UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2018

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F

X

Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes

No

X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

.)

AUDIT COMMITTEE´S REPORT

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017

Buenos Aires, March 7, 2018

To the Directors and Shareholders of

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA

NORTE S.A. (EDENOR S.A.)

Av. Del Libertador 6363, 11th floor

City of Buenos Aires

In our capacity as members of the Audit Committee of Empresa Distribuidora y Comercializadora Norte S.A. (“EDENOR S.A.” or “the Company”) and in compliance with the rules set forth by the Argentine National Securities Commission (

Comisión Nacional de Valores

, hereinafter “CNV”), we are pleased to submit to your consideration the following report on the treatment given by the Audit Committee to the issues for which it is responsible, all for the year ended December 31, 2017 (hereinafter “the fiscal year”).

I.

DUTIES AND RESPONSIBILITIES OF THE AUDIT COMMITTEE

A brief summary of the main duties and responsibilities of the Audit Committee is included below:

-

As regards reporting, internal control and risk management:

A-

To oversee external audit, assess its compliance with independence requirements, its audit plans and performance, expressing an opinion on such issues in the annual report and informing on external auditors´ fees and payment of other services rendered by auditing firms as well as by any other firms for auditing, accounting, IT, internal control and financial and administrative advisory services, as well as any payment for courses delivered in connection with those issues and, if applicable, to express an opinion on:

1.

The Board of Directors´ proposal to appoint or remove external auditors.

2.

Requests for special audits submitted by non-controlling shareholders (none in the fiscal year).

B.

To assess internal audit plans and performance, expressing an opinion thereon in the annual report.

C.

To oversee internal control and, as part of it, the operation and reliability of the administrative and accounting system.

D.

To monitor enforcement of the Company´s information policies on risk-management.

E.

To assess compliance with the rules of conduct applicable to the Company.

F.

To monitor effective operation of a channel, through which complaints about accounting, internal control and auditing matters can be made.

G.

To monitor reliability of the financial information and information on relevant facts submitted to the CNV and securities markets.

-

Other duties:

H.

To render an opinion on agreements executed with

related parties for amounts in excess of 1% of the Company’s Shareholders’

Equity, as stated in the most recently approved Balance Sheet, submitted to its

consideration by the Board of Directors or by one of its members in relation to

whether they qualify as arm’s length transactions.

I.

To render an opinion on

any case of conflict of interest, fully disclosing them to the market.

J.

To render an opinion on

the reasonableness

of the proposals made by the Board of Directors in connection with fees and

stock option plans

for directors and managers.

K.

To implement the training

program.

L.

Every year, to prepare an

action plan for the relevant fiscal year and report it to the Board of

Directors and to the Supervisory Committee.

M.

Every year, to analyze adequacy

of the Committee´s Rules and to inform any changes proposed to the Board of

Directors for their review and approval.

N.

To provide each and every

report, opinion or decision required by the rules in force.

O.

To render an opinion on

compliance with legal requirements and on the reasonableness of issuing terms and

conditions, in

case of issue of shares or convertible securities that exclude or restrict preemptive

rights (none in the fiscal year).

P.

To inform on the Board of

Directors´ resolution required in case of other purchases of treasury stock (none

in the fiscal year).

Q.

To render an opinion on

public tender offer of shares under voluntary delisting (none in the fiscal

year).

R.

To consider any other

issue timely delegated upon it by the Board of Directors, as well as to carry

out any other duty imposed on it by the Law (none in the fiscal year).

The following section

describes the relevant duties and responsibilities applicable during the fiscal

year. Nevertheless, for the sake of their understanding, we suggest reading the

relevant provisions (Law No. 26.831, Sections 64, 72, 73, 98, 108 and 110, CNV´s

Rules, Title II, Chapter III, Section V, Paragraph 18) and the Company´s Audit

Committee´s Rules.

II.

TREATMENT GIVEN BY THE

AUDIT COMMITTEE TO THE ISSUES ABOVE

On February 23, 2017, the

Audit Committee approved its work plan for the 2017 fiscal year, which was

submitted to the Board of Directors and to the Supervisory Committee.

