UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________

FORM 6-K

_______________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File Number 001-41180

_______________________________

Ermenegildo Zegna N.V.

(Translation of registrant’s name into English)

_______________________________

Viale Roma 99/100

13835 Valdilana loc. Trivero

Italy

(Address of principal executive offices)

_______________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

The press release attached hereto as Exhibit 99.1 is hereby incorporated by reference into the registration statement on Form F-3 (No. 333-271155) of Ermenegildo Zegna N.V. and shall be a part thereof from the date on which this Report is furnished, to the extent not superseded by documents or reports subsequently filed or furnished.

The following exhibit is furnished herewith:

Exhibit 99.1 Press Release, dated July 25, 2024.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorised.

| | | | | | | | | | | |

| Date: July 25, 2024 | ERMENEGILDO ZEGNA N.V. |

| | | |

| By: | /s/ Gianluca Ambrogio Tagliabue |

| | Name: | Gianluca Ambrogio Tagliabue |

| | Title: | Chief Operating Officer and Chief Financial Officer |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit Number | | Exhibit Description |

| 99.1 | | Press Release, dated July 25, 2024. |

ERMENEGILDO ZEGNA GROUP REVENUES REACH €960 MILLION1 IN H1 2024, UP 6% YEAR-ON-YEAR

•H1 2024 grew 6% Year-on-Year (YoY), +8% at constant currency and -2.7% organic2.

•In Q2 2024 revenues rose to €497 million, +5% YoY, +6% constant currency with flat organic growth:

•ZEGNA and TOM FORD FASHION recorded solid growth of +5% YoY and +30% YoY respectively (both achieving +5% organic).

•Direct-to-Consumer (DTC) drove the Group’s revenues growth with +10% YoY and +2% organic.

•United States and EMEA outperformed other geographies.

July 25, 2024 – MILAN—(Business Wire)—Ermenegildo Zegna N.V. (NYSE:ZGN) (the “Company” and, together with its consolidated subsidiaries, the “Ermenegildo Zegna Group” or the “Group”) today announced unaudited revenues of €960.1 million for the first half of 2024, +6.3% YoY from €903.1 million in the first half of 2023 (-2.7% organic). In the second quarter revenues reached €497.0 million, +4.7% YoY and -0.4% organic.

Ermenegildo “Gildo” Zegna, Chairman and CEO of the Ermenegildo Zegna Group, said: “In the first half of the year our Group reached €960 million of revenues with 6% growth and an improved organic performance in the second quarter.

ZEGNA continued to deliver robust performance with a +5.9% organic growth, driven by the DTC channel, up double-digit in EMEA and in the U.S. These results confirm that we are successfully delivering on ZEGNA’s evolution.

At Thom Browne we are focusing on the strategic projects crucial to unlocking the brand’s long-term potential. The couture show in Paris confirmed Thom’s extraordinary talent.

At TOM FORD FASHION, we have just announced that Peter Hawkings is stepping down as Creative Director of the brand and his successor will be announced in the near future. As we look to the next phase of the brand’s development, I am today even more optimistic about the bright future of this business.

Looking ahead, I remain fully confident in the strategy we have put in place and the trajectory we are on. Our Group is a custodian of three authentic brands, each with unexplored long-term growth potential. We all recognize that 2024 will remain challenging, which is why we have been working on cost control initiatives across the Group. Nevertheless, we will continue to act with perseverance and firmness, combined with foresight and vision, to pursue our long-term ambitions.”

1 Throughout this press release, revenues for the first half of 2024 are preliminary and unaudited.

2 Revenues on organic growth basis (organic or organic growth) and on a constant currency basis (constant currency), are non-IFRS financial measures. Constant currency growth is calculated excluding foreign exchange. Organic growth is calculated excluding (a) foreign exchange, (b) acquisitions & disposals, (c) changes in license agreements where the Group operates as a licensee. See the non-IFRS financial measures section starting on page 8 of this press release for the definition and reconciliation of non-IFRS financial measures

Revenues Analysis for the Six and Three Months Ended June 30, 2024

REVENUES BY SEGMENT (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the six months ended June 30, | | H1 2024 vs H1 2023 | | For the three months ended June 30, | | Q2 2024 vs Q2 2023 |

| (€ thousands, except percentages) | 2024 | | 2023(1) | | Revenues Growth | | Organic Growth | | 2024 | | 2023(1) | | Revenues Growth | | Organic Growth |

| Zegna | 660,538 | | 644,310 | | 2.5 | % | | 3.5 | % | | 335,638 | | 324,986 | | 3.3 | % | | 2.7 | % |

| Thom Browne | 166,935 | | 207,959 | | (19.7 | %) | | (27.0 | %) | | 87,869 | | 94,708 | | (7.2 | %) | | (17.8 | %) |

| Tom Ford Fashion | 148,493 | | 64,027 | | 131.9 | % | | 4.7 | % | | 83,473 | | 64,027 | | 30.4 | % | | 4.7 | % |

| Eliminations | (15,844) | | (13,237) | | n.m.(2) | | n.m. | | (10,015) | | (8,974) | | n.m. | | n.m. |

| Total revenues | 960,122 | | 903,059 | | 6.3 | % | | (2.7 | %) | | 496,965 | | 474,747 | | 4.7 | % | | (0.4 | %) |

________________________________________

(1)Revenues from Pelletteria Tizeta, a manufacturing company of the Group, which were allocated to the Zegna segment in H1 2023, are now presented within the Tom Ford Fashion segment in H1 2024. As a result, the related revenues in H1 2023 have been reclassified from the Zegna segment to the Tom Ford Fashion segment to conform to the current period presentation.

