ELS Declares First Quarter 2024 Dividend and Elects Radhika Papandreou to the Board of Directors

February 06 2024 - 4:54PM

Business Wire

On February 6, 2024, the Board of Directors (the “Board”) of

Equity LifeStyle Properties, Inc. (NYSE:ELS) (referred to herein as

“we,” “us,” and “our”) declared a first quarter 2024 dividend of

$0.4775 per common share, representing, on an annualized basis, a

dividend of $1.91 per common share. The dividend will be paid on

April 12, 2024 to stockholders of record at the close of business

on March 28, 2024.

In addition, on February 6, 2024, the Board increased the size

of the Board by one director from nine to ten directors and elected

Ms. Radhika Papandreou to fill the vacancy created by the increase

in the number of directors.

Ms. Papandreou has been managing partner for Korn Ferry’s

Chicago office since 2021 and previously served as senior client

partner from 2019 to 2021. Ms. Papandreou specializes in executive

and board placements and has managed large-scale client projects

including bankruptcies, turnarounds, spin-offs and mergers and

acquisitions. In addition, Ms. Papandreou leads Korn Ferry’s North

American travel, hospitality and leisure practice and is a core

member within the Korn Ferry board and CEO Services practice. Ms.

Papandreou was employed by an executive search firm from 2016 to

2019, where she was managing director and global head of its

hospitality and leisure practice and a core partner within the

board practice. From 1998 to 2016, Ms. Papandreou held various

positions in the investment banking industry.

There are no arrangements or understandings between Ms.

Papandreou and us related to her election as a director of the

Board. Ms. Papandreou will not initially serve on a committee of

the Board. In addition, the Board undertook a review of the

independence of Ms. Papandreou and affirmatively determined that

Ms. Papandreou is independent in accordance with the NYSE

standards.

This press release includes certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. When used, words such as “anticipate,” “expect,”

“believe,” “project,” “intend,” “may be” and “will be” and similar

words or phrases, or the negative thereof, unless the context

requires otherwise, are intended to identify forward-looking

statements and may include, without limitation, information

regarding our expectations, goals or intentions regarding the

future, and the expected effect of our acquisitions.

Forward-looking statements, by their nature, involve estimates,

projections, goals, forecasts and assumptions and are subject to

risks and uncertainties that could cause actual results or outcomes

to differ materially from those expressed in a forward-looking

statement due to a number of factors, which include, but are not

limited to the following: (i) the mix of site usage within the

portfolio; (ii) yield management on our short-term resort and

marina sites; (iii) scheduled or implemented rate increases on

community, resort and marina sites; (iv) scheduled or implemented

rate increases in annual payments under membership subscriptions;

(v) occupancy changes; (vi) our ability to attract and retain

membership customers; (vii) change in customer demand regarding

travel and outdoor vacation destinations; (viii) our ability to

manage expenses in an inflationary environment; (ix) our ability to

integrate and operate recent acquisitions in accordance with our

estimates; (x) our ability to execute expansion/development

opportunities in the face of supply chain delays/shortages; (xi)

completion of pending transactions in their entirety and on assumed

schedule; (xii) our ability to attract and retain property

employees, particularly seasonal employees; (xiii) ongoing legal

matters and related fees; (xiv) costs to restore property

operations and potential revenue losses following storms or other

unplanned events; and (xv) the potential impact of, and our ability

to remediate material weaknesses in our internal control over

financial reporting.

For further information on these and other factors that could

impact us and the statements contained herein, refer to our filings

with the Securities and Exchange Commission, including the “Risk

Factors” and “Forward-Looking Statements” sections in our most

recent Annual Report on Form 10-K or Form 10-K/A and any subsequent

Quarterly Reports on Form 10-Q or Form 10-Q/A.

These forward-looking statements are based on management’s

present expectations and beliefs about future events. As with any

projection or forecast, these statements are inherently susceptible

to uncertainty and changes in circumstances. We are under no

obligation to, and expressly disclaim any obligation to, update or

alter our forward-looking statements whether as a result of such

changes, new information, subsequent events or otherwise.

We are a fully integrated owner of lifestyle-oriented properties

and own or have an interest in 451 properties located predominantly

in the United States consisting of 172,465 sites as of January 29,

2024. We are a self-administered, self-managed, real estate

investment trust with headquarters in Chicago.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240206407038/en/

Paul Seavey (800) 247-5279

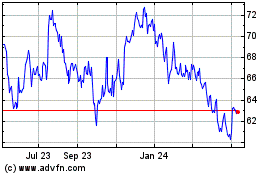

Equity Lifestyle Propert... (NYSE:ELS)

Historical Stock Chart

From Jun 2024 to Jul 2024

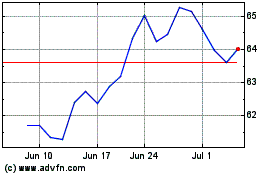

Equity Lifestyle Propert... (NYSE:ELS)

Historical Stock Chart

From Jul 2023 to Jul 2024