UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22795

First Trust Intermediate

Duration Preferred & Income Fund

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

registrant’s telephone number,

including area code: 630-765-8000

Date of fiscal year end: October

31

Date of reporting period: October

31, 2020

Form N-CSR is to be used by management

investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report

that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking

roles.

A registrant is required to disclose

the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to

respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management

and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden

estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington,

DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a) The Report to Shareholders

is attached herewith.

First Trust

Intermediate

Duration Preferred & Income Fund (FPF)

Annual Report

For the

Year Ended

October 31,

2020

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

Annual Report

October 31, 2020

|

1

|

|

2

|

|

4

|

|

6

|

|

15

|

|

16

|

|

17

|

|

18

|

|

19

|

|

20

|

|

28

|

|

29

|

|

34

|

|

38

|

|

40

|

Caution Regarding

Forward-Looking Statements

This report contains

certain forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding the goals,

beliefs, plans or current expectations of First Trust Advisors L.P. (“First Trust” or the “Advisor”) and/or Stonebridge Advisors LLC (“Stonebridge” or the “Sub-Advisor”)

and their respective representatives, taking into account the information currently available to them. Forward-looking statements include all statements that do not relate solely to current or historical fact. For

example, forward-looking statements include the use of words such as “anticipate,” “estimate,” “intend,” “expect,” “believe,” “plan,”

“may,” “should,” “would” or other words that convey uncertainty of future events or outcomes.

Forward-looking

statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of First Trust Intermediate Duration Preferred & Income Fund (the

“Fund”) to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. When evaluating the information included in this report, you

are cautioned not to place undue reliance on these forward-looking statements, which reflect the judgment of the Advisor and/or Sub-Advisor and their respective representatives only as of the date hereof. We undertake

no obligation to publicly revise or update these forward-looking statements to reflect events and circumstances that arise after the date hereof.

Performance and Risk

Disclosure

There is no assurance

that the Fund will achieve its investment objectives. The Fund is subject to market risk, which is the possibility that the market values of securities owned by the Fund will decline and that the value of the

Fund’s shares may therefore be less than what you paid for them. Accordingly, you can lose money by investing in the Fund. See “Risk Considerations” in the Additional Information section of this

report for a discussion of certain other risks of investing in the Fund.

Performance data quoted

represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.ftportfolios.com or speak with your financial advisor. Investment returns, net asset value and common share price will fluctuate and Fund shares, when sold,

may be worth more or less than their original cost.

The Advisor may also

periodically provide additional information on Fund performance on the Fund’s web page at www.ftportfolios.com.

How to Read This

Report

This report contains

information that may help you evaluate your investment in the Fund. It includes details about the Fund and presents data and analysis that provide insight into the Fund’s performance and investment approach.

By reading the portfolio

commentary by the portfolio management team of the Fund, you may obtain an understanding of how the market environment affected the Fund’s performance. The statistical information that follows may help you

understand the Fund’s performance compared to that of relevant market benchmarks.

It is important to keep

in mind that the opinions expressed by personnel of First Trust and Stonebridge are just that: informed opinions. They should not be considered to be promises or advice. The opinions, like the statistics, cover the

period through the date on the cover of this report. The material risks of investing in the Fund are spelled out in the prospectus, the statement of additional information, this report and other Fund regulatory

filings.

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

Annual Letter from the Chairman and

CEO

October 31, 2020

Dear Shareholders,

First Trust is pleased

to provide you with the annual report for the First Trust Intermediate Duration Preferred & Income Fund (the “Fund”), which contains detailed information about the Fund for the twelve months ended

October 31, 2020.

As I was collecting my

thoughts for this annual roundup it occurred to me that my message this year should touch on the tone of the markets and the investing climate rather than belabor all the news and events that brought us to this

juncture. We all know how tumultuous our lives have become over the past eight or so months. The phrase “shelter-at-home” says it all. I would rather talk about why I believe investors should be optimistic

about where we could be headed.

Having said that, allow

me to at least acknowledge the two elephants in the room: the coronavirus (“COVID-19”) and the election. In the first 12 days of November, we learned the following: that we likely have a new

President-elect (Joe Biden), though it may not be official for some time because it is being contested by President Donald Trump and some of his loyal backers in the Republican Party citing voter fraud in certain

states; that we still do not know which political party will have control of the Senate due to a couple of run-offs in Georgia to be held on January 5, 2021; and, that it looks as though we may be fortunate enough to

have an FDA-approved COVID-19 vaccine by either the end of 2020 or the start of 2021, though that too is not yet official. It could be a game-changer in the COVID-19 battle. And, we may gain access to additional

vaccines as well. The key to getting the economy back to running on all cylinders is to fully reopen, and a vaccine is “what the doctor ordered.”

With respect to the tone

of the markets and investment climate, to say that I am encouraged about what has transpired in 2020 would be an understatement. Despite the extraordinary challenges so far this year, the S&P 500® Index posted a total return of 2.77% over the first 10 months of 2020, this despite plunging 33.8% into bear market

territory from February 19, 2020 through March 23, 2020, according to Bloomberg. As impressive as that feat is, the future looks even brighter. While Bloomberg’s consensus earnings growth rate estimate for the

S&P 500® Index for 2020 was -16.51%, as of November 13, 2020, its 2021 and 2022 estimates were 21.74% and 16.95%, respectively.

That is a strong take on the prospects for a rebound in Corporate America over the next 24 months. One of the tailwinds that is providing a good deal of support to the economy and markets is the decision by the

Federal Reserve (the “Fed”) to keep interest rates artificially low for as long as need be to meet both its employment and inflation targets. By keeping rates lower for longer, the Fed is essentially

inviting investors to assume more risk to generate higher returns. Brian Wesbury, Chief Economist at First Trust, believes that the Fed could need until 2024 to accomplish its goals. That is a lot of runway for

investors to reposition their portfolios, if needed, and a very generous, and perhaps unprecedented, amount of guidance from the Fed, in our opinion. Those investors with cash on the sidelines earning next to nothing

have options if they choose to act.

We are encouraged about

the prospects for the economy and the markets, but investors should be prepared to weather some volatility until the COVID-19 pandemic is better contained. As always, we encourage investors to stay the course!

Thank you for giving

First Trust the opportunity to play a role in your financial future. We value our relationship with you and will report on the Fund again in six months.

Sincerely,

James A. Bowen

Chairman of the Board of Trustees

Chief Executive Officer of First Trust

Advisors L.P.

