UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-22795

First Trust Intermediate Duration Preferred & Income Fund

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

Registrant's telephone number, including area code: 630-765-8000

Date of fiscal year end: October 31

Date of reporting period: July 31, 2013

Form N-Q is to be used by management investment companies, other than small

business investment companies registered on Form N-5 (ss.ss. 239.24 and 274.5 of

this chapter), to file reports with the Commission, not later than 60 days after

the close of the first and third fiscal quarters, pursuant to rule 30b1-5 under

the Investment Company Act of 1940 (17 CFR 270.30b1-5). The Commission may use

the information provided on Form N-Q in its regulatory, disclosure review,

inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-Q, and

the Commission will make this information public. A registrant is not required

to respond to the collection of information contained in Form N-Q unless the

Form displays a currently valid Office of Management and Budget ("OMB") control

number. Please direct comments concerning the accuracy of the information

collection burden estimate and any suggestions for reducing the burden to the

Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC

20549. The OMB has reviewed this collection of information under the clearance

requirements of 44 U.S.C. ss. 3507.

ITEM 1. SCHEDULE OF INVESTMENTS. The Schedule(s) of Investments is attached

herewith.

FIRST TRUST INTERMEDIATE DURATION PREFERRED & INCOME FUND (FPF)

PORTFOLIO OF INVESTMENTS

JULY 31, 2013 (UNAUDITED)

STATED

SHARES DESCRIPTION RATE STATED MATURITY VALUE

---------------- ----------------------------------------------------- ----------- --------------- --------------

$20 PAR PREFERRED SECURITIES - 0.4%

REAL ESTATE INVESTMENT TRUSTS - 0.4%

312,157 CommonWealth REIT ................................... 7.50% 11/15/19 $ 6,520,960

--------------

TOTAL $20 PAR PREFERRED SECURITIES................................................. 6,520,960

--------------

(Cost $6,565,806)

$25 PAR PREFERRED SECURITIES - 19.0%

CAPITAL MARKETS - 1.9%

21,808 Affiliated Managers Group, Inc. ..................... 6.38% 08/15/42 544,110

100,000 Apollo Investment Corp. ............................. 6.88% 07/15/43 2,339,000

189,424 Ares Capital Corp. .................................. 7.00% 02/15/22 4,866,302

44,567 Ares Capital Corp. .................................. 7.75% 10/15/40 1,148,492

334,403 Goldman Sachs Group, Inc. ........................... 6.13% 11/01/60 8,447,020

85,000 Morgan Stanley Capital Trust VI ..................... 6.60% 02/01/46 2,130,950

100,000 Morgan Stanley Capital Trust VII .................... 6.60% 10/15/66 2,516,000

178,669 Raymond James Financial, Inc. ....................... 6.90% 03/15/42 4,615,020

--------------

26,606,894

--------------

COMMERCIAL BANKS - 4.4%

323,084 HSBC Holdings PLC, Series 2 ......................... 8.00% (a) 8,797,577

100,000 PNC Financial Services Group, Inc., Series P (b)..... 6.13% (a) 2,625,000

246,368 Regions Financial Corp., Series A ................... 6.38% (a) 6,068,044

323,170 Santander Finance Preferred SAU, Series 10 .......... 10.50% (a) 8,612,481

190,000 SunTrust Banks, Inc., Series E ...................... 5.88% (a) 4,491,600

200,000 Taylor Capital Group Inc. ........................... 8.00% (a) 5,124,000

165,000 Texas Capital Bancshares Inc. ....................... 6.50% (a) 4,057,350

44,618 Webster Financial Corp., Series E ................... 6.40% (a) 1,106,526

373,036 Wells Fargo & Co. (b)................................ 5.85% (a) 9,203,731

175,000 Wells Fargo & Co., Series J ......................... 8.00% (a) 4,968,250

66,300 Zions Bancorporation (b)............................. 6.30% (a) 1,673,412

195,000 Zions Bancorporation, Series C ...................... 9.50% (a) 4,980,300

--------------

61,708,271

--------------

CONSUMER FINANCE - 0.5%

279,601 Discover Financial Services, Series B ............... 6.50% (a) 6,987,229

--------------

DIVERSIFIED FINANCIAL SERVICES - 4.0%

817,473 Citigroup Capital XIII (b)........................... 7.88% 10/30/40 22,480,507

459,567 Countrywide Capital V ............................... 7.00% 11/01/36 11,539,727

196,292 ING Groep N.V. ...................................... 6.20% (a) 4,667,824

279,112 ING Groep N.V. ...................................... 6.38% (a) 6,718,226

77,290 ING Groep N.V. ...................................... 7.38% (a) 1,946,935

2,856 KKR Financial Holdings LLC .......................... 8.38% 11/15/41 78,369

216,813 KKR Financial Holdings LLC, Series A ................ 7.38% (a) 5,485,369

172,752 RBS Capital Funding Trust VII, Series G ............. 6.08% (a) 3,427,400

