Report of Foreign Issuer (6-k)

May 16 2018 - 2:44PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2018

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F

X

Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes

No

X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

.)

Buenos Aires, May 10, 2018

GAL Note No. 67/18

Messrs.

COMISIÓN NACIONAL DE VALORES

Argentine Securities and Exchange Commission

Issuers´ Sub-Management Office

25 de Mayo 175

City of Buenos Aires

Messrs.

BOLSAS Y MERCADOS ARGENTINOS S.A.

Sarmiento 299

City of Buenos Aires

Ref: Relevant Event. Acquisition of own shares.

Dear Sirs,

In compliance with applicable laws and regulations, I hereby address you on behalf of Empresa Distribuidora y Comercializadora Norte S.A. (indistinctly, “EDENOR” or the “Company”) to inform you that, in its meeting held today, the Company’s Board of Directors approved the acquisition of own shares pursuant to section 64 of Act No. 26,831 and the Rules of the Argentine Securities and Exchange Commission (

Comisión Nacional de Valores

, CNV).

To reach such decision, the Board of Directors has taken into consideration the difference between the Company assets’ value and its market share price, which fails to reflect either the value or the economic reality these assets currently or potentially have, this being detrimental to the interests of the Company’s shareholders. Moreover, the Board of Directors has considered the availability of Company funds and the fact that such acquisition would not affect its credit standing, as supported by the reports of the independent accountant,the Supervisory Committee and the Audit Committee.

The terms and conditions for the acquisition of own shares approved by the Board of Directors are detailed below:

1.

Purpose

: to contribute to closing the gap between the Company’s value resulting from its assets’ value and that based on its market share price to help strengthen its market position through an efficient liquidity allocation.

2.

Maximum amount to be invested

: up to US$ 40,000,000 (forty million United States dollars), without exceeding the limits set forth in items 3 and 6 below.

3.

Maximum number of shares or maximum percentage over the Company’s capital stock subject-matter of the acquisition

: portfolio shares may not exceed, as a whole, the limit of 10% of the capital stock (the Company currently has 7,521,927 million series B shares, which represent 0.8298% of its capital stock).

4.

Daily limit for transactions in the Argentine market

: pursuant to Act No. 26,831, it will amount to up to 25% of the average daily transactions volume during the previous 90 (ninety) business days.

5.

Price payable by the shares

: up to AR$60 (sixty pesos) per share in Bolsas y Mercados Argentinos S.A. (BYMA) and US$55 (fifty-five U.S. dollars) per ADR in the New York Stock Exchange.

6.

Source of funds

: acquisitions will be made with net realized profits. In compliance with the Rules of the Argentine Securities and Exchange Commission in its section 12, Article II, Chapter I, Title II, the Company currently has sufficient liquidity to make such acquisitions without affecting its credit standing, as evidenced by the quarterly Financial Statements as of March 31, 2018 approved by the Board of Directors in its meeting held today.

7.

Acquisition Term

: the Company may acquire shares for a term of 120 (one hundred and twenty) calendar days as from the first business day following the date of publication of the Company’s decision to acquire own shares, subject to any renewal or term extension to be approved by the Board of Directors which, if effective, would be informed to the investing public through the same media.

8.

Internal communication

: directors, statutory auditors and senior managers will be informed that, while the Company’s decision to acquire own shares is in effect, they may not sell Company shares held or directly or indirectly managed by them during the applicable term.

Yours faithfully,

Carlos D. Ariosa

Attorney-in-fact

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Empresa Distribuidora y Comercializadora Norte S.A.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Leandro Montero

|

|

|

Leandro Montero

|

|

|

Chief Financial Officer

|

Date: May 16, 2018

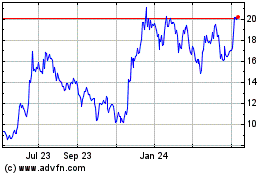

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jun 2024 to Jul 2024

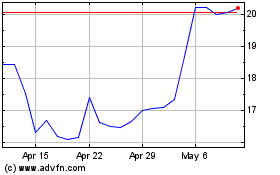

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jul 2023 to Jul 2024