Below please find a summary of the

treatment given by the Audit Committee to the issues under its scope of responsibility

as described above, except for those issues mentioned in I.A.2, I.O., I.P., I.Q.

and I.R., as they are not applicable. In such regard, we describe the main tasks performed and

the conclusions in relation to each one of the relevant duties and

responsibilities.

A.

External Audit

On March 8, 2017, the

Board of Directors proposed to appoint Price Waterhouse & Co. S.R.L. as the

Company´s external auditors for the fiscal year, with Mr. Sergio Cravero as

regular auditor and Mr. Norberto Fabián Montero as alternate auditor, partners

of the firm mentioned above.

On March 23, 2017, the

Audit Committee accepted the Board of Directors´ proposal.

On

April 18, 2017, the Shareholders´ Meeting appointed said auditors as proposed

by the Board of Directors.

In order to assess if the quality of

the work performed by the external auditors provides a reasonable level of

assurance on the documents subject to its examination, we have analyzed the

following aspects to the extent they relate to such purpose:

1.

Background

information of the external auditing firm and particularly personal and

professional data of regular and alternate auditors as regards their skills and

independence, including, but not limited to, the following tasks:

a.

Reading the sworn statements required

under section 104,

Law No. 26.831.

b.

Analyzing auditors´ independence policies and

quality control.

c.

Collecting information on

their training and education, experience, working methods, working teams and

clients.

d.

Obtaining a statement by auditors in

relation to their independence.

e.

Discussing the issues

above with the Company´s officers.

2.

Development

of auditing tasks basically through meetings with auditors where the following

issues were analyzed and evaluated, among others:

a.

Enforcement of the

relevant policies and application of working methods.

b.

General planning of tasks.

c.

Tasks carried out in key

areas.

d.

Most important written communications

between auditors and the Company´s officers.

e.

Outcome of the most

important works and relevant conclusions.

f.

Criteria used in

connection with key accounting and auditing matters.

3.

Analysis

of reports prepared by auditors upon completion of their work, including, but

not limited to, the following:

a.

Audit reports on

financial statements as of December 31, 2017 and on the review of the relevant Executive

Summary and supplementary information requested by the CNV.

b.

Limited review reports on

condensed interim financial statements as of March 31, June 30 and September 30,

2017 and on the review of the applicable Executive Summaries and of the

supplementary information requested by the CNV.

4.

Services

rendered by external auditors for a total invoicing amount in the fiscal year

of AR$9,510,905 as auditing services and as other services intended to build

trust in third parties.

In accordance with the

provisions of the Audit Committee´s Internal Rules, it is our responsibility to

further inform on fees for services rendered by other professionals during the

fiscal year in connection with auditing, accounting, IT, internal control and

financial and administrative advisory issues, as well as those related to

courses delivered on those issues. In such regard, we inform on the relevant

fees for the 2017 fiscal year.

|

SERVICES RENDERED

|

|

AMOUNT

(IN PESOS)

|

|

|

|

|

|

Internal

Audit and Internal Control

|

|

1,782,274.-

|

|

Information

System Consulting

|

|

440,000.-

|

|

Accounting

Consulting

|

|

81,000.-

|

|

Tax

Consulting

|

|

920,688.-

|

|

Financial

and Administrative Consulting

|

|

1,021,098.-

|

|

|

|

4,245,060.-

|

As a result of the work performed as

described and for the purposes above, no significant issue has come to our

attention that, in our opinion, we should mention in relation to the external

auditors appointed by the Meeting for the fiscal year, as regards their

engagement, independence, skills, performance, reports and services requested to

them by the Company during said fiscal year. Accordingly, we believe that

external audit planning and development during the fiscal year were

satisfactory as regards their purposes to offer a proper level of reliability

of the audited information.

B.