--------------

56,344,357

--------------

DIVERSIFIED TELECOMMUNICATION SERVICES - 1.1%

83,750 Qwest Corp. ......................................... 7.38% 06/01/51 2,123,063

|

See Notes to Quarterly Portfolio of Investments Page 1

FIRST TRUST INTERMEDIATE DURATION PREFERRED & INCOME FUND (FPF)

PORTFOLIO OF INVESTMENTS (CONTINUED)

JULY 31, 2013 (UNAUDITED)

STATED

SHARES DESCRIPTION RATE STATED MATURITY VALUE

---------------- ----------------------------------------------------- ----------- --------------- --------------

$25 PAR PREFERRED SECURITIES (CONTINUED)

DIVERSIFIED TELECOMMUNICATION SERVICES (CONTINUED)

148,899 Qwest Corp. ......................................... 7.50% 09/15/51 $ 3,817,770

120,211 Qwest Corp. ......................................... 7.00% 04/01/52 3,025,711

315,508 Qwest Corp. ......................................... 6.13% 06/01/53 7,111,550

--------------

16,078,094

--------------

ELECTRIC UTILITIES - 0.7%

189,962 Entergy Arkansas Inc. ............................... 4.75% 06/01/63 3,968,306

3,287 Entergy Mississippi, Inc. ........................... 6.00% 05/01/51 81,583

59,454 Entergy Texas, Inc. ................................. 7.88% 06/01/39 1,589,800

15,392 NextEra Energy Capital Holdings, Inc., Series F ..... 8.75% 03/01/69 406,041

31,781 NextEra Energy Capital Holdings, Inc., Series G ..... 5.70% 03/01/72 745,582

32,023 NextEra Energy Capital Holdings, Inc., Series H ..... 5.63% 06/15/72 742,613

101,653 PPL Capital Funding, Inc., Series B ................. 5.90% 04/30/73 2,337,003

--------------

9,870,928

--------------

INSURANCE - 3.4%

67,806 Arch Capital Group Ltd., Series C ................... 6.75% (a) 1,720,238

200,000 Aspen Insurance Holdings Ltd. (b).................... 5.95% (a) 5,140,000

94,500 Aspen Insurance Holdings Ltd. (b).................... 7.40% (a) 2,518,425

41,834 Aviva PLC ........................................... 8.25% 12/01/41 1,153,363

150,515 Axis Capital Holdings Ltd., Series C ................ 6.88% (a) 3,910,380

1,074 Endurance Specialty Holdings Ltd., Series A ......... 7.75% (a) 28,407

264,683 Endurance Specialty Holdings Ltd., Series B ......... 7.50% (a) 6,992,925

346,987 Hartford Financial Services Group, Inc. (b).......... 7.88% 04/15/42 10,204,888

222,240 MetLife, Inc., Series B ............................. 6.50% (a) 5,598,226

175,000 Montpelier Re Holdings Ltd. ......................... 8.88% (a) 4,632,250

85,000 PartnerRe Ltd., Series E ............................ 7.25% (a) 2,255,050

175,927 Reinsurance Group of America, Inc. (b)............... 6.20% 09/15/42 4,494,935

7,000 WR Berkley Corp. .................................... 5.63% 04/30/53 148,960

--------------

48,798,047

--------------

MULTI-UTILITIES - 0.0%

2,266 DTE Energy Co. ...................................... 6.50% 12/01/61 58,440

--------------

REAL ESTATE INVESTMENT TRUSTS - 2.8%

245,007 CommonWealth REIT ................................... 5.75% 08/01/42 5,301,951

178,774 CommonWealth REIT, Series E ......................... 7.25% (a) 4,424,657

90,000 Digital Realty Trust, Inc., Series E ................ 7.00% (a) 2,250,000

110,285 DuPont Fabros Technology Inc. ....................... 7.88% (a) 2,839,839

62,848 EPR Properties, Series F ............................ 6.63% (a) 1,508,352

3,370 Health Care REIT, Inc., Series J .................... 6.50% (a) 85,261

61,206 Hospitality Properties Trust, Series D .............. 7.13% (a) 1,561,977

30,980 Kilroy Realty Corp. ................................. 6.38% (a) 739,183

150,541 Kilroy Realty Corp. ................................. 6.88% (a) 3,686,749

|

Page 2 See Notes to Quarterly Portfolio of Investments

FIRST TRUST INTERMEDIATE DURATION PREFERRED & INCOME FUND (FPF)

PORTFOLIO OF INVESTMENTS (CONTINUED)

JULY 31, 2013 (UNAUDITED)

STATED

SHARES DESCRIPTION RATE STATED MATURITY VALUE

---------------- ----------------------------------------------------- ----------- --------------- --------------

$25 PAR PREFERRED SECURITIES (CONTINUED)

REAL ESTATE INVESTMENT TRUSTS (CONTINUED)

