Report of Foreign Issuer (6-k)

May 02 2019 - 12:37PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of

April

, 2019

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F

X

Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes

No

X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

.)

REPORT ISSUED BY THE AUDITING COMMISSION REQUIRED BY SECTION 64 OF THE

Securities Market Law

AND THE Argentine Securities and Exchange Commission (cnv) REGULATIONS

Autonomous city of Buenos Aires, April 8

th

, 2019

Addressed to Directors

Empresa Distribuidora y Comercializadora Norte S.A. (Edenor S.A.)

Av. Del Libertador 6363

Autonomous city of Buenos Aires

In our capacity of members of the Auditing Commisison of Empresa Distribuidora y Comercializadora Norte S.A. (Edenor S.A.) (hereinafter the “Company”) and pursuant to the provisions of Section 64 of the Securities Market Law and the regulations of the Argentine Securities and Exchange Commission in connection with the documents mentioned in II and within the aim expressed in III, we have carried out the tasks detailed in V, within the scope detailed in IV, reaching the conclusions mentioned in VI.

When going through this report, the considerations made in VII should be taken into account.

I.

BACKGROUND

The Company plans to acquire own shares to reduce the existing difference between the value of the Company based on the value of shares and, the value of the Company based on the market quote of its shares, within the aim of contributing to the market strengthening, allocating the Company’s liquidity in an efficient manner.

A summary of the terms and conditions for the acquisition of own shares, informed by the Company in the Note dated April 4

th

, 2019 signed by Edenor’s Chairman:

1. Purpose: contribute to the reduction of the existing difference between the value of the Company based on the value of shares and, the value of the Company based on the market quote of its shares, within the aim of contributing to the market strengthening, allocating the Company’s liquidity in an efficient manner.

2. Amount to be invested: up to $800.000.000 (eight million pesos).

3.

Maximum number of shares or maximum percentage of capital stock which will be subjected to the acquisition

: Shares in portfolio shall not exceed, jointly, the limit of 10% of capital stock (The Company’s portfolio, currently, has 29.604.808 Class B shares, equivalent to 3,2660% of capital stock).

4.

Daily limit for transactions in the Argentine market

: pursuant to provisions of Law 26.831, it shall be up to 25% of the daily transaction average volume experienced by the shares during the 90 (ninety) previous working days.

5.

Price to be paid for shares: up to a maximum of

US$ 23 per ADR in the New York Stock Exchange or the amount in pesos equivalent to US$ 1,15 per share in Bolsas y Mercados Argentinos S.A., taking as a reference the closing exchange rate of the day preceding the transaction.

6.

Source of funds

: the acquisitions are performed with realized net sales. Pursuant to the provisions of the Securities and Exchange Commission’s regulations under its Section 12, Part II, Chapter I, Title II, the Company at present has sufficient solvency to perform the mentioned acquisitions without affecting its solvency, as evidenced by the Annual Financial Statements at 31.12.18 approved by the Board of Directors in the meeting held on March 8

th

, 2019.

7.

Terms to carry out acquisitions

: the Company shall acquire shares for the term of 120 (one hundred and twenty) calendar days, as from the working day following the publication of the announcement of the Company to acquire its own shares, subject to any renovation or extension of the term decided by the Board of Directors, which will be notified to the investing audience by the same means.

8. Internal communication: Directors, auditors and first line managers will be informed that being in force a decision of the Company to acquire its own shares, they shall not be entitled to sell the Company shares owned or administered by them direct or indirectly, during the corresponding term.

II.

DOCUMENTS RELATED TO OUR WORK

Our labor included the following documents.

a)

Note issued by the Chairman of Company which includes a detail of the terms and conditions for the acquisition of won shares.

b)

Company’s Annual Financial Statements at December 31

st

, 2018

c)

Report issued by Independent Accountant performed by Price Waterhouse & Co S.R.L. dated April 8

th

, 2019.

d)

Company’s Cash Flow for the year 2019 elaborated by the Management of the Company.

III.

AIM

Our labor was aimed at issuing the opinion established in the Section 64 of the of the Securities Market Law and the regulations of the Argentine Securities and Exchange Commission

IV.

SCOPE

Taking into account the nature of our responsibility as the Company’s auditing body, our pertinent duty is restricted to issue our opinion on the liquidity and solvency required to perform the acquisition of own shares’ transaction.

V.

TASKS CARRIED OUT

In order to comply with the aim indicated in II we have carried out the following tasks:

a)

Analysis of the Company’s financial situation in the event of an eventual acquisition of own shares.

b)

Consultation to members of the Company’s Board of Directors related to the terms and conditions of the repurchase.

c)

Analysis of legal, regulatory and statutory provisions in force.

d)

Review of the report issued by the Independent Accountant, of the Annual Financial Statements at December 31

st

, 2018 and the cash flow report above mentioned.

VI.

OPINIONS

In accordance with the work carried our related to the documents mentioned in section II, within the aim pointed out in Section III, and the scope mentioned in IV, having understood the tasks indicated in Section V, in our opinion the Company has the liquidity and solvency required to perform the repurchase of its own shares.

VII.

CONSIDERATIONS RELATED TO THE USE OF THIS REPORT

This report has been exclusively elaborated with the aim expressed in section III. Any other use with a different purpose may not be appropriate.

This report should not be reproduced or distributed unless it is done in its complete version.

By the Auditing Commission

___________________________________________

Jorge Pardo

Permanent Auditor

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Empresa Distribuidora y Comercializadora Norte S.A.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Leandro Montero

|

|

|

Leandro Montero

|

|

|

Chief Financial Officer

|

Date:

April

30, 2019

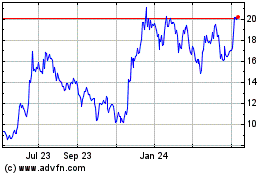

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jun 2024 to Jul 2024

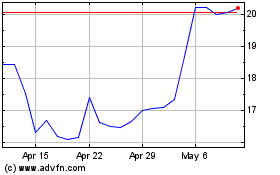

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jul 2023 to Jul 2024