

|

4,294

|

|

Bank of America Corp., Series L

|

|

7.25%

|

|

(a)

|

|

6,080,218

|

|

3,557

|

|

CoBank ACB, 3 Mo. LIBOR + 1.18% (d) (g)

|

|

1.37%

|

|

(a)

|

|

2,383,190

|

|

23,451

|

|

Wells Fargo & Co., Series L

|

|

7.50%

|

|

(a)

|

|

33,624,513

|

|

|

|

|

|

42,087,921

|

|

|

|

Diversified Financial Services – 0.9%

|

|

|

|

|

|

|

|

12,000

|

|

Compeer Financial ACA (b) (e) (f)

|

|

6.75%

|

|

(a)

|

|

12,960,000

|

|

|

|

Total $1,000 Par Preferred Securities

|

|

55,047,921

|

|

|

|

(Cost $52,127,213)

|

|

|

|

|

|

|

|

$1,000,000 PAR PREFERRED SECURITIES – 1.1%

|

|

|

|

Mortgage Real Estate Investment Trusts – 1.1%

|

|

|

|

|

|

|

|

12

|

|

FT Real Estate Securities Co., Inc. (g) (h) (i)

|

|

9.50%

|

|

(a)

|

|

16,270,572

|

|

|

|

(Cost $15,990,000)

|

|

|

|

|

|

|

Page 8

See Notes to Financial Statements

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

Portfolio of Investments

(Continued)

April 30, 2021

(Unaudited)

Par

Amount

|

|

Description

|

|

Stated

Rate

|

|

Stated

Maturity

|

|

Value

|

|

CAPITAL PREFERRED SECURITIES – 103.1%

|

|

|

|

Banks – 46.4%

|

|

|

|

|

|

|

|

$12,935,000

|

|

Australia & New Zealand Banking Group Ltd. (b) (e) (f) (j)

|

|

6.75%

|

|

(a)

|

|

$15,151,218

|

|

13,000,000

|

|

Banco Bilbao Vizcaya Argentaria S.A., Series 9 (b) (e) (j)

|

|

6.50%

|

|

(a)

|

|

14,250,600

|

|

5,000,000

|

|

Banco Mercantil del Norte S.A. (e) (f) (j)

|

|

7.50%

|

|

(a)

|

|

5,550,550

|

|

8,000,000

|

|

Banco Mercantil del Norte S.A. (e) (f) (j)

|

|

7.63%

|

|

(a)

|

|

8,885,720

|

|

7,400,000

|

|

Banco Mercantil del Norte S.A. (e) (f) (j)

|

|

8.38%

|

|

(a)

|

|

8,803,780

|

|

12,600,000

|

|

Banco Santander S.A. (e) (j) (k)

|

|

7.50%

|

|

(a)

|

|

13,930,875

|

|

7,400,000

|

|

Bank of America Corp., Series X (b) (e)

|

|

6.25%

|

|

(a)

|

|

8,255,625

|

|

10,300,000

|

|

Bank of Nova Scotia (The) (b) (e)

|

|

4.90%

|

|

(a)

|

|

11,084,860

|

|

40,000

|

|

Barclays Bank PLC (f)

|

|

10.18%

|

|

06/12/21

|

|

40,411

|

|

11,200,000

|

|

Barclays PLC (e) (j)

|

|

6.13%

|

|

(a)

|

|

12,399,184

|

|

12,460,000

|

|

Barclays PLC (e) (j)

|

|

7.75%

|

|

(a)

|

|

13,737,150

|

|

19,348,000

|

|

Barclays PLC (b) (e) (j) (k)

|

|

7.88%

|

|

(a)

|

|

20,351,677

|

|

33,000,000

|

|

Barclays PLC (b) (e) (j)

|

|

8.00%

|

|

(a)

|

|

37,475,625

|

|

8,550,000

|

|

BBVA Bancomer S.A. (c) (e) (f) (j)

|

|

5.88%

|

|

09/13/34

|

|

9,362,250

|

|

4,300,000

|

|

BNP Paribas S.A. (e) (f) (j)