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

“AT A GLANCE”

As of October 31, 2020

(Unaudited)

|

Fund Statistics

|

|

|

Symbol on New York Stock Exchange

|

FPF

|

|

Common Share Price

|

$21.56

|

|

Common Share Net Asset Value (“NAV”)

|

$22.66

|

|

Premium (Discount) to NAV

|

(4.85)%

|

|

Net Assets Applicable to Common Shares

|

$1,376,701,145

|

|

Current Distribution per Common Share(1)

|

$0.1325

|

|

Current Annualized Distribution per Common Share

|

$1.5900

|

|

Current Distribution Rate on Common Share Price(2)

|

7.37%

|

|

Current Distribution Rate on NAV(2)

|

7.02%

|

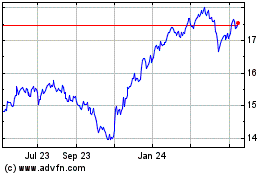

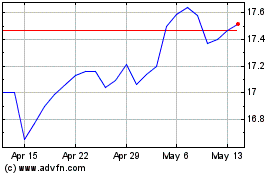

Common Share Price & NAV (weekly closing price)

|

Performance

|

|

|

|

|

|

|

Average Annual

Total Returns

|

|

|

1 Year Ended

10/31/20

|

5 Years Ended

10/31/20

|

Inception (5/23/13)

to 10/31/20

|

|

Fund Performance(3)

|

|

|

|

|

NAV

|

-0.05%

|

7.27%

|

7.63%

|

|

Market Value

|

-3.60%

|

7.85%

|

6.26%

|

|

Index Performance

|

|

|

|

|

ICE BofA Fixed Rate Preferred Securities Index

|

4.03%

|

5.78%

|

5.61%

|

|

ICE BofA U.S. Capital Securities Index

|

6.15%

|

6.41%

|

5.74%

|

|

Blended Index(4)

|

5.13%

|

6.11%

|

5.69%

|

|

(1)

|

Most recent distribution paid or declared through 10/31/2020. Subject to change in the future.

|

|

(2)

|

Distribution rates are calculated by annualizing the most recent distribution paid or declared through the report date and then dividing by Common Share Price or NAV, as applicable, as of 10/31/2020.

Subject to change in the future.

|

|

(3)

|

Total return is based on the combination of reinvested dividend, capital gain, and return of capital distributions, if any, at prices obtained by the Dividend Reinvestment Plan and changes in NAV per

share for NAV returns and changes in Common Share Price for market value returns. Total returns do not reflect sales load and are not annualized for periods of less than one year. Past performance is not indicative of

future results.

|

|

(4)

|

The Blended Index consists of the following: ICE BofA Fixed Rate Preferred Securities Index (50%) and ICE BofA U.S. Capital Securities Index (50%). The Blended Index was added to reflect the diverse

allocation of institutional preferred and hybrid securities in the Fund’s Portfolio. The indexes do not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the

performance shown. Indexes are unmanaged and an investor cannot invest directly in an index. The Blended Index returns are calculated by using the monthly return of the two indices during each period shown above. At

the beginning of each month the two indices are rebalanced to a 50-50 ratio to account for divergence from that ratio that occurred during the course of each month. The monthly returns are then compounded for each

period shown above, giving the performance for the Blended Index for each period shown above

|

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

“AT A GLANCE”

(Continued)

As of October 31, 2020

(Unaudited)

|

Industry Classification

|

% of Total

Investments

|

|

Banks

|

41.7%

|

|

Insurance

|

17.7

|

|

Capital Markets

|

8.5

|

|

Electric Utilities

|

5.9

|

|

Oil, Gas & Consumable Fuels

|

5.7

|

|

Food Products

|

5.3

|

|

Multi-Utilities

|

2.8

|

|

Diversified Financial Services

|

2.3

|

|

Trading Companies & Distributors

|

2.2

|

|

Diversified Telecommunication Services

|

2.2

|

|

Energy Equipment & Services

|

1.6

|

|

Transportation Infrastructure

|

1.1

|

|

Real Estate Management & Development

|

0.6

|

|

Consumer Finance

|

0.5

|

|

Independent Power & Renewable Electricity Producers

|

0.5

|

|

Thrifts & Mortgage Finance

|

0.4

|

|

Mortgage Real Estate Investment Trusts

|

0.4

|

|

Gas Utilities

|

0.3

|

|

Equity Real Estate Investment Trusts

|

0.2

|

|

Wireless Telecommunication Services

|

0.1

|

|

Total

|

100.0%

|

|

Top Ten Holdings

|

% of Total

Investments

|

|

Emera, Inc., Series 16-A

|

3.4%

|

|

Barclays PLC

|

1.8

|

|

Credit Agricole S.A.

|

1.8

|

|

Barclays PLC

|

1.7

|

|

Land O’Lakes, Inc.

|

1.7

|

|

AerCap Holdings N.V.

|

1.6

|

|

Wells Fargo & Co., Series L

|

1.5

|

|

Nordea Bank Abp

|

1.4

|

|

QBE Insurance Group Ltd.

|

1.4

|

|

CoBank ACB, Series I

|

1.4

|

|

Total

|

17.7%

|

|

Credit Quality(5)

|

% of Total

Fixed-Income

Investments

|

|

A-

|

0.8%

|

|

BBB+

|

12.3

|

|

BBB

|

24.1

|

|

BBB-

|

24.5

|

|

BB+

|

22.1

|

|

BB

|

7.9

|

|

BB-

|

2.2

|

|

B+

|

1.1

|

|

B

|

0.6

|

|

Not Rated

|

4.4

|

|

Total

|

100.0%

|

|

Fund Allocation

|

% of Net Assets

|

|

Capital Preferred Securities

|

102.4%

|

|

$25 Par Preferred Securities

|

30.8

|

|

$100 Par Preferred Securities

|

3.9

|

|

$1,000 Par Preferred Securities

|

3.2

|

|

Corporate Bonds and Notes

|

1.4

|

|

$1,000,000 Par Preferred Securities

|

1.1

|

|

Reverse Repurchase Agreements

|

(7.2)

|

|

Outstanding Loan

|

(37.5)

|

|

Net Other Assets and Liabilities(6)

|

1.9

|

|

Total

|

100.0%

|

|

(5)

|

The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including Standard &

Poor’s Ratings Group, a division of the McGraw Hill Companies, Inc., Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one

NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings

shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

|

(6)

|

Includes swap contracts.

|

Portfolio Commentary

First Trust Intermediate

Duration Preferred & Income Fund (FPF)

Annual Report

October 31, 2020

(Unaudited)

Advisor

First Trust Advisors L.P.

(“First Trust” or the “Advisor”) serves as the investment advisor to the First Trust Intermediate Duration Preferred & Income Fund (the “Fund”). First Trust is responsible for

the ongoing monitoring of the Fund’s investment portfolio, managing the Fund’s business affairs and providing certain administrative services necessary for the management of the Fund.

Sub-Advisor

Stonebridge Advisors LLC

(“Stonebridge” or the “Sub-Advisor”) is the sub-advisor to the Fund and is a registered investment advisor based in Wilton, Connecticut. Stonebridge specializes in the management of preferred

and hybrid securities.

Stonebridge Advisors LLC

Portfolio Management Team

Scott T. Fleming –

Chief Executive Officer and President

Robert Wolf – Chief

Investment Officer, Senior Vice President and Senior Portfolio Manager

Eric Weaver - Chief

Strategist, Senior Vice President and Portfolio Manager

Commentary

Market Recap

The 12-month period ended

October 31, 2020 was a volatile period for the preferred and hybrid securities market, yet all parts of the market earned positive returns. The beginning of the period was marked by very strong performance, as

supportive central bank policy, solid economic data, the extension of the BREXIT deadline in the United Kingdom and positive fund flows all helped drive the market higher. However, this all changed during the latter

part of the first quarter of 2020 with the onset of the coronavirus (“COVID-19”) pandemic and the associated economic shutdowns. Prices across the preferred and hybrid securities market dropped

precipitously as investors pulled money from the space, funds de-levered aggressively and investor sentiment plummeted. In response to the economic fallout, central banks globally embarked on unprecedented stimulus

measures while governments passed enormous fiscal spending plans to support consumers and households in the face of rising unemployment. These measures significantly improved liquidity and market functioning across

financial markets and helped support the economic recovery. In the U.S., rates dropped across the curve, with 10-Year Treasury yields reaching all-time low levels, while current yield spreads versus 10-Year Treasuries

in the preferred and hybrid securities market widened to levels not seen since the global financial crisis of 2008. Despite the economic slowdown, many issuers in the preferred and hybrid securities market were able

to beat earnings expectations in both the second and third quarters of 2020. Banks in particular reported strong quarterly numbers overall, increasing capital buffers and reporting less provisions than expected,

supporting the positive credit story. The improved investor sentiment and fundamentals during the latter part of the 12-month period ended October 31, 2020 spurred positive fund flows and spreads tightened across the

space. The credit strength across the major issuers in the preferred and hybrid securities market, including banks, insurance companies and utilities, remained intact and proved resilient in the face of large shocks

to the global economy. For the 12-month period ended October 31, 2020, the retail market produced returns of 4.03% while the institutional market gained 6.15%, according to the ICE BofA Fixed Rate Preferred Securities

Index (“P0P1”) and the ICE BofA US Capital Securities Index (“C0CS”), respectively. European contingent convertible capital securities (“CoCos”) also performed well, returning 5.25%

during the period, as measured by the ICE USD Investment Contingent Capital Index (“CDLR”).

