Report of Foreign Issuer (6-k)

July 30 2019 - 9:33AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of

July

, 2019

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F

X

Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes

No

X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

.)

TRANSLATION FROM SPANISH

ABSTRACT OF MINUTES No. 439 OF EDENOR S.A.´S BOARD OF DIRECTORS´ MEETING

MINUTES No. 439

:

In the City of Buenos Aires, on July 2, 2019, at 4:00 pm, the undersigning Directors of EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A.

(Edenor S.A.) (the “Company”), to wit: Ricardo Torres, Carolina Sigwald, María José Wuille-Bille, Carlos Iglesias, Lucas Amado, Miguel Ángel De Godoy, Carlos Alberto Lorenzetti and Mariano Garcia Mithieux held a meeting in the head office at Av. del Libertador 6363. Mr. Daniel Abelovich, Mr. Germán Wetzler Malbrán and Mr. Jorge Pardo attended the meeting, representing the Supervisory Committee. The Company`s Director of Finance and Control Mr. Leandro Montero also attended the meeting. The Meeting was chaired by Mr. Ricardo Torres, who after verifying quorum, declared the meeting duly held and submitted to the consideration of the attending Directors the

FIRST ITEM

of the Agenda as timely informed: […]. Thereafter, the

THIRD ITEM

of the Agenda was considered:

3°)

Call to General Ordinary Shareholders’ Meeting to consider creation of a Global Program to Issue Company´s Bonds for a maximum outstanding amount of U$S750,000,000 or its equivalent in other currencies. Appointment of one (1) Alternate Director. Agenda. Board´s Proposal

. The Chairman stated that, as the Company´s debt program created in 1997 was terminated, it was advisable to create a new global program other than actually involving any bond issue, but empowering the Company to do so as deemed necessary. To that end, an Ordinary Shareholders’ Meeting was required to be called to consider the

creation of a new Global Program for future issue of Bonds, for a maximum amount of United States dollars seven hundred and fifty million (U$S750,000,000) or its equivalent in other currencies, in effect for five (5) years. Therefore, the Chairman moved to approve the following call:

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A.

(EDENOR S.A.)

C A L L

GENERAL ORDINARY SHAREHOLDERS’ MEETING

Class A, B and C shareholders of EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (Edenor S.A.) (the “Company”) are called to the General Ordinary Shareholders’ Meeting to be held on August 8, 2019 at 10:30 am. on first call and at 11:30 am on second call, in the head office at Avenida del Libertador 6363, ground floor, City of Buenos Aires, in order to consider the following Agenda:

1°)

Appointment of two shareholders to approve and sign the

minutes;

2°)

Consideration of the

creation of a Global Program to issue Company´s Bonds for a maximum outstanding

amount of U$S750,000,000 (

United States dollars seven

hundred and fifty million) or its equivalent in other currencies

. Delegation

upon the Board of Directors of full powers to, up to the maximum amount fixed

by the Shareholders´ Meeting, set all other conditions to issue each class

and/or series including, without limitation: amount, currency, time, term, price,

interest rate, means and conditions of payment, characteristics and terms and

conditions of bonds to be issued, etc., with full power to request or not

public offering authorization by CNV and/or by any similar authority abroad, and

to request or not authorization to list or trade them in stock exchange or

markets in Argentina or abroad, at all times at the Board´s sole discretion and

by using any of the procedures provided for by the legal rules in force, to

approve and execute all applicable agreements, approve and execute any updates

to the Global Program as deemed necessary, the Prospectus required by the

regulatory authorities and any other documents, and to appoint the persons

authorized to obtain from the competent authorities all relevant authorizations

and approvals, with the Board of Directors being entitled to sub-delegate those

powers upon the persons it might deem advisable.

3°)

Appointment of one (1)

alternate director jointly representing B and C classes, with term of office

until the Shareholders´ Meeting held to consider the Company´s financial

statements as of December 31, 2019.

4°)

Granting of authorizations to

carry out any proceedings and filings required to obtain relevant registrations.

NOTE 1

: All Shareholders shall be reminded that Caja de

Valores S.A., with domicile at 25 de Mayo 362 (C1002ABH), City of Buenos Aires,

keeps records of the Company's book-entry shares. In order to attend the

Meeting, they shall obtain proof of the book-entry shares account, such proof

being issued for that purpose by Caja de Valores S.A. Moreover, they shall

submit such proof for its registration in the Meeting Attendance Registry kept

at Floor 10 (Management of Legal Affairs) in the corporate office located at

Avda. del Libertador 6363, City of Buenos Aires, by and including August 2,

2019, from 10:00 AM to 01:00 PM and from 02:00 PM to 05:00 PM.

NOTE 2:

In accordance with the provisions of General

Resolution No. 465/2004 of the Argentine Securities and Exchange Commission, at

the time of the registration to attend the Meeting, the following information

of the shareholder shall be provided: full name in the case of individuals or

corporate name in the case of legal entities, type and number of Identity

Document in the case of individuals or incorporation registration data in the

case of legal entities expressly identifying the Registry where the legal

entity is registered and its jurisdiction; domicile -specifying its type. Same

information shall be provided by the attendee in his/her capacity as the

shareholder’s representative.