|

|

7.38%

|

|

(a)

|

|

5,020,702

|

|

18,000,000

|

|

Citigroup, Inc. (b) (e)

|

|

3.88%

|

|

(a)

|

|

18,135,000

|

|

5,041,000

|

|

Citigroup, Inc. (b) (e)

|

|

5.90%

|

|

(a)

|

|

5,330,857

|

|

3,022,000

|

|

Citigroup, Inc. (e)

|

|

5.95%

|

|

(a)

|

|

3,195,765

|

|

6,437,000

|

|

Citigroup, Inc., Series D (e)

|

|

5.35%

|

|

(a)

|

|

6,662,295

|

|

8,600,000

|

|

Citigroup, Inc., Series P (b) (e)

|

|

5.95%

|

|

(a)

|

|

9,389,480

|

|

1,379,000

|

|

Citigroup, Inc., Series R, 3 Mo. LIBOR + 4.48% (d)

|

|

4.67%

|

|

(a)

|

|

1,380,724

|

|

7,486,000

|

|

Citigroup, Inc., Series W (b) (e)

|

|

4.00%

|

|

(a)

|

|

7,600,536

|

|

7,200,000

|

|

Citizens Financial Group, Inc., Series F (b) (e)

|

|

5.65%

|

|

(a)

|

|

7,983,000

|

|

25,000,000

|

|

CoBank ACB, Series I (b) (e)

|

|

6.25%

|

|

(a)

|

|

28,117,500

|

|

5,000,000

|

|

Comerica, Inc. (b) (e)

|

|

5.63%

|

|

(a)

|

|

5,568,750

|

|

2,800,000

|

|

Commerzbank AG (e) (j) (k)

|

|

7.00%

|

|

(a)

|

|

3,024,101

|

|

20,000,000

|

|

Credit Agricole S.A. (b) (e) (f) (j)

|

|

6.88%

|

|

(a)

|

|

22,347,700

|

|

6,600,000

|

|

Credit Agricole S.A. (b) (e) (f) (j)

|

|

7.88%

|

|

(a)

|

|

7,474,500

|

|

29,240,000

|

|

Credit Agricole S.A. (b) (e) (f) (j)

|

|

8.13%

|

|

(a)

|

|

35,515,489

|

|

9,080,000

|

|

Danske Bank A.S. (e) (j) (k)

|

|

6.13%

|

|

(a)

|

|

9,832,759

|

|

6,740,000

|

|

Danske Bank A.S. (e) (j) (k)

|

|

7.00%

|

|

(a)

|

|

7,641,980

|

|

3,450,000

|

|

Farm Credit Bank of Texas, Series 3 (b) (e) (f)

|

|

6.20%

|

|

(a)

|

|

3,721,688

|

|

7,500,000

|

|

Farm Credit Bank of Texas, Series 4 (b) (c) (e) (f)

|

|

5.70%

|

|

(a)

|

|

8,165,625

|

|

689,000

|

|

Fifth Third Bancorp, Series H (e)

|

|

5.10%

|

|

(a)

|

|

712,254

|

|

9,400,000

|

|

Fifth Third Bancorp, Series L (b) (e)

|

|

4.50%

|

|

(a)

|

|

10,046,250

|

|

3,300,000

|

|

HSBC Holdings PLC (e) (j)

|

|

4.60%

|

|

(a)

|

|

3,345,375

|

|

18,000,000

|

|

HSBC Holdings PLC (b) (e) (j)

|

|

6.38%

|

|

(a)

|

|

19,952,550

|

|

1,600,000

|

|

Huntington Bancshares, Inc., Series G (b) (e)

|

|

4.45%

|

|

(a)

|

|

1,714,800

|

|

14,092,000

|

|

ING Groep N.V. (e) (j)

|

|

5.75%

|

|

(a)

|

|

15,546,647

|

|

13,920,000

|

|

ING Groep N.V. (e) (j)

|

|

6.50%

|

|

(a)

|

|

15,529,848

|

|

6,000,000

|

|

ING Groep N.V. (b) (e) (j) (k)