Performance Analysis

For the 12-month period

ended October 31, 2020, the net asset value (“NAV”) and market price total returns for the Fund were -0.05% and -3.60%, respectively. This compares to a total return of 5.13% for the Fund’s

benchmark, which is a 50/50 blend of the ICE BofA Fixed Rate Preferred Securities Index (“P0P1”) and the ICE BofA U.S. Capital Securities Index (“C0CS”). The Fund’s divergence in

performance from the benchmark was primarily due to the effect of leverage, the Fund’s defensive interest rate positioning and its overweight allocation to non-investment grade (non-IG) securities. Investments

in newly issued securities in the last half of the period contributed positively to the Fund’s relative performance.

As rates quickly dropped

across the U.S. Treasury yield curve following the Federal Reserve’s (the “Fed”) unprecedented response to the COVID-19 pandemic, long duration securities outperformed, while floating rate and short

duration securities underperformed. The Fund’s weighting in floating rate securities, which are not held in the benchmark, and its underweight allocation to long duration (10+ years) securities both contributed

to underperformance during the period. We believe it is prudent to not extend duration of the Fund to match the benchmark as the prospect for yield curve steepening is increasing, which may result in a negative impact

on longer duration preferred and hybrid securities.

Portfolio Commentary (Continued)

First Trust Intermediate

Duration Preferred & Income Fund (FPF)

Annual Report

October 31, 2020

(Unaudited)

Another consequence to

the economic slowdown from the COVID-19 pandemic was spread decompression between investment grade and non-investment grade securities. The benchmark is entirely comprised of investment grade securities, including a

relatively large weighting in high quality Japanese issuers, which outperformed during the period.

Furthermore, as travel

and energy consumption materially decreased after the onset of the COVID-19 pandemic, midstream energy pipelines and aircraft lessors also underperformed during the period. The Fund maintains a small exposure to both

industry segments, which had an outsized adverse impact to relative performance. However, we remain confident in the outlook for the securities held by the Fund in these industry segments, as issuer credit

fundamentals are stable with recent earnings that have exceeded expectations, along with sufficient liquidity and favorable security structures.

Within the $25 par retail

market, liquidity and pricing dislocations that occurred in March 2020 after the onset of the COVID-19 pandemic created opportunities as well as risks for the Fund. In particular, the Fund reduced its allocation to

higher beta industries, such as mortgage real estate investment trusts (“REITs”), during the sell-off as liquidity became challenged. However, the Fund was also very active adding to select names within

the insurance, energy and banking industries, which contributed to relative outperformance during the second half of the period.

After spreads widened

following the pandemic, new issuance in the second and third quarters of 2020 came to market with attractive reset spreads and structures, such as constant maturity Treasury resets and discrete call features. The Fund

took advantage of these new issuance opportunities within the primary issuance market during the period, selectively focusing on newly issued securities with the best combination of credit, relative valuation, and

structure.

The Fund also employed a

hedging strategy throughout the year in order to further manage its interest rate risk. This strategy consisted of an interest rate swap, which was impacted by the falling interest rate environment, resulting in a

modest negative effect on the Fund’s performance.

Market and Fund Outlook

With the uncertainty due

to macro conditions, Stonebridge is committed to protecting investor portfolios against near-term risks, while also positioning for future outperformance. Our focus is on improving the quality of investor portfolios,

including strengthening the holdings in terms of credit and security structure, while also positioning for the possibility of interest-rate volatility due to fiscal stimulus and inflationary pressures. We are finding

value across the entire universe of preferred and hybrid securities, including both the $25 par exchange traded and $1000 par over-the-counter markets and strive to make portfolio adjustments as opportunities are

presented. We believe the secondary market will likely find technical support from investor inflows and limited net new issue supply expectations. Attractive valuations, combined with high yields and strong issuer

credit fundamentals, will likely drive outperformance of preferred and hybrid securities compared to other asset classes, in our opinion.

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

Portfolio of Investments

October 31, 2020

|

Shares

|

|

Description

|

|

Stated

Rate

|

|

Stated

Maturity

|

|

Value

|

|

$25 PAR PREFERRED SECURITIES – 30.8%

|

|

|

|

Banks – 5.4%

|

|

|

|

|

|

|

|

2,037

|

|

Banco Santander S.A., Series 6, 3 Mo. LIBOR + 0.52%, minimum 4.00% (a)

|

|

4.00%

|

|

(b)

|

|

$51,434

|

|

222,355

|

|

Bank of America Corp., Series NN

|

|

4.38%

|

|

(b)

|

|

5,558,875

|

|

18,137

|

|

Citizens Financial Group, Inc., Series E

|

|

5.00%

|

|

(b)

|

|

458,866

|

|

421,392

|

|

Fifth Third Bancorp, Series A (c)

|

|

6.00%

|

|

(b)

|

|

11,192,172

|

|

89,744

|

|

First Midwest Bancorp, Inc., Series A (c)

|

|

7.00%

|

|

(b)

|

|

2,447,319

|

|

208,076

|

|

First Republic Bank, Series K (c)

|

|

4.13%

|

|

(b)

|

|

5,237,273

|

|

204,643

|

|

Fulton Financial Corp., Series A

|

|

5.13%

|

|

(b)

|

|

5,187,700

|

|

674,619

|

|

GMAC Capital Trust I, Series 2, 3 Mo. LIBOR + 5.79% (a) (c) (d)

|

|

6.07%

|

|

02/15/40

|

|

17,364,693

|

|

11,438

|

|

KeyCorp, Series F

|

|

5.65%

|

|

(b)

|

|

302,993

|

|

24,566

|

|

KeyCorp, Series G

|

|

5.63%

|

|

(b)

|

|

664,510

|

|

168,733

|

|

Pinnacle Financial Partners, Inc., Series B (c)

|

|

6.75%

|

|

(b)

|

|

4,522,044

|

|

57,102

|

|

Truist Financial Corp., Series R

|

|

4.75%

|

|

(b)

|

|

1,489,791

|

|

10,639

|

|

Wells Fargo & Co., Series O

|

|

5.13%

|

|

(b)

|

|

267,890

|

|

166,970

|

|

Wells Fargo & Co., Series X (c)

|

|

5.50%

|

|

(b)

|

|

4,252,726

|

|

85,578

|

|

Wells Fargo & Co., Series Y

|

|

5.63%

|

|

(b)

|

|

2,217,326

|

|

205,000

|

|

WesBanco, Inc., Series A (c) (e)

|

|

6.75%

|

|

(b)

|

|

5,418,150

|

|

278,658

|

|

Wintrust Financial Corp., Series E (c) (e)