22,444 Kimco Realty Corp., Series H ........................ 6.90% (a) $ 568,731

203,508 National Retail Properties, Inc., Series D .......... 6.63% (a) 5,089,735

1,007 PS Business Parks Inc. .............................. 6.88% (a) 25,316

34,535 PS Business Parks, Inc., Series S ................... 6.45% (a) 849,216

67,037 PS Business Parks, Inc., Series T ................... 6.00% (a) 1,553,247

11,480 Public Storage ...................................... 6.50% (a) 290,444

29,394 Public Storage, Series R ............................ 6.35% (a) 741,023

33,338 Regency Centers Corp., Series 6 ..................... 6.63% (a) 833,783

99,794 Taubman Centers, Inc., Series J ..................... 6.50% (a) 2,457,926

70,879 Taubman Centers, Inc., Series K ..................... 6.25% (a) 1,679,832

33,609 Vornado Realty Trust, Series I ...................... 6.63% (a) 849,636

88,499 Vornado Realty Trust, Series J ...................... 6.88% (a) 2,272,654

--------------

39,609,512

--------------

WIRELESS TELECOMMUNICATION SERVICES - 0.2%

29,358 Telephone & Data Systems Inc. ....................... 6.63% 03/31/45 735,418

57,253 Telephone & Data Systems, Inc. ...................... 6.88% 11/15/59 1,465,104

1,989 Telephone & Data Systems, Inc. ...................... 7.00% 03/15/60 51,336

32,455 US Cellular Corp. ................................... 6.95% 05/15/60 827,603

--------------

3,079,461

--------------

TOTAL $25 PAR PREFERRED SECURITIES................................................. 269,141,233

(Cost $275,699,613) --------------

$50 PAR PREFERRED SECURITIES - 0.2%

CONSUMER FINANCE - 0.2%

54,367 SLM Corp. ........................................... 6.97% (a) 2,650,391

--------------

TOTAL $50 PAR PREFERRED SECURITIES................................................. 2,650,391

--------------

(Cost $2,677,798)

$100 PAR PREFERRED SECURITIES - 2.3%

COMMERCIAL BANKS - 1.6%

50,000 CoBank ACB .......................................... 6.13% (a) 4,990,625

175,000 CoBank ACB (b) (c)................................... 6.25% (a) 18,063,290

--------------

23,053,915

--------------

DIVERSIFIED FINANCIAL SERVICES - 0.7%

100,000 Farm Credit Bank of Texas (b) (c).................... 6.75% (a) 10,025,000

------------

TOTAL $100 PAR PREFERRED SECURITIES................................................ 33,078,915

(Cost $33,913,750) --------------

$1,000 PAR PREFERRED SECURITIES - 4.6%

COMMERCIAL BANKS - 1.4%

9,310 Santander Finance Preferred SAU, Series 11 (b)....... 10.50% (a) 9,909,331

|

See Notes to Quarterly Portfolio of Investments Page 3

FIRST TRUST INTERMEDIATE DURATION PREFERRED & INCOME FUND (FPF)

PORTFOLIO OF INVESTMENTS (CONTINUED)

JULY 31, 2013 (UNAUDITED)

STATED

SHARES DESCRIPTION RATE STATED MATURITY VALUE

---------------- ----------------------------------------------------- ----------- --------------- --------------

$1,000 PAR PREFERRED SECURITIES (CONTINUED)

COMMERCIAL BANKS (CONTINUED)

10,000 AgStar Financial Services ACA (b) (c)................ 6.75% (a) $ 9,961,875

--------------

19,871,206

--------------

DIVERSIFIED FINANCIAL SERVICES - 1.1%

15,000 Pitney Bowes International Holdings Inc. (c)......... 6.13% (a) 14,888,438

--------------

DIVERSIFIED TELECOMMUNICATION SERVICES - 1.4%

16,000 Centaur Funding Corp. (c)............................ 9.08% 04/21/20 19,635,000

--------------

REAL ESTATE INVESTMENT TRUSTS - 0.7%

8,000 Sovereign Real Estate Investment Trust (c)........... 12.00% (a) 10,457,160

--------------

TOTAL $1,000 PAR PREFERRED SECURITIES.............................................. 64,851,804

(Cost $65,673,043) --------------

PAR STATED

AMOUNT DESCRIPTION RATE STATED MATURITY VALUE

---------------- ----------------------------------------------------- ----------- --------------- --------------

CAPITAL PREFERRED SECURITIES - 102.0%

CAPITAL MARKETS - 3.3%

$ 28,850,000 Deutsche Bank Capital Funding Trust VII (b) (c)...... 5.63% (a) 28,922,125

18,500,000 Goldman Sachs Capital I ............................. 6.35% 02/15/34 18,405,391

--------------

47,327,516

--------------

COMMERCIAL BANKS - 35.7%

18,600,000 Banco Bilbao Vizcaya Argentaria S.A. (b)............. 9.00% (a) 18,224,280

10,000,000 Barclays Bank PLC ................................... 7.63% 11/21/22 9,975,000

