- Statement of Beneficial Ownership (SC 13D)

August 12 2011 - 3:56PM

Edgar (US Regulatory)

SCHEDULE 13D

DATE OF EVENT WHICH REQUIRES FILING OF THIS STATEMENT

8/4/11

1. NAME OF REPORTING PERSON

Bulldog Investors, Brooklyn Capital Management,

Phillip Goldstein and Andrew Dakos

2. CHECK THE BOX IF MEMBER OF A GROUP a[X]

b[]

3. SEC USE ONLY

4. SOURCE OF FUNDS

WC

5. CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) AND 2(e) []

6. CITIZENSHIP OR PLACE OF ORGANIZATION

USA

7. SOLE VOTING POWER

410,727

8. SHARED VOTING POWER

146,909

9. SOLE DISPOSITIVE POWER

557,636

10. SHARED DISPOSITIVE POWER

0

11. AGGREGATE AMOUNT OWNED BY EACH REPORTING PERSON

577,636

12. CHECK IF THE AGGREGATE AMOUNT EXCLUDES CERTAIN SHARES

[]

13. PERCENT OF CLASS REPRESENTED BY ROW 11

5.28%

14. TYPE OF REPORTING PERSON

IA

Item 1. SECURITY AND ISSUER

This Schedule 13D relates to the shares of Common Stock

of Equus Total Return, Inc.

("EQS" or the "Issuer").

The principal executive offices of EQS are located at

Eight Greenway Plaza

Suite 930

Houston, TX 77046

Item 2. IDENTITY AND BACKGROUND

This statement is filed on behalf of Bulldog Investors,

Brooklyn Capital Mangement, Phillip Goldstein,

60 Heritage Drive Pleasantville, NY 10570 a principal of Bulldog Investors

and Andrew Dakos, Park 80 West,Saddle Brook, NJ 07663, also a principal

of Bulldog Investors. Mr.Goldstein and Mr. Dakos are self-employed

investment advisors.

On January 31, 2007 the Acting Director of the Securities Division of the

Massachusetts Secretary of State filed a complaint against Bulldog Investors,

Messrs. Goldstein, Dakos and Samuels and certain related parties

(the Bulldog Parties) alleging that they violated Massachusetts law by

operating a website containing information about certain unregistered

investments and by sending an e-mail about such investments to an individual

who requested it. On March 23, 2007 the Bulldog Parties filed a lawsuit in

the Massachusetts Superior Court against the Secretary alleging that his

enforcement action violated 42 U.S.C. ss 1983 because, among other things,

it violated their First Amendment rights. On October 17, 2007 the Secretary

issued an "obey the law" cease and desist order (the Order) and fined the

Bulldog Parties $25,000. On November 15, 2007 the Bulldog Parties filed

an appeal of the Order in the Massachusetts Superior Court which subsequently

upheld the Order. The Bulldog Parties further appealed the Order to the

Massachusetts Appeals Court. On October 21, 2009 the Massachusetts Supreme

Judicial Court (the SJC) unilaterally transferred the case to itself and on

July 2, 2010 upheld the Order except for the Bulldog Parties' First

Amendment claim which it ruled must be decided in the appeal of the

aforementioned ss 1983 lawsuit. In the ss 1983 lawsuit, the Secretary

stipulated that the website and email in question did not concern an illegal

transaction and were not misleading. Nevertheless, on September 26, 2009,

the Superior Court ruled that the Secretary's enforcement action did not

violate the Bulldog Parties' First Amendment rights. The Bulldog Parties

filed an appeal of the Superior Court's ruling in the Massachusetts Appeals

Court. On July 23, 2010, the SJC unilaterally transferred the appeal of

the ss 1983 lawsuit to itself. Oral argument was held in the SJC on January 6,

2011 and a decision is pending.

ITEM 3. SOURCE AND AMOUNT OF FUNDS AND OTHER CONSIDERATIONS

Shares of the Issuer have been accumulated on behalf of managed

accounts.

ITEM 4. PURPOSE OF TRANSACTION

The group is buying for investment purposes.

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER

As per the 10-Q filed on May 16, 2011 there were 10,561,646 shares of

common stock outstanding as of 05/06/2011 The percentage set forth in item 5

was derived using such number. Bulldog Investors, Brooklyn Capital Management,

Phillip Goldstein and Andrew Dakos beneficially own an aggregate of 557,636

shares of EQS or 5.28% of the outstanding shares.Power to dispose of and vote

securities resides either with Mr. Goldstein, Mr. Dakos or with clients.

c) During the past 60 days the following shares of EQS were purchased:

Date: Shares: Price:

06/21/11 86,855 2.3886

06/22/11 15,700 2.3993

06/24/11 2,300 2.4000

06/28/11 1,300 2.4000

06/29/11 2,700 2.4000

06/30/11 3,584 2.4000

07/05/11 2,648 2.3917

07/06/11 17,700 2.3800

07/07/11 11,519 2.3987

07/08/11 6 2.3500

07/11/11 1,052 2.3905

07/12/11 6,686 2.3890

07/13/11 700 2.3700

07/13/11 6,476 2.3500

07/14/11 1 2.3500

07/15/11 2,329 2.4000

07/18/11 2,052 2.4000

07/19/11 4,002 2.4000

07/20/11 2,000 2.4000

07/21/11 4,700 2.4000

07/25/11 200 2.4000

07/26/11 5,581 2.4000

07/27/11 900 2.3300

07/28/11 1,950 2.3974

07/29/11 4,100 2.2998

08/01/11 200 2.3500

08/02/11 100 2.3600

08/03/11 16,400 2.3999

08/04/11 25,852 2.3438

08/05/11 2,132 2.2000

08/09/11 2,800 2.1000

08/10/11 600 2.1500

08/11/11 900 2.1600

|

d) Beneficiaries of managed accounts are entitled to receive any

dividends or sales proceeds.

e) NA

ITEM 6. CONTRACTS,ARRANGEMENTS,UNDERSTANDINGS OR RELATIONSHIPS

WITH RESPECT TO SECURITIES OF THE ISSUER.

None.

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS

None.

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this

statement is true, complete and correct.

Dated: 8/12/2011

By: /s/ Phillip Goldstein

Name: Phillip Goldstein

By: /S/ Andrew Dakos

Name: Andrew Dakos

|

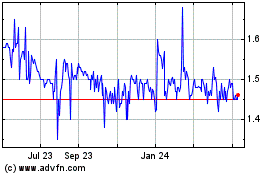

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

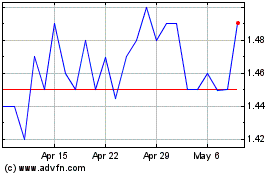

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jul 2023 to Jul 2024