|

|

6.88%

|

|

(b)

|

|

7,417,876

|

|

|

|

|

|

74,051,638

|

|

|

|

Capital Markets – 1.2%

|

|

|

|

|

|

|

|

118,444

|

|

Affiliated Managers Group, Inc. (c) (d)

|

|

5.88%

|

|

03/30/59

|

|

3,175,484

|

|

103,953

|

|

Affiliated Managers Group, Inc. (d)

|

|

4.75%

|

|

09/30/60

|

|

2,731,365

|

|

6,300

|

|

Apollo Global Management, Inc., Series A (d)

|

|

6.38%

|

|

(b)

|

|

163,611

|

|

245,538

|

|

Apollo Global Management, Inc., Series B (c)

|

|

6.38%

|

|

(b)

|

|

6,504,302

|

|

48,026

|

|

Legg Mason, Inc. (d)

|

|

5.45%

|

|

09/15/56

|

|

1,234,748

|

|

1,119

|

|

Morgan Stanley, Series F (e)

|

|

6.88%

|

|

(b)

|

|

31,265

|

|

19,625

|

|

Morgan Stanley, Series K (e)

|

|

5.85%

|

|

(b)

|

|

553,032

|

|

45,494

|

|

Oaktree Capital Group LLC, Series A (d)

|

|

6.63%

|

|

(b)

|

|

1,215,600

|

|

55,351

|

|

Oaktree Capital Group LLC, Series B (c) (d)

|

|

6.55%

|

|

(b)

|

|

1,482,853

|

|

|

|

|

|

17,092,260

|

|

|

|

Consumer Finance – 0.6%

|

|

|

|

|

|

|

|

240,805

|

|

Capital One Financial Corp., Series I (c)

|

|

5.00%

|

|

(b)

|

|

6,056,246

|

|

81,056

|

|

Capital One Financial Corp., Series J (c)

|

|

4.80%

|

|

(b)

|

|

2,007,757

|

|

|

|

|

|

8,064,003

|

|

|

|

Diversified Financial Services – 1.1%

|

|

|

|

|

|

|

|

508,291

|

|

Equitable Holdings, Inc., Series A (c)

|

|

5.25%

|

|

(b)

|

|

12,854,680

|

|

59,946

|

|

National Rural Utilities Cooperative Finance Corp. (d)

|

|

5.50%

|

|

05/15/64

|

|

1,630,531

|

|

|

|

|

|

14,485,211

|

|

|

|

Diversified Telecommunication Services – 1.4%

|

|

|

|

|

|

|

|

307,305

|

|

AT&T, Inc., Series C (c)

|

|

4.75%

|

|

(b)

|

|

7,771,743

|

|

98,542

|

|

Qwest Corp. (d)

|

|

7.00%

|

|

02/01/56

|

|

2,515,777

|

|

135,804

|

|

Qwest Corp. (d)

|

|

6.50%

|

|

09/01/56

|

|

3,450,780

|

|

217,759

|

|

Qwest Corp. (c) (d)

|

|

6.75%

|

|

06/15/57

|

|

5,690,043

|

|

|

|

|

|

19,428,343

|

|

|

|

Electric Utilities – 1.0%

|

|

|

|

|

|

|

|

519,322

|

|

Southern (The) Co., Series C (c) (d)

|

|

4.20%

|

|

10/15/60

|

|

13,214,148

|

|

|

|

Equity Real Estate Investment Trusts – 0.3%

|

|

|

|

|

|

|

|

86,630

|

|

Digital Realty Trust, Inc., Series L (c) (d)

|

|

5.20%

|

|

(b)

|

|

2,304,358

|

|

80,655

|

|

Global Net Lease, Inc., Series A (d)

|

|

7.25%

|

|

(b)

|

|

2,072,834

|

Page 6

See Notes to Financial Statements

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

Portfolio of Investments

(Continued)

October 31, 2020

|

Shares

|

|

Description

|

|

Stated

Rate

|

|

Stated

Maturity

|

|

Value

|

|

$25 PAR PREFERRED SECURITIES (Continued)

|

|

|

|

Equity Real Estate Investment Trusts (Continued)

|

|

|

|

|

|

|

|

3,971

|

|

Public Storage, Series M (d)

|

|

4.13%

|

|

(b)

|

|

$102,650

|

|

|

|

|

|

4,479,842

|

|

|

|

Food Products – 2.7%

|

|

|

|

|

|

|

|

824,835

|

|

CHS, Inc., Series 2 (c) (e)

|

|

7.10%

|

|

(b)

|

|

22,633,472

|

|

546,059

|

|

CHS, Inc., Series 3 (c) (e)

|

|

6.75%

|

|

(b)

|

|

14,465,103

|

|

|

|

|

|

37,098,575

|

|

|

|

Gas Utilities – 0.5%

|

|

|

|

|

|

|

|

197,017

|

|

South Jersey Industries, Inc. (c) (d)

|

|

5.63%

|

|

09/16/79

|

|

5,018,023

|

|

55,498

|

|

Spire, Inc., Series A (c)

|

|

5.90%

|

|

(b)

|

|

1,518,425

|

|

|

|

|

|

6,536,448

|

|

|

|

Independent Power & Renewable Electricity Producers – 0.3%

|

|

|

|

|

|

|

|

164,218

|

|

Brookfield Renewable Partners L.P., Series 17 (d)

|

|

5.25%

|

|

(b)

|

|

4,263,099

|

|

|

|

Insurance – 8.9%

|

|

|

|

|

|

|

|

501,024

|

|

Aegon Funding Co., LLC (c) (d)

|

|

5.10%

|

|

12/15/49

|

|

13,056,685

|

|

590,691

|

|

American Equity Investment Life Holding Co., Series A (c) (e)

|

|

5.95%

|

|

(b)

|

|

14,708,206

|

|

237,560

|

|

American Equity Investment Life Holding Co., Series B (c) (e)

|

|

6.63%

|

|

(b)

|

|

6,190,814

|

|

193,648

|

|

AmTrust Financial Services, Inc.

|

|

7.25%

|

|

06/15/55

|

|

3,466,299

|

|

210,480

|

|

AmTrust Financial Services, Inc.

|

|

7.50%

|

|

09/15/55

|

|

3,748,649

|

|

63,510

|

|

Aspen Insurance Holdings Ltd. (d)

|

|

5.63%

|

|

(b)

|

|

1,622,045

|

|

343,285

|

|

Aspen Insurance Holdings Ltd. (c)

|

|

5.63%

|

|

(b)

|

|

8,599,289

|

|

15,655

|

|

Aspen Insurance Holdings Ltd. (d) (e)

|

|

5.95%

|

|

(b)

|

|

410,004

|

|

654,224

|

|

Athene Holding Ltd., Series A (c) (d) (e)

|

|

6.35%

|

|

(b)

|

|

17,520,119

|

|

202,453

|

|

Athene Holding Ltd., Series C (c) (e)

|

|

6.38%

|

|

(b)

|

|

5,445,986

|

|

81,045

|

|

Axis Capital Holdings Ltd., Series E (c)

|

|

5.50%

|

|

(b)

|

|

2,065,027

|

|

584,250

|

|

Delphi Financial Group, Inc., 3 Mo. LIBOR + 3.19% (a) (c) (d)

|

|

3.47%

|

|

05/15/37

|

|

11,392,875

|

|

153,564

|

|

Enstar Group Ltd., Series D (c) (d) (e)

|

|

7.00%

|

|

(b)

|

|

4,087,874

|

|

175,443

|

|

Global Indemnity Group LLC (d)

|

|

7.88%

|

|

04/15/47

|

|

4,535,202

|

|

31,517

|

|

National General Holdings Corp. (d)

|

|

7.63%

|

|

09/15/55

|

|

805,259

|

|

46,147

|

|

National General Holdings Corp., Series B

|

|

7.50%

|

|

(b)

|

|

1,167,981

|

|

143,132

|

|

National General Holdings Corp., Series C

|

|

7.50%

|

|

(b)

|

|

3,725,726

|

|

2,419

|

|

PartnerRe Ltd., Series I

|

|

5.88%

|

|

(b)

|

|

62,241

|

|

193,528

|

|

Phoenix Cos. (The), Inc.