(2)Throughout this section “n.m.” means not meaningful.

REVENUES BY BRAND AND PRODUCT LINE (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the six months ended June 30, | H1 2024 vs H1 2023 | | For the three months ended June 30, | Q2 2024 vs Q2 2023 |

| (€ thousands, except percentages) | 2024 | | 2023 | | Revenues Growth | | Organic Growth | | 2024 | | 2023 | | Revenues Growth | | Organic Growth |

| ZEGNA brand | 566,067 | | 541,319 | | 4.6 | % | | 5.9 | % | | 283,197 | | 269,430 | | 5.1 | % | | 5.0 | % |

| Thom Browne | 166,721 | | 206,951 | | (19.4 | %) | | (26.7 | %) | | 87,514 | | 94,399 | | (7.3 | %) | | (17.9 | %) |

| TOM FORD FASHION | 148,493 | | 64,015 | | 132.0 | % | | 4.7 | % | | 83,473 | | 64,015 | | 30.4 | % | | 4.7 | % |

| Textile | 71,836 | | 73,072 | | (1.7 | %) | | (0.6 | %) | | 38,593 | | 39,254 | | (1.7 | %) | | (0.5 | %) |

Other (1) | 7,005 | | 17,702 | | (60.4 | %) | | (32.9 | %) | | 4,188 | | 7,649 | | (45.2 | %) | | (23.0 | %) |

| Total revenues | 960,122 | | 903,059 | | 6.3 | % | | (2.7 | %) | | 496,965 | | 474,747 | | 4.7 | % | | (0.4 | %) |

________________________________________

(1)Other mainly includes revenues from agreements with third party brands.

Zegna segment

In H1 2024, revenues for the Zegna segment, which includes the ZEGNA brand, textile and other, amounted to €660.5 million compared to €644.3 million in H1 2023, +2.5% YoY (+3.5% organic). Revenues in Q2 were €335.6 million, +3.3% YoY (+2.7% organic) driven by the solid performance from the ZEGNA brand.

In H1 2024, revenues for the ZEGNA brand were €566.1 million compared to €541.3 million in H1 2023, +4.6% YoY (+5.9% organic3). The performance was driven by ongoing robust growth in the U.S. and EMEA. Organic performance in the Greater China Region (GCR) remained in line with Q1 2024 (single-digit negative) in an increasingly challenging environment for the sector.

In H1 2024, revenues for Textile were €71.8 million compared to €73.1 million in H1 2023 (-1.7% YoY and -0.6% organic), with Q2 coming in substantially in line with Q1. Other revenues, which mainly includes revenues for third-party brands, were €7.0 million compared to €17.7 million in H1 2023 (-60.4% YoY and -32.9% organic), due to the termination of the Tom Ford International distribution license for Tom Ford products4, following the acquisition of Tom Ford International LLC on April 28, 2023.

3 Excludes foreign exchange impact and revenues in Korea, both DTC and wholesale for each period, since the Group purchased the Korean business on January 1, 2024.

4 The licensing agreement for the production and worldwide distribution of luxury men’s ready-to-wear and made-to-measure clothing, footwear, and accessories under the TOM FORD brand expired with the deliveries of the Fall/Winter 2022 collection, and a supply agreement to act as the exclusive supplier for certain TOM FORD menswear products commenced starting with the Spring/Summer 2023 collection and ended with the acquisition of TFI.

Thom Browne segment

In H1 2024, revenues for the Thom Browne segment amounted to €166.9 million, compared to €208.0 million in H1 2023 (-19.7% YoY and -27.0% organic5). The performance of the second quarter (-7.2% YoY and -17.8% organic), which improved sequentially, reflected the ongoing streamlining of the wholesale business, which was only partially counterbalanced by improved DTC performance and by a less demanding base of comparison. The brand continued to record strong results in Japan, which were offset by a decline in the GCR, EMEA and the Americas, also impacted by the decision to streamline the wholesale business.

Thom Browne brand results are substantially aligned to the segment, with H1 2024 revenues at €166.7 million compared to €207.0 million in H1 2023 (-19.4% YoY and -26.7% organic).6

Tom Ford Fashion segment

Since the consolidation of Tom Ford International LLC and its subsidiaries occurred on April 29, 2023, this section comments only the organic performance, which compares the revenues of the two months in which Tom Ford International LLC was consolidated in 2023 and 2024.

In H1 2024, revenues for the Tom Ford Fashion segment amounted to €148.5 million, +4.7% organic (compared to the last two months of Q2 2023), driven by a good performance in DTC and the U.S. The company is continuing to strengthen the team and set the foundation for its next evolution.

Eliminations include revenues from products that the Textile and Other lines sell to the Group’s brands.