Internal Audit

Internal Audit is an independent,

objective, assurance and consulting activity that adds

value to and improves the Company´s operations. It helps the Company

accomplish its organizational objectives by bringing a systematic, disciplined

approach to evaluate and improve the effectiveness of risk management, control,

and governance processes. Internal Audit Management is focused on ascertaining

if the risk management scheme and corporate governance and control processes

designed and executed by management are appropriate and effectively work to

ensure that:

a)

risks are properly identified

and managed.

b)

interaction by different groups

across corporate governance is appropriate.

c)

critical information (whether

information on finance, management or operations) is complete, accurate,

reliable and appropriate.

d)

actions taken by

employees are in line with applicable policies, rules, procedures, laws and

regulations.

e)

resources are

economically acquired, efficiently used and properly protected.

f)

goals are achieved and

approved plan and programs are implemented.

g)

quality and continuous

improvement are developed in all the organization´s processes.

Our work in connection

with internal audit does not cover those matters related to the efficiency and

effectiveness of operations as we believe that they are out of our scope of

responsibility.

For the purposes of

evaluating whether Internal Audit Management duly complied with its relevant

duties and responsibilities, we have analyzed the following tasks:

1.

Review

of the following elements, to the extent they are related to the purpose

described above:

a.

Mission,

duties and working methods of the Internal Audit Management in line with its

Internal Audit General Rule.

b.

Organizational

and reporting structures.

c.

Its

staff´s key skills.

d.

Annual

working plan.

2.

Regular

meetings held with the Internal Audit Management to follow-up full implementation

of the audit plan and analyze results of works done.

As a result of our work,

performed for the purposes and with the scope already mentioned, no relevant

issue has come to our attention that, in our opinion, we should mention in

relation to the organization, independence, oversight and implementation of

tasks performed during the fiscal year, or to the communication of their

results. In view of the foregoing, it is our opinion that planning and

development of the internal audit work performed by said Management during the

fiscal year were appropriate in relation to its purposes as mentioned before,

except that we express no opinion on the work done in relation to the

efficiency and effectiveness of operations as they are out of our scope of

responsibility.

C.

Internal Control

As described above, internal control

comprises the rules, systems, skills and attitudes of the personnel intended,

among other purposes, to protect the shareholders’ equity, ensure reliability

and appropriate disclosure of the Company´s financial information and relevant

events and emphasize compliance with laws, regulations and rules passed by the

Company, particularly those related to accounting and financial matters.

Our work in connection

with internal control did not cover those matters related to the efficiency and

effectiveness of operations as we believe that they are out of our scope of

responsibility.

In order to assess if the Company’s

internal control in general, and its administrative and accounting system in

particular (an integral part thereof), duly fulfills the purposes mentioned

above, to which we have limited the scope of our work, we have performed the

following tasks:

1.

Discussion of matters

related to the Company´s internal control and its administrative and accounting system with the Company´s key

officers.

2.

Consideration

of tasks mentioned in item B above.

3.

Analysis

of related work performed by external auditors and their results.

4.

Analysis

of tasks performed by the Company in compliance with the applicable provisions

of the Sarbanes-Oxley Act:

As the Company is subject to and governed by the

provisions of the Sarbanes-Oxley Act, it must perform all tasks required to

certify internal control as prescribed by said Act.

The Audit Committee has been informed of the tasks

already performed and has analyzed their results.

The Audit Committee need not make any comment on the

work done or the results obtained.

As a result of our work, performed

for the purposes and with the scope already mentioned, no relevant issue has

come to our attention that, in our opinion, we should mention particularly in

relation to the Company´s internal control and administrative and accounting

system, that was properly dealt with by the Company during the fiscal year, limiting this conclusion

to the internal control aspects related to protection of the Company´s

shareholders’ equity,

compliance

with applicable rules and regulations and reliability

and appropriate disclosure of financial-accounting information and relevant

events.

D.

Risk Management

Audit Committee´s responsibilities

in relation to risk management consist in overseeing implementation of the

Company´s information policies on risk management.

For the purposes of

evaluating implementation of the Company´s information policies on risk

management, we have conducted the following tasks:

1.

Reading

the Company’s rule on Risk Management.

2.

Considering

the work performed by the Company in that sense up to the date hereof and its

results.

3.

Defining

the extent to which identified and assessed risks, if applicable, were properly

informed, in accordance with statutory, regulatory, professional (on accounting

issues) and the Company´s applicable rules.