|

|

7.45%

|

|

01/15/32

|

|

2,721,487

|

|

621,115

|

|

Prudential Financial, Inc. (d)

|

|

4.13%

|

|

09/01/60

|

|

15,717,253

|

|

24,290

|

|

Reinsurance Group of America, Inc. (d) (e)

|

|

5.75%

|

|

06/15/56

|

|

661,174

|

|

11,945

|

|

W.R. Berkley Corp. (d)

|

|

5.75%

|

|

06/01/56

|

|

307,464

|

|

40,143

|

|

W.R. Berkley Corp. (d)

|

|

4.25%

|

|

09/30/60

|

|

1,031,474

|

|

|

|

|

|

123,049,133

|

|

|

|

Mortgage Real Estate Investment Trusts – 0.5%

|

|

|

|

|

|

|

|

23,458

|

|

AGNC Investment Corp., Series C (d) (e)

|

|

7.00%

|

|

(b)

|

|

536,016

|

|

221,445

|

|

AGNC Investment Corp., Series F (d) (e)

|

|

6.13%

|

|

(b)

|

|

4,794,284

|

|

77,579

|

|

Annaly Capital Management, Inc., Series F (e)

|

|

6.95%

|

|

(b)

|

|

1,746,303

|

|

|

|

|

|

7,076,603

|

|

|

|

Multi-Utilities – 3.0%

|

|

|

|

|

|

|

|

254,761

|

|

Algonquin Power & Utilities Corp. (c) (d) (e)

|

|

6.88%

|

|

10/17/78

|

|

6,804,666

|

|

378,150

|

|

Algonquin Power & Utilities Corp., Series 19-A (c) (d) (e)

|

|

6.20%

|

|

07/01/79

|

|

10,179,798

|

|

208,075

|

|

Brookfield Infrastructure Partners L.P., Series 13 (d)

|

|

5.13%

|

|

(b)

|

|

5,353,770

|

|

675,875

|

|

Integrys Holding, Inc. (d) (e)

|

|

6.00%

|

|

08/01/73

|

|

18,451,388

|

|

|

|

|

|

40,789,622

|

See Notes to Financial Statements

Page 7

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

Portfolio of Investments

(Continued)

October 31, 2020

|

Shares

|

|

Description

|

|

Stated

Rate

|

|

Stated

Maturity

|

|

Value

|

|

$25 PAR PREFERRED SECURITIES (Continued)

|

|

|

|

Oil, Gas & Consumable Fuels – 1.4%

|

|

|

|

|

|

|

|

31,082

|

|

DCP Midstream L.P., Series B (e)

|

|

7.88%

|

|

(b)

|

|

$538,962

|

|

112,548

|

|

Enbridge, Inc., Series B (d) (e)

|

|

6.38%

|

|

04/15/78

|

|

2,872,225

|

|

15,235

|

|

Energy Transfer Operating L.P., Series C (e)

|

|

7.38%

|

|

(b)

|

|

278,648

|

|

37,273

|

|

Energy Transfer Operating L.P., Series D (e)

|

|

7.63%

|

|

(b)

|

|

698,496

|

|

533,788

|

|

Energy Transfer Operating L.P., Series E (c) (d) (e)

|

|

7.60%

|

|

(b)

|

|

10,382,177

|

|

108,358

|

|

NuStar Energy L.P., Series A (e)

|

|

8.50%

|

|

(b)

|

|

2,029,545

|

|

135,233

|

|

NuStar Logistics, L.P., 3 Mo. LIBOR + 6.73% (a) (d)

|

|

6.97%

|

|

01/15/43

|

|

2,534,266

|

|

|

|

|

|

19,334,319

|

|

|

|

Real Estate Management & Development – 0.9%

|

|

|

|

|

|

|

|

242,025

|

|

Brookfield Property Partners L.P., Series A

|

|

5.75%

|

|

(b)

|

|

4,695,285

|

|

360,341

|

|

Brookfield Property Partners L.P., Series A2 (c) (d)

|

|

6.38%

|

|

(b)

|

|

7,278,888

|

|

|

|

|

|

11,974,173

|

|

|

|

Thrifts & Mortgage Finance – 0.6%

|

|

|

|

|

|

|

|

325,159

|

|

New York Community Bancorp, Inc., Series A (c) (e)

|

|

6.38%

|

|

(b)

|

|

8,431,373

|

|

|

|

Trading Companies & Distributors – 0.9%

|

|

|

|

|

|

|

|

328,890

|

|

Air Lease Corp., Series A (c) (e)

|

|

6.15%

|

|

(b)

|

|

7,544,737

|

|

176,498

|

|

WESCO International, Inc., Series A (c) (e)

|

|

10.63%

|

|

(b)

|

|

5,114,912

|

|

|

|

|

|

12,659,649

|

|

|

|

Wireless Telecommunication Services – 0.1%

|

|

|

|

|

|

|

|

75,137

|

|

United States Cellular Corp. (d)

|

|

6.25%

|

|

09/01/69

|

|

1,976,855

|

|

|

|

Total $25 Par Preferred Securities

|

|

424,005,294

|

|

|

|

(Cost $416,975,712)

|

|

|

|

|

|

|

|

$100 PAR PREFERRED SECURITIES – 3.9%

|

|

|

|

Banks – 3.8%

|

|

|

|

|

|

|

|

80,000

|

|

AgriBank FCB (e)

|

|

6.88%

|

|

(b)

|

|

8,680,000

|

|

179,000

|

|

CoBank ACB, Series F (c) (e)

|

|

6.25%

|

|

(b)

|

|

18,795,000

|

|

82,220

|

|

CoBank ACB, Series G (c)

|

|

6.13%

|

|

(b)

|

|

8,345,330

|

|

54,250

|

|

CoBank ACB, Series H (c) (e)

|

|

6.20%

|

|

(b)

|

|

5,750,500

|

|

102,000

|

|

Farm Credit Bank of Texas (c) (e) (f)

|

|

6.75%

|

|

(b)

|

|

11,016,000

|

|

|

|

|

|

52,586,830

|

|

|

|

Consumer Finance – 0.1%

|

|

|

|

|

|

|

|

35,000

|

|

SLM Corp., Series B, 3 Mo. LIBOR + 1.70% (a)

|

|

1.95%

|

|

(b)

|

|

1,598,800

|

|

|

|

Total $100 Par Preferred Securities

|

|

54,185,630

|

|

|

|

(Cost $52,927,346)

|

|

|

|

|

|

|

|

$1,000 PAR PREFERRED SECURITIES – 3.2%

|

|

|

|

Banks – 2.3%

|

|

|

|

|

|

|

|

3,557

|

|

CoBank ACB, 3 Mo. LIBOR + 1.18% (a) (g)

|

|

1.40%

|

|

(b)

|

|

2,258,695

|

|

21,168

|

|

Wells Fargo & Co., Series L

|

|

7.50%

|

|

(b)

|

|

28,550,551

|

|

|

|

|

|

30,809,246

|

|

|

|

Diversified Financial Services – 0.9%

|

|

|

|

|

|

|

|

12,000

|

|

Compeer Financial ACA (c) (e) (f)

|

|

6.75%

|

|

(b)

|

|

12,600,000

|

|

|

|

Total $1,000 Par Preferred Securities

|

|

43,409,246

|

|

|

|

(Cost $42,762,736)

|

|

|

|

|

|

|

|

$1,000,000 PAR PREFERRED SECURITIES – 1.1%

|

|

|

|

Banks – 1.1%

|

|

|

|

|

|

|

|

12

|

|

FT Real Estate Securities Co., Inc. (g) (h) (i)

|

|

9.50%

|

|

(b)

|

|

14,725,500

|

|

|

|

(Cost $15,990,000)

|

|

|

|

|

|

|

Page 8

See Notes to Financial Statements

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

Portfolio of Investments

(Continued)