REVENUES BY DISTRIBUTION CHANNEL (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the six months ended June 30, | H1 2024 vs H1 2023 | | For the three months ended June 30, | Q2 2024 vs Q2 2023 |

| (€ thousands, except percentages) | 2024 | | 2023 | | Revenues Growth | | Organic Growth | | 2024 | | 2023 | | Revenues Growth | | Organic Growth |

| Direct to Consumer (DTC) | | |

| ZEGNA brand | 486,561 | | 465,710 | | 4.5 | % | | 5.1 | % | | 246,946 | | 236,114 | | 4.6 | % | | 4.0 | % |

| Thom Browne | 89,976 | | 82,924 | | 8.5 | % | | (12.8 | %) | | 45,257 | | 40,075 | | 12.9 | % | | (11.6 | %) |

| TOM FORD FASHION | 93,062 | | 34,751 | | 167.8 | % | | 1.3 | % | | 49,361 | | 34,751 | | 42.0 | % | | 1.3 | % |

| Total Direct to Consumer (DTC) | 669,599 | | 583,385 | | 14.8 | % | | 2.4 | % | | 341,564 | | 310,940 | | 9.8 | % | | 1.7 | % |

As a percentage of branded products (1) | 76% | | 72% | | | | | | 75% | | 73% | | | | |

| Wholesale branded | | |

| ZEGNA brand | 79,506 | | 75,609 | | 5.2 | % | | 10.4 | % | | 36,251 | | 33,316 | | 8.8 | % | | 11.8 | % |

| Thom Browne | 76,745 | | 124,027 | | (38.1 | %) | | (36.0 | %) | | 42,257 | | 54,324 | | (22.2 | %) | | (22.4 | %) |

| TOM FORD FASHION | 55,431 | | 29,264 | | 89.4 | % | | 8.7 | % | | 34,112 | | 29,264 | | 16.6 | % | | 8.7 | % |

| Total Wholesale branded | 211,682 | | 228,900 | | (7.5 | %) | | (14.9 | %) | | 112,620 | | 116,904 | | (3.7 | %) | | (5.0 | %) |

| As a percentage of branded products | 24% | | 28% | | | | | | 25% | | 27% | | | | |

| Textile | 71,836 | | 73,072 | | (1.7 | %) | | (0.6 | %) | | 38,593 | | 39,254 | | (1.7 | %) | | (0.5 | %) |

Other (2) | 7,005 | | 17,702 | | (60.4 | %) | | (32.9 | %) | | 4,188 | | 7,649 | | (45.2 | %) | | (23.0 | %) |

| Total revenues | 960,122 | | 903,059 | | 6.3 | % | | (2.7 | %) | | 496,965 | | 474,747 | | 4.7 | % | | (0.4 | %) |

________________________________________

(1)Branded products refer to the products sold under the three brands that the Group operates, through the DTC or wholesale branded distribution channels.

(2)Other mainly includes revenues from agreements with third party brands.

5 Excludes foreign exchange impact and revenues in Korea, both DTC and wholesale for each period, since the Group purchased the Korean business on July 1, 2023 in the country.

6 The difference between Thom Browne segment and Thom Browne brand refers to Thom Browne stores in MEA managed by Zegna Gulf Trading LLC on behalf of Thom Browne and allocated to Other in the revenues by brand and product line.

DTC Revenues Analysis

In H1 2024, DTC revenues were €669.6 million compared to €583.4 million in H1 2023 (+14.8% YoY and +2.4% organic). ZEGNA DTC revenues drove the Group’s performance, increasing by 4.5% YoY and +5.1% organic growth, thanks to the solid performance in the Americas and EMEA. In Q2 ZEGNA DTC organic growth reached a good +4.0% notwithstanding the challenging base of comparison. At the end of June, ZEGNA counted 279 Directly Operated Stores (DOS), with 2 net openings in Q2, including Taormina, Italy.

Thom Browne DTC revenues were +8.5% YoY in H1 2024. Excluding the effect of the acquisition of the Thom Browne business in South Korea (previously accounted in the wholesale channel), DTC revenues declined by 12.8% organic, reflecting the challenging environment, especially in the GCR. Revenues improved slightly in Q2, mainly driven by a stronger Japan, but still with negative growth. At the end of June, Thom Browne counted 102 DOS, including 13 new small concession stores at Nordstrom and one store in Beijing WF Central.

TOM FORD FASHION DTC revenues reached €93.1 million, with 56 DOS at the end of June, including two net openings in the second quarter.

Wholesale Branded Revenues Analysis

In H1 2024, wholesale branded revenues were €211.7 million compared to €228.9 million in H1 2023 (-7.5% YoY and -14.9% organic).

ZEGNA wholesale revenues were €79.5 million compared to €75.6 million in H1 2023 (+5.2% YoY and +10.4% organic), mainly driven by different timing in deliveries.

Thom Browne wholesale revenues declined to €76.7 million compared to €124.0 million in H1 2023 (-38.1% YoY and -36.0% organic), still reflecting the decision to streamline the brand’s wholesale business. In Q2 2024 Thom Browne wholesale performance slightly improved thanks to a less demanding base of comparison.

TOM FORD FASHION wholesale revenues were €55.4 million.