21,000,000 Barclays Bank PLC (b)................................ 7.75% 04/10/23 21,630,000

6,000,000 Barclays Bank PLC (b) (c)............................ 7.43% (a) 6,501,000

16,750,000 BBVA International Preferred SAU (b)................. 5.92% (a) 15,326,250

17,000,000 BNP Paribas S.A. (b) (c)............................. 7.20% (a) 17,178,500

7,500,000 BPCE S.A. (b) (c).................................... 12.50% (a) 9,346,875

3,000,000 BPCE S.A. ........................................... 13.00% (a) 3,409,500

20,000,000 Cooperatieve Centrale Raiffeisen-Boerenleenbank

BA (b)........................................... 8.40% (a) 21,911,600

21,604,000 Cooperatieve Centrale Raiffeisen-Boerenleenbank

BA (b) (c)....................................... 11.00% (a) 28,045,362

6,000,000 Credit Agricole S.A. (b) (c)......................... 8.38% (a) 6,480,000

5,000,000 Danske Bank A/S ..................................... 7.13% 09/21/37 5,093,750

8,700,000 Fifth Third Capital Trust IV (b)..................... 6.50% 04/15/37 8,700,000

6,725,000 HSBC Capital Funding LP (b) (c)...................... 10.18% (a) 9,700,812

26,000,000 KBC Bank NV (b)...................................... 8.00% 01/25/23 26,611,000

9,000,000 LBG Capital No.1 PLC (b) (c)......................... 8.00% (a) 9,178,677

22,755,000 Lloyds Banking Group PLC (b) (c)..................... 5.92% (a) 18,886,650

23,500,000 Lloyds Banking Group PLC (b) (c)..................... 6.27% (a) 19,857,500

13,500,000 Lloyds TSB Bank PLC (b) (c).......................... 12.00% (a) 18,258,750

|

Page 4 See Notes to Quarterly Portfolio of Investments

FIRST TRUST INTERMEDIATE DURATION PREFERRED & INCOME FUND (FPF)

PORTFOLIO OF INVESTMENTS (CONTINUED)

JULY 31, 2013 (UNAUDITED)

PAR STATED

AMOUNT DESCRIPTION RATE STATED MATURITY VALUE

---------------- ----------------------------------------------------- ----------- --------------- --------------

CAPITAL PREFERRED SECURITIES (CONTINUED)

COMMERCIAL BANKS (CONTINUED)

$ 23,020,000 M&T Bank Corp. (c)................................... 6.88% (a) $ 23,973,673

10,000,000 Macquarie PMI LLC ................................... 8.38% (a) 10,450,000

9,964,000 Mizuho Capital Investment, Ltd. (b) (c).............. 14.95% (a) 11,109,860

10,754,000 Natixis (b).......................................... 10.00% (a) 12,259,560

2,000,000 Natixis (b).......................................... 10.00% (a) 2,280,000

4,200,000 NIBC Bank N.V. ...................................... 7.63% (a) 3,633,000

24,600,000 Royal Bank of Scotland Group PLC, Series U (b)....... 7.64% (a) 22,447,500

7,750,000 SMFG Preferred Capital USD 3 Ltd. (b) (c)............ 9.50% (a) 9,514,675

37,600,000 Societe Generale S.A. (b)............................ 6.63% (a) 38,164,000

15,184,000 Standard Chartered Bank (b).......................... 9.50% (a) 16,588,520

4,500,000 Standard Chartered PLC (b) (c)....................... 6.41% (a) 4,589,438

8,500,000 UBS AG (b)........................................... 7.25% 02/22/22 9,152,562

46,000,000 Wells Fargo & Co., Series K (b)...................... 7.98% (a) 51,865,000

10,000,000 Westpac Capital Trust III (b)........................ 5.82% (a) 10,085,000

6,800,000 Zions Bancorporation (b)............................. 5.80% (a) 6,358,000

--------------

506,786,294

--------------

DIVERSIFIED FINANCIAL SERVICES - 20.2%

1,000,000 Ageas Hybrid Financing S.A. ......................... 8.25% (a) 1,005,714

25,500,000 Bank of America Corp. (b)............................ 8.00% (a) 28,371,682

20,000,000 Bank of America Corp. (b)............................ 8.13% (a) 22,300,280

800,000 Citigroup Inc. (b)................................... 8.40% (a) 882,867

28,000,000 Citigroup, Inc. (b).................................. 5.95% (a) 27,160,000

10,000,000 Credit Suisse Group Guernsey I Ltd. (b).............. 7.88% 02/24/41 10,650,000

47,500,000 General Electric Capital Corp., Series A (b)......... 7.13% (a) 53,526,895

20,520,000 Glen Meadow Pass Through Trust (b) (c)............... 6.51% 02/12/67 19,596,600

9,000,000 ING Groep N.V. (b)................................... 5.78% (a) 9,000,000

14,530,000 ING US, Inc. (b) (c)................................. 5.65% 05/15/53 13,694,525