October 31, 2020

Par

Amount

|

|

Description

|

|

Stated

Rate

|

|

Stated

Maturity

|

|

Value

|

|

CAPITAL PREFERRED SECURITIES – 102.4%

|

|

|

|

Banks – 47.1%

|

|

|

|

|

|

|

|

$18,335,000

|

|

Australia & New Zealand Banking Group Ltd. (c) (e) (f) (j)

|

|

6.75%

|

|

(b)

|

|

$20,811,967

|

|

13,000,000

|

|

Banco Bilbao Vizcaya Argentaria S.A., Series 9 (c) (e) (j)

|

|

6.50%

|

|

(b)

|

|

12,837,922

|

|

5,000,000

|

|

Banco Mercantil del Norte S.A. (e) (f) (j)

|

|

7.50%

|

|

(b)

|

|

4,985,250

|

|

8,000,000

|

|

Banco Mercantil del Norte S.A. (e) (f) (j)

|

|

7.63%

|

|

(b)

|

|

8,000,000

|

|

7,400,000

|

|

Banco Mercantil del Norte S.A. (e) (f) (j)

|

|

8.38%

|

|

(b)

|

|

7,864,424

|

|

12,600,000

|

|

Banco Santander S.A. (e) (j) (k)

|

|

7.50%

|

|

(b)

|

|

13,124,160

|

|

9,900,000

|

|

Bank of America Corp., Series X (c) (e)

|

|

6.25%

|

|

(b)

|

|

10,805,114

|

|

15,300,000

|

|

Bank of Nova Scotia (The) (c) (e)

|

|

4.90%

|

|

(b)

|

|

16,008,390

|

|

40,000

|

|

Barclays Bank PLC (f)

|

|

10.18%

|

|

06/12/21

|

|

42,126

|

|

11,200,000

|

|

Barclays PLC (e) (j)

|

|

6.13%

|

|

(b)

|

|

11,422,699

|

|

31,808,000

|

|

Barclays PLC (c) (e) (j) (k)

|

|

7.88%

|

|

(b)

|

|

32,899,014

|

|

33,000,000

|

|

Barclays PLC (c) (e) (j)

|

|

8.00%

|

|

(b)

|

|

35,409,226

|

|

8,550,000

|

|

BBVA Bancomer S.A. (d) (e) (f) (j)

|

|

5.88%

|

|

09/13/34

|

|

8,888,238

|

|

4,300,000

|

|

BNP Paribas S.A. (e) (f) (j)

|

|

7.38%

|

|

(b)

|

|

4,802,864

|

|

15,100,000

|

|

Citigroup, Inc. (c) (e)

|

|

5.90%

|

|

(b)

|

|

15,651,150

|

|

6,000,000

|

|

Citigroup, Inc., Series P (c) (e)

|

|

5.95%

|

|

(b)

|

|

6,286,549

|

|

2,000,000

|

|

Citigroup, Inc., Series R (e)

|

|

6.13%

|

|

(b)

|

|

1,985,471

|

|

3,500,000

|

|

Citizens Financial Group, Inc., Series C (c) (e)

|

|

6.38%

|

|

(b)

|

|

3,506,563

|

|

9,800,000

|

|

Citizens Financial Group, Inc., Series F (c) (e)

|

|

5.65%

|

|

(b)

|

|

10,449,250

|

|

25,000,000

|

|

CoBank ACB, Series I (c) (e)

|

|

6.25%

|

|

(b)

|

|

26,750,000

|

|

5,000,000

|

|

Comerica, Inc. (c) (e)

|

|

5.63%

|

|

(b)

|

|

5,350,000

|

|

20,000,000

|

|

Credit Agricole S.A. (c) (e) (f) (j)

|

|

6.88%

|

|

(b)

|

|

21,426,300

|

|

11,600,000

|

|

Credit Agricole S.A. (c) (e) (f) (j)

|

|

7.88%

|

|

(b)

|

|

12,819,856

|

|

29,240,000

|

|

Credit Agricole S.A. (c) (e) (f) (j)

|

|

8.13%

|

|

(b)

|

|

34,406,708

|

|

9,080,000

|

|

Danske Bank A.S. (e) (j) (k)

|

|

6.13%

|

|

(b)

|

|

9,363,986

|

|

6,740,000

|

|

Danske Bank A.S. (e) (j) (k)

|

|

7.00%

|

|

(b)

|

|

7,252,712

|

|

3,450,000

|

|

Farm Credit Bank of Texas, Series 3 (c) (e) (f)

|

|

6.20%

|

|

(b)

|

|

3,452,812

|

|

7,500,000

|

|

Farm Credit Bank of Texas, Series 4 (c) (d) (e) (f)

|

|

5.70%

|

|

(b)

|

|

8,088,750

|

|

9,400,000

|

|

Fifth Third Bancorp, Series L (c) (e)

|

|

4.50%

|

|

(b)

|

|

9,517,500

|

|

18,000,000

|

|

HSBC Holdings PLC (c) (e) (j)

|

|

6.38%

|

|

(b)

|

|

18,749,668

|

|

7,300,000

|

|

Huntington Bancshares, Inc., Series F (c) (e)

|

|

5.63%

|

|

(b)

|

|

8,185,125

|

|

8,600,000

|

|

Huntington Bancshares, Inc., Series G (c) (e)

|

|

4.45%

|

|

(b)

|

|

8,578,500

|

|

10,360,000

|

|

ING Groep N.V. (e) (j)

|

|

5.75%

|

|

(b)

|

|

10,802,527

|

|

13,920,000

|

|

ING Groep N.V. (e) (j)

|

|

6.50%

|

|

(b)

|

|

14,790,000

|

|

10,000,000

|

|

ING Groep N.V. (c) (e) (j) (k)

|

|

6.88%

|

|

(b)

|

|

10,366,350

|

|

16,200,000

|

|

Intesa Sanpaolo S.p.A. (e) (f) (j)

|

|

7.70%

|

|

(b)

|

|

17,097,922

|

|

1,000,000

|

|

JPMorgan Chase & Co., Series R (c) (e)

|

|

6.00%

|

|

(b)

|

|

1,025,825

|

|

10,300,000

|

|

JPMorgan Chase & Co., Series V, 3 Mo. LIBOR + 3.32% (a) (c)

|

|

3.55%

|

|

(b)

|

|

9,601,234

|

|

13,045,000

|

|

Lloyds Banking Group PLC (e) (j)

|

|

6.75%

|

|

(b)

|

|

13,691,836

|

|

21,213,000

|

|

Lloyds Banking Group PLC (e) (j)