|

|

6.88%

|

|

(a)

|

|

6,273,912

|

|

16,200,000

|

|

Intesa Sanpaolo S.p.A. (b) (e) (f) (j)

|

|

7.70%

|

|

(a)

|

|

18,468,000

|

|

6,806,000

|

|

JPMorgan Chase & Co., Series Q (e)

|

|

5.15%

|

|

(a)

|

|

7,027,195

|

|

2,667,000

|

|

JPMorgan Chase & Co., Series V, 3 Mo. LIBOR + 3.32% (d)

|

|

3.52%

|

|

(a)

|

|

2,673,668

|

|

13,045,000

|

|

Lloyds Banking Group PLC (b) (e) (j)

|

|

6.75%

|

|

(a)

|

|

14,874,105

|

|

21,213,000

|

|

Lloyds Banking Group PLC (b) (e) (j)

|

|

7.50%

|

|

(a)

|

|

24,015,025

|

|

2,900,000

|

|

Natwest Group PLC (e) (j)

|

|

6.00%

|

|

(a)

|

|

3,215,230

|

|

1,200,000

|

|

Natwest Group PLC (b) (e) (j)

|

|

8.00%

|

|

(a)

|

|

1,416,024

|

|

24,400,000

|

|

Nordea Bank Abp (b) (e) (f) (j)

|

|

6.63%

|

|

(a)

|

|

28,251,174

|

|

6,000,000

|

|

Regions Financial Corp., Series D (b) (e)

|

|

5.75%

|

|

(a)

|

|

6,705,000

|

|

8,000,000

|

|

Skandinaviska Enskilda Banken AB (e) (j) (k)

|

|

5.13%

|

|

(a)

|

|

8,523,000

|

|

1,200,000

|

|

Skandinaviska Enskilda Banken AB (e) (j) (k)

|

|

5.63%

|

|

(a)

|

|

1,243,500

|

|

27,900,000

|

|

Societe Generale S.A. (b) (e) (f) (j)

|

|

5.38%

|

|

(a)

|

|

29,085,750

|

|

4,200,000

|

|

Societe Generale S.A. (e) (f) (j)

|

|

7.38%

|

|

(a)

|

|

4,284,336

|

|

21,710,000

|

|

Societe Generale S.A. (b) (e) (f) (j)

|

|

7.88%

|

|

(a)

|

|

24,353,192

|

See Notes to Financial Statements

Page 9

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

Portfolio of Investments

(Continued)

April 30, 2021

(Unaudited)

Par

Amount

|

|

Description

|

|

Stated

Rate

|

|

Stated

Maturity

|

|

Value

|

|

CAPITAL PREFERRED SECURITIES (Continued)

|

|

|

|

Banks (Continued)

|

|

|

|

|

|

|

|

$1,300,000

|

|

Societe Generale S.A. (e) (f) (j)

|

|

8.00%

|

|

(a)

|

|

$1,534,566

|

|

9,400,000

|

|

Standard Chartered PLC (e) (f) (j)

|

|

6.00%

|

|

(a)

|

|

10,298,170

|

|

65,000

|

|

Standard Chartered PLC (e) (k)

|

|

7.01%

|

|

(a)

|

|

87,588

|

|

4,800,000

|

|

Swedbank AB, Series NC5 (e) (j) (k)

|

|

5.63%

|

|

(a)

|

|

5,190,000

|

|

2,779,000

|

|

Texas Capital Bancshares, Inc. (e)

|

|

4.00%

|

|

05/06/31

|

|

2,803,316

|

|

6,175,000

|

|

Truist Financial Corp., Series P (b) (e)

|

|

4.95%

|

|

(a)

|

|

6,807,937

|

|

21,201,000

|

|

UniCredit S.p.A. (b) (e) (j) (k)

|

|

8.00%

|

|

(a)

|

|

23,755,720

|

|

5,000,000

|

|

UniCredit S.p.A. (c) (e) (f)

|

|

5.46%

|

|

06/30/35

|

|

5,379,887

|

|

14,681,000

|

|

Wells Fargo & Co., Series BB (b) (e)