REVENUES BY GEOGRAPHIC AREA (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the six months ended June 30, | | H1 2024 vs H1 2023 | | For the three months ended June 30, | | Q2 2024 vs Q2 2023 |

| (€ thousands, except percentages) | 2024 | | 2023 | | Revenues Growth | | Organic Growth | | 2024 | | 2023 | | Revenues Growth | | Organic Growth |

EMEA (1) | 336,591 | | 322,680 | | 4.3 | % | | (1.5 | %) | | 180,029 | | 172,572 | | 4.3 | % | | 2.8 | % |

Americas (2) | 246,046 | | 190,112 | | 29.4 | % | | 6.7 | % | | 131,869 | | 117,705 | | 12.0 | % | | 4.5 | % |

| Greater China Region | 266,324 | | 306,835 | | (13.2 | %) | | (11.7 | %) | | 126,925 | | 142,309 | | (10.8 | %) | | (10.0 | %) |

Rest of APAC (3) | 109,990 | | 82,190 | | 33.8 | % | | 5.4 | % | | 57,556 | | 41,463 | | 38.8 | % | | 5.9 | % |

Other (4) | 1,171 | | 1,242 | | (5.7 | %) | | (17.5 | %) | | 586 | | 698 | | (16.0 | %) | | (21.2 | %) |

| Total revenues | 960,122 | | 903,059 | | 6.3 | % | | (2.7 | %) | | 496,965 | | 474,747 | | 4.7 | % | | (0.4 | %) |

________________________________________

(1)EMEA includes Europe, the Middle East and Africa.

(2)Americas includes the United States of America, Canada, Mexico, Brazil and other Central and South American countries.

(3)Rest of APAC includes Japan, South Korea, Singapore, Thailand, Malaysia, Vietnam, Indonesia, Philippines, Australia, New Zealand, India and other Southeast Asian countries.

(4)Other revenues mainly include royalties.

In H1 2024, EMEA recorded revenues of €336.6 million (+4.3% YoY and -1.5% organic), accounting for 35% of Group’s revenues. Performance for the region was influenced by strong ZEGNA results, offset by the negative results of Thom Browne, especially in the wholesale channel.

Revenues in the Americas amounted to €246.0 million (+29.4% YoY and +6.7% organic), accounting for 26% of the Group revenues, with double-digit growth from ZEGNA and a solid performance from TOM FORD FASHION.

The GCR recorded revenues of €266.3 million (-13.2% YoY and -11.7% organic), accounting for 28% of the Group’s revenues, impacted by a still-subdued consumer confidence, with ZEGNA continuing to outperform in the region. Revenues in the rest of APAC grew to €110.0 million (+33.8% YoY and +5.4% organic), driven by the strong double-digit organic performance in the Japanese market offset by the performance of the other markets in the region.

Group Monobrand(1) Store Network at June 30, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| At June 30, 2024 | | At December 31, 2023 | | At June 30, 2023 |

| Stores | ZEGNA | | Thom Browne | | TOM FORD FASHION | | Group | | ZEGNA | | Thom Browne | | TOM FORD FASHION | | Group | | ZEGNA | | Thom Browne | | TOM FORD FASHION | | Group |

EMEA (2) | 75 | | 9 | | 7 | | 91 | | 71 | | 9 | | 4 | | 84 | | 69 | | 10 | | 4 | | 83 |

| Americas | 64 | | 20 | | 12 | | 96 | | 59 | | 7 | | 12 | | 78 | | 55 | | 7 | | 11 | | 73 |

| Greater China Region | 82 | | 35 | | 11 | | 128 | | 79 | | 33 | | 10 | | 122 | | 79 | | 32 | | 11 | | 122 |

Rest of APAC | 58 | | 38 | | 26 | | 122 | | 44 | | 37 | | 25 | | 106 | | 43 | | 17 | | 25 | | 85 |

| Total Direct to Consumer (DTC) | 279 | | 102 | | 56 | | 437 | | 253 | | 86 | | 51 | | 390 | | 246 | | 66 | | 51 | | 363 |

EMEA (2) | 46 | | 7 | | 16 | | 69 | | 55 | | 7 | | 14 | | 76 | | 59 | | 7 | | 12 | | 78 |

| Americas | 67 | | 3 | | 50 | | 120 | | 63 | | 3 | | 50 | | 116 | | 63 | | 3 | | 51 | | 117 |

| Greater China Region | 13 | | 10 | | — | | 23 | | 13 | | 10 | | — | | 23 | | 13 | | 11 | | — | | 24 |

Rest of APAC | 4 | | 4 | | 5 | | 13 | | 20 | | 5 | | 6 | | 31 | | 22 | | 22 | | 7 | | 51 |

| Total Wholesale | 130 | | 24 | | 71 | | 225 | | 151 | | 25 | | 70 | | 246 | | 157 | | 43 | | 70 | | 270 |

| Total | 409 | | 126 | | 127 | | 662 | | 404 | | 111 | | 121 | | 636 | | 403 | | 109 | | 121 | | 633 |

________________________________________(1)Monobrand store count includes our DOSs (which are divided into boutiques and outlets) and our Wholesale monobrand stores (including also monobrand franchisees).

(2)Does not include any stores in Russia at June 30, 2024, December 31, 2023 or at June 30, 2023. Although some stores may still be operating at June 30, 2024, they have not been supplied by the Group since February 2022 and have therefore been excluded from the Group’s store count.