|

|

7.50%

|

|

(b)

|

|

22,426,808

|

|

2,800,000

|

|

Lloyds Banking Group PLC (e) (j)

|

|

7.50%

|

|

(b)

|

|

3,019,395

|

|

2,900,000

|

|

Natwest Group PLC (e) (j)

|

|

6.00%

|

|

(b)

|

|

3,007,880

|

|

1,200,000

|

|

Natwest Group PLC (c) (e) (j)

|

|

8.00%

|

|

(b)

|

|

1,345,920

|

|

24,400,000

|

|

Nordea Bank Abp (c) (e) (f) (j)

|

|

6.63%

|

|

(b)

|

|

27,317,874

|

|

6,000,000

|

|

Regions Financial Corp., Series D (c) (e)

|

|

5.75%

|

|

(b)

|

|

6,442,500

|

|

8,000,000

|

|

Skandinaviska Enskilda Banken AB (e) (j) (k)

|

|

5.13%

|

|

(b)

|

|

8,139,216

|

|

1,200,000

|

|

Skandinaviska Enskilda Banken AB (e) (j) (k)

|

|

5.63%

|

|

(b)

|

|

1,231,416

|

|

16,500,000

|

|

Societe Generale S.A. (c) (e) (f) (j)

|

|

7.38%

|

|

(b)

|

|

16,985,430

|

|

15,950,000

|

|

Societe Generale S.A. (c) (e) (f) (j)

|

|

7.88%

|

|

(b)

|

|

17,027,821

|

|

1,300,000

|

|

Societe Generale S.A. (e) (f) (j)

|

|

8.00%

|

|

(b)

|

|

1,461,422

|

|

9,400,000

|

|

Standard Chartered PLC (e) (f) (j)

|

|

6.00%

|

|

(b)

|

|

9,682,000

|

|

65,000

|

|

Standard Chartered PLC (e) (k)

|

|

7.01%

|

|

(b)

|

|

79,172

|

|

1,700,000

|

|

Standard Chartered PLC (c) (e) (f) (j)

|

|

7.75%

|

|

(b)

|

|

1,809,208

|

|

825,000

|

|

Standard Chartered PLC (e) (j) (k)

|

|

7.75%

|

|

(b)

|

|

877,998

|

|

4,800,000

|

|

Swedbank AB (e) (j) (k)

|

|

6.00%

|

|

(b)

|

|

4,915,723

|

See Notes to Financial Statements

Page 9

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

Portfolio of Investments

(Continued)

October 31, 2020

Par

Amount

|

|

Description

|

|

Stated

Rate

|

|

Stated

Maturity

|

|

Value

|

|

CAPITAL PREFERRED SECURITIES (Continued)

|

|

|

|

Banks (Continued)

|

|

|

|

|

|

|

|

$7,400,000

|

|

Truist Financial Corp., Series P (c) (e)

|

|

4.95%

|

|

(b)

|

|

$7,862,500

|

|

9,200,000

|

|

Truist Financial Corp., Series Q (c) (e)

|

|

5.10%

|

|

(b)

|

|

10,090,652

|

|

21,201,000

|

|

UniCredit S.p.A. (c) (e) (j) (k)

|

|

8.00%

|

|

(b)

|

|

22,363,536

|

|

5,000,000

|

|

UniCredit S.p.A. (d) (e) (f)

|

|

5.46%

|

|

06/30/35

|

|

5,073,597

|

|

|

|

|

|

648,258,056

|

|

|

|

Capital Markets – 10.8%

|

|

|

|

|

|

|

|

12,296,000

|

|

Apollo Management Holdings L.P. (c) (d) (e) (f)

|

|

4.95%

|

|

01/14/50

|

|

12,314,864

|

|

8,500,000

|

|

Bank of New York Mellon (The) Corp., Series G (c) (e)

|

|

4.70%

|

|

(b)

|

|

9,116,250

|

|

6,143,000

|

|

Bank of New York Mellon (The) Corp., Series H (e)

|

|

3.70%

|

|

(b)

|

|

6,111,231

|

|

19,000,000

|

|

Charles Schwab (The) Corp., Series G (c) (e)

|

|

5.38%

|

|

(b)

|

|

20,839,200

|

|

11,200,000

|

|

Credit Suisse Group AG (e) (f) (j)

|

|

5.25%

|

|

(b)

|

|

11,304,160

|

|

16,800,000

|

|

Credit Suisse Group AG (c) (e) (f) (j)

|

|

6.38%

|

|

(b)

|

|

18,053,028

|

|

5,100,000

|

|

Credit Suisse Group AG (e) (f) (j)

|

|

7.25%

|

|

(b)

|

|

5,530,466

|

|

7,829,000

|

|

Credit Suisse Group AG (c) (e) (f) (j)

|

|

7.50%

|

|

(b)

|

|

8,524,998

|

|

22,250,000

|

|

Credit Suisse Group AG (c) (e) (f) (j)

|

|

7.50%

|

|

(b)

|

|

23,640,848

|

|

23,900,000

|

|

Goldman Sachs Group (The), Inc., Series Q (c) (e)

|

|

5.50%

|

|

(b)

|

|

25,654,623

|

|

300,000

|

|

Goldman Sachs Group (The), Inc., Series R (c) (e)

|

|

4.95%

|

|

(b)

|

|

307,703

|

|

1,000,000

|

|

Morgan Stanley, Series H, 3 Mo. LIBOR + 3.61% (a)

|

|

3.85%

|

|

(b)

|

|

962,481

|

|

4,800,000

|

|

UBS Group AG (e) (j) (k)

|

|

6.88%

|

|

(b)

|

|

5,311,440

|

|

1,165,000

|

|

UBS Group AG (e) (f) (j)

|

|

7.00%

|

|

(b)

|

|

1,254,641

|

|

|

|

|

|

148,925,933

|

|

|

|

Diversified Financial Services – 1.2%

|

|

|

|

|

|

|

|

11,949,000

|

|

Voya Financial, Inc. (c) (e)

|

|

5.65%

|

|

05/15/53

|

|

12,343,377

|

|

4,781,000

|

|

Voya Financial, Inc., Series A (c) (e)

|

|

6.13%

|

|

(b)

|

|

4,915,800

|

|

|

|

|

|

17,259,177

|

|

|

|

Diversified Telecommunication Services – 1.7%

|

|

|

|

|

|

|

|

14,272,000

|

|

Koninklijke KPN N.V. (d) (e) (f)

|

|

7.00%

|

|

03/28/73

|

|

14,969,086

|

|

8,250,000

|

|

Koninklijke KPN N.V. (c) (d) (e) (k)

|

|

7.00%

|

|

03/28/73

|

|

8,652,954

|

|

|

|

|

|

23,622,040

|

|

|

|

Electric Utilities – 7.4%

|

|

|

|

|

|

|

|

1,588,000

|

|

Duke Energy Corp. (c) (e)

|

|

4.88%

|

|

(b)

|

|

1,682,895

|

|

59,786,000

|

|

Emera, Inc., Series 16-A (d) (e)

|

|

6.75%

|

|

06/15/76

|

|

66,317,321

|

|

20,600,000

|

|

Enel S.p.A. (c) (e) (f)

|

|

8.75%

|

|

09/24/73

|

|

23,844,500

|

|

10,000,000

|

|

Southern (The) Co., Series B (c) (d) (e)