40,009,000 JPMorgan Chase & Co., Series 1 (b)................... 7.90% (a) 44,554,342

25,000,000 JPMorgan Chase & Co., Series R (b)................... 6.00% (a) 24,656,250

7,500,000 Svensk Exportkredit AB (c)........................... 6.38% (a) 7,462,473

10,000,000 UBS AG .............................................. 7.63% 08/17/22 11,143,660

11,585,000 ZFS Finance USA Trust II (b) (c)..................... 6.45% 12/15/65 12,424,913

--------------

286,430,201

--------------

ELECTRIC UTILITIES - 2.8%

14,975,000 NextEra Energy Capital Holdings Inc. (b)............. 7.30% 09/01/67 16,674,483

17,500,000 PPL Capital Funding Inc. (b)......................... 6.70% 03/30/67 18,214,665

4,179,000 Southern California Edison Co., Series E (b)......... 6.25% (a) 4,471,530

--------------

39,360,678

--------------

ENERGY EQUIPMENT & SERVICES - 0.5%

7,000,000 DCP Midstream LLC (b) (c)............................ 5.85% 05/21/43 6,720,000

--------------

INSURANCE - 35.3%

23,000,000 American International Group, Inc. (b)............... 8.18% 05/15/58 28,232,500

|

See Notes to Quarterly Portfolio of Investments Page 5

FIRST TRUST INTERMEDIATE DURATION PREFERRED & INCOME FUND (FPF)

PORTFOLIO OF INVESTMENTS (CONTINUED)

JULY 31, 2013 (UNAUDITED)

PAR STATED

AMOUNT DESCRIPTION RATE STATED MATURITY VALUE

---------------- ----------------------------------------------------- ----------- --------------- --------------

CAPITAL PREFERRED SECURITIES (CONTINUED)

INSURANCE (CONTINUED)

$ 25,500,000 Aquarius + Investments PLC for Swiss Reinsurance Co.

Ltd. (b)......................................... 8.25% (a) $ 27,476,250

5,000,000 Assured Guaranty Municipal Holdings, Inc. (b) (c).... 6.40% 12/15/66 4,450,000

31,337,000 Aviva PLC ........................................... 8.25% (a) 33,641,836

6,800,000 AXA S.A. ............................................ 8.60% 12/15/30 8,253,004

15,000,000 AXA S.A. (b) (c)..................................... 6.38% (a) 15,000,000

25,055,000 AXA S.A. (b) (c)..................................... 6.46% (a) 25,117,638

1,050,000 Catlin Insurance Co Ltd. (b) (c)..................... 7.25% (a) 1,102,500

8,500,000 CHUBB Corp. (b)...................................... 6.38% 03/29/67 9,243,750

5,500,000 Cloverie PLC for Zurich Insurance Co. Ltd. (b)....... 8.25% (a) 6,331,892

12,500,000 Dai-ichi Life Insurance Co Ltd. (The) (b) (c)........ 7.25% (a) 13,896,275

22,200,000 Genworth Holdings Inc. (b)........................... 6.15% 11/15/66 19,674,750

23,782,000 Hartford Financial Services Group Inc. (b)........... 8.13% 06/15/38 27,230,390

8,100,000 Liberty Mutual Group, Inc. (b) (c)................... 7.00% 03/15/37 8,403,750

23,000,000 Lincoln National Corp. (b)........................... 7.00% 05/17/66 23,805,000

18,000,000 Lincoln National Corp. (b)........................... 6.05% 04/20/67 18,090,000

10,000,000 MetLife Capital Trust IV (c)......................... 7.88% 12/15/37 11,850,000

3,500,000 MetLife Capital Trust X (c).......................... 9.25% 04/08/38 4,672,500

16,265,000 MetLife Inc. ........................................ 10.75% 08/01/39 24,804,125

25,000,000 MetLife, Inc. ....................................... 6.40% 12/15/36 26,000,000

3,000,000 Nationwide Financial Services Capital Trust ......... 7.90% 03/01/37 3,305,280

13,000,000 Nationwide Financial Services Inc. .................. 6.75% 05/15/37 13,325,000

5,000,000 Provident Financing Trust I ......................... 7.41% 03/15/38 5,551,855

23,265,000 Prudential Financial Inc. (b)........................ 8.88% 06/15/38 28,150,650

19,389,000 Prudential PLC (b)................................... 11.75% (a) 21,837,908

36,520,000 QBE Capital Funding III Ltd. (b) (c)................. 7.25% 05/24/41 39,259,000

5,500,000 StanCorp Financial Group Inc. (b).................... 6.90% 06/01/67 5,561,875

8,000,000 Swiss Re Capital I LP (b) (c)........................ 6.85% (a) 8,420,000

39,311,000 XL Group PLC, Series E (b)........................... 6.50% (a) 38,819,612

--------------

501,507,340

--------------

METALS & MINING - 1.1%

14,872,000 ArcelorMittal (b).................................... 8.75% (a) 16,139,838