As a result of our work,

performed for the purposes and with the scope already mentioned, no relevant

issue has come to our attention that, in our opinion, we should mention as a

deviation from the implementation of the Company´s information policies on risk management nor from statutory or regulatory rules and from

the accounting profession as regards risk information.

E.

Rules of Conduct

In relation to our

responsibility of assessing compliance with applicable rules of conduct, our

work was focused, as regards members of the Company´s governing body and other

officers reporting to accounting and financial areas, on matters related to the

transparency, reliability and adequate disclosure of financial information and

relevant events and due application and protection of Shareholders´ Equity. In

this respect, we have considered those standards established by statutory, regulatory

and the Company’s own rules and regulations.

Our work was limited to

those matters of which we were aware in our capacity as Company´s Directors, of

works conducted in relation to other matters under the Committee´s scope of

responsibility (particularly those mentioned in items B and C) and the

following tasks:

1.

Reviewing

most important rules approved by the Company, including the Code of Ethics and

related standards and policies.

2.

Considering

the Supervisory Committee´s reports.

3.

Discussing

all issues above with the Company´s key officers.

As a result of our work,

performed for the purposes and with the scope already mentioned, no relevant

issue has come to our attention that, in our opinion, we should mention in

relation to the compliance with the rules of conduct referred to above.

F.

Complaints related to

Accounting and Auditing Matters

In compliance with the

rules applicable to the Company, it has implemented a complaint channel to

submit to the Audit Committee´s consideration any claims and complaints related

to accounting, internal control and auditing matters, guaranteeing concealed

identity and confidentiality upon the complainant´s request.

We believe that said

channel has worked effectively and helped fulfill the Audit Committee´s

responsibilities as mentioned above.

The Committee has no

issue to mention or note in connection with operation of the complaint cannel, analysis

of information received or the results obtained as regards its scope of

responsibility.

G.

Financial Information and

Information on Relevant Events

For the purposes of

assessing the reliability of the financial information and information on

relevant events filed with the CNV and with the markets where the Company´s

shares are traded, we have conducted the tasks described below.

Our responsibility in

this respect does not include performance of examinations according to audit

standards and therefore, we have not performed them. The scope of our work has

been limited to the tasks described below and therefore, our conclusion on the

information included below should not be interpreted as a professional opinion

on it but rather as a description of the results of tasks performed. In

relation to the financial statements for the

fiscal

year, external auditors and the Supervisory Committee are the parties

responsible for issuing the applicable reports. We have relied, in part, on the

work carried out by them.

Our work covered the

following documents:

a. The financial

statements for the fiscal year ended December 31, 2017 and the interim financial

statements for the periods ended March 31, June 30 and September 30, 2017.

b. The executive

summaries required by the CNV´s Rules for the fiscal year and for the interim

periods mentioned in the preceding item.

c. The supplementary

information required by the CNV for the fiscal year and for the interim periods

mentioned above.

d. The Board of Directors´

Annual Report for the fiscal year.

e. Communications on

relevant events and on key financial information other than the financial

information referred to above filed with the CNV and with the markets where the

Company´s shares are traded.

In relation to these

documents, and for the purpose and with the scope already mentioned, we have

carried out the following tasks:

1.

Analysis

of the main accounting policies of the Company.

2.

Consideration

of the work performed as provided for in items A to F above and their results

as regards the documents described above.

3.

Discussion

of key accounting matters with external auditors, members of the Supervisory

Committee and the Company´s key officers.

4.

Analysis

of the documents mentioned in items a) to c) hereof, as applicable and prior to

their issue, with external auditors, members of the Supervisory Committee and the Company´s

key officers.

5.

Analysis

of the Annual Report for the fiscal year, of the work performed on it by the

external auditor and its discussion with the Company´s key officers.

6.

Analysis

of the information mentioned in item e), considering the provisions of

paragraph 7 and discussing it with the Company´s relevant officers as deemed necessary.

7.

Verification of the

inclusion of all the relevant events and circumstances of which we were aware

at the time of its issue.

8.

Consideration

of related tasks to be conducted by the Disclosure Committee.