***

SIGNIFICANT EVENTS OCCURRED IN THE SECOND QUARTER OF 2024

VILLA ZEGNA - Oasi Linen in Shanghai

On May 23, 2024, ZEGNA brought the new “VILLA ZEGNA” experience to Shanghai. “VILLA ZEGNA” reflects ZEGNA’s new approach to interacting with its customers, offering them immersive experiences that foster emotional connections to the brand. The one-week event was hosted in a building of three floors, seamlessly blending the vision of the founder, the brand’s history and the fabrics that made ZEGNA the leading menswear brand in the world – which, together, gave guests the opportunity to immerse themselves in the realm of top luxury.

ZEGNA Summer 2025 Fashion Show

On June 17, 2024, ZEGNA presented its Summer 2025 Fashion Show in an industrial Milanese space that was transformed into a field of linen to evoke the golden fields of Normandy ready for harvest. Envisioned by Artistic Director, Alessandro Sartori, the menswear collection celebrated the unique characteristics of the brand’s fabric of choice for summer: Oasi Lino. The collection represents a development central to the brand’s Our Road to Traceability, as the Oasi Lino fibers are fully traceable.

Thom Browne Couture Show

On June 24, 2024, with references to the upcoming Olympic Games, Thom Browne held its second women’s and men’s 2024 couture collection in Paris. The show was an immersive experience that centered on muslin and with references to the upcoming Olympic Games, all of which revealed an incredible exhibit of traditional couture techniques.

SIGNIFICANT EVENTS OCCURRED AFTER JUNE 30, 2024

TOM FORD FASHION - Departure of Creative Director

On July 22, 2024, it was announced that Peter Hawkings is stepping down as Creative Director of the brand. Peter Hawkings has been at TOM FORD since its inception and at the helm of creative since April 2023.

The Spring-Summer 2025 collection will be presented in the Milan showroom in September 2024. A successor will be announced in the near future.

UPCOMING EVENTS

Next releases

•September 18, 2024: H1 2024 Financial Results

•October 22, 2024: Q3 2024 Unaudited Revenues

***

Contacts

Paola Durante, Chief of External Relations

Alice Poggioli, Investor Relations Director

Clementina Tito, Head of Corporate Communication

ir@zegna.com / corporatepress@zegna.com

***

Forward Looking Statements

This communication contains forward-looking statements that are based on beliefs and assumptions and on information currently available to the Company. In particular, statements regarding future financial performance and the Group’s expectations as to the achievement of certain targeted metrics at any future date or for any future period are forward-looking statements. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” “target,” “seek”, “aspire,” “goal,” “outlook,” “guidance,” “forecast,” “prospect” or the negative or plural of these words, or other similar expressions that are predictions or indicate future events or prospects, although not all forward-looking statements contain these words. Any statements that refer to expectations, projections or other characterizations of future events or circumstances, including strategies or plans, are also forward-looking statements. These statements involve risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements, and, as such, undue reliance should not be placed on them. Actual results may differ materially from those expressed in forward-looking statements as a result of a variety of factors, including: the recognition, integrity and reputation of our brands; our ability to anticipate trends and to identify and respond to new and changing consumer preference; the COVID-19 pandemic or similar public health crises; international business, regulatory, social and political risks; the conflict in Ukraine and sanctions imposed onto Russia; the occurrence of acts of terrorism or similar events, conflicts, civil unrest or situations of political instability; developments in Greater China and other growth and emerging markets; our ability to implement our strategy; recent and potential future acquisitions; disruption to our manufacturing and logistics facilities; risks related to the sale of our products through our direct-to-consumer channel, as well as through points of sale operated by third parties; our dependence on our local partners to sell our products in certain markets; fluctuations in the price or quality of, or disruptions in the availability of, raw materials; our ability to negotiate, maintain or renew our license or co-branding agreements with high end third party brands; tourist traffic and demand; our dependence on certain key senior personnel as well as skilled personnel; our ability to protect our intellectual property rights; disruption in our information technology, including as a result of cybercrime; the theft or unauthorized use of personal information of our customers, employees or other parties; fluctuations in currency exchange rates or interest rates; the level of competition in the industry in which we operate; global economic conditions and macro events, including inflation; failures to comply with applicable laws and regulations; climate change and other environmental impacts and our ability to meet our customers’ and other stakeholders’ expectations on environment, social and governance matters; the enactment of tax reforms or other changes in tax laws and regulations; and other risks and uncertainties, including those described in our filings with the SEC.

Most of these factors are outside the Company’s control and are difficult to predict. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by the Company and its directors, officers or employees or any other person that the Company will achieve its objectives and plans in any specified time frame, or at all. The forward-looking statements in this communication represent the views of the Company as of the date of this communication. Subsequent events and developments may cause that view to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company disclaims any obligation to update or revise publicly forward-looking statements. You should, therefore, not rely on these forward-looking statements as representing the views of the Company as of any date subsequent to the date of this communication.