--------------

MULTI-UTILITIES - 1.1%

9,000,000 Dominion Resources Inc. (b).......................... 7.50% 06/30/66 9,861,462

5,000,000 RWE AG .............................................. 7.00% 10/12/72 5,422,500

--------------

15,283,962

--------------

OIL, GAS & CONSUMABLE FUELS - 2.0%

5,000,000 BG Energy Capital PLC (b)............................ 6.50% 11/30/72 5,375,500

16,000,000 Enbridge Energy Partners LP (b)...................... 8.05% 10/01/37 18,170,960

|

Page 6 See Notes to Quarterly Portfolio of Investments

FIRST TRUST INTERMEDIATE DURATION PREFERRED & INCOME FUND (FPF)

PORTFOLIO OF INVESTMENTS (CONTINUED)

JULY 31, 2013 (UNAUDITED)

PAR STATED

AMOUNT DESCRIPTION RATE STATED MATURITY VALUE

---------------- ----------------------------------------------------- ----------- --------------- --------------

CAPITAL PREFERRED SECURITIES (CONTINUED)

OIL, GAS & CONSUMABLE FUELS (CONTINUED)

$ 4,000,000 Enterprise Products Operating LLC (b)................ 7.03% 01/15/68 $ 4,494,328

--------------

28,040,788

--------------

TOTAL CAPITAL PREFERRED SECURITIES................................................. 1,447,596,617

(Cost $1,479,950,775) --------------

PRINCIPAL STATED

VALUE DESCRIPTION COUPON STATED MATURITY VALUE

---------------- ----------------------------------------------------- ----------- --------------- --------------

CORPORATE BONDS AND NOTES - 2.7%

CAPITAL MARKETS - 0.7%

10,000,000 Goldman Sachs Group Inc. (The) ...................... 6.75% 10/01/37 10,553,720

--------------

COMMERCIAL BANKS - 2.0%

9,940,000 Barclays Bank PLC (c)................................ 10.18% 06/12/21 12,793,724

2,560,000 Barclays Bank PLC ................................... 10.18% 06/12/21 3,294,963

1,010,000 BBVA Global Finance Ltd. ............................ 7.00% 12/01/25 1,012,518

10,000,000 Royal Bank of Scotland PLC (The) (b)................. 9.50% 03/16/22 11,091,500

--------------

28,192,705

--------------

TOTAL CORPORATE BONDS AND NOTES.................................................... 38,746,425

(Cost $39,479,735) --------------

TOTAL INVESTMENTS - 131.2%......................................................... 1,862,586,345

(Cost $1,903,960,520) (d)

OUTSTANDING LOAN - (35.2%)......................................................... (500,000,000)

NET OTHER ASSETS AND LIABILITIES - 4.0%............................................ 56,853,905

--------------

NET ASSETS - 100.0%................................................................ $1,419,440,250

==============

|

(a) Perpetual maturity.

(b) Fixed-to-floating or fixed-to-variable rate security. The interest rate

shown reflects the fixed rate in effect at July 31, 2013. At a

predetermined date, the fixed rate will change to a floating rate or a

variable rate.

(c) This security, sold within the terms of a private placement memorandum, is

exempt from registration upon resale under Rule 144A under the Securities

Act of 1933, as amended, and may be resold in transactions exempt from

registration, normally to qualified institutional buyers. Pursuant to

procedures adopted by the Fund's Board of Trustees, this security has been

determined to be liquid by Stonebridge Advisors LLC, the Fund's

sub-advisor. Although market instability can result in periods of

increased overall market illiquidity, liquidity for each security is

determined based on security specific factors and assumptions, which

require subjective judgment. At July 31, 2013, securities noted as such

amounted to $521,698,116 or 36.75% of net assets.

(d) Aggregate cost for financial reporting purposes, which approximates the

aggregate cost for federal income tax purposes. As of July 31, 2013, the

aggregate gross unrealized appreciation for all securities in which there

was an excess of value over tax cost was $3,376,717 and the aggregate

gross unrealized depreciation for all securities in which there was an

excess of tax cost over value was $44,750,892.

See Notes to Quarterly Portfolio of Investments Page 7

FIRST TRUST INTERMEDIATE DURATION PREFERRED & INCOME FUND (FPF)

PORTFOLIO OF INVESTMENTS (CONTINUED)

JULY 31, 2013 (UNAUDITED)

VALUATION INPUTS

A summary of the inputs used to value the Fund's investments as of July 31, 2013

is as follows (see Note 2A - Portfolio Valuation in the Notes to Quarterly

Portfolio of Investments):

LEVEL 2 LEVEL 3

TOTAL LEVEL 1 SIGNIFICANT SIGNIFICANT

VALUE AT QUOTED OBSERVABLE UNOBSERVABLE

INVESTMENTS 7/31/2013 PRICES INPUTS INPUTS

------------------------------------------------ -------------- ------------ -------------- ------------

