Eni Simplifies Shareholder Remuneration Policy As Part of 2023-26 Strategy

February 23 2023 - 7:54AM

Dow Jones News

By Giulia Petroni

Eni SpA has simplified its shareholder remuneration policy as

part of its strategic plan for 2023-26 and raised the dividend for

the current year.

The Italian oil-and-gas major said at its capital markets day on

Thursday that it aims to distribute between 25%-30% of annual cash

flow from operations through a combination of dividend and share

buyback.

The company has set the 2023 annual dividend at EUR0.94 per

share, which represents a 7% increase on year, and said it will

launch a 2.2 billion euros ($2.33 billion) share buyback following

shareholder approval.

Eni has also outlined its financial objectives, saying it

targets earnings before interest and taxes of EUR13 billion in

2023. CFFO before working capital is seen at over EUR17 billion in

2023 and over EUR69 billion over the plan period. The company said

this will allow it to organically fund investment and enhance

shareholder distributions while maintaining leverage in a 10%-20%

range.

Capital expenditure is seen at around EUR9.5 billion in 2023 and

EUR37 billion over 2023-26.

Eni expects production to grow at an average of 3%-4% over

2023-26 and plateau to 2030, and said it will progressively

increase the share of gas in the portfolio to 60% by the end of the

decade. The upstream segment's capex will be between EUR6

billion-EUR6.5 billion on average per year during the strategy plan

period.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

February 23, 2023 07:39 ET (12:39 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

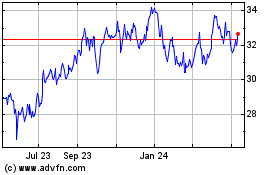

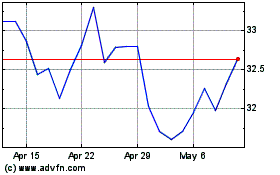

ENI (NYSE:E)

Historical Stock Chart

From Jun 2024 to Jul 2024

ENI (NYSE:E)

Historical Stock Chart

From Jul 2023 to Jul 2024