|

|

3.90%

|

|

(a)

|

|

15,019,030

|

|

|

|

|

|

693,521,025

|

|

|

|

Capital Markets – 11.6%

|

|

|

|

|

|

|

|

12,296,000

|

|

Apollo Management Holdings L.P. (b) (c) (e) (f)

|

|

4.95%

|

|

01/14/50

|

|

12,710,990

|

|

6,300,000

|

|

Bank of New York Mellon (The) Corp., Series G (b) (e)

|

|

4.70%

|

|

(a)

|

|

6,961,500

|

|

7,224,000

|

|

Charles Schwab (The) Corp., Series G (b) (e)

|

|

5.38%

|

|

(a)

|

|

8,050,426

|

|

21,590,000

|

|

Charles Schwab (The) Corp., Series I (b) (e)

|

|

4.00%

|

|

(a)

|

|

22,238,995

|

|

10,000,000

|

|

Credit Suisse Group AG (b) (e) (f) (j)

|

|

4.50%

|

|

(a)

|

|

9,575,000

|

|

11,200,000

|

|

Credit Suisse Group AG (e) (f) (j)

|

|

5.25%

|

|

(a)

|

|

11,662,000

|

|

16,800,000

|

|

Credit Suisse Group AG (b) (e) (f) (j)

|

|

6.38%

|

|

(a)

|

|

18,281,004

|

|

5,100,000

|

|

Credit Suisse Group AG (e) (f) (j)

|

|

7.25%

|

|

(a)

|

|

5,648,225

|

|

1,629,000

|

|

Credit Suisse Group AG (b) (e) (f) (j)

|

|

7.50%

|

|

(a)

|

|

1,795,973

|

|

28,250,000

|

|

Credit Suisse Group AG (b) (e) (f) (j)

|

|

7.50%

|

|

(a)

|

|

30,292,475

|

|

20,300,000

|

|

Goldman Sachs Group (The), Inc., Series Q (b) (e)

|

|

5.50%

|

|

(a)

|

|

22,228,500

|

|

300,000

|

|

Goldman Sachs Group (The), Inc., Series R (b) (e)

|

|

4.95%

|

|

(a)

|

|

323,265

|

|

4,680,000

|

|

Goldman Sachs Group (The), Inc., Series T (e)

|

|

3.80%

|

|

(a)

|

|

4,694,040

|

|

5,700,000

|

|

Morgan Stanley, Series H, 3 Mo. LIBOR + 3.61% (d)

|

|

3.79%

|

|

(a)

|

|

5,720,092

|

|

6,200,000

|

|

UBS Group AG (b) (e) (f) (j)

|

|

4.38%

|

|

(a)

|

|

6,192,312

|

|

4,800,000

|

|

UBS Group AG (e) (j) (k)

|

|

6.88%

|

|

(a)

|

|

5,468,885

|

|

1,165,000

|

|

UBS Group AG (e) (f) (j)

|

|

7.00%

|

|

(a)

|

|

1,285,944

|

|

|

|

|

|

173,129,626

|

|

|

|

Diversified Financial Services – 1.9%

|

|

|

|

|

|

|

|

9,350,000

|

|

Capital Farm Credit ACA, Series 1 (b) (e) (f)

|

|

5.00%

|

|

(a)

|

|

9,560,375

|

|

11,949,000

|

|

Voya Financial, Inc. (b) (e)

|

|

5.65%

|

|

05/15/53

|

|

12,836,153

|

|

4,781,000

|

|

Voya Financial, Inc., Series A (b) (e)

|

|

6.13%

|

|

(a)

|

|

5,282,862

|

|

|

|

|

|

27,679,390

|

|

|

|

Diversified Telecommunication Services – 1.6%

|

|

|

|

|

|

|

|

14,272,000

|

|

Koninklijke KPN N.V. (c) (e) (f)

|

|

7.00%

|

|

03/28/73

|

|

15,288,880

|

|

8,250,000

|

|

Koninklijke KPN N.V. (b) (c) (e) (k)