***

Non-IFRS financial measures

The Group’s management monitors and evaluates operating and financial performance using several non-IFRS financial measures including: revenues on a constant currency basis (constant currency) and revenues on an organic growth basis (organic or organic growth). The Group’s management believes that these non-IFRS financial measures provide useful and relevant information regarding the Group’s financial performance and financial condition, and improve the ability of management and investors to assess and compare the financial performance and financial position of the Group with those of other companies. They also provide comparable measures that facilitate management’s ability to identify operational trends, as well as make decisions regarding future spending, resource allocations and other strategic and operational decisions. While similar measures are widely used in the industry in which the Group operates, the financial measures that the Group uses may not be comparable to other similarly named measures used by other companies nor are they intended to be substitutes for measures of financial performance or financial position as prepared in accordance with IFRS.

Revenues on a constant currency basis (constant currency)

In addition to presenting our revenues on a current currency basis, we also present certain revenue information on a constant currency basis (constant currency), which excludes the effects of foreign currency translation from our subsidiaries with functional currencies different from the Euro.

We calculate constant currency revenues by applying the current period average foreign currency exchange rates to translate prior period revenues of foreign subsidiaries expressed in local functional currencies different than the Euro.

We use revenues on a constant currency basis to analyze how our underlying revenues have changed between periods independent of the effects of foreign currency translation.

Revenues on a constant currency basis are not a substitute for revenues on a current currency basis or any IFRS-related measures, however we believe that revenues excluding the impact of foreign currency translation provide additional useful information to management and to investors in analyzing and evaluating our revenues and operating performance.

Revenues on an organic growth basis (organic growth or organic)

In addition to presenting our revenues on a current currency basis, we also present certain revenue information on an organic growth basis (organic growth or organic). Organic growth is calculated as the change in revenues from period to period, excluding the effects of (a) foreign exchange, (b) acquisitions and disposals and (c) changes in license agreements where the Group operates as a licensee.

In calculating organic growth, the following adjustments are made to revenues:

(a) Foreign exchange – Current period average foreign currency exchange rates are used to translate prior period revenues of foreign subsidiaries expressed in local functional currencies different than the Euro.

(b) Acquisitions and disposals – Revenues generated by businesses and operations acquired in the current year are excluded. Revenues generated by businesses and operations acquired in the prior year are excluded from the current year for the same period that corresponds to the pre-acquisition period in the prior year. Additionally, where a business or operation was a customer prior to an acquisition, the related pre-acquisition revenues are excluded from the current and prior periods. Revenues generated by businesses and operations disposed of in the current year or prior year are excluded from both periods as applicable.

(c) Changes in license agreements where the Group operates as a licensee – Revenues generated from license agreements where the Group operates as a licensee that are new or terminated in the current year or prior year are excluded from both periods (except if the effects are already included in acquisitions and disposals). Additionally, revenues generated from license agreements where the Group operates as a licensee that experienced a structural change in the scope or perimeter in the current year or prior year are excluded from both periods, including changes to product categories, distribution channels or geographies of the underlying license agreements.

We believe the presentation of organic growth is useful to better understand and analyze the underlying change in the Group’s revenues from period to period on a consistent perimeter and constant currency basis.

Revenues on an organic growth basis are not a substitute for revenues on a current currency basis or any IFRS-related measures, however we believe that revenues excluding the effects of (a) foreign exchange, (b) acquisitions and disposals and (c) changes in license agreements where the Group operates as a licensee provide additional useful information to management and to investors in analyzing and evaluating our revenues and operating performance.

The tables below show a reconciliation of reported revenue growth to constant currency, excluding the effects of foreign exchange, and to organic growth, which excludes also acquisitions and disposals and changes in license agreements where the Group operates as a licensee, by segment, by brand and product line, by distribution channel and by geography for the six months ended June 30, 2024 compared to the six months ended June 30, 2023 (H1 2024 vs H1 2023) and for the three months ended June 30, 2024 compared to the three months ended June 30, 2023 (Q2 2024 vs Q2 2023).

Segment

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| H1 2024 vs H1 2023 |

| Revenues Growth | | less

Foreign exchange | | Constant

Currency | | less

Acquisitions and disposals | | less

Changes in license agreements where the Group operates as a licensee | | Organic Growth |

| Zegna | 2.5 | % | | (1.9 | %) | | 4.4 | % | | 0.7 | % | | 0.2 | % | | 3.5 | % |

| Thom Browne | (19.7 | %) | | (1.2 | %) | | (18.5 | %) | | 8.5 | % | | — | % | | (27.0 | %) |

| Tom Ford Fashion | 131.9 | % | | (1.4 | %) | | 133.3 | % | | 128.6 | % | | — | % | | 4.7 | % |

| Total | 6.3 | % | | (1.8 | %) | | 8.1 | % | | 11.6 | % | | (0.8 | %) | | (2.7 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2024 vs Q2 2023 |

| Revenues Growth | | less

Foreign exchange | | Constant

Currency | | less

Acquisitions and disposals | | less

Changes in license agreements where the Group operates as a licensee | | Organic Growth |

| Zegna | 3.3 | % | | (1.1 | %) | | 4.4 | % | | 1.1 | % | | 0.6 | % | | 2.7 | % |

| Thom Browne | (7.2 | %) | | (1.0 | %) | | (6.2 | %) | | 11.6 | % | | — | % | | (17.8 | %) |

| Tom Ford Fashion | 30.4 | % | | (1.0 | %) | | 31.4 | % | | 26.7 | % | | — | % | | 4.7 | % |

| Total | 4.7 | % | | (1.1 | %) | | 5.8 | % | | 6.7 | % | | (0.5 | %) | | (0.4 | %) |