$20 Par Preferred Securities*................... $ 6,520,960 $ 6,520,960 $ -- $ --

$25 Par Preferred Securities*................... 269,141,233 269,141,233 -- --

$50 Par Preferred Securities*................... 2,650,391 2,650,391 -- --

$100 Par Preferred Securities*.................. 33,078,915 33,078,915 -- --

$1,000 Par Preferred Securities*................ 64,851,804 64,851,804 -- --

Capital Preferred Securities*................... 1,447,596,617 -- 1,447,596,617 --

Corporate Bonds and Notes*...................... 38,746,425 -- 38,746,425 --

-------------- ------------ -------------- ------------

TOTAL INVESTMENTS............................... $1,862,586,345 $376,243,303 $1,486,343,042 $ --

============== ============ ============== ============

|

* See Portfolio of Investments for industry breakout.

All transfers in and out of the Levels during the period are assumed to be

transferred on the last day of the period at their current value. There were no

transfers between Levels at July 31, 2013.

Page 8 See Notes to Quarterly Portfolio of Investments

NOTES TO QUARTERLY PORTFOLIO OF INVESTMENTS

FIRST TRUST INTERMEDIATE DURATION PREFERRED & INCOME FUND (FPF)

JULY 31, 2013 (UNAUDITED)

1. ORGANIZATION

First Trust Intermediate Duration Preferred & Income Fund (the "Fund") is a

non-diversified, closed-end management investment company organized as a

Massachusetts business trust on February 4, 2013 and is registered with the

Securities and Exchange Commission ("SEC") under the Investment Company Act of

1940, as amended ( the "1940 Act"). The Fund trades under the ticker symbol FPF

on the New York Stock Exchange ("NYSE").

2. VALUATION AND INVESTMENT PRACTICES

A. PORTFOLIO VALUATION:

The net asset value ("NAV") of the Common Shares of the Fund is determined daily

as of the close of regular trading on the NYSE, normally 4:00 p.m. Eastern time,

on each day the NYSE is open for trading. If the NYSE closes early on a

valuation day, the NAV is determined as of that time. Domestic debt securities

and foreign securities are priced using data reflecting the earlier closing of

the principal markets for those securities. The NAV per Common Share is

calculated by dividing the value of all assets of the Fund (including accrued

interest and dividends), less all liabilities (including accrued expenses,

dividends declared but unpaid and any borrowings of the Fund), by the total

number of Common Shares outstanding.

The Fund's investments are valued daily in accordance with valuation procedures

adopted by the Fund's Board of Trustees and in accordance with provisions of the

1940 Act. The Fund's securities will be valued as follows:

Preferred stocks and other equity securities listed on any national or

foreign exchange (excluding the NASDAQ(R) Stock Market LLC ("NASDAQ") and

the London Stock Exchange Alternative Investment Market ("AIM")), are

valued at the last sale price on the exchange on which they are

principally traded or, for NASDAQ and AIM securities, the official closing

price. Securities traded on more than one securities exchange are valued

at the last sale price or official closing price, as applicable, at the

close of the securities exchange representing the principal market for

such securities.

Bonds, notes and other debt securities are valued on the basis of

valuations provided by dealers who make markets in such securities or by

an independent pricing service approved by the Trust's Board of Trustees,

which may use the following valuation inputs when available:

1) benchmark yields;

2) reported trades;

3) broker/dealer quotes;

4) issuer spreads;

5) benchmark securities;

6) bids and offers; and

7) reference data including market research publications.

Securities traded in an over-the-counter market are valued at their

closing bid prices.

Debt securities having a remaining maturity of sixty days or less when

purchased are valued at cost adjusted for amortization of premiums and

accretion of discounts.

All market quotations used in valuing the Fund's securities will be obtained

from a third party pricing service. If no quotation is received from a pricing

service, attempts will be made to obtain one or more broker quotes for the

security. In the event the pricing service does not provide a valuation, broker

quotations are not readily available, or the valuations received are deemed

unreliable, the Trust's Board of Trustees has designated First Trust Advisors

L.P. ("First Trust") to use a fair value method to value the Fund's securities.

Additionally, if events occur after the close of the principal markets for

certain securities (e.g., domestic debt and foreign securities) that could

materially affect the Fund's NAV, First Trust will use a fair value method to

value the Fund's securities. The use of fair value pricing is governed by

valuation procedures adopted by the Trust's Board of Trustees, and in accordance

with the provisions of the 1940 Act. As a general principle, the fair value of a

security is the amount which the Fund might reasonably expect to receive for the

security upon its current sale. In light of the judgment involved in fair

valuations, there can be no assurance that a fair value assigned to a particular

security will be the amount which the Fund might be able to receive upon its

current sale. Fair valuation of a security will be based on the consideration of

all available information, including, but not limited to, the following:

1) the type of security;

2) the size of the holding;

3) the initial cost of the security;

4) transactions in comparable securities;

Page 9

NOTES TO QUARTERLY PORTFOLIO OF INVESTMENTS (CONTINUED)

FIRST TRUST INTERMEDIATE DURATION PREFERRED & INCOME FUND (FPF)

JULY 31, 2013 (UNAUDITED)

5) price quotes from dealers and/or pricing services;

6) relationships among various securities;

7) information obtained by contacting the issuer, analysts, or the

appropriate stock exchange;

8) an analysis of the issuer's financial statements; and

9) the existence of merger proposals or tender offers that might affect

the value of the security.