|

|

7.00%

|

|

03/28/73

|

|

8,837,812

|

|

|

|

|

|

24,126,692

|

|

|

|

Electric Utilities – 4.8%

|

|

|

|

|

|

|

|

45,176,000

|

|

Emera, Inc., Series 16-A (b) (c) (e)

|

|

6.75%

|

|

06/15/76

|

|

52,374,570

|

|

15,300,000

|

|

Enel S.p.A. (b) (e) (f)

|

|

8.75%

|

|

09/24/73

|

|

17,901,000

|

|

2,110,000

|

|

Southern California Edison Co., Series E (e)

|

|

6.25%

|

|

(a)

|

|

2,152,200

|

|

|

|

|

|

72,427,770

|

|

|

|

Energy Equipment & Services – 1.6%

|

|

|

|

|

|

|

|

22,600,000

|

|

Transcanada Trust (b) (c) (e)

|

|

5.50%

|

|

09/15/79

|

|

24,554,448

|

|

|

|

Food Products – 4.8%

|

|

|

|

|

|

|

|

6,000,000

|

|

Dairy Farmers of America, Inc. (b) (g)

|

|

7.13%

|

|

(a)

|

|

6,030,000

|

|

17,788,000

|

|

Land O’Lakes Capital Trust I (b) (c) (g)

|

|

7.45%

|

|

03/15/28

|

|

20,811,960

|

|

10,000,000

|

|

Land O’Lakes, Inc. (b) (f)

|

|

7.25%

|

|

(a)

|

|

10,450,000

|

Page 10

See Notes to Financial Statements

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

Portfolio of Investments

(Continued)

April 30, 2021

(Unaudited)

Par

Amount

|

|

Description

|

|

Stated

Rate

|

|

Stated

Maturity

|

|

Value

|

|

CAPITAL PREFERRED SECURITIES (Continued)

|

|

|

|

Food Products (Continued)

|

|

|

|

|

|

|

|

$33,000,000

|

|

Land O’Lakes, Inc. (b) (f)

|

|

8.00%

|

|

(a)

|

|

$35,145,000

|

|

|

|

|

|

72,436,960

|

|

|

|

Gas Utilities – 0.4%

|

|

|

|

|

|

|

|

5,775,000

|

|

South Jersey Industries, Inc.

|

|

5.02%

|

|

04/15/31

|

|

6,034,210

|

|

|

|

Independent Power & Renewable Electricity Producers – 0.3%

|

|

|

|

|

|

|

|

3,900,000

|

|

AES Gener S.A. (e) (f)

|

|

6.35%

|

|

10/07/79

|

|

4,162,022

|

|

|

|

Insurance – 15.0%

|

|

|

|

|

|

|

|

7,400,000

|

|

Allianz SE (e) (f)

|

|

3.50%

|

|

(a)

|

|

7,612,750

|

|

13,968,000

|

|

Asahi Mutual Life Insurance Co. (b) (e) (k)

|

|

6.50%

|

|

(a)

|

|

15,049,688

|

|

2,039,000

|

|

Asahi Mutual Life Insurance Co. (e) (k)

|

|

7.25%

|

|

(a)

|

|

2,114,741

|

|

17,585,000

|

|

Assurant, Inc. (b) (c) (e)

|

|

7.00%

|

|

03/27/48

|

|

19,915,012

|

|

5,150,000

|

|

Assured Guaranty Municipal Holdings, Inc. (c) (e) (f)

|

|

6.40%

|

|

12/15/66

|

|

5,363,333

|

|

16,490,000

|

|

AXIS Specialty Finance LLC (c) (e)

|

|

4.90%

|

|

01/15/40

|

|

17,165,266

|

|

8,704,000

|

|

Enstar Finance LLC (b) (c) (e)

|

|

5.75%

|

|

09/01/40

|

|

9,193,600

|

|

15,300,000

|

|

Fortegra Financial Corp. (b) (c) (e) (g)

|

|

8.50%

|

|

10/15/57

|

|

17,405,102

|

|

6,200,000

|

|

Hartford Financial Services Group (The), Inc., 3 Mo. LIBOR + 2.13% (b) (d) (f)