Brand and product line

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| H1 2024 vs H1 2023 |

| Revenues Growth | | less

Foreign exchange | | Constant

Currency | | less

Acquisitions and disposals | | less

Changes in license agreements where the Group operates as a licensee | | Organic Growth |

| ZEGNA brand | 4.6 | % | | (2.1 | %) | | 6.7 | % | | 0.8 | % | | — | % | | 5.9 | % |

| Thom Browne | (19.4 | %) | | (1.2 | %) | | (18.2 | %) | | 8.5 | % | | — | % | | (26.7 | %) |

| TOM FORD FASHION | 132.0 | % | | (1.3 | %) | | 133.3 | % | | 128.6 | % | | — | % | | 4.7 | % |

| Textile | (1.7 | %) | | (1.0 | %) | | (0.7 | %) | | (0.1 | %) | | — | % | | (0.6 | %) |

| Other | (60.4 | %) | | (0.2 | %) | | (60.2 | %) | | (0.3 | %) | | (27.0 | %) | | (32.9 | %) |

| Total | 6.3 | % | | (1.8 | %) | | 8.1 | % | | 11.6 | % | | (0.8 | %) | | (2.7 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2024 vs Q2 2023 |

| Revenues Growth | | less

Foreign exchange | | Constant

Currency | | less

Acquisitions and disposals | | less

Changes in license agreements where the Group operates as a licensee | | Organic Growth |

| ZEGNA brand | 5.1 | % | | (1.2 | %) | | 6.3 | % | | 1.3 | % | | — | % | | 5.0 | % |

| Thom Browne | (7.3 | %) | | (1.0 | %) | | (6.3 | %) | | 11.6 | % | | — | % | | (17.9 | %) |

| TOM FORD FASHION | 30.4 | % | | (1.0 | %) | | 31.4 | % | | 26.7 | % | | — | % | | 4.7 | % |

| Textile | (1.7 | %) | | (1.2 | %) | | (0.5 | %) | | — | % | | — | % | | (0.5 | %) |

| Other | (45.2 | %) | | — | % | | (45.2 | %) | | — | % | | (22.2 | %) | | (23.0 | %) |

| Total | 4.7 | % | | (1.1 | %) | | 5.8 | % | | 6.7 | % | | (0.5 | %) | | (0.4 | %) |

Distribution channel

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| H1 2024 vs H1 2023 |

| Revenues Growth | | less Foreign exchange | | Constant

Currency | | less Acquisitions and disposals | | less Changes in license agreements where the Group operates as a licensee | | Organic Growth |

| Direct to Consumer (DTC) | | | | | | | | | | | |

| ZEGNA brand | 4.5 | % | | (2.3 | %) | | 6.8 | % | | 1.7 | % | | — | % | | 5.1 | % |

| Thom Browne | 8.5 | % | | (4.2 | %) | | 12.7 | % | | 25.5 | % | | — | % | | (12.8 | %) |

| TOM FORD FASHION | 167.8 | % | | (2.9 | %) | | 170.7 | % | | 169.4 | % | | — | % | | 1.3 | % |

| Total Direct to Consumer (DTC) | 14.8 | % | | (2.7 | %) | | 17.5 | % | | 15.1 | % | | — | % | | 2.4 | % |

| Wholesale branded | | | | | | | | | | | |

| ZEGNA brand | 5.2 | % | | (0.7 | %) | | 5.9 | % | | (4.5 | %) | | — | % | | 10.4 | % |

| Thom Browne | (38.1 | %) | | — | % | | (38.1 | %) | | (2.1 | %) | | — | % | | (36.0 | %) |

| TOM FORD FASHION | 89.4 | % | | (0.1 | %) | | 89.5 | % | | 80.8 | % | | — | % | | 8.7 | % |

| Total Wholesale branded | (7.5 | %) | | (0.2 | %) | | (7.3 | %) | | 7.6 | % | | — | % | | (14.9 | %) |

| Textile | (1.7 | %) | | (1.0 | %) | | (0.7 | %) | | (0.1 | %) | | — | % | | (0.6 | %) |

| Other | (60.4 | %) | | (0.2 | %) | | (60.2 | %) | | (0.3 | %) | | (27.0 | %) | | (32.9 | %) |

| Total | 6.3 | % | | (1.8 | %) | | 8.1 | % | | 11.6 | % | | (0.8 | %) | | (2.7 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2024 vs Q2 2023 |

| Revenues Growth | | less Foreign exchange | | Constant

Currency | | less Acquisitions and disposals | | less Changes in license agreements where the Group operates as a licensee | | Organic Growth |

| Direct to Consumer (DTC) | | | | | | | | | | | |

| ZEGNA brand | 4.6 | % | | (1.3 | %) | | 5.9 | % | | 1.9 | % | | — | % | | 4.0 | % |

| Thom Browne | 12.9 | % | | (2.9 | %) | | 15.8 | % | | 27.4 | % | | — | % | | (11.6 | %) |