If the securities in question are foreign securities, the following additional

information may be considered:

1) the value of similar foreign securities traded on other foreign

markets;

2) ADR trading of similar securities;

3) closed-end fund trading of similar securities;

4) foreign currency exchange activity;

5) the trading prices of financial products that are tied to baskets of

foreign securities;

6) factors relating to the event that precipitated the pricing problem;

7) whether the event is likely to recur; and

8) whether the effects of the event are isolated or whether they affect

entire markets, countries or regions.

The Fund is subject to fair value accounting standards that define fair value,

establish the framework for measuring fair value and provide a three-level

hierarchy for fair valuation based upon the inputs to the valuation as of the

measurement date. The three levels of the fair value hierarchy are as follows:

o Level 1 - Level 1 inputs are quoted prices in active markets for

identical investments. An active market is a market in which

transactions for the investment occur with sufficient frequency and

volume to provide pricing information on an ongoing basis.

o Level 2 - Level 2 inputs are observable inputs, either directly or

indirectly, and include the following:

o Quoted prices for similar investments in active markets.

o Quoted prices for identical or similar investments in markets

that are non-active. A non-active market is a market where

there are few transactions for the investment, the prices are

not current, or price quotations vary substantially either

over time or among market makers, or in which little

information is released publicly.

o Inputs other than quoted prices that are observable for the

investment (for example, interest rates and yield curves

observable at commonly quoted intervals, volatilities,

prepayment speeds, loss severities, credit risks, and default

rates).

o Inputs that are derived principally from or corroborated by

observable market data by correlation or other means.

o Level 3 - Level 3 inputs are unobservable inputs. Unobservable

inputs may reflect the reporting entity's own assumptions about the

assumptions that market participants would use in pricing the

investment.

The inputs or methodology used for valuing investments are not necessarily an

indication of the risk associated with investing in those investments. A summary

of the inputs used to value the Fund's investments as of July 31, 2013, is

included with the Fund's Portfolio of Investments.

B. SECURITIES TRANSACTIONS:

Securities transactions are recorded as of the trade date. Realized gains and

losses from securities transactions are recorded on the identified cost basis.

Page 10

ITEM 2. CONTROLS AND PROCEDURES.

(a) The registrant's principal executive and principal financial officers, or

persons performing similar functions, have concluded that the

registrant's disclosure controls and procedures (as defined in Rule

30a-3(c) under the Investment Company Act of 1940, as amended (the "1940

Act") (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days

of the filing date of the report that includes the disclosure required by

this paragraph, based on their evaluation of these controls and

procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR

270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Securities

Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)).

(b) There were no changes in the registrant's internal control over financial

reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR

270.30a-3(d)) that occurred during the registrant's last fiscal quarter

that have materially affected, or are reasonably likely to materially

affect, the registrant's internal control over financial reporting.

ITEM 3. EXHIBITS.

Certifications pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of

the Sarbanes-Oxley Act of 2002 are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, the registrant has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) First Trust Intermediate Duration Preferred & Income Fund

By (Signature and Title)* /s/ Mark R. Bradley

----------------------------------------

Mark R. Bradley, President and

Chief Executive Officer

(principal executive officer)

Date: September 18, 2013

----------------------

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, this report has been signed below by the

following persons on behalf of the registrant and in the capacities and on the

dates indicated.

By (Signature and Title)* /s/ Mark R. Bradley

----------------------------------------

Mark R. Bradley, President and

Chief Executive Officer

(principal executive officer)

Date: September 18, 2013

----------------------

By (Signature and Title)* /s/ James M. Dykas

----------------------------------------

James M. Dykas, Treasurer,

Chief Financial Officer and

Chief Accounting Officer

(principal financial officer)

Date: September 18, 2013

----------------------

|

* Print the name and title of each signing officer under his or her signature.

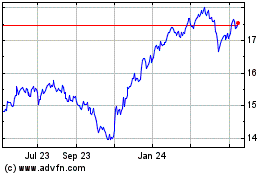

First Trust Intermediate... (NYSE:FPF)

Historical Stock Chart

From Jul 2024 to Aug 2024

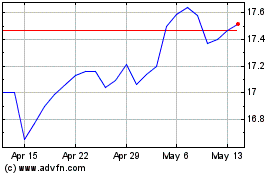

First Trust Intermediate... (NYSE:FPF)

Historical Stock Chart

From Aug 2023 to Aug 2024