A Message to Equus Stockholders from the Committee to Enhance Equus

May 25 2010 - 8:30AM

Business Wire

The Committee to Enhance Equus, collectively owning 11.4% of the

outstanding shares of Equus Total Return, Inc. (NYSE: EQS), today

issued the following statement related to the results of the

Company’s Annual Meeting of stockholders:

The results of the Annual Meeting of stockholders confirm that a

substantial percentage of Equus stockholders are disappointed by

the 65% decline in the company’s stock price. We are deeply

grateful that Equus stockholders took an active interest in the

proxy contest and that our slate of highly qualified nominees

received approximately 39% of the total votes cast at the annual

meeting. This represents a significant voice that cannot be

ignored.

The election results were very close. The incumbent board spent

an extraordinary amount of shareholder money to entrench themselves

and elect four directors from Versatile/Mobiquity to represent its

9.28% stake in the Company. We also believe that the Company

conducted the meeting in a manner intended to discourage personal

attendance and voting by shareholders. We are particularly troubled

by the Company’s refusal to count the votes cast in favor of our

slate by a registered holder of 257,600 shares who was improperly

denied access to the meeting until after the polls were closed. If

this stockholder had been permitted to attend the meeting and cast

his vote in favor of our slate, as he desired, we would have

received approximately 42% of the total votes cast. Despite these

concerns about the integrity of the process, we have concluded that

further contest of the 2010 board election is not in the best

interests of the Company or its shareholders.

As the returning incumbent directors and the four new

Versatile/Mobiquity directors begin their one year terms as

directors of Equus, we ask that all Equus stockholders continue to

actively monitor the actions of the board and the performance of

the Company. The Committee’s website and its materials remain at

www.enhanceequus.com. In the coming year, we urge you to hold the

board accountable to deliver on its professed commitment to

increasing shareholder value and to reverse the deterioration in

both the stock price and the net asset value, which declined

approximately 37% in 2009 alone. Specifically, we expect the board

to (i) immediately initiate a formal search for an experienced CEO

with fund management experience, (ii) reduce grossly excessive fund

administrative costs and third party professional fees and expenses

to a level appropriate for the size of the Company, (iii) seriously

consider reducing the size of the board to five directors, which

would be appropriate for the size of the Company, and (iv) commit

to appropriate corporate governance practices. On an individual

level, we ask each director to align their interest with that of

all stockholders, and to evidence their sincere commitment to

Equus, by making a meaningful personal investment in the Company’s

stock.

Thank you again for your support of our efforts on behalf of all

Equus stockholders.

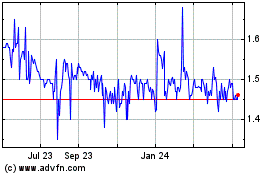

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

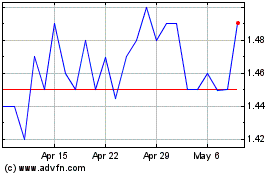

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jul 2023 to Jul 2024