As a result of our work,

performed for the purposes and with the scope already mentioned and that

comprised the tasks listed above, no material comment has come to our

attention, that, in our opinion, should be made to the information mentioned above

nor to the policies, procedures

or controls related to their preparation.

H.

Agreements with Related

Parties

Our responsibility in this respect

consists in approving transactions with related parties for a relevant amount

submitted to our consideration by the Company´s Board of Directors or by any of

its members and expressing an opinion on whether they have been agreed as arm’s

length transactions.

Pursuant to Act No. 26.831, Section

72, we have considered as relevant amount that amount equal to 1% of the

Shareholders´ Equity, as reflected in the Balance Sheet most recently approved

by the Shareholder´s Meeting.

In compliance with our

responsibility, on May 17, 2017 we have issued a pronouncement in favor of the

agreement with Pampa Energía S.A. ("Pampa") for the civil

construction and electromechanical installation by the Company, of a new output

field to be carried out at Edenor’s Transformer Substation No. 158

"Pilar" located in the Pilar Industrial Park and the implementation

by Edenor of the project, civil works and cabling of a conduit and a remote

control optical fiber to interface the Transformer Substation No. 158

"Pilar" with Pampa’s future "Pilar" thermoelectric

generating plant, both located within the Pilar Industrial Park.

During the fiscal year, the Board of

Directors has not approved any other agreement with related parties for a

relevant amount nor are we aware of any other relevant agreement with related

parties.

I.

Conflicts of Interest

During the tasks

performed by us, both in our capacity as members of the Audit Committee and as

the Company´s Directors, we were not aware of any relevant case in which a

member of any governing body has been involved in any conflict of interest, in breach

of statutory, regulatory and the Company´s rules and regulations.

In addition, we inform

that:

1.

After

reading and conceptually analyzing the financial statements, we verified that

the information on transactions with parent companies, subsidiaries and related

companies is posted on them by the Company as provided for by statutory,

regulatory and professional applicable rules.

2.

We

have discussed with the external auditors the work performed by them in

connection with the reliability of the information mentioned in the item above.

3.

We

have verified that the Supervisory Committee has made no comment in that

respect in its reports.

Based on the work

performed by us, as described above, we were not aware of any relevant comment

to be made by us as regards our responsibility to inform any case of conflict

of interest.

J.

Proposal of Directors´

Fees

In relation to our responsibility of

expressing an opinion on the reasonability

of fees

payable to Directors, we inform that on March 23, 2017, the Committee decided

on the reasonability

of the proposal

of fees payable to Directors

for 2016 fiscal year.

K.

Training Plan

The Committee has complied with the

agreed training plan.

L.

Work Plan

On February 26, 2018, the

Committee approved its work plan for 2018 fiscal year.

M.

Adequacy of the

Committee’s Rules

The Committee has reviewed

the adequacy of the Committee´s Rules and resolved that no changes were necessary.

N.

Reports Issued

As set forth in the paragraphs

above, the Committee has issued all relevant and/or required reports (see

paragraphs A, H and J).

III.

GENERAL CONCLUSION

As described above, in our capacity as members of the Company´s Audit Committee, we have carried out several tasks in fulfillment of the responsibilities assumed by us pursuant to statutory, regulatory and the Company´s rules and regulations.

As a result of the tasks described above, and as already expressed, we are not aware of any situation that, in our opinion, should be particularly mentioned in this report in relation to the responsibilities we have assumed.

|

Eduardo L. Llanos

|

Lucas Amado

|

Maximiliano Fernández

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Empresa Distribuidora y Comercializadora Norte S.A.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Leandro Montero

|

|

|

Leandro Montero

|

|

|

Chief Financial Officer

|

Date: March 19, 2018

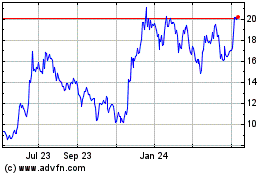

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jun 2024 to Jul 2024

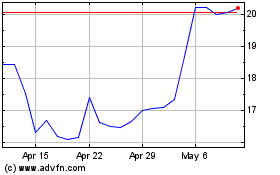

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jul 2023 to Jul 2024