| TOM FORD FASHION | 42.0 | % | | (1.8 | %) | | 43.8 | % | | 42.5 | % | | — | % | | 1.3 | % |

| Total Direct to Consumer (DTC) | 9.8 | % | | (1.6 | %) | | 11.4 | % | | 9.7 | % | | — | % | | 1.7 | % |

| Wholesale branded | | | | | | | | | | | |

| ZEGNA brand | 8.8 | % | | (0.3 | %) | | 9.1 | % | | (2.7 | %) | | — | % | | 11.8 | % |

| Thom Browne | (22.2 | %) | | — | % | | (22.2 | %) | | 0.2 | % | | — | % | | (22.4 | %) |

| TOM FORD FASHION | 16.6 | % | | (0.4 | %) | | 17.0 | % | | 8.3 | % | | — | % | | 8.7 | % |

| Total Wholesale branded | (3.7 | %) | | (0.2 | %) | | (3.5 | %) | | 1.5 | % | | — | % | | (5.0 | %) |

| Textile | (1.7 | %) | | (1.2 | %) | | (0.5 | %) | | — | % | | — | % | | (0.5 | %) |

| Other | (45.2 | %) | | — | % | | (45.2 | %) | | — | % | | (22.2 | %) | | (23.0 | %) |

| Total | 4.7 | % | | (1.1 | %) | | 5.8 | % | | 6.7 | % | | (0.5 | %) | | (0.4 | %) |

Geographic area

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| H1 2024 vs H1 2023 |

| Revenues Growth | | less Foreign exchange | | Constant

Currency | | less Acquisitions and disposals | | less Changes in license agreements where the Group operates as a licensee | | Organic Growth |

EMEA (1) | 4.3 | % | | (0.1 | %) | | 4.4 | % | | 6.9 | % | | (1.0 | %) | | (1.5 | %) |

Americas (2) | 29.4 | % | | 0.1 | % | | 29.3 | % | | 24.4 | % | | (1.8 | %) | | 6.7 | % |

| Greater China Region | (13.2 | %) | | (2.9 | %) | | (10.3 | %) | | 1.4 | % | | — | % | | (11.7 | %) |

Rest of APAC (3) | 33.8 | % | | (8.5 | %) | | 42.3 | % | | 37.8 | % | | (0.9 | %) | | 5.4 | % |

Other (4) | (5.7 | %) | | — | % | | (5.7 | %) | | 11.8 | % | | — | % | | (17.5 | %) |

| Total | 6.3 | % | | (1.8 | %) | | 8.1 | % | | 11.6 | % | | (0.8 | %) | | (2.7 | %) |

________________________________________(1)EMEA includes Europe, the Middle East and Africa.

(2)Americas includes the United States of America, Canada, Mexico, Brazil and other Central and South American countries.

(3)APAC includes Japan, South Korea, Thailand, Malaysia, Vietnam, Indonesia, Philippines, Australia, New Zealand, India and other Southeast Asian countries.

(4)Other revenues mainly include royalties.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2024 vs Q2 2023 |

| Revenues Growth | | less Foreign exchange | | Constant

Currency | | less Acquisitions and disposals | | less Changes in license agreements where the Group operates as a licensee | | Organic Growth |

EMEA (1) | 4.3 | % | | 0.3 | % | | 4.0 | % | | 2.0 | % | | (0.8 | %) | | 2.8 | % |

Americas (2) | 12.0 | % | | (0.2 | %) | | 12.2 | % | | 8.4 | % | | (0.7 | %) | | 4.5 | % |

| Greater China Region | (10.8 | %) | | (1.5 | %) | | (9.3 | %) | | 0.8 | % | | (0.1 | %) | | (10.0 | %) |

Rest of APAC (3) | 38.8 | % | | (9.7 | %) | | 48.5 | % | | 42.9 | % | | (0.3 | %) | | 5.9 | % |

Other (4) | (16.0 | %) | | (0.1 | %) | | (15.9 | %) | | 5.3 | % | | — | % | | (21.2 | %) |

| Total | 4.7 | % | | (1.1 | %) | | 5.8 | % | | 6.7 | % | | (0.5 | %) | | (0.4 | %) |

________________________________________

(1)EMEA includes Europe, the Middle East and Africa.

(2)Americas includes the United States of America, Canada, Mexico, Brazil and other Central and South American countries.

(3)APAC includes Japan, South Korea, Thailand, Malaysia, Vietnam, Indonesia, Philippines, Australia, New Zealand, India and other Southeast Asian countries.

(4)Other revenues mainly include royalties.

***

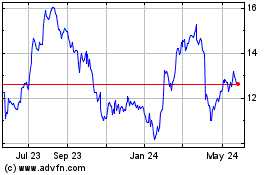

Ermenegildo Zegna NV (NYSE:ZGN)

Historical Stock Chart

From Oct 2024 to Nov 2024

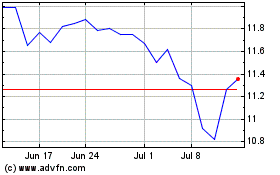

Ermenegildo Zegna NV (NYSE:ZGN)

Historical Stock Chart

From Nov 2023 to Nov 2024