|

|

2.32%

|

|

02/12/47

|

|

5,967,676

|

|

8,183,000

|

|

Kuvare US Holdings, Inc. (b) (e) (f)

|

|

7.00%

|

|

02/17/51

|

|

8,409,747

|

|

2,000,000

|

|

La Mondiale SAM (b) (e) (k)

|

|

5.88%

|

|

01/26/47

|

|

2,273,942

|

|

4,723,000

|

|

Lincoln National Corp., 3 Mo. LIBOR + 2.36% (d)

|

|

2.55%

|

|

05/17/66

|

|

4,073,588

|

|

18,700,000

|

|

Markel Corp. (b) (e)

|

|

6.00%

|

|

(a)

|

|

20,406,375

|

|

2,442,000

|

|

Nationwide Financial Services Capital Trust (c) (l)

|

|

7.90%

|

|

03/01/37

|

|

3,324,821

|

|

2,910,000

|

|

Nationwide Financial Services, Inc. (b) (c)

|

|

6.75%

|

|

05/15/37

|

|

3,572,025

|

|

1,700,000

|

|

Nippon Life Insurance Co. (e) (f)

|

|

2.75%

|

|

01/21/51

|

|

1,642,625

|

|

4,000,000

|

|

PartnerRe Finance B LLC (c) (e)

|

|

4.50%

|

|

10/01/50

|

|

4,118,435

|

|

2,000,000

|

|

Principal Financial Group, Inc., 3 Mo. LIBOR + 3.04% (d)

|

|

3.24%

|

|

05/15/55

|

|

1,985,000

|

|

12,900,000

|

|

QBE Insurance Group Ltd. (b) (e) (f)

|

|

5.88%

|

|

(a)

|

|

14,012,625

|

|

24,300,000

|

|

QBE Insurance Group Ltd. (b) (e) (f)

|

|

7.50%

|

|

11/24/43

|

|

27,216,000

|

|

22,465,000

|

|

QBE Insurance Group Ltd. (b) (e) (k)

|

|

6.75%

|

|

12/02/44

|

|

25,291,659

|

|

2,000,000

|

|

QBE Insurance Group Ltd. (e) (k)

|

|

5.88%

|

|

06/17/46

|

|

2,199,339

|

|

6,751,000

|

|

Reinsurance Group of America, Inc., 3 Mo. LIBOR + 2.67% (d)

|

|

2.85%

|

|

12/15/65

|

|

6,379,695

|

|

|

|

|

|

224,693,044

|

|

|

|

Multi-Utilities – 1.5%

|

|

|

|

|

|

|

|

1,900,000

|

|

CenterPoint Energy, Inc., Series A (b) (e)

|

|

6.13%

|

|

(a)

|

|

2,027,062

|

|

6,252,000

|

|

CMS Energy Corp. (b) (e)

|

|

3.75%

|

|

12/01/50

|

|

6,306,705

|

|

6,400,000

|

|

NiSource, Inc. (b) (e)

|

|

5.65%

|

|

(a)

|

|

6,696,000

|

|

6,000,000

|

|

Sempra Energy (b) (e)

|

|

4.88%

|

|

(a)

|

|

6,578,640

|

|

|

|

|

|

21,608,407

|

|

|

|

Oil, Gas & Consumable Fuels – 8.4%

|

|

|

|

|

|

|

|

6,115,000

|

|

BP Capital Markets PLC (b) (e)

|

|

4.88%

|

|

(a)

|

|

6,565,981

|

|

2,000,000

|

|

Buckeye Partners L.P. (e)

|

|

6.38%

|

|

01/22/78

|

|

1,648,590

|

|

8,461,000

|

|

DCP Midstream L.P., Series A (e)

|

|

7.38%

|

|

(a)

|

|

7,762,967

|

|

3,907,000

|

|

DCP Midstream Operating L.P. (e) (f)

|

|

5.85%

|

|

05/21/43

|

|

3,552,615

|

|

4,626,000

|

|