NOTE 3:

For the purposes of considering Item 3 of the Agenda,

a Special Meeting of Class B and C Shareholders shall be held.

NOTE 4:

Shareholders

shall appear at least 15 minutes in advance to the

time scheduled for the Meeting, to furnish the relevant powers of attorney and

to sign the Meeting Attendance Registry.

After discussing the motion, the Board of Directors unanimously

RESOLVED

TO:

Approve the call to General Ordinary Shareholders´ Meeting and the

Agenda transcribed above, delegating upon the Board´s Secretary any proceedings

required to publish the call in the Official Gazette and in a widely circulated

newspaper, as well as any other communication, as required, authorizing the

Chairman and/or Carlos D. Ariosa and/or Gabriela L. Chillari and/or Camila

Macarena Fernández Santiso to that

end. Furthermore,

after brief discussion and as required under the Deposit Agreement in effect

executed by the Company and Bank of New York, the Board of Directors

unanimously further

RESOLVED TO:

Recommend the Company´s Shareholders´

Meeting as regards each of the items of the Agenda approved above as follows:

In relation to the first item

of the Agenda

: 1)

Appointment of two shareholders to approve and sign the

Meeting´s Minutes:

Move the Shareholders´ Meeting to appoint the

representatives of Pampa Energía S.A., Administración Nacional de Seguridad

Social – Fondo de Garantía de Sustentabilidad and The Bank of New York Mellon

to sign the minutes.

In relation to the second item

of the Agenda

:

2°) Consideration of the creation of a Global Program to issue

Company´s Bonds for a maximum outstanding amount of U$S750,000,000 (

United States dollars seven hundred and fifty million) or

its equivalent in other currencies

. Delegation upon the Board of

Directors of full powers to, up to the maximum amount fixed by the

Shareholders´ Meeting, set all other conditions to issue each class and/or

series including, without limitation: amount, currency, time, term, price,

interest rate, means and conditions of payment, characteristics and terms and

conditions of bonds to be issued, etc., with full power to request or not

public offering authorization by CNV and/or by any similar authority abroad,

and to request or not authorization to list or trade them in stock exchange or

markets in Argentina or abroad, at all times at the Board´s sole discretion and

by using any of the procedures provided for by the legal rules in force, to

approve and execute all applicable agreements, approve and execute any updates

to the Global Program as deemed necessary, the Prospectus required by the

regulatory authorities and any other documents, and to appoint the persons

authorized to obtain from the competent authorities all relevant authorizations

and approvals, with the Board of Directors being entitled to sub-delegate those

powers upon the persons it might deem advisable

: Move the Shareholders´

Meeting to approve creation of a Global Program to issue Company´s Bonds for a

maximum outstanding amount of U$S750,000,000 (

United

States dollars seven hundred and fifty million) or its equivalent in other

currencies

, delegating upon the Board of Directors full powers to, up to

the maximum amount fixed by the Shareholders´ Meeting, set all other conditions

to issue each class, with the Board of Directors being entitled to sub-delegate

those powers upon the persons it might deem advisable.-

In relation to the third item of the Agenda

:

3°) Appointment of one (1) alternate director jointly representing B and C classes, with term of office until the Shareholders´ Meeting held to consider the Company´s financial statements as of December 31, 2019:

The Board of Directors refrained from submitting any proposal.-

In relation to the fourth item of the Agenda

:

4°) Granting of authorizations to carry out any proceedings and filings required to obtain relevant registrations

: Move the Shareholders’ Meeting to grant relevant authorizations to Carlos D. Ariosa, Gabriela L. Chillari, Marcos Caprarulo, Diego O. Nuñez and/or Camila M. Fernández Santiso, to any of them, acting on behalf of the Company, register the resolutions passed by the Shareholders´ Meeting and to carry out any necessary filings and acts before the relevant authorities including, without limitation, any filings to be made before Comisión Nacional de Valores, Bolsas y Mercados Argentinos and Inspección General de Justicia, as applicable. […]. There being no further issues to transact, the meeting was adjourned at 05:30 pm.

Undersigning Attendees: Ricardo Torres, Carolina Sigwald, María José Wuille-Bille, Carlos Iglesias, Lucas Amado, Miguel Ángel De Godoy, Carlos Alberto Lorenzetti, Mariano García Mithieux, Daniel Abelovich, Germán Wetzler Malbrán and Jorge Pardo.-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Empresa Distribuidora y Comercializadora Norte S.A.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Leandro Montero

|

|

|

Leandro Montero

|

|

|

Chief Financial Officer

|

Date:

July

31, 2019

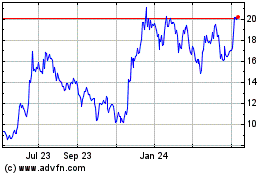

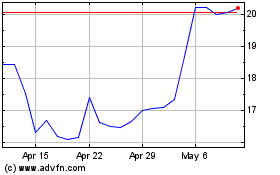

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jul 2023 to Jul 2024