|

|

4.00%

|

|

01/15/51

|

|

10,173,900

|

|

|

|

|

|

102,018,616

|

|

|

|

Energy Equipment & Services – 2.3%

|

|

|

|

|

|

|

|

25,600,000

|

|

Transcanada Trust (c) (d) (e)

|

|

5.50%

|

|

09/15/79

|

|

26,265,047

|

|

5,000,000

|

|

Transcanada Trust, Series 16-A (d) (e)

|

|

5.88%

|

|

08/15/76

|

|

5,318,714

|

|

|

|

|

|

31,583,761

|

|

|

|

Food Products – 4.9%

|

|

|

|

|

|

|

|

6,000,000

|

|

Dairy Farmers of America, Inc. (c) (g)

|

|

7.13%

|

|

(b)

|

|

5,497,289

|

|

17,788,000

|

|

Land O’Lakes Capital Trust I (c) (d) (g)

|

|

7.45%

|

|

03/15/28

|

|

20,278,320

|

|

10,000,000

|

|

Land O’Lakes, Inc. (c) (f)

|

|

7.25%

|

|

(b)

|

|

9,342,950

|

|

33,000,000

|

|

Land O’Lakes, Inc. (c) (f)

|

|

8.00%

|

|

(b)

|

|

32,835,000

|

|

|

|

|

|

67,953,559

|

|

|

|

Independent Power & Renewable Electricity Producers – 0.4%

|

|

|

|

|

|

|

|

4,900,000

|

|

AES Gener S.A. (e) (f)

|

|

6.35%

|

|

10/07/79

|

|

4,944,713

|

Page 10

See Notes to Financial Statements

First Trust Intermediate Duration

Preferred & Income Fund (FPF)

Portfolio of Investments

(Continued)

October 31, 2020

Par

Amount

|

|

Description

|

|

Stated

Rate

|

|

Stated

Maturity

|

|

Value

|

|

CAPITAL PREFERRED SECURITIES (Continued)

|

|

|

|

Insurance – 15.0%

|

|

|

|

|

|

|

|

$13,968,000

|

|

Asahi Mutual Life Insurance Co. (c) (e) (k)

|

|

6.50%

|

|

(b)

|

|

$14,910,840

|

|

4,039,000

|

|

Asahi Mutual Life Insurance Co. (c) (e) (k)

|

|

7.25%

|

|

(b)

|

|

4,245,975

|

|

17,585,000

|

|

Assurant, Inc. (c) (d) (e)

|

|

7.00%

|

|

03/27/48

|

|

19,171,407

|

|

2,500,000

|

|

Assured Guaranty Municipal Holdings, Inc. (d) (e) (f)

|

|

6.40%

|

|

12/15/66

|

|

2,452,432

|

|

16,490,000

|

|

AXIS Specialty Finance LLC (d) (e)

|

|

4.90%

|

|

01/15/40

|

|

16,729,026

|

|

8,704,000

|

|

Enstar Finance LLC (c) (d) (e)

|

|

5.75%

|

|

09/01/40

|

|

8,864,582

|

|

15,300,000

|

|

Fortegra Financial Corp. (c) (d) (e) (g)

|

|

8.50%

|

|

10/15/57

|

|

16,682,364

|

|

6,200,000

|

|

Hartford Financial Services Group (The), Inc., 3 Mo. LIBOR + 2.13% (a) (f)

|

|

2.41%

|

|

02/12/47

|

|

5,420,640

|

|

2,000,000

|

|

La Mondiale SAM (c) (e) (k)

|

|

5.88%

|

|

01/26/47

|

|

2,254,804

|

|

4,723,000

|

|

Lincoln National Corp., 3 Mo. LIBOR + 2.36% (a)

|

|

2.64%

|

|

05/17/66

|

|

3,361,572

|

|

18,700,000

|

|

Markel Corp. (c) (e)

|

|

6.00%

|

|

(b)

|

|

19,892,125

|

|

1,219,000

|

|

MetLife, Inc. (d)

|

|

6.40%

|

|

12/15/36

|

|

1,512,747

|

|

6,200,000

|

|

MetLife, Inc., Series G (c) (e)

|

|

3.85%

|

|

(b)

|

|

6,233,232

|

|

3,000,000

|

|

Nationwide Financial Services Capital Trust (c) (d) (l)

|

|

7.90%

|

|

03/01/37

|

|

3,627,265

|

|

2,910,000

|

|

Nationwide Financial Services, Inc. (c) (d)

|

|

6.75%

|

|

05/15/37

|

|

3,434,064

|

|

5,000,000

|

|

PartnerRe Finance B LLC (d) (e)

|

|

4.50%

|

|

10/01/50

|

|

5,021,084

|

|

12,900,000

|

|

QBE Insurance Group Ltd. (c) (e) (f)

|

|

5.88%

|

|

(b)

|

|

13,803,000

|

|

24,300,000

|

|

QBE Insurance Group Ltd. (c) (e) (f)

|

|

7.50%

|

|

11/24/43

|

|

27,317,527

|

|

22,465,000

|

|

QBE Insurance Group Ltd. (c) (e) (k)

|

|

6.75%

|

|

12/02/44

|

|

25,068,132

|

|

7,000,000

|

|

Reinsurance Group of America, Inc., 3 Mo. LIBOR + 2.67% (a)

|

|

2.92%

|

|

12/15/65

|

|

5,915,000

|

|

|

|

|

|

205,917,818

|

|

|

|

Multi-Utilities – 1.1%

|

|

|

|

|

|

|

|

1,900,000

|

|

CenterPoint Energy, Inc., Series A (c) (e)

|

|

6.13%

|

|

(b)

|

|

1,923,331

|

|

6,400,000

|

|

NiSource, Inc. (c) (e)

|

|

5.65%

|

|

(b)

|

|

6,403,136

|

|

6,000,000

|

|

Sempra Energy (c) (e)

|

|

4.88%

|

|

(b)

|

|

6,255,000

|

|

|

|

|

|

14,581,467

|

|

|

|

Oil, Gas & Consumable Fuels – 6.7%

|

|

|

|

|

|

|

|

8,600,000

|

|

BP Capital Markets PLC (c) (e)

|

|

4.88%

|

|

(b)

|

|

9,004,544

|

|

4,200,000

|

|

DCP Midstream L.P., Series A (e)

|

|

7.38%

|

|

(b)

|

|

2,732,974

|

|

4,905,000

|

|

DCP Midstream Operating L.P. (e) (f)

|

|

5.85%

|

|

05/21/43

|

|

3,667,493

|

|

4,626,000

|

|

Enbridge, Inc. (c) (e)

|

|

5.50%

|

|

07/15/77

|

|

4,423,151

|

|

24,100,000

|

|

Enbridge, Inc. (c) (e)

|

|

6.25%

|

|

03/01/78

|

|

24,154,330

|

|

19,128,000

|

|

Enbridge, Inc., Series 16-A (c) (e)

|

|

6.00%

|

|

01/15/77

|

|

19,051,829

|

|

11,200,000

|

|

Enbridge, Inc., Series 20-A (c) (e)

|

|

5.75%

|

|

07/15/80

|

|

11,441,031

|

|

20,365,000

|

|

Energy Transfer Operating L.P., 3 Mo. LIBOR + 3.02% (a)

|

|

3.27%

|

|

11/01/66

|

|

10,554,161

|

|

3,000,000

|

|

Energy Transfer Operating L.P., Series G (e)

|

|

7.13%

|

|

(b)

|

|

2,455,830

|

|

6,500,000

|

|

Enterprise Products Operating LLC, 3 Mo. LIBOR + 2.78% (a)

|

|

3.02%

|

|

06/01/67

|